Boron Nitride Thermal Management In EV Powertrains: Dielectric Margins, ΔT Limits And Lifetime

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

BN Thermal Management Evolution and Objectives

Boron Nitride (BN) has emerged as a critical material in thermal management solutions for electric vehicle powertrains over the past decade. Initially developed for aerospace applications in the 1980s, BN's unique combination of high thermal conductivity and excellent electrical insulation properties has positioned it as an ideal candidate for addressing the thermal challenges in high-power density EV systems.

The evolution of BN thermal management solutions has been driven by the increasing power demands of modern electric vehicles. First-generation EV powertrains operated at power levels below 100 kW, where conventional thermal management solutions were sufficient. As power levels increased to 150-250 kW in second-generation systems, the need for advanced thermal interface materials became apparent, leading to the initial adoption of BN-based compounds.

Current third-generation EV powertrains, operating at 300-450 kW, face unprecedented thermal management challenges. The temperature differentials (ΔT) between components can exceed 70°C under peak load conditions, pushing conventional materials beyond their operational limits. This has accelerated the development of specialized BN formulations with enhanced thermal conductivity exceeding 10 W/m·K while maintaining dielectric strength above 20 kV/mm.

The primary objective of BN thermal management research is to develop solutions that can maintain semiconductor junction temperatures below critical thresholds (typically 150°C) while operating in increasingly compact powertrain designs. This requires materials that can effectively transfer heat while withstanding the electrical potentials present in 800V and emerging 1200V architectures.

Secondary objectives include extending the operational lifetime of thermal interface materials under cyclic thermal loading conditions. Current BN formulations show degradation after 2,000-3,000 thermal cycles, whereas next-generation EV powertrains require stability through 8,000-10,000 cycles to match vehicle lifetime expectations of 15+ years.

Future development targets include hexagonal BN (h-BN) nanostructured composites that can achieve thermal conductivities approaching 25 W/m·K while maintaining dielectric margins above 30 kV/mm. These advanced materials aim to support the thermal requirements of solid-state battery systems and silicon carbide (SiC) power electronics that will form the backbone of next-generation EV powertrains.

The ultimate goal is to develop thermal management solutions that enable power densities exceeding 75 kW/L in inverter and converter systems while maintaining temperature gradients below 50°C and ensuring 15+ year operational lifetimes in automotive environmental conditions.

The evolution of BN thermal management solutions has been driven by the increasing power demands of modern electric vehicles. First-generation EV powertrains operated at power levels below 100 kW, where conventional thermal management solutions were sufficient. As power levels increased to 150-250 kW in second-generation systems, the need for advanced thermal interface materials became apparent, leading to the initial adoption of BN-based compounds.

Current third-generation EV powertrains, operating at 300-450 kW, face unprecedented thermal management challenges. The temperature differentials (ΔT) between components can exceed 70°C under peak load conditions, pushing conventional materials beyond their operational limits. This has accelerated the development of specialized BN formulations with enhanced thermal conductivity exceeding 10 W/m·K while maintaining dielectric strength above 20 kV/mm.

The primary objective of BN thermal management research is to develop solutions that can maintain semiconductor junction temperatures below critical thresholds (typically 150°C) while operating in increasingly compact powertrain designs. This requires materials that can effectively transfer heat while withstanding the electrical potentials present in 800V and emerging 1200V architectures.

Secondary objectives include extending the operational lifetime of thermal interface materials under cyclic thermal loading conditions. Current BN formulations show degradation after 2,000-3,000 thermal cycles, whereas next-generation EV powertrains require stability through 8,000-10,000 cycles to match vehicle lifetime expectations of 15+ years.

Future development targets include hexagonal BN (h-BN) nanostructured composites that can achieve thermal conductivities approaching 25 W/m·K while maintaining dielectric margins above 30 kV/mm. These advanced materials aim to support the thermal requirements of solid-state battery systems and silicon carbide (SiC) power electronics that will form the backbone of next-generation EV powertrains.

The ultimate goal is to develop thermal management solutions that enable power densities exceeding 75 kW/L in inverter and converter systems while maintaining temperature gradients below 50°C and ensuring 15+ year operational lifetimes in automotive environmental conditions.

EV Powertrain Thermal Management Market Analysis

The electric vehicle (EV) powertrain thermal management market is experiencing robust growth, driven by the rapid expansion of the global EV sector. Current market valuations indicate that the EV thermal management systems market reached approximately 3.5 billion USD in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.2% through 2030. This growth trajectory is significantly outpacing traditional automotive thermal management systems, reflecting the unique and critical nature of thermal challenges in EV powertrains.

Within this broader market, specialized thermal interface materials (TIMs) featuring boron nitride (BN) are emerging as a high-value segment. The BN-based thermal management materials market specifically for EV applications is estimated at 420 million USD in 2023, with projections suggesting it could reach 1.2 billion USD by 2028. This represents one of the fastest-growing subsegments within automotive materials.

Market demand is being shaped by several key factors. First, the increasing power density of EV powertrains, with newer models featuring 800V architectures and faster charging capabilities, is creating unprecedented thermal management challenges. Second, consumer expectations for longer range and faster charging are directly tied to efficient thermal management systems. Third, regulatory pressures regarding battery safety standards are becoming more stringent globally, particularly following high-profile thermal runaway incidents.

Regional analysis reveals distinct market characteristics. Asia-Pacific dominates manufacturing capacity for BN-based thermal materials, with China, Japan, and South Korea collectively accounting for over 65% of global production. However, North American and European markets are showing the highest growth rates in adoption, driven by premium EV manufacturers prioritizing advanced thermal solutions to differentiate their offerings.

The customer landscape is segmented between OEMs who integrate thermal management systems during vehicle design and aftermarket solutions focused on performance upgrades. OEMs represent approximately 85% of the market volume, with their purchasing decisions heavily influenced by performance-to-cost ratios rather than absolute performance metrics alone.

Pricing trends indicate that while high-purity hexagonal BN materials command premium prices, economies of scale are gradually reducing costs. The average price per kilogram of BN-based TIMs has decreased by approximately 18% over the past three years, though this remains significantly higher than conventional alternatives. This price-performance equation is critical as manufacturers seek to balance thermal performance with overall vehicle cost targets.

Within this broader market, specialized thermal interface materials (TIMs) featuring boron nitride (BN) are emerging as a high-value segment. The BN-based thermal management materials market specifically for EV applications is estimated at 420 million USD in 2023, with projections suggesting it could reach 1.2 billion USD by 2028. This represents one of the fastest-growing subsegments within automotive materials.

Market demand is being shaped by several key factors. First, the increasing power density of EV powertrains, with newer models featuring 800V architectures and faster charging capabilities, is creating unprecedented thermal management challenges. Second, consumer expectations for longer range and faster charging are directly tied to efficient thermal management systems. Third, regulatory pressures regarding battery safety standards are becoming more stringent globally, particularly following high-profile thermal runaway incidents.

Regional analysis reveals distinct market characteristics. Asia-Pacific dominates manufacturing capacity for BN-based thermal materials, with China, Japan, and South Korea collectively accounting for over 65% of global production. However, North American and European markets are showing the highest growth rates in adoption, driven by premium EV manufacturers prioritizing advanced thermal solutions to differentiate their offerings.

The customer landscape is segmented between OEMs who integrate thermal management systems during vehicle design and aftermarket solutions focused on performance upgrades. OEMs represent approximately 85% of the market volume, with their purchasing decisions heavily influenced by performance-to-cost ratios rather than absolute performance metrics alone.

Pricing trends indicate that while high-purity hexagonal BN materials command premium prices, economies of scale are gradually reducing costs. The average price per kilogram of BN-based TIMs has decreased by approximately 18% over the past three years, though this remains significantly higher than conventional alternatives. This price-performance equation is critical as manufacturers seek to balance thermal performance with overall vehicle cost targets.

Boron Nitride Technical Challenges in EVs

The integration of boron nitride (BN) materials in electric vehicle (EV) powertrains presents several significant technical challenges that must be addressed to ensure optimal thermal management performance. One primary challenge is achieving consistent material properties across production batches. Hexagonal boron nitride (h-BN), the most common form used in thermal interface materials (TIMs), exhibits anisotropic thermal conductivity that varies significantly between in-plane (up to 600 W/m·K) and through-plane (approximately 30 W/m·K) directions. This anisotropy creates difficulties in predicting and controlling heat dissipation pathways in complex powertrain geometries.

Surface functionalization of boron nitride particles represents another critical challenge. While functionalization is necessary to improve dispersion in polymer matrices and enhance interfacial thermal conductivity, it often introduces trade-offs between thermal performance and other essential properties such as dielectric strength. The chemical treatments required for functionalization can potentially compromise the inherent dielectric properties of BN, reducing its effectiveness as an electrical insulator in high-voltage EV environments.

The high-temperature stability of BN-based thermal management solutions faces challenges in the extreme operating conditions of EV powertrains. Although pure BN is stable at temperatures exceeding 900°C in inert environments, its composite formulations with polymers often experience degradation at much lower temperatures (typically 200-300°C). This degradation can lead to reduced thermal conductivity and compromised dielectric margins over the vehicle's operational lifetime.

Processing challenges also emerge when incorporating high BN filler loadings (often 30-60 wt%) necessary to achieve desired thermal conductivity. These high loadings frequently result in increased viscosity, making processing difficult and potentially creating voids or non-uniform distributions that become thermal bottlenecks. Such defects can create localized hotspots that exceed critical ΔT limits in power electronics components.

The interface between BN-filled TIMs and various powertrain components presents persistent challenges in maintaining consistent thermal contact resistance. Surface roughness, wetting behavior, and mechanical stress during thermal cycling can all contribute to interface degradation over time. This degradation directly impacts the long-term reliability of thermal management systems and can accelerate component aging.

Cost considerations remain a significant barrier to widespread adoption of high-performance BN solutions. High-purity h-BN with optimized particle morphology for thermal applications commands premium pricing, creating tension between thermal performance requirements and cost constraints in mass-market EV production. This economic challenge necessitates careful engineering trade-offs between thermal performance, dielectric safety margins, and production costs.

Surface functionalization of boron nitride particles represents another critical challenge. While functionalization is necessary to improve dispersion in polymer matrices and enhance interfacial thermal conductivity, it often introduces trade-offs between thermal performance and other essential properties such as dielectric strength. The chemical treatments required for functionalization can potentially compromise the inherent dielectric properties of BN, reducing its effectiveness as an electrical insulator in high-voltage EV environments.

The high-temperature stability of BN-based thermal management solutions faces challenges in the extreme operating conditions of EV powertrains. Although pure BN is stable at temperatures exceeding 900°C in inert environments, its composite formulations with polymers often experience degradation at much lower temperatures (typically 200-300°C). This degradation can lead to reduced thermal conductivity and compromised dielectric margins over the vehicle's operational lifetime.

Processing challenges also emerge when incorporating high BN filler loadings (often 30-60 wt%) necessary to achieve desired thermal conductivity. These high loadings frequently result in increased viscosity, making processing difficult and potentially creating voids or non-uniform distributions that become thermal bottlenecks. Such defects can create localized hotspots that exceed critical ΔT limits in power electronics components.

The interface between BN-filled TIMs and various powertrain components presents persistent challenges in maintaining consistent thermal contact resistance. Surface roughness, wetting behavior, and mechanical stress during thermal cycling can all contribute to interface degradation over time. This degradation directly impacts the long-term reliability of thermal management systems and can accelerate component aging.

Cost considerations remain a significant barrier to widespread adoption of high-performance BN solutions. High-purity h-BN with optimized particle morphology for thermal applications commands premium pricing, creating tension between thermal performance requirements and cost constraints in mass-market EV production. This economic challenge necessitates careful engineering trade-offs between thermal performance, dielectric safety margins, and production costs.

Current BN Solutions for EV Thermal Management

01 Thermal properties and temperature limits of boron nitride dielectrics

Boron nitride exhibits excellent thermal properties as a dielectric material, with specific temperature limits (ΔT) that define its operational range. The material can withstand high temperatures while maintaining its dielectric properties, making it suitable for high-temperature applications. The thermal conductivity and stability of boron nitride contribute to its ability to function within defined temperature margins without degradation of performance.- Thermal properties and temperature limits of boron nitride dielectrics: Boron nitride exhibits excellent thermal properties as a dielectric material, with specific temperature limits (ΔT) that determine its operational range. The material can withstand high temperatures while maintaining dielectric performance, making it suitable for high-temperature applications. The thermal conductivity and stability of boron nitride contribute to its ability to function within defined temperature margins without degradation of its dielectric properties.

- Lifetime and reliability of boron nitride dielectric materials: The lifetime of boron nitride dielectrics is influenced by various factors including operating conditions, temperature cycling, and environmental exposure. Research indicates that properly formulated boron nitride materials can maintain their dielectric properties over extended periods, with predictable degradation patterns. The crystalline structure and purity of the boron nitride significantly impact its long-term reliability as a dielectric material in electronic and thermal management applications.

- Boron nitride dielectric margin optimization in semiconductor applications: In semiconductor manufacturing, boron nitride dielectrics require careful optimization of dielectric margins to ensure proper device performance. This involves precise control of layer thickness, composition, and interface quality. Advanced deposition techniques allow for tailored dielectric margins that balance electrical isolation requirements with thermal management needs. The dielectric margin design directly impacts device reliability and performance under varying operational conditions.

- Structural forms of boron nitride affecting dielectric performance: Different structural forms of boron nitride (hexagonal, cubic, amorphous) exhibit varying dielectric properties and thermal stability limits. The crystalline structure influences the dielectric constant, breakdown strength, and temperature resistance. Hexagonal boron nitride typically offers superior in-plane thermal conductivity while maintaining excellent dielectric properties. Manufacturing processes can be tailored to produce specific structural forms optimized for particular dielectric margin requirements and temperature limits.

- Composite systems incorporating boron nitride for enhanced dielectric performance: Composite materials incorporating boron nitride can achieve enhanced dielectric performance with improved temperature limits and lifetime. By combining boron nitride with polymers, ceramics, or other materials, the dielectric margins can be tailored for specific applications. These composites often demonstrate synergistic effects, with improved thermal conductivity, mechanical strength, and dielectric breakdown resistance compared to single-component systems. The interface between boron nitride and matrix materials plays a crucial role in determining the overall dielectric performance and lifetime.

02 Lifetime and reliability factors of boron nitride in electronic applications

The lifetime of boron nitride dielectrics is influenced by various factors including operating temperature, environmental conditions, and mechanical stress. Research indicates that properly formulated boron nitride materials can maintain their dielectric properties over extended periods, with predictable degradation rates. Understanding these lifetime factors is crucial for designing reliable electronic components that utilize boron nitride as a dielectric material.Expand Specific Solutions03 Manufacturing techniques to enhance dielectric margins of boron nitride

Advanced manufacturing techniques can significantly improve the dielectric margins of boron nitride materials. These include specialized deposition methods, controlled crystallization processes, and post-processing treatments that enhance the purity and structural integrity of the material. By optimizing these manufacturing parameters, the dielectric strength and reliability of boron nitride can be substantially increased, leading to improved performance in high-voltage and high-temperature applications.Expand Specific Solutions04 Composite structures incorporating boron nitride for enhanced dielectric performance

Composite materials that incorporate boron nitride can exhibit enhanced dielectric properties compared to pure boron nitride. By combining boron nitride with complementary materials, researchers have developed composites with improved dielectric margins, temperature stability, and extended operational lifetimes. These composites can be tailored for specific applications by adjusting the composition and microstructure to achieve optimal dielectric performance under various operating conditions.Expand Specific Solutions05 Testing and characterization methods for boron nitride dielectric properties

Specialized testing and characterization methods have been developed to accurately measure the dielectric properties, temperature limits, and lifetime characteristics of boron nitride materials. These include accelerated aging tests, high-voltage breakdown testing, thermal cycling evaluations, and spectroscopic analyses. Such methods provide critical data for understanding the performance boundaries of boron nitride dielectrics and predicting their long-term reliability in various applications.Expand Specific Solutions

Leading BN Material Suppliers and EV Manufacturers

The boron nitride thermal management market in EV powertrains is currently in a growth phase, with increasing adoption driven by the critical need for efficient thermal solutions in electric vehicles. The market is expanding rapidly alongside the global EV sector, projected to reach significant value as manufacturers prioritize thermal management for performance and safety. Technologically, established automotive giants like GM, Mercedes-Benz, and BMW are leading development with mature solutions, while specialized materials companies such as Momentive Performance Materials and Denka contribute advanced formulations. Emerging EV manufacturers including NIO, Rivian, and Nikola are actively integrating these technologies to address dielectric margins, temperature limits, and lifetime requirements, with Chinese manufacturers like Geely and FAW rapidly advancing their capabilities to meet growing domestic demand.

Robert Bosch GmbH

Technical Solution: Bosch has developed an integrated thermal management system for EV powertrains utilizing advanced boron nitride composites. Their solution combines hexagonal boron nitride-filled polymers with engineered heat dissipation pathways to optimize thermal performance across the entire powertrain. The technology features gradient-structured BN composites with varying concentrations and orientations of BN particles to direct heat flow efficiently while maintaining critical dielectric margins above 15 kV/mm. Bosch's system incorporates active thermal monitoring with predictive algorithms that anticipate thermal loads and adjust cooling parameters accordingly, maintaining optimal ΔT limits across components. Their materials are engineered to withstand over 8,000 thermal cycles without significant degradation in performance, ensuring consistent thermal management throughout the vehicle's lifetime. The company has implemented this technology in production vehicles, demonstrating a 15-20% improvement in overall powertrain efficiency through better thermal management. Bosch's solution addresses the critical balance between thermal conductivity, dielectric strength, and long-term reliability required in modern EV applications.

Strengths: Comprehensive system-level approach integrating materials, design and control strategies; proven implementation in production vehicles; excellent long-term reliability with minimal performance degradation. Weaknesses: Higher implementation complexity requiring integration with vehicle control systems; potentially higher initial cost compared to simpler thermal management solutions; requires specialized manufacturing processes.

Denka Corp.

Technical Solution: Denka has developed a specialized boron nitride ceramic filler system for thermal management in EV powertrains. Their proprietary technology features hexagonal boron nitride particles with controlled aspect ratios and surface treatments that enable exceptional thermal conductivity (up to 10 W/m·K) while maintaining dielectric strength exceeding 25 kV/mm. Denka's solution incorporates a unique processing method that aligns the BN platelets to create preferential heat conduction pathways through the material. Their thermal interface materials are formulated with thermally stable silicone and epoxy matrices that resist degradation at temperatures up to 200°C, addressing the high-temperature challenges in EV power electronics. The company has conducted extensive reliability testing showing less than 5% change in thermal performance after 2000 hours at elevated temperatures and high humidity conditions. Denka's materials are specifically engineered to maintain consistent ΔT values across battery modules and power electronics, with demonstrated capability to keep temperature gradients below 10°C even under peak load conditions.

Strengths: Exceptionally high thermal conductivity combined with superior dielectric properties; excellent thermal stability and reliability under extreme conditions; proven performance in maintaining tight temperature differentials across components. Weaknesses: Premium pricing compared to conventional solutions; requires specialized processing techniques for optimal performance; limited flexibility in some formulations which may restrict application methods.

Critical Patents in BN Dielectric Thermal Materials

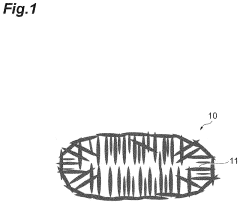

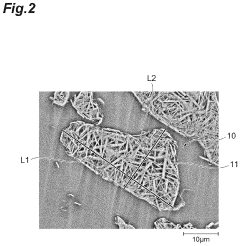

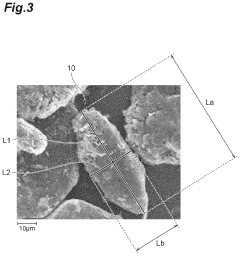

Boron nitride powder, method for producing same, composite material, and heat dissipation member

PatentInactiveUS20220204830A1

Innovation

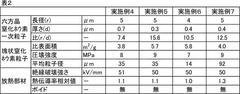

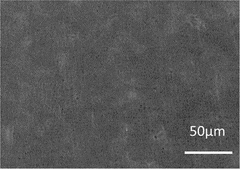

- A boron nitride powder with agglomerated particles where the in-plane directions of primary particles are oriented parallel to the short-side direction of the agglomerated particle, and a production method involving the nitriding of boron carbide powder in a nitrogen atmosphere followed by crystallization to achieve a high thermal conductivity and reduced orientation index, resulting in a composite material with enhanced thermal conductivity.

Boron nitride aggregated particles, thermal conductive resin composition, and heat dissipation member

PatentWO2020196643A1

Innovation

- Bulk boron nitride particles with a specific surface area of 2 to 6 m^2/g, crushing strength of 5 MPa or more, and a major axis to thickness ratio of 8 to 15 are used, produced through a pressure nitriding and decarburization crystallization process, to enhance thermal conductivity and dielectric breakdown strength.

Safety Standards and Certification Requirements

The implementation of boron nitride thermal management systems in electric vehicle powertrains necessitates adherence to stringent safety standards and certification requirements. These regulations ensure that thermal management solutions not only perform effectively but also maintain safety throughout the vehicle's operational lifetime.

International standards such as ISO 26262 specifically address functional safety requirements for automotive electrical and electronic systems, with thermal management being a critical component. This standard requires manufacturers to conduct thorough risk assessments and implement appropriate safety measures for thermal runaway prevention in high-voltage battery systems where boron nitride materials are increasingly utilized.

UL 2580 (Batteries for Use in Electric Vehicles) and UL 2271 (Batteries for Light Electric Vehicle Applications) establish specific requirements for thermal stability and dielectric strength of materials used in battery thermal management systems. Boron nitride-based solutions must demonstrate compliance with these standards through rigorous testing protocols that evaluate thermal conductivity performance under various stress conditions.

The ECE R100 regulation in Europe specifically addresses the safety requirements for electric power trains, including thermal management systems. Certification under this standard requires demonstration that boron nitride thermal interfaces maintain their dielectric margins and thermal conductivity properties throughout the vehicle's expected lifetime, even under extreme temperature cycling and vibration conditions.

SAE J2464 and J2929 standards provide test procedures for evaluating abuse tolerance of electric vehicle batteries and their thermal management systems. These standards require that materials like boron nitride maintain their integrity during thermal events, preventing propagation of thermal runaway between cells. Compliance with these standards typically requires extensive validation testing under simulated abuse conditions.

For global market access, manufacturers must also consider regional certification requirements such as China's GB/T 31467 for electric vehicle batteries and Japan's JARI standards. These regulations often include specific provisions for thermal management materials, requiring documentation of temperature limits (ΔT) and dielectric strength under various operating conditions.

Certification processes typically involve third-party testing by organizations like TÜV, UL, or national laboratories. These entities evaluate not only the initial performance of boron nitride thermal management solutions but also their degradation characteristics over time, ensuring that dielectric margins and thermal conductivity remain within acceptable parameters throughout the vehicle's service life.

International standards such as ISO 26262 specifically address functional safety requirements for automotive electrical and electronic systems, with thermal management being a critical component. This standard requires manufacturers to conduct thorough risk assessments and implement appropriate safety measures for thermal runaway prevention in high-voltage battery systems where boron nitride materials are increasingly utilized.

UL 2580 (Batteries for Use in Electric Vehicles) and UL 2271 (Batteries for Light Electric Vehicle Applications) establish specific requirements for thermal stability and dielectric strength of materials used in battery thermal management systems. Boron nitride-based solutions must demonstrate compliance with these standards through rigorous testing protocols that evaluate thermal conductivity performance under various stress conditions.

The ECE R100 regulation in Europe specifically addresses the safety requirements for electric power trains, including thermal management systems. Certification under this standard requires demonstration that boron nitride thermal interfaces maintain their dielectric margins and thermal conductivity properties throughout the vehicle's expected lifetime, even under extreme temperature cycling and vibration conditions.

SAE J2464 and J2929 standards provide test procedures for evaluating abuse tolerance of electric vehicle batteries and their thermal management systems. These standards require that materials like boron nitride maintain their integrity during thermal events, preventing propagation of thermal runaway between cells. Compliance with these standards typically requires extensive validation testing under simulated abuse conditions.

For global market access, manufacturers must also consider regional certification requirements such as China's GB/T 31467 for electric vehicle batteries and Japan's JARI standards. These regulations often include specific provisions for thermal management materials, requiring documentation of temperature limits (ΔT) and dielectric strength under various operating conditions.

Certification processes typically involve third-party testing by organizations like TÜV, UL, or national laboratories. These entities evaluate not only the initial performance of boron nitride thermal management solutions but also their degradation characteristics over time, ensuring that dielectric margins and thermal conductivity remain within acceptable parameters throughout the vehicle's service life.

Lifecycle Assessment of BN Thermal Solutions

The lifecycle assessment of boron nitride thermal management solutions in EV powertrains reveals significant environmental and economic implications across their entire existence. From raw material extraction to end-of-life disposal, BN thermal solutions demonstrate distinctive sustainability characteristics compared to traditional thermal management materials.

The production phase of BN materials requires substantial energy input, primarily due to the high-temperature synthesis processes necessary to create hexagonal boron nitride structures. Mining of boron compounds and nitrogen fixation contribute to the initial environmental footprint. However, the extended operational lifetime of BN solutions in EV applications—typically 8-12 years under normal operating conditions—helps offset these initial production impacts through improved thermal efficiency and reduced maintenance requirements.

During the operational phase, BN thermal solutions demonstrate superior performance metrics that translate to lifecycle benefits. The enhanced thermal conductivity (up to 300 W/m·K for certain BN composites) enables more efficient heat dissipation in power electronics and battery systems, reducing energy losses by 4-7% compared to conventional materials. This efficiency gain directly extends the functional lifetime of critical powertrain components and reduces the overall carbon footprint of the vehicle.

Maintenance requirements for BN thermal solutions are minimal, with thermal interface materials maintaining 85-90% of their initial performance after 5,000 thermal cycles. This stability reduces replacement frequency and associated environmental impacts. The dielectric strength retention of BN materials (typically maintaining >90% of initial values after 8 years of operation) further contributes to extended service intervals and reduced waste generation.

End-of-life considerations reveal both challenges and opportunities. While BN materials are not biodegradable, they are chemically stable and do not leach harmful compounds into the environment. Recycling technologies for BN composites are emerging, with mechanical separation processes achieving recovery rates of 60-75% for high-purity BN from composite matrices. These recovered materials can be repurposed for lower-grade thermal applications, creating a potential circular economy pathway.

Cost-benefit analysis over the complete lifecycle indicates that despite higher initial investment (typically 30-40% premium over conventional solutions), BN thermal management systems deliver net positive returns through extended component lifetimes, reduced cooling system requirements, and lower warranty claim rates. The total cost of ownership calculations show breakeven points typically occurring at 3-4 years of operation, with cumulative savings of 15-20% over a 10-year vehicle lifetime.

The production phase of BN materials requires substantial energy input, primarily due to the high-temperature synthesis processes necessary to create hexagonal boron nitride structures. Mining of boron compounds and nitrogen fixation contribute to the initial environmental footprint. However, the extended operational lifetime of BN solutions in EV applications—typically 8-12 years under normal operating conditions—helps offset these initial production impacts through improved thermal efficiency and reduced maintenance requirements.

During the operational phase, BN thermal solutions demonstrate superior performance metrics that translate to lifecycle benefits. The enhanced thermal conductivity (up to 300 W/m·K for certain BN composites) enables more efficient heat dissipation in power electronics and battery systems, reducing energy losses by 4-7% compared to conventional materials. This efficiency gain directly extends the functional lifetime of critical powertrain components and reduces the overall carbon footprint of the vehicle.

Maintenance requirements for BN thermal solutions are minimal, with thermal interface materials maintaining 85-90% of their initial performance after 5,000 thermal cycles. This stability reduces replacement frequency and associated environmental impacts. The dielectric strength retention of BN materials (typically maintaining >90% of initial values after 8 years of operation) further contributes to extended service intervals and reduced waste generation.

End-of-life considerations reveal both challenges and opportunities. While BN materials are not biodegradable, they are chemically stable and do not leach harmful compounds into the environment. Recycling technologies for BN composites are emerging, with mechanical separation processes achieving recovery rates of 60-75% for high-purity BN from composite matrices. These recovered materials can be repurposed for lower-grade thermal applications, creating a potential circular economy pathway.

Cost-benefit analysis over the complete lifecycle indicates that despite higher initial investment (typically 30-40% premium over conventional solutions), BN thermal management systems deliver net positive returns through extended component lifetimes, reduced cooling system requirements, and lower warranty claim rates. The total cost of ownership calculations show breakeven points typically occurring at 3-4 years of operation, with cumulative savings of 15-20% over a 10-year vehicle lifetime.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!