Solid oxide electrolysis cells adaptation in various industrial sectors

OCT 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SOEC Technology Evolution and Objectives

Solid oxide electrolysis cells (SOECs) have evolved significantly since their conceptual development in the mid-20th century. Initially derived from solid oxide fuel cell (SOFC) technology, SOECs have transitioned from laboratory curiosities to commercially viable systems for energy conversion and storage. The fundamental operating principle—using high-temperature electrolysis to split water or carbon dioxide into valuable products—has remained consistent, while materials, designs, and applications have undergone substantial refinement.

The evolution of SOEC technology can be traced through several distinct phases. The pioneering phase (1980s-1990s) focused on basic materials research and proof-of-concept demonstrations. The development phase (2000s-early 2010s) saw significant improvements in cell durability and efficiency, with operating temperatures gradually decreasing from 1000°C to more manageable 700-800°C ranges. The current commercialization phase (2015-present) has witnessed the emergence of pilot and demonstration projects across various industrial sectors.

Key technological milestones include the development of more stable electrolyte materials, particularly yttria-stabilized zirconia (YSZ) and scandium-stabilized zirconia (ScSZ), which have enhanced ionic conductivity while maintaining mechanical integrity at high temperatures. Electrode materials have evolved from simple nickel-YSZ cermets to complex engineered structures incorporating advanced catalysts that minimize degradation during operation.

The primary objective of current SOEC research is to achieve widespread industrial adaptation through addressing several critical challenges. Foremost among these is reducing system costs, which remain prohibitively high for many applications. This cost reduction must be achieved while simultaneously improving durability, as current degradation rates of 1-2% per 1000 hours fall short of the <0.5% target needed for long-term industrial viability.

Another crucial objective is expanding operational flexibility to accommodate the variable nature of renewable energy sources. This includes developing systems capable of rapid start-up/shutdown cycles and operation under fluctuating power inputs—capabilities that traditional high-temperature ceramic systems have historically lacked.

The ultimate technological goal is to create versatile SOEC platforms that can be readily adapted across diverse industrial sectors, from hydrogen production and synthetic fuel synthesis to carbon capture utilization and metal processing. This requires standardized modular designs that can be scaled and customized according to specific industry requirements while maintaining performance integrity and economic viability.

The evolution of SOEC technology can be traced through several distinct phases. The pioneering phase (1980s-1990s) focused on basic materials research and proof-of-concept demonstrations. The development phase (2000s-early 2010s) saw significant improvements in cell durability and efficiency, with operating temperatures gradually decreasing from 1000°C to more manageable 700-800°C ranges. The current commercialization phase (2015-present) has witnessed the emergence of pilot and demonstration projects across various industrial sectors.

Key technological milestones include the development of more stable electrolyte materials, particularly yttria-stabilized zirconia (YSZ) and scandium-stabilized zirconia (ScSZ), which have enhanced ionic conductivity while maintaining mechanical integrity at high temperatures. Electrode materials have evolved from simple nickel-YSZ cermets to complex engineered structures incorporating advanced catalysts that minimize degradation during operation.

The primary objective of current SOEC research is to achieve widespread industrial adaptation through addressing several critical challenges. Foremost among these is reducing system costs, which remain prohibitively high for many applications. This cost reduction must be achieved while simultaneously improving durability, as current degradation rates of 1-2% per 1000 hours fall short of the <0.5% target needed for long-term industrial viability.

Another crucial objective is expanding operational flexibility to accommodate the variable nature of renewable energy sources. This includes developing systems capable of rapid start-up/shutdown cycles and operation under fluctuating power inputs—capabilities that traditional high-temperature ceramic systems have historically lacked.

The ultimate technological goal is to create versatile SOEC platforms that can be readily adapted across diverse industrial sectors, from hydrogen production and synthetic fuel synthesis to carbon capture utilization and metal processing. This requires standardized modular designs that can be scaled and customized according to specific industry requirements while maintaining performance integrity and economic viability.

Industrial Market Demand Analysis

The global market for Solid Oxide Electrolysis Cells (SOECs) is experiencing significant growth driven by increasing industrial demand for clean hydrogen production and carbon reduction technologies. Current market assessments indicate that the industrial hydrogen market alone represents a substantial opportunity, with global demand exceeding 70 million tons annually, primarily for ammonia production, petroleum refining, and methanol synthesis. This established demand provides a ready market for SOEC technology adoption.

Energy-intensive industries such as steel manufacturing, cement production, and chemical processing are actively seeking decarbonization solutions, creating a robust market pull for SOEC technology. The steel industry, which contributes approximately 7-9% of global CO2 emissions, has begun pilot projects utilizing hydrogen produced via electrolysis as a reducing agent to replace coal in the production process, signaling strong future demand potential.

Market analysis reveals regional variations in SOEC adoption readiness. European markets show the highest immediate demand due to stringent carbon regulations and substantial government support for hydrogen infrastructure. The European Hydrogen Strategy targets 40GW of electrolyzer capacity by 2030, creating significant market opportunities for SOEC deployment. Asian markets, particularly Japan, South Korea, and increasingly China, demonstrate growing interest driven by national hydrogen roadmaps and energy security concerns.

The power-to-X sector represents another significant market opportunity, where SOECs can convert surplus renewable electricity into storable chemical energy carriers. This application addresses grid balancing challenges associated with intermittent renewable generation, with market projections suggesting this segment could grow at a compound annual rate exceeding 20% through 2030.

Industrial heat applications constitute an emerging market segment for SOECs, as their high-temperature operation makes them particularly suitable for integration with industrial processes requiring both heat and hydrogen. Industries such as glass manufacturing, ceramics production, and certain chemical processes could benefit from this dual-output capability, expanding the total addressable market.

Customer requirements analysis indicates that industrial adopters prioritize reliability, durability, and total cost of ownership over initial capital expenditure. Survey data from potential industrial users highlights that achieving operational lifetimes exceeding 40,000 hours and system efficiencies above 80% are critical thresholds for widespread adoption across multiple sectors.

Energy-intensive industries such as steel manufacturing, cement production, and chemical processing are actively seeking decarbonization solutions, creating a robust market pull for SOEC technology. The steel industry, which contributes approximately 7-9% of global CO2 emissions, has begun pilot projects utilizing hydrogen produced via electrolysis as a reducing agent to replace coal in the production process, signaling strong future demand potential.

Market analysis reveals regional variations in SOEC adoption readiness. European markets show the highest immediate demand due to stringent carbon regulations and substantial government support for hydrogen infrastructure. The European Hydrogen Strategy targets 40GW of electrolyzer capacity by 2030, creating significant market opportunities for SOEC deployment. Asian markets, particularly Japan, South Korea, and increasingly China, demonstrate growing interest driven by national hydrogen roadmaps and energy security concerns.

The power-to-X sector represents another significant market opportunity, where SOECs can convert surplus renewable electricity into storable chemical energy carriers. This application addresses grid balancing challenges associated with intermittent renewable generation, with market projections suggesting this segment could grow at a compound annual rate exceeding 20% through 2030.

Industrial heat applications constitute an emerging market segment for SOECs, as their high-temperature operation makes them particularly suitable for integration with industrial processes requiring both heat and hydrogen. Industries such as glass manufacturing, ceramics production, and certain chemical processes could benefit from this dual-output capability, expanding the total addressable market.

Customer requirements analysis indicates that industrial adopters prioritize reliability, durability, and total cost of ownership over initial capital expenditure. Survey data from potential industrial users highlights that achieving operational lifetimes exceeding 40,000 hours and system efficiencies above 80% are critical thresholds for widespread adoption across multiple sectors.

Global SOEC Development Status and Barriers

Solid oxide electrolysis cells (SOECs) have gained significant traction globally, with development efforts concentrated in Europe, North America, and Asia. Europe leads SOEC advancement, with countries like Denmark, Germany, and France hosting major research institutions and companies such as Sunfire, Haldor Topsoe, and SOLIDpower. The European Union has invested substantially in SOEC technology through programs like Horizon 2020 and the European Green Deal, establishing a robust ecosystem for research and commercialization.

In North America, the United States has positioned itself as a key player through Department of Energy initiatives and national laboratory research at institutions like Idaho National Laboratory and Pacific Northwest National Laboratory. Companies including Bloom Energy and FuelCell Energy are actively developing commercial SOEC solutions, though market penetration remains limited compared to Europe.

Asia's SOEC landscape is dominated by Japan, South Korea, and increasingly China. Japan's New Energy and Industrial Technology Development Organization (NEDO) has supported significant SOEC research, while South Korea has integrated SOEC development into its hydrogen economy roadmap. China has rapidly expanded its research capabilities, with growing patent filings indicating increased activity.

Despite global progress, SOEC technology faces substantial barriers to widespread industrial adoption. Material degradation remains a critical challenge, with high operating temperatures (700-900°C) accelerating component deterioration and reducing system longevity. Current SOEC systems typically demonstrate degradation rates of 1-2% per 1000 hours, significantly higher than the 0.1-0.25% target needed for commercial viability in most applications.

Cost factors present another major barrier, with current SOEC systems costing approximately $2000-3000/kW, substantially higher than the $500-700/kW threshold considered necessary for competitive hydrogen production. Manufacturing scalability issues compound these economic challenges, as many production processes remain labor-intensive and difficult to automate.

System integration complexities further hinder adoption, as SOECs require sophisticated thermal management systems and specialized balance-of-plant components that add cost and complexity. Additionally, the intermittent nature of renewable energy sources necessitates advanced control systems to manage variable inputs while maintaining optimal operating conditions.

Regulatory frameworks and standardization remain underdeveloped globally, creating market uncertainty and impeding investment. While Europe has made progress in establishing hydrogen economy regulations, most regions lack comprehensive policies specifically addressing SOEC deployment across diverse industrial sectors.

In North America, the United States has positioned itself as a key player through Department of Energy initiatives and national laboratory research at institutions like Idaho National Laboratory and Pacific Northwest National Laboratory. Companies including Bloom Energy and FuelCell Energy are actively developing commercial SOEC solutions, though market penetration remains limited compared to Europe.

Asia's SOEC landscape is dominated by Japan, South Korea, and increasingly China. Japan's New Energy and Industrial Technology Development Organization (NEDO) has supported significant SOEC research, while South Korea has integrated SOEC development into its hydrogen economy roadmap. China has rapidly expanded its research capabilities, with growing patent filings indicating increased activity.

Despite global progress, SOEC technology faces substantial barriers to widespread industrial adoption. Material degradation remains a critical challenge, with high operating temperatures (700-900°C) accelerating component deterioration and reducing system longevity. Current SOEC systems typically demonstrate degradation rates of 1-2% per 1000 hours, significantly higher than the 0.1-0.25% target needed for commercial viability in most applications.

Cost factors present another major barrier, with current SOEC systems costing approximately $2000-3000/kW, substantially higher than the $500-700/kW threshold considered necessary for competitive hydrogen production. Manufacturing scalability issues compound these economic challenges, as many production processes remain labor-intensive and difficult to automate.

System integration complexities further hinder adoption, as SOECs require sophisticated thermal management systems and specialized balance-of-plant components that add cost and complexity. Additionally, the intermittent nature of renewable energy sources necessitates advanced control systems to manage variable inputs while maintaining optimal operating conditions.

Regulatory frameworks and standardization remain underdeveloped globally, creating market uncertainty and impeding investment. While Europe has made progress in establishing hydrogen economy regulations, most regions lack comprehensive policies specifically addressing SOEC deployment across diverse industrial sectors.

Current SOEC Implementation Solutions

01 Electrode materials and structures for SOECs

Various electrode materials and structures are used in solid oxide electrolysis cells to enhance performance and durability. These include specialized cathode and anode materials that can withstand high operating temperatures while maintaining conductivity. Advanced electrode designs incorporate porous structures to facilitate gas diffusion and reaction sites, while composite electrodes combine multiple materials to optimize electrochemical performance and stability during operation.- Electrode materials and structures for SOECs: Advanced electrode materials and structures are crucial for improving the performance of solid oxide electrolysis cells. These include novel cathode and anode compositions with enhanced catalytic activity, durability, and conductivity. Structured electrodes with optimized porosity and microstructure facilitate efficient gas diffusion and electrochemical reactions. Composite electrodes combining multiple functional materials can provide synergistic effects that enhance overall cell performance and longevity under high-temperature operating conditions.

- Electrolyte development for high-temperature operation: Electrolyte materials for solid oxide electrolysis cells must exhibit high ionic conductivity while maintaining stability at elevated temperatures. Research focuses on developing thin-film electrolytes to reduce ohmic resistance and improve overall efficiency. Advanced ceramic materials such as yttria-stabilized zirconia (YSZ), gadolinium-doped ceria (GDC), and lanthanum gallate-based compounds are being investigated to enhance oxygen ion transport while minimizing electronic conductivity. Composite and multilayer electrolyte structures can provide improved performance and thermal cycling resistance.

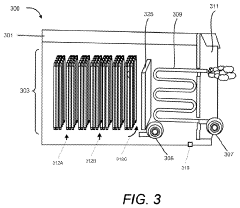

- System integration and stack design: Effective integration of solid oxide electrolysis cells into complete systems requires advanced stack designs that optimize electrical connections, gas flow distribution, and thermal management. Innovations in sealing technologies ensure gas-tight operation while accommodating thermal expansion during cycling. Modular approaches to stack assembly facilitate maintenance and scalability for industrial applications. Control systems that monitor and regulate operating parameters help maintain optimal performance and prevent degradation under varying load conditions.

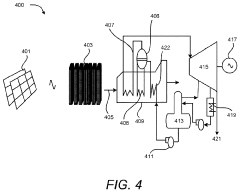

- High-efficiency hydrogen production methods: Advanced methods for hydrogen production using solid oxide electrolysis cells focus on improving energy efficiency and production rates. These include co-electrolysis of steam and carbon dioxide to produce syngas, pressurized operation to enhance thermodynamic efficiency, and integration with renewable energy sources for sustainable operation. Optimized operating parameters such as temperature profiles, gas composition, and current density distribution can significantly increase hydrogen yield while minimizing degradation mechanisms. Novel cell configurations enable direct production of compressed hydrogen, reducing downstream processing requirements.

- Degradation mechanisms and durability enhancement: Understanding and mitigating degradation mechanisms is essential for improving the long-term durability of solid oxide electrolysis cells. Research addresses issues such as chromium poisoning, electrode delamination, and electrolyte cracking through materials engineering and protective coatings. Thermal cycling resistance is enhanced through careful matching of thermal expansion coefficients and robust cell designs. Advanced manufacturing techniques produce more uniform microstructures with fewer defects that could serve as degradation initiation sites. Operational strategies including controlled startup/shutdown procedures and intermediate temperature operation can significantly extend cell lifetime.

02 Electrolyte compositions for high-temperature operation

Solid oxide electrolysis cells require specialized electrolyte materials that can conduct ions efficiently at high temperatures. These electrolytes are typically ceramic materials with high oxygen ion conductivity. Research focuses on developing thin-film electrolytes to reduce ohmic resistance and improve overall cell efficiency. Modified compositions with dopants are used to enhance ionic conductivity and mechanical stability under the harsh operating conditions of SOECs.Expand Specific Solutions03 System integration and stack design

The integration of solid oxide electrolysis cells into complete systems involves specialized stack designs that optimize electrical connections, gas flow, and thermal management. These systems include sealing technologies to prevent gas leakage between electrodes and interconnect components that provide electrical contact while withstanding high temperatures. Advanced stack configurations aim to minimize internal resistance and maximize active cell area while ensuring uniform temperature distribution across the stack.Expand Specific Solutions04 High-efficiency hydrogen production methods

Solid oxide electrolysis cells can be optimized for hydrogen production through various operational strategies and cell designs. These include co-electrolysis of steam and carbon dioxide, pressurized operation to improve thermodynamic efficiency, and integration with renewable energy sources. Advanced control systems manage input parameters such as temperature, voltage, and steam concentration to maximize hydrogen production rates while minimizing degradation of cell components.Expand Specific Solutions05 Degradation mechanisms and durability enhancement

Understanding and mitigating degradation mechanisms is crucial for improving the long-term durability of solid oxide electrolysis cells. Research focuses on addressing issues such as chromium poisoning, electrode delamination, and electrolyte cracking. Protective coatings, modified microstructures, and optimized operating conditions are employed to extend cell lifetime. Advanced characterization techniques help identify failure modes and develop strategies to enhance the stability of cell components during extended operation.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The solid oxide electrolysis cells (SOEC) market is currently in a growth phase, transitioning from early commercialization to wider industrial adoption. The global market is projected to expand significantly as industries seek decarbonization solutions, with estimates suggesting a multi-billion dollar opportunity by 2030. Technologically, SOECs are advancing toward commercial maturity, with leading academic institutions (Technical University of Denmark, Tsinghua University) conducting foundational research while industrial players develop practical applications. Companies like Phillips 66, Saudi Aramco, and Hyundai are exploring integration into existing industrial processes, while specialized firms such as Rondo Energy and CoorsTek focus on materials and system optimization. Chinese institutions and corporations (Sinopec, DICP) are making significant advances, challenging traditional Western leadership from Bosch and Toshiba in this emerging clean energy technology sector.

Technical University of Denmark

Technical Solution: The Technical University of Denmark (DTU) has developed cutting-edge SOEC technology through their Department of Energy Conversion and Storage. Their research focuses on advanced ceramic materials and cell architectures that enable high-efficiency electrolysis at temperatures between 650-850°C. DTU's approach incorporates novel electrode materials including lanthanum strontium cobalt ferrite cathodes and nickel-yttria stabilized zirconia anodes with enhanced catalytic properties. Their cells have demonstrated remarkable durability with degradation rates below 0.3% per 1000 hours during extended testing[7]. DTU has pioneered co-electrolysis processes that simultaneously convert steam and CO2 into syngas (H2 + CO), providing a direct pathway for producing synthetic fuels and chemicals. Their laboratory-scale systems have achieved electrical efficiencies exceeding 90% when accounting for heat integration, with current densities above 1 A/cm² at thermoneutral voltage[8]. DTU collaborates extensively with industrial partners to transfer their technology to commercial applications across sectors including chemicals, fuels, and steel manufacturing.

Strengths: World-leading research in materials science and cell design; exceptional performance metrics in laboratory testing; advanced co-electrolysis capabilities for syngas production. Weaknesses: Technology primarily at laboratory and small demonstration scale; requires further development for full commercial implementation; high-temperature operation presents materials challenges for long-term stability.

Battelle Energy Alliance LLC

Technical Solution: Battelle Energy Alliance has developed advanced solid oxide electrolysis cell (SOEC) technology for hydrogen production and carbon utilization. Their approach integrates high-temperature electrolysis with nuclear energy sources to provide clean power for industrial applications. The company's Idaho National Laboratory has pioneered reversible solid oxide cell systems that can operate in both fuel cell and electrolysis modes, allowing for flexible energy storage and production. Their technology incorporates novel electrode materials with enhanced durability and conductivity, enabling operation at temperatures between 700-850°C with improved efficiency. Battelle has also developed specialized sealing technologies to address one of the key challenges in SOEC deployment - maintaining gas-tight seals at high operating temperatures. Their systems have demonstrated hydrogen production rates exceeding 50 Nm³/h with electrical efficiency approaching 90% when accounting for heat integration[1][2].

Strengths: Integration with nuclear energy provides stable, carbon-free power source; reversible operation adds flexibility for grid balancing; advanced materials improve durability in harsh conditions. Weaknesses: High capital costs compared to conventional hydrogen production; requires specialized high-temperature infrastructure; limited commercial-scale demonstrations outside laboratory settings.

Critical Patents and Technical Innovations

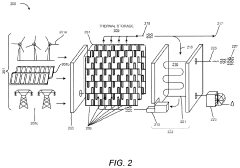

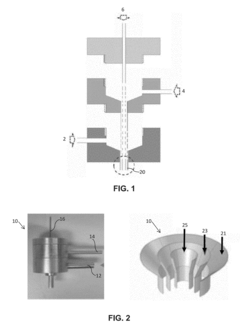

Thermal energy storage system coupled with a solid oxide electrolysis system

PatentActiveUS20230323793A1

Innovation

- A thermal energy storage system that uses vertically oriented thermal storage units with insulative layers and a dynamic insulation system to manage temperature balances and energy flow, coupled with a controller that adjusts energy output based on ambient conditions, allowing for efficient charging and discharging of high-temperature heat to solid oxide electrolysis systems.

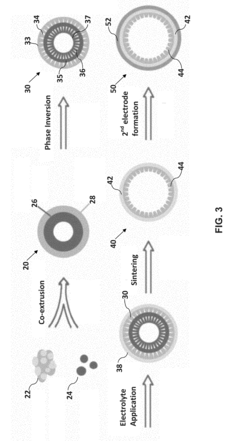

Fabrication Method For Micro-Tubular Solid Oxide Cells

PatentActiveUS20180053947A1

Innovation

- A method involving co-extrusion of multi-layer precursor tubes with a sacrificial layer, followed by phase inversion and sintering, creates a micro-channel array structure that enhances fuel/gas diffusion by forming a porous electrode substrate with improved porosity and surface area for electrochemical reactions.

Energy Policy Impact on SOEC Adoption

Energy policies across different regions significantly influence the adoption trajectory of Solid Oxide Electrolysis Cell (SOEC) technology in various industrial sectors. The European Union has established ambitious decarbonization targets through its Green Deal, providing substantial funding mechanisms specifically for hydrogen technologies, including SOECs. These policies create favorable market conditions through carbon pricing mechanisms, renewable energy subsidies, and direct research grants that accelerate SOEC commercialization efforts. The EU Hydrogen Strategy explicitly positions electrolysis as a cornerstone technology for achieving climate neutrality by 2050.

In North America, policy approaches vary significantly between countries and even states. The United States has recently strengthened its commitment through the Inflation Reduction Act, which allocates unprecedented funding for clean hydrogen production technologies. This legislation includes production tax credits specifically designed to make green hydrogen economically competitive with fossil-fuel alternatives, directly benefiting SOEC deployment. Canada has similarly developed a hydrogen strategy that emphasizes electrolysis technologies for industrial decarbonization.

Asia-Pacific nations demonstrate diverse policy landscapes regarding SOEC adoption. Japan's hydrogen roadmap prioritizes technological leadership in hydrogen technologies, with substantial government backing for research and demonstration projects. China's latest Five-Year Plan incorporates hydrogen as a frontier technology, with increasing support for electrolysis research and manufacturing capabilities to establish domestic supply chains for critical components.

Policy instruments that have proven most effective for SOEC adoption include technology-specific research funding, demonstration project support, and market creation mechanisms. Carbon pricing schemes, particularly in Europe, have begun shifting economic calculations in favor of green hydrogen production via electrolysis. Investment subsidies that reduce capital expenditure requirements for early adopters have successfully accelerated deployment in several pilot projects across multiple regions.

Regulatory frameworks addressing grid integration, renewable energy coupling, and safety standards for hydrogen production facilities also significantly impact adoption rates. Countries with streamlined permitting processes for hydrogen infrastructure and clear technical standards for electrolysis systems have demonstrated faster implementation of industrial-scale SOEC projects. The harmonization of these standards across jurisdictions remains a challenge but would substantially reduce market barriers for technology providers.

Future policy developments likely to shape SOEC adoption include increasingly stringent carbon emissions regulations, expanded green procurement requirements for industrial products, and potential hydrogen import/export regulations that may create international markets for SOEC-produced hydrogen and derivative products.

In North America, policy approaches vary significantly between countries and even states. The United States has recently strengthened its commitment through the Inflation Reduction Act, which allocates unprecedented funding for clean hydrogen production technologies. This legislation includes production tax credits specifically designed to make green hydrogen economically competitive with fossil-fuel alternatives, directly benefiting SOEC deployment. Canada has similarly developed a hydrogen strategy that emphasizes electrolysis technologies for industrial decarbonization.

Asia-Pacific nations demonstrate diverse policy landscapes regarding SOEC adoption. Japan's hydrogen roadmap prioritizes technological leadership in hydrogen technologies, with substantial government backing for research and demonstration projects. China's latest Five-Year Plan incorporates hydrogen as a frontier technology, with increasing support for electrolysis research and manufacturing capabilities to establish domestic supply chains for critical components.

Policy instruments that have proven most effective for SOEC adoption include technology-specific research funding, demonstration project support, and market creation mechanisms. Carbon pricing schemes, particularly in Europe, have begun shifting economic calculations in favor of green hydrogen production via electrolysis. Investment subsidies that reduce capital expenditure requirements for early adopters have successfully accelerated deployment in several pilot projects across multiple regions.

Regulatory frameworks addressing grid integration, renewable energy coupling, and safety standards for hydrogen production facilities also significantly impact adoption rates. Countries with streamlined permitting processes for hydrogen infrastructure and clear technical standards for electrolysis systems have demonstrated faster implementation of industrial-scale SOEC projects. The harmonization of these standards across jurisdictions remains a challenge but would substantially reduce market barriers for technology providers.

Future policy developments likely to shape SOEC adoption include increasingly stringent carbon emissions regulations, expanded green procurement requirements for industrial products, and potential hydrogen import/export regulations that may create international markets for SOEC-produced hydrogen and derivative products.

Cross-Sector Integration Strategies

The integration of Solid Oxide Electrolysis Cells (SOECs) across multiple industrial sectors requires strategic approaches that maximize synergies while addressing sector-specific challenges. A comprehensive cross-sector integration strategy begins with identifying common infrastructure requirements that can serve multiple industries simultaneously. For instance, developing centralized hydrogen production hubs using SOECs can simultaneously supply chemical manufacturing, steel production, and transportation sectors, creating economies of scale that reduce implementation costs for all stakeholders.

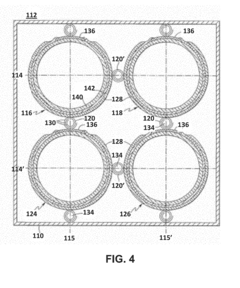

Standardization of SOEC modules represents another critical integration strategy. By designing modular systems with standardized interfaces and control protocols, manufacturers can produce units adaptable to various industrial settings with minimal customization. This approach significantly reduces manufacturing costs while accelerating deployment across sectors, particularly beneficial for industries with similar temperature and pressure requirements.

Knowledge transfer mechanisms between early-adopting sectors and emerging applications constitute an essential component of successful cross-sector integration. Industries with established SOEC implementations, such as chemical manufacturing, can provide valuable operational data and best practices to sectors like cement production that are in earlier stages of adoption. Formal industry consortia and collaborative research initiatives facilitate this knowledge exchange while distributing development costs.

Grid integration strategies represent another dimension of cross-sector implementation. SOECs can serve as flexible grid assets across multiple industries, providing demand response capabilities during periods of renewable energy abundance. This multi-sector grid balancing approach enhances the economic case for SOEC adoption while supporting broader energy system decarbonization goals.

Supply chain coordination across sectors presents both challenges and opportunities. Strategic co-location of SOEC facilities near multiple industrial users can optimize logistics while creating industrial symbiosis opportunities. For example, waste heat from one process can support SOEC operation for another application, while oxygen byproducts from electrolysis can serve adjacent industrial processes.

Finally, policy frameworks that recognize the cross-cutting nature of SOEC technology are essential for successful multi-sector deployment. Regulatory approaches that incentivize system-level benefits rather than sector-specific applications will accelerate adoption across the industrial landscape. This includes carbon pricing mechanisms that value emissions reductions consistently across sectors and innovation funding that prioritizes technologies with multi-sector applicability.

Standardization of SOEC modules represents another critical integration strategy. By designing modular systems with standardized interfaces and control protocols, manufacturers can produce units adaptable to various industrial settings with minimal customization. This approach significantly reduces manufacturing costs while accelerating deployment across sectors, particularly beneficial for industries with similar temperature and pressure requirements.

Knowledge transfer mechanisms between early-adopting sectors and emerging applications constitute an essential component of successful cross-sector integration. Industries with established SOEC implementations, such as chemical manufacturing, can provide valuable operational data and best practices to sectors like cement production that are in earlier stages of adoption. Formal industry consortia and collaborative research initiatives facilitate this knowledge exchange while distributing development costs.

Grid integration strategies represent another dimension of cross-sector implementation. SOECs can serve as flexible grid assets across multiple industries, providing demand response capabilities during periods of renewable energy abundance. This multi-sector grid balancing approach enhances the economic case for SOEC adoption while supporting broader energy system decarbonization goals.

Supply chain coordination across sectors presents both challenges and opportunities. Strategic co-location of SOEC facilities near multiple industrial users can optimize logistics while creating industrial symbiosis opportunities. For example, waste heat from one process can support SOEC operation for another application, while oxygen byproducts from electrolysis can serve adjacent industrial processes.

Finally, policy frameworks that recognize the cross-cutting nature of SOEC technology are essential for successful multi-sector deployment. Regulatory approaches that incentivize system-level benefits rather than sector-specific applications will accelerate adoption across the industrial landscape. This includes carbon pricing mechanisms that value emissions reductions consistently across sectors and innovation funding that prioritizes technologies with multi-sector applicability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!