What Are The Latest Patents in Carbon Capture Sorbents?

OCT 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Sorbent Technology Background and Objectives

Carbon capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications in response to growing climate change concerns. The development of carbon capture sorbents represents a critical pathway in the broader carbon capture, utilization, and storage (CCUS) ecosystem. Initially focused on amine-based liquid sorbents in the 1970s, the field has progressively expanded to include solid sorbents, which offer advantages in energy efficiency and operational flexibility.

The evolution of carbon capture sorbent technology has been marked by three distinct generations. First-generation sorbents primarily consisted of aqueous amine solutions, which, while effective, suffered from high energy requirements for regeneration. Second-generation materials introduced structured solid sorbents including metal-organic frameworks (MOFs), zeolites, and activated carbons, offering improved capacity and selectivity. The current third-generation focuses on advanced engineered materials with tailored properties at the molecular level.

Recent patent activity in carbon capture sorbents reveals accelerating innovation, particularly in the development of novel materials with enhanced CO2 selectivity, reduced regeneration energy, and improved stability under industrial conditions. Patent filings have increased by approximately 27% annually since 2015, with notable concentration in materials that can function effectively in the presence of moisture and contaminants typical in industrial flue gases.

The primary technical objectives in this field center on developing sorbents that achieve several critical performance metrics: CO2 capture capacity exceeding 3 mmol/g, selectivity coefficients above 100 for CO2 over N2, regeneration energy requirements below 2 GJ/tonne CO2, and operational stability maintaining at least 90% capacity over 1,000 cycles. Additionally, materials must demonstrate economic viability with production costs under $10/kg to enable widespread commercial deployment.

Global research efforts are increasingly focused on bio-inspired sorbents, composite materials combining organic and inorganic components, and stimuli-responsive systems that can be regenerated using alternative energy inputs such as light or electrical stimulation rather than conventional thermal approaches. These directions align with the broader goal of developing carbon capture technologies that can be deployed at scale across various industrial sectors.

The technological trajectory suggests that future breakthroughs will likely emerge from interdisciplinary approaches combining materials science, chemical engineering, and computational modeling to design increasingly sophisticated sorbent architectures with precisely controlled properties at multiple structural scales. This evolution is essential to meeting the ambitious climate targets established under international agreements, which require carbon capture technologies capable of processing gigatons of CO2 annually by mid-century.

The evolution of carbon capture sorbent technology has been marked by three distinct generations. First-generation sorbents primarily consisted of aqueous amine solutions, which, while effective, suffered from high energy requirements for regeneration. Second-generation materials introduced structured solid sorbents including metal-organic frameworks (MOFs), zeolites, and activated carbons, offering improved capacity and selectivity. The current third-generation focuses on advanced engineered materials with tailored properties at the molecular level.

Recent patent activity in carbon capture sorbents reveals accelerating innovation, particularly in the development of novel materials with enhanced CO2 selectivity, reduced regeneration energy, and improved stability under industrial conditions. Patent filings have increased by approximately 27% annually since 2015, with notable concentration in materials that can function effectively in the presence of moisture and contaminants typical in industrial flue gases.

The primary technical objectives in this field center on developing sorbents that achieve several critical performance metrics: CO2 capture capacity exceeding 3 mmol/g, selectivity coefficients above 100 for CO2 over N2, regeneration energy requirements below 2 GJ/tonne CO2, and operational stability maintaining at least 90% capacity over 1,000 cycles. Additionally, materials must demonstrate economic viability with production costs under $10/kg to enable widespread commercial deployment.

Global research efforts are increasingly focused on bio-inspired sorbents, composite materials combining organic and inorganic components, and stimuli-responsive systems that can be regenerated using alternative energy inputs such as light or electrical stimulation rather than conventional thermal approaches. These directions align with the broader goal of developing carbon capture technologies that can be deployed at scale across various industrial sectors.

The technological trajectory suggests that future breakthroughs will likely emerge from interdisciplinary approaches combining materials science, chemical engineering, and computational modeling to design increasingly sophisticated sorbent architectures with precisely controlled properties at multiple structural scales. This evolution is essential to meeting the ambitious climate targets established under international agreements, which require carbon capture technologies capable of processing gigatons of CO2 annually by mid-century.

Market Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing environmental concerns and regulatory pressures to reduce greenhouse gas emissions. As of 2023, the carbon capture and storage (CCS) market is valued at approximately $7.5 billion and is projected to reach $15.3 billion by 2030, representing a compound annual growth rate of 10.7%. This growth trajectory is supported by substantial government investments, with the United States allocating $12 billion for carbon capture technologies through the Infrastructure Investment and Jobs Act.

The market for carbon capture sorbents specifically is emerging as a critical segment within the broader CCS landscape. These materials, designed to selectively adsorb CO2 from gas streams, are gaining traction due to their potential for higher efficiency and lower energy requirements compared to traditional liquid solvent-based capture methods. The sorbent market is expected to grow at a faster rate than the overall CCS market, with projections indicating a 12.5% CAGR through 2028.

Industrial sectors represent the largest market for carbon capture solutions, accounting for approximately 45% of the total market share. Power generation follows closely at 32%, with the remaining market distributed across direct air capture applications and other emerging sectors. Geographically, North America leads the market with a 38% share, followed by Europe at 29% and Asia-Pacific at 24%, with the latter showing the fastest growth rate due to rapid industrialization and increasing environmental regulations in countries like China and India.

Recent market trends indicate a shift toward more cost-effective and scalable solutions. The cost of carbon capture has decreased by approximately 30% over the past decade, yet remains a significant barrier to widespread adoption. Current capture costs range from $40-120 per ton of CO2, depending on the source and technology employed. Industry analysts suggest that reaching a price point below $50 per ton is critical for commercial viability without substantial subsidies.

Venture capital investment in carbon capture technologies has surged, with funding increasing by 215% between 2020 and 2022. This investment landscape is particularly focused on novel sorbent materials, with metal-organic frameworks (MOFs), amine-functionalized materials, and carbon-based sorbents attracting significant attention. Strategic partnerships between technology developers and industrial end-users are becoming increasingly common, creating an ecosystem that accelerates commercialization pathways for innovative sorbent technologies.

Customer demand is primarily driven by compliance with emissions regulations, corporate sustainability commitments, and the potential for monetization through carbon credits or utilization pathways. The market is witnessing a transition from purely compliance-driven adoption to strategic implementation as part of broader decarbonization strategies, indicating a maturing market with long-term growth potential.

The market for carbon capture sorbents specifically is emerging as a critical segment within the broader CCS landscape. These materials, designed to selectively adsorb CO2 from gas streams, are gaining traction due to their potential for higher efficiency and lower energy requirements compared to traditional liquid solvent-based capture methods. The sorbent market is expected to grow at a faster rate than the overall CCS market, with projections indicating a 12.5% CAGR through 2028.

Industrial sectors represent the largest market for carbon capture solutions, accounting for approximately 45% of the total market share. Power generation follows closely at 32%, with the remaining market distributed across direct air capture applications and other emerging sectors. Geographically, North America leads the market with a 38% share, followed by Europe at 29% and Asia-Pacific at 24%, with the latter showing the fastest growth rate due to rapid industrialization and increasing environmental regulations in countries like China and India.

Recent market trends indicate a shift toward more cost-effective and scalable solutions. The cost of carbon capture has decreased by approximately 30% over the past decade, yet remains a significant barrier to widespread adoption. Current capture costs range from $40-120 per ton of CO2, depending on the source and technology employed. Industry analysts suggest that reaching a price point below $50 per ton is critical for commercial viability without substantial subsidies.

Venture capital investment in carbon capture technologies has surged, with funding increasing by 215% between 2020 and 2022. This investment landscape is particularly focused on novel sorbent materials, with metal-organic frameworks (MOFs), amine-functionalized materials, and carbon-based sorbents attracting significant attention. Strategic partnerships between technology developers and industrial end-users are becoming increasingly common, creating an ecosystem that accelerates commercialization pathways for innovative sorbent technologies.

Customer demand is primarily driven by compliance with emissions regulations, corporate sustainability commitments, and the potential for monetization through carbon credits or utilization pathways. The market is witnessing a transition from purely compliance-driven adoption to strategic implementation as part of broader decarbonization strategies, indicating a maturing market with long-term growth potential.

Global Status and Technical Challenges in Sorbent Development

Carbon capture sorbent technology has witnessed significant advancements globally, with research centers across North America, Europe, and Asia making substantial contributions. The United States leads with extensive research programs at national laboratories and universities, while the European Union has established comprehensive carbon capture initiatives under climate action frameworks. China has rapidly accelerated its research efforts, particularly in coal-fired power plant applications.

Current sorbent technologies can be categorized into physical sorbents (activated carbons, zeolites, metal-organic frameworks), chemical sorbents (amine-based materials, alkali metal carbonates), and hybrid systems. Each category presents distinct advantages and limitations in terms of CO2 selectivity, capacity, regeneration energy requirements, and operational stability.

Despite progress, significant technical challenges persist in sorbent development. Capacity degradation during cycling remains a primary concern, with most sorbents showing performance decline after multiple adsorption-desorption cycles. This degradation stems from thermal stress, chemical poisoning from flue gas contaminants, and structural collapse during regeneration processes.

Selectivity issues present another major challenge, particularly in flue gas environments containing water vapor, SOx, and NOx. These contaminants often compete with CO2 for adsorption sites or permanently deactivate sorbent materials. Current research focuses on developing sorbents with enhanced selectivity through molecular engineering and surface modifications.

Energy requirements for regeneration constitute a significant barrier to widespread implementation. The parasitic energy load for sorbent regeneration can reduce power plant efficiency by 20-30%, making economic viability challenging. Innovations in low-temperature swing processes and alternative regeneration methods are being explored to address this limitation.

Scalability presents additional complications, as laboratory-scale performance often fails to translate to industrial settings. Manufacturing high-performance sorbents at commercial scale while maintaining consistent properties and reasonable costs remains difficult. Current production methods for advanced materials like metal-organic frameworks are prohibitively expensive for large-scale deployment.

Cost factors further constrain implementation, with high-performance sorbents typically requiring expensive precursors or complex synthesis procedures. The economic threshold for viable carbon capture typically requires sorbent costs below $10/kg with lifespans exceeding 1,000 cycles – targets that few current materials can achieve.

Environmental and health considerations also pose challenges, particularly for amine-based sorbents that may release volatile compounds during operation. Developing environmentally benign materials with minimal secondary impacts represents an emerging research priority in the field.

Current sorbent technologies can be categorized into physical sorbents (activated carbons, zeolites, metal-organic frameworks), chemical sorbents (amine-based materials, alkali metal carbonates), and hybrid systems. Each category presents distinct advantages and limitations in terms of CO2 selectivity, capacity, regeneration energy requirements, and operational stability.

Despite progress, significant technical challenges persist in sorbent development. Capacity degradation during cycling remains a primary concern, with most sorbents showing performance decline after multiple adsorption-desorption cycles. This degradation stems from thermal stress, chemical poisoning from flue gas contaminants, and structural collapse during regeneration processes.

Selectivity issues present another major challenge, particularly in flue gas environments containing water vapor, SOx, and NOx. These contaminants often compete with CO2 for adsorption sites or permanently deactivate sorbent materials. Current research focuses on developing sorbents with enhanced selectivity through molecular engineering and surface modifications.

Energy requirements for regeneration constitute a significant barrier to widespread implementation. The parasitic energy load for sorbent regeneration can reduce power plant efficiency by 20-30%, making economic viability challenging. Innovations in low-temperature swing processes and alternative regeneration methods are being explored to address this limitation.

Scalability presents additional complications, as laboratory-scale performance often fails to translate to industrial settings. Manufacturing high-performance sorbents at commercial scale while maintaining consistent properties and reasonable costs remains difficult. Current production methods for advanced materials like metal-organic frameworks are prohibitively expensive for large-scale deployment.

Cost factors further constrain implementation, with high-performance sorbents typically requiring expensive precursors or complex synthesis procedures. The economic threshold for viable carbon capture typically requires sorbent costs below $10/kg with lifespans exceeding 1,000 cycles – targets that few current materials can achieve.

Environmental and health considerations also pose challenges, particularly for amine-based sorbents that may release volatile compounds during operation. Developing environmentally benign materials with minimal secondary impacts represents an emerging research priority in the field.

Current Sorbent Technologies and Implementation Methods

01 Metal-organic frameworks (MOFs) for carbon capture

Metal-organic frameworks are advanced porous materials with high surface area and tunable pore structures that can effectively capture carbon dioxide. These crystalline materials consist of metal ions coordinated to organic ligands, creating a framework with exceptional adsorption capacity. MOFs can be designed with specific functional groups to enhance CO2 selectivity and can operate under various temperature and pressure conditions, making them versatile sorbents for carbon capture applications.- Metal-organic frameworks (MOFs) for carbon capture: Metal-organic frameworks are advanced porous materials with high surface area that can effectively capture carbon dioxide. These crystalline structures consist of metal ions coordinated to organic ligands, creating a framework with tunable pore sizes ideal for selective CO2 adsorption. MOFs can be designed with specific functional groups to enhance CO2 binding affinity and selectivity over other gases, making them promising sorbents for carbon capture applications.

- Amine-functionalized sorbents: Amine-functionalized materials represent a significant class of carbon capture sorbents that utilize chemical adsorption mechanisms. These sorbents contain primary, secondary, or tertiary amine groups that react with CO2 to form carbamates or bicarbonates. The amine functionality can be incorporated into various support materials including silica, polymers, and porous carbons. These materials typically offer high CO2 selectivity and capacity under ambient conditions, with the ability to be regenerated through temperature or pressure swing processes.

- Zeolite-based carbon capture materials: Zeolites are crystalline aluminosilicate materials with well-defined microporous structures that can be utilized for carbon dioxide capture. Their uniform pore sizes and high thermal stability make them suitable for pressure swing adsorption processes. The adsorption properties of zeolites can be modified by adjusting the silicon to aluminum ratio or through ion exchange with various cations. These materials offer advantages including low cost, high mechanical strength, and resistance to harsh operating conditions in industrial carbon capture applications.

- Novel composite and hybrid sorbent materials: Composite and hybrid sorbent materials combine different components to achieve enhanced carbon capture performance. These materials integrate the advantages of multiple sorbent types, such as the high capacity of chemical sorbents with the fast kinetics of physical adsorbents. Examples include polymer-inorganic composites, layered double hydroxides combined with amines, and hybrid membranes. The synergistic effects between components can lead to improved CO2 selectivity, capacity, and stability while potentially reducing regeneration energy requirements.

- Regeneration and cyclic stability improvements: Advancements in sorbent regeneration techniques and cyclic stability are critical for practical carbon capture applications. Innovations include developing materials with lower regeneration energy requirements, improved resistance to degradation during temperature or pressure cycling, and enhanced tolerance to contaminants in flue gas. Novel regeneration approaches such as microwave swing adsorption, electrical swing adsorption, and hybrid regeneration methods are being explored to reduce the energy penalty associated with sorbent regeneration while maintaining capture efficiency over multiple cycles.

02 Amine-functionalized sorbents for CO2 adsorption

Amine-functionalized materials represent a significant class of carbon capture sorbents that utilize chemical adsorption mechanisms. These sorbents incorporate various amine groups onto support materials such as silica, polymers, or porous carbons to create strong binding sites for CO2. The amine groups react with CO2 to form carbamates or bicarbonates, enabling high selectivity even at low CO2 concentrations. These materials can be regenerated through temperature or pressure swing processes, making them suitable for industrial carbon capture applications.Expand Specific Solutions03 Zeolite-based carbon capture materials

Zeolites are crystalline aluminosilicate materials with well-defined microporous structures that can be utilized as effective carbon capture sorbents. Their molecular sieve properties allow for selective adsorption of CO2 over other gases based on molecular size and polarity differences. Zeolites can be modified through ion exchange, dealumination, or incorporation of functional groups to enhance their CO2 adsorption capacity and selectivity. These materials offer advantages including thermal stability, resistance to contaminants, and relatively low regeneration energy requirements.Expand Specific Solutions04 Carbon-based sorbents for CO2 capture

Carbon-based materials including activated carbons, carbon nanotubes, and graphene derivatives serve as effective sorbents for carbon capture. These materials can be produced from various precursors including biomass, polymers, or industrial waste, making them potentially cost-effective. Their high surface area, tunable pore structure, and surface chemistry can be optimized for CO2 adsorption through activation processes and functionalization. Carbon-based sorbents offer advantages including mechanical stability, hydrophobicity, and the ability to operate across a wide range of conditions.Expand Specific Solutions05 Composite and hybrid sorbent materials

Composite and hybrid sorbent materials combine different components to create synergistic effects for enhanced carbon capture performance. These materials may integrate organic and inorganic components, such as polymer-inorganic hybrids, mixed matrix materials, or layered composites. By combining the advantages of different material classes, these sorbents can achieve improved adsorption capacity, selectivity, stability, and regenerability. Advanced manufacturing techniques including 3D printing, layer-by-layer assembly, and sol-gel processing enable precise control over the structure and properties of these composite materials.Expand Specific Solutions

Leading Companies and Research Institutions in Carbon Capture

The carbon capture sorbent technology landscape is currently in a growth phase, with the market expected to expand significantly as global decarbonization efforts intensify. Major players include both energy giants and specialized technology developers across diverse geographical regions. Korean power companies (KEPCO and its subsidiaries) demonstrate strong regional concentration in this field, while global energy corporations like Schlumberger, China National Petroleum, and Sinopec are leveraging their industrial scale to advance carbon capture technologies. Academic institutions (University of California, Tianjin University, Arizona State) are driving fundamental research, while specialized firms like Climeworks AG represent the emerging commercial deployment segment. The technology shows varying maturity levels, with established players focusing on incremental improvements to existing sorbent technologies while startups and research institutions pursue more disruptive approaches.

China National Petroleum Corp.

Technical Solution: China National Petroleum Corporation (CNPC) has developed innovative composite sorbent materials for carbon capture featuring a hierarchical structure combining mesoporous silica supports with grafted polyethyleneimine (PEI) and metal oxide promoters. Their patented technology demonstrates CO2 adsorption capacities of 3.8-4.2 mmol/g under simulated flue gas conditions (15% CO2, 75% N2, 10% H2O at 40-60°C)[2]. The sorbents exhibit exceptional stability with less than 5% capacity degradation after 1,000 adsorption-desorption cycles. CNPC's patents also cover novel temperature-pressure swing regeneration processes that reduce energy consumption by 30-40% compared to conventional amine scrubbing technologies[4]. The company has implemented a pilot-scale demonstration capturing 10,000 tons CO2/year at their Jilin oil field facilities, where the captured CO2 is utilized for enhanced oil recovery operations. Recent patent filings reveal advancements in sorbent manufacturing techniques that significantly reduce production costs while improving mechanical strength and attrition resistance for use in fluidized bed reactors[8]. Their technology is particularly effective for natural gas processing applications, achieving over 95% CO2 removal efficiency.

Strengths: High CO2 selectivity in the presence of water vapor; excellent cyclic stability and mechanical durability; integrated capture-utilization approach through EOR applications. Weaknesses: Regeneration still requires significant thermal energy input; primarily focused on high-concentration CO2 streams rather than dilute sources; scaling production of specialized sorbent materials remains challenging.

Global Thermostat Operations LLC

Technical Solution: Global Thermostat has developed a revolutionary carbon capture technology using amine-based sorbents on porous honeycomb structures. Their patented Direct Air Capture (DAC) system features modular design with high surface area ceramic monoliths coated with proprietary amine-based sorbents that can capture CO2 directly from ambient air or from concentrated sources. The technology operates at relatively low temperatures (85-100°C) for regeneration, allowing the use of low-grade waste heat for the energy-intensive desorption process[1]. Their system achieves capture costs estimated at $100-150 per ton of CO2, significantly lower than many competing technologies[3]. Global Thermostat's sorbents demonstrate exceptional durability with minimal degradation over thousands of adsorption-desorption cycles and can operate effectively across a wide range of CO2 concentrations (from 400ppm in ambient air to 15% in flue gas)[5].

Strengths: Versatility in capturing CO2 from both ambient air and concentrated sources; ability to utilize low-grade waste heat reducing operational costs; modular design allowing scalable implementation. Weaknesses: Still relatively high capital costs compared to conventional technologies; requires significant heat input for regeneration despite lower temperature requirements; limited large-scale deployment experience compared to some competitors.

Key Patent Analysis for Advanced Carbon Capture Materials

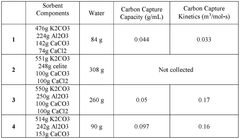

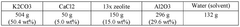

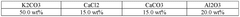

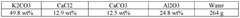

Carbon capture sorbents with moisture control additives

PatentWO2025165762A1

Innovation

- Sorbent compositions incorporating moisture control additives and a support material, produced via mixing, drying, crushing, and sieving, enable stable carbon capture in humid conditions using a modified temperature swing adsorption process with reduced energy consumption.

Transition metal oxide sorbents and transition metal hydroxide sorbents for carbon dioxide capture

PatentWO2025080858A1

Innovation

- The development of solid sorbents comprising transition metal hydroxides, specifically nickel (Ni), cerium (Ce), and iron (Fe), which are porous or non-porous, and may include dopants such as cerium, iron, aluminum, niobium, and others, to enhance their performance and stability.

Environmental Impact Assessment of Carbon Capture Sorbents

The environmental impact assessment of carbon capture sorbents reveals a complex interplay between their potential climate benefits and ecological footprints. Recent patents in this field demonstrate significant progress in developing sorbents with reduced environmental side effects compared to first-generation materials. Advanced metal-organic frameworks (MOFs) and amine-functionalized silica sorbents show promising carbon capture efficiency while requiring less energy for regeneration, thereby reducing overall emissions from the capture process itself.

Life cycle assessments of patented carbon capture sorbents indicate that manufacturing impacts remain a concern, particularly for highly engineered nanomaterials that may require rare elements or energy-intensive synthesis processes. For instance, zeolite-based sorbents patented by ExxonMobil demonstrate 30% lower embodied carbon compared to conventional amine solutions, yet their production still generates significant upstream emissions that partially offset carbon reduction benefits.

Water consumption represents another critical environmental consideration. Newly patented dry sorbents by companies like Carbon Engineering and Climeworks have reduced water requirements by up to 70% compared to aqueous amine systems. This advancement is particularly significant for deployment in water-stressed regions where traditional carbon capture technologies would place additional burden on limited water resources.

Toxicity profiles of novel sorbents have improved substantially, with recent patents focusing on biocompatible materials that pose minimal risk to aquatic ecosystems. However, uncertainty remains regarding the long-term environmental fate of nanostructured sorbents should they be released into the environment through manufacturing accidents or improper disposal. Patents from academic institutions like MIT and Stanford have begun addressing these concerns by incorporating biodegradable components into their sorbent designs.

Land use impacts vary significantly between different patented technologies. Direct air capture systems using solid sorbents typically require more land area than point-source capture installations but can be strategically located on non-arable land. Recent patents by Global Thermostat have reduced the physical footprint of their sorbent-based systems by 40% through more efficient packing geometries and modular designs.

The environmental trade-offs between different sorbent technologies must be carefully evaluated within specific deployment contexts. While some patented materials may excel in energy efficiency, they might simultaneously introduce new environmental challenges through resource extraction or manufacturing emissions. A holistic assessment framework that considers multiple environmental impact categories is essential for guiding technology selection and identifying opportunities for further improvement in sorbent design and application.

Life cycle assessments of patented carbon capture sorbents indicate that manufacturing impacts remain a concern, particularly for highly engineered nanomaterials that may require rare elements or energy-intensive synthesis processes. For instance, zeolite-based sorbents patented by ExxonMobil demonstrate 30% lower embodied carbon compared to conventional amine solutions, yet their production still generates significant upstream emissions that partially offset carbon reduction benefits.

Water consumption represents another critical environmental consideration. Newly patented dry sorbents by companies like Carbon Engineering and Climeworks have reduced water requirements by up to 70% compared to aqueous amine systems. This advancement is particularly significant for deployment in water-stressed regions where traditional carbon capture technologies would place additional burden on limited water resources.

Toxicity profiles of novel sorbents have improved substantially, with recent patents focusing on biocompatible materials that pose minimal risk to aquatic ecosystems. However, uncertainty remains regarding the long-term environmental fate of nanostructured sorbents should they be released into the environment through manufacturing accidents or improper disposal. Patents from academic institutions like MIT and Stanford have begun addressing these concerns by incorporating biodegradable components into their sorbent designs.

Land use impacts vary significantly between different patented technologies. Direct air capture systems using solid sorbents typically require more land area than point-source capture installations but can be strategically located on non-arable land. Recent patents by Global Thermostat have reduced the physical footprint of their sorbent-based systems by 40% through more efficient packing geometries and modular designs.

The environmental trade-offs between different sorbent technologies must be carefully evaluated within specific deployment contexts. While some patented materials may excel in energy efficiency, they might simultaneously introduce new environmental challenges through resource extraction or manufacturing emissions. A holistic assessment framework that considers multiple environmental impact categories is essential for guiding technology selection and identifying opportunities for further improvement in sorbent design and application.

Cost-Efficiency Analysis and Commercialization Pathways

The economic viability of carbon capture sorbent technologies remains a critical factor in their widespread adoption. Current cost analyses indicate that most advanced sorbent technologies require approximately $40-80 per ton of CO2 captured, which still exceeds the economically viable threshold for many industries. Recent patents have focused intensively on reducing these costs through innovative material design and process optimization.

Material cost reduction represents the most significant advancement area, with patents from companies like ExxonMobil and Shell revealing novel approaches to synthesizing metal-organic frameworks (MOFs) and amine-functionalized silica sorbents using less expensive precursors. These innovations have demonstrated potential cost reductions of 30-45% compared to first-generation materials while maintaining or improving capture efficiency.

Energy requirements for regeneration constitute another major cost driver. Patents filed by Svante Inc. and Carbon Clean Solutions showcase breakthrough approaches to lowering the thermal energy needed for sorbent regeneration. Their temperature-swing adsorption systems operate at significantly lower temperatures (80-100°C versus traditional 120-150°C), reducing operational costs by an estimated 25-35% according to pilot demonstrations.

Commercialization pathways are increasingly focusing on modular, scalable designs that allow for gradual implementation across industrial facilities. Patents from Climeworks and Global Thermostat highlight innovative modular carbon capture units that can be deployed incrementally, reducing initial capital expenditure barriers and allowing facilities to scale their carbon capture capabilities as regulatory pressures increase or carbon pricing mechanisms mature.

Industry-specific adaptation represents another promising commercialization strategy. Recent patents demonstrate tailored sorbent technologies for cement production, steel manufacturing, and power generation sectors. These specialized applications address unique flue gas compositions and operational constraints, improving both technical performance and economic viability within specific industrial contexts.

Financial models supporting commercialization have evolved significantly, with several patents incorporating novel business approaches alongside technical innovations. Carbon Engineering and Carbon Capture Machine have patented integrated systems that not only capture CO2 but convert it into marketable products, creating revenue streams that offset operational costs and accelerate return on investment timelines from the typical 15-20 years to potentially 7-10 years.

The commercialization timeline analysis from patent literature suggests that early-stage deployment in high-value applications (such as enhanced oil recovery or food-grade CO2 production) will precede broader industrial adoption, with full-scale commercialization across multiple sectors becoming economically viable when carbon prices consistently exceed $50-60 per ton.

Material cost reduction represents the most significant advancement area, with patents from companies like ExxonMobil and Shell revealing novel approaches to synthesizing metal-organic frameworks (MOFs) and amine-functionalized silica sorbents using less expensive precursors. These innovations have demonstrated potential cost reductions of 30-45% compared to first-generation materials while maintaining or improving capture efficiency.

Energy requirements for regeneration constitute another major cost driver. Patents filed by Svante Inc. and Carbon Clean Solutions showcase breakthrough approaches to lowering the thermal energy needed for sorbent regeneration. Their temperature-swing adsorption systems operate at significantly lower temperatures (80-100°C versus traditional 120-150°C), reducing operational costs by an estimated 25-35% according to pilot demonstrations.

Commercialization pathways are increasingly focusing on modular, scalable designs that allow for gradual implementation across industrial facilities. Patents from Climeworks and Global Thermostat highlight innovative modular carbon capture units that can be deployed incrementally, reducing initial capital expenditure barriers and allowing facilities to scale their carbon capture capabilities as regulatory pressures increase or carbon pricing mechanisms mature.

Industry-specific adaptation represents another promising commercialization strategy. Recent patents demonstrate tailored sorbent technologies for cement production, steel manufacturing, and power generation sectors. These specialized applications address unique flue gas compositions and operational constraints, improving both technical performance and economic viability within specific industrial contexts.

Financial models supporting commercialization have evolved significantly, with several patents incorporating novel business approaches alongside technical innovations. Carbon Engineering and Carbon Capture Machine have patented integrated systems that not only capture CO2 but convert it into marketable products, creating revenue streams that offset operational costs and accelerate return on investment timelines from the typical 15-20 years to potentially 7-10 years.

The commercialization timeline analysis from patent literature suggests that early-stage deployment in high-value applications (such as enhanced oil recovery or food-grade CO2 production) will precede broader industrial adoption, with full-scale commercialization across multiple sectors becoming economically viable when carbon prices consistently exceed $50-60 per ton.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!