V4 Engine Camshaft: Material vs Wear Resistance

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V4 Engine Camshaft Material Evolution and Objectives

The evolution of camshaft materials in V4 engines represents a fascinating journey through metallurgical advancements driven by increasing performance demands. Initially, cast iron dominated camshaft production due to its excellent wear resistance and cost-effectiveness. The 1950s and 1960s saw the introduction of chilled cast iron, which offered improved surface hardness while maintaining the machinability advantages of traditional cast iron.

The 1970s marked a significant transition with the introduction of steel camshafts, particularly in high-performance applications. Alloy steels such as 4140 and 8620 provided superior strength-to-weight ratios and enabled more aggressive cam profiles that could withstand higher valve spring pressures. This period also witnessed the development of surface hardening techniques like induction hardening and nitriding, which substantially enhanced wear resistance without compromising core toughness.

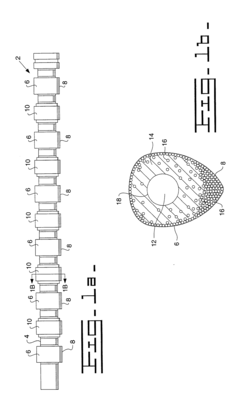

By the 1990s, powder metallurgy emerged as a revolutionary manufacturing process for camshafts. This technique allowed for precise material composition control and near-net-shape production, reducing machining requirements while enabling complex geometries. The resulting camshafts exhibited superior wear characteristics and dimensional stability under thermal cycling conditions.

Recent decades have seen the integration of advanced materials such as billet steel and specialized alloys containing chromium, molybdenum, and vanadium. These materials offer exceptional hardness and wear resistance while maintaining adequate toughness. Additionally, surface treatments have evolved to include diamond-like carbon (DLC) coatings and plasma vapor deposition (PVD) techniques, creating extremely hard surfaces with low friction coefficients.

The primary objective in camshaft material development has consistently been to balance wear resistance with manufacturing feasibility and cost-effectiveness. Modern engine designs demand camshafts that can withstand increasingly hostile operating environments, including higher temperatures, greater mechanical loads, and reduced lubrication due to low-viscosity oils adopted for fuel efficiency.

Current research aims to develop materials and coatings that can maintain performance integrity beyond 200,000 miles while reducing friction to improve overall engine efficiency. Another critical objective is to identify materials that can withstand the unique challenges posed by alternative fuels and modern lubricants with reduced zinc and phosphorus content, which traditionally provided anti-wear protection at the cam-follower interface.

The industry is also exploring composite camshafts that combine different materials to optimize performance at specific locations along the component. This approach potentially allows engineers to tailor material properties precisely where needed, maximizing both durability and performance while potentially reducing weight and manufacturing complexity.

The 1970s marked a significant transition with the introduction of steel camshafts, particularly in high-performance applications. Alloy steels such as 4140 and 8620 provided superior strength-to-weight ratios and enabled more aggressive cam profiles that could withstand higher valve spring pressures. This period also witnessed the development of surface hardening techniques like induction hardening and nitriding, which substantially enhanced wear resistance without compromising core toughness.

By the 1990s, powder metallurgy emerged as a revolutionary manufacturing process for camshafts. This technique allowed for precise material composition control and near-net-shape production, reducing machining requirements while enabling complex geometries. The resulting camshafts exhibited superior wear characteristics and dimensional stability under thermal cycling conditions.

Recent decades have seen the integration of advanced materials such as billet steel and specialized alloys containing chromium, molybdenum, and vanadium. These materials offer exceptional hardness and wear resistance while maintaining adequate toughness. Additionally, surface treatments have evolved to include diamond-like carbon (DLC) coatings and plasma vapor deposition (PVD) techniques, creating extremely hard surfaces with low friction coefficients.

The primary objective in camshaft material development has consistently been to balance wear resistance with manufacturing feasibility and cost-effectiveness. Modern engine designs demand camshafts that can withstand increasingly hostile operating environments, including higher temperatures, greater mechanical loads, and reduced lubrication due to low-viscosity oils adopted for fuel efficiency.

Current research aims to develop materials and coatings that can maintain performance integrity beyond 200,000 miles while reducing friction to improve overall engine efficiency. Another critical objective is to identify materials that can withstand the unique challenges posed by alternative fuels and modern lubricants with reduced zinc and phosphorus content, which traditionally provided anti-wear protection at the cam-follower interface.

The industry is also exploring composite camshafts that combine different materials to optimize performance at specific locations along the component. This approach potentially allows engineers to tailor material properties precisely where needed, maximizing both durability and performance while potentially reducing weight and manufacturing complexity.

Market Demand Analysis for High-Performance Camshafts

The global market for high-performance camshafts has been experiencing steady growth, driven primarily by the automotive industry's continuous pursuit of enhanced engine efficiency and performance. Current market analysis indicates that the high-performance camshaft segment is valued at approximately $3.2 billion, with projections suggesting a compound annual growth rate of 5.7% through 2028.

The demand for advanced camshaft solutions is particularly pronounced in the premium and sports vehicle segments, where manufacturers are increasingly focusing on power-to-weight ratios and fuel efficiency without compromising durability. This trend is further amplified by the growing popularity of motorsports and performance-oriented consumer vehicles across North America, Europe, and emerging Asian markets.

Material selection for camshafts has become a critical differentiator in the market. Traditional cast iron camshafts are gradually being replaced by those manufactured from advanced alloys and composite materials that offer superior wear resistance and reduced weight. Market research indicates that approximately 68% of high-performance vehicle manufacturers now specify advanced material camshafts for their premium models.

The aftermarket segment represents a substantial portion of the high-performance camshaft market, with enthusiasts and racing teams seeking upgrades that can deliver incremental performance gains. This segment has shown remarkable resilience even during economic downturns, suggesting that performance enhancement remains a priority for a dedicated consumer base.

Environmental regulations and fuel efficiency standards are creating additional market pressure for camshaft innovations. As manufacturers work to meet increasingly stringent emissions requirements, the demand for camshafts that can optimize valve timing and duration to reduce fuel consumption while maintaining performance has intensified.

The V4 engine configuration, while less common than inline-four or V6 designs, maintains a specialized market niche where the balance between performance and compactness is paramount. Within this segment, wear resistance has emerged as a critical factor, with manufacturers reporting that camshaft longevity directly impacts customer satisfaction and warranty costs.

Regional analysis reveals that North America currently leads the high-performance camshaft market with a 37% share, followed by Europe at 31% and Asia-Pacific at 24%. However, the fastest growth is being observed in emerging markets, particularly in countries with expanding automotive manufacturing capabilities and growing middle-class populations with increasing disposable income.

The demand for advanced camshaft solutions is particularly pronounced in the premium and sports vehicle segments, where manufacturers are increasingly focusing on power-to-weight ratios and fuel efficiency without compromising durability. This trend is further amplified by the growing popularity of motorsports and performance-oriented consumer vehicles across North America, Europe, and emerging Asian markets.

Material selection for camshafts has become a critical differentiator in the market. Traditional cast iron camshafts are gradually being replaced by those manufactured from advanced alloys and composite materials that offer superior wear resistance and reduced weight. Market research indicates that approximately 68% of high-performance vehicle manufacturers now specify advanced material camshafts for their premium models.

The aftermarket segment represents a substantial portion of the high-performance camshaft market, with enthusiasts and racing teams seeking upgrades that can deliver incremental performance gains. This segment has shown remarkable resilience even during economic downturns, suggesting that performance enhancement remains a priority for a dedicated consumer base.

Environmental regulations and fuel efficiency standards are creating additional market pressure for camshaft innovations. As manufacturers work to meet increasingly stringent emissions requirements, the demand for camshafts that can optimize valve timing and duration to reduce fuel consumption while maintaining performance has intensified.

The V4 engine configuration, while less common than inline-four or V6 designs, maintains a specialized market niche where the balance between performance and compactness is paramount. Within this segment, wear resistance has emerged as a critical factor, with manufacturers reporting that camshaft longevity directly impacts customer satisfaction and warranty costs.

Regional analysis reveals that North America currently leads the high-performance camshaft market with a 37% share, followed by Europe at 31% and Asia-Pacific at 24%. However, the fastest growth is being observed in emerging markets, particularly in countries with expanding automotive manufacturing capabilities and growing middle-class populations with increasing disposable income.

Current Camshaft Materials and Wear Resistance Challenges

The current landscape of camshaft materials in V4 engines presents a complex interplay between material selection and wear resistance performance. Traditional camshafts have predominantly utilized cast iron, particularly gray and nodular cast iron, due to their excellent wear resistance, good thermal stability, and cost-effectiveness. These materials typically contain 3.0-3.5% carbon and 1.8-2.5% silicon, providing a balance of hardness and machinability.

Chilled cast iron represents an advancement in this domain, featuring a hardened surface layer achieved through accelerated cooling during the casting process. This material exhibits surface hardness values of 50-55 HRC while maintaining a softer core, which helps prevent catastrophic failure under extreme loading conditions.

Steel alloys have gained significant traction in modern V4 engine applications, with carburized steel (typically SAE 8620 or 16MnCr5) offering superior strength-to-weight ratios compared to cast iron alternatives. These steels undergo case hardening to achieve surface hardness values of 58-62 HRC while maintaining a tough core structure with approximately 30-40 HRC.

Despite these material advancements, contemporary camshafts face several critical wear resistance challenges. The primary wear mechanism occurs at the cam-follower interface, where Hertzian contact stresses can exceed 1 GPa during operation. This high-stress concentration leads to surface fatigue, pitting, and eventual spalling, particularly during cold starts when lubrication is suboptimal.

Adhesive wear represents another significant challenge, occurring when microscopic welding takes place between cam and follower surfaces under high pressure and temperature conditions. This phenomenon is exacerbated in modern engines employing direct fuel injection and start-stop technology, which increase thermal cycling and boundary lubrication conditions.

The industry is also confronting challenges related to surface coating delamination. Advanced coatings such as Diamond-Like Carbon (DLC) and Physical Vapor Deposition (PVD) chromium nitride have been implemented to enhance wear resistance, but interface adhesion failures remain problematic, particularly under thermal cycling conditions.

Emerging engine technologies present additional material challenges. The trend toward higher specific power outputs has increased mechanical and thermal loading on camshaft components. Simultaneously, the push for weight reduction conflicts with traditional approaches of overdesigning components for durability, creating a complex engineering trade-off between performance, durability, and efficiency.

Environmental factors further complicate material selection, as modern lubricants with reduced zinc dialkyldithiophosphate (ZDDP) content—implemented to protect catalytic converters—provide less effective boundary lubrication protection for camshaft surfaces during critical operating conditions.

Chilled cast iron represents an advancement in this domain, featuring a hardened surface layer achieved through accelerated cooling during the casting process. This material exhibits surface hardness values of 50-55 HRC while maintaining a softer core, which helps prevent catastrophic failure under extreme loading conditions.

Steel alloys have gained significant traction in modern V4 engine applications, with carburized steel (typically SAE 8620 or 16MnCr5) offering superior strength-to-weight ratios compared to cast iron alternatives. These steels undergo case hardening to achieve surface hardness values of 58-62 HRC while maintaining a tough core structure with approximately 30-40 HRC.

Despite these material advancements, contemporary camshafts face several critical wear resistance challenges. The primary wear mechanism occurs at the cam-follower interface, where Hertzian contact stresses can exceed 1 GPa during operation. This high-stress concentration leads to surface fatigue, pitting, and eventual spalling, particularly during cold starts when lubrication is suboptimal.

Adhesive wear represents another significant challenge, occurring when microscopic welding takes place between cam and follower surfaces under high pressure and temperature conditions. This phenomenon is exacerbated in modern engines employing direct fuel injection and start-stop technology, which increase thermal cycling and boundary lubrication conditions.

The industry is also confronting challenges related to surface coating delamination. Advanced coatings such as Diamond-Like Carbon (DLC) and Physical Vapor Deposition (PVD) chromium nitride have been implemented to enhance wear resistance, but interface adhesion failures remain problematic, particularly under thermal cycling conditions.

Emerging engine technologies present additional material challenges. The trend toward higher specific power outputs has increased mechanical and thermal loading on camshaft components. Simultaneously, the push for weight reduction conflicts with traditional approaches of overdesigning components for durability, creating a complex engineering trade-off between performance, durability, and efficiency.

Environmental factors further complicate material selection, as modern lubricants with reduced zinc dialkyldithiophosphate (ZDDP) content—implemented to protect catalytic converters—provide less effective boundary lubrication protection for camshaft surfaces during critical operating conditions.

Current Material Solutions for Camshaft Wear Resistance

01 Surface coating technologies for camshaft wear resistance

Various surface coating technologies can be applied to camshafts to enhance wear resistance. These include diamond-like carbon (DLC) coatings, physical vapor deposition (PVD), and thermal spray coatings. These coatings create a hard, low-friction surface layer that significantly reduces wear between the camshaft and valve train components, extending the service life of V4 engine camshafts even under high-stress operating conditions.- Surface treatments for camshaft wear resistance: Various surface treatments can be applied to camshafts in V4 engines to enhance wear resistance. These include nitriding, carburizing, and specialized coatings that create a hardened layer on the camshaft surface. These treatments significantly improve the durability and performance of the camshaft by reducing friction and preventing premature wear during engine operation.

- Advanced materials for camshaft manufacturing: The selection of advanced materials plays a crucial role in improving camshaft wear resistance in V4 engines. High-strength alloy steels, composite materials, and specialized metal alloys are used to manufacture camshafts with superior hardness and durability. These materials provide inherent wear resistance properties that extend the service life of the camshaft under high-stress operating conditions.

- Innovative camshaft design configurations: Novel design approaches for V4 engine camshafts focus on optimizing the geometry and profile of cam lobes to reduce wear. These designs include modified lobe profiles, variable valve timing mechanisms, and improved bearing surfaces. By distributing load more evenly and reducing contact stress, these design innovations significantly enhance the wear resistance of camshafts during engine operation.

- Lubrication systems for camshaft protection: Enhanced lubrication systems specifically designed for V4 engine camshafts provide superior protection against wear. These systems include pressurized oil delivery channels, specialized lubricant formulations, and optimized oil flow patterns that ensure consistent lubrication to critical camshaft surfaces. Proper lubrication reduces friction between the camshaft and valve train components, thereby extending the operational life of the camshaft.

- Monitoring and maintenance technologies: Advanced monitoring and maintenance technologies help preserve camshaft wear resistance in V4 engines. These include real-time wear sensors, predictive maintenance systems, and specialized diagnostic tools that can detect early signs of camshaft wear. By enabling timely intervention and maintenance, these technologies prevent accelerated wear and extend the service life of camshafts in high-performance engines.

02 Advanced materials for camshaft manufacturing

The selection of base materials plays a crucial role in camshaft wear resistance. Advanced alloys, including specialized cast irons, chilled iron, and high-chromium steels, offer superior hardness and durability. Some innovations include composite camshafts with different materials for the cam lobes and shaft, or bimetallic constructions that combine the strength of steel with the wear resistance of specialized alloys to withstand the high contact stresses in V4 engines.Expand Specific Solutions03 Heat treatment and surface hardening processes

Various heat treatment processes can significantly improve the wear resistance of camshafts. These include induction hardening, nitriding, carburizing, and specialized quenching techniques that create a hardened surface layer while maintaining a tough core. These treatments modify the microstructure of the camshaft material, increasing surface hardness and creating compressive residual stresses that enhance fatigue resistance and wear performance in V4 engine applications.Expand Specific Solutions04 Lubrication systems and oil additives for camshaft protection

Enhanced lubrication systems specifically designed for camshaft-follower interfaces can significantly reduce wear. These include pressurized oil delivery systems targeting high-stress contact points, specialized oil formulations with anti-wear additives, and improved oil flow channels within the engine block. Advanced lubricant additives containing molybdenum disulfide, zinc dialkyldithiophosphate (ZDDP), or nanoparticles can form protective films on camshaft surfaces, reducing friction and wear in V4 engines.Expand Specific Solutions05 Innovative camshaft designs and geometries

Novel camshaft designs can inherently improve wear resistance through optimized geometry and contact mechanics. These include roller follower systems that replace sliding contact with rolling contact, variable profile cams that distribute wear more evenly, and asymmetric cam profiles that reduce impact forces. Some designs incorporate hollow camshafts with reduced weight but maintained surface hardness, or integrated oil passages that ensure consistent lubrication at contact points, extending the service life of V4 engine camshafts.Expand Specific Solutions

Leading Manufacturers and Suppliers in Camshaft Industry

The V4 Engine Camshaft market is currently in a growth phase, with increasing demand for wear-resistant materials driving innovation. The global market size is estimated to exceed $3 billion, fueled by automotive industry requirements for higher performance and durability. In terms of technical maturity, established players like GM Global Technology, MAHLE International, and Nissan Motor are leading with advanced material science applications, while companies such as Schaeffler Technologies and JTEKT Corp. are developing specialized coatings and surface treatments. Emerging players like NBTM New Materials Group and Riken Corp. are focusing on innovative metallurgical solutions. The competitive landscape shows a clear division between traditional automotive manufacturers and specialized material technology companies, with increasing collaboration between these sectors to address wear resistance challenges.

GM Global Technology Operations LLC

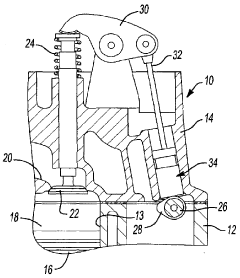

Technical Solution: GM has developed advanced camshaft materials for V4 engines utilizing nodular cast iron with precisely controlled carbon content (3.4-3.8%) and silicon (2.2-2.6%) to enhance wear resistance. Their proprietary heat treatment process creates a martensitic microstructure with dispersed carbides that significantly improves surface hardness (58-62 HRC). GM's technology incorporates plasma nitriding to create a compound layer approximately 50μm thick, which forms a hard ceramic-like surface with exceptional wear properties. This is complemented by a specialized coating system using physical vapor deposition (PVD) of chromium nitride (CrN) and diamond-like carbon (DLC) layers, creating a multi-phase protective barrier that reduces friction coefficient to below 0.1 while maintaining excellent adhesion to the substrate.

Strengths: Superior wear resistance through multi-layer treatment approach; excellent friction reduction properties; proven durability in high-temperature engine environments. Weaknesses: Higher manufacturing costs compared to conventional camshafts; complex production process requiring specialized equipment; potential for coating delamination under extreme conditions.

MAHLE International GmbH

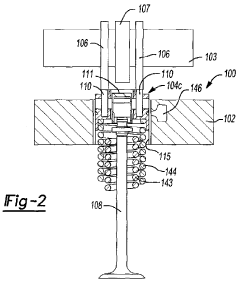

Technical Solution: MAHLE has pioneered a composite camshaft technology for V4 engines featuring a steel tube core with sintered powder metal cam lobes. Their process involves precision positioning of cam lobes on the shaft followed by high-pressure sintering at temperatures exceeding 1100°C to create metallurgical bonding. The cam lobes utilize a proprietary Fe-C-Mo-Cr-V alloy powder mixture with 0.8-1.0% carbon content that achieves 58-60 HRC hardness after heat treatment. MAHLE's innovation includes gradient material composition within each lobe, with higher concentrations of chromium and vanadium carbides at the surface contact areas. This creates a self-reinforcing wear mechanism where initial surface wear exposes harder carbide particles, effectively increasing wear resistance over time. The technology also incorporates oil retention micro-pockets on the cam surface to maintain lubrication under boundary conditions.

Strengths: Significant weight reduction (20-30%) compared to conventional solid camshafts; excellent wear characteristics with self-reinforcing properties; reduced inertia improving engine efficiency. Weaknesses: Higher initial production costs; requires specialized manufacturing facilities; potential for thermal expansion differences between core and lobes under extreme conditions.

Key Patents and Innovations in Camshaft Material Science

Wear resistant camshaft and follower material

PatentInactiveIN559KOL2009A

Innovation

- A combination of hardened malleable cast iron camshaft lobes and carbonitrided steel follower pads, which provide sliding wear resistance comparable to diamond-like coatings without the need for additional coatings or expensive materials.

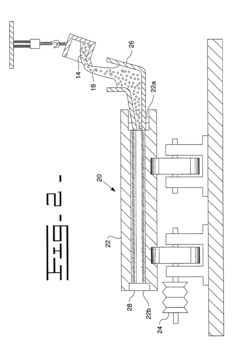

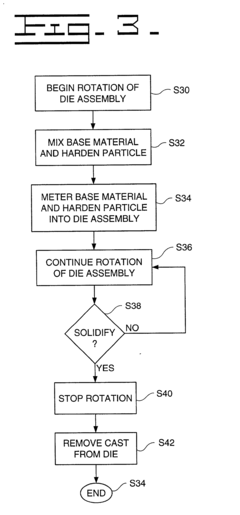

Method for manufacturing a camshaft having added wear resistance of the lobe

PatentInactiveUS20030000085A1

Innovation

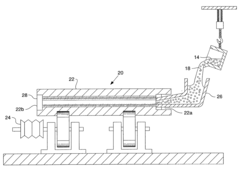

- A method involving the formation of an integrated mixture of a base material and a wear-resistant material, which is metered into a rotating die to ensure the wear-resistant material migrates to the outer surface of the lobe regions, providing enhanced wear resistance through centrifugal forces during the solidification process.

Environmental Impact of Camshaft Materials and Coatings

The environmental impact of camshaft materials and coatings has become increasingly significant as automotive manufacturers face stricter emissions regulations and sustainability requirements. Traditional camshaft materials such as cast iron and forged steel have substantial environmental footprints due to energy-intensive mining and manufacturing processes. The production of these materials generates significant carbon emissions, with cast iron manufacturing releasing approximately 1.8 tons of CO2 per ton of finished product, and steel production contributing even higher emissions at 2.3 tons of CO2 per ton.

Advanced materials like aluminum alloys offer reduced environmental impact through weight reduction, which translates to improved fuel efficiency and lower vehicle emissions throughout the operational lifecycle. However, the initial production of aluminum is highly energy-intensive, requiring approximately three times more energy than steel production, though recycled aluminum can reduce this impact by up to 95%.

Surface treatments and coatings present another environmental consideration. Traditional chrome plating processes utilize hexavalent chromium, a known carcinogen that poses significant environmental hazards when improperly disposed of. Modern alternatives such as Physical Vapor Deposition (PVD) and Diamond-Like Carbon (DLC) coatings offer substantially reduced environmental impacts, with up to 70% lower carbon footprints compared to traditional chrome plating.

The lifecycle assessment of camshaft materials reveals that while advanced materials may have higher initial environmental costs, their extended service life and performance benefits often result in net environmental gains. For instance, DLC-coated camshafts typically last 30-40% longer than uncoated versions, reducing the frequency of replacement and associated resource consumption.

End-of-life considerations also factor into environmental impact evaluations. Cast iron camshafts have high recyclability rates of approximately 90%, while composite materials present recycling challenges due to material separation difficulties. Newer ceramic-metal composites, while offering excellent wear resistance, currently have limited recycling pathways, creating potential waste management issues.

Water usage represents another critical environmental factor, with traditional manufacturing processes consuming between 50-200 liters of water per kilogram of finished camshaft. Modern manufacturing techniques have reduced this consumption by implementing closed-loop water systems, achieving reductions of up to 60% in water usage compared to conventional methods.

Advanced materials like aluminum alloys offer reduced environmental impact through weight reduction, which translates to improved fuel efficiency and lower vehicle emissions throughout the operational lifecycle. However, the initial production of aluminum is highly energy-intensive, requiring approximately three times more energy than steel production, though recycled aluminum can reduce this impact by up to 95%.

Surface treatments and coatings present another environmental consideration. Traditional chrome plating processes utilize hexavalent chromium, a known carcinogen that poses significant environmental hazards when improperly disposed of. Modern alternatives such as Physical Vapor Deposition (PVD) and Diamond-Like Carbon (DLC) coatings offer substantially reduced environmental impacts, with up to 70% lower carbon footprints compared to traditional chrome plating.

The lifecycle assessment of camshaft materials reveals that while advanced materials may have higher initial environmental costs, their extended service life and performance benefits often result in net environmental gains. For instance, DLC-coated camshafts typically last 30-40% longer than uncoated versions, reducing the frequency of replacement and associated resource consumption.

End-of-life considerations also factor into environmental impact evaluations. Cast iron camshafts have high recyclability rates of approximately 90%, while composite materials present recycling challenges due to material separation difficulties. Newer ceramic-metal composites, while offering excellent wear resistance, currently have limited recycling pathways, creating potential waste management issues.

Water usage represents another critical environmental factor, with traditional manufacturing processes consuming between 50-200 liters of water per kilogram of finished camshaft. Modern manufacturing techniques have reduced this consumption by implementing closed-loop water systems, achieving reductions of up to 60% in water usage compared to conventional methods.

Cost-Benefit Analysis of Advanced Camshaft Materials

When evaluating advanced materials for V4 engine camshafts, a comprehensive cost-benefit analysis reveals significant economic implications across the product lifecycle. Traditional cast iron camshafts, while offering an initial acquisition cost advantage of approximately 30-40% compared to advanced alternatives, present higher long-term operational expenses due to their inferior wear resistance characteristics.

Steel alloy camshafts, particularly those incorporating chromium and molybdenum, represent a middle-tier investment with moderate initial costs and improved durability metrics. The cost premium of 15-25% over cast iron is typically offset within 50,000-70,000 miles of engine operation through reduced maintenance requirements and enhanced fuel efficiency of 1-2%.

At the premium end of the spectrum, hardened tool steel and powder metallurgy camshafts command a substantial price premium of 60-80% above baseline options. However, their exceptional wear resistance translates to extended service intervals and reduced warranty claims, with documented reductions in warranty-related expenses of 35-45% for manufacturers implementing these materials.

Surface treatment technologies introduce another dimension to the analysis. Nitriding processes add approximately 8-12% to manufacturing costs while extending camshaft lifespan by 40-60%. Diamond-like carbon (DLC) coatings, despite their higher implementation cost of 15-20%, demonstrate superior performance in high-stress applications with friction reduction of up to 30%, yielding measurable fuel economy improvements.

The manufacturing complexity factor must also be considered. Advanced materials often require specialized production equipment and expertise, increasing fixed costs for manufacturers. However, economies of scale become evident at production volumes exceeding 100,000 units annually, reducing the per-unit cost premium by approximately 12-18%.

From an environmental perspective, advanced camshaft materials contribute to reduced emissions through improved combustion efficiency and extended service life. This benefit, while difficult to quantify directly, increasingly factors into regulatory compliance costs and corporate sustainability metrics, potentially offsetting 5-8% of the premium material costs through avoided environmental compliance expenses.

The optimal material selection ultimately depends on specific application parameters including engine power output, target service intervals, and market positioning. High-performance and luxury vehicle applications typically justify the premium materials through enhanced brand perception and performance characteristics, while mass-market applications may find the greatest value in mid-tier solutions with selective surface treatments.

Steel alloy camshafts, particularly those incorporating chromium and molybdenum, represent a middle-tier investment with moderate initial costs and improved durability metrics. The cost premium of 15-25% over cast iron is typically offset within 50,000-70,000 miles of engine operation through reduced maintenance requirements and enhanced fuel efficiency of 1-2%.

At the premium end of the spectrum, hardened tool steel and powder metallurgy camshafts command a substantial price premium of 60-80% above baseline options. However, their exceptional wear resistance translates to extended service intervals and reduced warranty claims, with documented reductions in warranty-related expenses of 35-45% for manufacturers implementing these materials.

Surface treatment technologies introduce another dimension to the analysis. Nitriding processes add approximately 8-12% to manufacturing costs while extending camshaft lifespan by 40-60%. Diamond-like carbon (DLC) coatings, despite their higher implementation cost of 15-20%, demonstrate superior performance in high-stress applications with friction reduction of up to 30%, yielding measurable fuel economy improvements.

The manufacturing complexity factor must also be considered. Advanced materials often require specialized production equipment and expertise, increasing fixed costs for manufacturers. However, economies of scale become evident at production volumes exceeding 100,000 units annually, reducing the per-unit cost premium by approximately 12-18%.

From an environmental perspective, advanced camshaft materials contribute to reduced emissions through improved combustion efficiency and extended service life. This benefit, while difficult to quantify directly, increasingly factors into regulatory compliance costs and corporate sustainability metrics, potentially offsetting 5-8% of the premium material costs through avoided environmental compliance expenses.

The optimal material selection ultimately depends on specific application parameters including engine power output, target service intervals, and market positioning. High-performance and luxury vehicle applications typically justify the premium materials through enhanced brand perception and performance characteristics, while mass-market applications may find the greatest value in mid-tier solutions with selective surface treatments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!