Thermoelectric Generator Materials For Waste Heat Recovery

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermoelectric Materials Background and Recovery Goals

Thermoelectric materials have evolved significantly since their discovery in the early 19th century when Thomas Johann Seebeck first observed the phenomenon of direct conversion of temperature differences to electric voltage. This discovery laid the foundation for thermoelectric generators (TEGs), which have since developed into devices capable of converting waste heat into usable electricity through the Seebeck effect. The historical trajectory shows a gradual improvement in material efficiency, with notable advancements occurring during the mid-20th century with the development of semiconductor-based thermoelectrics.

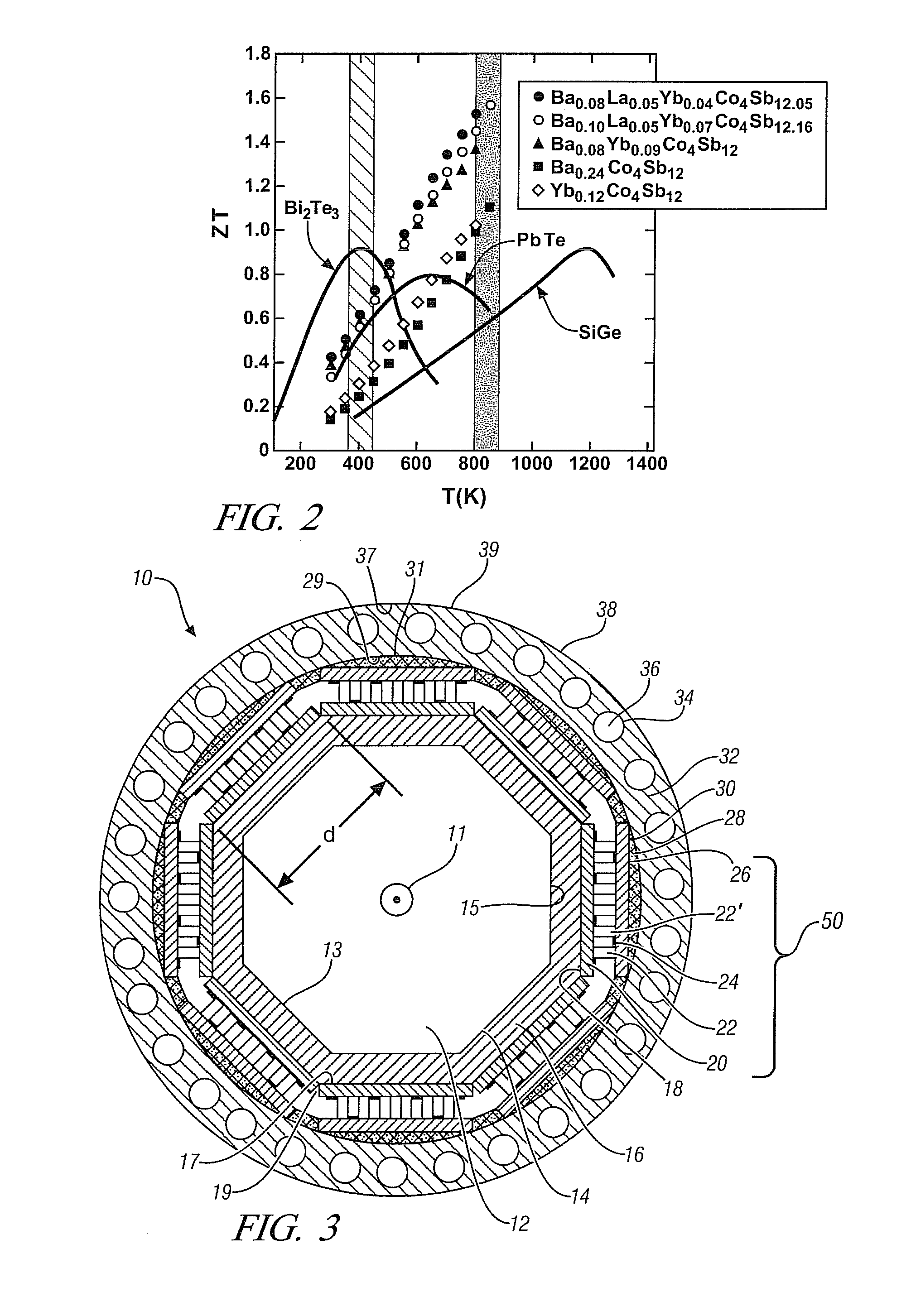

The technological evolution of thermoelectric materials has been characterized by three distinct generations. First-generation materials, primarily based on bismuth telluride (Bi2Te3) and lead telluride (PbTe), dominated the field until the 1990s with modest figure of merit (ZT) values around 1. Second-generation materials introduced nanostructuring techniques to enhance phonon scattering while preserving electrical conductivity, pushing ZT values to approximately 1.5-1.7. Current third-generation materials explore complex crystal structures and novel compositions, aiming to achieve ZT values exceeding 2.0.

The primary goal of thermoelectric material development for waste heat recovery is to significantly improve conversion efficiency. Current commercial thermoelectric generators typically operate at 5-8% efficiency, whereas the theoretical Carnot efficiency for many waste heat scenarios could exceed 20%. Bridging this gap requires materials with substantially higher ZT values, ideally above 2, while maintaining stability across wide temperature ranges relevant to industrial waste heat sources (200-600°C).

Another critical objective is cost reduction. Many high-performance thermoelectric materials contain rare or toxic elements like tellurium, making widespread industrial adoption economically challenging. Research aims to develop materials using earth-abundant, environmentally benign elements without sacrificing performance, targeting a cost reduction of at least 50% compared to current solutions.

Durability represents another key goal, as thermoelectric generators in waste heat recovery applications must withstand thermal cycling, oxidation, and mechanical stress for extended periods. Current materials often degrade after 3-5 years of continuous operation, whereas industrial applications typically require 10+ years of reliable performance to justify implementation costs.

The overarching technological trajectory points toward multifunctional thermoelectric systems that can operate efficiently across broader temperature ranges, potentially through segmented or cascaded designs incorporating different materials optimized for specific temperature zones. This approach aligns with the ultimate goal of creating modular, scalable waste heat recovery solutions applicable across diverse industrial sectors.

The technological evolution of thermoelectric materials has been characterized by three distinct generations. First-generation materials, primarily based on bismuth telluride (Bi2Te3) and lead telluride (PbTe), dominated the field until the 1990s with modest figure of merit (ZT) values around 1. Second-generation materials introduced nanostructuring techniques to enhance phonon scattering while preserving electrical conductivity, pushing ZT values to approximately 1.5-1.7. Current third-generation materials explore complex crystal structures and novel compositions, aiming to achieve ZT values exceeding 2.0.

The primary goal of thermoelectric material development for waste heat recovery is to significantly improve conversion efficiency. Current commercial thermoelectric generators typically operate at 5-8% efficiency, whereas the theoretical Carnot efficiency for many waste heat scenarios could exceed 20%. Bridging this gap requires materials with substantially higher ZT values, ideally above 2, while maintaining stability across wide temperature ranges relevant to industrial waste heat sources (200-600°C).

Another critical objective is cost reduction. Many high-performance thermoelectric materials contain rare or toxic elements like tellurium, making widespread industrial adoption economically challenging. Research aims to develop materials using earth-abundant, environmentally benign elements without sacrificing performance, targeting a cost reduction of at least 50% compared to current solutions.

Durability represents another key goal, as thermoelectric generators in waste heat recovery applications must withstand thermal cycling, oxidation, and mechanical stress for extended periods. Current materials often degrade after 3-5 years of continuous operation, whereas industrial applications typically require 10+ years of reliable performance to justify implementation costs.

The overarching technological trajectory points toward multifunctional thermoelectric systems that can operate efficiently across broader temperature ranges, potentially through segmented or cascaded designs incorporating different materials optimized for specific temperature zones. This approach aligns with the ultimate goal of creating modular, scalable waste heat recovery solutions applicable across diverse industrial sectors.

Market Analysis for Waste Heat Recovery Solutions

The global waste heat recovery market is experiencing significant growth, valued at approximately $54 billion in 2020 and projected to reach $80 billion by 2026, with a compound annual growth rate of 8.8%. This expansion is primarily driven by increasing industrial energy costs, stringent environmental regulations, and growing awareness of energy efficiency across manufacturing sectors.

Industrial processes represent the largest market segment, with steel, cement, glass, and chemical industries collectively accounting for over 60% of the total addressable market. These industries typically operate at high temperatures and generate substantial waste heat, creating ideal conditions for thermoelectric generator implementation. The automotive sector follows as the second-largest market, where thermoelectric generators can recover waste heat from exhaust systems, potentially improving fuel efficiency by 3-5%.

Geographically, Asia-Pacific dominates the market with approximately 40% share, led by China's massive industrial base and government-backed energy efficiency initiatives. North America and Europe each represent about 25% of the market, with particularly strong growth in Germany, France, and the United States due to favorable regulatory frameworks and sustainability targets.

The market structure reveals interesting dynamics between established players and new entrants. Traditional waste heat recovery solutions like heat exchangers and steam generators hold approximately 70% market share, while thermoelectric generator solutions currently represent only about 8% but are growing at twice the rate of conventional technologies.

Customer segmentation shows distinct needs across different sectors. Large industrial conglomerates prioritize return on investment and system reliability, typically requiring payback periods under three years. Automotive manufacturers focus on compact design and durability under variable conditions. Small and medium enterprises seek modular, low-maintenance solutions with minimal upfront investment.

Price sensitivity varies significantly by application. High-temperature industrial applications demonstrate lower price sensitivity due to greater potential energy savings, while commercial building applications show higher price sensitivity with longer expected payback periods.

Market barriers include high initial capital costs, technical integration challenges with existing systems, and limited awareness of thermoelectric technology benefits. However, these barriers are gradually diminishing as material costs decrease and demonstration projects prove commercial viability across various applications.

Industrial processes represent the largest market segment, with steel, cement, glass, and chemical industries collectively accounting for over 60% of the total addressable market. These industries typically operate at high temperatures and generate substantial waste heat, creating ideal conditions for thermoelectric generator implementation. The automotive sector follows as the second-largest market, where thermoelectric generators can recover waste heat from exhaust systems, potentially improving fuel efficiency by 3-5%.

Geographically, Asia-Pacific dominates the market with approximately 40% share, led by China's massive industrial base and government-backed energy efficiency initiatives. North America and Europe each represent about 25% of the market, with particularly strong growth in Germany, France, and the United States due to favorable regulatory frameworks and sustainability targets.

The market structure reveals interesting dynamics between established players and new entrants. Traditional waste heat recovery solutions like heat exchangers and steam generators hold approximately 70% market share, while thermoelectric generator solutions currently represent only about 8% but are growing at twice the rate of conventional technologies.

Customer segmentation shows distinct needs across different sectors. Large industrial conglomerates prioritize return on investment and system reliability, typically requiring payback periods under three years. Automotive manufacturers focus on compact design and durability under variable conditions. Small and medium enterprises seek modular, low-maintenance solutions with minimal upfront investment.

Price sensitivity varies significantly by application. High-temperature industrial applications demonstrate lower price sensitivity due to greater potential energy savings, while commercial building applications show higher price sensitivity with longer expected payback periods.

Market barriers include high initial capital costs, technical integration challenges with existing systems, and limited awareness of thermoelectric technology benefits. However, these barriers are gradually diminishing as material costs decrease and demonstration projects prove commercial viability across various applications.

Current State and Challenges in Thermoelectric Generator Materials

Thermoelectric generator (TEG) materials have witnessed significant advancements over the past decade, yet remain at a critical juncture between laboratory promise and widespread commercial implementation. Current state-of-the-art materials achieve a dimensionless figure of merit (ZT) between 1.5-2.0, with bismuth telluride (Bi2Te3) dominating low-temperature applications (300-500K) and lead telluride (PbTe) prevalent in mid-temperature ranges (500-900K). For high-temperature applications (>900K), silicon-germanium alloys and skutterudites have shown promising performance.

Despite these achievements, the field faces substantial challenges that impede broader adoption. The primary limitation remains conversion efficiency, with most commercial TEGs operating at only 5-8% efficiency—significantly lower than competing waste heat recovery technologies. This efficiency bottleneck stems from the inherent coupling of electrical and thermal properties in thermoelectric materials, creating a fundamental materials science paradox where improving one parameter often degrades another.

Material cost and availability present another critical barrier. High-performance thermoelectric materials frequently rely on tellurium, germanium, and other rare elements with limited global supply and geopolitical supply chain vulnerabilities. China currently controls approximately 70% of tellurium production, creating potential market instabilities for TEG manufacturers worldwide.

Manufacturing scalability remains problematic, with precision requirements for material composition and module assembly driving production costs upward. Current fabrication techniques struggle to maintain performance consistency across large-scale production, resulting in significant property variations between laboratory prototypes and mass-produced modules.

Environmental concerns also challenge wider implementation, as many high-performance thermoelectric materials contain toxic elements like lead and tellurium. This toxicity creates regulatory hurdles in certain markets and applications, particularly in consumer-facing and automotive sectors where end-of-life disposal presents environmental risks.

Mechanical durability presents another significant obstacle, with thermal cycling in real-world applications causing premature failure through thermal expansion mismatches, interfacial degradation, and mechanical stress. Most current TEG systems demonstrate operational lifetimes significantly shorter than competing technologies, limiting their application in long-term industrial settings.

Geographically, research leadership in thermoelectric materials shows distinct patterns, with North America leading in fundamental materials discovery, East Asia (particularly Japan, China, and South Korea) dominating in manufacturing innovation, and Europe focusing on systems integration and specialized applications. This distribution creates both collaborative opportunities and competitive challenges in advancing the technology globally.

Despite these achievements, the field faces substantial challenges that impede broader adoption. The primary limitation remains conversion efficiency, with most commercial TEGs operating at only 5-8% efficiency—significantly lower than competing waste heat recovery technologies. This efficiency bottleneck stems from the inherent coupling of electrical and thermal properties in thermoelectric materials, creating a fundamental materials science paradox where improving one parameter often degrades another.

Material cost and availability present another critical barrier. High-performance thermoelectric materials frequently rely on tellurium, germanium, and other rare elements with limited global supply and geopolitical supply chain vulnerabilities. China currently controls approximately 70% of tellurium production, creating potential market instabilities for TEG manufacturers worldwide.

Manufacturing scalability remains problematic, with precision requirements for material composition and module assembly driving production costs upward. Current fabrication techniques struggle to maintain performance consistency across large-scale production, resulting in significant property variations between laboratory prototypes and mass-produced modules.

Environmental concerns also challenge wider implementation, as many high-performance thermoelectric materials contain toxic elements like lead and tellurium. This toxicity creates regulatory hurdles in certain markets and applications, particularly in consumer-facing and automotive sectors where end-of-life disposal presents environmental risks.

Mechanical durability presents another significant obstacle, with thermal cycling in real-world applications causing premature failure through thermal expansion mismatches, interfacial degradation, and mechanical stress. Most current TEG systems demonstrate operational lifetimes significantly shorter than competing technologies, limiting their application in long-term industrial settings.

Geographically, research leadership in thermoelectric materials shows distinct patterns, with North America leading in fundamental materials discovery, East Asia (particularly Japan, China, and South Korea) dominating in manufacturing innovation, and Europe focusing on systems integration and specialized applications. This distribution creates both collaborative opportunities and competitive challenges in advancing the technology globally.

Existing Thermoelectric Material Solutions for Waste Heat Recovery

01 Bismuth telluride-based thermoelectric materials

Bismuth telluride (Bi2Te3) and its alloys are widely used in thermoelectric generators due to their high figure of merit at room temperature. These materials can be doped with various elements to enhance their thermoelectric properties. Advanced manufacturing techniques such as nanostructuring and thin film deposition are employed to improve the efficiency of these materials by reducing thermal conductivity while maintaining electrical conductivity.- Bismuth telluride-based thermoelectric materials: Bismuth telluride and its alloys are widely used in thermoelectric generators due to their high figure of merit (ZT) at room temperature. These materials can be doped with various elements to enhance their thermoelectric properties. Advanced manufacturing techniques such as nanostructuring and thin film deposition are employed to improve the efficiency of these materials by reducing thermal conductivity while maintaining electrical conductivity.

- Skutterudite and half-Heusler compounds: Skutterudite and half-Heusler compounds represent important classes of thermoelectric materials suitable for medium to high-temperature applications. These materials feature complex crystal structures that inherently reduce thermal conductivity. They can be filled with guest atoms (for skutterudites) or modified through elemental substitution (for half-Heuslers) to optimize their thermoelectric performance, making them excellent candidates for waste heat recovery applications.

- Organic and polymer-based thermoelectric materials: Organic and polymer-based thermoelectric materials offer advantages such as flexibility, low cost, and environmental friendliness. These materials can be processed using solution-based techniques, enabling large-area fabrication and integration into flexible devices. Recent developments focus on enhancing the power factor of these materials through molecular design, doping strategies, and composite formation with inorganic materials to improve their typically low ZT values.

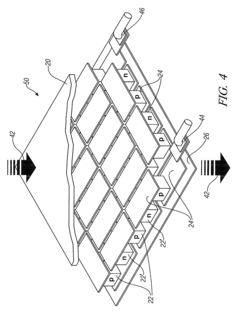

- Nanostructured thermoelectric materials: Nanostructuring approaches significantly enhance thermoelectric performance by introducing interfaces that scatter phonons more effectively than electrons, thereby reducing thermal conductivity while maintaining electrical conductivity. These approaches include quantum dots, nanowires, nanocomposites, and superlattice structures. Advanced fabrication techniques such as ball milling, spark plasma sintering, and molecular beam epitaxy are employed to create these nanostructured materials with controlled dimensions and interfaces.

- Silicon-germanium and oxide-based thermoelectric materials: Silicon-germanium alloys are particularly suitable for high-temperature applications, such as radioisotope thermoelectric generators used in space missions. Meanwhile, oxide-based thermoelectric materials offer excellent thermal stability, oxidation resistance, and environmental friendliness. These materials include layered cobaltites, perovskites, and other transition metal oxides. Recent research focuses on improving their relatively low ZT values through nanostructuring, doping, and defect engineering.

02 Skutterudite and half-Heusler compounds

Skutterudites (CoSb3-based) and half-Heusler compounds represent promising mid-to-high temperature thermoelectric materials. These materials feature complex crystal structures that inherently reduce thermal conductivity through phonon scattering. They can be filled with guest atoms in their structural cages to further reduce thermal conductivity while maintaining good electrical properties, making them suitable for waste heat recovery applications in automotive and industrial settings.Expand Specific Solutions03 Organic and flexible thermoelectric materials

Organic and polymer-based thermoelectric materials offer advantages of flexibility, light weight, and low-cost manufacturing. These materials can be processed using solution-based techniques and are suitable for wearable thermoelectric generators. Recent developments include conductive polymers with enhanced thermoelectric properties and organic-inorganic hybrid materials that combine the flexibility of organics with the efficiency of inorganic materials.Expand Specific Solutions04 Nanostructured thermoelectric materials

Nanostructuring techniques are employed to enhance the thermoelectric performance of various materials. By creating nanoscale features such as quantum dots, nanowires, and superlattices, thermal conductivity can be significantly reduced while preserving electrical conductivity. These approaches leverage quantum confinement effects and increased phonon scattering at interfaces to improve the figure of merit (ZT) of thermoelectric materials.Expand Specific Solutions05 Silicon-germanium and oxide-based thermoelectric materials

Silicon-germanium alloys are effective thermoelectric materials for high-temperature applications, particularly in space power generation. Oxide-based thermoelectric materials offer advantages of high thermal stability, oxidation resistance, and environmental friendliness. These materials include layered cobaltites, perovskites, and other transition metal oxides that can operate efficiently at elevated temperatures in air, making them suitable for industrial waste heat recovery applications.Expand Specific Solutions

Leading Companies and Research Institutions in Thermoelectric Industry

Thermoelectric Generator (TEG) materials for waste heat recovery are gaining significant traction as industries seek sustainable energy solutions. The market is in a growth phase, with increasing adoption across automotive, industrial, and consumer electronics sectors. The global TEG market is projected to expand substantially due to rising energy costs and environmental regulations. Technologically, companies like Toyota, Gentherm, and Toshiba Materials are leading innovation with advanced bismuth telluride and skutterudite-based materials, while research institutions such as NIMS and Dalian University of Technology are developing next-generation materials with higher efficiency. European players like EUROPEAN THERMODYNAMICS and Alternative Energy Innovations are focusing on industrial applications, while Asian manufacturers including Samsung Heavy Industries and Hyundai are integrating TEGs into vehicle systems for improved fuel efficiency.

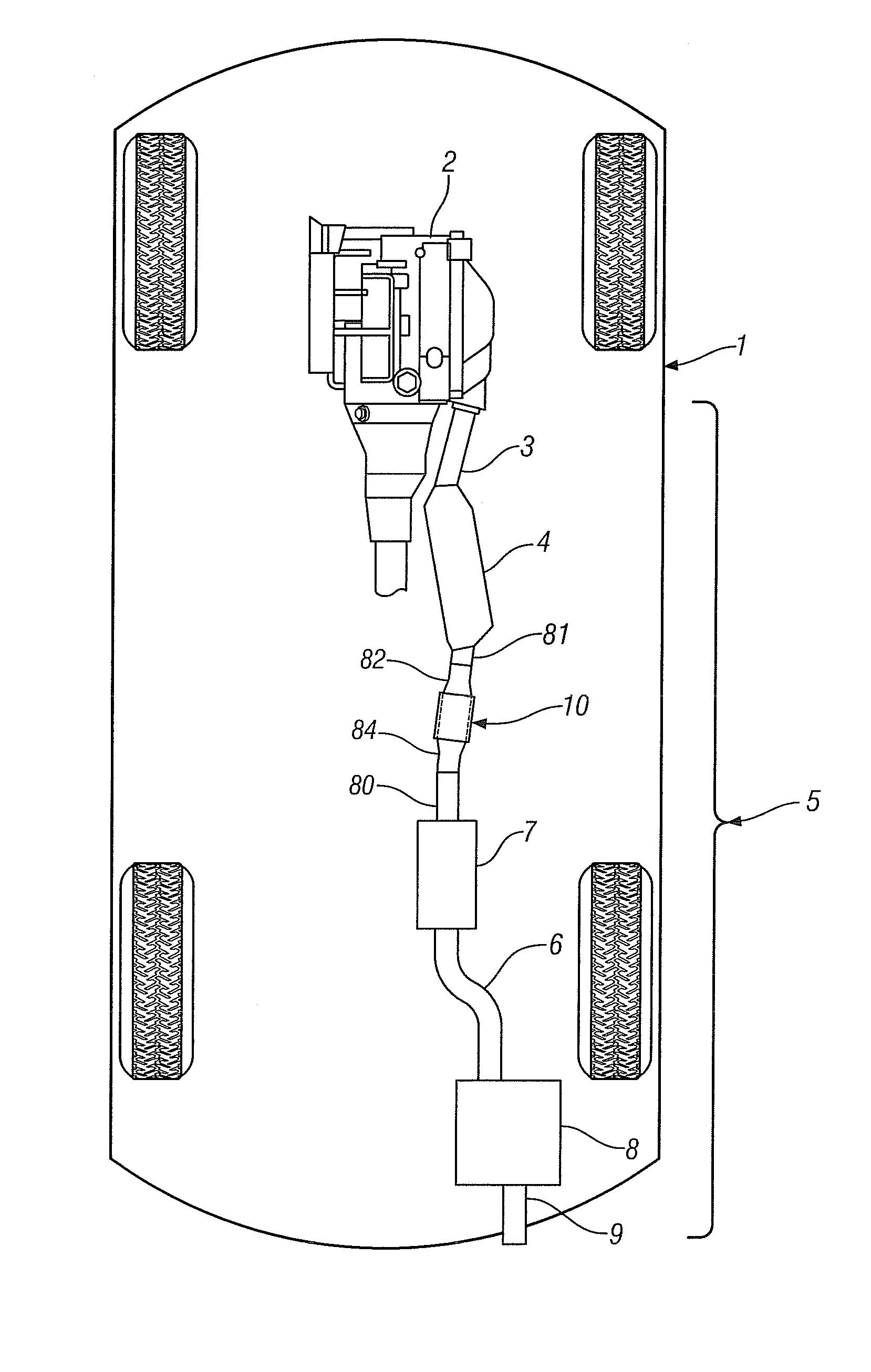

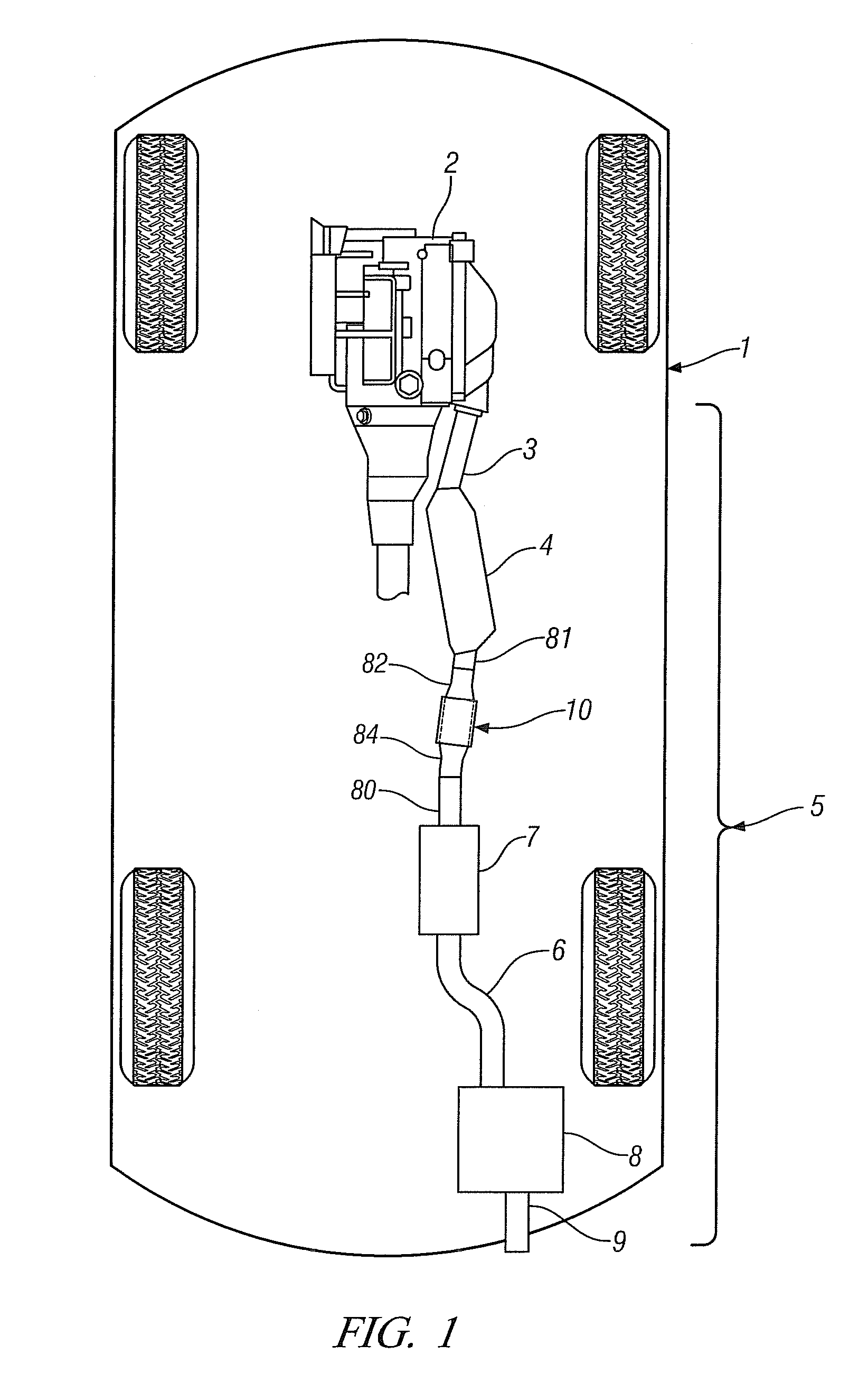

GM Global Technology Operations LLC

Technical Solution: GM has developed a sophisticated thermoelectric waste heat recovery system designed specifically for integration with their internal combustion and hybrid vehicle platforms. Their technology utilizes half-Heusler alloys (typically TiNiSn-based) that offer superior high-temperature stability and power density compared to traditional bismuth telluride materials. GM's system architecture places TEG modules directly in the exhaust gas recirculation (EGR) pathway, capturing waste heat that would otherwise be lost while simultaneously helping to manage engine temperatures. Their latest generation materials achieve ZT values of approximately 1.2-1.5 at operating temperatures between 400-600°C, and the integrated systems can generate 350-700W of electrical power during highway driving conditions. GM has also pioneered advanced manufacturing techniques that reduce the thermal contact resistance between TEG elements, improving overall system efficiency by up to 20% compared to earlier designs.

Strengths: Excellent high-temperature material performance; dual-purpose design that assists with thermal management; integration with existing vehicle electrical systems. Weaknesses: Lower efficiency at low-temperature operation (city driving); higher material costs for half-Heusler compounds; weight penalty in smaller vehicle applications.

Toyota Motor Corp.

Technical Solution: Toyota has developed a comprehensive waste heat recovery system using advanced thermoelectric materials that can be integrated into their hybrid vehicle powertrains. Their approach combines skutterudite-based materials for high-temperature applications (600-700°C) near the exhaust manifold and bismuth-telluride compounds for lower temperature regions (200-300°C). Toyota's system architecture employs a cascaded design that optimizes energy capture across the temperature gradient, achieving conversion efficiencies of up to 7-9% in real-world driving conditions. The company has also pioneered manufacturing techniques that reduce the reliance on rare earth elements, utilizing magnesium silicide and higher manganese silicides as alternative thermoelectric materials. Toyota's latest generation TEGs incorporate nano-structured interfaces that reduce thermal boundary resistance, improving overall system performance by approximately 15% compared to their previous designs.

Strengths: Comprehensive integration with existing hybrid systems; advanced materials research capabilities; reduced rare earth element dependency. Weaknesses: Complex system architecture increases manufacturing complexity; higher initial implementation costs; requires significant redesign of exhaust systems.

Key Innovations in High-Efficiency Thermoelectric Materials

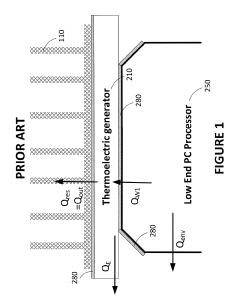

Thermoelectric generators incorporating phase-change materials for waste heat recovery from engine exhaust

PatentActiveUS20120073276A1

Innovation

- Integration of thermoelectric modules with phase-change materials in the exhaust conduit system to convert thermal energy from exhaust gases into electrical energy, using bypass pipes and air admittance to manage temperature and prevent overheating of thermoelectric modules.

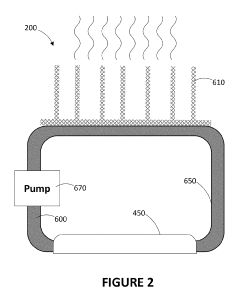

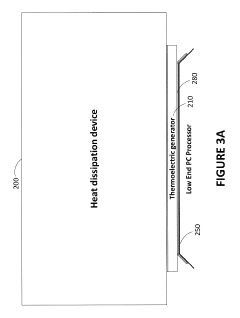

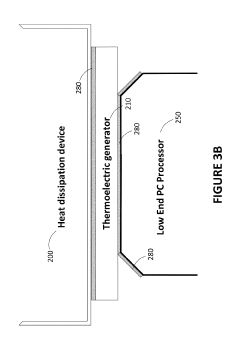

Apparatus for thermoelectric recovery of electronic waste heat

PatentActiveUS10424709B2

Innovation

- An apparatus comprising a thermoelectric generator with a heat dissipation device and a heat transfer device made of high thermal conductivity materials like copper or aluminum, along with thermal paste or adhesive, to effectively transfer and dissipate heat from electronic components, preventing overheating by actively cooling the system.

Environmental Impact and Sustainability of Thermoelectric Materials

The development of thermoelectric generator materials for waste heat recovery presents significant environmental implications that extend beyond energy efficiency. These materials offer a sustainable approach to energy generation by capturing waste heat that would otherwise be released into the environment, thereby reducing thermal pollution and greenhouse gas emissions associated with conventional power generation methods.

The manufacturing processes for thermoelectric materials, however, present environmental challenges that must be addressed. Many high-performance thermoelectric materials contain toxic or rare elements such as tellurium, bismuth, and lead, which raise concerns regarding resource depletion and environmental contamination. The extraction and processing of these elements often involve energy-intensive operations and chemical processes that can generate hazardous waste streams and contribute to environmental degradation.

Life cycle assessment (LCA) studies of thermoelectric systems reveal complex sustainability profiles. While operational benefits include emission-free energy generation and reduced fossil fuel consumption, the environmental footprint of material production and end-of-life disposal can partially offset these advantages. Research indicates that the environmental payback period for thermoelectric generators varies significantly depending on material composition, manufacturing methods, and application scenarios.

Recent advances in green thermoelectric materials show promising developments toward sustainability. Researchers are increasingly focusing on abundant, non-toxic alternatives such as silicides, oxides, and organic thermoelectric materials. These materials, while currently less efficient than their conventional counterparts, offer improved environmental compatibility and reduced dependence on critical raw materials.

Circular economy principles are gradually being integrated into thermoelectric material development. Strategies include designing for recyclability, implementing recovery processes for valuable elements, and exploring waste-derived precursors for material synthesis. These approaches aim to minimize resource consumption and waste generation throughout the material lifecycle.

The regulatory landscape surrounding thermoelectric materials is evolving, with increasing attention to environmental standards. Policies such as the European Union's Restriction of Hazardous Substances (RoHS) directive and the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation influence material selection and manufacturing practices in the thermoelectric industry, driving innovation toward more environmentally benign alternatives.

As thermoelectric technology advances, balancing performance requirements with environmental considerations remains a critical challenge. The development of environmentally sustainable thermoelectric materials represents not only a technical imperative but also an opportunity to align waste heat recovery technologies with broader sustainability goals and circular economy principles.

The manufacturing processes for thermoelectric materials, however, present environmental challenges that must be addressed. Many high-performance thermoelectric materials contain toxic or rare elements such as tellurium, bismuth, and lead, which raise concerns regarding resource depletion and environmental contamination. The extraction and processing of these elements often involve energy-intensive operations and chemical processes that can generate hazardous waste streams and contribute to environmental degradation.

Life cycle assessment (LCA) studies of thermoelectric systems reveal complex sustainability profiles. While operational benefits include emission-free energy generation and reduced fossil fuel consumption, the environmental footprint of material production and end-of-life disposal can partially offset these advantages. Research indicates that the environmental payback period for thermoelectric generators varies significantly depending on material composition, manufacturing methods, and application scenarios.

Recent advances in green thermoelectric materials show promising developments toward sustainability. Researchers are increasingly focusing on abundant, non-toxic alternatives such as silicides, oxides, and organic thermoelectric materials. These materials, while currently less efficient than their conventional counterparts, offer improved environmental compatibility and reduced dependence on critical raw materials.

Circular economy principles are gradually being integrated into thermoelectric material development. Strategies include designing for recyclability, implementing recovery processes for valuable elements, and exploring waste-derived precursors for material synthesis. These approaches aim to minimize resource consumption and waste generation throughout the material lifecycle.

The regulatory landscape surrounding thermoelectric materials is evolving, with increasing attention to environmental standards. Policies such as the European Union's Restriction of Hazardous Substances (RoHS) directive and the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation influence material selection and manufacturing practices in the thermoelectric industry, driving innovation toward more environmentally benign alternatives.

As thermoelectric technology advances, balancing performance requirements with environmental considerations remains a critical challenge. The development of environmentally sustainable thermoelectric materials represents not only a technical imperative but also an opportunity to align waste heat recovery technologies with broader sustainability goals and circular economy principles.

Cost-Benefit Analysis of Thermoelectric Waste Heat Recovery Systems

The economic viability of thermoelectric waste heat recovery systems hinges on a comprehensive cost-benefit analysis that considers both direct and indirect factors. Initial capital expenditure represents a significant barrier to adoption, with high-quality thermoelectric materials and precision manufacturing processes contributing substantially to system costs. Current market prices for bismuth telluride-based generators range from $5-10 per watt of generating capacity, while advanced materials utilizing skutterudites or half-Heusler alloys command premium pricing of $15-20 per watt due to their enhanced performance characteristics.

Installation expenses further impact the total investment, varying significantly based on application complexity. Industrial implementations typically require $2,000-5,000 per kilowatt of capacity for engineering, integration, and safety compliance. Automotive applications present unique challenges, with integration costs potentially reaching $200-300 per vehicle depending on exhaust system modifications required.

Operational benefits must be evaluated against these substantial investments. Energy recovery potential varies by application, with industrial furnaces and kilns demonstrating recovery rates of 3-7% of waste heat, translating to approximately 30-70 kWh per day for a medium-sized operation. Automotive applications typically recover 2-5% of exhaust heat, potentially generating 100-300W during highway operation.

Financial return calculations reveal varying payback periods across sectors. Industrial applications in regions with electricity costs exceeding $0.15/kWh may achieve payback within 3-5 years, while automotive implementations generally require 7-10 years to reach break-even, challenging their commercial viability under current cost structures.

Maintenance considerations must also factor into long-term economic assessments. Thermoelectric systems benefit from minimal moving parts, resulting in maintenance costs typically below 2% of initial capital expenditure annually. However, performance degradation over time—approximately 0.5-1% annually under normal operating conditions—must be incorporated into long-term financial projections.

Environmental benefits provide additional economic value through regulatory compliance and sustainability initiatives. Carbon emission reductions range from 0.5-2 tons annually for typical industrial implementations, potentially qualifying for carbon credits valued at $20-50 per ton in established markets. These environmental benefits increasingly influence investment decisions as organizations pursue decarbonization targets.

Sensitivity analysis reveals that system economics improve dramatically with higher waste heat temperatures and longer operational hours, making continuous industrial processes particularly attractive candidates for implementation. The financial viability threshold typically occurs when waste heat sources exceed 250°C and operate more than 5,000 hours annually, assuming current material costs and performance metrics.

Installation expenses further impact the total investment, varying significantly based on application complexity. Industrial implementations typically require $2,000-5,000 per kilowatt of capacity for engineering, integration, and safety compliance. Automotive applications present unique challenges, with integration costs potentially reaching $200-300 per vehicle depending on exhaust system modifications required.

Operational benefits must be evaluated against these substantial investments. Energy recovery potential varies by application, with industrial furnaces and kilns demonstrating recovery rates of 3-7% of waste heat, translating to approximately 30-70 kWh per day for a medium-sized operation. Automotive applications typically recover 2-5% of exhaust heat, potentially generating 100-300W during highway operation.

Financial return calculations reveal varying payback periods across sectors. Industrial applications in regions with electricity costs exceeding $0.15/kWh may achieve payback within 3-5 years, while automotive implementations generally require 7-10 years to reach break-even, challenging their commercial viability under current cost structures.

Maintenance considerations must also factor into long-term economic assessments. Thermoelectric systems benefit from minimal moving parts, resulting in maintenance costs typically below 2% of initial capital expenditure annually. However, performance degradation over time—approximately 0.5-1% annually under normal operating conditions—must be incorporated into long-term financial projections.

Environmental benefits provide additional economic value through regulatory compliance and sustainability initiatives. Carbon emission reductions range from 0.5-2 tons annually for typical industrial implementations, potentially qualifying for carbon credits valued at $20-50 per ton in established markets. These environmental benefits increasingly influence investment decisions as organizations pursue decarbonization targets.

Sensitivity analysis reveals that system economics improve dramatically with higher waste heat temperatures and longer operational hours, making continuous industrial processes particularly attractive candidates for implementation. The financial viability threshold typically occurs when waste heat sources exceed 250°C and operate more than 5,000 hours annually, assuming current material costs and performance metrics.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!