Boron Nitride Vs Silicon Carbide For Substrates: Thermal Conductivity, Breakdown And Reliability

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

BN vs SiC Substrate Technology Background and Objectives

The evolution of semiconductor technology has been marked by continuous innovation in substrate materials, with silicon (Si) dominating the market for decades. However, as electronic devices push toward higher power densities, faster switching speeds, and operation in harsh environments, traditional silicon substrates face fundamental physical limitations. This has driven research into wide bandgap (WBG) materials, with Silicon Carbide (SiC) emerging as a commercial success in recent years. Concurrently, Boron Nitride (BN), particularly in its hexagonal (h-BN) and cubic (c-BN) forms, has gained significant attention as a potential next-generation substrate material.

The technological trajectory of substrate materials has evolved from focusing primarily on electrical properties to a more holistic consideration of thermal management, breakdown performance, and long-term reliability. This shift reflects the changing demands of applications in power electronics, RF devices, and high-temperature electronics, where operational stability under extreme conditions is paramount.

SiC technology has matured considerably over the past two decades, transitioning from research laboratories to commercial production. Its wide bandgap (3.2 eV for 4H-SiC) and excellent thermal conductivity (approximately 370-490 W/m·K) have established it as the substrate of choice for many high-power applications. The market adoption curve for SiC has accelerated, particularly in automotive, industrial, and renewable energy sectors.

BN, while less commercially developed than SiC, presents intriguing properties that could potentially surpass SiC in specific applications. Hexagonal BN offers exceptional thermal conductivity (up to 2000 W/m·K in-plane), while cubic BN exhibits a wider bandgap (6.4 eV) than SiC, suggesting superior breakdown performance. These characteristics position BN as a compelling research focus for next-generation electronic substrates.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of BN and SiC as substrate materials, with specific emphasis on three critical parameters: thermal conductivity, breakdown performance, and reliability. This analysis aims to identify the optimal application domains for each material and to forecast technological development trajectories over the next 5-10 years.

Additionally, this research seeks to evaluate the manufacturing scalability and economic viability of BN substrates compared to the more established SiC technology. Current challenges in BN substrate production, including crystal growth, defect control, and wafer processing, will be examined against the backdrop of SiC's manufacturing ecosystem, which has benefited from significant industrial investment and process optimization.

The findings from this comparative analysis will inform strategic R&D investments, guide material selection for next-generation electronic devices, and identify potential technological breakthroughs that could alter the competitive landscape between these two promising substrate materials.

The technological trajectory of substrate materials has evolved from focusing primarily on electrical properties to a more holistic consideration of thermal management, breakdown performance, and long-term reliability. This shift reflects the changing demands of applications in power electronics, RF devices, and high-temperature electronics, where operational stability under extreme conditions is paramount.

SiC technology has matured considerably over the past two decades, transitioning from research laboratories to commercial production. Its wide bandgap (3.2 eV for 4H-SiC) and excellent thermal conductivity (approximately 370-490 W/m·K) have established it as the substrate of choice for many high-power applications. The market adoption curve for SiC has accelerated, particularly in automotive, industrial, and renewable energy sectors.

BN, while less commercially developed than SiC, presents intriguing properties that could potentially surpass SiC in specific applications. Hexagonal BN offers exceptional thermal conductivity (up to 2000 W/m·K in-plane), while cubic BN exhibits a wider bandgap (6.4 eV) than SiC, suggesting superior breakdown performance. These characteristics position BN as a compelling research focus for next-generation electronic substrates.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of BN and SiC as substrate materials, with specific emphasis on three critical parameters: thermal conductivity, breakdown performance, and reliability. This analysis aims to identify the optimal application domains for each material and to forecast technological development trajectories over the next 5-10 years.

Additionally, this research seeks to evaluate the manufacturing scalability and economic viability of BN substrates compared to the more established SiC technology. Current challenges in BN substrate production, including crystal growth, defect control, and wafer processing, will be examined against the backdrop of SiC's manufacturing ecosystem, which has benefited from significant industrial investment and process optimization.

The findings from this comparative analysis will inform strategic R&D investments, guide material selection for next-generation electronic devices, and identify potential technological breakthroughs that could alter the competitive landscape between these two promising substrate materials.

Market Analysis for Wide Bandgap Semiconductor Substrates

The wide bandgap semiconductor substrate market has experienced significant growth in recent years, driven by increasing demand for high-performance electronic devices across multiple industries. The global market for wide bandgap semiconductor substrates was valued at approximately $1.2 billion in 2022 and is projected to reach $3.5 billion by 2028, representing a compound annual growth rate (CAGR) of 19.6% during the forecast period.

Silicon Carbide (SiC) currently dominates the wide bandgap substrate market, accounting for roughly 65% of market share. This dominance is primarily due to its established manufacturing ecosystem and relatively mature supply chain. The SiC substrate market has been growing at 25% annually, largely driven by electric vehicle applications where its thermal properties and reliability offer significant advantages over traditional silicon.

Boron Nitride (BN) substrates, particularly hexagonal Boron Nitride (h-BN), represent a smaller but rapidly growing segment of the market. While currently accounting for less than 10% of the wide bandgap substrate market, BN substrates are experiencing accelerated adoption with a growth rate exceeding 30% annually, albeit from a smaller base.

The automotive sector constitutes the largest end-user market for these substrates, representing approximately 38% of total demand. Power electronics applications in electric vehicles particularly benefit from the superior thermal conductivity and breakdown performance of both SiC and BN substrates. The telecommunications sector follows at 27%, with aerospace and defense applications accounting for 18% of market demand.

Regional analysis reveals that Asia-Pacific dominates the market with 45% share, led by Japan and China's aggressive investments in semiconductor manufacturing capabilities. North America accounts for 30% of the market, while Europe represents 20%, with the remaining 5% distributed across other regions.

Key market drivers include the rapid expansion of electric vehicle production, increasing deployment of 5G infrastructure, growing demand for high-efficiency power electronics, and the push toward miniaturization of electronic components. The superior thermal conductivity of both SiC and BN substrates makes them particularly valuable in these high-power density applications.

Market challenges include high production costs, limited manufacturing capacity, and technical difficulties in producing large-diameter wafers with consistent quality. The average cost of SiC substrates remains 3-4 times higher than traditional silicon, while BN substrates can command premiums of 5-10 times depending on quality and specifications.

Silicon Carbide (SiC) currently dominates the wide bandgap substrate market, accounting for roughly 65% of market share. This dominance is primarily due to its established manufacturing ecosystem and relatively mature supply chain. The SiC substrate market has been growing at 25% annually, largely driven by electric vehicle applications where its thermal properties and reliability offer significant advantages over traditional silicon.

Boron Nitride (BN) substrates, particularly hexagonal Boron Nitride (h-BN), represent a smaller but rapidly growing segment of the market. While currently accounting for less than 10% of the wide bandgap substrate market, BN substrates are experiencing accelerated adoption with a growth rate exceeding 30% annually, albeit from a smaller base.

The automotive sector constitutes the largest end-user market for these substrates, representing approximately 38% of total demand. Power electronics applications in electric vehicles particularly benefit from the superior thermal conductivity and breakdown performance of both SiC and BN substrates. The telecommunications sector follows at 27%, with aerospace and defense applications accounting for 18% of market demand.

Regional analysis reveals that Asia-Pacific dominates the market with 45% share, led by Japan and China's aggressive investments in semiconductor manufacturing capabilities. North America accounts for 30% of the market, while Europe represents 20%, with the remaining 5% distributed across other regions.

Key market drivers include the rapid expansion of electric vehicle production, increasing deployment of 5G infrastructure, growing demand for high-efficiency power electronics, and the push toward miniaturization of electronic components. The superior thermal conductivity of both SiC and BN substrates makes them particularly valuable in these high-power density applications.

Market challenges include high production costs, limited manufacturing capacity, and technical difficulties in producing large-diameter wafers with consistent quality. The average cost of SiC substrates remains 3-4 times higher than traditional silicon, while BN substrates can command premiums of 5-10 times depending on quality and specifications.

Current Challenges in BN and SiC Substrate Development

Despite significant advancements in both Boron Nitride (BN) and Silicon Carbide (SiC) substrate technologies, several critical challenges persist that impede their widespread adoption and optimal performance. For BN substrates, the primary obstacle remains the difficulty in growing large-area, high-quality single crystals. Current manufacturing processes struggle to produce BN substrates exceeding 2 inches in diameter with consistent quality, severely limiting their application in large-scale electronic devices.

The synthesis of high-purity hexagonal BN (h-BN) faces considerable technical barriers, particularly in controlling defect density and ensuring crystallographic uniformity. Point defects and grain boundaries significantly compromise thermal conductivity, reducing it from theoretical values of approximately 2000 W/mK to practical measurements of 200-400 W/mK in commercially available substrates.

For SiC substrates, micropipe defects continue to be a persistent issue despite decades of research. These tubular voids running perpendicular to the substrate surface act as breakdown initiation sites, substantially reducing the effective breakdown voltage from theoretical limits of 3-4 MV/cm to practical values of 1-2 MV/cm in many commercial substrates.

Thermal management presents another significant challenge for SiC. While its thermal conductivity (approximately 370-490 W/mK) exceeds that of silicon, it still falls short of theoretical predictions due to phonon scattering at crystal imperfections. The presence of basal plane dislocations and stacking faults further compromises reliability under high-temperature operation, leading to premature device failure.

Cost factors remain prohibitive for both materials. Current SiC substrate production costs are 5-10 times higher than silicon, while high-quality BN substrates can be 20-50 times more expensive, significantly limiting their commercial viability for many applications. The complex manufacturing processes, low yields, and specialized equipment requirements contribute substantially to these elevated costs.

Interface engineering presents additional challenges, particularly for BN substrates. Creating reliable, low-resistance ohmic contacts and stable dielectric interfaces has proven difficult due to BN's wide bandgap and chemical inertness. This complicates device integration and reduces overall system reliability.

Environmental stability under extreme conditions remains problematic for both materials. While SiC demonstrates excellent high-temperature stability in oxidizing environments, its performance degrades in hydrogen-rich atmospheres above 600°C. Conversely, BN exhibits superior chemical resistance but can undergo surface degradation when exposed to water vapor at elevated temperatures, affecting long-term reliability.

The synthesis of high-purity hexagonal BN (h-BN) faces considerable technical barriers, particularly in controlling defect density and ensuring crystallographic uniformity. Point defects and grain boundaries significantly compromise thermal conductivity, reducing it from theoretical values of approximately 2000 W/mK to practical measurements of 200-400 W/mK in commercially available substrates.

For SiC substrates, micropipe defects continue to be a persistent issue despite decades of research. These tubular voids running perpendicular to the substrate surface act as breakdown initiation sites, substantially reducing the effective breakdown voltage from theoretical limits of 3-4 MV/cm to practical values of 1-2 MV/cm in many commercial substrates.

Thermal management presents another significant challenge for SiC. While its thermal conductivity (approximately 370-490 W/mK) exceeds that of silicon, it still falls short of theoretical predictions due to phonon scattering at crystal imperfections. The presence of basal plane dislocations and stacking faults further compromises reliability under high-temperature operation, leading to premature device failure.

Cost factors remain prohibitive for both materials. Current SiC substrate production costs are 5-10 times higher than silicon, while high-quality BN substrates can be 20-50 times more expensive, significantly limiting their commercial viability for many applications. The complex manufacturing processes, low yields, and specialized equipment requirements contribute substantially to these elevated costs.

Interface engineering presents additional challenges, particularly for BN substrates. Creating reliable, low-resistance ohmic contacts and stable dielectric interfaces has proven difficult due to BN's wide bandgap and chemical inertness. This complicates device integration and reduces overall system reliability.

Environmental stability under extreme conditions remains problematic for both materials. While SiC demonstrates excellent high-temperature stability in oxidizing environments, its performance degrades in hydrogen-rich atmospheres above 600°C. Conversely, BN exhibits superior chemical resistance but can undergo surface degradation when exposed to water vapor at elevated temperatures, affecting long-term reliability.

Comparative Technical Solutions for Thermal Management

01 Thermal conductivity properties of BN and SiC substrates

Boron Nitride (BN) and Silicon Carbide (SiC) substrates exhibit excellent thermal conductivity properties, making them suitable for high-temperature applications. These materials efficiently dissipate heat, which is crucial for electronic devices operating under thermal stress. The crystalline structure and purity of these substrates significantly influence their thermal conductivity performance, with higher quality materials showing superior heat transfer capabilities.- Thermal conductivity properties of BN and SiC substrates: Boron Nitride (BN) and Silicon Carbide (SiC) substrates exhibit excellent thermal conductivity properties, making them suitable for high-temperature applications. These materials efficiently dissipate heat, which is crucial for electronic devices operating under thermal stress. The crystalline structure and purity of these substrates significantly influence their thermal conductivity performance, with higher crystallinity generally resulting in better heat transfer capabilities.

- Electrical breakdown performance of semiconductor substrates: The electrical breakdown performance of BN and SiC substrates is characterized by their high breakdown voltage and resistance to electrical failure under extreme conditions. These materials maintain their electrical properties at high voltages, making them ideal for power electronics applications. The breakdown strength is influenced by factors such as crystal defects, impurities, and structural integrity, with engineered substrates showing enhanced performance through controlled doping and defect management.

- Reliability and long-term stability of BN and SiC materials: BN and SiC substrates demonstrate exceptional reliability and long-term stability under harsh operating conditions, including high temperatures, mechanical stress, and chemical exposure. These materials maintain their structural integrity and functional properties over extended periods, reducing device failure rates. The reliability is enhanced through advanced manufacturing techniques that minimize defects and optimize material composition, resulting in substrates that can withstand thermal cycling and environmental stressors.

- Fabrication methods affecting substrate performance: Various fabrication methods significantly impact the performance characteristics of BN and SiC substrates. Techniques such as chemical vapor deposition, hot pressing, and sintering influence the microstructure, purity, and defect density of these materials. Advanced processing methods can enhance thermal conductivity and breakdown performance by controlling grain size, orientation, and boundary interfaces. Post-processing treatments, including annealing and surface modification, further optimize the electrical and thermal properties of these semiconductor substrates.

- Composite and hybrid substrate structures: Composite and hybrid structures combining BN and SiC with other materials offer enhanced performance characteristics compared to single-material substrates. These engineered substrates can be tailored to specific applications by optimizing the ratio and arrangement of constituent materials. Layered structures and graded compositions provide balanced thermal and electrical properties while addressing challenges such as thermal expansion mismatch. The integration of these materials with metals, ceramics, or polymers creates multifunctional substrates with improved reliability and performance in extreme environments.

02 Electrical breakdown performance of semiconductor substrates

The electrical breakdown performance of BN and SiC substrates is characterized by their high breakdown voltage and resistance to electrical failure under extreme conditions. These materials can withstand strong electric fields without degradation, making them ideal for high-power electronic applications. The breakdown strength is influenced by factors such as crystal orientation, defect density, and doping concentration, with properly engineered substrates showing enhanced reliability in high-voltage environments.Expand Specific Solutions03 Reliability and long-term stability of BN and SiC materials

BN and SiC substrates demonstrate exceptional reliability and long-term stability under harsh operating conditions, including high temperatures, corrosive environments, and mechanical stress. These materials maintain their structural integrity and electrical properties over extended periods, reducing device failure rates. The reliability is attributed to their strong covalent bonds, chemical inertness, and resistance to thermal cycling, making them suitable for applications requiring sustained performance in extreme environments.Expand Specific Solutions04 Fabrication techniques for high-performance substrates

Advanced fabrication techniques for BN and SiC substrates focus on improving crystal quality, reducing defects, and enhancing thermal and electrical properties. Methods include chemical vapor deposition, physical vapor transport, and hot pressing. Post-processing treatments such as annealing and surface modification further optimize substrate performance. These techniques aim to produce substrates with uniform properties, minimal impurities, and tailored characteristics for specific applications in power electronics and thermal management systems.Expand Specific Solutions05 Composite and hybrid substrate structures

Composite and hybrid structures combining BN and SiC with other materials offer enhanced performance characteristics beyond those of single-material substrates. These engineered substrates can provide optimized thermal conductivity, electrical insulation, and mechanical strength. Layered structures, gradient compositions, and nanocomposites allow for tailored properties to meet specific application requirements. Such hybrid approaches enable better thermal management, improved reliability, and enhanced breakdown performance in advanced electronic devices and power systems.Expand Specific Solutions

Key Manufacturers and Research Institutions in BN/SiC Industry

The Boron Nitride versus Silicon Carbide substrate market is currently in a growth phase, with increasing demand driven by power electronics and high-temperature applications. The global market is expanding rapidly, projected to reach several billion dollars by 2030, fueled by electric vehicle adoption and renewable energy infrastructure. Technologically, Silicon Carbide has achieved greater maturity with companies like Wolfspeed, Sumitomo Electric, and Toshiba leading commercial production, while Boron Nitride remains in earlier development stages with research leadership from National Institute for Materials Science, Kyocera, and Denka. Key industry players are investing heavily in manufacturing capacity expansion, with Japanese and American firms dominating intellectual property, though Chinese institutions like Harbin Institute of Technology are rapidly advancing their research capabilities.

Sumitomo Electric Industries Ltd.

Technical Solution: Sumitomo Electric has developed advanced hexagonal Boron Nitride (h-BN) substrate technology with their proprietary high-temperature, high-pressure synthesis method. Their h-BN substrates achieve thermal conductivity values of approximately 400 W/mK in-plane and 180 W/mK through-plane, offering superior heat dissipation for high-power applications. Sumitomo's h-BN substrates demonstrate exceptional dielectric strength exceeding 10 MV/cm, significantly outperforming SiC in breakdown voltage capability. Their manufacturing process creates h-BN with high purity (>99.9%) and crystallinity, resulting in minimal defect concentrations and enhanced reliability. Sumitomo has also pioneered techniques for creating larger h-BN substrate sizes (up to 2 inches) while maintaining uniform thermal properties across the substrate. Their h-BN technology shows exceptional chemical stability, withstanding temperatures above 1000°C in oxidizing environments with minimal degradation, making it suitable for extreme operating conditions.

Strengths: Superior thermal anisotropy allowing for directional heat management, exceptional dielectric properties, and chemical stability in harsh environments. Weaknesses: Higher production costs and manufacturing complexity compared to SiC, with challenges in scaling to larger wafer sizes needed for commercial semiconductor production.

Toshiba Corp.

Technical Solution: Toshiba has developed a comprehensive substrate technology portfolio encompassing both SiC and BN materials. Their SiC substrate technology features a proprietary defect-reduction process that achieves dislocation densities below 10^3 cm^-2, significantly improving breakdown voltage consistency. Toshiba's SiC substrates demonstrate thermal conductivity of approximately 360-390 W/mK with uniform heat distribution properties. For specialized applications, Toshiba has pioneered cubic Boron Nitride (c-BN) substrate technology with thermal conductivity approaching 740 W/mK, nearly twice that of SiC. Their reliability testing shows SiC substrates maintaining performance through 1000+ thermal cycles between -40°C and 150°C with less than 5% degradation in thermal performance. Toshiba has also developed hybrid substrate architectures that combine SiC with thin BN layers to leverage the benefits of both materials, achieving breakdown field strengths exceeding 3 MV/cm while maintaining the manufacturing advantages of SiC.

Strengths: Diverse substrate technology portfolio allowing application-specific material selection, advanced defect management in SiC, and innovative hybrid substrate approaches. Weaknesses: Their c-BN technology faces significant manufacturing scalability challenges, and the hybrid substrate approach introduces additional interface reliability concerns that require further development.

Critical Patents and Research on BN/SiC Substrate Properties

Silicon carbide fiber having boron nitride layer in fiber surface and process for the production thereof

PatentInactiveUS20050031866A1

Innovation

- A silicon carbide fiber with a boron nitride layer is produced using a process involving modified polycarbosilane and an organic boron compound, where the boron concentration slopes towards the surface, achieving a specific ratio of 0.5-1.5% by weight in the surface region and 0-0.2% in the central region, forming a parallel boron nitride layered structure for improved interfacial bonding and oxidation resistance.

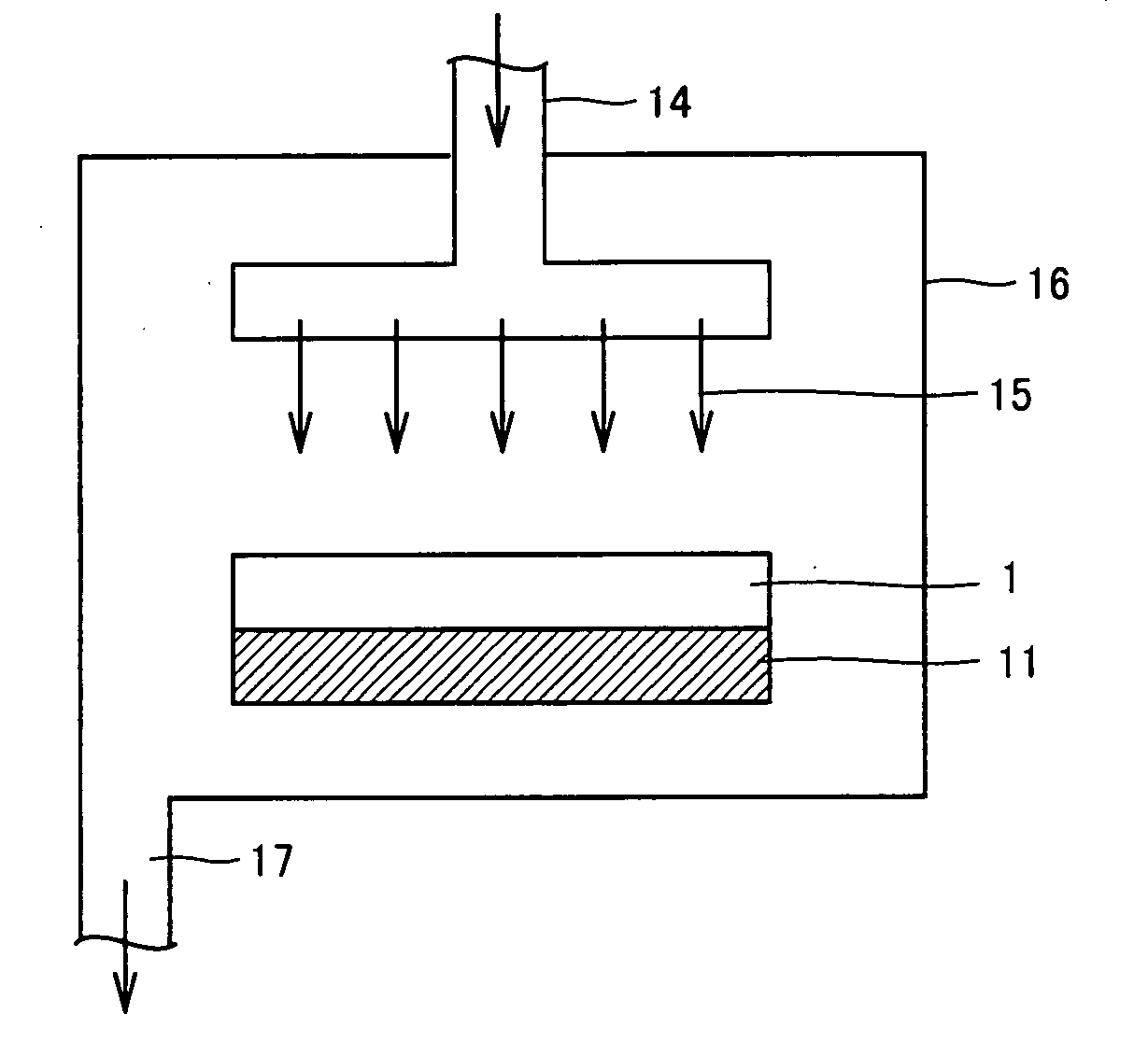

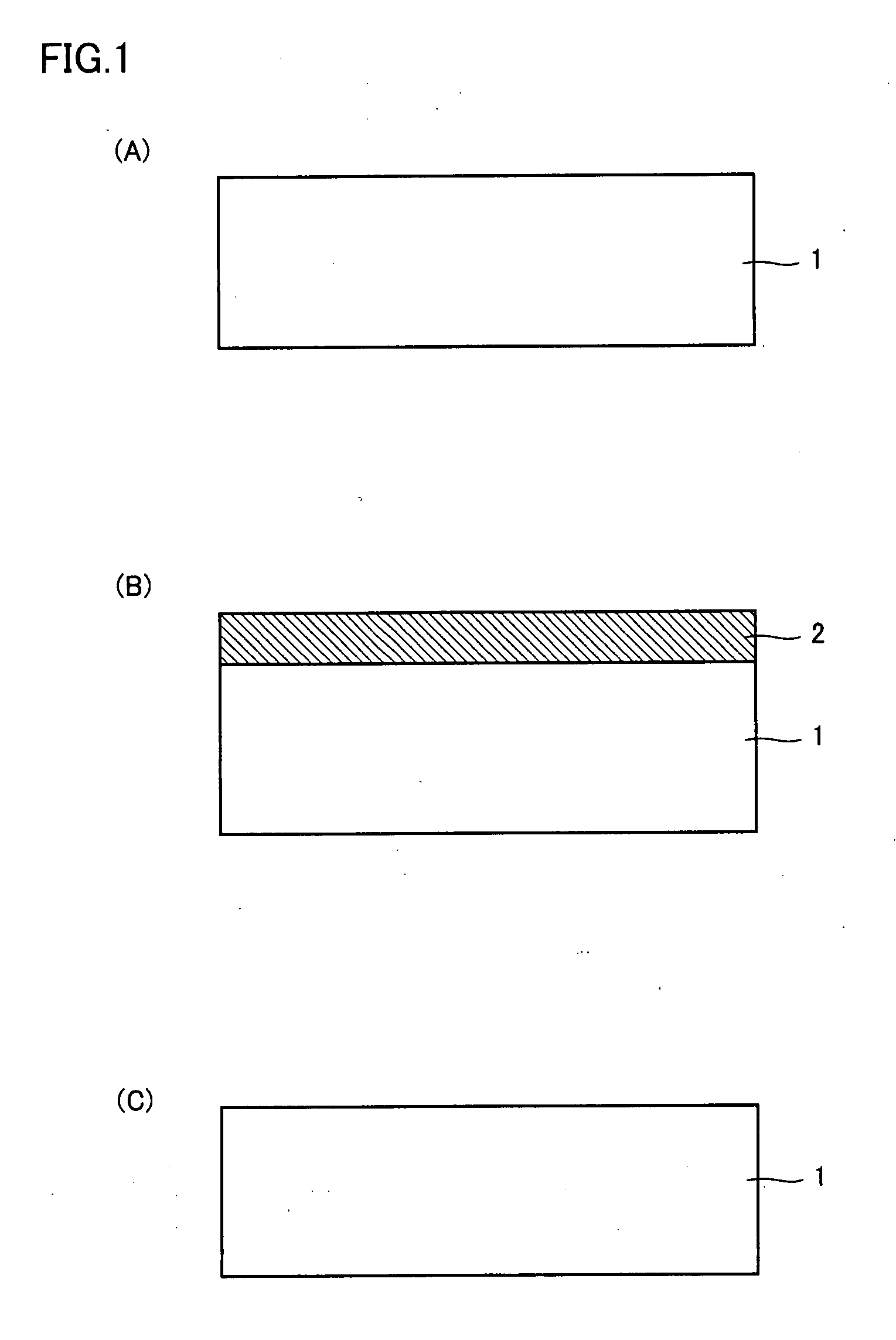

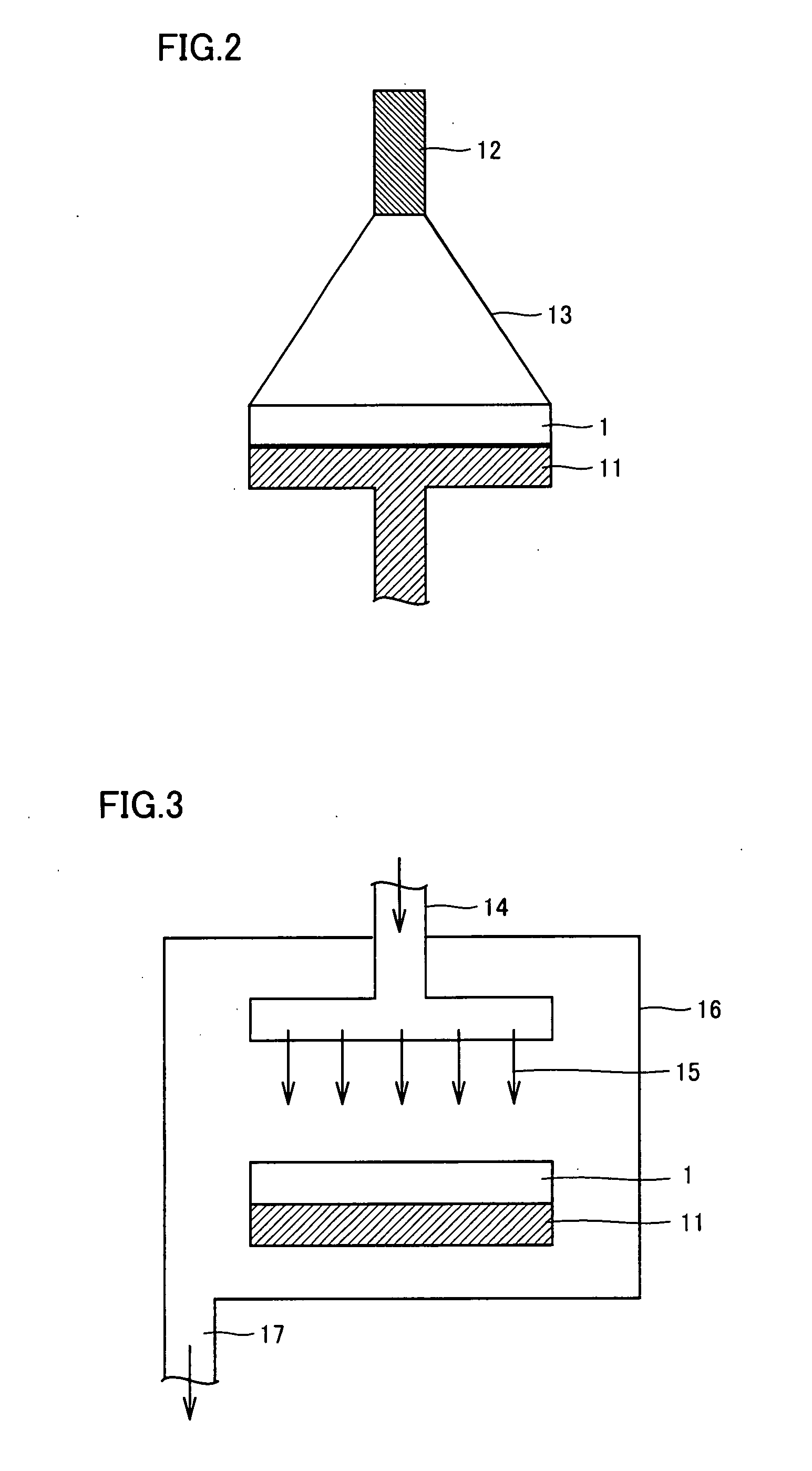

Surface Reconstruction Method for Silicon Carbide Substrate

PatentInactiveUS20080050844A1

Innovation

- A surface reconstruction method involving the formation of a silicon film on the silicon carbide substrate followed by heat treatment without a polycrystalline silicon carbide substrate, allowing for the closure of micropipes without epitaxial growth, using techniques like sputtering or vapor deposition, and optionally forming and removing silicon oxide films.

Supply Chain Analysis for BN and SiC Raw Materials

The supply chain for Boron Nitride (BN) and Silicon Carbide (SiC) materials represents a critical factor in their commercial viability as substrate materials. Both materials face distinct challenges and opportunities in their respective supply chains that directly impact their availability, cost structure, and ultimately their adoption in high-performance electronic applications.

BN raw material production begins with boron sources, primarily borax and boric acid, which are relatively abundant in countries like Turkey, the United States, and Russia. The global boron market is highly concentrated, with approximately 70% controlled by two major producers: Rio Tinto Borax and Eti Maden. This concentration creates potential supply vulnerabilities despite overall resource abundance. The conversion process from raw boron to high-purity hexagonal BN suitable for substrate applications requires sophisticated processing techniques, limiting the number of qualified suppliers globally.

SiC raw material production, by contrast, relies on silica and carbon sources that are widely available globally. However, the production of electronic-grade SiC involves energy-intensive processes requiring temperatures exceeding 2000°C. Major producers include Wolfspeed (formerly Cree), ROHM, and II-VI Incorporated, with significant production capacity in the United States, Japan, and increasingly China. The SiC supply chain benefits from decades of industrial development for abrasives and other applications, providing a more mature infrastructure.

Cost structures differ significantly between the two materials. BN substrate production costs remain high due to limited economies of scale and complex purification requirements to achieve the crystalline quality necessary for electronic applications. SiC benefits from greater production volumes and established manufacturing processes, though high-purity wafer production still commands premium pricing compared to silicon alternatives.

Geopolitical considerations also impact these supply chains differently. BN faces concentration risk with limited production centers, while SiC has a more distributed global manufacturing footprint. Recent initiatives in both the US and EU have identified SiC as a strategically important material for semiconductor sovereignty, resulting in significant investment in domestic production capacity.

Sustainability considerations are increasingly relevant for both materials. SiC production is energy-intensive but benefits from established recycling pathways for manufacturing waste. BN production typically has a lower energy footprint but faces challenges in recycling and recovery of manufacturing byproducts. As environmental regulations tighten globally, these factors may influence the long-term economics and availability of both materials.

BN raw material production begins with boron sources, primarily borax and boric acid, which are relatively abundant in countries like Turkey, the United States, and Russia. The global boron market is highly concentrated, with approximately 70% controlled by two major producers: Rio Tinto Borax and Eti Maden. This concentration creates potential supply vulnerabilities despite overall resource abundance. The conversion process from raw boron to high-purity hexagonal BN suitable for substrate applications requires sophisticated processing techniques, limiting the number of qualified suppliers globally.

SiC raw material production, by contrast, relies on silica and carbon sources that are widely available globally. However, the production of electronic-grade SiC involves energy-intensive processes requiring temperatures exceeding 2000°C. Major producers include Wolfspeed (formerly Cree), ROHM, and II-VI Incorporated, with significant production capacity in the United States, Japan, and increasingly China. The SiC supply chain benefits from decades of industrial development for abrasives and other applications, providing a more mature infrastructure.

Cost structures differ significantly between the two materials. BN substrate production costs remain high due to limited economies of scale and complex purification requirements to achieve the crystalline quality necessary for electronic applications. SiC benefits from greater production volumes and established manufacturing processes, though high-purity wafer production still commands premium pricing compared to silicon alternatives.

Geopolitical considerations also impact these supply chains differently. BN faces concentration risk with limited production centers, while SiC has a more distributed global manufacturing footprint. Recent initiatives in both the US and EU have identified SiC as a strategically important material for semiconductor sovereignty, resulting in significant investment in domestic production capacity.

Sustainability considerations are increasingly relevant for both materials. SiC production is energy-intensive but benefits from established recycling pathways for manufacturing waste. BN production typically has a lower energy footprint but faces challenges in recycling and recovery of manufacturing byproducts. As environmental regulations tighten globally, these factors may influence the long-term economics and availability of both materials.

Environmental Impact and Sustainability Considerations

The environmental impact of semiconductor substrate materials has become increasingly important as the electronics industry faces growing sustainability challenges. When comparing Boron Nitride (BN) and Silicon Carbide (SiC) substrates, their environmental footprints differ significantly throughout their lifecycle, from raw material extraction to end-of-life disposal.

BN substrates demonstrate several environmental advantages. The production of hexagonal Boron Nitride (h-BN) typically requires lower processing temperatures compared to SiC, potentially reducing energy consumption during manufacturing. Additionally, BN is non-toxic and chemically stable, minimizing environmental risks during both production and disposal phases. The excellent thermal conductivity of BN also contributes to energy efficiency in electronic devices, potentially reducing operational carbon footprints.

Conversely, SiC production involves energy-intensive processes requiring temperatures exceeding 2000°C, resulting in substantial carbon emissions. The mining and processing of silicon and carbon precursors also generate significant environmental impacts, including habitat disruption and potential water contamination. However, SiC's exceptional durability and long operational lifetime partially offset these initial environmental costs through extended product lifecycles.

From a resource perspective, boron is less abundant than silicon in Earth's crust, raising potential supply chain sustainability concerns for BN as demand increases. This scarcity could lead to more intensive mining activities with associated environmental degradation. SiC benefits from silicon's relative abundance, though high-purity silicon production remains energy-intensive.

Recycling capabilities represent another critical sustainability factor. Currently, both materials present challenges for end-of-life recovery and reprocessing. The strong chemical bonds in both BN and SiC make them difficult to decompose for material recovery, though research into specialized recycling techniques is advancing.

Water usage during manufacturing also differs between these substrates. SiC production typically requires substantial water for cooling and cleaning processes, while BN manufacturing generally has a lower water footprint. This distinction becomes increasingly significant as water scarcity concerns grow globally.

Looking forward, life cycle assessment (LCA) studies indicate that the environmental advantages of either substrate depend heavily on specific applications and operational conditions. For high-temperature, high-power applications where device efficiency and longevity are paramount, the initial environmental impact of manufacturing may be justified by operational energy savings and extended replacement intervals.

BN substrates demonstrate several environmental advantages. The production of hexagonal Boron Nitride (h-BN) typically requires lower processing temperatures compared to SiC, potentially reducing energy consumption during manufacturing. Additionally, BN is non-toxic and chemically stable, minimizing environmental risks during both production and disposal phases. The excellent thermal conductivity of BN also contributes to energy efficiency in electronic devices, potentially reducing operational carbon footprints.

Conversely, SiC production involves energy-intensive processes requiring temperatures exceeding 2000°C, resulting in substantial carbon emissions. The mining and processing of silicon and carbon precursors also generate significant environmental impacts, including habitat disruption and potential water contamination. However, SiC's exceptional durability and long operational lifetime partially offset these initial environmental costs through extended product lifecycles.

From a resource perspective, boron is less abundant than silicon in Earth's crust, raising potential supply chain sustainability concerns for BN as demand increases. This scarcity could lead to more intensive mining activities with associated environmental degradation. SiC benefits from silicon's relative abundance, though high-purity silicon production remains energy-intensive.

Recycling capabilities represent another critical sustainability factor. Currently, both materials present challenges for end-of-life recovery and reprocessing. The strong chemical bonds in both BN and SiC make them difficult to decompose for material recovery, though research into specialized recycling techniques is advancing.

Water usage during manufacturing also differs between these substrates. SiC production typically requires substantial water for cooling and cleaning processes, while BN manufacturing generally has a lower water footprint. This distinction becomes increasingly significant as water scarcity concerns grow globally.

Looking forward, life cycle assessment (LCA) studies indicate that the environmental advantages of either substrate depend heavily on specific applications and operational conditions. For high-temperature, high-power applications where device efficiency and longevity are paramount, the initial environmental impact of manufacturing may be justified by operational energy savings and extended replacement intervals.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!