Benchmarking Ultrafiltration Performance for Industry Adaptation

SEP 22, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ultrafiltration Technology Background and Objectives

Ultrafiltration technology has evolved significantly over the past five decades, transitioning from laboratory-scale applications to widespread industrial implementation. Initially developed in the 1960s as a membrane separation process, ultrafiltration has become a cornerstone technology in various industries including water treatment, food processing, biotechnology, and pharmaceutical manufacturing. The fundamental principle involves the separation of molecules based on size exclusion through semi-permeable membranes with pore sizes typically ranging from 0.001 to 0.1 micrometers.

The technological evolution of ultrafiltration membranes has progressed through several generations, from early cellulose acetate materials to advanced polymeric membranes such as polysulfone, polyethersulfone, and PVDF (polyvinylidene fluoride). Recent advancements have focused on developing ceramic and composite membranes with enhanced chemical, thermal, and mechanical stability, significantly expanding the application scope of ultrafiltration systems.

Current industry trends indicate a growing emphasis on energy efficiency, fouling resistance, and operational longevity of ultrafiltration systems. The global water scarcity crisis and increasingly stringent environmental regulations have accelerated the adoption of ultrafiltration technology in municipal water treatment and industrial wastewater recycling. Simultaneously, the biopharmaceutical sector has embraced ultrafiltration as a critical step in downstream processing for biologics production.

The primary objective of benchmarking ultrafiltration performance is to establish standardized metrics and methodologies for evaluating membrane systems across different industrial applications. This standardization aims to facilitate informed decision-making for technology selection, optimization of operational parameters, and prediction of long-term performance under varying conditions. Additionally, benchmarking seeks to identify performance gaps and innovation opportunities in current ultrafiltration technologies.

Specific technical goals include quantifying key performance indicators such as permeate flux, rejection rates, fouling propensity, energy consumption, and cleaning efficiency across different membrane configurations and operational conditions. The development of accelerated testing protocols that accurately predict long-term performance represents another critical objective, as it would significantly reduce the time and resources required for technology validation.

Furthermore, this benchmarking initiative aims to establish correlations between laboratory-scale testing and full-scale industrial performance, addressing the persistent challenge of scale-up in membrane technology. By creating a comprehensive performance database across various applications, the industry can develop more accurate predictive models and simulation tools, ultimately accelerating the adoption and optimization of ultrafiltration technology in emerging applications.

The technological evolution of ultrafiltration membranes has progressed through several generations, from early cellulose acetate materials to advanced polymeric membranes such as polysulfone, polyethersulfone, and PVDF (polyvinylidene fluoride). Recent advancements have focused on developing ceramic and composite membranes with enhanced chemical, thermal, and mechanical stability, significantly expanding the application scope of ultrafiltration systems.

Current industry trends indicate a growing emphasis on energy efficiency, fouling resistance, and operational longevity of ultrafiltration systems. The global water scarcity crisis and increasingly stringent environmental regulations have accelerated the adoption of ultrafiltration technology in municipal water treatment and industrial wastewater recycling. Simultaneously, the biopharmaceutical sector has embraced ultrafiltration as a critical step in downstream processing for biologics production.

The primary objective of benchmarking ultrafiltration performance is to establish standardized metrics and methodologies for evaluating membrane systems across different industrial applications. This standardization aims to facilitate informed decision-making for technology selection, optimization of operational parameters, and prediction of long-term performance under varying conditions. Additionally, benchmarking seeks to identify performance gaps and innovation opportunities in current ultrafiltration technologies.

Specific technical goals include quantifying key performance indicators such as permeate flux, rejection rates, fouling propensity, energy consumption, and cleaning efficiency across different membrane configurations and operational conditions. The development of accelerated testing protocols that accurately predict long-term performance represents another critical objective, as it would significantly reduce the time and resources required for technology validation.

Furthermore, this benchmarking initiative aims to establish correlations between laboratory-scale testing and full-scale industrial performance, addressing the persistent challenge of scale-up in membrane technology. By creating a comprehensive performance database across various applications, the industry can develop more accurate predictive models and simulation tools, ultimately accelerating the adoption and optimization of ultrafiltration technology in emerging applications.

Market Demand Analysis for Industrial Ultrafiltration

The ultrafiltration (UF) market has experienced significant growth in recent years, driven by increasing water scarcity, stringent environmental regulations, and growing industrial demand for efficient separation technologies. The global industrial ultrafiltration market was valued at approximately 1.5 billion USD in 2022 and is projected to reach 2.7 billion USD by 2028, representing a compound annual growth rate of 10.3%.

Water treatment applications dominate the industrial ultrafiltration market, accounting for nearly 40% of the total demand. This is primarily due to the escalating need for clean water in various industries and the growing emphasis on wastewater recycling. The food and beverage industry follows closely, representing about 30% of the market share, where ultrafiltration is extensively used for clarification, concentration, and purification processes.

Pharmaceutical and biotechnology sectors have emerged as rapidly growing segments for ultrafiltration technology, with an estimated growth rate of 12.5% annually. This surge is attributed to the increasing production of biopharmaceuticals and the critical role of ultrafiltration in downstream processing. Additionally, the chemical processing industry contributes approximately 15% to the overall market demand.

Geographically, Asia-Pacific leads the market with a share of 35%, driven by rapid industrialization in countries like China and India, coupled with increasing water treatment requirements. North America and Europe collectively account for about 45% of the market, where the demand is primarily fueled by technological advancements and replacement of aging infrastructure.

A significant trend shaping the market is the growing demand for energy-efficient and cost-effective ultrafiltration systems. Industries are increasingly seeking solutions that offer lower operational costs while maintaining high performance standards. This has led to innovations in membrane materials and module designs that optimize energy consumption and reduce fouling issues.

Sustainability concerns are also driving market growth, with industries looking for technologies that minimize chemical usage and waste generation. Ultrafiltration, being a physical separation process with minimal chemical requirements, aligns well with these sustainability goals.

The COVID-19 pandemic has further accelerated market growth, highlighting the importance of reliable water treatment systems in healthcare facilities and pharmaceutical manufacturing. This has created new opportunities for ultrafiltration technology providers to develop specialized solutions for these critical applications.

Customer preferences are evolving towards integrated systems that combine ultrafiltration with other separation technologies to achieve comprehensive treatment solutions. This trend is particularly evident in industries with complex separation requirements, such as food processing and pharmaceutical manufacturing.

Water treatment applications dominate the industrial ultrafiltration market, accounting for nearly 40% of the total demand. This is primarily due to the escalating need for clean water in various industries and the growing emphasis on wastewater recycling. The food and beverage industry follows closely, representing about 30% of the market share, where ultrafiltration is extensively used for clarification, concentration, and purification processes.

Pharmaceutical and biotechnology sectors have emerged as rapidly growing segments for ultrafiltration technology, with an estimated growth rate of 12.5% annually. This surge is attributed to the increasing production of biopharmaceuticals and the critical role of ultrafiltration in downstream processing. Additionally, the chemical processing industry contributes approximately 15% to the overall market demand.

Geographically, Asia-Pacific leads the market with a share of 35%, driven by rapid industrialization in countries like China and India, coupled with increasing water treatment requirements. North America and Europe collectively account for about 45% of the market, where the demand is primarily fueled by technological advancements and replacement of aging infrastructure.

A significant trend shaping the market is the growing demand for energy-efficient and cost-effective ultrafiltration systems. Industries are increasingly seeking solutions that offer lower operational costs while maintaining high performance standards. This has led to innovations in membrane materials and module designs that optimize energy consumption and reduce fouling issues.

Sustainability concerns are also driving market growth, with industries looking for technologies that minimize chemical usage and waste generation. Ultrafiltration, being a physical separation process with minimal chemical requirements, aligns well with these sustainability goals.

The COVID-19 pandemic has further accelerated market growth, highlighting the importance of reliable water treatment systems in healthcare facilities and pharmaceutical manufacturing. This has created new opportunities for ultrafiltration technology providers to develop specialized solutions for these critical applications.

Customer preferences are evolving towards integrated systems that combine ultrafiltration with other separation technologies to achieve comprehensive treatment solutions. This trend is particularly evident in industries with complex separation requirements, such as food processing and pharmaceutical manufacturing.

Current Status and Technical Challenges in Ultrafiltration

Ultrafiltration technology has evolved significantly over the past decades, establishing itself as a critical separation process across multiple industries. Currently, the global ultrafiltration market is valued at approximately $2.3 billion, with projections indicating growth to $3.7 billion by 2026, representing a CAGR of 10.2%. This growth trajectory underscores the increasing industrial adoption of ultrafiltration technologies.

In the water treatment sector, ultrafiltration has achieved widespread implementation, with over 60% of new municipal water treatment facilities incorporating UF membranes. The technology demonstrates removal efficiencies exceeding 99.9% for bacteria and 90% for viruses, positioning it as a reliable barrier in multi-stage water purification systems. However, membrane fouling remains a persistent challenge, reducing operational efficiency by 20-40% in typical industrial applications.

The pharmaceutical and biotechnology industries have embraced ultrafiltration for protein concentration and buffer exchange processes. Current systems achieve concentration factors of 10-30x with protein recovery rates of 95-98%. Nevertheless, the processing of complex biological fluids continues to present significant technical hurdles, particularly regarding membrane selectivity and throughput consistency.

Food and beverage applications represent another major sector, with dairy processing accounting for approximately 25% of industrial ultrafiltration installations. Modern ceramic membranes demonstrate extended lifespans of 7-10 years compared to 2-4 years for polymeric alternatives, though at 3-5 times higher initial investment costs.

Technologically, polymeric membranes dominate the market with approximately 75% share, primarily utilizing polysulfone, polyethersulfone, and PVDF materials. Ceramic membranes, despite higher costs, are gaining traction in applications requiring extreme pH tolerance and thermal stability. Recent innovations in membrane chemistry have yielded fouling-resistant materials showing 30-50% improvement in operational longevity.

The energy intensity of ultrafiltration systems presents a significant challenge, with current systems requiring 0.2-0.5 kWh per cubic meter of processed fluid. This energy demand creates adoption barriers in regions with high energy costs or unreliable power infrastructure. Additionally, the disposal of spent membranes poses environmental concerns, as most current materials have limited recyclability.

Geographically, North America and Europe lead in ultrafiltration technology development and implementation, collectively accounting for approximately 60% of the global market. However, the Asia-Pacific region demonstrates the fastest growth rate at 12.8% annually, driven by rapid industrialization and increasing water quality regulations in China and India.

In the water treatment sector, ultrafiltration has achieved widespread implementation, with over 60% of new municipal water treatment facilities incorporating UF membranes. The technology demonstrates removal efficiencies exceeding 99.9% for bacteria and 90% for viruses, positioning it as a reliable barrier in multi-stage water purification systems. However, membrane fouling remains a persistent challenge, reducing operational efficiency by 20-40% in typical industrial applications.

The pharmaceutical and biotechnology industries have embraced ultrafiltration for protein concentration and buffer exchange processes. Current systems achieve concentration factors of 10-30x with protein recovery rates of 95-98%. Nevertheless, the processing of complex biological fluids continues to present significant technical hurdles, particularly regarding membrane selectivity and throughput consistency.

Food and beverage applications represent another major sector, with dairy processing accounting for approximately 25% of industrial ultrafiltration installations. Modern ceramic membranes demonstrate extended lifespans of 7-10 years compared to 2-4 years for polymeric alternatives, though at 3-5 times higher initial investment costs.

Technologically, polymeric membranes dominate the market with approximately 75% share, primarily utilizing polysulfone, polyethersulfone, and PVDF materials. Ceramic membranes, despite higher costs, are gaining traction in applications requiring extreme pH tolerance and thermal stability. Recent innovations in membrane chemistry have yielded fouling-resistant materials showing 30-50% improvement in operational longevity.

The energy intensity of ultrafiltration systems presents a significant challenge, with current systems requiring 0.2-0.5 kWh per cubic meter of processed fluid. This energy demand creates adoption barriers in regions with high energy costs or unreliable power infrastructure. Additionally, the disposal of spent membranes poses environmental concerns, as most current materials have limited recyclability.

Geographically, North America and Europe lead in ultrafiltration technology development and implementation, collectively accounting for approximately 60% of the global market. However, the Asia-Pacific region demonstrates the fastest growth rate at 12.8% annually, driven by rapid industrialization and increasing water quality regulations in China and India.

Current Benchmarking Methodologies for Ultrafiltration

01 Membrane material optimization for ultrafiltration

Various membrane materials can be optimized to enhance ultrafiltration performance. These include composite membranes, polymer-based materials, and surface-modified membranes that improve filtration efficiency, reduce fouling, and extend operational lifespan. Advanced materials can provide better mechanical strength, chemical resistance, and separation capabilities while maintaining high flux rates.- Membrane material optimization for ultrafiltration: Various materials can be used to enhance ultrafiltration membrane performance, including composite materials, polymeric membranes, and surface-modified membranes. These materials can improve filtration efficiency, reduce fouling, and extend membrane lifespan. Advanced membrane materials can be engineered with specific pore sizes and surface properties to target particular contaminants while maintaining high flux rates and mechanical stability under operational conditions.

- Ultrafiltration system design and configuration: The design and configuration of ultrafiltration systems significantly impact performance. This includes module arrangement (parallel or series), flow patterns (cross-flow or dead-end), and system integration with pre-treatment or post-treatment processes. Optimized system designs can improve filtration efficiency, reduce energy consumption, and enhance overall process reliability. Considerations such as membrane packing density, module geometry, and hydrodynamic conditions are critical for maximizing system performance.

- Fouling control and cleaning strategies: Fouling is a major challenge in ultrafiltration that reduces performance over time. Various strategies can be employed to control fouling, including backwashing, chemical cleaning, air scouring, and feed pre-treatment. Advanced cleaning protocols can be optimized based on feed characteristics and membrane properties. Implementation of effective fouling control measures can maintain high flux rates, extend membrane life, and reduce operational costs associated with frequent cleaning or replacement.

- Process parameter optimization: Optimizing operational parameters such as transmembrane pressure, cross-flow velocity, temperature, and pH can significantly enhance ultrafiltration performance. These parameters affect permeate flux, rejection rates, and energy consumption. Automated control systems can be implemented to maintain optimal conditions throughout the filtration process. Understanding the relationship between these parameters and system performance allows for adaptive operation under varying feed conditions.

- Hybrid and integrated ultrafiltration systems: Combining ultrafiltration with other separation technologies can enhance overall performance. Hybrid systems may integrate ultrafiltration with processes such as coagulation, adsorption, biological treatment, or other membrane technologies (nanofiltration, reverse osmosis). These integrated approaches can address multiple contaminants simultaneously, improve water quality, and optimize resource utilization. The synergistic effects of combined processes often result in superior performance compared to standalone ultrafiltration systems.

02 Fouling control strategies in ultrafiltration systems

Techniques to mitigate membrane fouling are critical for maintaining ultrafiltration performance. These include physical cleaning methods, chemical cleaning protocols, hydrodynamic optimization, and pretreatment of feed solutions. Anti-fouling strategies such as air scouring, backwashing, and surface modifications can significantly extend membrane life and maintain consistent filtration efficiency over time.Expand Specific Solutions03 Process optimization for ultrafiltration operations

Operational parameters significantly impact ultrafiltration performance. Optimizing factors such as transmembrane pressure, cross-flow velocity, temperature, pH, and cleaning cycles can enhance filtration efficiency and membrane longevity. Advanced control systems and process monitoring techniques enable real-time adjustments to maintain optimal performance under varying feed conditions.Expand Specific Solutions04 Innovative ultrafiltration system designs

Novel system configurations and module designs can substantially improve ultrafiltration performance. These innovations include specialized flow patterns, enhanced module geometries, hybrid systems combining multiple separation technologies, and compact designs for specific applications. Advanced system designs can optimize energy consumption, increase throughput, and improve separation efficiency.Expand Specific Solutions05 Performance monitoring and evaluation methods

Techniques for accurately assessing ultrafiltration performance are essential for system optimization. These include advanced analytical methods, real-time monitoring technologies, performance indicators, and predictive modeling approaches. Effective monitoring enables early detection of performance issues, facilitates preventive maintenance, and provides data for continuous improvement of ultrafiltration processes.Expand Specific Solutions

Key Industry Players in Ultrafiltration Market

Ultrafiltration technology is currently in a growth phase, with the global market expected to reach significant expansion due to increasing industrial applications in water treatment, pharmaceuticals, and food processing. The technology demonstrates moderate maturity with established applications, yet continues to evolve with innovations in membrane materials and process efficiency. Key players shaping the competitive landscape include EMD Millipore Corp. (a leader in life science filtration), Kurita Water Industries Ltd. (specializing in water treatment solutions), and MANN+HUMMEL GmbH (advancing industrial filtration technologies). Academic institutions like New Jersey Institute of Technology and National University of Singapore are contributing research advancements, while corporations such as Bayer AG and BASF Corp. are implementing ultrafiltration in manufacturing processes, driving industry adaptation across diverse sectors.

EMD Millipore Corp.

Technical Solution: EMD Millipore has developed comprehensive ultrafiltration benchmarking protocols that incorporate multiple performance parameters including flux rates, fouling resistance, and separation efficiency across various industrial applications. Their Pellicon® cassette technology features controlled flow paths and optimized channel designs that enhance performance consistency during scale-up operations. The company employs standardized testing methodologies that measure performance under varying feed compositions, temperatures, and transmembrane pressures to generate comparative data sets. Their benchmarking approach includes accelerated aging tests to predict long-term membrane performance and durability in harsh industrial environments. EMD Millipore also utilizes computational fluid dynamics modeling to optimize membrane module configurations for specific industrial applications, allowing customers to select appropriate systems based on quantifiable performance metrics.

Strengths: Industry-leading standardization of testing protocols allowing for reliable cross-platform comparisons; extensive application-specific expertise across pharmaceutical, food and beverage, and water treatment sectors. Weaknesses: Premium pricing structure may limit accessibility for smaller operations; proprietary testing methodologies can make direct comparisons with competitors' systems challenging.

Gambro Lundia AB

Technical Solution: Gambro Lundia has pioneered ultrafiltration benchmarking methodologies specifically for medical and biopharmaceutical applications. Their approach centers on the PRISMA system which incorporates real-time performance monitoring with adaptive control algorithms to maintain optimal filtration parameters. The company has developed standardized testing protocols that evaluate membrane performance under varying protein concentrations, ionic strengths, and pH conditions to simulate real-world bioprocessing environments. Their benchmarking framework includes quantitative assessments of protein transmission, retention of target molecules, and fouling propensity using standardized biological solutions. Gambro's methodology incorporates both short-term performance metrics and long-term stability indicators, allowing for comprehensive evaluation of membrane lifespans in continuous bioprocessing operations. Their benchmarking data is validated through multi-site testing programs to ensure reproducibility across different manufacturing facilities.

Strengths: Specialized expertise in biomedical applications with robust validation protocols; advanced monitoring systems that provide real-time performance data. Weaknesses: Narrower industrial application range compared to competitors; benchmarking methodologies primarily optimized for pharmaceutical rather than broader industrial applications.

Critical Patents and Technical Literature in Ultrafiltration

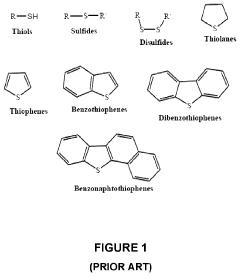

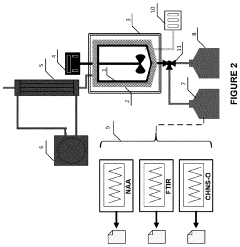

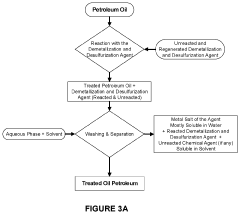

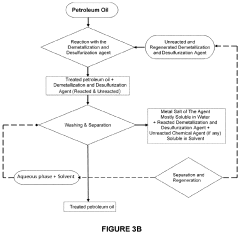

Process for removing metals, sulfur and other impurities in crude oil

PatentInactiveUS20210253957A1

Innovation

- A process using a demetallization and desulfurization agent comprising a phosphoric acid ester, which is miscible with crude oil, allowing for the removal of metals and sulfur-containing compounds through a series of reaction and separation steps, with the option to recover and reuse the agent, thereby reducing impurity levels and improving oil quality.

Standardization and Metrics for Ultrafiltration Benchmarking

Standardization of ultrafiltration benchmarking represents a critical foundation for industry-wide adoption and performance comparison. Currently, the ultrafiltration industry suffers from fragmented evaluation approaches, with manufacturers employing proprietary testing methodologies that hinder direct performance comparisons. This inconsistency creates significant barriers for end-users attempting to select optimal solutions for specific applications.

Establishing universal metrics requires consideration of multiple performance dimensions. Flux rate (L/m²/h) serves as a primary indicator of membrane throughput capacity, while rejection rate (%) quantifies filtration efficiency for target contaminants. Transmembrane pressure (TMP) measurements provide insights into energy requirements and operational costs. Additionally, fouling resistance indices and cleaning cycle frequency metrics enable long-term performance evaluation under real-world conditions.

Testing protocols must standardize critical parameters including feed water characteristics, temperature conditions, and operational duration. The American Society for Testing and Materials (ASTM) and International Organization for Standardization (ISO) have developed preliminary frameworks, but industry-specific adaptations remain necessary for specialized applications such as pharmaceutical processing, food and beverage production, and wastewater treatment.

Digital monitoring systems now enable real-time performance tracking against standardized benchmarks. Integration of IoT sensors with cloud-based analytics platforms facilitates continuous data collection across multiple parameters simultaneously. This technological advancement supports the implementation of dynamic benchmarking approaches that account for performance variations under fluctuating operational conditions.

Cross-industry collaboration represents a crucial pathway toward standardization. The formation of the International Ultrafiltration Benchmarking Consortium (IUBC) in 2021 brought together manufacturers, academic institutions, and end-users to develop consensus-based testing methodologies. Their proposed Universal Ultrafiltration Performance Index (UUPI) combines weighted metrics for comprehensive membrane evaluation across diverse applications.

Economic considerations must factor into benchmarking frameworks. Total cost of ownership (TCO) models incorporating initial capital expenditure, operational expenses, maintenance requirements, and membrane replacement frequency provide holistic performance evaluation beyond technical specifications. Standardized TCO calculators enable fair economic comparison between competing ultrafiltration technologies.

Future benchmarking standards must anticipate emerging industry needs, particularly regarding micropollutant removal capabilities and compatibility with circular water economy principles. Adaptable frameworks that can incorporate new performance indicators as filtration challenges evolve will ensure long-term relevance of standardization efforts.

Establishing universal metrics requires consideration of multiple performance dimensions. Flux rate (L/m²/h) serves as a primary indicator of membrane throughput capacity, while rejection rate (%) quantifies filtration efficiency for target contaminants. Transmembrane pressure (TMP) measurements provide insights into energy requirements and operational costs. Additionally, fouling resistance indices and cleaning cycle frequency metrics enable long-term performance evaluation under real-world conditions.

Testing protocols must standardize critical parameters including feed water characteristics, temperature conditions, and operational duration. The American Society for Testing and Materials (ASTM) and International Organization for Standardization (ISO) have developed preliminary frameworks, but industry-specific adaptations remain necessary for specialized applications such as pharmaceutical processing, food and beverage production, and wastewater treatment.

Digital monitoring systems now enable real-time performance tracking against standardized benchmarks. Integration of IoT sensors with cloud-based analytics platforms facilitates continuous data collection across multiple parameters simultaneously. This technological advancement supports the implementation of dynamic benchmarking approaches that account for performance variations under fluctuating operational conditions.

Cross-industry collaboration represents a crucial pathway toward standardization. The formation of the International Ultrafiltration Benchmarking Consortium (IUBC) in 2021 brought together manufacturers, academic institutions, and end-users to develop consensus-based testing methodologies. Their proposed Universal Ultrafiltration Performance Index (UUPI) combines weighted metrics for comprehensive membrane evaluation across diverse applications.

Economic considerations must factor into benchmarking frameworks. Total cost of ownership (TCO) models incorporating initial capital expenditure, operational expenses, maintenance requirements, and membrane replacement frequency provide holistic performance evaluation beyond technical specifications. Standardized TCO calculators enable fair economic comparison between competing ultrafiltration technologies.

Future benchmarking standards must anticipate emerging industry needs, particularly regarding micropollutant removal capabilities and compatibility with circular water economy principles. Adaptable frameworks that can incorporate new performance indicators as filtration challenges evolve will ensure long-term relevance of standardization efforts.

Environmental Impact and Sustainability Considerations

Ultrafiltration systems have significant environmental implications that must be considered for sustainable industrial adaptation. The energy consumption of ultrafiltration processes represents a major environmental concern, with typical systems requiring 1-5 kWh per cubic meter of treated water. This energy footprint varies considerably depending on feed water quality, membrane configuration, and operational parameters. Recent advancements in energy recovery devices and process optimization have demonstrated potential reductions of 20-30% in energy requirements, substantially improving the sustainability profile of these systems.

Water conservation represents another critical environmental dimension of ultrafiltration technology. Industrial applications of ultrafiltration can achieve water recovery rates of 85-95%, significantly reducing freshwater withdrawal requirements. This is particularly valuable in water-stressed regions where industrial operations face increasing regulatory and resource constraints. The high recovery rates also translate to reduced discharge volumes, minimizing the environmental impact on receiving water bodies.

Chemical usage in ultrafiltration systems presents both challenges and opportunities for sustainability. Conventional systems require periodic chemical cleaning using acids, bases, and disinfectants that may pose environmental risks if improperly managed. Recent innovations in membrane materials have extended cleaning intervals by 30-50% and reduced chemical requirements by implementing more environmentally benign cleaning agents. Bio-based antifoulants and green chemistry approaches are emerging as promising alternatives to traditional chemical regimens.

Waste management considerations are equally important in ultrafiltration benchmarking. The concentrated reject streams from ultrafiltration processes contain elevated levels of contaminants that require appropriate handling and disposal. Advanced waste minimization strategies, including reject stream recycling and resource recovery, can transform these waste streams into valuable byproducts. Several industries have successfully implemented zero liquid discharge configurations that incorporate ultrafiltration as a key component.

The carbon footprint of ultrafiltration systems extends beyond operational energy to include embodied carbon in membrane manufacturing and replacement. Life cycle assessment studies indicate that membrane replacement accounts for 15-25% of the total environmental impact of ultrafiltration systems. Extending membrane lifespans through improved materials and optimized operating conditions represents a significant opportunity for environmental improvement. Some manufacturers have begun implementing take-back programs for spent membranes, facilitating recycling and reducing landfill disposal.

Regulatory compliance and certification systems increasingly incorporate environmental performance metrics for ultrafiltration technologies. Standards such as ISO 14001 and industry-specific environmental certifications provide frameworks for benchmarking the environmental attributes of different ultrafiltration solutions. These standards are evolving to include more comprehensive sustainability criteria, driving innovation toward more environmentally responsible ultrafiltration technologies.

Water conservation represents another critical environmental dimension of ultrafiltration technology. Industrial applications of ultrafiltration can achieve water recovery rates of 85-95%, significantly reducing freshwater withdrawal requirements. This is particularly valuable in water-stressed regions where industrial operations face increasing regulatory and resource constraints. The high recovery rates also translate to reduced discharge volumes, minimizing the environmental impact on receiving water bodies.

Chemical usage in ultrafiltration systems presents both challenges and opportunities for sustainability. Conventional systems require periodic chemical cleaning using acids, bases, and disinfectants that may pose environmental risks if improperly managed. Recent innovations in membrane materials have extended cleaning intervals by 30-50% and reduced chemical requirements by implementing more environmentally benign cleaning agents. Bio-based antifoulants and green chemistry approaches are emerging as promising alternatives to traditional chemical regimens.

Waste management considerations are equally important in ultrafiltration benchmarking. The concentrated reject streams from ultrafiltration processes contain elevated levels of contaminants that require appropriate handling and disposal. Advanced waste minimization strategies, including reject stream recycling and resource recovery, can transform these waste streams into valuable byproducts. Several industries have successfully implemented zero liquid discharge configurations that incorporate ultrafiltration as a key component.

The carbon footprint of ultrafiltration systems extends beyond operational energy to include embodied carbon in membrane manufacturing and replacement. Life cycle assessment studies indicate that membrane replacement accounts for 15-25% of the total environmental impact of ultrafiltration systems. Extending membrane lifespans through improved materials and optimized operating conditions represents a significant opportunity for environmental improvement. Some manufacturers have begun implementing take-back programs for spent membranes, facilitating recycling and reducing landfill disposal.

Regulatory compliance and certification systems increasingly incorporate environmental performance metrics for ultrafiltration technologies. Standards such as ISO 14001 and industry-specific environmental certifications provide frameworks for benchmarking the environmental attributes of different ultrafiltration solutions. These standards are evolving to include more comprehensive sustainability criteria, driving innovation toward more environmentally responsible ultrafiltration technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!