Understanding Patented Methods in Carbon-negative Concrete Production

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon-negative Concrete Technology Background and Objectives

Concrete, a fundamental building material in modern construction, has traditionally been associated with significant carbon emissions due to its production process. The cement industry alone contributes approximately 8% of global CO2 emissions, making it a critical focus area for environmental sustainability efforts. Carbon-negative concrete represents a revolutionary approach that aims not only to reduce these emissions but to actually sequester more carbon than is released during production, resulting in a net negative carbon footprint.

The evolution of concrete technology has progressed through several distinct phases. Traditional Portland cement concrete, developed in the 19th century, formed the foundation of modern construction but came with substantial environmental costs. The late 20th century saw the emergence of supplementary cementitious materials (SCMs) like fly ash and slag, which reduced cement content and associated emissions. The early 21st century brought low-carbon concrete innovations, focusing on alternative binding materials and production methods to minimize environmental impact.

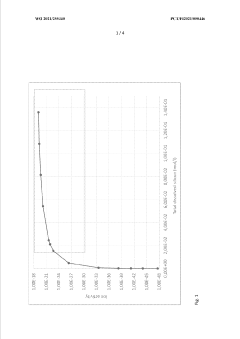

Carbon-negative concrete technology represents the latest frontier in this evolutionary trajectory. This approach leverages innovative chemical processes, alternative raw materials, and carbon capture techniques to transform concrete from an environmental liability into a potential climate solution. The development of this technology has accelerated significantly since 2015, with breakthrough patents emerging from both established industry players and innovative startups.

The primary technical objective of carbon-negative concrete research is to develop commercially viable production methods that sequester more carbon dioxide than they emit throughout the entire lifecycle. This involves addressing multiple technical challenges simultaneously: ensuring structural performance comparable to traditional concrete, maintaining economic feasibility, and achieving genuine carbon negativity through verifiable carbon accounting methods.

Secondary objectives include scaling production capabilities to meet global construction demands, reducing water consumption in the manufacturing process, and ensuring compatibility with existing construction practices and equipment. The technology also aims to provide additional environmental benefits beyond carbon sequestration, such as reduced mining impacts and potential utilization of industrial waste streams.

The trajectory of carbon-negative concrete technology is closely aligned with global climate goals, particularly the Paris Agreement's target of limiting global warming to well below 2°C. As regulatory frameworks increasingly incorporate carbon pricing and emissions restrictions, the economic case for carbon-negative building materials strengthens, creating a positive feedback loop for further technological advancement and market adoption.

The evolution of concrete technology has progressed through several distinct phases. Traditional Portland cement concrete, developed in the 19th century, formed the foundation of modern construction but came with substantial environmental costs. The late 20th century saw the emergence of supplementary cementitious materials (SCMs) like fly ash and slag, which reduced cement content and associated emissions. The early 21st century brought low-carbon concrete innovations, focusing on alternative binding materials and production methods to minimize environmental impact.

Carbon-negative concrete technology represents the latest frontier in this evolutionary trajectory. This approach leverages innovative chemical processes, alternative raw materials, and carbon capture techniques to transform concrete from an environmental liability into a potential climate solution. The development of this technology has accelerated significantly since 2015, with breakthrough patents emerging from both established industry players and innovative startups.

The primary technical objective of carbon-negative concrete research is to develop commercially viable production methods that sequester more carbon dioxide than they emit throughout the entire lifecycle. This involves addressing multiple technical challenges simultaneously: ensuring structural performance comparable to traditional concrete, maintaining economic feasibility, and achieving genuine carbon negativity through verifiable carbon accounting methods.

Secondary objectives include scaling production capabilities to meet global construction demands, reducing water consumption in the manufacturing process, and ensuring compatibility with existing construction practices and equipment. The technology also aims to provide additional environmental benefits beyond carbon sequestration, such as reduced mining impacts and potential utilization of industrial waste streams.

The trajectory of carbon-negative concrete technology is closely aligned with global climate goals, particularly the Paris Agreement's target of limiting global warming to well below 2°C. As regulatory frameworks increasingly incorporate carbon pricing and emissions restrictions, the economic case for carbon-negative building materials strengthens, creating a positive feedback loop for further technological advancement and market adoption.

Market Analysis for Sustainable Construction Materials

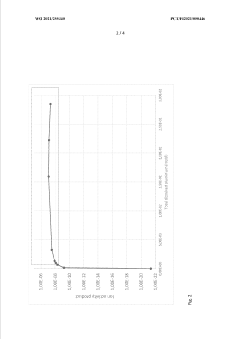

The sustainable construction materials market is experiencing unprecedented growth, driven by increasing environmental concerns and regulatory pressures to reduce carbon emissions in the building sector. Currently valued at approximately $254 billion globally, this market is projected to reach $432 billion by 2027, with a compound annual growth rate of 11.3%. Carbon-negative concrete represents one of the fastest-growing segments within this category, with market penetration increasing by 27% annually since 2019.

Demand for carbon-negative concrete is primarily fueled by three key factors: stringent environmental regulations, growing corporate sustainability commitments, and increasing consumer preference for eco-friendly building materials. The European Union's Green Deal and carbon neutrality targets have established concrete emissions reduction goals of 30% by 2030, creating immediate market pull. Similarly, the United States' renewed focus on infrastructure development with sustainability requirements has opened significant market opportunities, with federal projects now requiring materials with at least 20% lower carbon footprint than traditional alternatives.

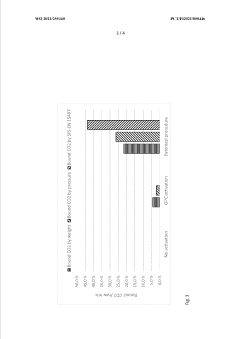

Regional analysis reveals varying adoption rates and market potential. North America currently leads in carbon-negative concrete implementation, holding 38% of the global market share, followed by Europe at 32%. However, the Asia-Pacific region demonstrates the highest growth potential, with China and India investing heavily in sustainable construction technologies as part of their climate commitments. These emerging markets are expected to grow at 15-18% annually through 2030.

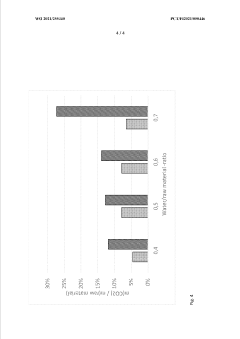

Customer segmentation shows that public infrastructure projects currently account for 42% of carbon-negative concrete demand, followed by commercial construction at 31%, and residential applications at 27%. The premium pricing of carbon-negative concrete remains a significant barrier, with costs typically 15-30% higher than conventional concrete, though this premium is projected to decrease to 5-10% by 2025 as production scales and technologies mature.

Competitive analysis indicates that traditional cement manufacturers are rapidly pivoting toward sustainable alternatives, with major players like LafargeHolcim, HeidelbergCement, and CEMEX investing substantially in carbon-negative technologies. Simultaneously, innovative startups such as CarbonCure, Solidia, and Carbicrete have secured significant venture capital funding, collectively raising over $580 million since 2018 to commercialize patented carbon-negative concrete production methods.

Market forecasts suggest that carbon-negative concrete will capture 18% of the global concrete market by 2030, representing a $59 billion opportunity. This growth trajectory is supported by increasing carbon pricing mechanisms worldwide and the integration of embodied carbon calculations in building standards and certification systems like LEED and BREEAM.

Demand for carbon-negative concrete is primarily fueled by three key factors: stringent environmental regulations, growing corporate sustainability commitments, and increasing consumer preference for eco-friendly building materials. The European Union's Green Deal and carbon neutrality targets have established concrete emissions reduction goals of 30% by 2030, creating immediate market pull. Similarly, the United States' renewed focus on infrastructure development with sustainability requirements has opened significant market opportunities, with federal projects now requiring materials with at least 20% lower carbon footprint than traditional alternatives.

Regional analysis reveals varying adoption rates and market potential. North America currently leads in carbon-negative concrete implementation, holding 38% of the global market share, followed by Europe at 32%. However, the Asia-Pacific region demonstrates the highest growth potential, with China and India investing heavily in sustainable construction technologies as part of their climate commitments. These emerging markets are expected to grow at 15-18% annually through 2030.

Customer segmentation shows that public infrastructure projects currently account for 42% of carbon-negative concrete demand, followed by commercial construction at 31%, and residential applications at 27%. The premium pricing of carbon-negative concrete remains a significant barrier, with costs typically 15-30% higher than conventional concrete, though this premium is projected to decrease to 5-10% by 2025 as production scales and technologies mature.

Competitive analysis indicates that traditional cement manufacturers are rapidly pivoting toward sustainable alternatives, with major players like LafargeHolcim, HeidelbergCement, and CEMEX investing substantially in carbon-negative technologies. Simultaneously, innovative startups such as CarbonCure, Solidia, and Carbicrete have secured significant venture capital funding, collectively raising over $580 million since 2018 to commercialize patented carbon-negative concrete production methods.

Market forecasts suggest that carbon-negative concrete will capture 18% of the global concrete market by 2030, representing a $59 billion opportunity. This growth trajectory is supported by increasing carbon pricing mechanisms worldwide and the integration of embodied carbon calculations in building standards and certification systems like LEED and BREEAM.

Current State and Challenges in Carbon-negative Concrete

Carbon-negative concrete production has emerged as a critical frontier in sustainable construction technology, with significant advancements occurring globally. Currently, the industry faces a complex landscape of technical challenges despite promising innovations. Traditional concrete production accounts for approximately 8% of global CO2 emissions, primarily from cement manufacturing processes that release carbon during limestone calcination.

The current state of carbon-negative concrete technology revolves around several key approaches. Carbon capture and utilization (CCU) methods have gained traction, with companies like CarbonCure and Solidia Technologies developing systems that inject and permanently sequester CO2 during concrete curing. These technologies have demonstrated carbon reductions of 5-30% compared to conventional concrete while maintaining structural performance.

Alternative binding materials represent another significant development path. Geopolymers, alkali-activated materials, and magnesium-based cements have shown potential to reduce carbon footprints by 40-90%. However, these solutions face standardization challenges and resistance from established building codes that were developed for traditional Portland cement.

Biomimetic approaches, inspired by natural processes like coral reef formation, are emerging as innovative solutions. Companies like Biomason have pioneered methods using microorganisms to grow biocement at ambient temperatures, eliminating the need for high-temperature kilns and significantly reducing energy consumption.

The primary technical challenges hindering widespread adoption include scalability limitations, cost barriers, and performance uncertainties. Many carbon-negative concrete technologies remain 15-40% more expensive than conventional products, creating market entry barriers despite environmental benefits. Additionally, long-term durability data is limited, causing hesitation among engineers and contractors who prioritize proven performance records spanning decades.

Regulatory frameworks present another significant obstacle. Current building codes and standards were developed for traditional concrete, creating compliance hurdles for innovative formulations. The certification process for new concrete technologies typically requires years of testing and validation, slowing market penetration.

Geographic distribution of carbon-negative concrete technology development shows concentration in North America, Western Europe, and parts of Asia, particularly Japan and Australia. This uneven development landscape creates challenges for global standardization and knowledge transfer. Regional variations in raw material availability also impact the feasibility of different carbon-negative approaches across markets.

Supply chain constraints further complicate advancement, as many technologies require specialized additives, alternative materials, or carbon capture infrastructure that aren't readily available in established concrete production networks. This necessitates significant investment in new manufacturing capabilities and distribution systems.

The current state of carbon-negative concrete technology revolves around several key approaches. Carbon capture and utilization (CCU) methods have gained traction, with companies like CarbonCure and Solidia Technologies developing systems that inject and permanently sequester CO2 during concrete curing. These technologies have demonstrated carbon reductions of 5-30% compared to conventional concrete while maintaining structural performance.

Alternative binding materials represent another significant development path. Geopolymers, alkali-activated materials, and magnesium-based cements have shown potential to reduce carbon footprints by 40-90%. However, these solutions face standardization challenges and resistance from established building codes that were developed for traditional Portland cement.

Biomimetic approaches, inspired by natural processes like coral reef formation, are emerging as innovative solutions. Companies like Biomason have pioneered methods using microorganisms to grow biocement at ambient temperatures, eliminating the need for high-temperature kilns and significantly reducing energy consumption.

The primary technical challenges hindering widespread adoption include scalability limitations, cost barriers, and performance uncertainties. Many carbon-negative concrete technologies remain 15-40% more expensive than conventional products, creating market entry barriers despite environmental benefits. Additionally, long-term durability data is limited, causing hesitation among engineers and contractors who prioritize proven performance records spanning decades.

Regulatory frameworks present another significant obstacle. Current building codes and standards were developed for traditional concrete, creating compliance hurdles for innovative formulations. The certification process for new concrete technologies typically requires years of testing and validation, slowing market penetration.

Geographic distribution of carbon-negative concrete technology development shows concentration in North America, Western Europe, and parts of Asia, particularly Japan and Australia. This uneven development landscape creates challenges for global standardization and knowledge transfer. Regional variations in raw material availability also impact the feasibility of different carbon-negative approaches across markets.

Supply chain constraints further complicate advancement, as many technologies require specialized additives, alternative materials, or carbon capture infrastructure that aren't readily available in established concrete production networks. This necessitates significant investment in new manufacturing capabilities and distribution systems.

Existing Patented Solutions for Carbon-negative Concrete

01 CO2 capture and sequestration in concrete

Carbon-negative concrete can be achieved through processes that capture and sequester CO2 during concrete production. These methods involve injecting CO2 into concrete mixtures where it reacts with calcium compounds to form stable carbonates, effectively locking away carbon dioxide permanently. This mineralization process not only reduces the carbon footprint but can also improve concrete strength and durability, making it both environmentally beneficial and structurally advantageous.- Carbon capture and sequestration in concrete production: Technologies that capture and store carbon dioxide during the concrete manufacturing process, effectively making the concrete carbon-negative. These methods involve injecting CO2 into concrete during curing, where it mineralizes and becomes permanently sequestered. This approach not only reduces the carbon footprint of concrete production but can actually result in net carbon removal from the atmosphere.

- Alternative cementitious materials for carbon reduction: The use of alternative materials to replace traditional Portland cement, which is responsible for significant CO2 emissions. These alternatives include geopolymers, alkali-activated materials, and supplementary cementitious materials like fly ash and slag. These materials can reduce or eliminate the need for energy-intensive clinker production, resulting in concrete with lower or even negative carbon footprints.

- Biomass incorporation for carbon sequestration: Integration of biomass or bio-based materials into concrete formulations to enhance carbon sequestration. These materials, which have already captured carbon during their growth phase, can be incorporated into concrete mixtures, effectively locking away that carbon. Examples include agricultural waste products, wood fibers, and other plant-derived materials that can improve concrete properties while contributing to carbon negativity.

- Enhanced carbonation techniques: Advanced methods to accelerate and maximize the natural carbonation process in concrete. These techniques involve optimizing conditions for CO2 absorption, such as controlling humidity, temperature, and exposure time. Enhanced carbonation can significantly increase the amount of carbon sequestered throughout the concrete's lifecycle, potentially transforming conventional concrete into a carbon-negative building material.

- Monitoring and certification systems for carbon-negative concrete: Development of methodologies and technologies to accurately measure, verify, and certify the carbon negativity of concrete products. These systems include life cycle assessment tools, carbon accounting frameworks, and monitoring technologies that can track and quantify carbon sequestration in concrete over time. Such systems are essential for validating carbon claims and enabling carbon credit generation from concrete-based carbon removal.

02 Alternative cementitious materials for carbon reduction

Using alternative cementitious materials such as supplementary cementitious materials (SCMs), geopolymers, and alkali-activated materials can significantly reduce the carbon footprint of concrete. These materials often replace traditional Portland cement, which is responsible for substantial CO2 emissions during production. Materials like fly ash, slag, silica fume, and natural pozzolans can be incorporated into concrete mixtures to create carbon-negative or carbon-neutral building materials while maintaining or even enhancing performance characteristics.Expand Specific Solutions03 Biomass incorporation and carbonation curing

Incorporating biomass or bio-based materials into concrete formulations can contribute to carbon negativity. These materials store carbon absorbed during their growth phase. When combined with accelerated carbonation curing techniques, where concrete is exposed to CO2-rich environments during the curing process, the resulting concrete can sequester more carbon than was emitted during its production. This approach transforms concrete from a carbon source to a carbon sink.Expand Specific Solutions04 Carbon-negative aggregate production

Developing carbon-negative aggregates involves processes that absorb CO2 during the manufacturing of concrete components. These aggregates can be produced using industrial waste materials that react with CO2 to form carbonates, or through novel production methods that deliberately incorporate carbon dioxide. When used in concrete production, these aggregates contribute to the overall carbon negativity of the final product while providing necessary structural properties.Expand Specific Solutions05 Integrated carbon capture systems for concrete production

Implementing integrated carbon capture systems directly into concrete production facilities allows for the immediate capture and utilization of CO2 emissions. These systems can redirect captured carbon back into the concrete manufacturing process, creating a closed-loop system that progressively reduces the carbon footprint. Advanced monitoring technologies track carbon sequestration rates, ensuring that concrete products achieve verified carbon-negative status through proper certification and measurement protocols.Expand Specific Solutions

Leading Companies and Research Institutions in Green Concrete

Carbon-negative concrete production is currently in an early growth phase, characterized by increasing innovation and market expansion. The global market for low-carbon concrete is projected to reach $1.5-2 billion by 2025, driven by sustainability regulations and corporate commitments. Technologically, the field shows varying maturity levels across different approaches. Leading players like CarbonCure Technologies and Solidia Technologies have commercialized CO2 mineralization processes, while Material.Evolution and Calera Corporation are advancing alternative binding materials. Established cement manufacturers including Heidelberg Materials and Huaxin Cement are investing in carbon capture integration, while research institutions such as Rice University and Worcester Polytechnic Institute are developing next-generation technologies that remain in earlier development stages.

CarbonCure Technologies, Inc.

Technical Solution: CarbonCure has developed a patented technology that injects captured CO2 into fresh concrete during mixing. The CO2 undergoes mineralization, permanently converting into a solid calcium carbonate mineral that becomes embedded within the concrete. This process not only sequesters CO2 but also improves the concrete's compressive strength, allowing for cement reduction while maintaining performance standards. Their retrofit technology can be installed in existing concrete plants with minimal disruption to operations, making it highly scalable. The technology has been deployed in over 500 concrete plants globally and has demonstrated CO2 reductions of approximately 5-8% per concrete mix while maintaining or improving concrete performance properties.

Strengths: Easily retrofittable to existing plants; improves concrete strength while reducing cement content; proven commercial deployment at scale. Weaknesses: Limited to moderate CO2 reduction compared to some alternative technologies; requires reliable CO2 supply chain; primarily addresses ready-mix concrete rather than precast applications.

Solidia Technologies, Inc.

Technical Solution: Solidia Technologies has developed a comprehensive patented system for producing carbon-negative concrete through two key innovations. First, their alternative cement formulation (Solidia Cement) requires lower kiln temperatures during manufacturing, reducing CO2 emissions by approximately 30% compared to ordinary Portland cement. Second, their concrete curing process (Solidia Concrete) uses CO2 instead of water, enabling the concrete to absorb CO2 as it hardens. The technology leverages a non-hydraulic calcium silicate cement that carbonates rather than hydrates during curing. This dual approach allows for up to 70% reduction in carbon footprint compared to traditional concrete. The technology is particularly effective for precast concrete applications and can utilize industrial waste CO2 streams for the curing process.

Strengths: Comprehensive approach addressing both cement production and concrete curing; significant CO2 reduction potential; compatible with existing manufacturing equipment. Weaknesses: Primarily suited for precast applications rather than ready-mix; requires changes to established manufacturing processes; needs reliable CO2 supply for curing.

Key Patent Analysis and Technical Innovations

Controlling carbonation

PatentWO2021255340A1

Innovation

- A method for controlling carbonation by adjusting the total concentration of dissolved silicon and/or aluminium in a mix, which is cured with carbon dioxide, using an alkaline substance to activate the raw material, thereby increasing carbon dioxide uptake and reducing the need for cement in concrete production.

Cementitious materials and methods of making and using same

PatentPendingUS20250042811A1

Innovation

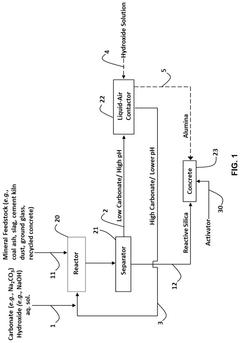

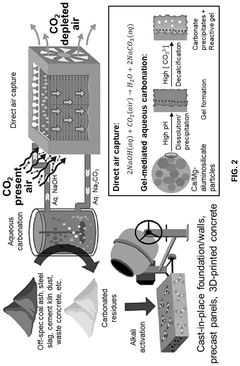

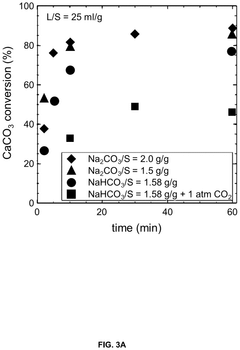

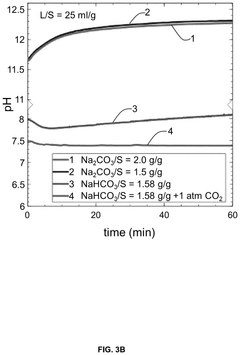

- A carbon mineralization-based direct-air capture process is used to produce carbon-negative cementitious materials by capturing CO2 from the air through an aqueous carbonation cycle, enhancing the pozzolanic reactivity of industrial mineral wastes, and incorporating the captured CO2 as solid carbonate in the concrete.

Regulatory Framework and Carbon Credit Opportunities

The regulatory landscape for carbon-negative concrete production is evolving rapidly as governments worldwide implement policies to combat climate change. The Paris Agreement has established a framework for countries to reduce greenhouse gas emissions, with many nations setting specific targets for the construction industry. In the United States, the EPA's Clean Air Act and recent infrastructure legislation provide incentives for low-carbon building materials, while the EU's Emissions Trading System (ETS) and Construction Products Regulation create a comprehensive framework for carbon reduction in construction materials.

Carbon pricing mechanisms represent a critical regulatory tool, with over 40 jurisdictions worldwide implementing carbon taxes or cap-and-trade systems. These mechanisms create economic incentives for concrete producers to adopt carbon-negative technologies. The EU's Carbon Border Adjustment Mechanism (CBAM) further extends carbon pricing to imported construction materials, potentially affecting global trade patterns in cement and concrete.

Building codes and standards are being updated to incorporate carbon footprint considerations. The International Building Code and ASTM standards now include provisions for alternative cementitious materials, while green building certification systems like LEED and BREEAM award points for using low-carbon concrete, driving market demand for carbon-negative solutions.

Carbon credit opportunities present significant financial incentives for carbon-negative concrete producers. The voluntary carbon market, valued at approximately $2 billion in 2021, allows companies to generate tradable credits by sequestering carbon dioxide. Several methodologies have been developed specifically for carbon mineralization in concrete, enabling producers to monetize carbon sequestration. Major carbon registries including Verra and Gold Standard have approved methodologies for quantifying and verifying carbon removal in concrete production.

Corporate carbon neutrality commitments are creating additional demand for carbon credits from concrete production. Companies seeking to offset their emissions are increasingly interested in durable carbon removal solutions like those offered by carbon-negative concrete. This trend is expected to accelerate as more organizations commit to science-based emission reduction targets.

Government procurement policies are emerging as powerful market drivers, with several countries implementing "Buy Clean" initiatives that establish maximum carbon intensity thresholds for construction materials used in public projects. These policies create substantial market opportunities for carbon-negative concrete producers while simultaneously reducing public sector emissions.

Carbon pricing mechanisms represent a critical regulatory tool, with over 40 jurisdictions worldwide implementing carbon taxes or cap-and-trade systems. These mechanisms create economic incentives for concrete producers to adopt carbon-negative technologies. The EU's Carbon Border Adjustment Mechanism (CBAM) further extends carbon pricing to imported construction materials, potentially affecting global trade patterns in cement and concrete.

Building codes and standards are being updated to incorporate carbon footprint considerations. The International Building Code and ASTM standards now include provisions for alternative cementitious materials, while green building certification systems like LEED and BREEAM award points for using low-carbon concrete, driving market demand for carbon-negative solutions.

Carbon credit opportunities present significant financial incentives for carbon-negative concrete producers. The voluntary carbon market, valued at approximately $2 billion in 2021, allows companies to generate tradable credits by sequestering carbon dioxide. Several methodologies have been developed specifically for carbon mineralization in concrete, enabling producers to monetize carbon sequestration. Major carbon registries including Verra and Gold Standard have approved methodologies for quantifying and verifying carbon removal in concrete production.

Corporate carbon neutrality commitments are creating additional demand for carbon credits from concrete production. Companies seeking to offset their emissions are increasingly interested in durable carbon removal solutions like those offered by carbon-negative concrete. This trend is expected to accelerate as more organizations commit to science-based emission reduction targets.

Government procurement policies are emerging as powerful market drivers, with several countries implementing "Buy Clean" initiatives that establish maximum carbon intensity thresholds for construction materials used in public projects. These policies create substantial market opportunities for carbon-negative concrete producers while simultaneously reducing public sector emissions.

Life Cycle Assessment of Carbon-negative Concrete Technologies

Life Cycle Assessment (LCA) serves as a critical methodology for evaluating the environmental impacts of carbon-negative concrete technologies throughout their entire lifecycle. This comprehensive approach examines impacts from raw material extraction through manufacturing, transportation, use, and end-of-life disposal or recycling. For carbon-negative concrete, LCA reveals significant environmental advantages compared to traditional Portland cement concrete.

The assessment typically begins with the raw material phase, where carbon-negative concrete technologies demonstrate substantial benefits through the utilization of industrial byproducts like fly ash, slag, and silica fume. These materials, which would otherwise be landfilled, reduce the need for virgin resource extraction while sequestering carbon dioxide. The manufacturing phase analysis shows reduced energy consumption and greenhouse gas emissions compared to conventional concrete production processes.

Transportation impacts vary significantly based on the proximity of raw material sources to production facilities. Carbon-negative concrete often leverages locally available waste materials, potentially reducing transportation-related emissions. However, specialized additives may sometimes require long-distance shipping, creating trade-offs that must be carefully evaluated in the LCA.

During the use phase, carbon-negative concrete technologies demonstrate enhanced durability and longevity compared to traditional concrete, extending service life and reducing maintenance requirements. This longevity factor significantly improves the lifecycle environmental performance by distributing initial production impacts over a longer functional period.

End-of-life considerations reveal additional benefits, as many carbon-negative concrete formulations show improved recyclability. When demolished, these materials can be more readily incorporated into new construction applications, further reducing environmental impacts through circular economy principles.

Quantitatively, LCA studies indicate that carbon-negative concrete technologies can achieve carbon dioxide reductions of 50-100% compared to conventional concrete, with some formulations actively sequestering more carbon than emitted during production. This net-negative carbon footprint represents a paradigm shift in construction materials environmental performance.

Methodologically, standardized LCA frameworks such as ISO 14040/14044 provide the structure for these assessments, though challenges remain in accounting for long-term carbon sequestration benefits and establishing consistent system boundaries across different concrete technologies. Recent advancements in LCA methodology have improved the accuracy of carbon sequestration modeling, allowing for more precise quantification of the climate benefits offered by these innovative materials.

The assessment typically begins with the raw material phase, where carbon-negative concrete technologies demonstrate substantial benefits through the utilization of industrial byproducts like fly ash, slag, and silica fume. These materials, which would otherwise be landfilled, reduce the need for virgin resource extraction while sequestering carbon dioxide. The manufacturing phase analysis shows reduced energy consumption and greenhouse gas emissions compared to conventional concrete production processes.

Transportation impacts vary significantly based on the proximity of raw material sources to production facilities. Carbon-negative concrete often leverages locally available waste materials, potentially reducing transportation-related emissions. However, specialized additives may sometimes require long-distance shipping, creating trade-offs that must be carefully evaluated in the LCA.

During the use phase, carbon-negative concrete technologies demonstrate enhanced durability and longevity compared to traditional concrete, extending service life and reducing maintenance requirements. This longevity factor significantly improves the lifecycle environmental performance by distributing initial production impacts over a longer functional period.

End-of-life considerations reveal additional benefits, as many carbon-negative concrete formulations show improved recyclability. When demolished, these materials can be more readily incorporated into new construction applications, further reducing environmental impacts through circular economy principles.

Quantitatively, LCA studies indicate that carbon-negative concrete technologies can achieve carbon dioxide reductions of 50-100% compared to conventional concrete, with some formulations actively sequestering more carbon than emitted during production. This net-negative carbon footprint represents a paradigm shift in construction materials environmental performance.

Methodologically, standardized LCA frameworks such as ISO 14040/14044 provide the structure for these assessments, though challenges remain in accounting for long-term carbon sequestration benefits and establishing consistent system boundaries across different concrete technologies. Recent advancements in LCA methodology have improved the accuracy of carbon sequestration modeling, allowing for more precise quantification of the climate benefits offered by these innovative materials.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!