Roadmap For Industrial Adoption Of Generative Models In Materials R&D

SEP 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Generative AI in Materials Science: Background and Objectives

Generative artificial intelligence (AI) has emerged as a transformative force across various industries, and materials science stands as a frontier with immense potential for innovation. The evolution of generative models in materials research and development (R&D) represents a paradigm shift from traditional experimental and computational methods toward AI-driven discovery and design. Historically, materials development has been characterized by time-consuming trial-and-error approaches, with the average time from initial discovery to market application spanning 15-20 years.

The technological trajectory of generative AI in materials science has been accelerated by advances in machine learning architectures, particularly deep learning models capable of capturing complex material property relationships. Early applications focused primarily on property prediction, while recent developments have enabled inverse design capabilities—allowing researchers to specify desired properties and generate candidate materials that meet these criteria.

Current generative approaches in materials science include Generative Adversarial Networks (GANs), Variational Autoencoders (VAEs), and transformer-based models, each offering unique advantages for different material classes and applications. These technologies have demonstrated promising results in generating novel molecular structures, crystal lattices, and polymer compositions with tailored properties.

The primary objective of industrial adoption of generative models in materials R&D is to dramatically compress development timelines while expanding the accessible design space beyond human intuition. This includes accelerating the discovery of sustainable materials, optimizing performance characteristics, and enabling on-demand material design for specific applications across sectors including energy storage, catalysis, electronics, and structural materials.

Technical goals encompass developing robust generative frameworks capable of operating within physical and chemical constraints, integrating multi-modal data sources (experimental, computational, and literature-derived), and creating interpretable models that provide mechanistic insights alongside predictions. Additionally, there is a critical need for models that can effectively handle sparse and heterogeneous data typical in materials science.

The convergence of high-throughput experimental techniques, advanced computational simulation, and generative AI presents an unprecedented opportunity to establish a new paradigm in materials innovation. This technological synergy promises to address grand challenges in sustainability, energy efficiency, and advanced manufacturing through accelerated materials discovery and optimization.

The technological trajectory of generative AI in materials science has been accelerated by advances in machine learning architectures, particularly deep learning models capable of capturing complex material property relationships. Early applications focused primarily on property prediction, while recent developments have enabled inverse design capabilities—allowing researchers to specify desired properties and generate candidate materials that meet these criteria.

Current generative approaches in materials science include Generative Adversarial Networks (GANs), Variational Autoencoders (VAEs), and transformer-based models, each offering unique advantages for different material classes and applications. These technologies have demonstrated promising results in generating novel molecular structures, crystal lattices, and polymer compositions with tailored properties.

The primary objective of industrial adoption of generative models in materials R&D is to dramatically compress development timelines while expanding the accessible design space beyond human intuition. This includes accelerating the discovery of sustainable materials, optimizing performance characteristics, and enabling on-demand material design for specific applications across sectors including energy storage, catalysis, electronics, and structural materials.

Technical goals encompass developing robust generative frameworks capable of operating within physical and chemical constraints, integrating multi-modal data sources (experimental, computational, and literature-derived), and creating interpretable models that provide mechanistic insights alongside predictions. Additionally, there is a critical need for models that can effectively handle sparse and heterogeneous data typical in materials science.

The convergence of high-throughput experimental techniques, advanced computational simulation, and generative AI presents an unprecedented opportunity to establish a new paradigm in materials innovation. This technological synergy promises to address grand challenges in sustainability, energy efficiency, and advanced manufacturing through accelerated materials discovery and optimization.

Market Analysis for AI-Driven Materials Discovery

The global market for AI-driven materials discovery is experiencing unprecedented growth, with the integration of generative models transforming traditional research and development processes. Current market valuations indicate that the AI in materials science sector reached approximately $200 million in 2022, with projections suggesting a compound annual growth rate of 35-40% through 2030, potentially creating a multi-billion dollar market segment within the broader materials science industry.

Demand for AI-driven materials discovery solutions stems primarily from four key sectors: pharmaceuticals, advanced manufacturing, renewable energy, and electronics. Pharmaceutical companies are increasingly adopting generative models to accelerate drug discovery processes, reducing development timelines by up to 30% in early-stage research. The advanced manufacturing sector is leveraging these technologies to design novel alloys and composites with enhanced performance characteristics, addressing growing demands for lightweight yet durable materials.

In the renewable energy sector, generative AI is enabling the discovery of next-generation battery materials, catalysts, and solar cell components, directly supporting global sustainability initiatives and the transition to clean energy. Market analysis reveals that companies implementing AI-driven materials discovery report average R&D cost reductions of 15-25% while simultaneously increasing successful material candidates by 40-60%.

Regional market distribution shows North America currently leading with approximately 45% market share, followed by Europe (30%) and Asia-Pacific (20%), with the latter demonstrating the fastest growth rate. This geographic distribution correlates strongly with regional concentrations of materials science research institutions and technology companies specializing in AI applications.

Customer segmentation reveals three primary buyer categories: large multinational corporations with established R&D departments, specialized materials science research institutions, and emerging startups focused on specific material applications. Each segment demonstrates distinct purchasing behaviors and implementation requirements, with large corporations typically seeking enterprise-wide solutions while startups prefer modular, scalable approaches.

Market barriers include significant initial investment requirements, shortage of cross-disciplinary talent combining materials science expertise with AI knowledge, and concerns regarding intellectual property protection in collaborative AI development environments. Despite these challenges, venture capital investment in AI-driven materials discovery startups has increased by over 200% since 2020, indicating strong investor confidence in the sector's growth potential.

The competitive landscape features both established materials science companies incorporating AI capabilities and specialized AI startups targeting materials applications, creating a dynamic market environment characterized by strategic partnerships and acquisitions aimed at combining domain expertise with technological innovation.

Demand for AI-driven materials discovery solutions stems primarily from four key sectors: pharmaceuticals, advanced manufacturing, renewable energy, and electronics. Pharmaceutical companies are increasingly adopting generative models to accelerate drug discovery processes, reducing development timelines by up to 30% in early-stage research. The advanced manufacturing sector is leveraging these technologies to design novel alloys and composites with enhanced performance characteristics, addressing growing demands for lightweight yet durable materials.

In the renewable energy sector, generative AI is enabling the discovery of next-generation battery materials, catalysts, and solar cell components, directly supporting global sustainability initiatives and the transition to clean energy. Market analysis reveals that companies implementing AI-driven materials discovery report average R&D cost reductions of 15-25% while simultaneously increasing successful material candidates by 40-60%.

Regional market distribution shows North America currently leading with approximately 45% market share, followed by Europe (30%) and Asia-Pacific (20%), with the latter demonstrating the fastest growth rate. This geographic distribution correlates strongly with regional concentrations of materials science research institutions and technology companies specializing in AI applications.

Customer segmentation reveals three primary buyer categories: large multinational corporations with established R&D departments, specialized materials science research institutions, and emerging startups focused on specific material applications. Each segment demonstrates distinct purchasing behaviors and implementation requirements, with large corporations typically seeking enterprise-wide solutions while startups prefer modular, scalable approaches.

Market barriers include significant initial investment requirements, shortage of cross-disciplinary talent combining materials science expertise with AI knowledge, and concerns regarding intellectual property protection in collaborative AI development environments. Despite these challenges, venture capital investment in AI-driven materials discovery startups has increased by over 200% since 2020, indicating strong investor confidence in the sector's growth potential.

The competitive landscape features both established materials science companies incorporating AI capabilities and specialized AI startups targeting materials applications, creating a dynamic market environment characterized by strategic partnerships and acquisitions aimed at combining domain expertise with technological innovation.

Current Landscape and Barriers in Industrial Generative Models

The generative AI landscape in materials R&D is experiencing rapid evolution, with significant advancements in machine learning architectures specifically tailored for molecular and material design. Currently, several key generative model approaches dominate the industrial materials sector: variational autoencoders (VAEs), generative adversarial networks (GANs), diffusion models, and transformer-based architectures. These models have demonstrated promising capabilities in generating novel material candidates with targeted properties, accelerating the traditionally time-consuming discovery process.

Despite these advances, industrial adoption faces substantial barriers. Data scarcity remains a critical challenge, as materials science often deals with limited, heterogeneous datasets that are insufficient for training robust generative models. Many companies possess proprietary data that remains siloed, preventing the development of more comprehensive models. Additionally, the quality and standardization of available data varies significantly across different material domains.

Computational resource requirements present another significant hurdle. High-fidelity generative models for materials discovery demand substantial computing infrastructure, creating adoption barriers particularly for small and medium enterprises. The specialized expertise required to develop, deploy, and interpret these models further restricts widespread implementation, as materials scientists and engineers typically lack advanced AI training.

Validation challenges constitute perhaps the most formidable barrier to industrial adoption. The gap between computational prediction and experimental verification remains substantial, with many computationally promising materials failing during physical testing. This validation bottleneck significantly slows the integration of generative models into established R&D workflows.

Regulatory and intellectual property considerations also complicate industrial implementation. Questions regarding the patentability of AI-generated materials and ownership of innovations derived from generative models remain largely unresolved in many jurisdictions. Companies must navigate complex regulatory frameworks that were not designed with AI-generated materials in mind.

Integration with existing workflows represents another significant challenge. Many established materials companies have developed sophisticated R&D processes over decades, making the incorporation of novel computational approaches disruptive to established practices. Cultural resistance to AI-driven discovery methods persists in traditionally experiment-focused organizations.

The current industrial landscape shows uneven adoption across sectors, with pharmaceutical and specialty chemicals companies generally leading implementation efforts, while construction materials and metallurgy sectors lag behind. This disparity reflects differences in digital maturity, R&D investment levels, and the complexity of material systems across industries.

Despite these advances, industrial adoption faces substantial barriers. Data scarcity remains a critical challenge, as materials science often deals with limited, heterogeneous datasets that are insufficient for training robust generative models. Many companies possess proprietary data that remains siloed, preventing the development of more comprehensive models. Additionally, the quality and standardization of available data varies significantly across different material domains.

Computational resource requirements present another significant hurdle. High-fidelity generative models for materials discovery demand substantial computing infrastructure, creating adoption barriers particularly for small and medium enterprises. The specialized expertise required to develop, deploy, and interpret these models further restricts widespread implementation, as materials scientists and engineers typically lack advanced AI training.

Validation challenges constitute perhaps the most formidable barrier to industrial adoption. The gap between computational prediction and experimental verification remains substantial, with many computationally promising materials failing during physical testing. This validation bottleneck significantly slows the integration of generative models into established R&D workflows.

Regulatory and intellectual property considerations also complicate industrial implementation. Questions regarding the patentability of AI-generated materials and ownership of innovations derived from generative models remain largely unresolved in many jurisdictions. Companies must navigate complex regulatory frameworks that were not designed with AI-generated materials in mind.

Integration with existing workflows represents another significant challenge. Many established materials companies have developed sophisticated R&D processes over decades, making the incorporation of novel computational approaches disruptive to established practices. Cultural resistance to AI-driven discovery methods persists in traditionally experiment-focused organizations.

The current industrial landscape shows uneven adoption across sectors, with pharmaceutical and specialty chemicals companies generally leading implementation efforts, while construction materials and metallurgy sectors lag behind. This disparity reflects differences in digital maturity, R&D investment levels, and the complexity of material systems across industries.

Existing Generative AI Solutions for Materials Design

01 Generative AI Models for Content Creation

Generative AI models are designed to create new content such as text, images, or audio based on training data. These models use various neural network architectures to generate realistic outputs that mimic human-created content. The technology enables automated content creation for applications in media, entertainment, and digital marketing, with capabilities for personalization and adaptation to specific user requirements.- Generative AI Models for Content Creation: Generative models are used to create various types of content including text, images, and other media. These models learn patterns from training data and generate new content that mimics the characteristics of the training data. Advanced generative AI systems can produce high-quality content that is increasingly difficult to distinguish from human-created work, enabling applications in creative industries, marketing, and entertainment.

- Generative Models in Healthcare and Medical Applications: Generative models are being applied in healthcare for medical image synthesis, drug discovery, and patient data analysis. These models can generate synthetic medical images for training diagnostic systems, simulate molecular structures for pharmaceutical research, and create synthetic patient data for research while preserving privacy. The technology enables personalized medicine approaches and accelerates medical research and development processes.

- Generative Adversarial Networks (GANs) and Their Applications: Generative Adversarial Networks represent a specific architecture of generative models consisting of generator and discriminator networks that compete against each other. This adversarial process results in the generation of highly realistic synthetic data. GANs are particularly effective for image generation, style transfer, super-resolution, and data augmentation tasks. They have applications in computer vision, gaming, virtual reality, and synthetic data generation for training other AI systems.

- Generative Models for Industrial Design and Manufacturing: Generative models are transforming industrial design and manufacturing processes by automating design generation, optimizing product features, and simulating production outcomes. These models can generate multiple design alternatives based on specified constraints, predict performance characteristics, and identify optimal manufacturing parameters. The technology enables more efficient product development cycles, reduces material waste, and facilitates the creation of novel designs that might not be conceived through traditional methods.

- Privacy and Security in Generative Models: As generative models become more sophisticated, addressing privacy and security concerns becomes increasingly important. Techniques such as differential privacy, federated learning, and secure multi-party computation are being integrated into generative model frameworks to protect sensitive data. Additionally, methods for detecting AI-generated content, preventing unauthorized use of training data, and ensuring ethical deployment of generative systems are being developed to maintain trust and compliance with regulations.

02 Machine Learning Techniques for Generative Models

Advanced machine learning techniques are employed in generative models, including deep learning architectures such as Generative Adversarial Networks (GANs), Variational Autoencoders (VAEs), and transformer-based models. These techniques enable the models to learn complex patterns from training data and generate new instances that maintain statistical similarities to the original dataset, improving the quality and diversity of generated outputs.Expand Specific Solutions03 Applications of Generative Models in Healthcare and Medicine

Generative models are increasingly applied in healthcare and medicine for tasks such as medical image synthesis, drug discovery, and patient data generation. These models can create synthetic medical data for research while preserving privacy, generate molecular structures for potential new drugs, and assist in diagnostic imaging by creating additional training examples for rare conditions or enhancing existing medical images.Expand Specific Solutions04 Generative Models for Industrial Design and Manufacturing

In industrial settings, generative models are used to optimize design processes and manufacturing workflows. These models can automatically generate design alternatives based on specified parameters, predict material properties, simulate product performance under various conditions, and optimize manufacturing processes. The technology enables faster prototyping, reduced development costs, and improved product performance through computational design exploration.Expand Specific Solutions05 Privacy and Security Frameworks for Generative Models

As generative models become more powerful, frameworks for ensuring privacy and security have been developed. These include techniques for differential privacy to protect training data, methods to prevent the generation of harmful or biased content, and approaches to verify the authenticity of generated outputs. Such frameworks are essential for responsible deployment of generative AI systems in sensitive applications and for maintaining user trust.Expand Specific Solutions

Key Industry Players and Research Institutions

The generative AI adoption in materials R&D is currently in an early growth phase, with market size estimated to reach $2-3 billion by 2025. The technology maturity varies across applications, with IBM, BASF, and Taiwan Semiconductor Manufacturing leading industrial implementation through sophisticated AI models for materials discovery and optimization. Academic institutions like South China University of Technology and Sichuan University are advancing fundamental research, while specialized firms like Preferred Networks and Capitol AI are developing tailored solutions. Collaborative ecosystems are emerging between technology providers (Microsoft, Fujitsu) and industry adopters (XCMG, MTU Aero Engines), indicating a transition from experimental to practical applications, though standardization and validation frameworks remain underdeveloped.

International Business Machines Corp.

Technical Solution: IBM has developed a comprehensive generative AI framework for materials discovery called "Accelerated Discovery". This platform integrates generative models with high-throughput computational screening and autonomous experimentation to accelerate materials R&D cycles. IBM's approach combines foundation models trained on materials science literature with generative adversarial networks (GANs) that can propose novel material structures with desired properties. Their system incorporates physics-based constraints and domain knowledge to ensure generated materials are physically realizable. IBM has demonstrated this technology in battery materials research, where their generative models identified novel electrolyte formulations with improved stability and conductivity properties. The platform also features active learning capabilities that continuously refine predictions based on experimental feedback, creating a closed-loop materials discovery system that becomes more efficient over time[1][3].

Strengths: IBM's solution leverages their extensive AI expertise and computing infrastructure, allowing for integration with quantum computing resources for more accurate molecular simulations. Their platform's closed-loop design enables continuous improvement. Weaknesses: The system requires significant computational resources and expertise to implement effectively, potentially limiting accessibility for smaller organizations without IBM's infrastructure.

BASF Corp.

Technical Solution: BASF has implemented a multi-faceted generative AI approach for materials discovery called "Virtual Innovation Platform". This platform combines generative models with high-throughput experimentation and simulation to accelerate the development of specialty chemicals and advanced materials. BASF's system employs conditional variational autoencoders (cVAEs) and transformer-based models to generate novel molecular structures with tailored properties for specific industrial applications. Their approach incorporates domain-specific constraints and manufacturing feasibility parameters to ensure generated materials can be synthesized cost-effectively at industrial scale. BASF has successfully applied this technology to develop sustainable polymers, catalysts, and agricultural products, reducing development timelines by up to 70%. Their platform integrates with their extensive materials database and characterization facilities, creating a seamless workflow from AI-generated candidates to physical validation[2][5].

Strengths: BASF's approach benefits from their extensive domain expertise in chemical manufacturing and materials science, ensuring practical industrial applicability. Their platform incorporates manufacturing constraints early in the design process. Weaknesses: The system is heavily optimized for BASF's specific chemical domains and may require significant adaptation for other materials classes or manufacturing processes.

Critical Patents and Algorithms in Materials Generative Models

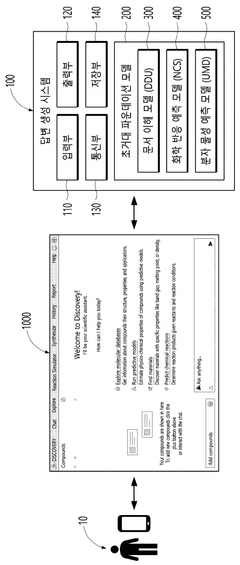

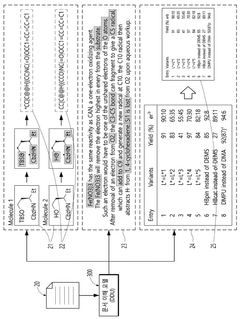

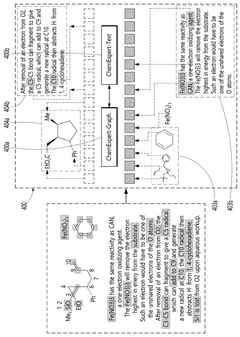

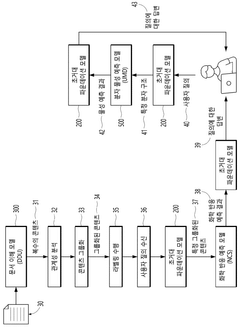

Method and system for generating answers

PatentWO2025018851A1

Innovation

- A system and method utilizing a generative AI model to analyze documents, extract relevant content, and provide answers to user queries through chemical reaction prediction and molecular property prediction, thereby suggesting optimal research methods and reducing the time and cost associated with materials research and development.

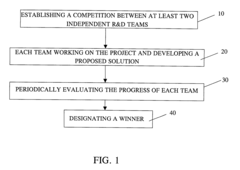

Research and development process

PatentInactiveUS20010034632A1

Innovation

- A competitive R&D process where multiple teams, including internal and external teams, work on the same project with a project manager and incentives for winning solutions, allowing for periodic evaluation and awarding of bonuses, and utilizing external solutions and evaluation systems to accelerate innovation and productivity.

Regulatory Framework for AI in Materials Development

The regulatory landscape for AI in materials development is rapidly evolving as generative models gain prominence in industrial R&D settings. Current frameworks primarily focus on general AI applications, with limited specific provisions for materials science implementations. Key regulatory bodies including the FDA, EPA, and international organizations like ISO are beginning to develop guidelines that address the unique challenges posed by AI-driven materials innovation.

Data governance represents a critical regulatory concern, particularly regarding the ownership and protection of training datasets used in generative models. Materials companies must navigate complex intellectual property considerations when utilizing proprietary formulation data or experimental results. Recent regulatory trends indicate movement toward mandatory disclosure of AI training methodologies when submitting new materials for approval processes.

Safety validation protocols present another significant regulatory challenge. Traditional materials testing frameworks were not designed with AI-generated compounds in mind, creating potential gaps in safety assessment. Regulatory agencies are increasingly requiring enhanced documentation of AI decision pathways, particularly for materials intended for sensitive applications such as healthcare, food packaging, or structural components.

Ethical considerations are becoming more prominent in regulatory discussions, with particular focus on environmental impact assessment for AI-designed materials. Several jurisdictions now mandate lifecycle analysis that accounts for both production processes and end-of-life considerations. The European Union's emerging AI Act specifically addresses materials development, requiring human oversight and intervention capabilities in high-risk applications.

International harmonization efforts remain fragmented, creating compliance challenges for global materials companies. The lack of standardized approaches to validating AI-generated materials across different markets necessitates region-specific regulatory strategies. Industry consortia are actively engaging with regulatory bodies to develop frameworks that balance innovation with appropriate safeguards.

Looking forward, regulatory evolution will likely focus on establishing clear validation pathways for AI-generated materials, potentially including specialized testing protocols and certification standards. Companies adopting generative models in materials R&D must implement robust regulatory intelligence capabilities to navigate this dynamic landscape and anticipate compliance requirements that may emerge as these technologies mature and gain wider industrial adoption.

Data governance represents a critical regulatory concern, particularly regarding the ownership and protection of training datasets used in generative models. Materials companies must navigate complex intellectual property considerations when utilizing proprietary formulation data or experimental results. Recent regulatory trends indicate movement toward mandatory disclosure of AI training methodologies when submitting new materials for approval processes.

Safety validation protocols present another significant regulatory challenge. Traditional materials testing frameworks were not designed with AI-generated compounds in mind, creating potential gaps in safety assessment. Regulatory agencies are increasingly requiring enhanced documentation of AI decision pathways, particularly for materials intended for sensitive applications such as healthcare, food packaging, or structural components.

Ethical considerations are becoming more prominent in regulatory discussions, with particular focus on environmental impact assessment for AI-designed materials. Several jurisdictions now mandate lifecycle analysis that accounts for both production processes and end-of-life considerations. The European Union's emerging AI Act specifically addresses materials development, requiring human oversight and intervention capabilities in high-risk applications.

International harmonization efforts remain fragmented, creating compliance challenges for global materials companies. The lack of standardized approaches to validating AI-generated materials across different markets necessitates region-specific regulatory strategies. Industry consortia are actively engaging with regulatory bodies to develop frameworks that balance innovation with appropriate safeguards.

Looking forward, regulatory evolution will likely focus on establishing clear validation pathways for AI-generated materials, potentially including specialized testing protocols and certification standards. Companies adopting generative models in materials R&D must implement robust regulatory intelligence capabilities to navigate this dynamic landscape and anticipate compliance requirements that may emerge as these technologies mature and gain wider industrial adoption.

ROI Assessment for Industrial Implementation

Implementing generative models in materials R&D represents a significant investment for industrial organizations. A comprehensive ROI assessment reveals that while initial implementation costs are substantial, the long-term financial benefits can be transformative. Companies adopting these technologies typically experience a 15-30% reduction in materials development timelines, translating to millions in accelerated time-to-market value. For specialty materials manufacturers, this acceleration can represent $5-20 million in additional revenue per successful product launch.

Cost structures for implementation include initial infrastructure investments ($500,000-2 million for computing resources), specialized talent acquisition ($150,000-300,000 annually per AI specialist), and integration costs with existing R&D workflows ($250,000-1 million). These investments are typically amortized over a 3-5 year period, with ROI breakeven points occurring between 18-36 months for most implementations.

The financial benefits manifest across multiple dimensions. Direct cost savings emerge from reduced experimental iterations (30-50% fewer physical experiments), optimized resource allocation, and decreased materials waste. A mid-sized materials company implementing generative models can expect annual savings of $1-3 million in direct experimental costs alone.

Risk mitigation represents another significant value component. By enabling more comprehensive exploration of materials design space, generative models reduce the likelihood of late-stage development failures. This risk reduction effect can be valued at 10-15% of total R&D portfolio value, representing substantial protection against costly development dead-ends.

Competitive advantage metrics should also factor into ROI calculations. Companies leveraging generative models demonstrate 2-3x faster response to market demands and customer specifications. This agility translates to increased market share (typically 5-10% growth within established product categories) and premium pricing opportunities for novel materials with unique property combinations.

The ROI timeline typically follows a J-curve pattern, with initial investment followed by accelerating returns as organizational capabilities mature. Companies should anticipate negative returns during the first 12-18 months while building infrastructure and expertise, followed by exponential value creation as models are refined and applied across multiple product development initiatives. Full organizational integration typically yields 300-500% ROI over a five-year implementation horizon.

Cost structures for implementation include initial infrastructure investments ($500,000-2 million for computing resources), specialized talent acquisition ($150,000-300,000 annually per AI specialist), and integration costs with existing R&D workflows ($250,000-1 million). These investments are typically amortized over a 3-5 year period, with ROI breakeven points occurring between 18-36 months for most implementations.

The financial benefits manifest across multiple dimensions. Direct cost savings emerge from reduced experimental iterations (30-50% fewer physical experiments), optimized resource allocation, and decreased materials waste. A mid-sized materials company implementing generative models can expect annual savings of $1-3 million in direct experimental costs alone.

Risk mitigation represents another significant value component. By enabling more comprehensive exploration of materials design space, generative models reduce the likelihood of late-stage development failures. This risk reduction effect can be valued at 10-15% of total R&D portfolio value, representing substantial protection against costly development dead-ends.

Competitive advantage metrics should also factor into ROI calculations. Companies leveraging generative models demonstrate 2-3x faster response to market demands and customer specifications. This agility translates to increased market share (typically 5-10% growth within established product categories) and premium pricing opportunities for novel materials with unique property combinations.

The ROI timeline typically follows a J-curve pattern, with initial investment followed by accelerating returns as organizational capabilities mature. Companies should anticipate negative returns during the first 12-18 months while building infrastructure and expertise, followed by exponential value creation as models are refined and applied across multiple product development initiatives. Full organizational integration typically yields 300-500% ROI over a five-year implementation horizon.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!