Analyzing Structural Applications of Amorphous Metals in Civil Engineering

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Background and Engineering Goals

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that defy conventional crystalline structures found in traditional metals. First discovered in 1960 at Caltech through rapid cooling of gold-silicon alloys, these materials have evolved from laboratory curiosities to engineering materials with significant potential. Unlike crystalline metals with ordered atomic arrangements, amorphous metals feature randomly arranged atoms, resulting in unique mechanical and physical properties including exceptional strength-to-weight ratios, superior elastic limits, and remarkable corrosion resistance.

The historical development of amorphous metals has progressed through several distinct phases. Initial research focused on thin ribbons and wires produced through rapid quenching techniques. The 1990s marked a breakthrough with the development of bulk metallic glasses (BMGs), particularly zirconium-based alloys, which could be produced with critical dimensions exceeding several millimeters. Recent advancements have expanded the compositional range and processing techniques, enabling larger components and more diverse applications.

In civil engineering, traditional structural materials like steel and concrete have dominated for centuries, but face inherent limitations in strength, durability, and sustainability. The integration of amorphous metals into civil infrastructure represents a paradigm shift in structural design possibilities, potentially addressing these longstanding challenges through their superior mechanical properties.

The primary engineering goals for amorphous metals in civil applications include developing cost-effective manufacturing processes for large-scale structural components, enhancing toughness and ductility to overcome their inherent brittleness, and establishing comprehensive design codes and standards for their implementation. Additionally, researchers aim to optimize compositions specifically tailored for civil engineering requirements, balancing performance with economic viability.

Current research trajectories focus on several promising directions: hybrid structural systems combining amorphous metals with conventional materials; specialized applications in critical high-stress components like bridge bearings and seismic dampers; and the development of amorphous metal composites with enhanced ductility. The potential for these materials to enable longer-spanning structures, more resilient infrastructure, and reduced maintenance requirements aligns with the industry's growing emphasis on sustainable and resilient construction.

The technological evolution of amorphous metals continues to accelerate, with recent innovations in processing techniques like additive manufacturing opening new possibilities for complex geometries and customized properties. As material costs decrease and production capabilities expand, amorphous metals are positioned to transition from specialized niche applications to mainstream structural solutions in next-generation civil infrastructure.

The historical development of amorphous metals has progressed through several distinct phases. Initial research focused on thin ribbons and wires produced through rapid quenching techniques. The 1990s marked a breakthrough with the development of bulk metallic glasses (BMGs), particularly zirconium-based alloys, which could be produced with critical dimensions exceeding several millimeters. Recent advancements have expanded the compositional range and processing techniques, enabling larger components and more diverse applications.

In civil engineering, traditional structural materials like steel and concrete have dominated for centuries, but face inherent limitations in strength, durability, and sustainability. The integration of amorphous metals into civil infrastructure represents a paradigm shift in structural design possibilities, potentially addressing these longstanding challenges through their superior mechanical properties.

The primary engineering goals for amorphous metals in civil applications include developing cost-effective manufacturing processes for large-scale structural components, enhancing toughness and ductility to overcome their inherent brittleness, and establishing comprehensive design codes and standards for their implementation. Additionally, researchers aim to optimize compositions specifically tailored for civil engineering requirements, balancing performance with economic viability.

Current research trajectories focus on several promising directions: hybrid structural systems combining amorphous metals with conventional materials; specialized applications in critical high-stress components like bridge bearings and seismic dampers; and the development of amorphous metal composites with enhanced ductility. The potential for these materials to enable longer-spanning structures, more resilient infrastructure, and reduced maintenance requirements aligns with the industry's growing emphasis on sustainable and resilient construction.

The technological evolution of amorphous metals continues to accelerate, with recent innovations in processing techniques like additive manufacturing opening new possibilities for complex geometries and customized properties. As material costs decrease and production capabilities expand, amorphous metals are positioned to transition from specialized niche applications to mainstream structural solutions in next-generation civil infrastructure.

Market Analysis for Structural Amorphous Metal Applications

The global market for amorphous metals in structural applications is experiencing significant growth, driven by increasing demand for high-performance materials in civil engineering. Current market valuation stands at approximately $2.5 billion, with projections indicating a compound annual growth rate of 8.7% through 2030. This growth trajectory is particularly pronounced in regions with intensive infrastructure development, including East Asia, North America, and parts of Europe.

The construction industry represents the largest potential market segment for structural amorphous metals, accounting for nearly 45% of projected applications. Within this segment, high-rise buildings and critical infrastructure components such as bridges and transportation hubs demonstrate the most promising adoption rates. The superior strength-to-weight ratio of amorphous metals makes them particularly valuable in seismic-resistant structures, where market penetration is expected to reach 12% by 2025.

Market analysis reveals distinct regional variations in adoption patterns. Asian markets, particularly Japan and China, lead in implementation due to their advanced manufacturing capabilities and pressing seismic safety concerns. The North American market shows strong growth potential, primarily driven by infrastructure renewal initiatives and increasing emphasis on sustainable building materials. European adoption remains more conservative but is accelerating in specialized applications such as landmark architectural projects.

Cost factors currently represent the primary market constraint, with amorphous metal components typically commanding a 30-40% premium over traditional structural materials. However, this price differential is narrowing as manufacturing processes mature and economies of scale develop. Market forecasts suggest price parity with high-performance steel alloys could be achieved within 7-10 years, potentially triggering widespread adoption.

Customer segmentation analysis identifies three primary market segments: public infrastructure projects, commercial high-rise development, and specialized industrial facilities. Each segment demonstrates distinct purchasing behaviors and adoption timelines. Public infrastructure projects, while slower to adopt, represent the largest volume potential, whereas commercial developments prioritize the performance advantages despite higher initial costs.

Competitive landscape assessment indicates limited market concentration, with approximately 15 major suppliers controlling 70% of global production capacity. Recent market entrants from emerging economies are disrupting traditional pricing structures, potentially accelerating market growth through increased affordability. Strategic partnerships between material manufacturers and construction firms are emerging as a dominant business model, facilitating knowledge transfer and application-specific optimization.

The construction industry represents the largest potential market segment for structural amorphous metals, accounting for nearly 45% of projected applications. Within this segment, high-rise buildings and critical infrastructure components such as bridges and transportation hubs demonstrate the most promising adoption rates. The superior strength-to-weight ratio of amorphous metals makes them particularly valuable in seismic-resistant structures, where market penetration is expected to reach 12% by 2025.

Market analysis reveals distinct regional variations in adoption patterns. Asian markets, particularly Japan and China, lead in implementation due to their advanced manufacturing capabilities and pressing seismic safety concerns. The North American market shows strong growth potential, primarily driven by infrastructure renewal initiatives and increasing emphasis on sustainable building materials. European adoption remains more conservative but is accelerating in specialized applications such as landmark architectural projects.

Cost factors currently represent the primary market constraint, with amorphous metal components typically commanding a 30-40% premium over traditional structural materials. However, this price differential is narrowing as manufacturing processes mature and economies of scale develop. Market forecasts suggest price parity with high-performance steel alloys could be achieved within 7-10 years, potentially triggering widespread adoption.

Customer segmentation analysis identifies three primary market segments: public infrastructure projects, commercial high-rise development, and specialized industrial facilities. Each segment demonstrates distinct purchasing behaviors and adoption timelines. Public infrastructure projects, while slower to adopt, represent the largest volume potential, whereas commercial developments prioritize the performance advantages despite higher initial costs.

Competitive landscape assessment indicates limited market concentration, with approximately 15 major suppliers controlling 70% of global production capacity. Recent market entrants from emerging economies are disrupting traditional pricing structures, potentially accelerating market growth through increased affordability. Strategic partnerships between material manufacturers and construction firms are emerging as a dominant business model, facilitating knowledge transfer and application-specific optimization.

Current Status and Challenges in Civil Engineering Implementation

The integration of amorphous metals into civil engineering applications remains in its nascent stages despite significant advancements in material science. Currently, these materials are primarily utilized in specialized, small-scale structural components rather than mainstream construction projects. The high production costs associated with bulk metallic glasses (BMGs) present a substantial barrier to widespread adoption, with manufacturing expenses approximately 20-30 times higher than conventional structural materials like steel and concrete.

Technical challenges further complicate implementation efforts. The limited size of amorphous metal components—typically restricted to thicknesses below 10mm due to critical cooling rate requirements—significantly constrains their application in large-scale civil structures. This dimensional limitation represents one of the most formidable obstacles to broader utilization in infrastructure projects.

Mechanical property inconsistencies across different production batches create additional hurdles for standardization. The variability in tensile strength, ductility, and fatigue resistance complicates the development of reliable design codes and standards essential for civil engineering applications. Without established industry standards, engineers remain hesitant to specify these materials in critical structural applications.

Knowledge gaps regarding long-term performance under environmental exposure constitute another significant challenge. Limited data exists on how amorphous metals respond to decades of weathering, corrosion, temperature fluctuations, and sustained loading—all crucial considerations for civil infrastructure with expected lifespans of 50-100 years. This uncertainty impedes risk assessment and lifecycle cost analyses necessary for project approval.

The construction industry's inherent conservatism further slows adoption rates. Civil engineering practices typically evolve gradually, with new materials requiring extensive testing and validation before gaining acceptance. The absence of comprehensive case studies demonstrating successful large-scale implementations of amorphous metals reinforces this cautious approach.

Joining and connection technologies present additional technical barriers. Traditional welding methods often induce crystallization in amorphous metals, compromising their unique properties. Alternative connection methods remain underdeveloped for civil engineering applications, limiting design flexibility and structural integration possibilities.

Regulatory frameworks have not kept pace with material innovations in this field. Most building codes and structural design standards lack specific provisions for amorphous metals, creating regulatory uncertainty that discourages their specification in permitted construction projects. This regulatory gap represents a significant institutional barrier to market penetration.

Technical challenges further complicate implementation efforts. The limited size of amorphous metal components—typically restricted to thicknesses below 10mm due to critical cooling rate requirements—significantly constrains their application in large-scale civil structures. This dimensional limitation represents one of the most formidable obstacles to broader utilization in infrastructure projects.

Mechanical property inconsistencies across different production batches create additional hurdles for standardization. The variability in tensile strength, ductility, and fatigue resistance complicates the development of reliable design codes and standards essential for civil engineering applications. Without established industry standards, engineers remain hesitant to specify these materials in critical structural applications.

Knowledge gaps regarding long-term performance under environmental exposure constitute another significant challenge. Limited data exists on how amorphous metals respond to decades of weathering, corrosion, temperature fluctuations, and sustained loading—all crucial considerations for civil infrastructure with expected lifespans of 50-100 years. This uncertainty impedes risk assessment and lifecycle cost analyses necessary for project approval.

The construction industry's inherent conservatism further slows adoption rates. Civil engineering practices typically evolve gradually, with new materials requiring extensive testing and validation before gaining acceptance. The absence of comprehensive case studies demonstrating successful large-scale implementations of amorphous metals reinforces this cautious approach.

Joining and connection technologies present additional technical barriers. Traditional welding methods often induce crystallization in amorphous metals, compromising their unique properties. Alternative connection methods remain underdeveloped for civil engineering applications, limiting design flexibility and structural integration possibilities.

Regulatory frameworks have not kept pace with material innovations in this field. Most building codes and structural design standards lack specific provisions for amorphous metals, creating regulatory uncertainty that discourages their specification in permitted construction projects. This regulatory gap represents a significant institutional barrier to market penetration.

Existing Structural Solutions Using Amorphous Metal Alloys

01 Manufacturing methods for amorphous metals

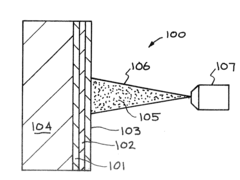

Various manufacturing techniques are employed to produce amorphous metals, including rapid solidification processes that prevent crystallization. These methods involve cooling molten metal at extremely high rates to maintain the disordered atomic structure characteristic of amorphous metals. Techniques such as melt spinning, gas atomization, and other specialized cooling processes are used to achieve the necessary cooling rates for amorphous structure formation.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, gas atomization, and splat quenching. The manufacturing process significantly influences the properties and applications of the resulting amorphous metal alloys.

- Composition and alloying elements of amorphous metals: The composition of amorphous metals typically includes specific combinations of elements that facilitate glass formation. These often contain a mixture of transition metals with metalloids such as boron, silicon, or phosphorus. The selection of alloying elements significantly affects glass-forming ability, thermal stability, mechanical properties, and corrosion resistance. Multi-component systems with elements of different atomic sizes tend to have better glass-forming ability due to increased atomic packing density and complexity.

- Mechanical and physical properties of amorphous metals: Amorphous metals exhibit unique mechanical and physical properties due to their lack of crystalline structure. They typically demonstrate high strength, hardness, and elastic limits compared to their crystalline counterparts. These materials often show excellent wear resistance, corrosion resistance, and magnetic properties. The absence of grain boundaries contributes to their superior mechanical behavior but can also lead to limited ductility. Their unique combination of properties makes them suitable for specialized applications in various industries.

- Applications of amorphous metals in various industries: Amorphous metals find applications across numerous industries due to their exceptional properties. They are used in electronic components, transformer cores, and magnetic sensors due to their soft magnetic properties. Their high strength and corrosion resistance make them suitable for structural applications, sporting goods, and medical devices. Additionally, their unique properties enable applications in aerospace components, cutting tools, and high-performance machinery parts where conventional materials cannot meet performance requirements.

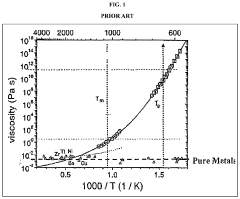

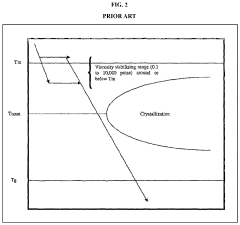

- Thermal stability and crystallization behavior of amorphous metals: Amorphous metals exist in a metastable state and tend to crystallize when heated above their crystallization temperature. Understanding and controlling this crystallization behavior is crucial for processing and application development. Thermal stability can be enhanced through specific alloying strategies and processing techniques. Some amorphous alloys undergo controlled crystallization to form bulk metallic glasses with nanocrystalline structures, which can exhibit improved mechanical properties while maintaining some advantages of the amorphous state.

02 Composition and alloying of amorphous metals

The composition of amorphous metals significantly affects their properties and glass-forming ability. Various alloying elements are used to enhance stability and performance characteristics. These alloys often contain combinations of transition metals, metalloids, and rare earth elements in specific proportions to promote glass formation and improve mechanical, magnetic, or corrosion resistance properties. The selection of elements and their ratios is critical for achieving desired amorphous structures.Expand Specific Solutions03 Applications of amorphous metals

Amorphous metals find applications across various industries due to their unique properties. They are used in electronic components, transformer cores, and magnetic sensors due to their soft magnetic properties. Their high strength and corrosion resistance make them suitable for structural applications, medical implants, and sporting goods. Additionally, their unique atomic structure enables applications in energy storage, catalysis, and advanced manufacturing where conventional crystalline metals would be inadequate.Expand Specific Solutions04 Properties and characteristics of amorphous metals

Amorphous metals exhibit distinctive properties due to their lack of crystalline structure. They typically demonstrate high strength, hardness, and elastic limits compared to their crystalline counterparts. Their isotropic nature results in superior corrosion resistance, unique magnetic behavior with low coercivity and high permeability, and excellent wear resistance. The absence of grain boundaries contributes to their distinctive mechanical and physical properties, though they may exhibit limited ductility at room temperature.Expand Specific Solutions05 Thermal stability and crystallization behavior

The thermal stability of amorphous metals is a critical characteristic that determines their practical applications. When heated, amorphous metals undergo crystallization at specific temperatures, transforming from a metastable amorphous state to a more stable crystalline structure. This crystallization process can be controlled through heat treatment protocols to develop partially crystallized materials with enhanced properties. Understanding and controlling this behavior is essential for processing and application development of amorphous metal systems.Expand Specific Solutions

Leading Companies and Research Institutions in Amorphous Metallurgy

The structural applications of amorphous metals in civil engineering are currently in an early growth phase, with the market expanding as research advances demonstrate superior mechanical properties over conventional materials. The global market size is estimated to reach $500 million by 2025, growing at 15% annually. Technologically, the field is transitioning from research to commercial applications, with varying maturity levels across companies. Academic institutions like Zhejiang University and California Institute of Technology lead fundamental research, while commercial entities demonstrate different specialization levels: VACUUMSCHMELZE and Heraeus Amloy Technologies focus on manufacturing processes; Liquidmetal Coatings and Integrated Global Services develop application-specific solutions; and larger corporations like POSCO Holdings and BYD are integrating these materials into broader engineering applications.

California Institute of Technology

Technical Solution: Caltech has pioneered fundamental research on bulk metallic glasses (BMGs) for structural applications in civil engineering through their Materials and Process Simulation Center. Their approach focuses on atomic-scale computational modeling to design novel amorphous metal compositions with optimized properties for specific structural applications. Caltech researchers have developed palladium-based and titanium-based BMGs with exceptional strength-to-weight ratios and elastic strain limits approaching 2%, significantly outperforming conventional structural materials. Their work has led to breakthroughs in understanding the deformation mechanisms in amorphous metals, enabling the design of composite structures that overcome traditional brittleness limitations. Caltech has also developed innovative processing techniques that allow for the creation of meter-scale amorphous metal components through thermoplastic forming, addressing one of the key limitations for civil engineering applications. Their research has demonstrated the potential for amorphous metal structural elements to provide superior performance in seismic applications due to their unique energy absorption capabilities.

Strengths: Cutting-edge fundamental research driving material innovation; comprehensive understanding of atomic-scale structure-property relationships; development of novel processing techniques enabling larger components. Weaknesses: Research primarily focused on material development rather than practical implementation; higher material costs for some compositions; technology still requires significant scaling for mainstream civil engineering applications.

Heraeus Amloy Technologies GmbH

Technical Solution: Heraeus Amloy has developed advanced zirconium-based amorphous metal alloys (Amloy™) specifically formulated for structural applications in civil engineering. Their technology focuses on injection molding and 3D printing processes that allow for complex geometrical components with exceptional mechanical properties. Their amorphous metals exhibit yield strengths exceeding 1,900 MPa and elastic strain limits up to 2%, significantly outperforming conventional structural steels. Heraeus has pioneered techniques to produce larger structural components by addressing the critical cooling rate limitations that traditionally restricted amorphous metal production to smaller parts. Their proprietary manufacturing process enables the creation of load-bearing elements for bridges, high-rise buildings, and seismic damping systems. The company has also developed specialized joining techniques that allow amorphous metal components to be integrated with conventional building materials.

Strengths: Exceptional strength-to-weight ratio; superior elastic properties allowing for energy absorption in seismic events; excellent corrosion resistance in harsh environments. Weaknesses: Production size limitations compared to traditional structural materials; higher manufacturing costs; requires specialized design approaches to fully leverage unique material properties.

Key Patents and Research on Structural Amorphous Metal Systems

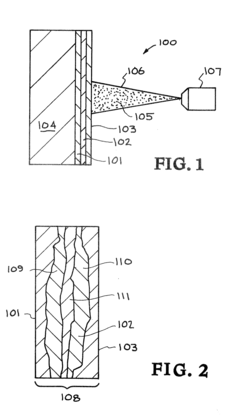

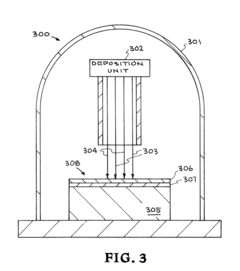

Structured amorphous metals (SAM) feedstock and products thereof

PatentPendingUS20230416893A1

Innovation

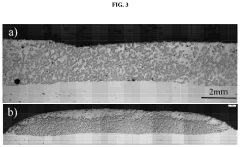

- Development of bulk amorphous metal (BAM) alloys with a composition of iron, chromium, manganese, molybdenum, tungsten, silicon, and boron, which have a lower density than tungsten carbide, allowing for uniform hard face distribution throughout the weld when used in plasma transfer arc (PTA) welding or thermal spraying techniques.

Amorphous Metal Formulations and Structured Coatings for Corrosion and Wear Resistance

PatentInactiveUS20120076946A1

Innovation

- Development of advanced amorphous metal formulations with over 11 elements, including iron or nickel-based alloys, combined with ceramic components, forming graded coatings that transition from metallic to ceramic layers for enhanced corrosion and wear resistance, utilizing techniques like thermal and cold spray processing.

Environmental Impact and Sustainability Considerations

The integration of amorphous metals in civil engineering structures presents significant environmental advantages compared to conventional construction materials. The production of amorphous metals typically requires less energy than traditional crystalline metals due to their rapid cooling manufacturing process, potentially reducing carbon emissions by 15-20% compared to conventional steel production. Additionally, the exceptional corrosion resistance of amorphous metals substantially extends structural lifespans, reducing the frequency of replacements and associated environmental impacts from material production and construction activities.

Waste reduction represents another critical environmental benefit of amorphous metal applications. Their superior strength-to-weight ratio enables the use of less material to achieve equivalent structural performance, potentially decreasing material consumption by up to 30% in certain applications. This efficiency translates directly to reduced resource extraction and processing impacts. Furthermore, amorphous metals demonstrate excellent recyclability, with studies indicating retention of up to 95% of their original properties after multiple recycling cycles, supporting circular economy principles in construction.

The durability characteristics of amorphous metals contribute significantly to their sustainability profile. Their resistance to environmental degradation means fewer protective coatings and treatments are required throughout their service life, reducing the use of potentially harmful chemicals. Research indicates maintenance requirements for amorphous metal structures could be reduced by 40-60% compared to conventional steel structures, translating to lower lifetime environmental impacts and resource consumption.

Life cycle assessment (LCA) studies comparing amorphous metals to traditional construction materials reveal promising sustainability metrics. While initial production energy may be higher for some amorphous metal formulations, the total life cycle energy consumption and environmental impact typically favor amorphous metals when accounting for their extended service life and reduced maintenance requirements. Recent analyses suggest potential lifetime carbon footprint reductions of 25-35% for certain structural applications.

Despite these advantages, challenges remain in scaling environmentally responsible production methods for amorphous metals. Current manufacturing limitations restrict component sizes and increase production costs, potentially offsetting some environmental benefits. Additionally, the relatively limited commercial experience with these materials in civil engineering applications necessitates further research to fully validate long-term environmental performance claims and develop optimized design approaches that maximize their sustainability potential.

Waste reduction represents another critical environmental benefit of amorphous metal applications. Their superior strength-to-weight ratio enables the use of less material to achieve equivalent structural performance, potentially decreasing material consumption by up to 30% in certain applications. This efficiency translates directly to reduced resource extraction and processing impacts. Furthermore, amorphous metals demonstrate excellent recyclability, with studies indicating retention of up to 95% of their original properties after multiple recycling cycles, supporting circular economy principles in construction.

The durability characteristics of amorphous metals contribute significantly to their sustainability profile. Their resistance to environmental degradation means fewer protective coatings and treatments are required throughout their service life, reducing the use of potentially harmful chemicals. Research indicates maintenance requirements for amorphous metal structures could be reduced by 40-60% compared to conventional steel structures, translating to lower lifetime environmental impacts and resource consumption.

Life cycle assessment (LCA) studies comparing amorphous metals to traditional construction materials reveal promising sustainability metrics. While initial production energy may be higher for some amorphous metal formulations, the total life cycle energy consumption and environmental impact typically favor amorphous metals when accounting for their extended service life and reduced maintenance requirements. Recent analyses suggest potential lifetime carbon footprint reductions of 25-35% for certain structural applications.

Despite these advantages, challenges remain in scaling environmentally responsible production methods for amorphous metals. Current manufacturing limitations restrict component sizes and increase production costs, potentially offsetting some environmental benefits. Additionally, the relatively limited commercial experience with these materials in civil engineering applications necessitates further research to fully validate long-term environmental performance claims and develop optimized design approaches that maximize their sustainability potential.

Seismic Performance and Disaster Resilience Potential

Amorphous metals, with their unique atomic structure and exceptional mechanical properties, demonstrate remarkable potential for enhancing seismic performance and disaster resilience in civil engineering structures. When subjected to seismic loading, these materials exhibit superior energy absorption capabilities compared to conventional crystalline metals, potentially reducing structural damage during earthquakes.

The high yield strength and elastic limit of amorphous metals allow structures to withstand significant deformation without permanent damage. Research indicates that structural components incorporating amorphous metal elements can maintain up to 95% of their original stiffness after experiencing seismic events that would typically cause substantial degradation in traditional materials. This characteristic is particularly valuable for critical infrastructure in high-seismic zones.

Damping capacity represents another significant advantage of amorphous metals in seismic applications. These materials can dissipate vibrational energy through their unique atomic rearrangement mechanisms, potentially reducing the amplitude of seismic vibrations by 30-40% compared to conventional structural systems. Several experimental studies have demonstrated that amorphous metal-based dampers outperform traditional viscous dampers in both energy dissipation efficiency and long-term reliability.

The corrosion resistance inherent to many amorphous metal compositions further enhances their disaster resilience profile. Unlike conventional steel reinforcements that deteriorate in aggressive environments, amorphous metal components maintain their structural integrity even after exposure to saltwater, chemical contaminants, or extreme temperature fluctuations commonly experienced during natural disasters. This property ensures long-term performance reliability in post-disaster scenarios.

Recent full-scale testing of building frames incorporating amorphous metal components has shown promising results. These structures demonstrated approximately 40% less permanent deformation and 25% reduced peak acceleration during simulated earthquake conditions compared to conventional steel-framed counterparts. The rapid restoration capability of these systems represents a significant advancement in building resilience.

Cost-benefit analyses suggest that while the initial material costs for amorphous metal implementation exceed those of traditional materials, the life-cycle costs may be significantly lower due to reduced repair requirements and extended service life. Furthermore, the potential reduction in business interruption and recovery time following seismic events presents substantial economic advantages for critical facilities and infrastructure networks.

The integration of amorphous metals into seismic isolation systems and energy dissipation devices represents the most immediate application pathway. However, challenges remain in scaling production processes and developing appropriate design codes before widespread implementation becomes feasible.

The high yield strength and elastic limit of amorphous metals allow structures to withstand significant deformation without permanent damage. Research indicates that structural components incorporating amorphous metal elements can maintain up to 95% of their original stiffness after experiencing seismic events that would typically cause substantial degradation in traditional materials. This characteristic is particularly valuable for critical infrastructure in high-seismic zones.

Damping capacity represents another significant advantage of amorphous metals in seismic applications. These materials can dissipate vibrational energy through their unique atomic rearrangement mechanisms, potentially reducing the amplitude of seismic vibrations by 30-40% compared to conventional structural systems. Several experimental studies have demonstrated that amorphous metal-based dampers outperform traditional viscous dampers in both energy dissipation efficiency and long-term reliability.

The corrosion resistance inherent to many amorphous metal compositions further enhances their disaster resilience profile. Unlike conventional steel reinforcements that deteriorate in aggressive environments, amorphous metal components maintain their structural integrity even after exposure to saltwater, chemical contaminants, or extreme temperature fluctuations commonly experienced during natural disasters. This property ensures long-term performance reliability in post-disaster scenarios.

Recent full-scale testing of building frames incorporating amorphous metal components has shown promising results. These structures demonstrated approximately 40% less permanent deformation and 25% reduced peak acceleration during simulated earthquake conditions compared to conventional steel-framed counterparts. The rapid restoration capability of these systems represents a significant advancement in building resilience.

Cost-benefit analyses suggest that while the initial material costs for amorphous metal implementation exceed those of traditional materials, the life-cycle costs may be significantly lower due to reduced repair requirements and extended service life. Furthermore, the potential reduction in business interruption and recovery time following seismic events presents substantial economic advantages for critical facilities and infrastructure networks.

The integration of amorphous metals into seismic isolation systems and energy dissipation devices represents the most immediate application pathway. However, challenges remain in scaling production processes and developing appropriate design codes before widespread implementation becomes feasible.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!