The Future Landscape of Ethylene Vinyl Acetate Market

JUL 8, 20258 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EVA Market Evolution and Objectives

Ethylene Vinyl Acetate (EVA) has emerged as a versatile and indispensable material across various industries, with its market experiencing significant evolution over the past decades. The EVA market's journey began in the 1950s when it was first developed as a copolymer of ethylene and vinyl acetate. Initially, its applications were limited, but as researchers and manufacturers recognized its unique properties, the market began to expand rapidly.

The evolution of the EVA market has been driven by several key factors. Technological advancements in production processes have led to improved quality and consistency of EVA products, enabling their use in more demanding applications. Additionally, the growing awareness of environmental concerns has pushed the market towards developing more sustainable and eco-friendly EVA formulations.

In recent years, the EVA market has witnessed a shift towards higher value-added applications. While traditional uses in footwear and packaging remain significant, there has been a notable increase in demand from sectors such as solar energy, automotive, and medical devices. This diversification has not only expanded the market but also enhanced its resilience to economic fluctuations.

The objectives of the EVA market are multifaceted and aligned with broader industry trends. One primary goal is to continue innovating and developing new grades of EVA with enhanced properties, such as improved thermal resistance, flexibility, and adhesion. This innovation is crucial for meeting the evolving needs of end-users across different sectors.

Another key objective is to address sustainability concerns. The industry is focusing on developing bio-based EVA alternatives and improving the recyclability of EVA products. This aligns with global efforts to reduce carbon footprints and promote circular economy principles.

The market also aims to expand its geographical footprint, particularly in emerging economies where industrialization and urbanization are driving demand for EVA-based products. This expansion requires strategic investments in production capacities and distribution networks.

Furthermore, the EVA market is striving to overcome challenges related to raw material price volatility and regulatory compliance. Developing more efficient production processes and exploring alternative feedstocks are part of the industry's strategy to maintain competitiveness and ensure long-term sustainability.

As the market continues to evolve, collaboration between manufacturers, researchers, and end-users will be crucial in driving innovation and addressing emerging challenges. The future landscape of the EVA market is poised for growth, with a focus on technological advancements, sustainability, and meeting the diverse needs of a global customer base.

The evolution of the EVA market has been driven by several key factors. Technological advancements in production processes have led to improved quality and consistency of EVA products, enabling their use in more demanding applications. Additionally, the growing awareness of environmental concerns has pushed the market towards developing more sustainable and eco-friendly EVA formulations.

In recent years, the EVA market has witnessed a shift towards higher value-added applications. While traditional uses in footwear and packaging remain significant, there has been a notable increase in demand from sectors such as solar energy, automotive, and medical devices. This diversification has not only expanded the market but also enhanced its resilience to economic fluctuations.

The objectives of the EVA market are multifaceted and aligned with broader industry trends. One primary goal is to continue innovating and developing new grades of EVA with enhanced properties, such as improved thermal resistance, flexibility, and adhesion. This innovation is crucial for meeting the evolving needs of end-users across different sectors.

Another key objective is to address sustainability concerns. The industry is focusing on developing bio-based EVA alternatives and improving the recyclability of EVA products. This aligns with global efforts to reduce carbon footprints and promote circular economy principles.

The market also aims to expand its geographical footprint, particularly in emerging economies where industrialization and urbanization are driving demand for EVA-based products. This expansion requires strategic investments in production capacities and distribution networks.

Furthermore, the EVA market is striving to overcome challenges related to raw material price volatility and regulatory compliance. Developing more efficient production processes and exploring alternative feedstocks are part of the industry's strategy to maintain competitiveness and ensure long-term sustainability.

As the market continues to evolve, collaboration between manufacturers, researchers, and end-users will be crucial in driving innovation and addressing emerging challenges. The future landscape of the EVA market is poised for growth, with a focus on technological advancements, sustainability, and meeting the diverse needs of a global customer base.

EVA Demand Analysis

The global Ethylene Vinyl Acetate (EVA) market is experiencing robust growth, driven by increasing demand across various industries. The construction sector remains a significant consumer of EVA, particularly in the production of solar panels, where EVA is used as an encapsulant material. The growing emphasis on renewable energy sources has led to a surge in solar panel installations worldwide, consequently boosting the demand for EVA.

In the footwear industry, EVA continues to be a preferred material for midsoles and outsoles due to its lightweight, cushioning, and durability properties. The rising health consciousness and growing popularity of athletic and leisure footwear have further propelled the demand for EVA in this sector. Additionally, the packaging industry has shown increased adoption of EVA for flexible packaging solutions, driven by the need for improved barrier properties and enhanced product protection.

The automotive sector represents another key market for EVA, with applications in interior components, wire and cable insulation, and sound dampening materials. As vehicle manufacturers focus on lightweight materials to improve fuel efficiency and reduce emissions, the demand for EVA in automotive applications is expected to grow steadily.

In the medical field, EVA is gaining traction in the production of medical devices and pharmaceutical packaging due to its biocompatibility and chemical resistance. The ongoing COVID-19 pandemic has further accelerated the demand for medical-grade EVA in the production of personal protective equipment (PPE) and medical packaging.

Geographically, Asia-Pacific remains the largest consumer of EVA, with China and India leading the demand. The rapid industrialization, urbanization, and infrastructure development in these countries continue to drive the consumption of EVA across various end-use industries. North America and Europe also maintain significant market shares, primarily due to the strong presence of automotive and renewable energy sectors.

The increasing focus on sustainability and environmental regulations has led to a growing demand for bio-based and recyclable EVA alternatives. This trend is expected to shape the future landscape of the EVA market, with manufacturers investing in research and development to create more eco-friendly products. As a result, the market is likely to witness a shift towards sustainable EVA formulations in the coming years, potentially altering the demand dynamics across different applications and regions.

In the footwear industry, EVA continues to be a preferred material for midsoles and outsoles due to its lightweight, cushioning, and durability properties. The rising health consciousness and growing popularity of athletic and leisure footwear have further propelled the demand for EVA in this sector. Additionally, the packaging industry has shown increased adoption of EVA for flexible packaging solutions, driven by the need for improved barrier properties and enhanced product protection.

The automotive sector represents another key market for EVA, with applications in interior components, wire and cable insulation, and sound dampening materials. As vehicle manufacturers focus on lightweight materials to improve fuel efficiency and reduce emissions, the demand for EVA in automotive applications is expected to grow steadily.

In the medical field, EVA is gaining traction in the production of medical devices and pharmaceutical packaging due to its biocompatibility and chemical resistance. The ongoing COVID-19 pandemic has further accelerated the demand for medical-grade EVA in the production of personal protective equipment (PPE) and medical packaging.

Geographically, Asia-Pacific remains the largest consumer of EVA, with China and India leading the demand. The rapid industrialization, urbanization, and infrastructure development in these countries continue to drive the consumption of EVA across various end-use industries. North America and Europe also maintain significant market shares, primarily due to the strong presence of automotive and renewable energy sectors.

The increasing focus on sustainability and environmental regulations has led to a growing demand for bio-based and recyclable EVA alternatives. This trend is expected to shape the future landscape of the EVA market, with manufacturers investing in research and development to create more eco-friendly products. As a result, the market is likely to witness a shift towards sustainable EVA formulations in the coming years, potentially altering the demand dynamics across different applications and regions.

EVA Tech Challenges

The Ethylene Vinyl Acetate (EVA) market faces several significant technological challenges that could impact its future landscape. One of the primary concerns is the optimization of production processes to enhance efficiency and reduce costs. Current EVA manufacturing methods often involve high energy consumption and substantial raw material waste, which not only affects profitability but also raises environmental concerns.

Another major challenge lies in improving the material properties of EVA to meet evolving industry demands. While EVA is known for its flexibility, transparency, and resistance to UV radiation, there is a growing need for enhanced thermal stability, improved barrier properties, and increased mechanical strength. Achieving these improvements without compromising the existing beneficial characteristics of EVA presents a complex technical hurdle.

The development of bio-based and sustainable EVA alternatives is also a pressing challenge. With increasing environmental awareness and stringent regulations, the industry is under pressure to reduce its reliance on petroleum-based raw materials. However, creating bio-based EVA with comparable performance and cost-effectiveness to traditional EVA remains a significant technical obstacle.

Recycling and end-of-life management of EVA products pose another set of challenges. The cross-linked structure of EVA, particularly in foam applications, makes it difficult to recycle using conventional methods. Developing efficient recycling technologies for EVA waste is crucial for improving the material's sustainability profile and meeting circular economy goals.

Furthermore, the EVA industry faces challenges in scaling up production to meet growing demand, especially in emerging markets. This requires not only technological advancements in manufacturing processes but also innovations in supply chain management and logistics to ensure consistent quality and timely delivery of products.

Lastly, the industry must address the challenge of product differentiation and customization. As competition intensifies, manufacturers need to develop EVA grades with unique properties tailored to specific applications. This demands continuous innovation in polymer chemistry and processing techniques to create value-added products that can command premium prices in the market.

Another major challenge lies in improving the material properties of EVA to meet evolving industry demands. While EVA is known for its flexibility, transparency, and resistance to UV radiation, there is a growing need for enhanced thermal stability, improved barrier properties, and increased mechanical strength. Achieving these improvements without compromising the existing beneficial characteristics of EVA presents a complex technical hurdle.

The development of bio-based and sustainable EVA alternatives is also a pressing challenge. With increasing environmental awareness and stringent regulations, the industry is under pressure to reduce its reliance on petroleum-based raw materials. However, creating bio-based EVA with comparable performance and cost-effectiveness to traditional EVA remains a significant technical obstacle.

Recycling and end-of-life management of EVA products pose another set of challenges. The cross-linked structure of EVA, particularly in foam applications, makes it difficult to recycle using conventional methods. Developing efficient recycling technologies for EVA waste is crucial for improving the material's sustainability profile and meeting circular economy goals.

Furthermore, the EVA industry faces challenges in scaling up production to meet growing demand, especially in emerging markets. This requires not only technological advancements in manufacturing processes but also innovations in supply chain management and logistics to ensure consistent quality and timely delivery of products.

Lastly, the industry must address the challenge of product differentiation and customization. As competition intensifies, manufacturers need to develop EVA grades with unique properties tailored to specific applications. This demands continuous innovation in polymer chemistry and processing techniques to create value-added products that can command premium prices in the market.

Current EVA Solutions

01 Composition and properties of EVA

Ethylene Vinyl Acetate (EVA) is a copolymer of ethylene and vinyl acetate. It exhibits properties such as flexibility, toughness, and resistance to stress-cracking. The composition and ratio of ethylene to vinyl acetate can be adjusted to achieve specific material characteristics for various applications.- Composition and properties of EVA: Ethylene Vinyl Acetate (EVA) is a copolymer of ethylene and vinyl acetate. It exhibits properties such as flexibility, toughness, and resistance to stress-cracking. The ratio of ethylene to vinyl acetate in the copolymer can be varied to achieve different characteristics, making it suitable for various applications.

- EVA in adhesive applications: EVA is widely used in adhesive formulations due to its excellent adhesion properties and compatibility with various substrates. It is particularly effective in hot melt adhesives, providing good bond strength and flexibility. EVA-based adhesives find applications in packaging, bookbinding, and product assembly.

- EVA in foam and insulation materials: EVA is utilized in the production of foam and insulation materials. Its closed-cell structure and low thermal conductivity make it suitable for applications such as footwear soles, sports equipment padding, and building insulation. EVA foams offer good shock absorption and cushioning properties.

- EVA in solar panel encapsulation: EVA is commonly used as an encapsulant material in photovoltaic modules. It provides excellent transparency, weatherability, and electrical insulation properties. EVA encapsulants help protect solar cells from environmental factors and enhance the overall performance and durability of solar panels.

- Modifications and blends of EVA: EVA can be modified or blended with other polymers to enhance its properties for specific applications. This includes crosslinking, grafting, or incorporating additives to improve characteristics such as heat resistance, flame retardancy, or UV stability. EVA blends are used in various industries, including automotive, packaging, and construction.

02 EVA in adhesive applications

EVA is widely used in adhesive formulations due to its excellent adhesion properties and compatibility with various substrates. It is utilized in hot melt adhesives, pressure-sensitive adhesives, and sealants for packaging, construction, and automotive industries.Expand Specific Solutions03 EVA in foam and insulation materials

EVA is employed in the production of foam and insulation materials. Its closed-cell structure and low thermal conductivity make it suitable for applications in footwear, sports equipment, and building insulation. EVA foams offer cushioning, shock absorption, and thermal insulation properties.Expand Specific Solutions04 EVA in solar panel encapsulation

EVA is extensively used as an encapsulant material in photovoltaic modules. It provides protection to solar cells from environmental factors, enhances light transmission, and ensures long-term durability of solar panels. The material's transparency and weathering resistance contribute to its effectiveness in this application.Expand Specific Solutions05 Modifications and blends of EVA

EVA can be modified or blended with other polymers and additives to enhance its properties for specific applications. These modifications can improve characteristics such as flame retardancy, UV resistance, and mechanical strength. Crosslinking and grafting techniques are also employed to tailor EVA properties.Expand Specific Solutions

EVA Industry Players

The ethylene vinyl acetate (EVA) market is in a growth phase, driven by increasing demand across various industries. The global market size is projected to expand significantly in the coming years, with a compound annual growth rate expected to be robust. Technologically, EVA production is relatively mature, but ongoing research and development efforts by key players such as China Petroleum & Chemical Corp., Celanese International Corp., and Hanwha Chemical Co., Ltd. are focused on improving product quality and production efficiency. These companies, along with others like Resonac Holdings Corp. and LyondellBasell Industries, are investing in advanced manufacturing processes and exploring new applications to maintain their competitive edge in this evolving market landscape.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced EVA production technologies, including a proprietary high-pressure tubular reactor process. This process allows for precise control of vinyl acetate content and molecular weight distribution, resulting in EVA with superior properties[1]. Sinopec has also invested in expanding its EVA production capacity, with plans to increase output by 200,000 tons per year by 2025[2]. The company is focusing on developing specialty EVA grades for high-value applications such as photovoltaic encapsulants, which are expected to see significant demand growth in the coming years[3].

Strengths: Large-scale production capacity, advanced proprietary technology, strong R&D capabilities. Weaknesses: Dependence on fossil fuel-based feedstocks, potential environmental concerns.

Celanese International Corp.

Technical Solution: Celanese has developed a range of innovative EVA products under its VitalDose® platform, specifically designed for controlled release drug delivery applications[4]. The company's EVA technology allows for customizable drug release profiles and improved bioavailability of active pharmaceutical ingredients. Celanese has also invested in sustainable EVA production, implementing energy-efficient processes and exploring bio-based feedstocks[5]. The company's EVA products are used in various industries, including automotive, packaging, and solar energy, with a focus on high-performance applications[6].

Strengths: Diverse product portfolio, strong presence in specialty applications, focus on sustainability. Weaknesses: Higher production costs for specialty grades, potential competition from alternative materials.

Key EVA Innovations

Method for ethylenevinylacetate with low melt index

PatentActiveKR1020160054313A

Innovation

- A method involving packaging ethylene vinyl acetate resin with a high vinyl acetate content into a packaging bag and irradiating it with an electron beam or X-ray at a specific dose to reduce the melt index to 10 g/10 min or less, enhancing mechanical properties and processability.

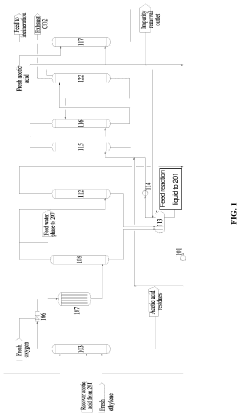

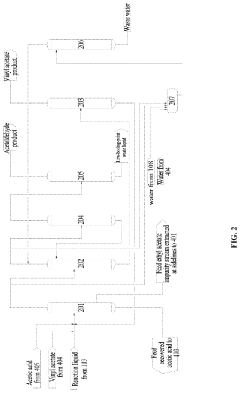

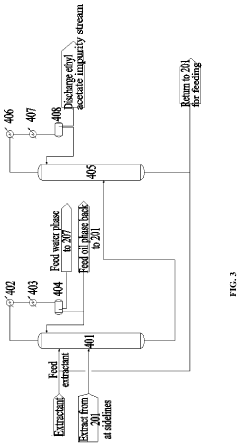

Method for producing vinyl acetate

PatentActiveUS20230312452A1

Innovation

- A method involving a gas phase oxidation process with a system integration that includes specific towers and reactors for ethylene recovery, acetic acid evaporation, oxygen mixing, and separation processes, utilizing acetic acid as an extractant in the rectifying and separating towers to enhance the separation of vinyl acetate from ethyl acetate.

EVA Sustainability Impact

The sustainability impact of Ethylene Vinyl Acetate (EVA) is becoming increasingly significant in shaping the future landscape of the EVA market. As environmental concerns continue to grow, the EVA industry is facing pressure to adopt more sustainable practices and develop eco-friendly alternatives.

One of the primary sustainability challenges for EVA is its reliance on fossil fuel-based raw materials. The production of ethylene and vinyl acetate monomers, the key components of EVA, typically involves petroleum-derived feedstocks. This dependency on non-renewable resources raises concerns about long-term sustainability and contributes to the carbon footprint of EVA products.

In response to these challenges, the EVA industry is exploring various avenues to enhance sustainability. Bio-based EVA alternatives are gaining traction, with researchers and manufacturers investigating the use of renewable feedstocks derived from plant sources. These bio-based EVAs aim to reduce reliance on fossil fuels and potentially offer a more environmentally friendly option for consumers.

Recycling and circular economy initiatives are also playing a crucial role in improving the sustainability profile of EVA. Efforts are being made to develop effective recycling processes for EVA-based products, particularly in industries such as footwear and packaging. By implementing closed-loop systems, manufacturers can reduce waste and minimize the environmental impact of EVA throughout its lifecycle.

The energy efficiency of EVA production processes is another area of focus for sustainability improvements. Manufacturers are investing in advanced technologies and optimized production methods to reduce energy consumption and minimize greenhouse gas emissions associated with EVA manufacturing.

Furthermore, the durability and versatility of EVA contribute to its sustainability potential. EVA's long-lasting properties in various applications, such as solar panel encapsulation, can lead to extended product lifespans and reduced material replacement frequency, ultimately lowering overall environmental impact.

As regulations and consumer preferences continue to prioritize sustainability, the EVA market is likely to see a shift towards more environmentally friendly products and processes. This transition may present both challenges and opportunities for industry players, potentially reshaping the competitive landscape and driving innovation in sustainable EVA solutions.

One of the primary sustainability challenges for EVA is its reliance on fossil fuel-based raw materials. The production of ethylene and vinyl acetate monomers, the key components of EVA, typically involves petroleum-derived feedstocks. This dependency on non-renewable resources raises concerns about long-term sustainability and contributes to the carbon footprint of EVA products.

In response to these challenges, the EVA industry is exploring various avenues to enhance sustainability. Bio-based EVA alternatives are gaining traction, with researchers and manufacturers investigating the use of renewable feedstocks derived from plant sources. These bio-based EVAs aim to reduce reliance on fossil fuels and potentially offer a more environmentally friendly option for consumers.

Recycling and circular economy initiatives are also playing a crucial role in improving the sustainability profile of EVA. Efforts are being made to develop effective recycling processes for EVA-based products, particularly in industries such as footwear and packaging. By implementing closed-loop systems, manufacturers can reduce waste and minimize the environmental impact of EVA throughout its lifecycle.

The energy efficiency of EVA production processes is another area of focus for sustainability improvements. Manufacturers are investing in advanced technologies and optimized production methods to reduce energy consumption and minimize greenhouse gas emissions associated with EVA manufacturing.

Furthermore, the durability and versatility of EVA contribute to its sustainability potential. EVA's long-lasting properties in various applications, such as solar panel encapsulation, can lead to extended product lifespans and reduced material replacement frequency, ultimately lowering overall environmental impact.

As regulations and consumer preferences continue to prioritize sustainability, the EVA market is likely to see a shift towards more environmentally friendly products and processes. This transition may present both challenges and opportunities for industry players, potentially reshaping the competitive landscape and driving innovation in sustainable EVA solutions.

EVA Regulatory Framework

The regulatory framework surrounding Ethylene Vinyl Acetate (EVA) plays a crucial role in shaping the future landscape of the EVA market. As environmental concerns and sustainability initiatives gain prominence globally, regulatory bodies are implementing stricter guidelines for the production, use, and disposal of EVA-based products.

In the European Union, the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation has a significant impact on the EVA industry. Manufacturers and importers are required to register EVA and provide detailed information on its properties, potential risks, and safe handling procedures. This regulation aims to ensure the protection of human health and the environment while promoting innovation and competitiveness in the chemical industry.

The United States Environmental Protection Agency (EPA) regulates EVA under the Toxic Substances Control Act (TSCA). The EPA conducts risk assessments and may impose restrictions on the manufacture, processing, distribution, use, or disposal of EVA if it poses unreasonable risks to human health or the environment. Additionally, the Food and Drug Administration (FDA) regulates the use of EVA in food contact materials, ensuring its safety for consumers.

In Asia, countries like China and Japan have implemented their own regulatory frameworks for chemical substances, including EVA. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law (CSCL) require manufacturers and importers to register and obtain approval for new chemical substances, including EVA, before they can be produced or imported.

The global trend towards circular economy and sustainable practices is influencing EVA regulations. Many countries are implementing extended producer responsibility (EPR) programs, which require manufacturers to take responsibility for the entire lifecycle of their products, including recycling and disposal. This trend is likely to drive innovation in EVA recycling technologies and the development of more environmentally friendly EVA formulations.

As concerns about microplastics and plastic pollution grow, regulatory bodies are increasingly focusing on the environmental impact of EVA-based products. This may lead to stricter regulations on the use of EVA in certain applications, particularly in single-use items or products with high environmental exposure.

The future regulatory landscape for EVA is expected to become more complex and stringent. Manufacturers and users of EVA will need to stay informed about evolving regulations across different regions and adapt their practices accordingly. This regulatory environment will likely drive innovation in sustainable EVA production methods, recycling technologies, and the development of bio-based alternatives to traditional EVA formulations.

In the European Union, the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation has a significant impact on the EVA industry. Manufacturers and importers are required to register EVA and provide detailed information on its properties, potential risks, and safe handling procedures. This regulation aims to ensure the protection of human health and the environment while promoting innovation and competitiveness in the chemical industry.

The United States Environmental Protection Agency (EPA) regulates EVA under the Toxic Substances Control Act (TSCA). The EPA conducts risk assessments and may impose restrictions on the manufacture, processing, distribution, use, or disposal of EVA if it poses unreasonable risks to human health or the environment. Additionally, the Food and Drug Administration (FDA) regulates the use of EVA in food contact materials, ensuring its safety for consumers.

In Asia, countries like China and Japan have implemented their own regulatory frameworks for chemical substances, including EVA. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law (CSCL) require manufacturers and importers to register and obtain approval for new chemical substances, including EVA, before they can be produced or imported.

The global trend towards circular economy and sustainable practices is influencing EVA regulations. Many countries are implementing extended producer responsibility (EPR) programs, which require manufacturers to take responsibility for the entire lifecycle of their products, including recycling and disposal. This trend is likely to drive innovation in EVA recycling technologies and the development of more environmentally friendly EVA formulations.

As concerns about microplastics and plastic pollution grow, regulatory bodies are increasingly focusing on the environmental impact of EVA-based products. This may lead to stricter regulations on the use of EVA in certain applications, particularly in single-use items or products with high environmental exposure.

The future regulatory landscape for EVA is expected to become more complex and stringent. Manufacturers and users of EVA will need to stay informed about evolving regulations across different regions and adapt their practices accordingly. This regulatory environment will likely drive innovation in sustainable EVA production methods, recycling technologies, and the development of bio-based alternatives to traditional EVA formulations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!