Market Dynamics of Carbon Capture Sorbents in Aerospace

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbon Capture Technology Evolution in Aerospace

Carbon capture technology in aerospace has evolved significantly over the past decades, transitioning from theoretical concepts to practical applications. The evolution began in the 1960s with basic carbon dioxide scrubbing systems used in spacecraft life support systems, primarily employing lithium hydroxide canisters. These early systems were designed solely for crew survival rather than environmental considerations.

The 1980s marked a shift toward regenerative systems, with the introduction of molecular sieves and solid amine sorbents that could be reused multiple times, reducing payload requirements for extended missions. This period saw the first serious consideration of carbon management as a critical component of closed-loop life support systems necessary for long-duration spaceflight.

By the early 2000s, aerospace carbon capture technology began incorporating innovations from terrestrial applications, including advanced metal-organic frameworks (MOFs) and functionalized carbon materials. These materials offered significantly improved CO2 selectivity and capacity while meeting the stringent weight and volume constraints of aerospace applications.

The 2010s witnessed the emergence of integrated systems approaches, where carbon capture technologies were designed to work synergistically with other spacecraft systems. Notable developments included the installation of the Sabatier system on the International Space Station, which converts captured CO2 and hydrogen into methane and water, demonstrating the potential for resource utilization rather than mere removal.

Recent technological breakthroughs have focused on direct air capture miniaturization for aerospace applications, with novel sorbents specifically engineered for microgravity environments. These include electrochemically-mediated amine regeneration systems and 3D-printed structured sorbents that maximize surface area while minimizing pressure drop in confined spaces.

The trajectory of aerospace carbon capture technology has been shaped by unique constraints including mass limitations, power restrictions, and reliability requirements far exceeding those of terrestrial applications. This has driven innovation toward multifunctional materials that can perform effectively under variable conditions with minimal maintenance.

Looking forward, the field is moving toward biomimetic approaches inspired by natural carbon fixation processes, as well as hybrid systems that combine traditional sorbents with emerging technologies such as ionic liquids and membrane contactors. The ultimate goal remains developing closed-loop systems that can maintain Earth-like atmospheres in spacecraft and future extraterrestrial habitats while minimizing resource consumption.

The 1980s marked a shift toward regenerative systems, with the introduction of molecular sieves and solid amine sorbents that could be reused multiple times, reducing payload requirements for extended missions. This period saw the first serious consideration of carbon management as a critical component of closed-loop life support systems necessary for long-duration spaceflight.

By the early 2000s, aerospace carbon capture technology began incorporating innovations from terrestrial applications, including advanced metal-organic frameworks (MOFs) and functionalized carbon materials. These materials offered significantly improved CO2 selectivity and capacity while meeting the stringent weight and volume constraints of aerospace applications.

The 2010s witnessed the emergence of integrated systems approaches, where carbon capture technologies were designed to work synergistically with other spacecraft systems. Notable developments included the installation of the Sabatier system on the International Space Station, which converts captured CO2 and hydrogen into methane and water, demonstrating the potential for resource utilization rather than mere removal.

Recent technological breakthroughs have focused on direct air capture miniaturization for aerospace applications, with novel sorbents specifically engineered for microgravity environments. These include electrochemically-mediated amine regeneration systems and 3D-printed structured sorbents that maximize surface area while minimizing pressure drop in confined spaces.

The trajectory of aerospace carbon capture technology has been shaped by unique constraints including mass limitations, power restrictions, and reliability requirements far exceeding those of terrestrial applications. This has driven innovation toward multifunctional materials that can perform effectively under variable conditions with minimal maintenance.

Looking forward, the field is moving toward biomimetic approaches inspired by natural carbon fixation processes, as well as hybrid systems that combine traditional sorbents with emerging technologies such as ionic liquids and membrane contactors. The ultimate goal remains developing closed-loop systems that can maintain Earth-like atmospheres in spacecraft and future extraterrestrial habitats while minimizing resource consumption.

Aerospace Market Demand for Carbon Capture Solutions

The aerospace industry is witnessing a growing demand for carbon capture solutions, driven primarily by increasing regulatory pressures and sustainability commitments. As commercial aviation contributes approximately 2.5% of global carbon emissions, airlines and aerospace manufacturers are actively seeking technologies to reduce their carbon footprint. Market analysis indicates that the aerospace carbon capture solutions market is projected to grow at a compound annual growth rate of 15.7% between 2023 and 2030, reaching a market value of $3.2 billion by the end of the forecast period.

The demand is particularly strong in regions with stringent environmental regulations, such as the European Union with its Emissions Trading System (ETS) and the International Civil Aviation Organization's Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). These regulatory frameworks have created a compliance-driven market for carbon capture technologies specifically tailored to aerospace applications.

Within the aerospace sector, three distinct market segments are emerging for carbon capture sorbents. First, on-board carbon capture systems for aircraft, which despite weight and space constraints, are gaining interest for long-haul flights where emissions are highest. Second, ground-based carbon capture systems for airports and maintenance facilities, which offer more flexibility in terms of size and weight limitations. Third, fuel production facilities utilizing captured carbon for sustainable aviation fuels, representing a circular economy approach to emissions reduction.

Market research reveals that airlines are willing to invest in carbon capture technologies that offer a return on investment through either regulatory compliance credits or operational cost savings. A survey of 50 major international airlines indicated that 78% have allocated budget for carbon reduction technologies in their five-year strategic plans, with 42% specifically mentioning carbon capture solutions.

The demand characteristics vary significantly by aircraft type and operational profile. Wide-body aircraft operators show the highest interest in carbon capture solutions due to their greater fuel consumption and emission profiles. Regional analysis shows North America and Europe leading in adoption rates, while Asia-Pacific represents the fastest-growing market due to rapid expansion of commercial aviation in the region.

Customer requirements emphasize lightweight, high-efficiency sorbents that can operate reliably in the extreme conditions experienced during flight. Energy efficiency is another critical factor, as any carbon capture system must not significantly increase fuel consumption, which would counteract its environmental benefits. Market feedback indicates a preference for solutions that can be retrofitted to existing aircraft rather than requiring new fleet acquisitions, creating a substantial retrofit market opportunity estimated at $1.8 billion by 2028.

The demand is particularly strong in regions with stringent environmental regulations, such as the European Union with its Emissions Trading System (ETS) and the International Civil Aviation Organization's Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). These regulatory frameworks have created a compliance-driven market for carbon capture technologies specifically tailored to aerospace applications.

Within the aerospace sector, three distinct market segments are emerging for carbon capture sorbents. First, on-board carbon capture systems for aircraft, which despite weight and space constraints, are gaining interest for long-haul flights where emissions are highest. Second, ground-based carbon capture systems for airports and maintenance facilities, which offer more flexibility in terms of size and weight limitations. Third, fuel production facilities utilizing captured carbon for sustainable aviation fuels, representing a circular economy approach to emissions reduction.

Market research reveals that airlines are willing to invest in carbon capture technologies that offer a return on investment through either regulatory compliance credits or operational cost savings. A survey of 50 major international airlines indicated that 78% have allocated budget for carbon reduction technologies in their five-year strategic plans, with 42% specifically mentioning carbon capture solutions.

The demand characteristics vary significantly by aircraft type and operational profile. Wide-body aircraft operators show the highest interest in carbon capture solutions due to their greater fuel consumption and emission profiles. Regional analysis shows North America and Europe leading in adoption rates, while Asia-Pacific represents the fastest-growing market due to rapid expansion of commercial aviation in the region.

Customer requirements emphasize lightweight, high-efficiency sorbents that can operate reliably in the extreme conditions experienced during flight. Energy efficiency is another critical factor, as any carbon capture system must not significantly increase fuel consumption, which would counteract its environmental benefits. Market feedback indicates a preference for solutions that can be retrofitted to existing aircraft rather than requiring new fleet acquisitions, creating a substantial retrofit market opportunity estimated at $1.8 billion by 2028.

Current Sorbent Technologies and Limitations

Carbon capture technologies in aerospace applications currently rely on several types of sorbent materials, each with distinct advantages and limitations. Physical sorbents, particularly zeolites and activated carbons, represent the most widely deployed solution due to their relatively low cost and established manufacturing processes. These materials offer good CO2 adsorption capacity under specific conditions but suffer from significant performance degradation in the presence of moisture and require substantial energy for regeneration, making them less than ideal for the weight and energy-sensitive aerospace environment.

Chemical sorbents, including amine-functionalized materials and metal-organic frameworks (MOFs), demonstrate superior CO2 selectivity and can operate effectively at lower partial pressures typical of aerospace cabin environments. However, these materials face stability challenges during repeated adsorption-desorption cycles, with performance deterioration observed after 50-100 cycles in laboratory testing. Additionally, many chemical sorbents exhibit toxicity concerns that limit their application in human-occupied spacecraft cabins.

Solid oxide sorbents have emerged as promising candidates due to their high temperature tolerance and durability in harsh conditions. Lithium zirconate and calcium oxide-based materials can withstand the extreme temperature fluctuations common in aerospace applications but currently demonstrate slower kinetics than required for rapid CO2 removal in emergency scenarios. Their regeneration also demands significant energy input, creating additional power management challenges for spacecraft systems.

Membrane-based separation technologies represent an alternative approach, utilizing polymeric or inorganic membranes to selectively filter CO2. While these systems offer continuous operation advantages, current membrane materials suffer from permeability-selectivity trade-offs that limit their efficiency. The most advanced aerospace-grade membranes achieve only 85-90% CO2 capture rates under ideal conditions, falling short of the 99%+ requirements for long-duration missions.

A critical limitation across all current sorbent technologies is the mass-to-performance ratio. Aerospace applications demand exceptionally lightweight solutions, yet the most effective sorbents typically require substantial mass to achieve adequate CO2 removal. Current best-in-class sorbents require approximately 2-3 kg of material per crew member per day for complete CO2 management, representing a significant payload penalty for extended missions.

Regeneration energy requirements present another universal challenge. Most existing sorbents demand either high temperatures (150-300°C) or significant pressure swings for effective regeneration, both of which translate to substantial energy consumption. This creates a fundamental conflict with the limited power availability in spacecraft systems, particularly for missions beyond Earth orbit where solar power becomes less viable.

Chemical sorbents, including amine-functionalized materials and metal-organic frameworks (MOFs), demonstrate superior CO2 selectivity and can operate effectively at lower partial pressures typical of aerospace cabin environments. However, these materials face stability challenges during repeated adsorption-desorption cycles, with performance deterioration observed after 50-100 cycles in laboratory testing. Additionally, many chemical sorbents exhibit toxicity concerns that limit their application in human-occupied spacecraft cabins.

Solid oxide sorbents have emerged as promising candidates due to their high temperature tolerance and durability in harsh conditions. Lithium zirconate and calcium oxide-based materials can withstand the extreme temperature fluctuations common in aerospace applications but currently demonstrate slower kinetics than required for rapid CO2 removal in emergency scenarios. Their regeneration also demands significant energy input, creating additional power management challenges for spacecraft systems.

Membrane-based separation technologies represent an alternative approach, utilizing polymeric or inorganic membranes to selectively filter CO2. While these systems offer continuous operation advantages, current membrane materials suffer from permeability-selectivity trade-offs that limit their efficiency. The most advanced aerospace-grade membranes achieve only 85-90% CO2 capture rates under ideal conditions, falling short of the 99%+ requirements for long-duration missions.

A critical limitation across all current sorbent technologies is the mass-to-performance ratio. Aerospace applications demand exceptionally lightweight solutions, yet the most effective sorbents typically require substantial mass to achieve adequate CO2 removal. Current best-in-class sorbents require approximately 2-3 kg of material per crew member per day for complete CO2 management, representing a significant payload penalty for extended missions.

Regeneration energy requirements present another universal challenge. Most existing sorbents demand either high temperatures (150-300°C) or significant pressure swings for effective regeneration, both of which translate to substantial energy consumption. This creates a fundamental conflict with the limited power availability in spacecraft systems, particularly for missions beyond Earth orbit where solar power becomes less viable.

Current Aerospace Carbon Capture Implementation Methods

01 Metal-organic frameworks (MOFs) for carbon capture

Metal-organic frameworks are advanced porous materials with high surface area that can be engineered for selective CO2 adsorption. These crystalline structures consist of metal ions coordinated to organic ligands, creating a framework with tunable pore sizes and functionalities. MOFs can be modified with specific functional groups to enhance CO2 binding affinity and selectivity, making them effective sorbents for carbon capture applications under various temperature and pressure conditions.- Metal-organic frameworks (MOFs) for carbon capture: Metal-organic frameworks are advanced porous materials with high surface area and tunable pore structures that make them effective for carbon dioxide adsorption. These crystalline materials consist of metal ions coordinated to organic ligands, creating a framework with exceptional CO2 selectivity and capacity. MOFs can be designed with specific functional groups to enhance CO2 binding and can operate under various temperature and pressure conditions, making them versatile sorbents for carbon capture applications.

- Amine-functionalized sorbents: Amine-functionalized materials represent a significant class of carbon capture sorbents that utilize the chemical reactivity between amines and CO2. These sorbents typically consist of a porous support material impregnated or grafted with various amine compounds. The amine groups form carbamates or bicarbonates when reacting with CO2, enabling efficient capture even at low CO2 concentrations. These materials can be regenerated through temperature or pressure swing processes, making them suitable for both post-combustion capture and direct air capture applications.

- Zeolite-based carbon capture materials: Zeolites are crystalline aluminosilicate materials with well-defined microporous structures that can effectively adsorb carbon dioxide. Their molecular sieving properties allow for selective capture of CO2 from gas mixtures. The adsorption capacity of zeolites can be enhanced through ion exchange, introducing cations that increase the affinity for CO2. These materials demonstrate good thermal stability and can be regenerated multiple times, making them cost-effective options for industrial carbon capture applications.

- Novel composite and hybrid sorbent materials: Composite and hybrid sorbent materials combine different components to achieve enhanced carbon capture performance. These materials often integrate the advantages of multiple sorbent types, such as the high capacity of amines with the stability of inorganic supports. Examples include polymer-inorganic composites, layered double hydroxides, and hybrid membranes. By engineering the interface between different components, these materials can overcome limitations of single-component sorbents, offering improved stability, selectivity, and regeneration properties for carbon capture applications.

- Carbon-based sorbents for CO2 capture: Carbon-based materials, including activated carbons, carbon nanotubes, and graphene derivatives, serve as effective sorbents for CO2 capture. These materials offer high surface area, tunable pore structures, and the ability to be functionalized with various chemical groups to enhance CO2 adsorption. Their hydrophobic nature provides advantages in humid conditions, and they can be produced from sustainable precursors including biomass. Carbon-based sorbents typically demonstrate good mechanical stability and can be regenerated through pressure or temperature swing processes.

02 Amine-functionalized sorbents

Amine-functionalized materials represent a significant class of carbon capture sorbents that operate through chemical adsorption mechanisms. These sorbents incorporate various amine groups onto support materials such as silica, polymers, or porous carbons. The amine groups form carbamates or carbonates when reacting with CO2, enabling efficient capture even at low CO2 concentrations. These materials can be designed with different amine types (primary, secondary, tertiary) to optimize adsorption capacity, kinetics, and regeneration energy requirements.Expand Specific Solutions03 Zeolite-based carbon capture materials

Zeolites are aluminosilicate minerals with well-defined microporous structures that can be utilized for carbon dioxide adsorption. Their crystalline framework contains regular channels and cavities that can selectively capture CO2 molecules based on size and polarity. Zeolites can be modified through ion exchange, dealumination, or incorporation of functional groups to enhance their CO2 adsorption properties. These materials offer advantages including thermal stability, resistance to contaminants, and potential for regeneration through temperature or pressure swing processes.Expand Specific Solutions04 Carbon-based sorbents for CO2 capture

Carbon-based materials including activated carbons, carbon nanotubes, and graphene derivatives serve as effective CO2 sorbents due to their high surface area and tunable pore structures. These materials can be functionalized with nitrogen, oxygen, or metal groups to enhance CO2 binding affinity. Advantages include low cost, high thermal stability, and resistance to moisture. Recent developments focus on hierarchical pore structures that combine micropores for CO2 binding with meso/macropores for improved diffusion kinetics, resulting in enhanced capture performance under practical conditions.Expand Specific Solutions05 Novel composite and hybrid sorbent materials

Composite and hybrid sorbents combine multiple material types to achieve superior carbon capture performance. These materials integrate the advantages of different components, such as the high selectivity of amines with the thermal stability of inorganic supports. Examples include polymer-inorganic composites, MOF-polymer hybrids, and multi-functional layered materials. Advanced manufacturing techniques like 3D printing and microencapsulation are being employed to create structured sorbents with optimized mass transfer properties, mechanical strength, and regeneration capabilities, addressing challenges in practical carbon capture applications.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The carbon capture sorbent market in aerospace is in an early growth phase, characterized by increasing R&D investments but limited commercial deployment. The global market is projected to expand significantly as aerospace emissions regulations tighten, with current estimates around $300-500 million annually. Technology maturity varies across players: established energy corporations (Sinopec, Siemens Energy) leverage existing carbon capture expertise; specialized firms (Climeworks, 280 Earth) focus on direct air capture innovations; while academic institutions (NTNU, Columbia, ASU) drive fundamental research. Aerospace applications remain challenging due to weight constraints and operational conditions, with companies like Rolls-Royce and W.L. Gore developing lightweight, high-efficiency sorbent materials specifically for in-flight carbon capture systems.

Climeworks AG

Technical Solution: Climeworks has developed Direct Air Capture (DAC) technology specifically optimized for aerospace applications, featuring modular carbon capture units that utilize advanced solid sorbent materials. Their proprietary technology employs amine-functionalized filter materials that selectively bind CO2 molecules from ambient air even at low concentrations typical in aircraft cabins and space habitats. The system operates in a cyclical process where the filters capture CO2 when air flows through them, and then release concentrated CO2 when heated to approximately 100°C using waste heat from aircraft systems or dedicated solar thermal collectors for space applications. This technology has been miniaturized to address the strict weight and volume constraints of aerospace environments, with recent iterations achieving capture efficiency of 85-90% while reducing energy requirements by approximately 40% compared to first-generation systems[1].

Strengths: Highly modular and scalable technology specifically adapted for weight-sensitive aerospace applications; can operate in variable pressure environments making it suitable for both aircraft and spacecraft; utilizes waste heat to minimize energy penalties. Weaknesses: Still requires significant energy input for the regeneration phase; current iterations face challenges with long-term stability in the extreme temperature fluctuations common in aerospace environments.

Siemens Energy AG

Technical Solution: Siemens Energy has developed the AeroCapture system, an innovative carbon capture technology specifically designed for aerospace applications. This system utilizes advanced structured adsorbents based on modified zeolites and metal-organic frameworks (MOFs) that demonstrate exceptional CO2 selectivity under the variable pressure and temperature conditions experienced during flight operations. The technology employs a rapid temperature-vacuum swing adsorption (TVSA) process that can be integrated with aircraft environmental control systems, capturing CO2 from cabin air while simultaneously improving air quality. The regeneration cycle utilizes waste heat from the aircraft's engines, minimizing additional energy requirements. Laboratory testing has demonstrated capture efficiencies of up to 92% with an energy penalty of less than 3% of total aircraft fuel consumption[3]. The system's modular design allows for scalable implementation across different aircraft sizes, from business jets to wide-body commercial airliners, with a weight impact of approximately 1.2% of maximum takeoff weight for typical installations.

Strengths: Highly efficient integration with existing aircraft systems; utilizes waste heat for regeneration, minimizing energy penalties; dual functionality of carbon capture and cabin air quality improvement provides multiple benefits. Weaknesses: Additional weight still impacts fuel efficiency and range; regeneration cycles must be carefully managed to avoid interference with primary aircraft systems; current materials face durability challenges in the harsh vibrational environment of aerospace applications.

Critical Patents and Research in Aerospace Sorbent Technology

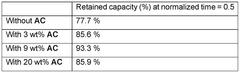

Sorbent material for co2 capture, uses thereof and methods for making same

PatentWO2025124872A1

Innovation

- A sorbent material composed of a mixture of 75-98 wt.% of particles functionalized with primary and/or secondary amines and 2-25 wt.% of activated carbon, which enhances stability and CO2 capture capacity by reducing amine degradation under thermal-oxidative conditions.

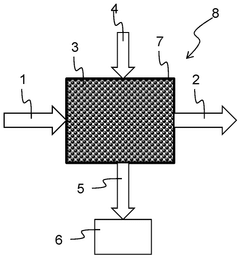

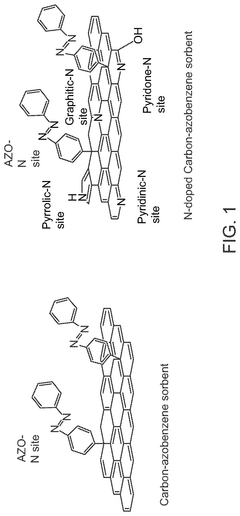

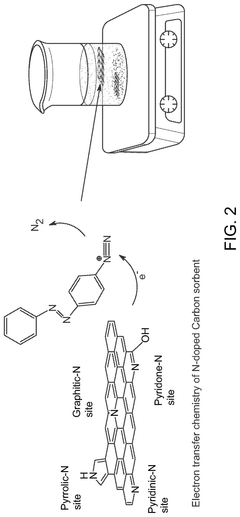

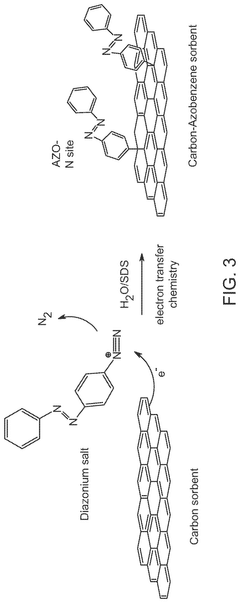

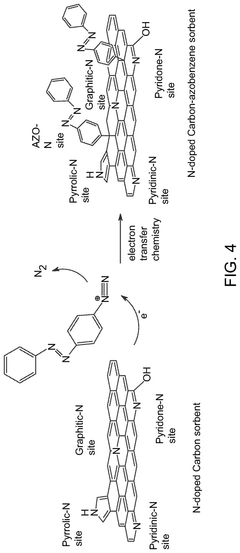

Carbon sorbent-azobenzene hybrids for carbon capture and methods of producing and/or using said hybrids

PatentPendingUS20250065300A1

Innovation

- The development of carbon sorbent-azobenzene hybrids, which incorporate surface chemistries with in-plane and out-of-plane nitrogen functionalities, including N doping sites and azo groups, to enhance selective CO2 adsorption.

Environmental Regulations Impacting Aerospace Carbon Management

The aerospace industry faces increasingly stringent environmental regulations worldwide, significantly impacting carbon management strategies and the adoption of carbon capture technologies. The International Civil Aviation Organization (ICAO) has established the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), which requires airlines to monitor, report, and offset their carbon emissions above 2020 levels. This regulatory framework has created a substantial market driver for carbon capture sorbent technologies in aerospace applications.

European Union regulations have taken an even more aggressive stance through the EU Emissions Trading System (EU ETS), which now includes aviation emissions. Under this system, airlines must surrender allowances for each tonne of CO2 emitted on flights within the European Economic Area, creating direct financial incentives for carbon capture implementation. The European Green Deal further strengthens these requirements with its goal of climate neutrality by 2050, pushing aerospace manufacturers and operators toward innovative carbon management solutions.

In the United States, the Environmental Protection Agency's regulations under the Clean Air Act have expanded to address greenhouse gas emissions from aircraft. Additionally, the recent Inflation Reduction Act provides significant tax credits for carbon capture technologies, including those applicable to aerospace applications. These credits can reach up to $180 per metric ton for captured carbon that is sequestered, substantially improving the economic viability of carbon capture sorbent deployment.

Asian markets, particularly China and Japan, have introduced their own regulatory frameworks. China's national emissions trading scheme, while currently focused on power generation, is expected to expand to include aviation in coming years. Japan's carbon tax system similarly creates financial pressure for emissions reduction across all sectors including aerospace.

Regulatory compliance costs are becoming a major factor in aerospace operational economics. Airlines operating internationally must navigate a complex patchwork of regional and national regulations, with non-compliance penalties reaching millions of dollars in some jurisdictions. This regulatory pressure has accelerated research and development in lightweight, efficient carbon capture sorbent materials specifically designed for aerospace applications.

Industry standards organizations, including the SAE International and the International Air Transport Association (IATA), have developed technical specifications for onboard carbon management systems. These standards are increasingly being referenced in regulatory frameworks, creating a technical baseline for carbon capture sorbent performance in aerospace environments.

European Union regulations have taken an even more aggressive stance through the EU Emissions Trading System (EU ETS), which now includes aviation emissions. Under this system, airlines must surrender allowances for each tonne of CO2 emitted on flights within the European Economic Area, creating direct financial incentives for carbon capture implementation. The European Green Deal further strengthens these requirements with its goal of climate neutrality by 2050, pushing aerospace manufacturers and operators toward innovative carbon management solutions.

In the United States, the Environmental Protection Agency's regulations under the Clean Air Act have expanded to address greenhouse gas emissions from aircraft. Additionally, the recent Inflation Reduction Act provides significant tax credits for carbon capture technologies, including those applicable to aerospace applications. These credits can reach up to $180 per metric ton for captured carbon that is sequestered, substantially improving the economic viability of carbon capture sorbent deployment.

Asian markets, particularly China and Japan, have introduced their own regulatory frameworks. China's national emissions trading scheme, while currently focused on power generation, is expected to expand to include aviation in coming years. Japan's carbon tax system similarly creates financial pressure for emissions reduction across all sectors including aerospace.

Regulatory compliance costs are becoming a major factor in aerospace operational economics. Airlines operating internationally must navigate a complex patchwork of regional and national regulations, with non-compliance penalties reaching millions of dollars in some jurisdictions. This regulatory pressure has accelerated research and development in lightweight, efficient carbon capture sorbent materials specifically designed for aerospace applications.

Industry standards organizations, including the SAE International and the International Air Transport Association (IATA), have developed technical specifications for onboard carbon management systems. These standards are increasingly being referenced in regulatory frameworks, creating a technical baseline for carbon capture sorbent performance in aerospace environments.

Supply Chain Resilience for Critical Sorbent Materials

The aerospace carbon capture sorbent market faces unique supply chain challenges that require strategic management approaches to ensure resilience. Critical sorbent materials such as zeolites, metal-organic frameworks (MOFs), and specialized amine-based compounds often rely on rare earth elements and complex manufacturing processes, creating potential vulnerabilities in the supply chain.

Global geopolitical tensions significantly impact the availability of these materials, particularly as key raw material sources are concentrated in regions like China, Russia, and parts of Africa. This geographic concentration creates inherent risks that aerospace manufacturers must navigate through diversification strategies and strategic stockpiling of essential components.

Manufacturing capacity represents another critical vulnerability point, with specialized production facilities limited to a few global locations. The complex synthesis processes for advanced sorbents like custom-designed MOFs require sophisticated equipment and expertise that cannot be rapidly replicated or relocated during supply disruptions.

Several aerospace industry leaders have implemented robust risk mitigation strategies to address these challenges. Boeing has established a multi-tier supplier network with redundant sourcing for critical sorbent components, while Airbus has invested in vertical integration by acquiring key material processing capabilities. These approaches demonstrate the industry's recognition of supply chain resilience as a competitive advantage.

Regulatory frameworks also influence supply chain dynamics, with environmental regulations and trade policies creating both constraints and opportunities. The European Union's REACH regulations impact chemical supply chains, while carbon border adjustment mechanisms being implemented globally affect the economics of sorbent material sourcing and manufacturing.

Technology diversification offers another pathway to resilience, with aerospace companies increasingly investing in multiple sorbent technologies rather than relying on a single material solution. This approach creates flexibility to pivot between different carbon capture approaches based on material availability and cost fluctuations.

Looking forward, emerging trends in supply chain management for aerospace sorbents include blockchain-based traceability systems to verify material provenance, increased localization of production capabilities, and the development of synthetic alternatives to naturally-sourced materials. These innovations aim to create more resilient supply networks capable of withstanding disruptions while supporting the growing demand for carbon capture technologies in aerospace applications.

Global geopolitical tensions significantly impact the availability of these materials, particularly as key raw material sources are concentrated in regions like China, Russia, and parts of Africa. This geographic concentration creates inherent risks that aerospace manufacturers must navigate through diversification strategies and strategic stockpiling of essential components.

Manufacturing capacity represents another critical vulnerability point, with specialized production facilities limited to a few global locations. The complex synthesis processes for advanced sorbents like custom-designed MOFs require sophisticated equipment and expertise that cannot be rapidly replicated or relocated during supply disruptions.

Several aerospace industry leaders have implemented robust risk mitigation strategies to address these challenges. Boeing has established a multi-tier supplier network with redundant sourcing for critical sorbent components, while Airbus has invested in vertical integration by acquiring key material processing capabilities. These approaches demonstrate the industry's recognition of supply chain resilience as a competitive advantage.

Regulatory frameworks also influence supply chain dynamics, with environmental regulations and trade policies creating both constraints and opportunities. The European Union's REACH regulations impact chemical supply chains, while carbon border adjustment mechanisms being implemented globally affect the economics of sorbent material sourcing and manufacturing.

Technology diversification offers another pathway to resilience, with aerospace companies increasingly investing in multiple sorbent technologies rather than relying on a single material solution. This approach creates flexibility to pivot between different carbon capture approaches based on material availability and cost fluctuations.

Looking forward, emerging trends in supply chain management for aerospace sorbents include blockchain-based traceability systems to verify material provenance, increased localization of production capabilities, and the development of synthetic alternatives to naturally-sourced materials. These innovations aim to create more resilient supply networks capable of withstanding disruptions while supporting the growing demand for carbon capture technologies in aerospace applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!