Patent Landscape of Advanced Carbon Capture Sorbents

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Sorbent Technology Background and Objectives

Carbon capture technology has evolved significantly over the past several decades, transitioning from theoretical concepts to practical applications in response to growing environmental concerns. The development of carbon capture sorbents began in earnest during the 1970s with basic chemical absorption processes using amines, particularly monoethanolamine (MEA). These early technologies laid the foundation for more sophisticated approaches that emerged in subsequent decades.

The 1990s witnessed a notable acceleration in carbon capture research, driven by increasing awareness of climate change and the need for industrial decarbonization solutions. This period saw the emergence of solid sorbents as alternatives to liquid-based systems, offering potential advantages in energy efficiency and operational flexibility. By the early 2000s, research expanded to include novel materials such as metal-organic frameworks (MOFs), zeolites, and functionalized porous carbons.

Recent technological evolution has focused on enhancing sorbent performance metrics including CO₂ selectivity, adsorption capacity, regeneration energy requirements, and operational stability. The development trajectory has been shaped by both environmental imperatives and economic considerations, with increasing emphasis on solutions that can be deployed at industrial scale with minimal energy penalties.

The patent landscape for advanced carbon capture sorbents reflects this evolutionary path, with initial patents focusing on basic chemical processes and gradually shifting toward more sophisticated material designs and system integrations. Patent activity has accelerated significantly since 2010, indicating growing commercial interest and technological maturity in this field.

The primary technical objectives in carbon capture sorbent development include achieving higher CO₂ selectivity in mixed gas environments, increasing adsorption capacity per unit mass of sorbent, reducing regeneration energy requirements, enhancing mechanical and chemical stability over multiple adsorption-desorption cycles, and lowering manufacturing costs to enable widespread deployment.

Long-term objectives extend beyond performance optimization to address system-level challenges, including process integration with existing industrial infrastructure, minimizing parasitic energy losses, and developing modular designs that can be scaled effectively. Additionally, there is growing interest in developing sorbents that can function effectively under diverse operating conditions, from power plants to direct air capture applications.

The technological trajectory suggests continued innovation in material science approaches, with increasing focus on hierarchical and composite materials that combine the advantages of different sorbent types. Computational modeling and high-throughput screening methodologies are becoming increasingly important in accelerating the discovery and optimization of next-generation carbon capture sorbents.

The 1990s witnessed a notable acceleration in carbon capture research, driven by increasing awareness of climate change and the need for industrial decarbonization solutions. This period saw the emergence of solid sorbents as alternatives to liquid-based systems, offering potential advantages in energy efficiency and operational flexibility. By the early 2000s, research expanded to include novel materials such as metal-organic frameworks (MOFs), zeolites, and functionalized porous carbons.

Recent technological evolution has focused on enhancing sorbent performance metrics including CO₂ selectivity, adsorption capacity, regeneration energy requirements, and operational stability. The development trajectory has been shaped by both environmental imperatives and economic considerations, with increasing emphasis on solutions that can be deployed at industrial scale with minimal energy penalties.

The patent landscape for advanced carbon capture sorbents reflects this evolutionary path, with initial patents focusing on basic chemical processes and gradually shifting toward more sophisticated material designs and system integrations. Patent activity has accelerated significantly since 2010, indicating growing commercial interest and technological maturity in this field.

The primary technical objectives in carbon capture sorbent development include achieving higher CO₂ selectivity in mixed gas environments, increasing adsorption capacity per unit mass of sorbent, reducing regeneration energy requirements, enhancing mechanical and chemical stability over multiple adsorption-desorption cycles, and lowering manufacturing costs to enable widespread deployment.

Long-term objectives extend beyond performance optimization to address system-level challenges, including process integration with existing industrial infrastructure, minimizing parasitic energy losses, and developing modular designs that can be scaled effectively. Additionally, there is growing interest in developing sorbents that can function effectively under diverse operating conditions, from power plants to direct air capture applications.

The technological trajectory suggests continued innovation in material science approaches, with increasing focus on hierarchical and composite materials that combine the advantages of different sorbent types. Computational modeling and high-throughput screening methodologies are becoming increasingly important in accelerating the discovery and optimization of next-generation carbon capture sorbents.

Market Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing environmental regulations and corporate sustainability commitments. As of 2023, the market was valued at approximately $7.5 billion, with projections indicating a compound annual growth rate (CAGR) of 19.2% through 2030, potentially reaching $35.6 billion by the end of the decade. This growth trajectory is supported by substantial government investments, with the US Inflation Reduction Act allocating $369 billion for climate and energy initiatives, including carbon capture technologies.

The demand for advanced carbon capture sorbents is particularly strong in power generation, which accounts for roughly 40% of global CO2 emissions. Industrial sectors including cement production (8% of global emissions), steel manufacturing (7%), and chemical processing (5%) represent other significant market segments with growing demand for carbon capture solutions.

Geographically, North America currently leads the market with approximately 35% share, followed by Europe at 30% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to witness the fastest growth rate of 22% annually through 2030, driven by China and India's industrial expansion coupled with emerging climate policies.

The market structure is evolving from primarily government-funded projects toward commercial applications, with the cost per ton of CO2 captured serving as a critical market driver. Current costs range from $58-$120 per ton, but technological innovations in advanced sorbents are projected to reduce this to $30-$50 per ton by 2030, significantly expanding market viability.

Customer segments can be categorized into three tiers: compliance-driven adopters (primarily heavy emitters subject to carbon pricing), voluntary corporate adopters pursuing net-zero commitments, and carbon removal purchasers seeking negative emissions. The first segment currently dominates market demand, but the latter two are growing rapidly as carbon markets mature.

Market barriers include high capital expenditure requirements, uncertain regulatory frameworks in many regions, and competition from alternative decarbonization strategies. However, the development of carbon pricing mechanisms globally is creating stronger economic incentives, with carbon prices in the EU Emissions Trading System reaching €80-90 per ton, making carbon capture increasingly economically viable.

The serviceable addressable market for advanced carbon capture sorbents is estimated at $3.2 billion in 2023, with potential to reach $15 billion by 2030 as technology costs decrease and regulatory pressures increase.

The demand for advanced carbon capture sorbents is particularly strong in power generation, which accounts for roughly 40% of global CO2 emissions. Industrial sectors including cement production (8% of global emissions), steel manufacturing (7%), and chemical processing (5%) represent other significant market segments with growing demand for carbon capture solutions.

Geographically, North America currently leads the market with approximately 35% share, followed by Europe at 30% and Asia-Pacific at 25%. However, the Asia-Pacific region is expected to witness the fastest growth rate of 22% annually through 2030, driven by China and India's industrial expansion coupled with emerging climate policies.

The market structure is evolving from primarily government-funded projects toward commercial applications, with the cost per ton of CO2 captured serving as a critical market driver. Current costs range from $58-$120 per ton, but technological innovations in advanced sorbents are projected to reduce this to $30-$50 per ton by 2030, significantly expanding market viability.

Customer segments can be categorized into three tiers: compliance-driven adopters (primarily heavy emitters subject to carbon pricing), voluntary corporate adopters pursuing net-zero commitments, and carbon removal purchasers seeking negative emissions. The first segment currently dominates market demand, but the latter two are growing rapidly as carbon markets mature.

Market barriers include high capital expenditure requirements, uncertain regulatory frameworks in many regions, and competition from alternative decarbonization strategies. However, the development of carbon pricing mechanisms globally is creating stronger economic incentives, with carbon prices in the EU Emissions Trading System reaching €80-90 per ton, making carbon capture increasingly economically viable.

The serviceable addressable market for advanced carbon capture sorbents is estimated at $3.2 billion in 2023, with potential to reach $15 billion by 2030 as technology costs decrease and regulatory pressures increase.

Global Status and Challenges in Sorbent Technology

Carbon capture sorbent technology has evolved significantly over the past decade, with research centers across North America, Europe, and Asia making substantial contributions. Currently, the global landscape shows uneven development, with the United States, China, and the European Union leading in both research output and patent filings. The United States maintains dominance through institutions like the National Energy Technology Laboratory and major universities, while China has rapidly expanded its research base through substantial government funding initiatives.

The current technological challenges in carbon capture sorbents center around four critical areas. First, capacity limitations remain a significant hurdle, with most commercial sorbents achieving CO2 uptake below theoretical maximums. Second, selectivity issues persist, particularly in flue gas environments containing multiple competing gases. Third, stability concerns under industrial conditions—including thermal cycling, moisture exposure, and contaminant presence—continue to limit widespread deployment. Fourth, regeneration energy requirements remain prohibitively high for many promising materials.

Geographically, research expertise is concentrated in specific regions. North America excels in novel material design and fundamental research, with particular strength in metal-organic frameworks (MOFs) and advanced polymer-based sorbents. European institutions focus heavily on process integration and system-level optimization, while Asian research centers, particularly in China and South Korea, demonstrate advantages in scaling up production and cost reduction strategies for established sorbent technologies.

The regulatory landscape adds another layer of complexity, with varying carbon pricing mechanisms and environmental policies creating an uneven playing field for technology adoption. Countries with more stringent carbon regulations have naturally become hotbeds for sorbent technology development, while regions with less regulatory pressure show limited commercial interest despite technical capabilities.

Material availability presents another challenge, particularly for advanced sorbents requiring rare elements or complex synthesis procedures. Supply chain considerations have become increasingly important, with researchers now prioritizing earth-abundant materials and scalable production methods to address potential bottlenecks in commercial deployment.

Recent technological breakthroughs have partially addressed these challenges, including the development of hierarchical porous structures that enhance both capacity and kinetics, and composite materials that combine the advantages of different sorbent classes. However, the translation of these laboratory advances to industrial-scale applications remains limited, highlighting the persistent gap between fundamental research and commercial implementation in the carbon capture sorbent landscape.

The current technological challenges in carbon capture sorbents center around four critical areas. First, capacity limitations remain a significant hurdle, with most commercial sorbents achieving CO2 uptake below theoretical maximums. Second, selectivity issues persist, particularly in flue gas environments containing multiple competing gases. Third, stability concerns under industrial conditions—including thermal cycling, moisture exposure, and contaminant presence—continue to limit widespread deployment. Fourth, regeneration energy requirements remain prohibitively high for many promising materials.

Geographically, research expertise is concentrated in specific regions. North America excels in novel material design and fundamental research, with particular strength in metal-organic frameworks (MOFs) and advanced polymer-based sorbents. European institutions focus heavily on process integration and system-level optimization, while Asian research centers, particularly in China and South Korea, demonstrate advantages in scaling up production and cost reduction strategies for established sorbent technologies.

The regulatory landscape adds another layer of complexity, with varying carbon pricing mechanisms and environmental policies creating an uneven playing field for technology adoption. Countries with more stringent carbon regulations have naturally become hotbeds for sorbent technology development, while regions with less regulatory pressure show limited commercial interest despite technical capabilities.

Material availability presents another challenge, particularly for advanced sorbents requiring rare elements or complex synthesis procedures. Supply chain considerations have become increasingly important, with researchers now prioritizing earth-abundant materials and scalable production methods to address potential bottlenecks in commercial deployment.

Recent technological breakthroughs have partially addressed these challenges, including the development of hierarchical porous structures that enhance both capacity and kinetics, and composite materials that combine the advantages of different sorbent classes. However, the translation of these laboratory advances to industrial-scale applications remains limited, highlighting the persistent gap between fundamental research and commercial implementation in the carbon capture sorbent landscape.

Current Sorbent Technologies and Implementation

01 Metal-organic frameworks (MOFs) for carbon capture

Metal-organic frameworks are advanced porous materials with high surface area that can be engineered for selective CO2 adsorption. These crystalline structures consist of metal ions coordinated to organic ligands, creating a framework with tunable pore sizes and functionalities. MOFs can be modified with specific functional groups to enhance CO2 binding capacity and selectivity, making them effective sorbents for carbon capture applications under various temperature and pressure conditions.- Metal-organic frameworks (MOFs) for carbon capture: Metal-organic frameworks are advanced porous materials with high surface area and tunable pore structures that make them effective for carbon dioxide adsorption. These crystalline materials consist of metal ions coordinated to organic ligands, creating a framework with exceptional CO2 selectivity and capacity. MOFs can be designed with specific functional groups to enhance their affinity for CO2 molecules, allowing for efficient capture even at low concentrations in flue gas streams.

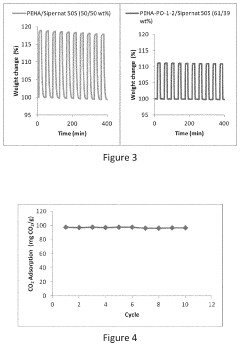

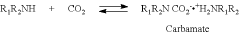

- Amine-functionalized sorbents: Amine-functionalized materials represent a significant class of carbon capture sorbents that operate through chemical adsorption mechanisms. These sorbents feature amine groups attached to various support structures such as silica, polymers, or porous carbons. The amine groups form carbamates or carbonates when reacting with CO2, enabling selective capture from gas mixtures. These materials offer advantages including high CO2 selectivity, good performance at low partial pressures, and the ability to operate in humid conditions that might challenge other sorbent types.

- Zeolite-based carbon capture materials: Zeolites are crystalline aluminosilicate materials with well-defined microporous structures that make them effective for carbon dioxide separation and capture. Their molecular sieving properties allow for selective adsorption based on molecular size and shape. Zeolites can be modified through ion exchange, introducing cations that enhance CO2 adsorption capacity and selectivity. These materials offer thermal stability, regenerability, and resistance to contaminants, making them suitable for industrial carbon capture applications under various operating conditions.

- Carbon-based sorbents for CO2 capture: Carbon-based materials, including activated carbons, carbon nanotubes, and graphene derivatives, serve as effective sorbents for carbon dioxide capture. These materials offer high surface area, tunable pore structures, and the ability to be functionalized with various chemical groups to enhance CO2 selectivity. Activated carbons can be produced from renewable biomass sources, providing an environmentally friendly approach to sorbent development. Their hydrophobic nature makes them particularly suitable for applications where water vapor might interfere with the capture process.

- Composite and hybrid sorbent materials: Composite and hybrid sorbents combine multiple material types to achieve enhanced carbon capture performance beyond what individual components can provide. These materials typically integrate the advantages of different sorbent classes, such as the high surface area of porous supports with the chemical reactivity of functional groups. Examples include polymer-inorganic composites, MOF-polymer hybrids, and multi-component structured materials. These hybrid approaches can overcome limitations of single-component sorbents, offering improved stability, selectivity, capacity, and regenerability for practical carbon capture applications.

02 Amine-functionalized sorbents

Amine-functionalized materials represent a significant class of carbon capture sorbents that operate through chemical adsorption mechanisms. These sorbents incorporate various amine groups onto support materials such as silica, activated carbon, or polymers to create reactive sites for CO2 binding. The amine groups form carbamates or bicarbonates when reacting with CO2, enabling efficient capture even at low CO2 concentrations. These materials can be designed with different amine types and loadings to optimize capture capacity, kinetics, and regeneration energy requirements.Expand Specific Solutions03 Zeolite-based carbon capture materials

Zeolites are crystalline aluminosilicate materials with well-defined microporous structures that can be utilized for carbon dioxide adsorption. Their molecular sieve properties allow for selective gas separation based on molecular size and shape. Zeolites can be modified through ion exchange, dealumination, or incorporation of functional groups to enhance CO2 adsorption capacity and selectivity. These materials offer advantages including thermal stability, mechanical strength, and resistance to contaminants, making them suitable for industrial carbon capture applications.Expand Specific Solutions04 Carbon-based sorbents for CO2 capture

Carbon-based materials including activated carbon, carbon nanotubes, graphene, and carbon molecular sieves serve as effective CO2 sorbents. These materials can be produced from various precursors including biomass, coal, or synthetic polymers and offer high surface area, tunable pore structures, and surface chemistry. Modification techniques such as chemical activation, physical activation, and surface functionalization can enhance their CO2 capture performance. Carbon-based sorbents are particularly valued for their low cost, high thermal stability, and potential for regeneration under mild conditions.Expand Specific Solutions05 Novel composite and hybrid sorbent materials

Composite and hybrid sorbent materials combine multiple components to achieve enhanced carbon capture performance beyond what individual materials can provide. These include polymer-inorganic composites, mixed matrix materials, and layered structures that integrate different capture mechanisms. By combining physical adsorption components with chemical absorption elements, these materials can achieve higher capacity, improved selectivity, and better cycling stability. Advanced manufacturing techniques such as 3D printing, electrospinning, and controlled polymerization enable precise control over the structure and properties of these composite sorbents.Expand Specific Solutions

Key Industry Players and Patent Holders

The carbon capture sorbent technology landscape is currently in a growth phase, with the market expected to expand significantly due to increasing global decarbonization efforts. The technology maturity varies across different sorbent types, with major players demonstrating diverse approaches. Academic institutions like Arizona State University, Tianjin University, and University of California are driving fundamental research, while energy giants including Schlumberger, China Petroleum & Chemical Corp., and CHN Energy are focusing on commercial applications. Specialized companies such as Global Thermostat and 8 Rivers Capital are developing proprietary technologies, creating a competitive environment where collaboration between research institutions and industry is accelerating innovation. The field is characterized by significant patent activity around novel materials and process optimization for enhanced CO2 capture efficiency.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a comprehensive carbon capture technology portfolio centered around advanced solid sorbents. Their proprietary technology includes modified activated carbon materials with enhanced surface area (>1500 m²/g) and tailored pore structures optimized for CO2 capture from flue gas streams. Sinopec has pioneered amine-functionalized mesoporous silica sorbents that demonstrate CO2 adsorption capacities of 3-4 mmol/g under typical flue gas conditions (15% CO2, 40-60°C). Their research has yielded composite materials combining the high surface area of inorganic supports with the selectivity of amine functional groups, achieving breakthrough improvements in both capacity and kinetics. Sinopec has implemented pilot-scale testing of these materials at several coal-fired power plants, demonstrating regeneration energy requirements approximately 30% lower than conventional MEA scrubbing technology. Their sorbents maintain performance over hundreds of adsorption-desorption cycles with minimal degradation, addressing a key challenge for commercial deployment.

Strengths: Extensive industrial implementation experience; materials optimized for real-world flue gas conditions including contaminant resistance; established manufacturing capabilities for large-scale production; integrated systems approach combining materials science with process engineering. Weaknesses: Higher initial capital costs compared to conventional technologies; some materials still require relatively high regeneration temperatures (>100°C); potential for performance degradation in the presence of SOx and NOx contaminants.

Global Thermostat Operations LLC

Technical Solution: Global Thermostat has developed a revolutionary carbon capture technology using proprietary amine-based solid sorbents capable of directly capturing CO2 from ambient air and concentrated sources. Their core innovation involves a honeycomb ceramic monolith structure coated with highly optimized amine polymers that demonstrate exceptional CO2 binding affinity even at atmospheric concentrations (400 ppm). The technology utilizes a rapid temperature swing adsorption process with low-grade waste heat (85-100°C) for regeneration, dramatically reducing energy requirements compared to conventional approaches. Global Thermostat's sorbents maintain performance over thousands of cycles with minimal degradation, addressing a critical challenge for commercial viability. Their modular system architecture allows for scalable deployment across various applications from industrial point sources to direct air capture. The company has demonstrated CO2 capture costs significantly below industry averages, with their latest generation technology targeting costs below $100 per ton for direct air capture applications and under $50 per ton for concentrated sources.

Strengths: Versatility in capturing CO2 from both dilute and concentrated sources; low regeneration energy requirements utilizing waste heat; modular, scalable system architecture; demonstrated long-term stability over thousands of cycles. Weaknesses: Higher initial capital costs compared to some competing technologies; potential for performance degradation in environments with certain contaminants; requires careful thermal management to maintain optimal performance.

Critical Patents and Technical Innovations

Highly attrition resistant and dry regenerable sorbents for carbon dioxide capture

PatentActiveUS7820591B2

Innovation

- A dry regenerable sorbent is developed using a method that combines an active component, a high specific surface area support, and an inorganic binder, formed through a spray drying process to create sorbent particles with optimal shape, size distribution, and mechanical strength, enabling efficient CO2 capture and regeneration at temperatures up to 200°C.

Regenerative adsorbents of modified amines on solid supports

PatentInactiveUS20210197172A1

Innovation

- A modified polyamine is reacted with an epoxide to form a cross-linked amine, which is then deposited on a nano-structured support, enhancing CO2 adsorption and desorption characteristics by increasing molecular weight and stability, while maintaining low volatility, thereby improving the sorbent's ability to capture CO2 from gas mixtures at various temperatures and humidity levels.

Regulatory Framework and Climate Policy Impacts

The global regulatory landscape for carbon capture technologies has evolved significantly over the past decade, creating both challenges and opportunities for advanced sorbent development. The Paris Agreement of 2015 marked a pivotal moment, establishing legally binding commitments for nations to limit global warming to well below 2°C above pre-industrial levels. This agreement has catalyzed the implementation of carbon pricing mechanisms in over 40 countries, directly influencing the economic viability of carbon capture technologies and creating market pull for advanced sorbents.

In the United States, the 45Q tax credit has emerged as a cornerstone policy, offering up to $50 per metric ton of CO2 sequestered. The 2022 Inflation Reduction Act further expanded these incentives, increasing credit values to $85 per ton for industrial carbon capture and $180 per ton for direct air capture. These financial mechanisms have significantly altered the commercial landscape for sorbent technologies, particularly favoring those with lower regeneration energy requirements and higher CO2 selectivity.

The European Union's Emissions Trading System (EU ETS) represents another influential regulatory framework, with carbon prices reaching record highs of over €90 per ton in 2022. The EU's Carbon Border Adjustment Mechanism (CBAM) further extends the impact of these regulations globally by imposing carbon-related tariffs on imports. These policies have accelerated patent filings for advanced sorbents in European jurisdictions, with particular emphasis on materials compatible with industrial point-source applications.

China's evolving regulatory approach merits special attention, as its national emissions trading scheme launched in 2021 represents the world's largest carbon market by volume. Chinese policy increasingly emphasizes indigenous innovation in carbon capture technologies, reflected in a 215% increase in domestic patent filings for novel sorbent materials between 2018 and 2022. The country's 14th Five-Year Plan explicitly prioritizes carbon neutrality technologies, creating a supportive environment for sorbent development.

Sectoral regulations also shape the patent landscape significantly. Stringent emissions standards in cement, steel, and power generation have driven industry-specific sorbent innovations. For instance, patents for high-temperature sorbents suitable for cement kiln conditions have increased threefold since 2019, directly responding to sector-specific regulatory pressures. Similarly, maritime regulations from the International Maritime Organization have spurred patents for compact carbon capture systems using advanced sorbents suitable for shipboard deployment.

In the United States, the 45Q tax credit has emerged as a cornerstone policy, offering up to $50 per metric ton of CO2 sequestered. The 2022 Inflation Reduction Act further expanded these incentives, increasing credit values to $85 per ton for industrial carbon capture and $180 per ton for direct air capture. These financial mechanisms have significantly altered the commercial landscape for sorbent technologies, particularly favoring those with lower regeneration energy requirements and higher CO2 selectivity.

The European Union's Emissions Trading System (EU ETS) represents another influential regulatory framework, with carbon prices reaching record highs of over €90 per ton in 2022. The EU's Carbon Border Adjustment Mechanism (CBAM) further extends the impact of these regulations globally by imposing carbon-related tariffs on imports. These policies have accelerated patent filings for advanced sorbents in European jurisdictions, with particular emphasis on materials compatible with industrial point-source applications.

China's evolving regulatory approach merits special attention, as its national emissions trading scheme launched in 2021 represents the world's largest carbon market by volume. Chinese policy increasingly emphasizes indigenous innovation in carbon capture technologies, reflected in a 215% increase in domestic patent filings for novel sorbent materials between 2018 and 2022. The country's 14th Five-Year Plan explicitly prioritizes carbon neutrality technologies, creating a supportive environment for sorbent development.

Sectoral regulations also shape the patent landscape significantly. Stringent emissions standards in cement, steel, and power generation have driven industry-specific sorbent innovations. For instance, patents for high-temperature sorbents suitable for cement kiln conditions have increased threefold since 2019, directly responding to sector-specific regulatory pressures. Similarly, maritime regulations from the International Maritime Organization have spurred patents for compact carbon capture systems using advanced sorbents suitable for shipboard deployment.

Economic Viability and Commercialization Pathways

The economic viability of advanced carbon capture sorbents represents a critical factor in their widespread adoption and commercial success. Current cost analyses indicate that first-generation carbon capture technologies add approximately $40-80 per ton of CO2 captured, making them prohibitively expensive for many applications. Advanced sorbents show promising potential to reduce these costs by 30-50% through improved capacity, selectivity, and regeneration efficiency.

Market projections suggest the carbon capture market could reach $7-10 billion by 2030, with sorbent technologies potentially capturing 25-30% of this market. However, the path to commercialization faces significant economic hurdles, including high initial capital investments for manufacturing facilities and the need for economies of scale to drive down production costs.

Several commercialization pathways have emerged as viable routes to market. The technology licensing model, where developers license their sorbent technology to established industrial partners, offers lower capital requirements but reduced profit margins. Alternatively, joint ventures between technology developers and industrial end-users have proven effective in sharing development costs and market risks.

Government incentives play a crucial role in economic viability, with carbon pricing mechanisms, tax credits (such as the 45Q tax credit in the US offering $50-85 per ton of sequestered CO2), and direct subsidies significantly improving the business case for advanced sorbents. The EU Emissions Trading System and similar carbon markets worldwide are creating additional economic drivers for adoption.

The most economically promising applications currently include natural gas processing, cement production, and power generation, where the cost of carbon capture can be offset by regulatory compliance requirements or product premiums. Early commercial deployments have demonstrated that integration with existing industrial processes can reduce implementation costs by 15-25% compared to standalone systems.

For emerging startups and technology developers, a staged commercialization approach has proven most effective: beginning with high-value, niche applications where performance advantages outweigh cost concerns, then expanding to broader markets as production scales and costs decrease. This approach has been successfully demonstrated by companies like Carbon Clean and Svante, which have secured significant investment while progressively expanding their market presence.

Market projections suggest the carbon capture market could reach $7-10 billion by 2030, with sorbent technologies potentially capturing 25-30% of this market. However, the path to commercialization faces significant economic hurdles, including high initial capital investments for manufacturing facilities and the need for economies of scale to drive down production costs.

Several commercialization pathways have emerged as viable routes to market. The technology licensing model, where developers license their sorbent technology to established industrial partners, offers lower capital requirements but reduced profit margins. Alternatively, joint ventures between technology developers and industrial end-users have proven effective in sharing development costs and market risks.

Government incentives play a crucial role in economic viability, with carbon pricing mechanisms, tax credits (such as the 45Q tax credit in the US offering $50-85 per ton of sequestered CO2), and direct subsidies significantly improving the business case for advanced sorbents. The EU Emissions Trading System and similar carbon markets worldwide are creating additional economic drivers for adoption.

The most economically promising applications currently include natural gas processing, cement production, and power generation, where the cost of carbon capture can be offset by regulatory compliance requirements or product premiums. Early commercial deployments have demonstrated that integration with existing industrial processes can reduce implementation costs by 15-25% compared to standalone systems.

For emerging startups and technology developers, a staged commercialization approach has proven most effective: beginning with high-value, niche applications where performance advantages outweigh cost concerns, then expanding to broader markets as production scales and costs decrease. This approach has been successfully demonstrated by companies like Carbon Clean and Svante, which have secured significant investment while progressively expanding their market presence.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!