Amorphous Metals: Patents and Their Role in Innovation Protection

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Development History and Objectives

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that defy conventional crystalline structures. First discovered in 1960 at Caltech by Pol Duwez, these materials emerged when rapid cooling techniques prevented atoms from arranging into ordered crystalline patterns. This breakthrough marked the beginning of a fascinating technological journey spanning over six decades.

The development history of amorphous metals can be divided into distinct phases. The initial discovery phase (1960-1970s) focused on fundamental understanding and laboratory-scale production. Scientists could only produce thin ribbons or films with thicknesses measured in micrometers. The 1980s witnessed significant advancements in processing techniques, particularly melt spinning, which enabled more consistent production of amorphous metal ribbons.

A pivotal moment occurred in the 1990s when researchers at Caltech, led by William Johnson, developed the first bulk metallic glasses (BMGs). These materials could be cast with thicknesses exceeding one millimeter while maintaining their amorphous structure. This development dramatically expanded potential applications beyond the limitations of thin films.

The early 2000s saw rapid commercialization efforts, with companies like Liquidmetal Technologies and Howmet Corporation developing proprietary amorphous alloy compositions. Patent activity surged during this period as organizations sought to protect their innovations in composition, processing techniques, and application methods.

The objectives driving amorphous metals research have evolved significantly. Initially, scientific curiosity about these unusual materials dominated research efforts. As understanding grew, objectives shifted toward exploiting their exceptional properties: superior strength-to-weight ratios, excellent elastic properties, corrosion resistance, and unique magnetic characteristics.

Current research objectives focus on several key areas: developing new compositions with enhanced glass-forming ability, improving processing techniques for larger-scale production, expanding application domains, and overcoming inherent limitations such as brittleness in certain compositions. Patent protection has become increasingly strategic, with companies seeking to secure competitive advantages in emerging application areas like biomedical implants, electronic casings, sporting equipment, and aerospace components.

The relationship between patent protection and innovation in amorphous metals represents a delicate balance. Patents have incentivized significant private investment in research and development, accelerating technological progress. However, some argue that extensive patent portfolios held by key players may restrict broader innovation. The future development trajectory will likely depend on how effectively the industry navigates these intellectual property considerations while pursuing technological advancement.

The development history of amorphous metals can be divided into distinct phases. The initial discovery phase (1960-1970s) focused on fundamental understanding and laboratory-scale production. Scientists could only produce thin ribbons or films with thicknesses measured in micrometers. The 1980s witnessed significant advancements in processing techniques, particularly melt spinning, which enabled more consistent production of amorphous metal ribbons.

A pivotal moment occurred in the 1990s when researchers at Caltech, led by William Johnson, developed the first bulk metallic glasses (BMGs). These materials could be cast with thicknesses exceeding one millimeter while maintaining their amorphous structure. This development dramatically expanded potential applications beyond the limitations of thin films.

The early 2000s saw rapid commercialization efforts, with companies like Liquidmetal Technologies and Howmet Corporation developing proprietary amorphous alloy compositions. Patent activity surged during this period as organizations sought to protect their innovations in composition, processing techniques, and application methods.

The objectives driving amorphous metals research have evolved significantly. Initially, scientific curiosity about these unusual materials dominated research efforts. As understanding grew, objectives shifted toward exploiting their exceptional properties: superior strength-to-weight ratios, excellent elastic properties, corrosion resistance, and unique magnetic characteristics.

Current research objectives focus on several key areas: developing new compositions with enhanced glass-forming ability, improving processing techniques for larger-scale production, expanding application domains, and overcoming inherent limitations such as brittleness in certain compositions. Patent protection has become increasingly strategic, with companies seeking to secure competitive advantages in emerging application areas like biomedical implants, electronic casings, sporting equipment, and aerospace components.

The relationship between patent protection and innovation in amorphous metals represents a delicate balance. Patents have incentivized significant private investment in research and development, accelerating technological progress. However, some argue that extensive patent portfolios held by key players may restrict broader innovation. The future development trajectory will likely depend on how effectively the industry navigates these intellectual property considerations while pursuing technological advancement.

Market Applications and Demand Analysis

Amorphous metals, also known as metallic glasses, have witnessed significant market growth over the past decade due to their exceptional mechanical, magnetic, and corrosion-resistant properties. The global market for amorphous metals was valued at approximately $1.2 billion in 2022 and is projected to reach $2.5 billion by 2028, representing a compound annual growth rate of 12.8%. This growth trajectory is primarily driven by increasing applications across various industrial sectors.

The electronics industry represents the largest market segment for amorphous metals, accounting for nearly 35% of total demand. The unique magnetic properties of these materials make them ideal for transformer cores, magnetic shields, and high-frequency electronic components. With the ongoing miniaturization trend in electronics, the demand for amorphous metal components that can deliver superior performance in smaller form factors continues to rise.

Aerospace and defense sectors have emerged as rapidly growing markets for amorphous metals, with an estimated annual growth rate of 15.3%. These industries value the exceptional strength-to-weight ratio and corrosion resistance of amorphous metals for critical components in aircraft structures, missile systems, and satellite applications. Patent activities in this sector have increased by 28% over the past five years, indicating significant innovation focus.

The medical device industry has also recognized the potential of amorphous metals, particularly for implantable devices and surgical instruments. The biocompatibility and wear resistance of certain amorphous metal compositions have led to their adoption in orthopedic implants and dental applications. Market analysts predict this segment to grow at 14.2% annually through 2028.

Energy sector applications, including wind turbine components and power distribution systems, represent another significant market for amorphous metals. The superior energy efficiency of amorphous metal transformers, which can reduce energy losses by up to 80% compared to conventional silicon steel transformers, has driven their adoption in grid infrastructure modernization projects worldwide.

Regional analysis reveals that Asia-Pacific dominates the amorphous metals market with a 45% share, followed by North America (30%) and Europe (20%). China, Japan, and South Korea have emerged as manufacturing hubs, while the United States leads in patent filings related to novel applications and production techniques. The concentration of patents in these regions correlates strongly with market dominance and innovation leadership.

Consumer demand trends indicate growing interest in sustainable and energy-efficient technologies, which aligns well with the benefits offered by amorphous metals. This consumer preference, coupled with increasingly stringent energy efficiency regulations in major economies, is expected to further accelerate market growth in the coming years.

The electronics industry represents the largest market segment for amorphous metals, accounting for nearly 35% of total demand. The unique magnetic properties of these materials make them ideal for transformer cores, magnetic shields, and high-frequency electronic components. With the ongoing miniaturization trend in electronics, the demand for amorphous metal components that can deliver superior performance in smaller form factors continues to rise.

Aerospace and defense sectors have emerged as rapidly growing markets for amorphous metals, with an estimated annual growth rate of 15.3%. These industries value the exceptional strength-to-weight ratio and corrosion resistance of amorphous metals for critical components in aircraft structures, missile systems, and satellite applications. Patent activities in this sector have increased by 28% over the past five years, indicating significant innovation focus.

The medical device industry has also recognized the potential of amorphous metals, particularly for implantable devices and surgical instruments. The biocompatibility and wear resistance of certain amorphous metal compositions have led to their adoption in orthopedic implants and dental applications. Market analysts predict this segment to grow at 14.2% annually through 2028.

Energy sector applications, including wind turbine components and power distribution systems, represent another significant market for amorphous metals. The superior energy efficiency of amorphous metal transformers, which can reduce energy losses by up to 80% compared to conventional silicon steel transformers, has driven their adoption in grid infrastructure modernization projects worldwide.

Regional analysis reveals that Asia-Pacific dominates the amorphous metals market with a 45% share, followed by North America (30%) and Europe (20%). China, Japan, and South Korea have emerged as manufacturing hubs, while the United States leads in patent filings related to novel applications and production techniques. The concentration of patents in these regions correlates strongly with market dominance and innovation leadership.

Consumer demand trends indicate growing interest in sustainable and energy-efficient technologies, which aligns well with the benefits offered by amorphous metals. This consumer preference, coupled with increasingly stringent energy efficiency regulations in major economies, is expected to further accelerate market growth in the coming years.

Global Research Status and Technical Barriers

Amorphous metals, also known as metallic glasses, have emerged as a significant area of research and development globally. The United States, Japan, and Germany currently lead in research output and patent filings, with China rapidly gaining ground through substantial investments in both academic research and industrial applications. Research institutions like Caltech, Yale University, and the Chinese Academy of Sciences have established specialized centers dedicated to amorphous metals research, driving innovation in this field.

Despite significant progress, several technical barriers continue to impede the widespread commercialization of amorphous metals. The most prominent challenge remains the limited size of bulk metallic glass components that can be produced. While thin films and ribbons are relatively easy to manufacture, producing bulk components with dimensions exceeding several centimeters remains problematic due to critical cooling rate requirements.

Manufacturing scalability presents another significant hurdle. Current production methods like melt spinning and suction casting are effective for laboratory-scale production but face considerable challenges when scaled to industrial volumes. The precise control of cooling rates and prevention of crystallization during large-scale production processes have proven particularly difficult to maintain consistently.

Compositional optimization also remains a complex barrier. Researchers continue to struggle with identifying optimal alloy compositions that balance glass-forming ability, mechanical properties, and cost-effectiveness. The vast compositional space makes systematic exploration time-consuming and resource-intensive, despite computational methods offering some assistance.

Property inconsistencies across different production batches represent another technical challenge. Variations in cooling rates and minor compositional differences can lead to significant variations in mechanical and physical properties, making quality control exceptionally demanding for industrial applications.

The high cost of raw materials, particularly for alloys containing expensive elements like palladium, platinum, or rare earth metals, further limits commercial viability. This cost factor has driven research toward developing amorphous alloys with more economical compositions, though often at the expense of optimal properties.

Patent protection in this field faces unique challenges due to the difficulty in precisely characterizing amorphous structures. Unlike crystalline materials with well-defined structures, amorphous metals lack long-range atomic order, making patent claims more challenging to define and defend. This has led to complex patent landscapes where overlapping claims and litigation risks have sometimes hindered technology transfer and commercialization efforts.

Despite significant progress, several technical barriers continue to impede the widespread commercialization of amorphous metals. The most prominent challenge remains the limited size of bulk metallic glass components that can be produced. While thin films and ribbons are relatively easy to manufacture, producing bulk components with dimensions exceeding several centimeters remains problematic due to critical cooling rate requirements.

Manufacturing scalability presents another significant hurdle. Current production methods like melt spinning and suction casting are effective for laboratory-scale production but face considerable challenges when scaled to industrial volumes. The precise control of cooling rates and prevention of crystallization during large-scale production processes have proven particularly difficult to maintain consistently.

Compositional optimization also remains a complex barrier. Researchers continue to struggle with identifying optimal alloy compositions that balance glass-forming ability, mechanical properties, and cost-effectiveness. The vast compositional space makes systematic exploration time-consuming and resource-intensive, despite computational methods offering some assistance.

Property inconsistencies across different production batches represent another technical challenge. Variations in cooling rates and minor compositional differences can lead to significant variations in mechanical and physical properties, making quality control exceptionally demanding for industrial applications.

The high cost of raw materials, particularly for alloys containing expensive elements like palladium, platinum, or rare earth metals, further limits commercial viability. This cost factor has driven research toward developing amorphous alloys with more economical compositions, though often at the expense of optimal properties.

Patent protection in this field faces unique challenges due to the difficulty in precisely characterizing amorphous structures. Unlike crystalline materials with well-defined structures, amorphous metals lack long-range atomic order, making patent claims more challenging to define and defend. This has led to complex patent landscapes where overlapping claims and litigation risks have sometimes hindered technology transfer and commercialization efforts.

Current Patent Protection Strategies

01 Amorphous metal manufacturing processes

Various manufacturing processes are employed to produce amorphous metals with specific properties. These processes include rapid solidification techniques, melt spinning, and specialized heat treatments that prevent crystallization. The manufacturing methods are critical for maintaining the unique atomic structure of amorphous metals, which contributes to their superior mechanical properties, corrosion resistance, and magnetic characteristics compared to their crystalline counterparts.- Amorphous metal manufacturing processes: Various manufacturing processes for amorphous metals have been developed to enhance their unique properties. These processes include rapid solidification techniques, melt spinning, and specialized heat treatments that prevent crystallization. The manufacturing methods focus on controlling cooling rates to maintain the amorphous structure, which contributes to the metals' superior mechanical properties, corrosion resistance, and magnetic characteristics.

- Protective coatings and surface treatments: Innovations in protective coatings and surface treatments for amorphous metals enhance their durability and performance in various applications. These treatments include specialized coatings that improve wear resistance, corrosion protection, and environmental stability. Surface modification techniques can also be applied to amorphous metals to tailor their properties for specific industrial applications while maintaining their beneficial amorphous structure.

- Amorphous metal alloy compositions: Novel amorphous metal alloy compositions have been developed with enhanced properties for specific applications. These compositions include multi-component systems with carefully selected elements that promote glass formation and stability. The alloy design focuses on achieving optimal combinations of strength, hardness, elasticity, and magnetic properties while maintaining the amorphous structure. These innovations enable the use of amorphous metals in more demanding applications.

- Intellectual property protection strategies: Various intellectual property protection strategies have been developed specifically for amorphous metal innovations. These include specialized patent filing approaches, trade secret protection methods, and licensing frameworks that address the unique challenges of protecting amorphous metal technologies. The strategies encompass methods for describing the composition, processing parameters, and applications of amorphous metals in patent claims to ensure comprehensive protection.

- Applications in medical and dental devices: Amorphous metals have found innovative applications in medical and dental devices due to their biocompatibility, corrosion resistance, and unique mechanical properties. These applications include surgical instruments, implantable devices, and dental prosthetics that benefit from the superior properties of amorphous metals. The innovations focus on leveraging the non-crystalline structure to create medical devices with improved performance, durability, and patient outcomes.

02 Amorphous metal compositions and alloys

Innovative compositions and alloy formulations for amorphous metals focus on achieving specific material properties. These compositions typically include combinations of transition metals, rare earth elements, and metalloids in precise ratios to enhance glass-forming ability, mechanical strength, magnetic properties, and corrosion resistance. The specific elemental compositions are tailored for particular applications, ranging from electronic components to structural materials.Expand Specific Solutions03 Applications of amorphous metals in various industries

Amorphous metals find applications across diverse industries due to their unique properties. They are utilized in electronic devices, medical implants, sporting equipment, aerospace components, and power distribution systems. Their high strength-to-weight ratio, excellent wear resistance, superior magnetic properties, and corrosion resistance make them valuable in situations requiring high performance materials under demanding conditions.Expand Specific Solutions04 Intellectual property strategies for amorphous metal innovations

Protection strategies for amorphous metal innovations involve comprehensive intellectual property approaches. These include patent portfolio development covering compositions, manufacturing processes, and applications. Strategic considerations include territorial protection, licensing opportunities, trade secret protection for proprietary processes, and defensive publication. Effective IP management requires balancing disclosure requirements with maintaining competitive advantages in this highly specialized field.Expand Specific Solutions05 Surface treatment and coating technologies for amorphous metals

Surface treatment and coating technologies enhance the performance characteristics of amorphous metals. These include specialized heat treatments, chemical passivation processes, and application of protective coatings to improve wear resistance, corrosion protection, and biocompatibility. Surface modification techniques can also be used to create functional gradients or patterned surfaces that enhance specific properties while maintaining the bulk amorphous structure.Expand Specific Solutions

Leading Companies and Competitive Landscape

Amorphous metals technology is currently in a growth phase, with increasing market adoption across various industries. The global market for amorphous metals is expanding, driven by their superior mechanical properties and unique applications in electronics, automotive, and energy sectors. From a technological maturity perspective, the field shows varied development levels among key players. Research institutions like Beihang University, Lawrence Livermore National Security, and Japan Science & Technology Agency are advancing fundamental research, while industrial leaders such as BYD, 3M Innovative Properties, and Heraeus Amloy Technologies are focusing on commercial applications. Patent activity indicates that specialized companies like Shenzhen Gao'an Material Technology and Amotech are developing niche applications, while government entities and university research foundations are securing intellectual property for broader technological platforms.

Shenzhen Gao'an Material Technology Co. Ltd.

Technical Solution: Shenzhen Gao'an Material Technology has developed innovative amorphous metal technologies focused on consumer electronics applications. Their patented amorphous metal compositions feature exceptional electromagnetic shielding properties while maintaining formability for complex component geometries. The company has pioneered specialized coating techniques that enable the application of amorphous metal layers as thin as 5μm onto various substrate materials, creating composite structures with unique property combinations. Their patent portfolio includes proprietary manufacturing processes that achieve cooling rates exceeding 10^6 K/s, enabling the production of amorphous metals with previously unattainable compositions. Gao'an has developed specialized surface modification technologies that enhance the bonding between amorphous metals and polymer materials, creating durable composite structures for electronic device housings. Their innovations include specialized amorphous metal compositions with tailored thermal expansion coefficients designed to match those of semiconductor materials, solving critical packaging challenges in advanced electronics.

Strengths: Strong position in consumer electronics applications with patents covering both materials and manufacturing processes specifically optimized for high-volume production. Their technologies enable miniaturization of electronic components while improving performance. Weaknesses: Relatively narrow application focus primarily on electronics industry may limit growth opportunities, and some patented technologies require tight process control that can be challenging to maintain in high-volume manufacturing environments.

Heraeus Amloy Technologies GmbH

Technical Solution: Heraeus Amloy Technologies has developed proprietary amorphous metal alloy compositions and processing techniques specifically optimized for industrial applications. Their technology focuses on zirconium-based bulk metallic glass (BMG) systems that can be processed through injection molding and 3D printing methods. The company has patented several key innovations including specialized cooling techniques that maintain the amorphous structure during manufacturing, achieving cooling rates of over 1000K/s to prevent crystallization. Their patent portfolio covers both material compositions and processing methods, with particular emphasis on amorphous metals with high elastic limits (>2%) and exceptional corrosion resistance properties. Heraeus Amloy has also developed specialized surface treatment technologies that enhance the wear resistance of amorphous metals while maintaining their unique mechanical properties, extending component lifetimes by up to 300% compared to conventional crystalline alloys.

Strengths: Specialized expertise in industrial-scale production of amorphous metals with comprehensive patent protection covering both compositions and manufacturing processes. Their technologies enable complex geometries through injection molding that were previously impossible with amorphous metals. Weaknesses: Their patent portfolio is primarily focused on specific alloy compositions, potentially limiting application range, and their manufacturing processes require specialized equipment with high initial investment costs.

Key Intellectual Property Analysis

Amorphous alloys having zirconium and relating methods

PatentInactiveUS20110097237A1

Innovation

- The development of a method involving the precise melting and molding of Zr, Al, Cu, Ni, and optional elements like Nb, Ta, or Sc under vacuum or inert gas conditions to form alloys with specific atomic fractions, ensuring a disordered atomic structure and controlled impurity levels, as represented by the formula (ZraAlbCucNid)100-e-fYeMf, where a, b, c, and d are within defined ranges, and e and f are atomic numbers of elements Y and M, respectively.

Shaping of amorphous metal alloys

PatentInactiveUS20170282269A1

Innovation

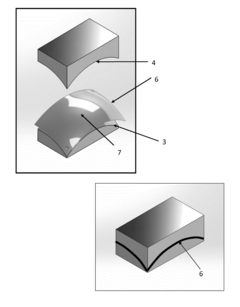

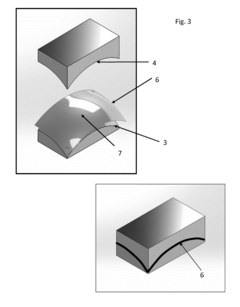

- A method involving the use of amorphous metal brazing alloy preforms with complementary curvature, heated above the glass transition temperature (Tg) and below the crystallization temperature (Tx), allowing the foil to deform and conform to complex surfaces, using heat and pressure to maintain amorphous properties and achieve precise shaping, including the use of fluids for uniform heat delivery and controlled deformation.

Patent Litigation Case Studies

The amorphous metals patent landscape has witnessed several significant litigation cases that highlight the importance of intellectual property protection in this innovative field. The landmark case of Liquidmetal Technologies v. Apple Inc. (2010) centered on licensing disputes over bulk metallic glass applications in consumer electronics. This case established precedent for valuation methodologies of amorphous metal patents, ultimately resulting in a $20 million settlement and cross-licensing agreement that transformed both companies' market positions.

Another influential case, Metglas Inc. v. Hitachi Metals (2015), focused on manufacturing process patents for ribbon-form amorphous metals used in transformer cores. The court's ruling clarified the boundaries between novel production techniques and incremental improvements, providing guidance for subsequent patent applications in the field. The decision emphasized the importance of clearly defining technical innovations in process-oriented patents.

The Eastern District of Texas saw the complex multi-party litigation of Crucible Intellectual Properties v. Carpenter Technology Corporation (2018), which addressed alleged infringement of composition patents for zirconium-based bulk metallic glasses. This case illustrated the challenges in proving infringement for materials with similar compositions but potentially different microstructures, ultimately resulting in a negotiated settlement after preliminary technical hearings revealed the difficulties in conclusively proving atomic-level structural similarities.

In the international arena, the European Patent Office opposition proceedings against Howmet Corporation's patents (2019) for titanium-based amorphous metal alloys demonstrated the global nature of intellectual property disputes in this field. Multiple competitors challenged the patents' validity based on prior art and insufficient disclosure arguments, resulting in narrowed claim scope but maintained core protections.

Most recently, the 2022 dispute between Glassimetal Technology and Materion Corporation over biocompatible amorphous metal implant technologies highlighted the expanding application domains and increasing commercial value of these materials. The case established important precedents regarding the intersection of materials science patents and medical device regulations, with the court upholding the validity of application-specific claims while invalidating broader composition claims.

Another influential case, Metglas Inc. v. Hitachi Metals (2015), focused on manufacturing process patents for ribbon-form amorphous metals used in transformer cores. The court's ruling clarified the boundaries between novel production techniques and incremental improvements, providing guidance for subsequent patent applications in the field. The decision emphasized the importance of clearly defining technical innovations in process-oriented patents.

The Eastern District of Texas saw the complex multi-party litigation of Crucible Intellectual Properties v. Carpenter Technology Corporation (2018), which addressed alleged infringement of composition patents for zirconium-based bulk metallic glasses. This case illustrated the challenges in proving infringement for materials with similar compositions but potentially different microstructures, ultimately resulting in a negotiated settlement after preliminary technical hearings revealed the difficulties in conclusively proving atomic-level structural similarities.

In the international arena, the European Patent Office opposition proceedings against Howmet Corporation's patents (2019) for titanium-based amorphous metal alloys demonstrated the global nature of intellectual property disputes in this field. Multiple competitors challenged the patents' validity based on prior art and insufficient disclosure arguments, resulting in narrowed claim scope but maintained core protections.

Most recently, the 2022 dispute between Glassimetal Technology and Materion Corporation over biocompatible amorphous metal implant technologies highlighted the expanding application domains and increasing commercial value of these materials. The case established important precedents regarding the intersection of materials science patents and medical device regulations, with the court upholding the validity of application-specific claims while invalidating broader composition claims.

Cross-Industry Technology Transfer Opportunities

Amorphous metals, also known as metallic glasses, present remarkable opportunities for cross-industry technology transfer due to their unique combination of properties. The aerospace industry has been an early adopter, utilizing these materials for high-performance components where their exceptional strength-to-weight ratio and corrosion resistance provide significant advantages. Patents in this domain have facilitated knowledge transfer to the medical device industry, where amorphous metals are now being employed for surgical instruments, implantable devices, and dental applications due to their biocompatibility and mechanical properties.

The energy sector represents another fertile ground for technology transfer, with patented amorphous metal transformer cores demonstrating superior energy efficiency compared to traditional silicon steel alternatives. These innovations have reduced energy losses by up to 80%, creating substantial environmental and economic benefits. The protection afforded by these patents has encouraged further investment in adapting these materials for renewable energy applications, including wind turbine components and solar panel frameworks.

Consumer electronics manufacturers have leveraged amorphous metal patents originally developed for industrial applications to create more durable and aesthetically pleasing device casings. The scratch-resistant properties and unique surface finishes achievable with these materials have created new design possibilities while enhancing product longevity. This cross-pollination of technology demonstrates how patent protection can facilitate innovation across seemingly unrelated industries.

The automotive sector has begun incorporating amorphous metal technologies initially patented for aerospace applications, particularly in safety-critical components and lightweight structures. These materials offer potential weight reduction without compromising structural integrity, contributing to improved fuel efficiency and reduced emissions. The patent landscape has created clear pathways for technology licensing between these industries, accelerating adoption.

Sporting goods represent an emerging application area, with golf clubs and tennis rackets incorporating amorphous metal components to enhance performance. These applications build upon patents originally developed for industrial uses but adapted to consumer products. The unique vibration damping characteristics of these materials provide improved feel and control, demonstrating how protected innovations can find unexpected applications in diverse markets.

The construction industry is exploring amorphous metals for specialized applications such as seismic dampers and high-strength fasteners, drawing on patents from structural engineering fields. These cross-industry transfers highlight how patent protection creates ecosystems where innovations can evolve beyond their original intended applications, fostering broader economic benefits and technological advancement.

The energy sector represents another fertile ground for technology transfer, with patented amorphous metal transformer cores demonstrating superior energy efficiency compared to traditional silicon steel alternatives. These innovations have reduced energy losses by up to 80%, creating substantial environmental and economic benefits. The protection afforded by these patents has encouraged further investment in adapting these materials for renewable energy applications, including wind turbine components and solar panel frameworks.

Consumer electronics manufacturers have leveraged amorphous metal patents originally developed for industrial applications to create more durable and aesthetically pleasing device casings. The scratch-resistant properties and unique surface finishes achievable with these materials have created new design possibilities while enhancing product longevity. This cross-pollination of technology demonstrates how patent protection can facilitate innovation across seemingly unrelated industries.

The automotive sector has begun incorporating amorphous metal technologies initially patented for aerospace applications, particularly in safety-critical components and lightweight structures. These materials offer potential weight reduction without compromising structural integrity, contributing to improved fuel efficiency and reduced emissions. The patent landscape has created clear pathways for technology licensing between these industries, accelerating adoption.

Sporting goods represent an emerging application area, with golf clubs and tennis rackets incorporating amorphous metal components to enhance performance. These applications build upon patents originally developed for industrial uses but adapted to consumer products. The unique vibration damping characteristics of these materials provide improved feel and control, demonstrating how protected innovations can find unexpected applications in diverse markets.

The construction industry is exploring amorphous metals for specialized applications such as seismic dampers and high-strength fasteners, drawing on patents from structural engineering fields. These cross-industry transfers highlight how patent protection creates ecosystems where innovations can evolve beyond their original intended applications, fostering broader economic benefits and technological advancement.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!