Predictive Modeling for Ethylene Vinyl Acetate Market Trends

JUL 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EVA Market Evolution and Objectives

Ethylene Vinyl Acetate (EVA) has emerged as a versatile and essential material in various industries over the past few decades. The evolution of the EVA market can be traced back to the 1950s when it was first developed as a copolymer of ethylene and vinyl acetate. Since then, its unique properties, including flexibility, durability, and low-temperature toughness, have driven its adoption across multiple sectors.

The EVA market has experienced significant growth, particularly in the packaging, footwear, and solar panel industries. The packaging sector has been a major driver, with EVA's excellent sealing properties and resistance to moisture making it ideal for food packaging and flexible films. In the footwear industry, EVA has revolutionized the production of comfortable and lightweight shoes, especially in the sports and leisure segments.

The solar panel industry has been a game-changer for the EVA market in recent years. EVA's use as an encapsulant material in photovoltaic modules has led to a surge in demand, driven by the global push towards renewable energy sources. This application has opened up new avenues for market growth and technological innovation.

As we look towards the future, the objectives for the EVA market are multifaceted. One primary goal is to enhance the material's performance characteristics, particularly in terms of heat resistance and weatherability. This is crucial for expanding its applications in more demanding environments and improving the longevity of products using EVA.

Another key objective is to develop more sustainable production methods for EVA. With increasing environmental concerns, there is a growing emphasis on reducing the carbon footprint associated with EVA manufacturing. This includes exploring bio-based alternatives and improving energy efficiency in the production process.

The market also aims to diversify EVA applications further. While traditional sectors continue to drive demand, emerging fields such as 3D printing and medical devices present new opportunities. Developing specialized grades of EVA tailored to these novel applications is a focus area for many industry players.

Predictive modeling for EVA market trends is becoming increasingly important in this dynamic landscape. The objective is to create sophisticated models that can accurately forecast demand patterns, price fluctuations, and technological shifts. These models need to incorporate a wide range of factors, including global economic indicators, regulatory changes, and technological advancements in related fields.

By leveraging advanced data analytics and machine learning techniques, the industry aims to develop predictive tools that can guide strategic decision-making, from production planning to investment in research and development. This forward-looking approach is essential for maintaining competitiveness in a rapidly evolving market and ensuring that the EVA industry can meet the changing needs of its diverse customer base.

The EVA market has experienced significant growth, particularly in the packaging, footwear, and solar panel industries. The packaging sector has been a major driver, with EVA's excellent sealing properties and resistance to moisture making it ideal for food packaging and flexible films. In the footwear industry, EVA has revolutionized the production of comfortable and lightweight shoes, especially in the sports and leisure segments.

The solar panel industry has been a game-changer for the EVA market in recent years. EVA's use as an encapsulant material in photovoltaic modules has led to a surge in demand, driven by the global push towards renewable energy sources. This application has opened up new avenues for market growth and technological innovation.

As we look towards the future, the objectives for the EVA market are multifaceted. One primary goal is to enhance the material's performance characteristics, particularly in terms of heat resistance and weatherability. This is crucial for expanding its applications in more demanding environments and improving the longevity of products using EVA.

Another key objective is to develop more sustainable production methods for EVA. With increasing environmental concerns, there is a growing emphasis on reducing the carbon footprint associated with EVA manufacturing. This includes exploring bio-based alternatives and improving energy efficiency in the production process.

The market also aims to diversify EVA applications further. While traditional sectors continue to drive demand, emerging fields such as 3D printing and medical devices present new opportunities. Developing specialized grades of EVA tailored to these novel applications is a focus area for many industry players.

Predictive modeling for EVA market trends is becoming increasingly important in this dynamic landscape. The objective is to create sophisticated models that can accurately forecast demand patterns, price fluctuations, and technological shifts. These models need to incorporate a wide range of factors, including global economic indicators, regulatory changes, and technological advancements in related fields.

By leveraging advanced data analytics and machine learning techniques, the industry aims to develop predictive tools that can guide strategic decision-making, from production planning to investment in research and development. This forward-looking approach is essential for maintaining competitiveness in a rapidly evolving market and ensuring that the EVA industry can meet the changing needs of its diverse customer base.

Demand Analysis for EVA Products

The global Ethylene Vinyl Acetate (EVA) market has been experiencing steady growth, driven by increasing demand across various industries. The automotive sector stands out as a significant consumer of EVA products, particularly in the production of solar panel encapsulants, automotive parts, and wire and cable insulation. The construction industry also contributes substantially to EVA demand, utilizing the material in applications such as waterproofing membranes, adhesives, and sealants.

In the packaging industry, EVA finds extensive use in flexible packaging materials, contributing to the market's expansion. The footwear sector, especially in the production of sports shoes and comfort footwear, continues to be a major consumer of EVA products. The growing emphasis on sustainable and eco-friendly materials has led to increased adoption of EVA in biodegradable packaging solutions, further boosting market demand.

The Asia-Pacific region dominates the global EVA market, with China and India leading in consumption and production. This regional dominance is attributed to rapid industrialization, urbanization, and the presence of key end-use industries. North America and Europe follow, with steady demand from established manufacturing sectors and ongoing technological advancements.

Market analysts project a compound annual growth rate (CAGR) for the EVA market in the range of 4-6% over the next five years. This growth is expected to be fueled by innovations in EVA formulations, expanding applications in emerging industries, and increasing demand for high-performance materials in developed economies.

The renewable energy sector, particularly solar power, is anticipated to be a major driver of EVA demand in the coming years. As countries worldwide push for greater adoption of clean energy solutions, the demand for EVA in photovoltaic module encapsulation is expected to surge.

However, the market faces challenges such as volatility in raw material prices and environmental concerns related to the disposal of non-biodegradable EVA products. These factors are prompting industry players to invest in research and development of more sustainable EVA formulations and recycling technologies.

In conclusion, the demand analysis for EVA products reveals a positive outlook, with diverse applications across multiple industries driving market growth. The ability to adapt to evolving environmental regulations and meet the increasing demand for high-performance, sustainable materials will be crucial for stakeholders in the EVA market to capitalize on emerging opportunities and maintain competitive advantage.

In the packaging industry, EVA finds extensive use in flexible packaging materials, contributing to the market's expansion. The footwear sector, especially in the production of sports shoes and comfort footwear, continues to be a major consumer of EVA products. The growing emphasis on sustainable and eco-friendly materials has led to increased adoption of EVA in biodegradable packaging solutions, further boosting market demand.

The Asia-Pacific region dominates the global EVA market, with China and India leading in consumption and production. This regional dominance is attributed to rapid industrialization, urbanization, and the presence of key end-use industries. North America and Europe follow, with steady demand from established manufacturing sectors and ongoing technological advancements.

Market analysts project a compound annual growth rate (CAGR) for the EVA market in the range of 4-6% over the next five years. This growth is expected to be fueled by innovations in EVA formulations, expanding applications in emerging industries, and increasing demand for high-performance materials in developed economies.

The renewable energy sector, particularly solar power, is anticipated to be a major driver of EVA demand in the coming years. As countries worldwide push for greater adoption of clean energy solutions, the demand for EVA in photovoltaic module encapsulation is expected to surge.

However, the market faces challenges such as volatility in raw material prices and environmental concerns related to the disposal of non-biodegradable EVA products. These factors are prompting industry players to invest in research and development of more sustainable EVA formulations and recycling technologies.

In conclusion, the demand analysis for EVA products reveals a positive outlook, with diverse applications across multiple industries driving market growth. The ability to adapt to evolving environmental regulations and meet the increasing demand for high-performance, sustainable materials will be crucial for stakeholders in the EVA market to capitalize on emerging opportunities and maintain competitive advantage.

EVA Industry Challenges

The Ethylene Vinyl Acetate (EVA) industry faces several significant challenges that impact its growth and market dynamics. One of the primary concerns is the volatility of raw material prices, particularly ethylene and vinyl acetate monomer. These fluctuations directly affect production costs and profit margins, making it difficult for manufacturers to maintain consistent pricing strategies.

Environmental regulations pose another major challenge for the EVA industry. With increasing global focus on sustainability and reducing carbon footprints, manufacturers are under pressure to adopt more eco-friendly production processes and develop biodegradable alternatives. This transition requires substantial investments in research and development, as well as modifications to existing manufacturing facilities.

Market saturation in certain segments is becoming a growing concern. As the EVA industry matures, some applications are reaching saturation points, leading to intensified competition and potential price wars. This situation is particularly evident in traditional markets such as footwear and packaging, forcing companies to seek new applications and market niches to sustain growth.

The industry also grapples with quality control issues, especially in emerging markets where manufacturing standards may be less stringent. Inconsistent product quality can lead to performance issues in end-use applications, potentially damaging the reputation of EVA materials and limiting their adoption in high-performance sectors.

Technological advancements present both opportunities and challenges. While new technologies can improve production efficiency and product performance, they also require significant capital investments. Smaller players in the industry may struggle to keep pace with these advancements, leading to a potential consolidation of the market.

Geopolitical tensions and trade disputes add another layer of complexity to the EVA industry. Tariffs, trade barriers, and shifting global supply chains can disrupt the flow of raw materials and finished products, impacting production schedules and market access.

The COVID-19 pandemic has exposed vulnerabilities in supply chains and highlighted the need for greater resilience. The industry now faces the challenge of balancing just-in-time manufacturing practices with the need for buffer stocks to mitigate future disruptions.

Lastly, the EVA industry must contend with the challenge of predictive modeling itself. Accurately forecasting market trends, demand fluctuations, and pricing dynamics is becoming increasingly complex due to the multitude of factors influencing the industry. Developing robust predictive models that can account for these variables and provide actionable insights is a significant challenge that requires advanced data analytics capabilities and industry expertise.

Environmental regulations pose another major challenge for the EVA industry. With increasing global focus on sustainability and reducing carbon footprints, manufacturers are under pressure to adopt more eco-friendly production processes and develop biodegradable alternatives. This transition requires substantial investments in research and development, as well as modifications to existing manufacturing facilities.

Market saturation in certain segments is becoming a growing concern. As the EVA industry matures, some applications are reaching saturation points, leading to intensified competition and potential price wars. This situation is particularly evident in traditional markets such as footwear and packaging, forcing companies to seek new applications and market niches to sustain growth.

The industry also grapples with quality control issues, especially in emerging markets where manufacturing standards may be less stringent. Inconsistent product quality can lead to performance issues in end-use applications, potentially damaging the reputation of EVA materials and limiting their adoption in high-performance sectors.

Technological advancements present both opportunities and challenges. While new technologies can improve production efficiency and product performance, they also require significant capital investments. Smaller players in the industry may struggle to keep pace with these advancements, leading to a potential consolidation of the market.

Geopolitical tensions and trade disputes add another layer of complexity to the EVA industry. Tariffs, trade barriers, and shifting global supply chains can disrupt the flow of raw materials and finished products, impacting production schedules and market access.

The COVID-19 pandemic has exposed vulnerabilities in supply chains and highlighted the need for greater resilience. The industry now faces the challenge of balancing just-in-time manufacturing practices with the need for buffer stocks to mitigate future disruptions.

Lastly, the EVA industry must contend with the challenge of predictive modeling itself. Accurately forecasting market trends, demand fluctuations, and pricing dynamics is becoming increasingly complex due to the multitude of factors influencing the industry. Developing robust predictive models that can account for these variables and provide actionable insights is a significant challenge that requires advanced data analytics capabilities and industry expertise.

Current EVA Predictive Models

01 Composition and manufacturing of EVA copolymers

Various methods and compositions for producing ethylene vinyl acetate (EVA) copolymers are described. These include specific polymerization techniques, the use of different catalysts, and the incorporation of additional monomers to enhance properties. The resulting EVA copolymers have applications in diverse industries due to their unique characteristics.- Improved EVA compositions: Development of enhanced Ethylene Vinyl Acetate (EVA) compositions with improved properties such as increased flexibility, durability, and thermal resistance. These advancements cater to various industrial applications and market demands.

- EVA in packaging and film applications: Growing use of EVA in packaging and film applications due to its excellent sealing properties, clarity, and flexibility. This trend is driven by the increasing demand for sustainable and high-performance packaging materials in various industries.

- EVA foam technology advancements: Innovations in EVA foam technology, including improved manufacturing processes and formulations. These advancements lead to enhanced product performance in applications such as footwear, sports equipment, and automotive components.

- EVA in renewable energy applications: Increasing adoption of EVA in solar panel encapsulation and other renewable energy applications. This trend is driven by the growing demand for sustainable energy solutions and the material's excellent weathering resistance and durability.

- EVA copolymer blends and composites: Development of novel EVA copolymer blends and composites to enhance specific properties or create multifunctional materials. These innovations cater to emerging market needs in various sectors, including automotive, construction, and consumer goods.

02 EVA foam production and applications

EVA foam production techniques and their applications in various industries are discussed. These foams offer properties such as lightweight, flexibility, and shock absorption. The manufacturing processes involve crosslinking, foaming agents, and specific molding techniques to create products for sectors like footwear, packaging, and sports equipment.Expand Specific Solutions03 EVA blends and composites

The development of EVA blends and composites with other materials to enhance performance characteristics is explored. These blends can improve properties such as tensile strength, thermal stability, and chemical resistance. Applications range from adhesives to packaging materials and construction products.Expand Specific Solutions04 EVA in solar panel encapsulation

The use of EVA in solar panel encapsulation is a significant market trend. EVA's properties, such as transparency, weather resistance, and adhesion, make it ideal for protecting solar cells. Research focuses on improving EVA formulations to enhance long-term durability and efficiency of solar modules.Expand Specific Solutions05 Sustainable and bio-based EVA alternatives

There is a growing trend towards developing sustainable and bio-based alternatives to traditional EVA. This includes the incorporation of renewable resources and the development of biodegradable EVA variants. These innovations aim to address environmental concerns while maintaining the desirable properties of EVA.Expand Specific Solutions

Key EVA Market Players

The Predictive Modeling for Ethylene Vinyl Acetate (EVA) Market Trends is in a mature stage, with a growing market size driven by diverse applications across industries. The global EVA market is expected to expand steadily due to increasing demand in sectors such as packaging, solar panels, and footwear. Technologically, the field is well-established, with major players like China Petroleum & Chemical Corp., Kuraray Co., Ltd., and LG Chem Ltd. leading innovation. These companies, along with others like Celanese International Corp. and DuPont de Nemours, Inc., are investing in R&D to enhance EVA properties and explore new applications, indicating a competitive landscape focused on product differentiation and market expansion.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced predictive modeling techniques for the Ethylene Vinyl Acetate (EVA) market. Their approach combines machine learning algorithms with comprehensive market data analysis to forecast EVA demand, pricing trends, and production capacities. Sinopec's model incorporates factors such as global economic indicators, petrochemical feedstock prices, and end-use industry growth rates to generate accurate short-term and long-term predictions[1]. The company has also integrated real-time data from their production facilities and supply chain networks to enhance the model's accuracy and responsiveness to market changes[2]. Sinopec's predictive modeling system has been successful in optimizing their EVA production planning and inventory management, resulting in improved operational efficiency and market responsiveness[3].

Strengths: Extensive industry data access, integrated production and supply chain data, proven track record in petrochemical forecasting. Weaknesses: Potential bias towards Chinese market conditions, may require frequent updates to maintain accuracy in rapidly changing global markets.

Kuraray Co., Ltd.

Technical Solution: Kuraray Co., Ltd. has developed a sophisticated predictive modeling system for EVA market trends, leveraging its position as a leading global manufacturer of EVA resins. Their approach combines traditional time series analysis with advanced machine learning techniques, including neural networks and ensemble methods[4]. Kuraray's model incorporates a wide range of variables, such as raw material costs, energy prices, regional economic indicators, and end-use industry demand forecasts. The company has also implemented a unique feature that accounts for technological advancements and regulatory changes in key EVA application areas, such as solar panel encapsulation and packaging materials[5]. Kuraray's predictive modeling system is designed to provide insights across different grades of EVA, allowing for more nuanced market predictions and product development strategies.

Strengths: Comprehensive coverage of EVA grades and applications, strong focus on technological and regulatory factors. Weaknesses: May have limited visibility into competitor activities, potential for overfitting due to complex model structure.

Advanced EVA Forecasting Techniques

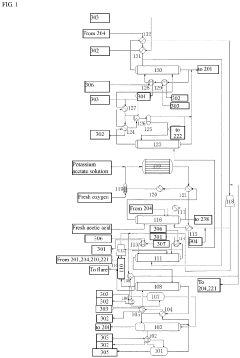

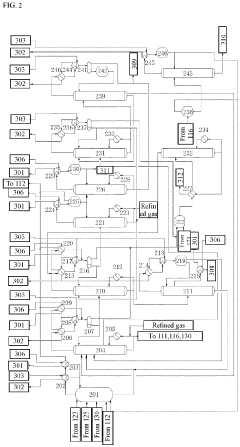

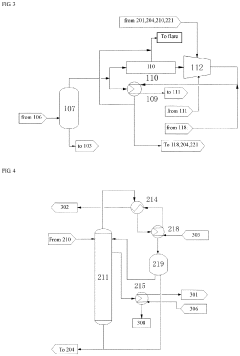

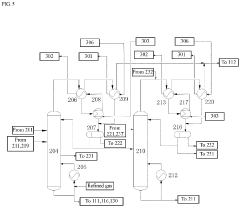

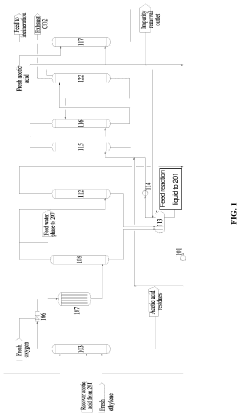

Preparation method of vinyl acetate by ethylene process and device thereof

PatentPendingEP4371972A1

Innovation

- A novel process incorporating an ethylene recovery membrane assembly, refined VAC tower side-draw stream additions, and improved cooling methods using circulating and chilled water for high-purity vinyl acetate production, reducing emissions and preventing material leakage by recovering ethylene and optimizing the distillation process.

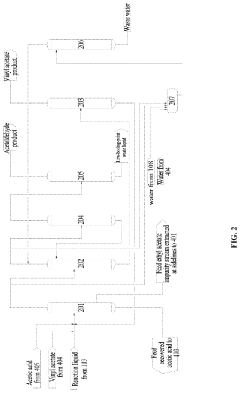

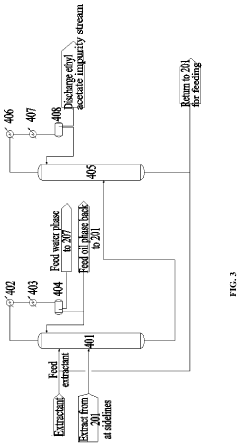

Method for producing vinyl acetate

PatentActiveUS20230312452A1

Innovation

- A method involving a gas phase oxidation process with a system integration that includes specific towers and reactors for ethylene recovery, acetic acid evaporation, oxygen mixing, and separation processes, utilizing acetic acid as an extractant in the rectifying and separating towers to enhance the separation of vinyl acetate from ethyl acetate.

EVA Supply Chain Dynamics

The EVA supply chain dynamics play a crucial role in shaping market trends and predictive modeling for the Ethylene Vinyl Acetate (EVA) industry. The supply chain for EVA encompasses a complex network of raw material suppliers, manufacturers, distributors, and end-users across various industries.

At the upstream level, the availability and pricing of key raw materials, primarily ethylene and vinyl acetate monomer (VAM), significantly impact the EVA supply chain. Fluctuations in oil and natural gas prices, which are the primary feedstocks for ethylene production, can cause ripple effects throughout the supply chain. Additionally, the capacity and production levels of VAM manufacturers directly influence the supply and cost dynamics of EVA.

The midstream segment of the EVA supply chain involves the production and processing of EVA resins. Manufacturers must carefully balance their production capacity with market demand to maintain optimal inventory levels and avoid supply disruptions. The ability to adjust production volumes and grades of EVA in response to changing market conditions is a critical factor in supply chain management.

Distribution networks play a vital role in connecting manufacturers with end-users across various industries. The efficiency and reliability of these networks can significantly impact lead times, transportation costs, and overall supply chain performance. Global trade dynamics, including tariffs, trade agreements, and geopolitical factors, can also influence the flow of EVA products across international markets.

End-user industries, such as packaging, footwear, solar panel manufacturing, and automotive, drive demand patterns in the EVA market. Changes in consumer preferences, technological advancements, and regulatory requirements in these sectors can lead to shifts in demand, affecting the entire supply chain. For instance, the growing adoption of solar energy has increased demand for EVA as an encapsulant material, creating new supply chain challenges and opportunities.

Inventory management strategies employed by various stakeholders in the supply chain can significantly impact market dynamics. Just-in-time inventory practices, common in industries like automotive manufacturing, require a highly responsive supply chain to meet fluctuating demand. Conversely, industries with more stable demand patterns may opt for larger inventory buffers to mitigate supply risks.

The increasing focus on sustainability and circular economy principles is reshaping EVA supply chain dynamics. Efforts to develop bio-based feedstocks for EVA production and improve recycling technologies for EVA products are gaining traction. These initiatives may lead to the emergence of new supply chain models and partnerships focused on closed-loop systems and material recovery.

At the upstream level, the availability and pricing of key raw materials, primarily ethylene and vinyl acetate monomer (VAM), significantly impact the EVA supply chain. Fluctuations in oil and natural gas prices, which are the primary feedstocks for ethylene production, can cause ripple effects throughout the supply chain. Additionally, the capacity and production levels of VAM manufacturers directly influence the supply and cost dynamics of EVA.

The midstream segment of the EVA supply chain involves the production and processing of EVA resins. Manufacturers must carefully balance their production capacity with market demand to maintain optimal inventory levels and avoid supply disruptions. The ability to adjust production volumes and grades of EVA in response to changing market conditions is a critical factor in supply chain management.

Distribution networks play a vital role in connecting manufacturers with end-users across various industries. The efficiency and reliability of these networks can significantly impact lead times, transportation costs, and overall supply chain performance. Global trade dynamics, including tariffs, trade agreements, and geopolitical factors, can also influence the flow of EVA products across international markets.

End-user industries, such as packaging, footwear, solar panel manufacturing, and automotive, drive demand patterns in the EVA market. Changes in consumer preferences, technological advancements, and regulatory requirements in these sectors can lead to shifts in demand, affecting the entire supply chain. For instance, the growing adoption of solar energy has increased demand for EVA as an encapsulant material, creating new supply chain challenges and opportunities.

Inventory management strategies employed by various stakeholders in the supply chain can significantly impact market dynamics. Just-in-time inventory practices, common in industries like automotive manufacturing, require a highly responsive supply chain to meet fluctuating demand. Conversely, industries with more stable demand patterns may opt for larger inventory buffers to mitigate supply risks.

The increasing focus on sustainability and circular economy principles is reshaping EVA supply chain dynamics. Efforts to develop bio-based feedstocks for EVA production and improve recycling technologies for EVA products are gaining traction. These initiatives may lead to the emergence of new supply chain models and partnerships focused on closed-loop systems and material recovery.

Sustainability in EVA Production

Sustainability in EVA production has become a critical focus for the ethylene vinyl acetate (EVA) industry, driven by increasing environmental concerns and regulatory pressures. The production of EVA traditionally involves energy-intensive processes and the use of fossil fuel-based raw materials, which contribute to significant carbon emissions and environmental impact. However, recent advancements in technology and growing market demand for eco-friendly products have spurred innovations in sustainable EVA production methods.

One of the key areas of improvement is the development of bio-based feedstocks for EVA production. Researchers are exploring the use of renewable resources, such as plant-based ethanol and acetic acid, to replace petroleum-derived raw materials. This shift not only reduces the carbon footprint of EVA production but also decreases dependence on finite fossil fuel resources. Several companies have already begun pilot projects to assess the feasibility and scalability of bio-based EVA production.

Energy efficiency in the manufacturing process is another crucial aspect of sustainability in EVA production. Advanced process control systems and heat integration techniques are being implemented to optimize energy consumption. Additionally, the use of renewable energy sources, such as solar and wind power, in EVA production facilities is gaining traction. These measures not only reduce greenhouse gas emissions but also lead to cost savings in the long run.

Waste reduction and recycling initiatives are also playing a significant role in enhancing the sustainability of EVA production. Closed-loop manufacturing systems are being developed to minimize waste generation and maximize resource utilization. Moreover, advancements in chemical recycling technologies are enabling the recovery and reuse of EVA materials from end-of-life products, further reducing the environmental impact of the industry.

Water management is another critical aspect of sustainable EVA production. Companies are implementing water-saving technologies and wastewater treatment systems to minimize water consumption and reduce the discharge of pollutants. Some facilities are exploring the use of rainwater harvesting and water recycling techniques to further improve their water efficiency.

The adoption of green chemistry principles in EVA production is gaining momentum. This approach focuses on designing chemical processes and products that reduce or eliminate the use and generation of hazardous substances. It includes the development of safer catalysts, solvents, and additives that minimize environmental and health risks associated with EVA production.

As the market demand for sustainable products continues to grow, EVA manufacturers are increasingly incorporating sustainability metrics into their product development and marketing strategies. Life cycle assessments (LCA) are being conducted to evaluate the environmental impact of EVA products from cradle to grave, enabling companies to identify areas for improvement and communicate their sustainability efforts to consumers and stakeholders.

One of the key areas of improvement is the development of bio-based feedstocks for EVA production. Researchers are exploring the use of renewable resources, such as plant-based ethanol and acetic acid, to replace petroleum-derived raw materials. This shift not only reduces the carbon footprint of EVA production but also decreases dependence on finite fossil fuel resources. Several companies have already begun pilot projects to assess the feasibility and scalability of bio-based EVA production.

Energy efficiency in the manufacturing process is another crucial aspect of sustainability in EVA production. Advanced process control systems and heat integration techniques are being implemented to optimize energy consumption. Additionally, the use of renewable energy sources, such as solar and wind power, in EVA production facilities is gaining traction. These measures not only reduce greenhouse gas emissions but also lead to cost savings in the long run.

Waste reduction and recycling initiatives are also playing a significant role in enhancing the sustainability of EVA production. Closed-loop manufacturing systems are being developed to minimize waste generation and maximize resource utilization. Moreover, advancements in chemical recycling technologies are enabling the recovery and reuse of EVA materials from end-of-life products, further reducing the environmental impact of the industry.

Water management is another critical aspect of sustainable EVA production. Companies are implementing water-saving technologies and wastewater treatment systems to minimize water consumption and reduce the discharge of pollutants. Some facilities are exploring the use of rainwater harvesting and water recycling techniques to further improve their water efficiency.

The adoption of green chemistry principles in EVA production is gaining momentum. This approach focuses on designing chemical processes and products that reduce or eliminate the use and generation of hazardous substances. It includes the development of safer catalysts, solvents, and additives that minimize environmental and health risks associated with EVA production.

As the market demand for sustainable products continues to grow, EVA manufacturers are increasingly incorporating sustainability metrics into their product development and marketing strategies. Life cycle assessments (LCA) are being conducted to evaluate the environmental impact of EVA products from cradle to grave, enabling companies to identify areas for improvement and communicate their sustainability efforts to consumers and stakeholders.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!