Patents and innovations in solid oxide electrolysis cells exploration

OCT 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SOEC Technology Evolution and Objectives

Solid Oxide Electrolysis Cells (SOECs) have evolved significantly since their conceptual inception in the mid-20th century. Initially developed as a reverse application of Solid Oxide Fuel Cell (SOFC) technology, SOECs have transitioned from laboratory curiosities to promising industrial solutions for clean hydrogen production and carbon dioxide utilization. The fundamental operating principle—using high-temperature electrolysis to split water or carbon dioxide molecules—has remained consistent, while materials, designs, and applications have undergone substantial refinement.

The evolution of SOEC technology can be traced through several distinct phases. The pioneering phase (1980s-1990s) focused on basic proof-of-concept and fundamental electrochemical understanding. The development phase (2000s-early 2010s) saw significant improvements in cell materials, particularly electrolytes transitioning from purely yttria-stabilized zirconia (YSZ) to more advanced composite and doped materials with enhanced ionic conductivity.

The current optimization phase (mid-2010s-present) has been characterized by innovations addressing key challenges: durability enhancement, reduction of operating temperatures, and scale-up for industrial implementation. Patent activity has accelerated dramatically during this period, with particular focus on novel electrode materials, cell architectures, and system integration approaches.

The primary technical objectives driving SOEC development include achieving higher conversion efficiencies (currently approaching 90% electrical-to-chemical efficiency), extending operational lifetimes beyond 40,000 hours, reducing degradation rates to below 0.5% per 1000 hours, and decreasing manufacturing costs to make the technology economically competitive with conventional hydrogen production methods.

Recent patent trends reveal increasing interest in reversible solid oxide cells (rSOCs) that can function in both fuel cell and electrolysis modes, offering flexibility for grid balancing and energy storage applications. Additionally, co-electrolysis of H2O and CO2 to produce syngas has emerged as a promising pathway for carbon utilization and synthetic fuel production, reflected in growing patent activity in this area.

The technological trajectory aims toward modular, scalable SOEC systems capable of integration with renewable energy sources, particularly addressing intermittency challenges through efficient energy storage. Long-term objectives include developing SOEC technology as a cornerstone of the hydrogen economy, enabling sector coupling between electricity, transportation, and industrial processes while contributing to decarbonization goals across multiple industries.

The evolution of SOEC technology can be traced through several distinct phases. The pioneering phase (1980s-1990s) focused on basic proof-of-concept and fundamental electrochemical understanding. The development phase (2000s-early 2010s) saw significant improvements in cell materials, particularly electrolytes transitioning from purely yttria-stabilized zirconia (YSZ) to more advanced composite and doped materials with enhanced ionic conductivity.

The current optimization phase (mid-2010s-present) has been characterized by innovations addressing key challenges: durability enhancement, reduction of operating temperatures, and scale-up for industrial implementation. Patent activity has accelerated dramatically during this period, with particular focus on novel electrode materials, cell architectures, and system integration approaches.

The primary technical objectives driving SOEC development include achieving higher conversion efficiencies (currently approaching 90% electrical-to-chemical efficiency), extending operational lifetimes beyond 40,000 hours, reducing degradation rates to below 0.5% per 1000 hours, and decreasing manufacturing costs to make the technology economically competitive with conventional hydrogen production methods.

Recent patent trends reveal increasing interest in reversible solid oxide cells (rSOCs) that can function in both fuel cell and electrolysis modes, offering flexibility for grid balancing and energy storage applications. Additionally, co-electrolysis of H2O and CO2 to produce syngas has emerged as a promising pathway for carbon utilization and synthetic fuel production, reflected in growing patent activity in this area.

The technological trajectory aims toward modular, scalable SOEC systems capable of integration with renewable energy sources, particularly addressing intermittency challenges through efficient energy storage. Long-term objectives include developing SOEC technology as a cornerstone of the hydrogen economy, enabling sector coupling between electricity, transportation, and industrial processes while contributing to decarbonization goals across multiple industries.

Market Analysis for Hydrogen Production via Electrolysis

The global hydrogen market is experiencing significant growth, driven by increasing demand for clean energy solutions and decarbonization efforts across industries. Currently valued at approximately $130 billion, the hydrogen market is projected to reach $500 billion by 2030, with electrolysis-based hydrogen production playing a pivotal role in this expansion. Green hydrogen, produced via electrolysis powered by renewable energy sources, is emerging as a particularly promising segment with projected annual growth rates of 50-60% through 2030.

Water electrolysis technologies, including alkaline electrolysis, proton exchange membrane (PEM) electrolysis, and solid oxide electrolysis cells (SOECs), are competing for market share. SOECs, while currently representing less than 5% of the electrolysis market, are gaining attention due to their superior efficiency potential, especially when integrated with high-temperature heat sources.

The cost structure of hydrogen production via electrolysis remains a critical market factor. Current production costs range from $3-8 per kilogram, with electricity costs accounting for 60-80% of total production expenses. SOEC technology offers potential cost advantages through higher electrical efficiency and the ability to utilize waste heat, potentially reducing production costs to below $2 per kilogram when scaled appropriately.

Regional market dynamics show Europe leading in electrolysis deployment with over 40% of global installed capacity, followed by Asia-Pacific and North America. China is rapidly expanding its electrolysis capabilities, with ambitious targets to deploy 100-200 GW of electrolysis capacity by 2035. Japan and South Korea are focusing on hydrogen as a key component of their energy transition strategies.

Key market drivers include strengthening policy support through subsidies and carbon pricing mechanisms, declining renewable electricity costs, and increasing industrial demand for low-carbon hydrogen. The steel, ammonia, and refining sectors represent the largest potential off-takers, collectively accounting for over 70% of industrial hydrogen demand.

Market barriers include high capital costs for electrolysis systems, currently ranging from $800-1,500/kW for SOECs, limited manufacturing scale, and infrastructure challenges related to hydrogen storage and transport. Additionally, regulatory frameworks for hydrogen certification and standardization remain underdeveloped in many regions.

Investment in the hydrogen electrolysis sector has grown substantially, with over $25 billion committed to electrolysis projects globally between 2020-2023. Venture capital and corporate investments in SOEC technology specifically have increased threefold since 2018, indicating growing market confidence in high-temperature electrolysis solutions.

Water electrolysis technologies, including alkaline electrolysis, proton exchange membrane (PEM) electrolysis, and solid oxide electrolysis cells (SOECs), are competing for market share. SOECs, while currently representing less than 5% of the electrolysis market, are gaining attention due to their superior efficiency potential, especially when integrated with high-temperature heat sources.

The cost structure of hydrogen production via electrolysis remains a critical market factor. Current production costs range from $3-8 per kilogram, with electricity costs accounting for 60-80% of total production expenses. SOEC technology offers potential cost advantages through higher electrical efficiency and the ability to utilize waste heat, potentially reducing production costs to below $2 per kilogram when scaled appropriately.

Regional market dynamics show Europe leading in electrolysis deployment with over 40% of global installed capacity, followed by Asia-Pacific and North America. China is rapidly expanding its electrolysis capabilities, with ambitious targets to deploy 100-200 GW of electrolysis capacity by 2035. Japan and South Korea are focusing on hydrogen as a key component of their energy transition strategies.

Key market drivers include strengthening policy support through subsidies and carbon pricing mechanisms, declining renewable electricity costs, and increasing industrial demand for low-carbon hydrogen. The steel, ammonia, and refining sectors represent the largest potential off-takers, collectively accounting for over 70% of industrial hydrogen demand.

Market barriers include high capital costs for electrolysis systems, currently ranging from $800-1,500/kW for SOECs, limited manufacturing scale, and infrastructure challenges related to hydrogen storage and transport. Additionally, regulatory frameworks for hydrogen certification and standardization remain underdeveloped in many regions.

Investment in the hydrogen electrolysis sector has grown substantially, with over $25 billion committed to electrolysis projects globally between 2020-2023. Venture capital and corporate investments in SOEC technology specifically have increased threefold since 2018, indicating growing market confidence in high-temperature electrolysis solutions.

SOEC Development Status and Technical Barriers

Solid Oxide Electrolysis Cells (SOECs) have emerged as a promising technology for efficient hydrogen production and carbon dioxide utilization. Currently, SOECs are being developed and demonstrated at various scales, from laboratory prototypes to early commercial systems. Leading research institutions in Europe, North America, and Asia have achieved significant breakthroughs in cell performance, with current density capabilities reaching 1-2 A/cm² at operating temperatures between 700-850°C.

Despite these advancements, widespread commercialization faces substantial technical barriers. Durability remains a primary challenge, with most state-of-the-art systems showing degradation rates of 1-2% per 1000 hours of operation, significantly higher than the 0.1-0.2% target needed for commercial viability. This degradation stems from multiple mechanisms including electrode delamination, chromium poisoning, and microstructural changes during thermal cycling.

Material limitations constitute another major barrier. Current ceramic-based electrodes and electrolytes struggle with mechanical stability under thermal cycling conditions. The oxygen electrode, typically composed of perovskite materials, suffers from delamination and chemical instability when operated at high current densities. Meanwhile, hydrogen electrodes face challenges with carbon deposition when using hydrocarbon fuels.

Cost-effectiveness presents an additional hurdle. Current SOEC stack manufacturing costs exceed $2000/kW, significantly higher than the $500/kW threshold considered necessary for market competitiveness. This is largely due to expensive ceramic materials and complex manufacturing processes requiring high-temperature sintering and precise quality control.

System integration challenges further complicate SOEC deployment. The high operating temperatures necessitate sophisticated thermal management systems and specialized balance-of-plant components capable of withstanding extreme conditions. Additionally, the integration with renewable energy sources requires advanced control systems to manage intermittent power inputs while maintaining stable electrolyzer operation.

Patent landscape analysis reveals concentrated intellectual property ownership among a few key players. Companies like Sunfire, Haldor Topsoe, and Bloom Energy hold significant patent portfolios covering cell architecture, materials, and system design. Academic institutions, particularly in Denmark, Germany, and the United States, contribute substantially to fundamental research patents, though commercialization pathways remain challenging.

Recent innovations focus on intermediate-temperature SOECs operating at 500-650°C, which could mitigate several degradation mechanisms while enabling the use of less expensive materials and simpler system designs. However, these advances introduce new challenges in ionic conductivity and electrode kinetics that require further research and development.

Despite these advancements, widespread commercialization faces substantial technical barriers. Durability remains a primary challenge, with most state-of-the-art systems showing degradation rates of 1-2% per 1000 hours of operation, significantly higher than the 0.1-0.2% target needed for commercial viability. This degradation stems from multiple mechanisms including electrode delamination, chromium poisoning, and microstructural changes during thermal cycling.

Material limitations constitute another major barrier. Current ceramic-based electrodes and electrolytes struggle with mechanical stability under thermal cycling conditions. The oxygen electrode, typically composed of perovskite materials, suffers from delamination and chemical instability when operated at high current densities. Meanwhile, hydrogen electrodes face challenges with carbon deposition when using hydrocarbon fuels.

Cost-effectiveness presents an additional hurdle. Current SOEC stack manufacturing costs exceed $2000/kW, significantly higher than the $500/kW threshold considered necessary for market competitiveness. This is largely due to expensive ceramic materials and complex manufacturing processes requiring high-temperature sintering and precise quality control.

System integration challenges further complicate SOEC deployment. The high operating temperatures necessitate sophisticated thermal management systems and specialized balance-of-plant components capable of withstanding extreme conditions. Additionally, the integration with renewable energy sources requires advanced control systems to manage intermittent power inputs while maintaining stable electrolyzer operation.

Patent landscape analysis reveals concentrated intellectual property ownership among a few key players. Companies like Sunfire, Haldor Topsoe, and Bloom Energy hold significant patent portfolios covering cell architecture, materials, and system design. Academic institutions, particularly in Denmark, Germany, and the United States, contribute substantially to fundamental research patents, though commercialization pathways remain challenging.

Recent innovations focus on intermediate-temperature SOECs operating at 500-650°C, which could mitigate several degradation mechanisms while enabling the use of less expensive materials and simpler system designs. However, these advances introduce new challenges in ionic conductivity and electrode kinetics that require further research and development.

Current SOEC Design Solutions and Implementations

01 Electrode materials and structures for SOECs

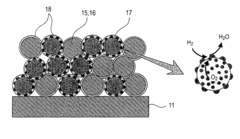

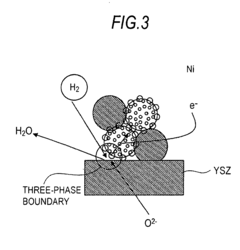

Various electrode materials and structures are used in solid oxide electrolysis cells to enhance performance and durability. These include specialized cathode and anode materials that can withstand high operating temperatures while maintaining electrochemical activity. Advanced electrode designs may incorporate composite structures, nanoparticles, or porous architectures to increase active surface area and improve reaction kinetics. These materials and structures are critical for efficient hydrogen or syngas production through electrolysis.- Electrode materials and structures for solid oxide electrolysis cells: Various electrode materials and structures can be used in solid oxide electrolysis cells to improve performance and durability. These include specialized cathode and anode materials that enhance electrochemical reactions, reduce degradation, and improve conductivity. Advanced electrode structures such as porous designs facilitate gas diffusion and increase active reaction sites, while composite electrodes combining multiple materials can provide synergistic benefits for electrolysis efficiency.

- Electrolyte compositions for high-temperature operation: Specialized electrolyte compositions are developed for solid oxide electrolysis cells operating at high temperatures. These electrolytes typically feature enhanced ionic conductivity, thermal stability, and mechanical strength to withstand the harsh operating conditions. Materials such as yttria-stabilized zirconia (YSZ), gadolinium-doped ceria (GDC), and other ceramic composites are engineered to maintain performance while minimizing degradation during extended high-temperature operation.

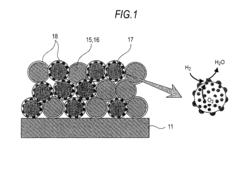

- System integration and stack design for solid oxide electrolysis: Advanced stack designs and system integration approaches are crucial for efficient solid oxide electrolysis cell operation. These include innovative cell stacking configurations, sealing technologies, and interconnect designs that minimize electrical resistance and thermal stress. Complete systems incorporate thermal management, gas handling, and control subsystems to optimize hydrogen or syngas production while ensuring long-term stability and safety during operation.

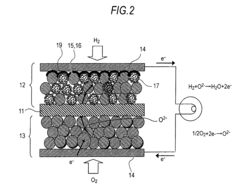

- Reversible operation and co-electrolysis capabilities: Solid oxide cells can be designed for reversible operation, functioning as both fuel cells and electrolysis cells depending on operational needs. These reversible systems offer flexibility for energy storage and conversion applications. Additionally, co-electrolysis capabilities allow simultaneous electrolysis of water and carbon dioxide to produce syngas (H₂ and CO mixture), which can be further processed into various hydrocarbon fuels and chemicals, enhancing the versatility of solid oxide electrolysis technology.

- Manufacturing methods and cost reduction techniques: Various manufacturing methods and cost reduction techniques are employed to make solid oxide electrolysis cells more commercially viable. These include advanced ceramic processing techniques, thin-film deposition methods, and scalable production processes that maintain quality while reducing material usage. Novel approaches such as 3D printing, tape casting, and infiltration techniques help optimize cell performance while decreasing manufacturing complexity and overall system costs.

02 Electrolyte compositions for high-temperature operation

Specialized electrolyte materials are developed for solid oxide electrolysis cells that can operate at high temperatures (700-900°C). These electrolytes, typically based on yttria-stabilized zirconia (YSZ) or other ceramic materials, must exhibit high ionic conductivity while maintaining mechanical and chemical stability under operating conditions. Advanced compositions may include doped ceramics or composite structures to enhance performance and reduce degradation during long-term operation.Expand Specific Solutions03 System integration and stack design

Effective integration of solid oxide electrolysis cells into complete systems requires specialized stack designs that address thermal management, gas flow distribution, and electrical connections. These systems may incorporate advanced sealing technologies to prevent gas leakage at high temperatures, interconnect materials that resist oxidation, and thermal cycling management strategies. Optimized stack designs can improve overall system efficiency, durability, and economic viability for industrial applications.Expand Specific Solutions04 Reversible operation for energy storage applications

Solid oxide cells can be designed for reversible operation, functioning as both fuel cells (generating electricity) and electrolysis cells (producing hydrogen or syngas). This reversibility makes them valuable for energy storage applications, where excess renewable energy can be converted to storable fuels and later reconverted to electricity when needed. Special materials and designs are required to maintain performance in both operating modes and to withstand the stresses of switching between them.Expand Specific Solutions05 Co-electrolysis for syngas production

Solid oxide electrolysis cells can be used for co-electrolysis of steam and carbon dioxide to produce syngas (a mixture of hydrogen and carbon monoxide), which serves as a precursor for synthetic fuels and chemicals. This process requires specialized catalysts and operating conditions to optimize the ratio of hydrogen to carbon monoxide in the product gas. Co-electrolysis technology offers a pathway for carbon utilization and production of sustainable hydrocarbon fuels using renewable electricity.Expand Specific Solutions

Leading Companies and Research Institutions in SOEC Field

The solid oxide electrolysis cells (SOEC) market is in a growth phase, with increasing patent activity reflecting its emerging importance in green hydrogen production and energy storage. The global market is projected to expand significantly as countries pursue decarbonization strategies. Technologically, the field shows varying maturity levels across players. Academic institutions like Tsinghua University, Technical University of Denmark, and Georgia Tech are advancing fundamental research, while industrial leaders including Samsung Electro-Mechanics, Toshiba, and Hyundai are developing commercial applications. Chinese entities (CAS institutes, Sinopec) are rapidly increasing patent filings, while established energy companies (Phillips 66, Linde) focus on integration with existing infrastructure. European and Japanese firms demonstrate particular strength in system efficiency and durability innovations.

Technical University of Denmark

Technical Solution: The Technical University of Denmark (DTU) has pioneered significant innovations in SOEC technology through their Department of Energy Conversion and Storage. Their patented cell designs feature metal-supported SOECs that dramatically improve mechanical robustness while reducing materials costs. DTU has developed proprietary infiltration techniques for nano-structured electrodes that enhance triple-phase boundary length and catalytic activity. Their research has yielded breakthrough composite oxygen electrodes containing lanthanum strontium cobalt ferrite (LSCF) and gadolinium-doped ceria (CGO) that demonstrate exceptional durability under high current density operation (>2 A/cm²). DTU's reversible solid oxide cell technology enables efficient operation in both electrolysis and fuel cell modes with minimal performance degradation during mode switching. Their innovations include specialized protective coatings for interconnects that have demonstrated corrosion resistance for over 20,000 hours of operation at 750°C, addressing one of the key challenges in SOEC commercialization.

Strengths: Exceptional expertise in materials science and electrochemistry with demonstrated long-term durability solutions and innovative manufacturing approaches that reduce production costs. Weaknesses: Some of their advanced materials solutions involve rare earth elements that may face supply chain constraints, and their metal-supported cell technology requires specialized manufacturing capabilities not widely available in the industry.

Dalian Institute of Chemical Physics of CAS

Technical Solution: The Dalian Institute of Chemical Physics (DICP) has developed proprietary SOEC technology focused on intermediate-temperature operation (600-750°C) that balances performance with durability. Their patented innovations include novel composite electrodes incorporating nanostructured perovskite materials that demonstrate exceptional electrochemical performance. DICP has pioneered the development of proton-conducting ceramic electrolytes based on doped barium zirconate-cerate materials that enable efficient hydrogen production at lower temperatures than conventional oxygen-ion conducting SOECs. Their research includes advanced manufacturing techniques for asymmetric cell structures with ultra-thin electrolytes (5-10 μm) supported on porous electrodes, achieving area-specific resistances below 0.15 Ω·cm² at 700°C. DICP has demonstrated integrated SOEC systems for CO₂ electrolysis with conversion efficiencies exceeding 85% and remarkable stability, showing degradation rates below 0.5% per 1000 hours during extended testing. Their technology has been successfully scaled to stack level with proprietary sealing solutions that maintain gas-tightness through multiple thermal cycles.

Strengths: Leading expertise in intermediate-temperature SOEC operation and proton-conducting ceramics with demonstrated high efficiency and stability. Their technology shows excellent performance in both steam and CO₂ electrolysis applications. Weaknesses: Their advanced materials and manufacturing approaches may face challenges in cost-effective mass production, and their proton-conducting electrolyte technology is less mature than conventional oxygen-ion conducting systems.

Key Patent Analysis in SOEC Innovation

Solid oxide electrochemical cell and processes for producing the same

PatentActiveUS20090220837A1

Innovation

- A hydrogen electrode is developed with a conductive film having mixed conductivity, using an oxide sinter with fine metal particles (Ni, Co, Fe, or Cu) deposited on an aluminum-based or magnesium-based oxide, coated with a mixed conductivity film, and a conductive layer with high porosity and metal materials, ensuring effective contact with a current collector and reducing thermal expansion differences.

Composite oxygen electrode and method

PatentWO2010121828A1

Innovation

- A composite oxygen electrode with a porous backbone structure comprising two percolating phases (electronic and oxide ion conducting phases) and an electrocatalytic layer of randomly distributed nanoparticles, which enhances conductivity and stability by eliminating porosity and ensuring good contact between phases, thereby improving electrical performance and matching thermal expansion coefficients with other cell materials.

Materials Science Advancements for SOEC Durability

Recent advancements in materials science have significantly contributed to enhancing the durability of Solid Oxide Electrolysis Cells (SOECs). The primary challenge in SOEC technology has been the degradation of cell components during long-term operation at high temperatures (700-850°C). Material innovations have focused on addressing this critical issue through the development of more robust electrodes, electrolytes, and interconnects.

Perovskite-structured materials have emerged as promising candidates for oxygen electrodes, with patents highlighting lanthanum strontium cobalt ferrite (LSCF) and barium strontium cobalt ferrite (BSCF) compositions that demonstrate improved stability under electrolysis conditions. These materials exhibit reduced chromium poisoning and enhanced resistance to delamination, which are common failure modes in conventional electrodes.

For hydrogen electrodes, nickel-based cermet materials remain dominant, but recent innovations have introduced ceramic-infiltrated structures that minimize nickel agglomeration during operation. Patent US10263255B2 describes a novel approach using scandium-doped zirconia scaffolds infiltrated with nickel nanoparticles, resulting in a 40% improvement in durability under cyclic operation compared to conventional Ni-YSZ cermets.

Electrolyte materials have also undergone significant development, with scandia-stabilized zirconia (ScSZ) and gadolinium-doped ceria (GDC) showing superior ionic conductivity and mechanical stability compared to traditional yttria-stabilized zirconia (YSZ). These materials enable lower operating temperatures, which inherently reduces degradation rates across all cell components.

Protective coatings represent another critical innovation area, with multiple patents describing atomic layer deposition (ALD) techniques for applying nanoscale protective layers to vulnerable components. These coatings effectively mitigate chromium volatilization from metallic interconnects and prevent silicon poisoning at the electrode-electrolyte interfaces.

Composite materials that combine the beneficial properties of multiple constituents have shown remarkable promise. Patent EP3456934A1 details a composite oxygen electrode with a graded functional layer that gradually transitions from electrolyte to electrode composition, significantly reducing thermal expansion mismatches and associated mechanical stresses during thermal cycling.

Recent innovations have also focused on self-healing materials that can repair microcracks during operation. These materials incorporate secondary phases that react with oxygen or hydrogen to form expansion products that fill developing cracks, thereby extending cell lifetime under demanding industrial conditions.

Perovskite-structured materials have emerged as promising candidates for oxygen electrodes, with patents highlighting lanthanum strontium cobalt ferrite (LSCF) and barium strontium cobalt ferrite (BSCF) compositions that demonstrate improved stability under electrolysis conditions. These materials exhibit reduced chromium poisoning and enhanced resistance to delamination, which are common failure modes in conventional electrodes.

For hydrogen electrodes, nickel-based cermet materials remain dominant, but recent innovations have introduced ceramic-infiltrated structures that minimize nickel agglomeration during operation. Patent US10263255B2 describes a novel approach using scandium-doped zirconia scaffolds infiltrated with nickel nanoparticles, resulting in a 40% improvement in durability under cyclic operation compared to conventional Ni-YSZ cermets.

Electrolyte materials have also undergone significant development, with scandia-stabilized zirconia (ScSZ) and gadolinium-doped ceria (GDC) showing superior ionic conductivity and mechanical stability compared to traditional yttria-stabilized zirconia (YSZ). These materials enable lower operating temperatures, which inherently reduces degradation rates across all cell components.

Protective coatings represent another critical innovation area, with multiple patents describing atomic layer deposition (ALD) techniques for applying nanoscale protective layers to vulnerable components. These coatings effectively mitigate chromium volatilization from metallic interconnects and prevent silicon poisoning at the electrode-electrolyte interfaces.

Composite materials that combine the beneficial properties of multiple constituents have shown remarkable promise. Patent EP3456934A1 details a composite oxygen electrode with a graded functional layer that gradually transitions from electrolyte to electrode composition, significantly reducing thermal expansion mismatches and associated mechanical stresses during thermal cycling.

Recent innovations have also focused on self-healing materials that can repair microcracks during operation. These materials incorporate secondary phases that react with oxygen or hydrogen to form expansion products that fill developing cracks, thereby extending cell lifetime under demanding industrial conditions.

Economic Viability and Scaling Challenges

The economic viability of solid oxide electrolysis cells (SOECs) remains a significant challenge despite their promising technological advantages. Current cost structures reveal that SOEC systems require substantial capital investment, with estimates ranging from $800-1,500/kW for stack components alone. When factoring in balance-of-plant equipment, installation costs, and system integration, total capital expenditures can reach $2,000-3,500/kW, significantly higher than competing hydrogen production technologies like alkaline electrolyzers.

Material costs constitute approximately 40-60% of SOEC stack expenses, with rare earth elements and specialized ceramics commanding premium prices. The manufacturing processes for these complex ceramic-metal assemblies further inflate costs due to high-temperature sintering requirements and precision fabrication techniques. Patent analysis reveals that major industry players are increasingly focusing on cost reduction strategies, with over 30% of recent SOEC patents addressing manufacturing optimization and material substitution.

Scaling challenges present additional economic hurdles. Laboratory-scale SOEC demonstrations have achieved impressive efficiencies, but commercial-scale implementation faces significant degradation issues. Current systems show performance degradation rates of 1-2% per 1,000 operating hours, substantially reducing lifetime economic returns. Patents from companies like Sunfire, Haldor Topsoe, and Bloom Energy indicate progress in addressing this challenge, with recent innovations claiming degradation rates below 0.5% per 1,000 hours.

Grid integration represents another scaling obstacle. SOECs operate most efficiently at constant high temperatures, but renewable energy sources provide intermittent power. This mismatch necessitates either thermal management systems or hybrid grid connections, both adding complexity and cost. Recent patent filings show increasing attention to thermal cycling resilience and rapid response capabilities to address this limitation.

Market analysis indicates that SOEC technology requires further cost reduction of 50-70% to achieve broad commercial viability without subsidies. However, in specialized applications like space-constrained industrial settings or integrated energy systems where waste heat is available, SOECs may reach economic competitiveness sooner. The learning curve suggests that with continued innovation and manufacturing scale-up, SOECs could achieve cost parity with conventional hydrogen production methods by 2030-2035, particularly in regions with low electricity costs and strong carbon pricing mechanisms.

Material costs constitute approximately 40-60% of SOEC stack expenses, with rare earth elements and specialized ceramics commanding premium prices. The manufacturing processes for these complex ceramic-metal assemblies further inflate costs due to high-temperature sintering requirements and precision fabrication techniques. Patent analysis reveals that major industry players are increasingly focusing on cost reduction strategies, with over 30% of recent SOEC patents addressing manufacturing optimization and material substitution.

Scaling challenges present additional economic hurdles. Laboratory-scale SOEC demonstrations have achieved impressive efficiencies, but commercial-scale implementation faces significant degradation issues. Current systems show performance degradation rates of 1-2% per 1,000 operating hours, substantially reducing lifetime economic returns. Patents from companies like Sunfire, Haldor Topsoe, and Bloom Energy indicate progress in addressing this challenge, with recent innovations claiming degradation rates below 0.5% per 1,000 hours.

Grid integration represents another scaling obstacle. SOECs operate most efficiently at constant high temperatures, but renewable energy sources provide intermittent power. This mismatch necessitates either thermal management systems or hybrid grid connections, both adding complexity and cost. Recent patent filings show increasing attention to thermal cycling resilience and rapid response capabilities to address this limitation.

Market analysis indicates that SOEC technology requires further cost reduction of 50-70% to achieve broad commercial viability without subsidies. However, in specialized applications like space-constrained industrial settings or integrated energy systems where waste heat is available, SOECs may reach economic competitiveness sooner. The learning curve suggests that with continued innovation and manufacturing scale-up, SOECs could achieve cost parity with conventional hydrogen production methods by 2030-2035, particularly in regions with low electricity costs and strong carbon pricing mechanisms.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!