Comparative Study of Sorbent Materials in Carbon Capture

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Sorbent Evolution and Objectives

Carbon capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications in response to growing environmental concerns. The journey began in the 1970s with initial research into carbon dioxide separation methods, primarily focused on natural gas processing. By the 1990s, as climate change awareness increased, research expanded to include post-combustion capture from power plants and industrial facilities, marking a pivotal shift in the field's trajectory.

The evolution of sorbent materials represents a critical aspect of carbon capture advancement. First-generation sorbents were primarily based on aqueous amine solutions, notably monoethanolamine (MEA), which offered reliable but energy-intensive capture capabilities. The second generation introduced improved liquid sorbents with reduced regeneration energy requirements, including advanced amines, ammonia-based solutions, and ionic liquids.

The current third generation focuses on solid sorbents and membrane technologies, representing a paradigm shift in capture methodology. These include metal-organic frameworks (MOFs), zeolites, activated carbons, and amine-functionalized silica materials, which demonstrate superior CO2 selectivity and reduced energy penalties compared to their liquid counterparts.

The primary objective of contemporary carbon capture sorbent research is to develop materials that maximize CO2 uptake capacity while minimizing energy requirements for regeneration. This delicate balance represents the central challenge in the field, as high capture efficiency often correlates with strong binding energies that subsequently demand significant energy input for sorbent regeneration.

Additional critical objectives include enhancing sorbent stability across multiple capture-regeneration cycles, improving tolerance to contaminants present in flue gases, and reducing production costs to enable economically viable large-scale deployment. Researchers are particularly focused on materials that can maintain performance under realistic operating conditions, including the presence of moisture, SOx, NOx, and varying temperature profiles.

Looking forward, the field aims to develop "fourth-generation" sorbents that integrate multiple beneficial properties: high selectivity for CO2 even at low concentrations, rapid adsorption-desorption kinetics, minimal regeneration energy requirements, and cost-effective scalable production methods. Emerging research directions include bio-inspired sorbents, hybrid materials combining multiple capture mechanisms, and direct air capture optimized materials capable of extracting CO2 from ambient atmospheric conditions.

The evolution of sorbent materials represents a critical aspect of carbon capture advancement. First-generation sorbents were primarily based on aqueous amine solutions, notably monoethanolamine (MEA), which offered reliable but energy-intensive capture capabilities. The second generation introduced improved liquid sorbents with reduced regeneration energy requirements, including advanced amines, ammonia-based solutions, and ionic liquids.

The current third generation focuses on solid sorbents and membrane technologies, representing a paradigm shift in capture methodology. These include metal-organic frameworks (MOFs), zeolites, activated carbons, and amine-functionalized silica materials, which demonstrate superior CO2 selectivity and reduced energy penalties compared to their liquid counterparts.

The primary objective of contemporary carbon capture sorbent research is to develop materials that maximize CO2 uptake capacity while minimizing energy requirements for regeneration. This delicate balance represents the central challenge in the field, as high capture efficiency often correlates with strong binding energies that subsequently demand significant energy input for sorbent regeneration.

Additional critical objectives include enhancing sorbent stability across multiple capture-regeneration cycles, improving tolerance to contaminants present in flue gases, and reducing production costs to enable economically viable large-scale deployment. Researchers are particularly focused on materials that can maintain performance under realistic operating conditions, including the presence of moisture, SOx, NOx, and varying temperature profiles.

Looking forward, the field aims to develop "fourth-generation" sorbents that integrate multiple beneficial properties: high selectivity for CO2 even at low concentrations, rapid adsorption-desorption kinetics, minimal regeneration energy requirements, and cost-effective scalable production methods. Emerging research directions include bio-inspired sorbents, hybrid materials combining multiple capture mechanisms, and direct air capture optimized materials capable of extracting CO2 from ambient atmospheric conditions.

Market Analysis for Carbon Capture Technologies

The global carbon capture market is experiencing significant growth, driven by increasing environmental regulations and corporate sustainability commitments. As of 2023, the market was valued at approximately $7.3 billion, with projections indicating a compound annual growth rate (CAGR) of 19.2% through 2030, potentially reaching $35.6 billion by the end of the decade. This growth trajectory is supported by substantial government investments, with the US Inflation Reduction Act allocating $369 billion for climate initiatives, including carbon capture technologies.

The demand for advanced sorbent materials in carbon capture applications is particularly robust across multiple sectors. Power generation remains the largest market segment, accounting for roughly 45% of carbon capture implementations, followed by industrial applications at 30%, with oil and gas recovery operations representing 20% of the market. The remaining 5% encompasses emerging applications in direct air capture and other specialized implementations.

Regional market distribution shows North America leading with approximately 40% market share, driven by extensive oil and gas operations and supportive policy frameworks. Europe follows at 30%, with its ambitious climate targets and strong regulatory environment. The Asia-Pacific region, currently at 25% market share, is experiencing the fastest growth rate at 22% annually, primarily due to China and India's expanding industrial sectors and increasing environmental regulations.

The sorbent materials market specifically is segmented into several categories: amine-based sorbents (38%), metal-organic frameworks (22%), activated carbons (18%), zeolites (12%), and other emerging materials (10%). Each material category serves different application niches based on their specific properties and cost profiles. The market is witnessing a shift toward more efficient and cost-effective materials, with research indicating that reducing sorbent costs by 30% could expand market adoption by up to 45%.

Customer segments for carbon capture technologies include utility companies (35%), industrial manufacturers (25%), oil and gas producers (20%), chemical companies (15%), and emerging direct air capture ventures (5%). The purchasing decisions are increasingly influenced by total cost of ownership rather than initial capital expenditure, with operational efficiency and sorbent regeneration costs becoming critical factors.

Market barriers include high implementation costs, with current carbon capture solutions adding 25-40% to operational expenses in power generation. Technological maturity varies significantly across different sorbent types, with traditional materials being well-established but newer, more efficient options still scaling toward commercial viability. Regulatory uncertainty in some regions also impacts market growth, though this is gradually improving as climate policies become more standardized globally.

The demand for advanced sorbent materials in carbon capture applications is particularly robust across multiple sectors. Power generation remains the largest market segment, accounting for roughly 45% of carbon capture implementations, followed by industrial applications at 30%, with oil and gas recovery operations representing 20% of the market. The remaining 5% encompasses emerging applications in direct air capture and other specialized implementations.

Regional market distribution shows North America leading with approximately 40% market share, driven by extensive oil and gas operations and supportive policy frameworks. Europe follows at 30%, with its ambitious climate targets and strong regulatory environment. The Asia-Pacific region, currently at 25% market share, is experiencing the fastest growth rate at 22% annually, primarily due to China and India's expanding industrial sectors and increasing environmental regulations.

The sorbent materials market specifically is segmented into several categories: amine-based sorbents (38%), metal-organic frameworks (22%), activated carbons (18%), zeolites (12%), and other emerging materials (10%). Each material category serves different application niches based on their specific properties and cost profiles. The market is witnessing a shift toward more efficient and cost-effective materials, with research indicating that reducing sorbent costs by 30% could expand market adoption by up to 45%.

Customer segments for carbon capture technologies include utility companies (35%), industrial manufacturers (25%), oil and gas producers (20%), chemical companies (15%), and emerging direct air capture ventures (5%). The purchasing decisions are increasingly influenced by total cost of ownership rather than initial capital expenditure, with operational efficiency and sorbent regeneration costs becoming critical factors.

Market barriers include high implementation costs, with current carbon capture solutions adding 25-40% to operational expenses in power generation. Technological maturity varies significantly across different sorbent types, with traditional materials being well-established but newer, more efficient options still scaling toward commercial viability. Regulatory uncertainty in some regions also impacts market growth, though this is gradually improving as climate policies become more standardized globally.

Current Sorbent Materials Landscape and Challenges

Carbon capture technology has evolved significantly over the past decades, with sorbent materials playing a crucial role in its development. Currently, the landscape of carbon capture sorbent materials encompasses several major categories, each with distinct characteristics and applications. Physical sorbents such as activated carbon and zeolites offer high surface areas and established manufacturing processes but suffer from relatively low CO2 selectivity and capacity under ambient conditions. Chemical sorbents including amines, metal-organic frameworks (MOFs), and alkali metal-based materials demonstrate higher CO2 selectivity but often face challenges related to regeneration energy requirements and stability over multiple cycles.

The current state-of-the-art in commercial applications predominantly features amine-based sorbents, particularly monoethanolamine (MEA) solutions, which have been deployed in industrial settings for decades. However, these systems require significant energy for regeneration, typically 3-4 GJ/ton CO2 captured, creating a substantial energy penalty for the overall process. Additionally, amine degradation and equipment corrosion remain persistent challenges that increase operational costs and reduce efficiency.

Recent advancements in solid sorbents, particularly metal-organic frameworks and functionalized porous materials, have shown promising results in laboratory settings, with some materials achieving CO2 capacities exceeding 4-5 mmol/g under relevant conditions. However, the translation of these materials from laboratory to industrial scale faces significant hurdles, including cost-effective synthesis routes, mechanical stability under pressure-swing or temperature-swing operations, and long-term performance consistency.

Geographically, research and development in advanced sorbent materials is concentrated primarily in North America, Europe, and East Asia, with the United States, China, Japan, and Germany leading patent filings in this domain. Commercial deployment, however, remains limited to a handful of demonstration projects, with notable examples in Canada, the United States, and Norway.

A critical challenge facing the field is the trade-off between CO2 selectivity and energy required for regeneration. Materials with strong CO2 binding typically require more energy for release, while those with weaker interactions may suffer from poor selectivity in mixed gas streams. This fundamental challenge has driven research toward "smart" materials with tunable binding properties or hybrid systems that combine physical and chemical sorption mechanisms.

Water tolerance represents another significant hurdle, as many promising sorbents show dramatically reduced performance in humid conditions typical of flue gas streams. Additionally, contaminants such as SOx and NOx can permanently deactivate certain sorbent materials, necessitating either upstream purification or development of more robust materials.

The current state-of-the-art in commercial applications predominantly features amine-based sorbents, particularly monoethanolamine (MEA) solutions, which have been deployed in industrial settings for decades. However, these systems require significant energy for regeneration, typically 3-4 GJ/ton CO2 captured, creating a substantial energy penalty for the overall process. Additionally, amine degradation and equipment corrosion remain persistent challenges that increase operational costs and reduce efficiency.

Recent advancements in solid sorbents, particularly metal-organic frameworks and functionalized porous materials, have shown promising results in laboratory settings, with some materials achieving CO2 capacities exceeding 4-5 mmol/g under relevant conditions. However, the translation of these materials from laboratory to industrial scale faces significant hurdles, including cost-effective synthesis routes, mechanical stability under pressure-swing or temperature-swing operations, and long-term performance consistency.

Geographically, research and development in advanced sorbent materials is concentrated primarily in North America, Europe, and East Asia, with the United States, China, Japan, and Germany leading patent filings in this domain. Commercial deployment, however, remains limited to a handful of demonstration projects, with notable examples in Canada, the United States, and Norway.

A critical challenge facing the field is the trade-off between CO2 selectivity and energy required for regeneration. Materials with strong CO2 binding typically require more energy for release, while those with weaker interactions may suffer from poor selectivity in mixed gas streams. This fundamental challenge has driven research toward "smart" materials with tunable binding properties or hybrid systems that combine physical and chemical sorption mechanisms.

Water tolerance represents another significant hurdle, as many promising sorbents show dramatically reduced performance in humid conditions typical of flue gas streams. Additionally, contaminants such as SOx and NOx can permanently deactivate certain sorbent materials, necessitating either upstream purification or development of more robust materials.

Mainstream Sorbent Material Solutions

01 Carbon-based sorbent materials

Carbon-based materials are widely used as sorbents due to their high surface area and adsorption capacity. These materials include activated carbon, carbon nanotubes, and graphene-based composites. They are effective for removing various contaminants from gases and liquids, including organic compounds, heavy metals, and other pollutants. The adsorption properties can be enhanced through surface modifications and activation processes to increase porosity and active sites.- Carbon-based sorbent materials: Carbon-based materials are widely used as sorbents due to their high surface area and adsorption capacity. These materials include activated carbon, carbon nanotubes, and graphene-based composites. They are effective for removing various contaminants from gases and liquids, including organic compounds, heavy metals, and other pollutants. The adsorption properties can be enhanced through surface modifications and activation processes to increase porosity and surface functionality.

- Polymer-based sorbent materials: Polymer-based sorbents offer versatility in adsorption applications due to their customizable chemical structures. These materials include synthetic polymers, resins, and polymer composites designed with specific functional groups to target particular contaminants. They can be engineered to have high selectivity, mechanical stability, and regeneration capabilities. Polymer sorbents are used in various applications including water purification, gas separation, and industrial waste treatment.

- Mineral and clay-based sorbent materials: Mineral and clay-based sorbents utilize natural or modified inorganic materials with high surface area and ion exchange properties. These include zeolites, bentonite, diatomaceous earth, and various silicates. Their layered structures and charged surfaces make them effective for capturing ions, polar molecules, and certain gases. These materials are valued for their abundance, low cost, and environmental compatibility, making them suitable for large-scale environmental remediation and industrial applications.

- Composite and hybrid sorbent materials: Composite and hybrid sorbent materials combine different types of materials to achieve enhanced performance characteristics. These composites often integrate organic and inorganic components to create synergistic effects that improve adsorption capacity, selectivity, and mechanical properties. Examples include polymer-clay composites, metal-organic frameworks (MOFs), and functionalized nanoparticles. These advanced materials are designed to overcome limitations of single-component sorbents and can be tailored for specific contaminants and operating conditions.

- Specialized sorbent materials for specific applications: Specialized sorbent materials are engineered for targeted applications with specific requirements. These include sorbents designed for medical applications (such as wound dressings and drug delivery), environmental remediation of specific contaminants, industrial gas separation, and nuclear waste management. These materials often incorporate unique chemical functionalities, controlled release mechanisms, or specific physical properties to address challenging separation problems or regulatory requirements in specialized fields.

02 Polymer-based sorbent materials

Polymer-based sorbents offer versatility in adsorption applications through their customizable structures and functional groups. These materials include synthetic polymers, resins, and polymer composites designed to selectively capture specific contaminants. Their advantages include regenerability, chemical stability, and the ability to be engineered for targeted applications. Polymer sorbents can be formulated as beads, membranes, or fibers depending on the intended use and environmental conditions.Expand Specific Solutions03 Mineral and clay-based sorbent materials

Mineral and clay-based sorbents utilize natural or modified inorganic materials with high adsorption capacities. These include zeolites, bentonite, diatomaceous earth, and silica-based materials. Their layered structures and ion exchange properties make them effective for removing heavy metals, radioactive elements, and organic pollutants. These materials often combine physical adsorption with chemical interactions, providing multiple mechanisms for contaminant removal. They are valued for their abundance, low cost, and environmental compatibility.Expand Specific Solutions04 Composite and hybrid sorbent materials

Composite and hybrid sorbents combine different materials to achieve enhanced performance characteristics. These materials integrate the advantages of multiple components, such as organic-inorganic hybrids, polymer-clay composites, or metal-organic frameworks. The synergistic effects between components can improve adsorption capacity, selectivity, and mechanical stability. These advanced materials are designed to overcome limitations of single-component sorbents and can be tailored for specific environmental remediation applications or industrial separation processes.Expand Specific Solutions05 Functionalized sorbent materials for selective adsorption

Functionalized sorbents feature modified surface chemistry to enhance selectivity for specific target compounds. These materials incorporate functional groups, chelating agents, or reactive sites that interact with contaminants through mechanisms such as complexation, hydrogen bonding, or electrostatic attraction. Surface modification techniques include chemical grafting, impregnation with reactive agents, or post-synthesis treatments. These specialized sorbents are particularly valuable for applications requiring high selectivity, such as precious metal recovery, pharmaceutical purification, or removal of trace contaminants from complex mixtures.Expand Specific Solutions

Leading Organizations in Carbon Capture Research

The carbon capture sorbent materials market is in a growth phase, with increasing global focus on decarbonization driving expansion. The market is projected to grow significantly as carbon capture technologies become essential for climate change mitigation strategies. Technologically, the field shows varying maturity levels across different sorbent approaches. Leading companies like Climeworks AG have commercialized direct air capture solutions with permanent storage capabilities, while research institutions such as MIT, Cornell University, and Rice University are advancing next-generation materials. Industrial players including ExxonMobil, GE, and Sinopec are scaling up carbon capture technologies for industrial applications. The competitive landscape features a mix of specialized startups, established energy corporations, and academic institutions collaborating to overcome cost and efficiency challenges.

Climeworks AG

Technical Solution: Climeworks has developed a proprietary Direct Air Capture (DAC) technology using solid sorbent materials arranged in filter-based collectors. Their approach employs amine-functionalized sorbents that selectively capture CO2 from ambient air. The process works in cycles where air passes through the collectors, binding CO2 to the sorbent surface. Once saturated, the collectors are heated to approximately 100°C, releasing concentrated CO2 that can be permanently stored underground or utilized in various applications. Their commercial plants, including Orca in Iceland and the larger Mammoth facility under development, demonstrate the scalability of their technology. Climeworks' sorbents are designed for thousands of adsorption-desorption cycles, maintaining efficiency over extended operational periods.

Strengths: High selectivity for CO2 even at low atmospheric concentrations; modular design allowing scalable implementation; integration with geothermal energy for low-carbon operation; proven commercial deployment. Weaknesses: Relatively high energy requirements for the regeneration phase; higher costs compared to point-source carbon capture; limited by geographical constraints for optimal renewable energy integration.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a comprehensive carbon capture technology portfolio centered around advanced solid sorbent materials. Their research focuses on mesoporous silica-supported polyethyleneimine (PEI) sorbents that demonstrate high CO2 adsorption capacity (up to 5.6 mmol/g) and selectivity. Sinopec's approach involves precise control of pore structure and amine loading to optimize performance across varying temperature and pressure conditions. Their technology incorporates a multi-cycle temperature swing adsorption process with proprietary heat management systems that reduce regeneration energy by approximately 30% compared to conventional methods. Sinopec has successfully deployed these sorbents in pilot projects at several of their refineries and petrochemical facilities, demonstrating the technology's effectiveness in real-world industrial settings with diverse flue gas compositions.

Strengths: High CO2 adsorption capacity and selectivity; good stability over multiple adsorption-desorption cycles; relatively low regeneration temperatures (70-90°C); integration potential with existing industrial infrastructure. Weaknesses: Performance degradation in the presence of certain flue gas contaminants; higher manufacturing costs for specialized mesoporous supports; potential for amine leaching during extended operation.

Key Innovations in Sorbent Material Design

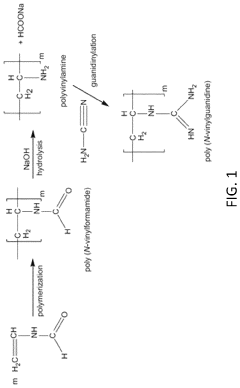

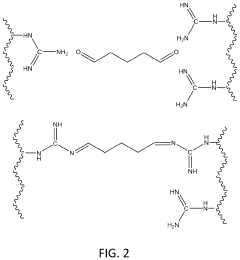

Polymeric materials for carbon dioxide capture

PatentPendingUS20240033682A1

Innovation

- The use of poly(N-vinyl guanidine)-based (PVG) polymer materials as a sorbent, which can be shaped into nanofibers or dissolved in water for enhanced surface area and sorption capability, and is regenerated through heating or hydroxide ion exchange for repeated use, offering low energy regeneration routes and high CO2 sorption capacities.

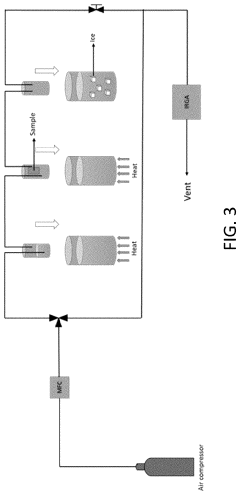

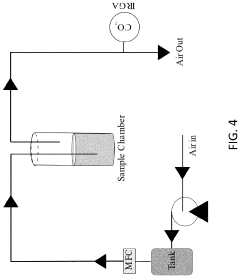

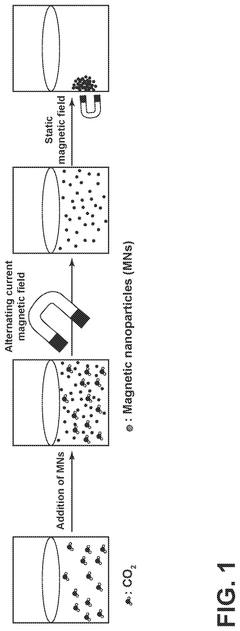

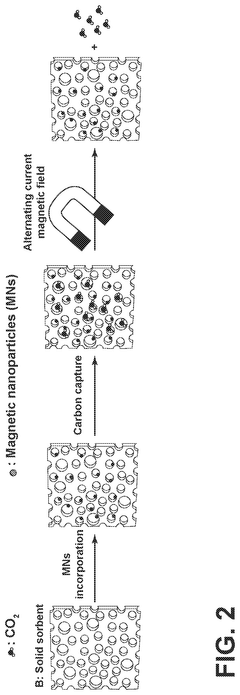

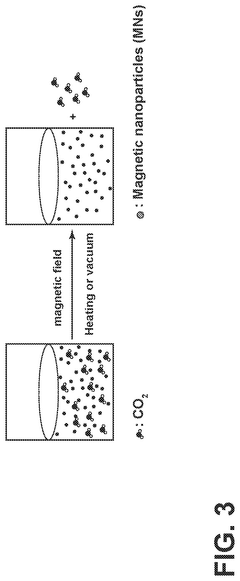

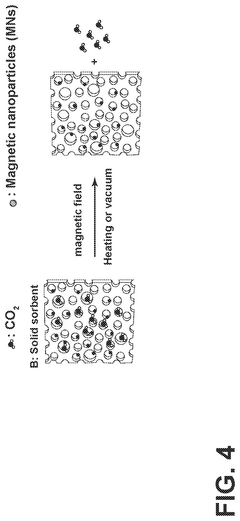

Carbon-capture sorbent regeneration by magnetic heating of nanoparticles

PatentPendingUS20250099901A1

Innovation

- The method employs magnetic nanoparticles to generate heat through a magnetic field, allowing for efficient regeneration of carbon-capture sorbents by releasing adsorbed carbon dioxide, thereby reducing energy costs and improving heat transfer efficiency.

Environmental Impact Assessment

The environmental impact of carbon capture technologies extends far beyond their primary function of reducing atmospheric CO2. When evaluating sorbent materials for carbon capture, a comprehensive environmental assessment is essential to ensure that the solution doesn't create more problems than it solves.

Different sorbent materials present varying environmental footprints throughout their lifecycle. Amine-based sorbents, while effective for CO2 capture, often require significant energy for regeneration and may degrade into potentially harmful compounds. Their production involves chemical processes that can generate hazardous waste streams and contribute to water pollution if not properly managed.

Solid sorbents such as metal-organic frameworks (MOFs) and zeolites generally demonstrate lower environmental impacts during operation but may require energy-intensive synthesis procedures. The mining of raw materials for these sorbents, particularly for metal components in MOFs, can lead to habitat destruction, soil erosion, and water contamination in extraction regions.

Carbon-based sorbents, including activated carbon and biochar, often present more favorable environmental profiles. Biochar production can utilize agricultural waste streams, creating a circular economy approach. However, large-scale production could potentially compete with food production if not carefully managed.

Water consumption represents another critical environmental consideration. Wet scrubbing technologies using liquid sorbents typically require significant water resources, potentially straining local water supplies in water-scarce regions. Solid sorbents generally have lower water requirements but may still need water during synthesis or regeneration processes.

Land use impacts vary considerably among different carbon capture approaches. Direct air capture facilities using solid sorbents require substantial land area, potentially competing with agriculture or natural habitats. Post-combustion capture systems integrated into existing facilities have smaller additional land footprints but may still require expansion of industrial sites.

Waste management challenges emerge as sorbent materials degrade over time. Spent sorbents may contain concentrated contaminants requiring special disposal procedures. Some materials, particularly certain MOFs and specialized polymers, present recycling challenges due to their complex chemical structures.

The energy penalty associated with sorbent regeneration represents perhaps the most significant environmental concern. Higher regeneration energy requirements translate directly to increased fuel consumption and associated emissions, potentially offsetting some of the climate benefits of carbon capture if not powered by renewable sources.

Different sorbent materials present varying environmental footprints throughout their lifecycle. Amine-based sorbents, while effective for CO2 capture, often require significant energy for regeneration and may degrade into potentially harmful compounds. Their production involves chemical processes that can generate hazardous waste streams and contribute to water pollution if not properly managed.

Solid sorbents such as metal-organic frameworks (MOFs) and zeolites generally demonstrate lower environmental impacts during operation but may require energy-intensive synthesis procedures. The mining of raw materials for these sorbents, particularly for metal components in MOFs, can lead to habitat destruction, soil erosion, and water contamination in extraction regions.

Carbon-based sorbents, including activated carbon and biochar, often present more favorable environmental profiles. Biochar production can utilize agricultural waste streams, creating a circular economy approach. However, large-scale production could potentially compete with food production if not carefully managed.

Water consumption represents another critical environmental consideration. Wet scrubbing technologies using liquid sorbents typically require significant water resources, potentially straining local water supplies in water-scarce regions. Solid sorbents generally have lower water requirements but may still need water during synthesis or regeneration processes.

Land use impacts vary considerably among different carbon capture approaches. Direct air capture facilities using solid sorbents require substantial land area, potentially competing with agriculture or natural habitats. Post-combustion capture systems integrated into existing facilities have smaller additional land footprints but may still require expansion of industrial sites.

Waste management challenges emerge as sorbent materials degrade over time. Spent sorbents may contain concentrated contaminants requiring special disposal procedures. Some materials, particularly certain MOFs and specialized polymers, present recycling challenges due to their complex chemical structures.

The energy penalty associated with sorbent regeneration represents perhaps the most significant environmental concern. Higher regeneration energy requirements translate directly to increased fuel consumption and associated emissions, potentially offsetting some of the climate benefits of carbon capture if not powered by renewable sources.

Cost-Efficiency Analysis

The economic viability of carbon capture technologies hinges significantly on the cost-efficiency of sorbent materials employed. Current analysis reveals substantial variations in both capital and operational expenditures across different sorbent categories. Amine-based sorbents, while demonstrating high capture efficiency, often incur elevated costs due to their energy-intensive regeneration processes and susceptibility to degradation, necessitating frequent replacement. The estimated operational cost ranges from $50-80 per ton of CO2 captured, with regeneration energy requirements typically between 3.0-4.5 GJ/ton CO2.

Metal-Organic Frameworks (MOFs) present a contrasting economic profile, with higher initial synthesis costs but potentially lower operational expenses due to their superior regeneration characteristics. Recent advancements in MOF manufacturing have reduced production costs by approximately 30% over the past five years, though economies of scale remain a significant challenge for widespread industrial adoption. The current cost trajectory suggests MOFs could achieve economic parity with traditional sorbents within the next decade.

Zeolites and activated carbons offer more balanced cost profiles, with moderate initial investment and operational expenses. These materials benefit from established manufacturing processes and supply chains, resulting in acquisition costs 40-60% lower than novel sorbents. However, their lower CO2 selectivity often necessitates larger equipment dimensions and consequently higher capital expenditures for equivalent capture capacity.

Life-cycle cost assessment reveals that while initial sorbent procurement represents only 15-25% of total carbon capture costs, the long-term operational expenses—particularly energy consumption during regeneration—constitute the dominant economic factor. Materials demonstrating superior cycling stability, such as certain hydrotalcite derivatives, may present higher upfront costs but deliver superior long-term economic performance through extended operational lifespans exceeding 1,000 cycles.

Recent economic modeling incorporating carbon pricing mechanisms indicates that the break-even point for carbon capture technologies varies significantly based on sorbent selection. Systems utilizing advanced composite sorbents achieve economic viability at carbon prices of approximately $40-60 per ton, whereas conventional systems require $70-90 per ton. This differential underscores the strategic importance of sorbent selection in determining the overall economic feasibility of carbon capture implementations.

The integration of waste heat recovery systems has demonstrated potential to reduce regeneration energy costs by 20-35%, significantly enhancing the cost-efficiency of thermally-regenerated sorbents. This approach particularly benefits temperature swing adsorption systems employing mesoporous silica-supported amines and certain classes of MOFs, potentially reducing the levelized cost of carbon capture by $12-18 per ton CO2.

Metal-Organic Frameworks (MOFs) present a contrasting economic profile, with higher initial synthesis costs but potentially lower operational expenses due to their superior regeneration characteristics. Recent advancements in MOF manufacturing have reduced production costs by approximately 30% over the past five years, though economies of scale remain a significant challenge for widespread industrial adoption. The current cost trajectory suggests MOFs could achieve economic parity with traditional sorbents within the next decade.

Zeolites and activated carbons offer more balanced cost profiles, with moderate initial investment and operational expenses. These materials benefit from established manufacturing processes and supply chains, resulting in acquisition costs 40-60% lower than novel sorbents. However, their lower CO2 selectivity often necessitates larger equipment dimensions and consequently higher capital expenditures for equivalent capture capacity.

Life-cycle cost assessment reveals that while initial sorbent procurement represents only 15-25% of total carbon capture costs, the long-term operational expenses—particularly energy consumption during regeneration—constitute the dominant economic factor. Materials demonstrating superior cycling stability, such as certain hydrotalcite derivatives, may present higher upfront costs but deliver superior long-term economic performance through extended operational lifespans exceeding 1,000 cycles.

Recent economic modeling incorporating carbon pricing mechanisms indicates that the break-even point for carbon capture technologies varies significantly based on sorbent selection. Systems utilizing advanced composite sorbents achieve economic viability at carbon prices of approximately $40-60 per ton, whereas conventional systems require $70-90 per ton. This differential underscores the strategic importance of sorbent selection in determining the overall economic feasibility of carbon capture implementations.

The integration of waste heat recovery systems has demonstrated potential to reduce regeneration energy costs by 20-35%, significantly enhancing the cost-efficiency of thermally-regenerated sorbents. This approach particularly benefits temperature swing adsorption systems employing mesoporous silica-supported amines and certain classes of MOFs, potentially reducing the levelized cost of carbon capture by $12-18 per ton CO2.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!