Ultrafiltration's Role in Process Intensification Strategies for Manufacturing

SEP 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ultrafiltration Technology Evolution and Objectives

Ultrafiltration technology has evolved significantly since its inception in the mid-20th century, transforming from a laboratory-scale separation technique to a cornerstone technology in modern manufacturing processes. The initial development focused primarily on water treatment applications, but the versatility of ultrafiltration membranes quickly expanded its utility across diverse industries including pharmaceuticals, food processing, biotechnology, and chemical manufacturing.

The evolution trajectory of ultrafiltration technology can be traced through several key developmental phases. The 1960s-1970s marked the emergence of the first commercially viable ultrafiltration membranes, characterized by limited flux rates and relatively poor selectivity. The 1980s-1990s witnessed significant advancements in membrane materials science, introducing polymeric membranes with enhanced mechanical strength, chemical resistance, and separation efficiency.

The early 2000s brought revolutionary changes with the development of ceramic and composite membranes, offering unprecedented thermal stability and operational longevity. Recent innovations have focused on surface modification techniques, anti-fouling properties, and the integration of nanotechnology to create "smart" membranes with tunable pore sizes and surface characteristics.

In the context of process intensification strategies, ultrafiltration aims to achieve several critical objectives. Primarily, it seeks to enhance manufacturing efficiency by enabling continuous processing capabilities, thereby reducing batch-to-batch variability and minimizing production footprints. The technology targets significant reductions in energy consumption compared to traditional separation methods such as centrifugation or distillation, aligning with sustainable manufacturing principles.

Another key objective involves improving product quality through precise molecular weight cut-off capabilities, allowing for highly selective separation of desired compounds from complex mixtures. This precision directly translates to higher product purity and consistency, critical factors in regulated industries like pharmaceuticals and food production.

The integration of ultrafiltration into manufacturing processes also aims to minimize waste generation and reduce environmental impact. By enabling solvent recovery and product concentration without thermal degradation, ultrafiltration supports circular economy principles in industrial operations.

Looking forward, ultrafiltration technology development objectives include advancing membrane durability to withstand harsh processing conditions, improving fouling resistance to extend operational cycles, and developing hybrid systems that combine ultrafiltration with complementary separation technologies. These advancements collectively seek to position ultrafiltration as a cornerstone technology in next-generation manufacturing paradigms focused on efficiency, sustainability, and product quality.

The evolution trajectory of ultrafiltration technology can be traced through several key developmental phases. The 1960s-1970s marked the emergence of the first commercially viable ultrafiltration membranes, characterized by limited flux rates and relatively poor selectivity. The 1980s-1990s witnessed significant advancements in membrane materials science, introducing polymeric membranes with enhanced mechanical strength, chemical resistance, and separation efficiency.

The early 2000s brought revolutionary changes with the development of ceramic and composite membranes, offering unprecedented thermal stability and operational longevity. Recent innovations have focused on surface modification techniques, anti-fouling properties, and the integration of nanotechnology to create "smart" membranes with tunable pore sizes and surface characteristics.

In the context of process intensification strategies, ultrafiltration aims to achieve several critical objectives. Primarily, it seeks to enhance manufacturing efficiency by enabling continuous processing capabilities, thereby reducing batch-to-batch variability and minimizing production footprints. The technology targets significant reductions in energy consumption compared to traditional separation methods such as centrifugation or distillation, aligning with sustainable manufacturing principles.

Another key objective involves improving product quality through precise molecular weight cut-off capabilities, allowing for highly selective separation of desired compounds from complex mixtures. This precision directly translates to higher product purity and consistency, critical factors in regulated industries like pharmaceuticals and food production.

The integration of ultrafiltration into manufacturing processes also aims to minimize waste generation and reduce environmental impact. By enabling solvent recovery and product concentration without thermal degradation, ultrafiltration supports circular economy principles in industrial operations.

Looking forward, ultrafiltration technology development objectives include advancing membrane durability to withstand harsh processing conditions, improving fouling resistance to extend operational cycles, and developing hybrid systems that combine ultrafiltration with complementary separation technologies. These advancements collectively seek to position ultrafiltration as a cornerstone technology in next-generation manufacturing paradigms focused on efficiency, sustainability, and product quality.

Market Demand Analysis for Process Intensification

Process intensification (PI) has emerged as a critical strategy in modern manufacturing, with ultrafiltration technology playing an increasingly vital role. The global market for process intensification technologies is experiencing robust growth, projected to reach $38 billion by 2027, with a compound annual growth rate of approximately 9.5% from 2022. This growth is primarily driven by industries seeking more efficient, sustainable, and cost-effective manufacturing processes.

The pharmaceutical sector represents one of the largest markets for ultrafiltration-based process intensification, valued at $7.2 billion in 2022. This demand stems from stringent regulatory requirements for product purity and the need to reduce production footprints while maintaining or increasing output. Biopharmaceutical manufacturing, in particular, has seen a 15% annual increase in adoption of ultrafiltration technologies for downstream processing.

Chemical processing industries follow closely, with a market size of $6.8 billion for process intensification technologies. Here, ultrafiltration offers significant advantages in separation processes, reducing energy consumption by up to 40% compared to traditional methods. The food and beverage sector has also recognized ultrafiltration's potential, with market demand growing at 11% annually as companies seek to improve product quality while reducing waste and energy usage.

Environmental regulations and sustainability goals are powerful market drivers across all sectors. Companies face increasing pressure to reduce water consumption, minimize waste generation, and lower carbon footprints. Ultrafiltration-based process intensification directly addresses these challenges, offering water recycling capabilities that can reduce freshwater requirements by up to 70% in some manufacturing processes.

Regional analysis reveals that North America and Europe currently dominate the market for advanced ultrafiltration technologies, accounting for 65% of global demand. However, the Asia-Pacific region is experiencing the fastest growth rate at 12.3% annually, driven by rapid industrialization in China and India, coupled with increasingly stringent environmental regulations.

Economic factors further strengthen market demand, as manufacturers seek to reduce operational costs in the face of rising energy prices and resource constraints. Case studies across various industries demonstrate that ultrafiltration-based process intensification can reduce production costs by 15-30% through combined savings in energy, water, and raw materials, while simultaneously increasing throughput by 20-40%.

The COVID-19 pandemic has accelerated this trend, highlighting vulnerabilities in traditional manufacturing supply chains and creating renewed interest in more resilient, flexible, and efficient production methods. This has translated to a 22% increase in research and development investments related to ultrafiltration technologies since 2020.

The pharmaceutical sector represents one of the largest markets for ultrafiltration-based process intensification, valued at $7.2 billion in 2022. This demand stems from stringent regulatory requirements for product purity and the need to reduce production footprints while maintaining or increasing output. Biopharmaceutical manufacturing, in particular, has seen a 15% annual increase in adoption of ultrafiltration technologies for downstream processing.

Chemical processing industries follow closely, with a market size of $6.8 billion for process intensification technologies. Here, ultrafiltration offers significant advantages in separation processes, reducing energy consumption by up to 40% compared to traditional methods. The food and beverage sector has also recognized ultrafiltration's potential, with market demand growing at 11% annually as companies seek to improve product quality while reducing waste and energy usage.

Environmental regulations and sustainability goals are powerful market drivers across all sectors. Companies face increasing pressure to reduce water consumption, minimize waste generation, and lower carbon footprints. Ultrafiltration-based process intensification directly addresses these challenges, offering water recycling capabilities that can reduce freshwater requirements by up to 70% in some manufacturing processes.

Regional analysis reveals that North America and Europe currently dominate the market for advanced ultrafiltration technologies, accounting for 65% of global demand. However, the Asia-Pacific region is experiencing the fastest growth rate at 12.3% annually, driven by rapid industrialization in China and India, coupled with increasingly stringent environmental regulations.

Economic factors further strengthen market demand, as manufacturers seek to reduce operational costs in the face of rising energy prices and resource constraints. Case studies across various industries demonstrate that ultrafiltration-based process intensification can reduce production costs by 15-30% through combined savings in energy, water, and raw materials, while simultaneously increasing throughput by 20-40%.

The COVID-19 pandemic has accelerated this trend, highlighting vulnerabilities in traditional manufacturing supply chains and creating renewed interest in more resilient, flexible, and efficient production methods. This has translated to a 22% increase in research and development investments related to ultrafiltration technologies since 2020.

Current Ultrafiltration Challenges in Manufacturing

Despite significant advancements in ultrafiltration technology, several critical challenges persist in manufacturing applications that limit the full potential of process intensification strategies. Membrane fouling remains the most pervasive issue, occurring when particles, colloids, and macromolecules accumulate on membrane surfaces or within pores, leading to reduced flux rates and increased operational costs. This phenomenon is particularly problematic in continuous manufacturing processes where downtime for cleaning cycles significantly impacts productivity.

Concentration polarization presents another substantial challenge, manifesting as the accumulation of retained solutes near the membrane surface. This creates a boundary layer that increases resistance to permeate flow and reduces separation efficiency. In high-throughput manufacturing environments, this effect becomes more pronounced and difficult to mitigate through conventional hydrodynamic approaches.

Energy consumption continues to be a significant concern, particularly as manufacturers face increasing pressure to reduce carbon footprints. Current ultrafiltration systems often require substantial pumping energy to maintain transmembrane pressure, especially as fouling progresses. This energy demand contradicts the core principles of process intensification, which aims to reduce resource utilization while maintaining or improving output.

Scalability issues persist when transitioning from laboratory-scale ultrafiltration to industrial implementation. Many promising ultrafiltration techniques demonstrate excellent performance in controlled environments but fail to maintain efficiency when scaled up. This scaling challenge is often related to flow distribution problems, membrane module design limitations, and increased fouling propensity at larger scales.

Membrane material limitations represent another significant barrier. Current polymeric membranes often face trade-offs between selectivity, permeability, and mechanical/chemical stability. While ceramic membranes offer superior durability, their higher cost and lower packing density limit widespread adoption in cost-sensitive manufacturing sectors.

Process control and monitoring capabilities remain inadequate for real-time optimization. Many manufacturing facilities still rely on indirect measurements and periodic sampling rather than continuous monitoring systems that could enable dynamic process adjustments. This limitation prevents the implementation of advanced control strategies that could maximize efficiency and product quality.

Cross-industry standardization is notably lacking, with ultrafiltration applications often developed as bespoke solutions for specific manufacturing challenges. This fragmentation impedes knowledge transfer between sectors and slows the adoption of best practices, ultimately hindering broader implementation of ultrafiltration-based process intensification strategies across manufacturing industries.

Concentration polarization presents another substantial challenge, manifesting as the accumulation of retained solutes near the membrane surface. This creates a boundary layer that increases resistance to permeate flow and reduces separation efficiency. In high-throughput manufacturing environments, this effect becomes more pronounced and difficult to mitigate through conventional hydrodynamic approaches.

Energy consumption continues to be a significant concern, particularly as manufacturers face increasing pressure to reduce carbon footprints. Current ultrafiltration systems often require substantial pumping energy to maintain transmembrane pressure, especially as fouling progresses. This energy demand contradicts the core principles of process intensification, which aims to reduce resource utilization while maintaining or improving output.

Scalability issues persist when transitioning from laboratory-scale ultrafiltration to industrial implementation. Many promising ultrafiltration techniques demonstrate excellent performance in controlled environments but fail to maintain efficiency when scaled up. This scaling challenge is often related to flow distribution problems, membrane module design limitations, and increased fouling propensity at larger scales.

Membrane material limitations represent another significant barrier. Current polymeric membranes often face trade-offs between selectivity, permeability, and mechanical/chemical stability. While ceramic membranes offer superior durability, their higher cost and lower packing density limit widespread adoption in cost-sensitive manufacturing sectors.

Process control and monitoring capabilities remain inadequate for real-time optimization. Many manufacturing facilities still rely on indirect measurements and periodic sampling rather than continuous monitoring systems that could enable dynamic process adjustments. This limitation prevents the implementation of advanced control strategies that could maximize efficiency and product quality.

Cross-industry standardization is notably lacking, with ultrafiltration applications often developed as bespoke solutions for specific manufacturing challenges. This fragmentation impedes knowledge transfer between sectors and slows the adoption of best practices, ultimately hindering broader implementation of ultrafiltration-based process intensification strategies across manufacturing industries.

Current Ultrafiltration Process Intensification Solutions

01 Membrane configuration and design optimization

Optimizing membrane configurations and designs can significantly enhance ultrafiltration process efficiency. This includes developing specialized membrane geometries, multi-stage filtration systems, and innovative module designs that maximize surface area while minimizing fouling. Advanced membrane configurations can improve flux rates, reduce energy consumption, and extend operational lifespans of filtration systems.- Membrane configuration and design optimization: Innovative membrane configurations and designs can significantly enhance ultrafiltration efficiency. This includes the development of specialized membrane geometries, module designs, and surface modifications that improve flux rates while reducing fouling. Advanced membrane materials and structures enable better separation performance, increased throughput, and extended operational lifetimes, ultimately intensifying the ultrafiltration process.

- Hydrodynamic optimization techniques: Hydrodynamic optimization involves manipulating flow patterns and fluid dynamics to enhance ultrafiltration performance. Techniques include implementing turbulence promoters, pulsatile flow, variable cross-flow velocities, and optimized pressure gradients. These approaches improve mass transfer, reduce concentration polarization and membrane fouling, leading to more efficient ultrafiltration processes with higher throughput and lower energy consumption.

- Integration of physical and chemical pretreatment methods: Combining physical and chemical pretreatment methods before ultrafiltration can significantly intensify process performance. Techniques such as coagulation, flocculation, pH adjustment, oxidation, and adsorption help reduce membrane fouling and improve filtration efficiency. These integrated approaches extend membrane life, maintain higher flux rates, and enhance separation quality, resulting in more sustainable and economical ultrafiltration operations.

- Energy efficiency and recovery systems: Implementing energy recovery systems and efficiency improvements can significantly intensify ultrafiltration processes. Techniques include pressure exchangers, energy recovery devices, optimized pump configurations, and smart control systems that minimize energy consumption. Advanced energy management approaches reduce operational costs while maintaining or improving filtration performance, making ultrafiltration more sustainable and economically viable for various applications.

- Process monitoring and control automation: Advanced monitoring and control automation systems enhance ultrafiltration process intensification through real-time optimization. These systems utilize sensors, data analytics, and machine learning algorithms to continuously monitor membrane performance, detect fouling, and automatically adjust operating parameters. Intelligent control strategies optimize cleaning cycles, backwashing frequency, and operational settings, resulting in improved efficiency, reduced downtime, and extended membrane life.

02 Hydrodynamic improvements and flow optimization

Enhancing hydrodynamic conditions during ultrafiltration can intensify process performance. Techniques include optimizing cross-flow velocities, implementing pulsatile or oscillatory flows, and designing improved flow distribution systems. These approaches reduce concentration polarization and membrane fouling while increasing mass transfer rates, resulting in higher throughput and more efficient separation processes.Expand Specific Solutions03 Integration of physical and chemical pretreatment methods

Combining ultrafiltration with physical and chemical pretreatment methods can significantly intensify overall process efficiency. Pretreatment approaches include coagulation, flocculation, pH adjustment, and oxidation processes that modify feed characteristics before ultrafiltration. These integrated approaches reduce membrane fouling, extend operational cycles, and improve separation quality while decreasing energy and chemical consumption.Expand Specific Solutions04 Energy efficiency and sustainable operation techniques

Implementing energy-efficient designs and sustainable operation techniques can intensify ultrafiltration processes while reducing environmental impact. Approaches include energy recovery systems, renewable energy integration, optimized pressure management, and smart control systems that adjust operational parameters in real-time. These techniques minimize energy consumption while maintaining or improving separation performance.Expand Specific Solutions05 Advanced monitoring and control systems

Incorporating advanced monitoring and control systems enables real-time optimization of ultrafiltration processes. Technologies include inline sensors, artificial intelligence algorithms, predictive maintenance systems, and automated cleaning protocols. These systems allow for dynamic adjustment of operational parameters, early detection of performance issues, and optimization of cleaning cycles, resulting in intensified process efficiency and extended membrane life.Expand Specific Solutions

Key Industry Players and Competitive Landscape

Ultrafiltration technology in process intensification is evolving rapidly, with the market currently in a growth phase. The global market size for ultrafiltration in manufacturing processes is expanding at approximately 15% annually, driven by increasing demands for efficient separation technologies across pharmaceutical, chemical, and food industries. Technologically, companies like Corning, Inc. and Genentech are leading innovation in membrane technology development, while ExxonMobil and SABIC Global Technologies are advancing industrial-scale applications. Academic institutions such as Tianjin University and Rensselaer Polytechnic Institute are contributing fundamental research. The competitive landscape shows pharmaceutical companies (Novartis, AbbVie, Baxter) focusing on bioprocessing applications, while chemical manufacturers (Merck, Ciba) are developing specialized filtration solutions for chemical synthesis and purification processes.

Corning, Inc.

Technical Solution: Corning has developed innovative ceramic ultrafiltration membrane technology specifically designed for process intensification in manufacturing environments requiring extreme chemical and thermal stability. Their Corning® FlowCor™ ultrafiltration system utilizes proprietary silicon carbide membranes with uniform pore structure (ranging from 0.04 to 0.2 μm) that maintain consistent performance under harsh processing conditions where polymeric membranes would fail. The technology features a unique asymmetric membrane architecture that provides exceptional flux rates (up to 1200 LMH) while minimizing fouling through turbulence-promoting channel designs. Corning's ultrafiltration systems incorporate modular, stackable elements that enable easy scaling from laboratory to industrial production without performance variations. The company has demonstrated successful implementation in chemical processing applications where the membranes operate continuously at temperatures exceeding 200°C and pH ranges from 0-14, conditions that would rapidly degrade conventional membranes. This extreme durability translates to extended membrane lifetimes (3-5 years versus 6-18 months for polymeric alternatives) and significantly reduced replacement costs in continuous manufacturing operations.

Strengths: Exceptional chemical and thermal stability allowing operation in extreme conditions, high flux rates that reduce required membrane area, and extended operational lifetime reducing total cost of ownership. Weaknesses: Higher initial capital investment compared to polymeric membrane systems, and limited flexibility for retrofitting into existing manufacturing processes due to specialized housing requirements.

Genentech, Inc.

Technical Solution: Genentech has developed advanced ultrafiltration systems specifically designed for biopharmaceutical manufacturing process intensification. Their technology employs high-performance tangential flow filtration (TFF) with specialized membrane configurations that enable continuous processing rather than traditional batch methods. The system incorporates automated pressure control mechanisms that maintain optimal transmembrane pressure throughout the filtration process, resulting in up to 40% higher protein recovery rates compared to conventional methods. Genentech's ultrafiltration technology integrates seamlessly with their continuous bioprocessing platform, featuring real-time monitoring capabilities through integrated Process Analytical Technology (PAT) tools that analyze critical quality attributes during filtration. This allows for immediate process adjustments based on product quality parameters rather than fixed process parameters, significantly reducing manufacturing footprint and processing time while maintaining product quality consistency.

Strengths: Superior protein recovery rates, seamless integration with continuous manufacturing platforms, and real-time quality monitoring capabilities. Weaknesses: Higher initial capital investment required compared to traditional batch systems, and specialized training needed for operators to manage the advanced control systems effectively.

Critical Patents and Innovations in Membrane Technology

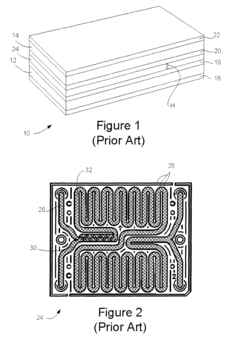

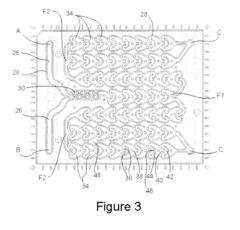

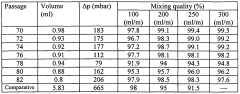

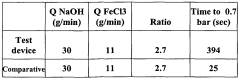

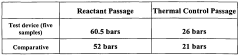

Process intensified microfluidic devices

PatentActiveEP2017000A1

Innovation

- The microfluidic device features a reactant passage with multiple successive chambers, each splitting into sub-passages that change direction by at least 90 degrees, and a narrowing exit, which induces secondary flows for improved heat transfer and mixing, along with a design that maximizes the volume of the reactant passage and minimizes thermal cross-talk.

Process intensified microfluidic devices

PatentWO2009009129A1

Innovation

- The design incorporates multiple successive chambers within the reactant passage, featuring a split and re-direction of sub-passages with a 90-degree change in direction, along with a narrowing exit and concave surfaces, which maximizes heat transfer and reduces pressure drop by inducing secondary flows and optimizing chamber layout.

Sustainability Impact and Environmental Considerations

Ultrafiltration technology significantly contributes to sustainable manufacturing through multiple environmental pathways. The implementation of ultrafiltration systems in manufacturing processes reduces water consumption by enabling water recycling and reuse, with recovery rates typically reaching 85-95% in optimized systems. This water conservation aspect becomes increasingly critical as industrial water scarcity intensifies globally, particularly in water-stressed regions where manufacturing facilities face stringent usage restrictions.

Beyond water conservation, ultrafiltration delivers substantial energy efficiency improvements compared to conventional separation technologies. Studies indicate energy consumption reductions of 30-50% when replacing thermal separation processes with membrane-based ultrafiltration systems. This energy advantage stems from the elimination of phase changes required in distillation and evaporation processes, directly contributing to reduced carbon emissions and operational costs.

Waste reduction represents another key sustainability benefit of ultrafiltration implementation. By enabling precise separation of valuable components from waste streams, manufacturers can recover materials previously discarded, creating closed-loop systems that align with circular economy principles. For instance, in the food processing industry, ultrafiltration recovers proteins and other high-value components from waste streams, transforming potential pollutants into marketable by-products.

The environmental footprint of ultrafiltration extends to chemical usage reduction. Traditional clarification and separation processes often require substantial chemical additives for flocculation, precipitation, and pH adjustment. Ultrafiltration systems typically reduce chemical consumption by 40-60%, minimizing the environmental impact associated with chemical manufacturing, transportation, and disposal.

Life cycle assessments of manufacturing facilities implementing ultrafiltration reveal significant reductions in greenhouse gas emissions. A comprehensive analysis across various industries shows that ultrafiltration integration can reduce the carbon footprint of separation processes by 25-45% compared to conventional technologies. This reduction becomes particularly significant in energy-intensive industries such as pharmaceuticals, chemicals, and food processing.

Regulatory compliance represents an increasingly important driver for ultrafiltration adoption. As environmental regulations become more stringent worldwide, manufacturers face growing pressure to reduce effluent discharge and improve wastewater quality. Ultrafiltration provides a technically viable solution for meeting these regulatory requirements while simultaneously improving operational efficiency and sustainability metrics that increasingly factor into corporate environmental, social, and governance (ESG) reporting.

Beyond water conservation, ultrafiltration delivers substantial energy efficiency improvements compared to conventional separation technologies. Studies indicate energy consumption reductions of 30-50% when replacing thermal separation processes with membrane-based ultrafiltration systems. This energy advantage stems from the elimination of phase changes required in distillation and evaporation processes, directly contributing to reduced carbon emissions and operational costs.

Waste reduction represents another key sustainability benefit of ultrafiltration implementation. By enabling precise separation of valuable components from waste streams, manufacturers can recover materials previously discarded, creating closed-loop systems that align with circular economy principles. For instance, in the food processing industry, ultrafiltration recovers proteins and other high-value components from waste streams, transforming potential pollutants into marketable by-products.

The environmental footprint of ultrafiltration extends to chemical usage reduction. Traditional clarification and separation processes often require substantial chemical additives for flocculation, precipitation, and pH adjustment. Ultrafiltration systems typically reduce chemical consumption by 40-60%, minimizing the environmental impact associated with chemical manufacturing, transportation, and disposal.

Life cycle assessments of manufacturing facilities implementing ultrafiltration reveal significant reductions in greenhouse gas emissions. A comprehensive analysis across various industries shows that ultrafiltration integration can reduce the carbon footprint of separation processes by 25-45% compared to conventional technologies. This reduction becomes particularly significant in energy-intensive industries such as pharmaceuticals, chemicals, and food processing.

Regulatory compliance represents an increasingly important driver for ultrafiltration adoption. As environmental regulations become more stringent worldwide, manufacturers face growing pressure to reduce effluent discharge and improve wastewater quality. Ultrafiltration provides a technically viable solution for meeting these regulatory requirements while simultaneously improving operational efficiency and sustainability metrics that increasingly factor into corporate environmental, social, and governance (ESG) reporting.

Economic Analysis and ROI for Implementation

Implementing ultrafiltration technology in manufacturing processes requires substantial initial investment, but offers significant economic benefits over time. Capital expenditures typically include membrane systems, pumping equipment, control systems, and installation costs, ranging from $100,000 for small-scale operations to several million dollars for large industrial applications. Operating expenses encompass membrane replacement (typically every 2-5 years), energy consumption, cleaning chemicals, and maintenance, collectively representing 3-8% of total production costs depending on application scale.

ROI analysis reveals that ultrafiltration systems generally achieve payback periods of 1.5-3 years in most manufacturing contexts. Key economic benefits driving this favorable return include reduced waste treatment costs (30-50% reduction), decreased energy consumption compared to thermal separation methods (40-60% savings), and improved product quality leading to higher market value (5-15% premium). Additionally, ultrafiltration enables valuable component recovery from process streams that would otherwise be discarded, creating new revenue streams.

Case studies across industries demonstrate compelling economic outcomes. In pharmaceutical manufacturing, ultrafiltration implementation reduced production costs by 22% while increasing throughput by 35%. Food processing operations reported 28% reduction in water consumption and 45% decrease in waste disposal costs. Chemical manufacturers achieved 15-20% improvement in overall process efficiency with corresponding reductions in operating expenses.

Sensitivity analysis indicates ROI is most affected by production scale, feed composition complexity, and regulatory requirements. Larger operations typically achieve faster returns due to economies of scale, while processes with highly fouling components may experience higher maintenance costs affecting overall returns. Implementation costs can be optimized through strategic phasing, beginning with critical process areas before expanding to full-scale deployment.

Long-term economic benefits extend beyond direct cost savings. Ultrafiltration contributes to sustainability goals by reducing water and energy consumption, potentially qualifying operations for environmental incentives and credits. The technology also provides manufacturing flexibility, allowing rapid adaptation to changing market demands with minimal additional investment, creating strategic competitive advantages that enhance overall business valuation.

ROI analysis reveals that ultrafiltration systems generally achieve payback periods of 1.5-3 years in most manufacturing contexts. Key economic benefits driving this favorable return include reduced waste treatment costs (30-50% reduction), decreased energy consumption compared to thermal separation methods (40-60% savings), and improved product quality leading to higher market value (5-15% premium). Additionally, ultrafiltration enables valuable component recovery from process streams that would otherwise be discarded, creating new revenue streams.

Case studies across industries demonstrate compelling economic outcomes. In pharmaceutical manufacturing, ultrafiltration implementation reduced production costs by 22% while increasing throughput by 35%. Food processing operations reported 28% reduction in water consumption and 45% decrease in waste disposal costs. Chemical manufacturers achieved 15-20% improvement in overall process efficiency with corresponding reductions in operating expenses.

Sensitivity analysis indicates ROI is most affected by production scale, feed composition complexity, and regulatory requirements. Larger operations typically achieve faster returns due to economies of scale, while processes with highly fouling components may experience higher maintenance costs affecting overall returns. Implementation costs can be optimized through strategic phasing, beginning with critical process areas before expanding to full-scale deployment.

Long-term economic benefits extend beyond direct cost savings. Ultrafiltration contributes to sustainability goals by reducing water and energy consumption, potentially qualifying operations for environmental incentives and credits. The technology also provides manufacturing flexibility, allowing rapid adaptation to changing market demands with minimal additional investment, creating strategic competitive advantages that enhance overall business valuation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!