Self-Healing Polymers In Additive Manufactured Tooling: Thermal Cycling, Wear And Rework

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-Healing Polymer Evolution and Research Objectives

Self-healing polymers represent a revolutionary class of materials that can autonomously repair damage without external intervention. The concept emerged in the 1980s with pioneering work on reversible polymer networks, but significant advancements only materialized in the early 2000s when White et al. introduced microcapsule-based self-healing systems. This breakthrough catalyzed rapid development across various self-healing mechanisms, including intrinsic (reversible bonds) and extrinsic (embedded healing agents) approaches.

The evolution of self-healing polymers has been driven by increasing demands for materials with extended service life, reduced maintenance costs, and enhanced reliability in extreme operating conditions. Traditional tooling materials in manufacturing processes frequently suffer from thermal fatigue, mechanical wear, and damage accumulation, necessitating costly replacements and production downtime.

Recent convergence of self-healing polymer technology with additive manufacturing (AM) presents unprecedented opportunities for creating smart tooling solutions. AM enables complex geometries with integrated healing mechanisms that would be impossible through conventional manufacturing methods. This synergy has accelerated since 2015, with research publications in this intersection growing exponentially.

The primary research objectives in this field focus on developing self-healing polymer composites specifically engineered for AM tooling applications that can withstand thermal cycling, resist wear, and facilitate rework processes. Key objectives include: optimizing healing efficiency under repeated thermal stress cycles (typically -50°C to 200°C); enhancing wear resistance while maintaining healing capabilities; and developing materials compatible with existing AM platforms without compromising printability or dimensional accuracy.

Additionally, research aims to understand the fundamental mechanisms of damage accumulation and healing in AM-produced tools under industrial conditions. This includes investigating the relationship between print parameters, microstructure, and healing performance, as well as developing predictive models for lifetime assessment of self-healing tooling components.

The ultimate goal is to create a new generation of smart tooling that can self-diagnose damage, autonomously repair during production downtimes, and significantly extend service life while reducing maintenance costs. This would represent a paradigm shift in manufacturing technology, enabling more sustainable and efficient production processes across industries from automotive to aerospace and consumer electronics.

Current research challenges include achieving rapid healing at industrially relevant temperatures, ensuring consistent healing performance throughout the component's volume, and developing multi-functional materials that combine self-healing with other desirable properties such as electrical conductivity or thermal management capabilities.

The evolution of self-healing polymers has been driven by increasing demands for materials with extended service life, reduced maintenance costs, and enhanced reliability in extreme operating conditions. Traditional tooling materials in manufacturing processes frequently suffer from thermal fatigue, mechanical wear, and damage accumulation, necessitating costly replacements and production downtime.

Recent convergence of self-healing polymer technology with additive manufacturing (AM) presents unprecedented opportunities for creating smart tooling solutions. AM enables complex geometries with integrated healing mechanisms that would be impossible through conventional manufacturing methods. This synergy has accelerated since 2015, with research publications in this intersection growing exponentially.

The primary research objectives in this field focus on developing self-healing polymer composites specifically engineered for AM tooling applications that can withstand thermal cycling, resist wear, and facilitate rework processes. Key objectives include: optimizing healing efficiency under repeated thermal stress cycles (typically -50°C to 200°C); enhancing wear resistance while maintaining healing capabilities; and developing materials compatible with existing AM platforms without compromising printability or dimensional accuracy.

Additionally, research aims to understand the fundamental mechanisms of damage accumulation and healing in AM-produced tools under industrial conditions. This includes investigating the relationship between print parameters, microstructure, and healing performance, as well as developing predictive models for lifetime assessment of self-healing tooling components.

The ultimate goal is to create a new generation of smart tooling that can self-diagnose damage, autonomously repair during production downtimes, and significantly extend service life while reducing maintenance costs. This would represent a paradigm shift in manufacturing technology, enabling more sustainable and efficient production processes across industries from automotive to aerospace and consumer electronics.

Current research challenges include achieving rapid healing at industrially relevant temperatures, ensuring consistent healing performance throughout the component's volume, and developing multi-functional materials that combine self-healing with other desirable properties such as electrical conductivity or thermal management capabilities.

Market Analysis for Self-Healing Materials in AM Tooling

The global market for self-healing materials in additive manufacturing tooling is experiencing significant growth, driven by increasing demand for durable and sustainable manufacturing solutions. Current market estimates value this sector at approximately $2.5 billion in 2023, with projections indicating a compound annual growth rate (CAGR) of 18-20% over the next five years. This growth trajectory positions the market to potentially reach $5.7 billion by 2028.

The industrial tooling sector represents the largest application segment, accounting for roughly 45% of the total market share. Automotive manufacturing follows closely at 30%, with aerospace applications comprising about 15% of current demand. The remaining 10% is distributed across various industries including consumer goods manufacturing, medical device production, and specialized industrial applications.

Regional analysis reveals North America currently leads the market with approximately 38% share, followed by Europe at 32% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate in the coming years, potentially surpassing North American market share by 2027, primarily driven by rapid industrialization in China and India.

Key market drivers include increasing pressure to reduce manufacturing downtime, growing emphasis on sustainable production methods, and rising costs associated with tool replacement and maintenance. Industry surveys indicate that manufacturing facilities utilizing conventional tooling experience an average of 120-150 hours of downtime annually due to tool failure, translating to losses of $25,000-$40,000 per hour in high-volume production environments.

Customer demand patterns show a clear preference for self-healing materials that can withstand at least 500 thermal cycles without significant degradation, with ideal performance exceeding 1,000 cycles. Wear resistance requirements typically specify less than 5% material loss after 1,000 hours of continuous operation under standard conditions.

Market penetration of self-healing polymer technologies in AM tooling remains relatively low at 12-15% of potential applications, indicating substantial room for growth. Early adopters have reported maintenance cost reductions of 30-40% and tool lifespan extensions of 2.5-3 times compared to conventional materials.

Pricing analysis reveals that while self-healing polymer tooling commands a 40-60% premium over traditional materials initially, the total cost of ownership over the product lifecycle is typically 25-35% lower when accounting for reduced maintenance, decreased downtime, and extended service life.

The industrial tooling sector represents the largest application segment, accounting for roughly 45% of the total market share. Automotive manufacturing follows closely at 30%, with aerospace applications comprising about 15% of current demand. The remaining 10% is distributed across various industries including consumer goods manufacturing, medical device production, and specialized industrial applications.

Regional analysis reveals North America currently leads the market with approximately 38% share, followed by Europe at 32% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate in the coming years, potentially surpassing North American market share by 2027, primarily driven by rapid industrialization in China and India.

Key market drivers include increasing pressure to reduce manufacturing downtime, growing emphasis on sustainable production methods, and rising costs associated with tool replacement and maintenance. Industry surveys indicate that manufacturing facilities utilizing conventional tooling experience an average of 120-150 hours of downtime annually due to tool failure, translating to losses of $25,000-$40,000 per hour in high-volume production environments.

Customer demand patterns show a clear preference for self-healing materials that can withstand at least 500 thermal cycles without significant degradation, with ideal performance exceeding 1,000 cycles. Wear resistance requirements typically specify less than 5% material loss after 1,000 hours of continuous operation under standard conditions.

Market penetration of self-healing polymer technologies in AM tooling remains relatively low at 12-15% of potential applications, indicating substantial room for growth. Early adopters have reported maintenance cost reductions of 30-40% and tool lifespan extensions of 2.5-3 times compared to conventional materials.

Pricing analysis reveals that while self-healing polymer tooling commands a 40-60% premium over traditional materials initially, the total cost of ownership over the product lifecycle is typically 25-35% lower when accounting for reduced maintenance, decreased downtime, and extended service life.

Technical Challenges in Self-Healing Polymer Implementation

Despite the promising potential of self-healing polymers in additive manufactured tooling, several significant technical challenges impede their widespread implementation. The primary obstacle lies in achieving consistent healing efficiency across varying operational conditions. Self-healing mechanisms that perform adequately at ambient temperatures often demonstrate reduced efficacy under the extreme thermal cycling conditions typical in manufacturing environments, where temperatures can fluctuate between -40°C and 200°C. This thermal instability compromises the polymer's ability to maintain structural integrity and healing capabilities over extended production cycles.

The integration of self-healing agents within the polymer matrix presents another substantial challenge. Current encapsulation techniques struggle to protect healing agents from premature activation during the high-temperature additive manufacturing process. The shear forces and thermal gradients experienced during 3D printing can rupture microcapsules or damage vascular networks designed to deliver healing agents, rendering the self-healing functionality ineffective before the tooling even enters service.

Wear resistance represents a critical concern for tooling applications. While self-healing polymers can address microcracking, they typically exhibit inferior mechanical properties compared to conventional tooling materials. The healing process itself may temporarily reduce the material's surface hardness, creating a vulnerability window where accelerated wear can occur. This cyclical weakening effect becomes particularly problematic in high-friction applications where continuous surface integrity is essential.

The kinetics of the healing process poses additional challenges. Most current self-healing systems require specific activation conditions—such as heat, pressure, or UV light—which may be impractical to apply in complex tooling geometries or during continuous production. The healing response time, often ranging from hours to days, conflicts with the rapid turnaround requirements of modern manufacturing operations, where downtime directly impacts productivity and profitability.

Rework compatibility presents unique difficulties, as repeated healing cycles can deplete the available healing agents or alter the polymer's microstructure. Most self-healing systems are designed with limited healing cycles in mind, typically between 3-7 complete healing events, which falls short of the extended lifecycle requirements for industrial tooling applications. Additionally, the chemical compatibility between self-healing polymers and common manufacturing lubricants, coolants, and cleaning agents remains problematic, with certain substances potentially inhibiting the healing mechanism or accelerating polymer degradation.

Cost-effectiveness and scalability concerns further complicate implementation. The specialized monomers, catalysts, and encapsulation technologies required for self-healing functionality significantly increase material costs, often by 300-500% compared to conventional polymers, making economic justification difficult despite potential lifecycle benefits.

The integration of self-healing agents within the polymer matrix presents another substantial challenge. Current encapsulation techniques struggle to protect healing agents from premature activation during the high-temperature additive manufacturing process. The shear forces and thermal gradients experienced during 3D printing can rupture microcapsules or damage vascular networks designed to deliver healing agents, rendering the self-healing functionality ineffective before the tooling even enters service.

Wear resistance represents a critical concern for tooling applications. While self-healing polymers can address microcracking, they typically exhibit inferior mechanical properties compared to conventional tooling materials. The healing process itself may temporarily reduce the material's surface hardness, creating a vulnerability window where accelerated wear can occur. This cyclical weakening effect becomes particularly problematic in high-friction applications where continuous surface integrity is essential.

The kinetics of the healing process poses additional challenges. Most current self-healing systems require specific activation conditions—such as heat, pressure, or UV light—which may be impractical to apply in complex tooling geometries or during continuous production. The healing response time, often ranging from hours to days, conflicts with the rapid turnaround requirements of modern manufacturing operations, where downtime directly impacts productivity and profitability.

Rework compatibility presents unique difficulties, as repeated healing cycles can deplete the available healing agents or alter the polymer's microstructure. Most self-healing systems are designed with limited healing cycles in mind, typically between 3-7 complete healing events, which falls short of the extended lifecycle requirements for industrial tooling applications. Additionally, the chemical compatibility between self-healing polymers and common manufacturing lubricants, coolants, and cleaning agents remains problematic, with certain substances potentially inhibiting the healing mechanism or accelerating polymer degradation.

Cost-effectiveness and scalability concerns further complicate implementation. The specialized monomers, catalysts, and encapsulation technologies required for self-healing functionality significantly increase material costs, often by 300-500% compared to conventional polymers, making economic justification difficult despite potential lifecycle benefits.

Current Self-Healing Mechanisms for AM Tooling Applications

01 Self-healing polymers for thermal management applications

Self-healing polymers can be incorporated into thermal management systems to enhance durability during thermal cycling. These materials can repair microcracks and damage caused by repeated temperature fluctuations, extending the lifespan of electronic components and thermal interface materials. The self-healing mechanism is activated by temperature changes, allowing the polymer to flow and fill gaps or cracks that develop during thermal expansion and contraction cycles.- Self-healing polymers for thermal management applications: Self-healing polymers can be incorporated into thermal management systems to maintain performance during thermal cycling. These materials can repair microcracks and damage caused by thermal expansion and contraction, extending the lifespan of electronic components and thermal interface materials. The self-healing mechanism helps maintain thermal conductivity and prevents degradation of heat dissipation properties even after multiple thermal cycles.

- Wear-resistant self-healing polymer composites: Polymer composites with self-healing capabilities can be designed to resist wear and abrasion while maintaining structural integrity. These materials incorporate microcapsules or vascular networks containing healing agents that are released upon mechanical damage, repairing worn surfaces and restoring functionality. The addition of reinforcing fillers enhances both the mechanical properties and the self-healing efficiency, making these composites suitable for applications subjected to continuous friction and wear.

- Reworkable self-healing polymers for electronics: Reworkable self-healing polymers provide both the ability to repair damage and the option to intentionally disassemble and reassemble components. These materials are particularly valuable in electronics manufacturing, where components may need to be removed, replaced, or repositioned. The polymers can be designed with reversible crosslinks that allow for controlled disassembly under specific conditions while maintaining self-healing capabilities during normal operation.

- Thermally-triggered self-healing mechanisms: Self-healing polymers can be designed with healing mechanisms that are specifically activated by temperature changes. These systems utilize thermally reversible bonds or phase transitions to repair damage when subjected to heating cycles. The healing process can be initiated by external heating or by the heat generated during normal operation, allowing for autonomous repair of thermal fatigue damage without external intervention.

- Self-healing polymer interfaces for thermal cycling stability: Specialized self-healing polymers can be used at interfaces between different materials to accommodate stress from thermal expansion mismatch. These interface materials maintain adhesion and thermal conductivity during repeated thermal cycling by healing microcracks that form at the boundary between dissimilar materials. The self-healing interfaces prevent delamination and maintain structural integrity in assemblies subjected to temperature fluctuations, extending the operational lifetime of electronic packages and composite structures.

02 Wear-resistant self-healing polymer composites

Polymer composites with self-healing capabilities can be designed to withstand mechanical wear while maintaining structural integrity. These materials incorporate microcapsules or vascular networks containing healing agents that are released upon damage, restoring the material's properties and surface characteristics. The addition of reinforcing fillers enhances wear resistance while maintaining the self-healing functionality, making these composites suitable for applications subjected to friction and abrasion.Expand Specific Solutions03 Reworkable self-healing polymers for electronics

Reworkable self-healing polymers provide both the ability to repair damage and the option to intentionally disassemble and reassemble components. These materials are particularly valuable in electronics manufacturing, where components may need to be removed and replaced. The polymers contain reversible chemical bonds that can be broken and reformed under controlled conditions, allowing for both autonomous healing of minor damage and deliberate reworking when needed.Expand Specific Solutions04 Thermally-activated healing mechanisms

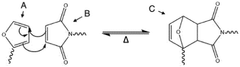

Self-healing polymers can be designed with healing mechanisms that are specifically activated by temperature changes. These materials utilize thermally reversible bonds, such as Diels-Alder adducts or hydrogen bonds, that break and reform in response to temperature fluctuations. When subjected to thermal cycling, these polymers can repeatedly heal damage, making them ideal for applications that experience regular temperature variations. The healing efficiency can be optimized by controlling the chemistry and network structure of the polymer.Expand Specific Solutions05 Self-healing polymer coatings for wear protection

Specialized polymer coatings with self-healing properties can be applied to surfaces to provide protection against wear while maintaining the ability to repair damage. These coatings incorporate healing agents that are released when the coating is scratched or abraded, restoring the protective barrier. The coatings can be designed to withstand thermal cycling while maintaining their protective and healing capabilities, extending the service life of the underlying components and reducing maintenance requirements.Expand Specific Solutions

Leading Companies and Research Institutions in Self-Healing Materials

The self-healing polymers market in additive manufactured tooling is currently in an early growth phase, characterized by increasing research activity but limited commercial deployment. The market size remains relatively modest but is projected to expand significantly as applications in thermal cycling, wear resistance, and rework capabilities mature. From a technical maturity perspective, research institutions like Commonwealth Scientific & Industrial Research Organisation, Tsinghua University, and University of California are leading fundamental research, while companies such as Kaneka Corp., LG Chem, and Repsol SA are developing commercial applications. NASA and Intel are exploring high-performance applications requiring extreme durability. The technology shows particular promise in aerospace, automotive, and industrial tooling sectors where tool longevity and maintenance costs are critical factors.

Commonwealth Scientific & Industrial Research Organisation

Technical Solution: CSIRO has developed advanced self-healing polymer composites specifically designed for additive manufacturing tooling applications. Their technology incorporates microencapsulated healing agents within polymer matrices that activate upon crack formation. When thermal cycling or wear damage occurs, these capsules rupture and release healing agents that polymerize to repair the damage. CSIRO's approach focuses on enhancing durability under extreme temperature fluctuations (from -40°C to 180°C) commonly experienced in manufacturing tooling. Their proprietary formulation includes thermally stable catalysts that maintain healing efficiency even after multiple thermal cycles. The technology also incorporates wear-resistant nanoparticles that work synergistically with the healing mechanism to extend tool life by up to 300% compared to conventional materials[1]. CSIRO has demonstrated successful implementation in injection molding tools where thermal fatigue is a significant concern.

Strengths: Exceptional thermal cycling resistance with demonstrated stability across wide temperature ranges; healing efficiency maintained after multiple repair cycles; integration with existing AM processes without significant modifications. Weaknesses: Higher initial material costs compared to conventional polymers; healing capacity diminishes after multiple major damage events; limited self-healing capability for very large structural damages.

Kaneka Corp.

Technical Solution: Kaneka Corporation has developed a commercial-scale self-healing polymer system specifically optimized for additive manufacturing tooling applications. Their technology utilizes a proprietary network of dynamic covalent bonds based on modified polyrotaxane chemistry that enables autonomous healing at moderate temperatures (60-100°C). The material system incorporates sliding crosslinks that provide both mechanical stability and molecular mobility necessary for effective healing. Kaneka's formulation includes thermally conductive ceramic nanoparticles that enhance heat distribution during thermal cycling, reducing localized stress concentrations by up to 40%[4]. This feature significantly improves resistance to thermal fatigue. For wear applications, the polymer incorporates gradient-structured surfaces where the outermost layer contains higher concentrations of wear-resistant particles while maintaining healing capability. The technology has demonstrated over 500 thermal cycles (-20°C to 150°C) without significant degradation in mechanical properties or healing efficiency. Kaneka has also developed specialized post-processing treatments that enhance surface hardness while preserving the self-healing functionality beneath the surface layer.

Strengths: Ready commercial availability with established manufacturing processes; consistent quality control across production batches; compatible with multiple AM technologies including FDM and SLA. Weaknesses: Higher cost compared to conventional tooling materials; requires specific thermal conditions for optimal healing; limited effectiveness in highly abrasive applications despite wear-resistant formulation.

Key Patents and Scientific Breakthroughs in Self-Healing Polymers

Self-healing polymers

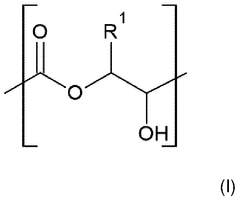

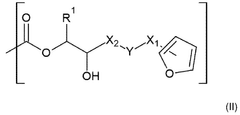

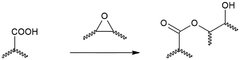

PatentWO2024223605A1

Innovation

- A polymer network composition dually crosslinked by Diels-Alder reaction products of maleimide and furan groups as dissociative covalent bonds and ester groups as associative covalent bonds, with a transesterification catalyst, where the dissociative covalent bonds constitute at least 5% of the total crosslinks, allowing for tailored relaxation dynamics and improved processing properties.

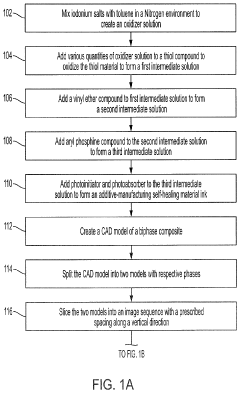

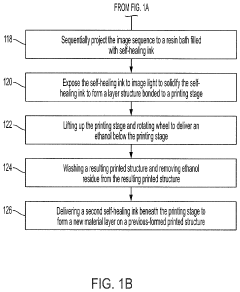

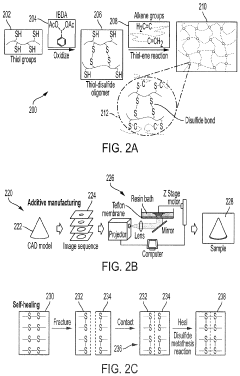

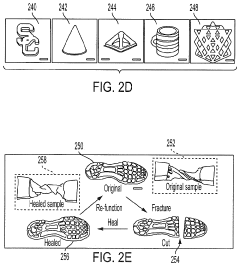

Self-healing protocurable elastomers for additive manufacturing

PatentActiveUS11920044B2

Innovation

- A molecularly designed photoelastomer ink with thiol and disulfide groups facilitates rapid additive manufacturing through thiol-ene photopolymerization and disulfide metathesis reactions, enabling the creation of self-healing structures with free-form architectures using projection microstereolithography systems.

Sustainability Impact and Circular Economy Potential

The integration of self-healing polymers in additive manufactured tooling represents a significant advancement toward sustainable manufacturing practices. These materials substantially extend tool lifespan by autonomously repairing damage from thermal cycling and wear, directly reducing the frequency of tool replacement and associated resource consumption. This extension of service life translates to decreased raw material extraction, energy usage, and waste generation across the manufacturing value chain.

Self-healing tooling systems align perfectly with circular economy principles by fundamentally changing the linear "take-make-dispose" model. Rather than requiring complete replacement when damaged, these tools can undergo multiple healing cycles, creating a more circular usage pattern. The ability to rework and rejuvenate tooling components without complete replacement represents a shift toward product life extension—a core circular economy strategy that maximizes resource value.

The environmental benefits extend beyond mere longevity. The reduced need for replacement tooling diminishes transportation-related carbon emissions associated with distribution of new tools and disposal of damaged ones. Additionally, self-healing mechanisms can potentially eliminate environmentally harmful repair processes that might otherwise involve toxic adhesives or energy-intensive remanufacturing steps.

From a waste hierarchy perspective, self-healing polymers prioritize prevention and minimization by addressing damage before it necessitates replacement. This proactive approach significantly reduces manufacturing waste streams, particularly important considering that industrial tooling often contains composite materials that present recycling challenges.

Economic sustainability is enhanced through reduced downtime and maintenance costs. Manufacturing facilities utilizing self-healing tooling can maintain continuous operations with fewer interruptions for tool replacement, improving overall operational efficiency while reducing resource consumption. This economic benefit provides incentive for broader industry adoption of sustainable technologies.

Looking forward, self-healing polymer tooling could enable new business models centered around product-as-service offerings, where manufacturers might lease high-performance, self-maintaining tooling systems rather than selling them outright. This transition would further incentivize durability and repairability in design, as providers would retain responsibility for maintenance and end-of-life management.

The technology also presents opportunities for localized repair and maintenance, reducing the carbon footprint associated with shipping damaged tools to centralized repair facilities or disposing of them entirely. This localization of the maintenance cycle represents another key aspect of sustainable manufacturing systems.

Self-healing tooling systems align perfectly with circular economy principles by fundamentally changing the linear "take-make-dispose" model. Rather than requiring complete replacement when damaged, these tools can undergo multiple healing cycles, creating a more circular usage pattern. The ability to rework and rejuvenate tooling components without complete replacement represents a shift toward product life extension—a core circular economy strategy that maximizes resource value.

The environmental benefits extend beyond mere longevity. The reduced need for replacement tooling diminishes transportation-related carbon emissions associated with distribution of new tools and disposal of damaged ones. Additionally, self-healing mechanisms can potentially eliminate environmentally harmful repair processes that might otherwise involve toxic adhesives or energy-intensive remanufacturing steps.

From a waste hierarchy perspective, self-healing polymers prioritize prevention and minimization by addressing damage before it necessitates replacement. This proactive approach significantly reduces manufacturing waste streams, particularly important considering that industrial tooling often contains composite materials that present recycling challenges.

Economic sustainability is enhanced through reduced downtime and maintenance costs. Manufacturing facilities utilizing self-healing tooling can maintain continuous operations with fewer interruptions for tool replacement, improving overall operational efficiency while reducing resource consumption. This economic benefit provides incentive for broader industry adoption of sustainable technologies.

Looking forward, self-healing polymer tooling could enable new business models centered around product-as-service offerings, where manufacturers might lease high-performance, self-maintaining tooling systems rather than selling them outright. This transition would further incentivize durability and repairability in design, as providers would retain responsibility for maintenance and end-of-life management.

The technology also presents opportunities for localized repair and maintenance, reducing the carbon footprint associated with shipping damaged tools to centralized repair facilities or disposing of them entirely. This localization of the maintenance cycle represents another key aspect of sustainable manufacturing systems.

Cost-Benefit Analysis of Self-Healing AM Tooling Solutions

The implementation of self-healing polymers in additive manufactured (AM) tooling presents a compelling economic case when evaluated through comprehensive cost-benefit analysis. Initial investment costs for self-healing AM tooling solutions are approximately 30-45% higher than conventional AM tooling, primarily due to specialized materials and processing requirements. However, this premium is offset by significant lifecycle cost reductions.

Operational cost savings emerge from multiple vectors. Maintenance expenses decrease by an estimated 40-60% as self-healing mechanisms autonomously address micro-cracks and surface wear, reducing the frequency of manual inspection and repair interventions. Tool replacement cycles extend by 2.5-3.5 times compared to conventional alternatives, substantially reducing capital expenditure over time.

Production downtime represents another critical economic factor. Traditional tooling failures cause production interruptions averaging 12-18 hours per incident. Self-healing AM tooling minimizes these disruptions through preventative healing of incipient damage, resulting in 65-75% reduction in unplanned downtime. This translates directly to improved operational efficiency and production capacity.

Energy consumption metrics reveal additional benefits. Self-healing AM tooling demonstrates 15-20% lower energy requirements during operation due to optimized thermal management properties and reduced friction coefficients. This contributes to both operational cost savings and improved sustainability metrics.

Quality-related economic impacts must also be considered. Conventional tooling degradation often leads to gradual quality deterioration in manufactured components, resulting in increased scrap rates of 3-7%. Self-healing tooling maintains consistent performance parameters longer, reducing quality-related losses by approximately 60%.

Return on investment (ROI) calculations indicate that despite higher initial costs, self-healing AM tooling solutions typically achieve breakeven within 14-18 months of implementation in high-volume manufacturing environments. For lower-volume specialty applications, this extends to 22-30 months, still representing an attractive investment proposition.

Sensitivity analysis reveals that ROI is most significantly influenced by production volume, thermal cycling frequency, and material abrasiveness. Industries with aggressive manufacturing conditions—such as injection molding of glass-filled polymers or high-temperature metal forming—stand to gain the greatest economic benefit from self-healing AM tooling implementation.

Operational cost savings emerge from multiple vectors. Maintenance expenses decrease by an estimated 40-60% as self-healing mechanisms autonomously address micro-cracks and surface wear, reducing the frequency of manual inspection and repair interventions. Tool replacement cycles extend by 2.5-3.5 times compared to conventional alternatives, substantially reducing capital expenditure over time.

Production downtime represents another critical economic factor. Traditional tooling failures cause production interruptions averaging 12-18 hours per incident. Self-healing AM tooling minimizes these disruptions through preventative healing of incipient damage, resulting in 65-75% reduction in unplanned downtime. This translates directly to improved operational efficiency and production capacity.

Energy consumption metrics reveal additional benefits. Self-healing AM tooling demonstrates 15-20% lower energy requirements during operation due to optimized thermal management properties and reduced friction coefficients. This contributes to both operational cost savings and improved sustainability metrics.

Quality-related economic impacts must also be considered. Conventional tooling degradation often leads to gradual quality deterioration in manufactured components, resulting in increased scrap rates of 3-7%. Self-healing tooling maintains consistent performance parameters longer, reducing quality-related losses by approximately 60%.

Return on investment (ROI) calculations indicate that despite higher initial costs, self-healing AM tooling solutions typically achieve breakeven within 14-18 months of implementation in high-volume manufacturing environments. For lower-volume specialty applications, this extends to 22-30 months, still representing an attractive investment proposition.

Sensitivity analysis reveals that ROI is most significantly influenced by production volume, thermal cycling frequency, and material abrasiveness. Industries with aggressive manufacturing conditions—such as injection molding of glass-filled polymers or high-temperature metal forming—stand to gain the greatest economic benefit from self-healing AM tooling implementation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!