Benchmarking Cost-Effectiveness of Electrochemical Cell Materials

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Electrochemical Cell Materials Evolution and Objectives

Electrochemical cell technology has evolved significantly over the past century, transforming from simple galvanic cells to sophisticated energy storage and conversion systems. The journey began with Alessandro Volta's invention of the first true battery in 1800, which laid the foundation for subsequent developments. By the mid-20th century, advancements in material science accelerated innovation in this field, leading to the commercialization of various battery technologies including lead-acid, nickel-cadmium, and eventually lithium-ion cells.

The evolution of electrochemical cell materials has been driven by increasing demands for higher energy density, longer cycle life, faster charging capabilities, and reduced costs. Traditional materials like lead, cadmium, and nickel have gradually given way to more advanced options such as lithium, cobalt, nickel manganese cobalt (NMC), lithium iron phosphate (LFP), and emerging solid-state electrolytes. This transition reflects the industry's response to both technological limitations and environmental concerns associated with earlier materials.

Recent years have witnessed a paradigm shift toward sustainable and abundant materials, prompted by supply chain vulnerabilities and environmental regulations. Research efforts have intensified around sodium-ion, aluminum-ion, and organic electrode materials as potential alternatives to lithium-based systems. Simultaneously, manufacturing processes have evolved to enhance material utilization efficiency and reduce production costs, contributing significantly to the overall cost-effectiveness of electrochemical cells.

The primary objective of benchmarking cost-effectiveness in electrochemical cell materials is to establish standardized metrics for comparing different material options across multiple dimensions. These include raw material costs, processing expenses, performance characteristics, durability, and environmental impact. Such benchmarking aims to identify optimal material combinations that balance performance requirements with economic constraints, ultimately accelerating the development of next-generation energy storage solutions.

Another critical goal is to forecast future material price trends and availability, enabling strategic decision-making in research and development investments. By understanding the cost drivers and potential bottlenecks in material supply chains, researchers and manufacturers can prioritize innovations that offer the greatest potential for cost reduction while maintaining or improving performance parameters.

The benchmarking process also seeks to quantify the relationship between material properties and device-level performance, establishing clear connections between molecular-scale characteristics and system-level metrics such as energy density, power capability, and lifetime. This knowledge is essential for directing research efforts toward the most promising material modifications and combinations.

The evolution of electrochemical cell materials has been driven by increasing demands for higher energy density, longer cycle life, faster charging capabilities, and reduced costs. Traditional materials like lead, cadmium, and nickel have gradually given way to more advanced options such as lithium, cobalt, nickel manganese cobalt (NMC), lithium iron phosphate (LFP), and emerging solid-state electrolytes. This transition reflects the industry's response to both technological limitations and environmental concerns associated with earlier materials.

Recent years have witnessed a paradigm shift toward sustainable and abundant materials, prompted by supply chain vulnerabilities and environmental regulations. Research efforts have intensified around sodium-ion, aluminum-ion, and organic electrode materials as potential alternatives to lithium-based systems. Simultaneously, manufacturing processes have evolved to enhance material utilization efficiency and reduce production costs, contributing significantly to the overall cost-effectiveness of electrochemical cells.

The primary objective of benchmarking cost-effectiveness in electrochemical cell materials is to establish standardized metrics for comparing different material options across multiple dimensions. These include raw material costs, processing expenses, performance characteristics, durability, and environmental impact. Such benchmarking aims to identify optimal material combinations that balance performance requirements with economic constraints, ultimately accelerating the development of next-generation energy storage solutions.

Another critical goal is to forecast future material price trends and availability, enabling strategic decision-making in research and development investments. By understanding the cost drivers and potential bottlenecks in material supply chains, researchers and manufacturers can prioritize innovations that offer the greatest potential for cost reduction while maintaining or improving performance parameters.

The benchmarking process also seeks to quantify the relationship between material properties and device-level performance, establishing clear connections between molecular-scale characteristics and system-level metrics such as energy density, power capability, and lifetime. This knowledge is essential for directing research efforts toward the most promising material modifications and combinations.

Market Analysis of Cost-Effective Battery Solutions

The global battery market has witnessed unprecedented growth, driven by the increasing adoption of electric vehicles, renewable energy storage systems, and portable electronics. As of 2023, the market size for advanced batteries exceeds $110 billion, with projections indicating a compound annual growth rate of 14.1% through 2030. Cost-effective battery solutions represent a critical segment within this market, as manufacturers and end-users alike seek to optimize performance while minimizing expenses.

Lithium-ion batteries continue to dominate the market, accounting for approximately 70% of the total battery market value. However, the rising costs of key materials such as lithium, cobalt, and nickel have created significant pressure on manufacturers to identify alternative, more cost-effective electrochemical cell materials. This trend has accelerated research into sodium-ion, zinc-air, and aluminum-ion battery technologies, which utilize more abundant and less expensive raw materials.

Consumer electronics remains the largest application segment for cost-effective battery solutions, representing 45% of the market share. However, the electric vehicle sector is experiencing the fastest growth rate at 22% annually, creating substantial demand for batteries that balance cost-effectiveness with high energy density and longevity. Energy storage systems for grid applications constitute another rapidly expanding segment, growing at 18% annually as renewable energy integration accelerates globally.

Regional analysis reveals that Asia-Pacific dominates the market with 58% share, led by China's massive manufacturing capacity and domestic demand. North America and Europe follow with 22% and 17% market shares respectively, with both regions investing heavily in domestic battery production capabilities to reduce dependency on Asian imports. Emerging markets in Latin America and Africa are showing increased interest in cost-effective battery solutions, particularly for off-grid applications and telecommunications infrastructure.

Price sensitivity varies significantly across application segments. While premium electric vehicle manufacturers can absorb higher battery costs, mass-market consumer electronics and utility-scale storage projects are extremely price-sensitive, driving demand for materials that optimize the cost-performance ratio. This market dynamic has created distinct tiers within the battery market, with different electrochemical cell materials targeting specific price-performance segments.

Supply chain considerations have become increasingly important following recent global disruptions. Manufacturers are prioritizing materials with diverse and stable supply sources, even sometimes at a modest cost premium, to ensure production continuity. This trend favors electrochemical cell materials derived from more geographically distributed resources, creating market opportunities for alternatives to traditional lithium-ion chemistries.

Lithium-ion batteries continue to dominate the market, accounting for approximately 70% of the total battery market value. However, the rising costs of key materials such as lithium, cobalt, and nickel have created significant pressure on manufacturers to identify alternative, more cost-effective electrochemical cell materials. This trend has accelerated research into sodium-ion, zinc-air, and aluminum-ion battery technologies, which utilize more abundant and less expensive raw materials.

Consumer electronics remains the largest application segment for cost-effective battery solutions, representing 45% of the market share. However, the electric vehicle sector is experiencing the fastest growth rate at 22% annually, creating substantial demand for batteries that balance cost-effectiveness with high energy density and longevity. Energy storage systems for grid applications constitute another rapidly expanding segment, growing at 18% annually as renewable energy integration accelerates globally.

Regional analysis reveals that Asia-Pacific dominates the market with 58% share, led by China's massive manufacturing capacity and domestic demand. North America and Europe follow with 22% and 17% market shares respectively, with both regions investing heavily in domestic battery production capabilities to reduce dependency on Asian imports. Emerging markets in Latin America and Africa are showing increased interest in cost-effective battery solutions, particularly for off-grid applications and telecommunications infrastructure.

Price sensitivity varies significantly across application segments. While premium electric vehicle manufacturers can absorb higher battery costs, mass-market consumer electronics and utility-scale storage projects are extremely price-sensitive, driving demand for materials that optimize the cost-performance ratio. This market dynamic has created distinct tiers within the battery market, with different electrochemical cell materials targeting specific price-performance segments.

Supply chain considerations have become increasingly important following recent global disruptions. Manufacturers are prioritizing materials with diverse and stable supply sources, even sometimes at a modest cost premium, to ensure production continuity. This trend favors electrochemical cell materials derived from more geographically distributed resources, creating market opportunities for alternatives to traditional lithium-ion chemistries.

Current Limitations and Technical Barriers in Cell Materials

Despite significant advancements in electrochemical cell technology, several critical limitations and technical barriers continue to impede the cost-effectiveness of cell materials. The cathode materials, particularly those containing cobalt and nickel, remain a major cost driver, accounting for approximately 30-40% of the total cell cost. The limited global supply of these critical minerals, coupled with geopolitical concerns and ethical mining issues, creates significant price volatility and supply chain vulnerabilities.

Anode materials face different challenges. While graphite remains the dominant commercial solution due to its stability and relatively low cost, its theoretical capacity limitations (372 mAh/g) restrict further energy density improvements. Silicon-based alternatives offer substantially higher theoretical capacities but suffer from severe volume expansion issues during cycling, leading to rapid capacity fade and shortened cell lifespans.

Electrolyte formulations present another significant barrier. Current liquid electrolytes face inherent safety concerns due to their flammability and limited electrochemical stability windows. While solid-state electrolytes promise enhanced safety and wider voltage windows, they struggle with low ionic conductivity at room temperature and poor interfacial contact with electrode materials, resulting in high internal resistance and reduced power capabilities.

Separator materials, though less costly than active materials, still face technical challenges in balancing mechanical strength, thermal stability, and ionic conductivity. Current polyolefin-based separators with ceramic coatings add manufacturing complexity and cost while providing only incremental improvements in safety and performance.

Manufacturing processes for cell materials remain energy-intensive and often require environmentally problematic solvents. The N-Methyl-2-pyrrolidone (NMP) commonly used in cathode manufacturing is expensive, toxic, and energy-intensive to recover, adding significant costs to production. Alternative aqueous processing methods show promise but face challenges in achieving comparable electrode quality and performance.

Scale-up from laboratory to industrial production introduces additional barriers. Material properties often change unpredictably at scale, requiring extensive reformulation and process optimization. The capital-intensive nature of cell manufacturing facilities creates high barriers to entry and limits rapid implementation of novel materials.

Recycling infrastructure for cell materials remains underdeveloped, with current processes being energy-intensive and yielding materials of inconsistent quality. The complex mixture of materials in cells makes separation challenging, and the economic viability of recycling depends heavily on the recovery of high-value elements like cobalt and nickel, creating a disincentive for developing cobalt-free chemistries.

Anode materials face different challenges. While graphite remains the dominant commercial solution due to its stability and relatively low cost, its theoretical capacity limitations (372 mAh/g) restrict further energy density improvements. Silicon-based alternatives offer substantially higher theoretical capacities but suffer from severe volume expansion issues during cycling, leading to rapid capacity fade and shortened cell lifespans.

Electrolyte formulations present another significant barrier. Current liquid electrolytes face inherent safety concerns due to their flammability and limited electrochemical stability windows. While solid-state electrolytes promise enhanced safety and wider voltage windows, they struggle with low ionic conductivity at room temperature and poor interfacial contact with electrode materials, resulting in high internal resistance and reduced power capabilities.

Separator materials, though less costly than active materials, still face technical challenges in balancing mechanical strength, thermal stability, and ionic conductivity. Current polyolefin-based separators with ceramic coatings add manufacturing complexity and cost while providing only incremental improvements in safety and performance.

Manufacturing processes for cell materials remain energy-intensive and often require environmentally problematic solvents. The N-Methyl-2-pyrrolidone (NMP) commonly used in cathode manufacturing is expensive, toxic, and energy-intensive to recover, adding significant costs to production. Alternative aqueous processing methods show promise but face challenges in achieving comparable electrode quality and performance.

Scale-up from laboratory to industrial production introduces additional barriers. Material properties often change unpredictably at scale, requiring extensive reformulation and process optimization. The capital-intensive nature of cell manufacturing facilities creates high barriers to entry and limits rapid implementation of novel materials.

Recycling infrastructure for cell materials remains underdeveloped, with current processes being energy-intensive and yielding materials of inconsistent quality. The complex mixture of materials in cells makes separation challenging, and the economic viability of recycling depends heavily on the recovery of high-value elements like cobalt and nickel, creating a disincentive for developing cobalt-free chemistries.

Benchmarking Methodologies for Cell Material Cost-Performance

01 Low-cost electrode materials for electrochemical cells

Various low-cost materials can be used as electrodes in electrochemical cells to improve cost-effectiveness while maintaining performance. These include carbon-based materials, non-precious metal catalysts, and composite materials that reduce or eliminate the need for expensive platinum group metals. The selection of these alternative materials can significantly reduce manufacturing costs while providing adequate electrochemical performance for various applications.- Cost-effective electrode materials for electrochemical cells: Various electrode materials can be used in electrochemical cells to improve cost-effectiveness while maintaining performance. These materials include modified carbon-based electrodes, metal alloys, and composite materials that reduce the need for expensive noble metals. By optimizing electrode composition and structure, manufacturers can achieve a balance between performance and cost, making electrochemical cells more economically viable for various applications.

- Electrolyte formulations for improved cost-performance ratio: Advanced electrolyte formulations can significantly impact the cost-effectiveness of electrochemical cells. By developing electrolytes with enhanced ionic conductivity, stability, and compatibility with electrode materials, researchers have been able to improve cell performance while reducing overall costs. These formulations often include optimized salt concentrations, solvent mixtures, and additives that extend cell life and improve efficiency without substantially increasing production costs.

- Manufacturing process optimization for cost reduction: Innovations in manufacturing processes have led to significant cost reductions in electrochemical cell production. These include automated assembly techniques, roll-to-roll processing, and other scalable manufacturing methods that reduce labor costs and material waste. Additionally, process optimization can lead to higher yields, fewer defects, and more efficient use of raw materials, all contributing to improved cost-effectiveness of the final electrochemical cell products.

- Alternative low-cost materials and substitutes: Research has focused on identifying and developing alternative materials to replace expensive components in electrochemical cells. This includes using earth-abundant elements instead of rare or precious metals, developing synthetic substitutes for costly natural materials, and repurposing industrial byproducts as cell components. These alternative materials can significantly reduce the overall cost of electrochemical cells while maintaining acceptable performance levels for specific applications.

- Economic analysis and lifecycle cost assessment: Comprehensive economic analysis and lifecycle cost assessment methodologies have been developed to evaluate the true cost-effectiveness of electrochemical cell materials. These approaches consider not only initial material costs but also longevity, performance degradation, maintenance requirements, and end-of-life recycling potential. By applying these assessment tools, researchers and manufacturers can make more informed decisions about material selection and design trade-offs to optimize the overall economic value of electrochemical cells.

02 Cost-effective electrolyte formulations

Innovative electrolyte formulations can enhance the cost-effectiveness of electrochemical cells. These formulations may include alternative salts, solvents, and additives that are less expensive than conventional materials while maintaining or improving ionic conductivity and electrochemical stability. Some formulations also extend cell lifetime, improving the overall economic value of the electrochemical system.Expand Specific Solutions03 Manufacturing process optimization for cost reduction

Optimized manufacturing processes can significantly reduce the production costs of electrochemical cells. These optimizations include streamlined assembly techniques, reduced energy consumption during production, automated manufacturing systems, and improved quality control methods that minimize waste. Process innovations can lower the overall cost of electrochemical cells without compromising their performance or reliability.Expand Specific Solutions04 Economic analysis and lifecycle cost assessment

Economic analysis and lifecycle cost assessment methodologies help evaluate the true cost-effectiveness of electrochemical cell materials and designs. These approaches consider not only initial material costs but also longevity, efficiency, maintenance requirements, and end-of-life disposal or recycling. Such comprehensive economic assessments enable better decision-making regarding material selection and cell design to optimize overall cost-effectiveness.Expand Specific Solutions05 Recycling and circular economy approaches

Recycling and circular economy approaches can improve the cost-effectiveness of electrochemical cell materials by recovering valuable components from spent cells. These methods include processes for extracting and purifying electrode materials, electrolytes, and other components for reuse in new cells. Implementing effective recycling strategies reduces the need for virgin materials and lowers the overall environmental and economic costs of electrochemical cell production.Expand Specific Solutions

Industry Leaders and Competitive Landscape

The electrochemical cell materials market is currently in a growth phase, with increasing demand driven by the expanding electric vehicle and energy storage sectors. The global market size is projected to reach significant scale as renewable energy integration accelerates. Technologically, the field shows varying maturity levels across different material categories. Leading players like LG Chem, Samsung SDI, and Toyota are advancing commercial applications, while research institutions such as Fraunhofer-Gesellschaft and universities collaborate with industry to develop next-generation solutions. Innovative companies like 24M Technologies and CAMX Power are disrupting traditional approaches with novel cell architectures and materials. The competitive landscape features established battery manufacturers competing with specialized materials developers and automotive OEMs investing in proprietary technologies to secure supply chain advantages.

24M Technologies, Inc.

Technical Solution: 24M Technologies has developed an innovative approach to benchmarking electrochemical cell materials specifically optimized for their semi-solid electrode manufacturing process. Their "Material-Process Compatibility Index" evaluates materials not just on intrinsic electrochemical properties, but on how well they perform within their unique manufacturing approach that eliminates multiple conventional production steps. 24M's benchmarking methodology places particular emphasis on electrode thickness capabilities, as their technology enables electrodes 3-5 times thicker than conventional processes, fundamentally changing the cost-effectiveness equation for many materials. Their approach incorporates specialized rheological testing to assess how materials perform in semi-solid states, with precise quantification of electronic and ionic conductivity under various compression scenarios. 24M has developed proprietary testing protocols that evaluate material performance in their simplified cell architecture, which eliminates approximately 80% of the inactive components found in conventional cells. Their benchmarking has demonstrated that certain lower-cost cathode materials previously considered suboptimal in conventional cells can achieve superior cost-performance metrics when formulated for their thick-electrode, simplified-architecture approach.

Strengths: Unique evaluation framework specifically optimized for their innovative manufacturing process; ability to identify cost-effective materials that may be overlooked in conventional benchmarking; strong focus on manufacturing simplification as a cost-reduction strategy. Weaknesses: Highly specialized benchmarking approach may not translate well to conventional manufacturing processes; relatively limited commercial deployment history compared to larger industry players.

LG Chem Ltd.

Technical Solution: LG Chem has developed a comprehensive electrochemical cell material benchmarking system that evaluates cost-effectiveness through a multi-parameter approach. Their methodology incorporates high-throughput screening of cathode materials with precise measurement of energy density, cycle life, and production costs. The company utilizes advanced computational models to predict long-term performance and degradation patterns, allowing for accurate total cost of ownership calculations. Their proprietary "Cost-Performance Index" (CPI) evaluates materials based on raw material costs, processing requirements, energy density, and lifecycle performance. LG Chem's benchmarking includes real-world testing under various temperature and load conditions, with standardized protocols that enable direct comparison between different material compositions. Their approach has demonstrated that certain nickel-rich cathodes offer optimal cost-effectiveness when balanced against performance metrics, achieving up to 20% improvement in energy density while maintaining comparable production costs to conventional materials.

Strengths: Comprehensive evaluation methodology that balances multiple performance parameters with cost factors; extensive manufacturing expertise that allows for realistic scalability assessment; global supply chain integration that provides accurate raw material cost projections. Weaknesses: Heavy focus on lithium-ion chemistry may limit applicability to emerging battery technologies; benchmarking methods may favor materials compatible with existing production infrastructure.

Critical Patents and Research in Cost-Effective Materials

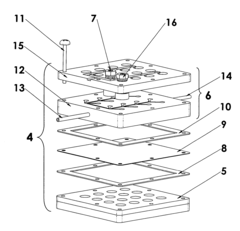

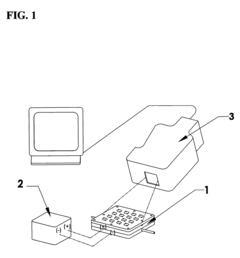

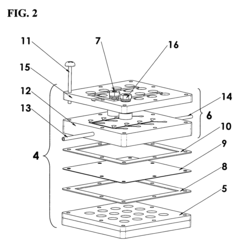

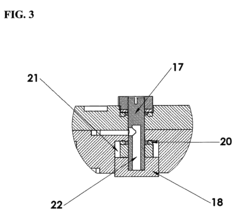

Apparatus for combinatorial screening of electrochemical materials

PatentActiveUS7633267B2

Innovation

- A combinatorial screening apparatus and method that uses an array of electrochemical cells connected in parallel or series with a single electronic load and a device to monitor the relative temperature of each cell, allowing for simultaneous evaluation of multiple electrochemical material compositions based on their electrochemical efficiency.

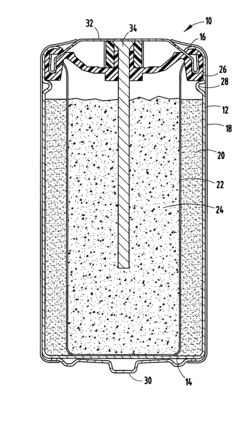

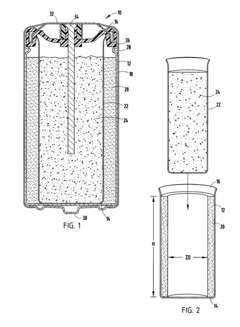

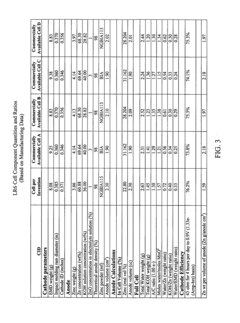

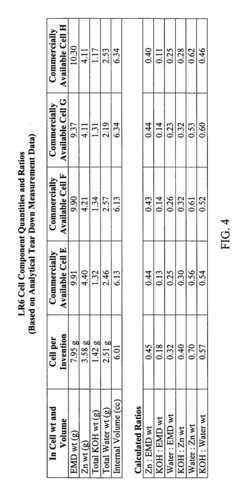

Alkaline electrochemical cell

PatentActiveUS20070292762A1

Innovation

- The alkaline electrochemical cell optimizes the use of zinc and manganese dioxide by adjusting their ratios and incorporating a higher volume of water, with a zinc weight to anode volume ratio less than 1.80 and a water to manganese dioxide ratio greater than 0.28, along with a larger cathode interface area, to enhance cost efficiency without compromising performance.

Supply Chain Considerations for Battery Materials

The global battery material supply chain represents a critical component in the cost-effectiveness analysis of electrochemical cell materials. Raw material sourcing significantly impacts both production costs and environmental footprints, with lithium, cobalt, nickel, and graphite extraction concentrated in specific geographical regions. China dominates processing operations for most battery materials, creating potential supply vulnerabilities for manufacturers in other regions.

Transportation logistics constitute approximately 5-15% of total battery material costs, varying based on material type and distance. Recent global disruptions have highlighted the fragility of extended supply chains, prompting manufacturers to consider regionalization strategies. Companies like Tesla and CATL have initiated vertical integration efforts to secure material supplies and reduce dependency on external providers.

Regulatory frameworks increasingly influence supply chain decisions, with legislation like the EU Battery Directive and US Inflation Reduction Act imposing requirements for material sourcing transparency and environmental impact disclosure. These regulations create additional compliance costs but also drive innovation in sustainable sourcing practices.

Material price volatility presents significant challenges for cost benchmarking, with lithium carbonate prices fluctuating by over 400% between 2020 and 2022. Such volatility necessitates sophisticated hedging strategies and long-term supply agreements to maintain predictable cost structures for electrochemical cell production.

Recycling infrastructure development offers promising opportunities for supply chain resilience, with companies like Redwood Materials and Li-Cycle establishing facilities capable of recovering up to 95% of critical materials from spent batteries. These closed-loop systems could potentially reduce raw material dependency by 25-30% by 2030, according to industry projections.

Emerging alternative material pathways, such as sodium-ion and solid-state technologies, may reshape supply chain considerations by reducing dependence on constrained materials like cobalt and nickel. However, these alternatives introduce new supply chain challenges that require careful evaluation in cost-effectiveness benchmarking.

Supply chain transparency tools, including blockchain-based tracking systems and AI-powered predictive analytics, are increasingly being deployed to optimize material sourcing decisions and ensure compliance with sustainability requirements. These technologies enable more accurate cost benchmarking by providing granular visibility into the environmental and social impacts associated with different material sources.

Transportation logistics constitute approximately 5-15% of total battery material costs, varying based on material type and distance. Recent global disruptions have highlighted the fragility of extended supply chains, prompting manufacturers to consider regionalization strategies. Companies like Tesla and CATL have initiated vertical integration efforts to secure material supplies and reduce dependency on external providers.

Regulatory frameworks increasingly influence supply chain decisions, with legislation like the EU Battery Directive and US Inflation Reduction Act imposing requirements for material sourcing transparency and environmental impact disclosure. These regulations create additional compliance costs but also drive innovation in sustainable sourcing practices.

Material price volatility presents significant challenges for cost benchmarking, with lithium carbonate prices fluctuating by over 400% between 2020 and 2022. Such volatility necessitates sophisticated hedging strategies and long-term supply agreements to maintain predictable cost structures for electrochemical cell production.

Recycling infrastructure development offers promising opportunities for supply chain resilience, with companies like Redwood Materials and Li-Cycle establishing facilities capable of recovering up to 95% of critical materials from spent batteries. These closed-loop systems could potentially reduce raw material dependency by 25-30% by 2030, according to industry projections.

Emerging alternative material pathways, such as sodium-ion and solid-state technologies, may reshape supply chain considerations by reducing dependence on constrained materials like cobalt and nickel. However, these alternatives introduce new supply chain challenges that require careful evaluation in cost-effectiveness benchmarking.

Supply chain transparency tools, including blockchain-based tracking systems and AI-powered predictive analytics, are increasingly being deployed to optimize material sourcing decisions and ensure compliance with sustainability requirements. These technologies enable more accurate cost benchmarking by providing granular visibility into the environmental and social impacts associated with different material sources.

Sustainability Impact of Material Selection

The material selection process for electrochemical cells carries significant sustainability implications that extend far beyond immediate performance metrics. When evaluating materials for electrodes, electrolytes, separators, and other cell components, environmental footprint considerations must be integrated into cost-effectiveness benchmarking frameworks.

Primary materials used in conventional electrochemical cells, particularly lithium-ion batteries, often involve rare earth elements and transition metals that present substantial extraction challenges. Mining operations for cobalt, nickel, and lithium generate considerable carbon emissions while potentially causing habitat destruction, water pollution, and soil contamination in extraction regions. The environmental justice dimension cannot be overlooked, as many mining operations occur in regions with limited environmental regulations.

Energy consumption during material processing represents another critical sustainability factor. High-temperature synthesis routes for cathode materials like LiCoO₂ and LiFePO₄ require significant energy inputs, directly correlating with increased carbon emissions when powered by fossil fuel sources. Alternative low-temperature synthesis pathways may offer reduced environmental impact despite potentially higher direct costs.

Material toxicity profiles must be evaluated across the entire lifecycle. Certain electrolyte components, particularly fluorinated compounds and organic solvents, present environmental persistence concerns and potential groundwater contamination risks during improper disposal. Substituting these with bio-derived alternatives or water-based systems may improve sustainability metrics despite performance trade-offs.

Recyclability emerges as a defining sustainability characteristic for electrochemical cell materials. Designs that facilitate end-of-life material recovery can significantly reduce the need for virgin material extraction. Current recycling processes for lithium-ion batteries recover only 50-60% of critical materials, highlighting substantial improvement opportunities through intentional material selection and cell design approaches.

Water usage intensity varies dramatically across different material processing routes. Silicon anode production, for instance, requires substantial water inputs for purification processes. In water-stressed regions, this represents a significant sustainability concern that must be factored into comprehensive material benchmarking methodologies.

Circular economy principles increasingly influence material selection strategies, with emphasis on designing for disassembly, material recovery, and potential second-life applications. Materials that enable longer cycle life inherently improve sustainability profiles by extending product lifespans and reducing replacement frequency.

Primary materials used in conventional electrochemical cells, particularly lithium-ion batteries, often involve rare earth elements and transition metals that present substantial extraction challenges. Mining operations for cobalt, nickel, and lithium generate considerable carbon emissions while potentially causing habitat destruction, water pollution, and soil contamination in extraction regions. The environmental justice dimension cannot be overlooked, as many mining operations occur in regions with limited environmental regulations.

Energy consumption during material processing represents another critical sustainability factor. High-temperature synthesis routes for cathode materials like LiCoO₂ and LiFePO₄ require significant energy inputs, directly correlating with increased carbon emissions when powered by fossil fuel sources. Alternative low-temperature synthesis pathways may offer reduced environmental impact despite potentially higher direct costs.

Material toxicity profiles must be evaluated across the entire lifecycle. Certain electrolyte components, particularly fluorinated compounds and organic solvents, present environmental persistence concerns and potential groundwater contamination risks during improper disposal. Substituting these with bio-derived alternatives or water-based systems may improve sustainability metrics despite performance trade-offs.

Recyclability emerges as a defining sustainability characteristic for electrochemical cell materials. Designs that facilitate end-of-life material recovery can significantly reduce the need for virgin material extraction. Current recycling processes for lithium-ion batteries recover only 50-60% of critical materials, highlighting substantial improvement opportunities through intentional material selection and cell design approaches.

Water usage intensity varies dramatically across different material processing routes. Silicon anode production, for instance, requires substantial water inputs for purification processes. In water-stressed regions, this represents a significant sustainability concern that must be factored into comprehensive material benchmarking methodologies.

Circular economy principles increasingly influence material selection strategies, with emphasis on designing for disassembly, material recovery, and potential second-life applications. Materials that enable longer cycle life inherently improve sustainability profiles by extending product lifespans and reducing replacement frequency.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!