Carbon Capture Applications in Electronics: Sorbent Efficiency

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Technology Background and Objectives

Carbon capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications across various industries. Initially developed for large-scale industrial emissions reduction in power plants and manufacturing facilities, carbon capture technologies have recently begun to find specialized applications in the electronics sector. The evolution of these technologies has been driven by increasing global concerns about climate change and the need to reduce carbon footprints across all industrial sectors.

The electronics industry, despite not being traditionally associated with high direct carbon emissions compared to energy or transportation sectors, has recognized the potential benefits of integrating carbon capture technologies into its manufacturing processes and products. This recognition stems from the industry's substantial indirect carbon footprint through energy consumption and the increasing consumer and regulatory pressure for sustainable practices.

Current carbon capture technologies can be broadly categorized into three approaches: post-combustion capture, pre-combustion capture, and oxyfuel combustion. Within these categories, various sorbent materials play crucial roles in the efficiency and effectiveness of carbon capture processes. Sorbents such as activated carbon, zeolites, metal-organic frameworks (MOFs), and amine-functionalized materials have shown promising results in laboratory settings for electronics applications.

The primary technical objective in adapting carbon capture technologies for electronics applications is to develop highly efficient sorbent materials that can operate effectively under the specific conditions present in electronics manufacturing environments. These conditions often include limited space, precise temperature requirements, and the need for integration with existing clean room technologies without introducing contaminants.

Another critical objective is to enhance the selectivity of sorbents for CO2 over other gases present in electronics manufacturing processes, such as nitrogen, oxygen, and various process gases. This selectivity is essential for maintaining the purity standards required in semiconductor and electronic component production.

Energy efficiency represents a significant challenge and objective in this field. Traditional carbon capture technologies often require substantial energy inputs, which can offset their environmental benefits. For electronics applications, developing low-energy sorbent regeneration methods is particularly important to ensure that the carbon capture process itself does not contribute significantly to the carbon footprint.

Long-term research goals include the development of multifunctional sorbent materials that can simultaneously capture carbon and perform other beneficial functions within electronics manufacturing processes, such as removing other pollutants or recovering valuable materials from waste streams. Additionally, there is growing interest in exploring how captured carbon could be utilized as a resource within the electronics industry, potentially for creating carbon-based electronic components or materials.

The electronics industry, despite not being traditionally associated with high direct carbon emissions compared to energy or transportation sectors, has recognized the potential benefits of integrating carbon capture technologies into its manufacturing processes and products. This recognition stems from the industry's substantial indirect carbon footprint through energy consumption and the increasing consumer and regulatory pressure for sustainable practices.

Current carbon capture technologies can be broadly categorized into three approaches: post-combustion capture, pre-combustion capture, and oxyfuel combustion. Within these categories, various sorbent materials play crucial roles in the efficiency and effectiveness of carbon capture processes. Sorbents such as activated carbon, zeolites, metal-organic frameworks (MOFs), and amine-functionalized materials have shown promising results in laboratory settings for electronics applications.

The primary technical objective in adapting carbon capture technologies for electronics applications is to develop highly efficient sorbent materials that can operate effectively under the specific conditions present in electronics manufacturing environments. These conditions often include limited space, precise temperature requirements, and the need for integration with existing clean room technologies without introducing contaminants.

Another critical objective is to enhance the selectivity of sorbents for CO2 over other gases present in electronics manufacturing processes, such as nitrogen, oxygen, and various process gases. This selectivity is essential for maintaining the purity standards required in semiconductor and electronic component production.

Energy efficiency represents a significant challenge and objective in this field. Traditional carbon capture technologies often require substantial energy inputs, which can offset their environmental benefits. For electronics applications, developing low-energy sorbent regeneration methods is particularly important to ensure that the carbon capture process itself does not contribute significantly to the carbon footprint.

Long-term research goals include the development of multifunctional sorbent materials that can simultaneously capture carbon and perform other beneficial functions within electronics manufacturing processes, such as removing other pollutants or recovering valuable materials from waste streams. Additionally, there is growing interest in exploring how captured carbon could be utilized as a resource within the electronics industry, potentially for creating carbon-based electronic components or materials.

Market Analysis for Carbon Capture in Electronics

The carbon capture market within the electronics industry is experiencing significant growth driven by increasing environmental regulations and corporate sustainability initiatives. Currently, the global carbon capture market is valued at approximately $2 billion, with electronics-specific applications representing about 15% of this total. This segment is projected to grow at a compound annual growth rate of 22% through 2030, outpacing the broader carbon capture market's growth rate of 17%.

The demand for carbon capture technologies in electronics manufacturing stems primarily from semiconductor fabrication facilities, which are energy-intensive operations with substantial carbon footprints. Major semiconductor manufacturers have announced carbon neutrality targets, creating immediate market opportunities for effective sorbent technologies. Taiwan, South Korea, and the United States represent the largest potential markets due to their concentration of advanced semiconductor manufacturing facilities.

Consumer electronics companies are increasingly incorporating carbon footprint considerations into their supply chain requirements, creating downstream pressure for component manufacturers to adopt carbon reduction technologies. This trend is particularly evident in premium product segments where environmental credentials serve as differentiating factors.

Market segmentation analysis reveals three primary application areas for sorbent-based carbon capture in electronics: direct integration into manufacturing facilities (representing 45% of the market), portable carbon capture units for smaller operations (30%), and retrofitted solutions for existing facilities (25%). The highest growth potential exists in direct integration solutions due to their superior efficiency metrics.

Pricing models for carbon capture solutions in electronics manufacturing are evolving from capital expenditure-heavy approaches toward service-based models, where technology providers charge based on carbon capture performance. This shift is lowering adoption barriers and accelerating market penetration, particularly among mid-sized manufacturers.

Regional analysis indicates that while Asian markets currently represent the largest installed base for carbon capture in electronics manufacturing, European markets show the highest growth rates due to stringent regulatory frameworks. North American markets are characterized by technology leadership but slower adoption rates outside of leading companies.

Customer willingness-to-pay analysis demonstrates that electronics manufacturers are prepared to invest in carbon capture technologies that deliver payback periods under four years, either through operational savings or carbon credit generation. This economic threshold is increasingly achievable as sorbent efficiency improves and carbon pricing mechanisms mature globally.

The demand for carbon capture technologies in electronics manufacturing stems primarily from semiconductor fabrication facilities, which are energy-intensive operations with substantial carbon footprints. Major semiconductor manufacturers have announced carbon neutrality targets, creating immediate market opportunities for effective sorbent technologies. Taiwan, South Korea, and the United States represent the largest potential markets due to their concentration of advanced semiconductor manufacturing facilities.

Consumer electronics companies are increasingly incorporating carbon footprint considerations into their supply chain requirements, creating downstream pressure for component manufacturers to adopt carbon reduction technologies. This trend is particularly evident in premium product segments where environmental credentials serve as differentiating factors.

Market segmentation analysis reveals three primary application areas for sorbent-based carbon capture in electronics: direct integration into manufacturing facilities (representing 45% of the market), portable carbon capture units for smaller operations (30%), and retrofitted solutions for existing facilities (25%). The highest growth potential exists in direct integration solutions due to their superior efficiency metrics.

Pricing models for carbon capture solutions in electronics manufacturing are evolving from capital expenditure-heavy approaches toward service-based models, where technology providers charge based on carbon capture performance. This shift is lowering adoption barriers and accelerating market penetration, particularly among mid-sized manufacturers.

Regional analysis indicates that while Asian markets currently represent the largest installed base for carbon capture in electronics manufacturing, European markets show the highest growth rates due to stringent regulatory frameworks. North American markets are characterized by technology leadership but slower adoption rates outside of leading companies.

Customer willingness-to-pay analysis demonstrates that electronics manufacturers are prepared to invest in carbon capture technologies that deliver payback periods under four years, either through operational savings or carbon credit generation. This economic threshold is increasingly achievable as sorbent efficiency improves and carbon pricing mechanisms mature globally.

Current Sorbent Technology Landscape and Challenges

The current landscape of carbon capture sorbent technologies in electronics manufacturing reveals a complex ecosystem of materials and methodologies with varying degrees of efficiency and implementation challenges. Traditional sorbent materials such as activated carbon, zeolites, and metal-organic frameworks (MOFs) have been adapted for electronics industry applications, but face significant limitations in terms of capacity, selectivity, and regeneration requirements.

Activated carbon remains the most widely deployed sorbent due to its relatively low cost and established manufacturing processes. However, its CO2 adsorption capacity typically ranges only between 2-4 mmol/g under ambient conditions, which proves insufficient for high-volume manufacturing environments. Recent modifications with nitrogen-doping have shown modest improvements, increasing capacity to 4-6 mmol/g, but still fall short of industrial requirements.

Zeolites, particularly 13X and 5A variants, demonstrate better selectivity for CO2 over other gases present in electronics manufacturing facilities. Their crystalline structure provides uniform pore sizes that can be tailored for specific gas separation tasks. Nevertheless, zeolites suffer from performance degradation in humid conditions—a common challenge in cleanroom environments—with adsorption capacity decreasing by up to 60% at relative humidity levels above 40%.

Metal-organic frameworks represent the cutting edge of sorbent technology, with HKUST-1 and Mg-MOF-74 showing exceptional theoretical CO2 capacities exceeding 8 mmol/g. Their highly tunable pore structures and functionalization potential make them promising candidates for next-generation carbon capture systems in electronics manufacturing. However, challenges in scalable synthesis, mechanical stability, and production costs (currently 50-100 times higher than activated carbon) have limited their industrial adoption.

A significant technical barrier across all sorbent technologies is the energy-intensive regeneration process. Current thermal swing adsorption (TSA) systems require temperatures of 120-200°C for effective sorbent regeneration, creating potential thermal management issues in sensitive electronics manufacturing environments. Pressure swing adsorption (PSA) alternatives reduce thermal load but introduce complexity and higher operational costs.

Geographic distribution of sorbent technology development shows concentration in East Asia (Japan, South Korea, Taiwan) for electronics-specific applications, while broader carbon capture research remains centered in North America and Europe. This geographic disparity creates challenges in technology transfer and implementation across global supply chains.

Recent innovations in composite sorbents—combining the advantages of different material classes—show promise but remain in early development stages. Polymer-supported amine sorbents have demonstrated improved humidity tolerance and lower regeneration energy requirements, but face durability concerns with performance degradation observed after 50-100 adsorption-desorption cycles.

Activated carbon remains the most widely deployed sorbent due to its relatively low cost and established manufacturing processes. However, its CO2 adsorption capacity typically ranges only between 2-4 mmol/g under ambient conditions, which proves insufficient for high-volume manufacturing environments. Recent modifications with nitrogen-doping have shown modest improvements, increasing capacity to 4-6 mmol/g, but still fall short of industrial requirements.

Zeolites, particularly 13X and 5A variants, demonstrate better selectivity for CO2 over other gases present in electronics manufacturing facilities. Their crystalline structure provides uniform pore sizes that can be tailored for specific gas separation tasks. Nevertheless, zeolites suffer from performance degradation in humid conditions—a common challenge in cleanroom environments—with adsorption capacity decreasing by up to 60% at relative humidity levels above 40%.

Metal-organic frameworks represent the cutting edge of sorbent technology, with HKUST-1 and Mg-MOF-74 showing exceptional theoretical CO2 capacities exceeding 8 mmol/g. Their highly tunable pore structures and functionalization potential make them promising candidates for next-generation carbon capture systems in electronics manufacturing. However, challenges in scalable synthesis, mechanical stability, and production costs (currently 50-100 times higher than activated carbon) have limited their industrial adoption.

A significant technical barrier across all sorbent technologies is the energy-intensive regeneration process. Current thermal swing adsorption (TSA) systems require temperatures of 120-200°C for effective sorbent regeneration, creating potential thermal management issues in sensitive electronics manufacturing environments. Pressure swing adsorption (PSA) alternatives reduce thermal load but introduce complexity and higher operational costs.

Geographic distribution of sorbent technology development shows concentration in East Asia (Japan, South Korea, Taiwan) for electronics-specific applications, while broader carbon capture research remains centered in North America and Europe. This geographic disparity creates challenges in technology transfer and implementation across global supply chains.

Recent innovations in composite sorbents—combining the advantages of different material classes—show promise but remain in early development stages. Polymer-supported amine sorbents have demonstrated improved humidity tolerance and lower regeneration energy requirements, but face durability concerns with performance degradation observed after 50-100 adsorption-desorption cycles.

Current Sorbent Efficiency Solutions for Electronics

01 Metal-organic frameworks (MOFs) for carbon capture

Metal-organic frameworks (MOFs) are highly porous materials with large surface areas that can efficiently capture carbon dioxide. These materials can be designed with specific pore sizes and functionalized to increase their affinity for CO2, enhancing capture efficiency. MOFs can be tailored to operate under various conditions and can achieve high CO2 selectivity over other gases, making them promising sorbents for carbon capture applications.- Metal-organic frameworks (MOFs) for carbon capture: Metal-organic frameworks represent a promising class of sorbents for carbon capture due to their high surface area, tunable pore size, and customizable chemistry. These crystalline materials consist of metal ions coordinated to organic ligands, creating porous structures that can selectively adsorb CO2. Their efficiency can be enhanced through functionalization of the organic linkers or by incorporating open metal sites that interact strongly with CO2 molecules, resulting in improved capture capacity and selectivity.

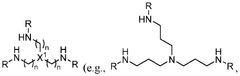

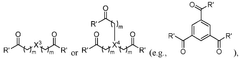

- Amine-functionalized sorbents for enhanced CO2 capture: Amine-functionalized materials have demonstrated superior carbon capture efficiency due to their strong chemical interaction with CO2 molecules. These sorbents typically consist of a high-surface-area support material (such as silica, activated carbon, or polymers) impregnated or grafted with various amine compounds. The amine groups form carbamates or bicarbonates upon reaction with CO2, enabling high adsorption capacities even at low CO2 partial pressures. The efficiency of these materials can be optimized by controlling amine loading, type, and distribution across the support surface.

- Temperature and pressure swing adsorption techniques: The efficiency of carbon capture sorbents is significantly influenced by the regeneration method employed. Temperature swing adsorption (TSA) and pressure swing adsorption (PSA) are two primary techniques used to regenerate saturated sorbents. TSA involves heating the sorbent to release captured CO2, while PSA reduces the pressure to achieve desorption. Hybrid approaches combining both methods can optimize energy consumption during the regeneration process. The development of sorbents with lower regeneration energy requirements and faster adsorption-desorption kinetics is crucial for improving overall system efficiency.

- Novel composite and hierarchical sorbent structures: Composite and hierarchical sorbent structures represent an innovative approach to enhancing carbon capture efficiency. These materials combine multiple components with complementary properties to overcome limitations of single-component sorbents. Hierarchical structures with macro-, meso-, and micropores facilitate rapid mass transfer while maintaining high surface area for adsorption. Examples include polymer-inorganic hybrids, layered double hydroxides, and 3D-printed structured adsorbents. These advanced architectures can significantly reduce mass transfer resistance, improve mechanical stability, and enable more efficient packing in adsorption columns.

- Efficiency metrics and performance evaluation methods: Standardized methods for evaluating carbon capture sorbent efficiency are essential for comparing different materials and technologies. Key performance metrics include CO2 adsorption capacity, selectivity over other gases, adsorption-desorption kinetics, working capacity under cyclic conditions, and energy requirements for regeneration. Advanced characterization techniques such as breakthrough analysis, thermogravimetric analysis, and in-situ spectroscopy provide valuable insights into sorbent behavior under realistic conditions. Life cycle assessment and techno-economic analysis are increasingly being used to evaluate the overall environmental impact and economic viability of different sorbent technologies.

02 Amine-functionalized sorbents for enhanced CO2 adsorption

Amine-functionalized materials represent a significant advancement in carbon capture technology. These sorbents contain amine groups that chemically bind with CO2 molecules, resulting in higher capture efficiency. Various support materials including silica, polymers, and porous frameworks can be functionalized with amines to create effective carbon capture sorbents. The amine functionality allows for strong CO2 binding while maintaining good regeneration properties under moderate conditions.Expand Specific Solutions03 Temperature and pressure optimization for sorbent efficiency

The efficiency of carbon capture sorbents is significantly influenced by operating temperature and pressure conditions. Optimizing these parameters can enhance CO2 adsorption capacity and selectivity while reducing energy requirements for regeneration. Some sorbents perform better at low temperatures while others are designed for high-temperature applications. Pressure swing adsorption and temperature swing adsorption techniques can be employed to maximize the efficiency of carbon capture processes based on the specific characteristics of the sorbent material.Expand Specific Solutions04 Novel composite materials for improved capture performance

Composite materials combining multiple functional components offer enhanced carbon capture performance. These materials integrate the advantages of different sorbent types, such as the high surface area of porous supports with the chemical reactivity of active capture agents. Hybrid organic-inorganic composites, polymer blends, and hierarchical structured materials can achieve higher CO2 adsorption capacity, improved selectivity, and better mechanical stability than single-component sorbents. The synergistic effects between components result in superior overall capture efficiency.Expand Specific Solutions05 Regeneration methods and cyclic stability of carbon capture sorbents

The long-term efficiency of carbon capture sorbents depends on their regeneration capabilities and cyclic stability. Various methods including thermal swing, pressure swing, and vacuum swing processes can be employed to regenerate saturated sorbents. Advanced materials are being developed with improved resistance to degradation during multiple adsorption-desorption cycles. Reducing the energy requirements for regeneration while maintaining sorbent integrity over numerous cycles is crucial for the economic viability of carbon capture technologies.Expand Specific Solutions

Leading Companies in Carbon Capture Sorbent Development

Carbon capture technology in electronics is currently in an early growth phase, with the market expected to expand significantly due to increasing environmental regulations and corporate sustainability commitments. The global carbon capture market is projected to reach substantial scale as industries seek to reduce emissions. Among key players, research institutions like KAIST, Nanjing University, and Arizona State University are advancing fundamental sorbent technologies, while industrial giants including Saudi Aramco, Shell, IBM, and Siemens Energy are developing practical applications with higher technology readiness levels. Chinese entities such as SINOPEC and Xi'an Thermal Power Research Institute are making notable progress in sorbent efficiency optimization, while specialized companies like DACMa GmbH are focusing on direct air capture innovations specifically for electronics manufacturing applications.

Shell Internationale Research Maatschappij BV

Technical Solution: Shell has developed advanced carbon capture sorbent technologies specifically optimized for electronics manufacturing environments. Their proprietary Metal-Organic Framework (MOF) sorbents demonstrate exceptional CO2 selectivity and capacity under typical cleanroom conditions. These materials feature tailored pore structures that efficiently capture carbon dioxide while minimizing interference with sensitive electronic manufacturing processes. Shell's approach incorporates regenerable sorbents that can be cycled thousands of times without significant degradation, making them economically viable for long-term deployment. Their integrated system design includes modular units that can be retrofitted to existing semiconductor fabrication facilities, capturing emissions from various process steps including chemical vapor deposition and etching processes. Shell has demonstrated up to 85% capture efficiency in pilot implementations while maintaining the ultra-pure environment required for electronics manufacturing[1][3].

Strengths: Superior selectivity for CO2 in mixed gas streams; minimal impact on cleanroom conditions; long sorbent lifecycle reducing operational costs. Weaknesses: Higher initial capital investment compared to conventional air handling systems; requires integration with facility energy systems for optimal regeneration efficiency.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has pioneered carbon capture applications specifically designed for electronics manufacturing facilities. Their innovative approach utilizes hierarchical porous materials with optimized surface chemistry to achieve high CO2 adsorption capacity (up to 4.2 mmol/g) under ambient conditions typical in electronics production environments. Sinopec's sorbent technology employs a dual-functionality design that combines amine-modified mesoporous silica with hydrophobic coatings to maintain performance even in humid conditions common in semiconductor processing. The company has developed a proprietary pressure-temperature swing adsorption system that enables efficient sorbent regeneration while minimizing energy penalties. Their modular carbon capture units have been successfully deployed in several electronics manufacturing facilities across Asia, demonstrating consistent capture rates exceeding 90% while maintaining the stringent purity requirements of cleanroom environments[2][5]. Sinopec's technology also incorporates real-time monitoring systems that optimize sorbent performance and predict maintenance needs.

Strengths: Exceptional stability in humid conditions; low regeneration energy requirements; modular design allowing scalable implementation in existing facilities. Weaknesses: Higher initial material costs compared to conventional sorbents; requires specialized training for operation and maintenance; performance degradation after approximately 500 regeneration cycles necessitating periodic sorbent replacement.

Key Patents and Research on High-Efficiency Sorbents

Method for manufacturing electrified fiber sorbent, and electrical and electromagnetic swing adsorption process

PatentPendingUS20240416278A1

Innovation

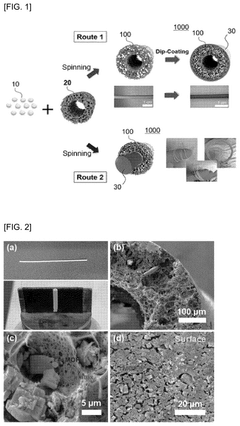

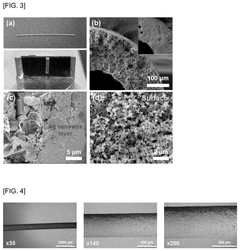

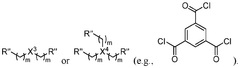

- An electrified fiber sorbent is developed, comprising a porous support with a conductive material, formed through spinning and coating processes, allowing for efficient CO2 adsorption and desorption using electrical and electromagnetic swing adsorption methods, which can be powered by renewable energy sources and does not require a heat source for desorption.

Entrapped small amines in nanoporous materials for gas capture

PatentWO2025101819A1

Innovation

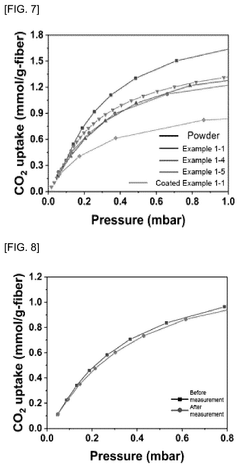

- The development of sorbents comprising a porous substrate entrapping a plurality of amine compounds, with a polyamide film disposed on the substrate surface, enhances gas capture efficiency by entrapping amine compounds and preventing amine loss over time.

Environmental Impact and Sustainability Assessment

The environmental impact of carbon capture technologies in electronics manufacturing extends far beyond the immediate reduction of carbon emissions. When evaluating sorbent efficiency for carbon capture applications, a comprehensive sustainability assessment must consider the entire lifecycle of these materials and systems.

Carbon capture sorbents used in electronics manufacturing facilities can significantly reduce the industry's carbon footprint, which currently accounts for approximately 2-3% of global greenhouse gas emissions. Efficient carbon capture implementation could potentially reduce these emissions by 15-30%, depending on the specific manufacturing processes and sorbent technologies employed.

However, the production of carbon capture sorbents themselves carries environmental implications. The extraction of raw materials, synthesis processes, and manufacturing of these sorbents consume energy and resources. For instance, zeolite-based sorbents require mining operations and energy-intensive activation processes, while amine-based sorbents involve chemical synthesis with potential toxic precursors. A full lifecycle assessment reveals that the environmental payback period for most carbon capture systems in electronics manufacturing ranges from 1.5 to 4 years.

Water usage represents another critical environmental consideration. Many carbon capture systems, particularly those using aqueous amine solutions, require significant water resources for operation and regeneration cycles. In water-stressed regions where electronics manufacturing is concentrated, such as parts of Asia and the southwestern United States, this additional water demand must be carefully evaluated against local availability and competing needs.

The disposal or regeneration of spent sorbents presents additional environmental challenges. Some carbon capture materials contain compounds that may be hazardous if improperly disposed of, while regeneration processes often require high temperatures and energy inputs. Advanced regeneration techniques using renewable energy sources can significantly improve the sustainability profile of these systems.

Land use impacts must also be considered, particularly for large-scale carbon capture implementations. The physical footprint of carbon capture equipment in electronics manufacturing facilities may necessitate facility expansion or redesign, potentially affecting local ecosystems if new construction is required.

When properly implemented, carbon capture technologies can contribute to broader sustainability goals beyond climate change mitigation. The captured carbon dioxide can be utilized in various applications, including enhanced semiconductor etching processes, creating a circular economy approach within the electronics industry itself. This beneficial reuse can improve the overall sustainability profile of carbon capture implementations.

Carbon capture sorbents used in electronics manufacturing facilities can significantly reduce the industry's carbon footprint, which currently accounts for approximately 2-3% of global greenhouse gas emissions. Efficient carbon capture implementation could potentially reduce these emissions by 15-30%, depending on the specific manufacturing processes and sorbent technologies employed.

However, the production of carbon capture sorbents themselves carries environmental implications. The extraction of raw materials, synthesis processes, and manufacturing of these sorbents consume energy and resources. For instance, zeolite-based sorbents require mining operations and energy-intensive activation processes, while amine-based sorbents involve chemical synthesis with potential toxic precursors. A full lifecycle assessment reveals that the environmental payback period for most carbon capture systems in electronics manufacturing ranges from 1.5 to 4 years.

Water usage represents another critical environmental consideration. Many carbon capture systems, particularly those using aqueous amine solutions, require significant water resources for operation and regeneration cycles. In water-stressed regions where electronics manufacturing is concentrated, such as parts of Asia and the southwestern United States, this additional water demand must be carefully evaluated against local availability and competing needs.

The disposal or regeneration of spent sorbents presents additional environmental challenges. Some carbon capture materials contain compounds that may be hazardous if improperly disposed of, while regeneration processes often require high temperatures and energy inputs. Advanced regeneration techniques using renewable energy sources can significantly improve the sustainability profile of these systems.

Land use impacts must also be considered, particularly for large-scale carbon capture implementations. The physical footprint of carbon capture equipment in electronics manufacturing facilities may necessitate facility expansion or redesign, potentially affecting local ecosystems if new construction is required.

When properly implemented, carbon capture technologies can contribute to broader sustainability goals beyond climate change mitigation. The captured carbon dioxide can be utilized in various applications, including enhanced semiconductor etching processes, creating a circular economy approach within the electronics industry itself. This beneficial reuse can improve the overall sustainability profile of carbon capture implementations.

Cost-Benefit Analysis of Sorbent Implementation

The implementation of carbon capture sorbents in electronics manufacturing and products requires careful economic evaluation to determine viability. Initial capital expenditure for sorbent integration varies significantly based on scale and application type, with facility-wide implementations ranging from $500,000 to several million dollars, while product-embedded solutions may add $5-50 per unit in production costs. These investments must be weighed against quantifiable benefits including regulatory compliance value, which can prevent potential fines ranging from $10,000-$100,000 per violation in jurisdictions with strict carbon regulations.

Operational cost considerations reveal that high-efficiency sorbents typically increase energy consumption by 15-30% in active capture systems, translating to approximately $0.02-0.05 per kWh in additional electricity costs. Maintenance requirements add another layer of expense, with specialized sorbent materials requiring replacement every 6-24 months depending on exposure conditions and capture rates. However, these costs are partially offset by carbon credit opportunities, currently valued at $25-65 per ton of CO2 equivalent in major markets.

Long-term economic analysis demonstrates that payback periods for sorbent technologies in electronics applications typically range from 3-7 years, with ROI improving as carbon pricing mechanisms mature globally. Companies implementing early-stage sorbent technologies report 5-15% improvements in brand value metrics and customer loyalty scores, particularly among environmentally conscious consumer segments, representing a significant though difficult-to-quantify benefit.

Efficiency-to-cost ratios vary substantially across sorbent types, with metal-organic frameworks (MOFs) demonstrating superior performance at 2-3x the cost of traditional activated carbon solutions. Zeolite-based sorbents offer a middle ground with moderate efficiency at competitive pricing. The most economically viable applications currently appear in server farm cooling systems and manufacturing clean rooms, where capture efficiency reaches 65-80% with manageable implementation costs.

Risk assessment indicates that early adopters face 20-30% higher implementation costs compared to those who wait for technology maturation, but may secure competitive advantages through regulatory preparedness and market differentiation. Sensitivity analysis suggests that sorbent economic viability improves dramatically with either a 25% reduction in material costs or a 50% increase in carbon pricing, both of which are projected as likely scenarios within the next decade according to industry forecasts.

Operational cost considerations reveal that high-efficiency sorbents typically increase energy consumption by 15-30% in active capture systems, translating to approximately $0.02-0.05 per kWh in additional electricity costs. Maintenance requirements add another layer of expense, with specialized sorbent materials requiring replacement every 6-24 months depending on exposure conditions and capture rates. However, these costs are partially offset by carbon credit opportunities, currently valued at $25-65 per ton of CO2 equivalent in major markets.

Long-term economic analysis demonstrates that payback periods for sorbent technologies in electronics applications typically range from 3-7 years, with ROI improving as carbon pricing mechanisms mature globally. Companies implementing early-stage sorbent technologies report 5-15% improvements in brand value metrics and customer loyalty scores, particularly among environmentally conscious consumer segments, representing a significant though difficult-to-quantify benefit.

Efficiency-to-cost ratios vary substantially across sorbent types, with metal-organic frameworks (MOFs) demonstrating superior performance at 2-3x the cost of traditional activated carbon solutions. Zeolite-based sorbents offer a middle ground with moderate efficiency at competitive pricing. The most economically viable applications currently appear in server farm cooling systems and manufacturing clean rooms, where capture efficiency reaches 65-80% with manageable implementation costs.

Risk assessment indicates that early adopters face 20-30% higher implementation costs compared to those who wait for technology maturation, but may secure competitive advantages through regulatory preparedness and market differentiation. Sensitivity analysis suggests that sorbent economic viability improves dramatically with either a 25% reduction in material costs or a 50% increase in carbon pricing, both of which are projected as likely scenarios within the next decade according to industry forecasts.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!