Comparative Analysis of Conductive and Non-Conductive Polymer Composites

OCT 23, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Polymer Composites Evolution and Research Objectives

Polymer composites have evolved significantly over the past several decades, transforming from simple mixtures to sophisticated engineered materials with tailored properties. The journey began in the 1960s with the introduction of glass fiber reinforced polymers, which marked the first generation of modern composite materials. By the 1980s, carbon fiber reinforced polymers emerged, offering superior strength-to-weight ratios that revolutionized aerospace and automotive industries.

The evolution of conductive polymer composites represents a particularly significant development trajectory. Initially, polymers were valued primarily for their electrical insulation properties. However, the discovery of conductive polymers by Alan Heeger, Alan MacDiarmid, and Hideki Shirakawa in the late 1970s—work that earned them the Nobel Prize in Chemistry in 2000—opened new possibilities for creating electrically conductive polymer-based materials.

Non-conductive polymer composites have simultaneously undergone their own evolutionary path, with innovations focusing on mechanical properties, thermal stability, and chemical resistance. The incorporation of various fillers such as silica, clay, and metal oxides has enabled the development of materials with enhanced performance characteristics suited for specific applications ranging from construction to medical devices.

Recent advancements in nanotechnology have dramatically accelerated the development of both conductive and non-conductive polymer composites. The integration of nanomaterials such as carbon nanotubes, graphene, and metal nanoparticles has enabled unprecedented control over electrical, thermal, and mechanical properties at the nanoscale, blurring the traditional boundaries between conductive and non-conductive materials.

The primary research objectives in this field now center on understanding the fundamental mechanisms governing the relationship between composite structure and resultant properties. Specifically, researchers aim to elucidate how filler type, concentration, dispersion quality, and interfacial interactions affect the electrical conductivity, mechanical strength, and thermal behavior of polymer composites.

Additionally, there is growing interest in developing sustainable and environmentally friendly composite materials that maintain or exceed the performance of conventional options. This includes exploring bio-based polymers and natural fillers as alternatives to petroleum-derived materials, as well as designing composites with improved recyclability and end-of-life management.

The ultimate goal of current research efforts is to establish comprehensive design principles that enable the precise engineering of polymer composites with predictable properties for targeted applications. This includes developing reliable models for predicting composite behavior, standardizing characterization methods, and scaling up production processes to facilitate broader industrial adoption of these advanced materials.

The evolution of conductive polymer composites represents a particularly significant development trajectory. Initially, polymers were valued primarily for their electrical insulation properties. However, the discovery of conductive polymers by Alan Heeger, Alan MacDiarmid, and Hideki Shirakawa in the late 1970s—work that earned them the Nobel Prize in Chemistry in 2000—opened new possibilities for creating electrically conductive polymer-based materials.

Non-conductive polymer composites have simultaneously undergone their own evolutionary path, with innovations focusing on mechanical properties, thermal stability, and chemical resistance. The incorporation of various fillers such as silica, clay, and metal oxides has enabled the development of materials with enhanced performance characteristics suited for specific applications ranging from construction to medical devices.

Recent advancements in nanotechnology have dramatically accelerated the development of both conductive and non-conductive polymer composites. The integration of nanomaterials such as carbon nanotubes, graphene, and metal nanoparticles has enabled unprecedented control over electrical, thermal, and mechanical properties at the nanoscale, blurring the traditional boundaries between conductive and non-conductive materials.

The primary research objectives in this field now center on understanding the fundamental mechanisms governing the relationship between composite structure and resultant properties. Specifically, researchers aim to elucidate how filler type, concentration, dispersion quality, and interfacial interactions affect the electrical conductivity, mechanical strength, and thermal behavior of polymer composites.

Additionally, there is growing interest in developing sustainable and environmentally friendly composite materials that maintain or exceed the performance of conventional options. This includes exploring bio-based polymers and natural fillers as alternatives to petroleum-derived materials, as well as designing composites with improved recyclability and end-of-life management.

The ultimate goal of current research efforts is to establish comprehensive design principles that enable the precise engineering of polymer composites with predictable properties for targeted applications. This includes developing reliable models for predicting composite behavior, standardizing characterization methods, and scaling up production processes to facilitate broader industrial adoption of these advanced materials.

Market Applications and Demand Analysis for Conductive Polymers

The global market for conductive polymers has witnessed substantial growth over the past decade, driven primarily by increasing demand in electronics, automotive, and healthcare sectors. Current market valuations place the conductive polymer industry at approximately $3.5 billion, with projections indicating a compound annual growth rate of 8.2% through 2028. This growth trajectory is significantly outpacing traditional materials markets, reflecting the expanding application landscape for these versatile materials.

Electronics manufacturing represents the largest application segment, accounting for nearly 40% of the total market share. The miniaturization trend in consumer electronics has intensified demand for conductive polymers that can replace metallic components while offering weight reduction, design flexibility, and cost advantages. Particularly notable is the surge in demand for electromagnetic interference (EMI) shielding solutions, where conductive polymer composites provide effective alternatives to conventional metal-based shields.

The automotive industry has emerged as the fastest-growing application sector, with an annual growth rate exceeding 10%. This acceleration is primarily attributed to the rapid expansion of electric vehicle production, where conductive polymers find applications in battery components, sensors, and lightweight structural elements. The industry's shift toward sustainable manufacturing has further bolstered demand for conductive polymers derived from renewable sources.

Healthcare applications represent a promising frontier, with conductive polymers increasingly utilized in biosensors, drug delivery systems, and tissue engineering. The market for medical-grade conductive polymers is expected to double within the next five years, driven by innovations in wearable health monitoring devices and implantable medical technologies.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for approximately 45% of global consumption, followed by North America and Europe. China and South Korea have established themselves as manufacturing hubs for conductive polymer-based products, while significant R&D investments in North America and Europe continue to drive innovation in high-performance applications.

Customer requirements are evolving toward enhanced conductivity at lower filler loadings, improved mechanical properties, and better environmental stability. Market surveys indicate that over 70% of industrial users prioritize consistent electrical performance across varying environmental conditions, while 65% emphasize the importance of processing compatibility with existing manufacturing infrastructure.

The price sensitivity varies significantly across application segments, with consumer electronics manufacturers demonstrating higher price elasticity compared to aerospace and defense contractors, who prioritize performance reliability over cost considerations. This market segmentation has created opportunities for tiered product offerings catering to diverse performance and price requirements.

Electronics manufacturing represents the largest application segment, accounting for nearly 40% of the total market share. The miniaturization trend in consumer electronics has intensified demand for conductive polymers that can replace metallic components while offering weight reduction, design flexibility, and cost advantages. Particularly notable is the surge in demand for electromagnetic interference (EMI) shielding solutions, where conductive polymer composites provide effective alternatives to conventional metal-based shields.

The automotive industry has emerged as the fastest-growing application sector, with an annual growth rate exceeding 10%. This acceleration is primarily attributed to the rapid expansion of electric vehicle production, where conductive polymers find applications in battery components, sensors, and lightweight structural elements. The industry's shift toward sustainable manufacturing has further bolstered demand for conductive polymers derived from renewable sources.

Healthcare applications represent a promising frontier, with conductive polymers increasingly utilized in biosensors, drug delivery systems, and tissue engineering. The market for medical-grade conductive polymers is expected to double within the next five years, driven by innovations in wearable health monitoring devices and implantable medical technologies.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for approximately 45% of global consumption, followed by North America and Europe. China and South Korea have established themselves as manufacturing hubs for conductive polymer-based products, while significant R&D investments in North America and Europe continue to drive innovation in high-performance applications.

Customer requirements are evolving toward enhanced conductivity at lower filler loadings, improved mechanical properties, and better environmental stability. Market surveys indicate that over 70% of industrial users prioritize consistent electrical performance across varying environmental conditions, while 65% emphasize the importance of processing compatibility with existing manufacturing infrastructure.

The price sensitivity varies significantly across application segments, with consumer electronics manufacturers demonstrating higher price elasticity compared to aerospace and defense contractors, who prioritize performance reliability over cost considerations. This market segmentation has created opportunities for tiered product offerings catering to diverse performance and price requirements.

Technical Barriers and Global Development Status

The development of polymer composites faces significant technical barriers that vary between conductive and non-conductive variants. For conductive polymer composites, achieving uniform dispersion of conductive fillers remains a persistent challenge. When fillers like carbon nanotubes or graphene are incorporated at high concentrations to reach percolation threshold, they tend to agglomerate due to strong van der Waals forces, creating inconsistent electrical properties throughout the material. This heterogeneity significantly impacts performance reliability in applications requiring precise conductivity levels.

Processing difficulties present another major obstacle, particularly for high-viscosity polymer melts containing conductive fillers. Conventional processing methods often damage the aspect ratio of fillers like carbon nanotubes, reducing their effectiveness. Additionally, the interface between polymer matrices and conductive fillers frequently suffers from poor compatibility, leading to mechanical weakness and electrical discontinuities.

For non-conductive polymer composites, achieving balanced mechanical properties poses a significant challenge. Enhancing stiffness typically sacrifices toughness, creating a persistent trade-off that limits application versatility. Furthermore, long-term durability issues such as creep, fatigue, and environmental degradation continue to restrict their implementation in demanding environments.

Globally, development status shows distinct regional patterns. North America leads in research publications on conductive polymer composites, with significant contributions from institutions like MIT and Stanford University focusing on novel nanofiller integration techniques. The European Union emphasizes environmentally sustainable approaches, with German and French research centers pioneering bio-based conductive composites with reduced environmental footprint.

Asia-Pacific region, particularly China, Japan, and South Korea, dominates in patent filings and manufacturing scale-up. Chinese institutions have made remarkable progress in cost-effective production methods for graphene-based composites, while Japanese companies lead in high-precision applications for automotive electronics.

The development trajectory reveals an acceleration in cross-disciplinary approaches. Recent advancements include self-healing conductive composites from South Korean researchers and stimuli-responsive materials from Singapore that can switch between conductive and non-conductive states. However, standardization remains fragmented globally, with different regions adopting varied testing protocols that complicate international collaboration and technology transfer.

Emerging economies like India and Brazil are rapidly expanding their research capabilities in specialized niches, with India focusing on affordable healthcare applications and Brazil on renewable resource-based composites. This global landscape reflects both the technical challenges and the diverse approaches being pursued to overcome them.

Processing difficulties present another major obstacle, particularly for high-viscosity polymer melts containing conductive fillers. Conventional processing methods often damage the aspect ratio of fillers like carbon nanotubes, reducing their effectiveness. Additionally, the interface between polymer matrices and conductive fillers frequently suffers from poor compatibility, leading to mechanical weakness and electrical discontinuities.

For non-conductive polymer composites, achieving balanced mechanical properties poses a significant challenge. Enhancing stiffness typically sacrifices toughness, creating a persistent trade-off that limits application versatility. Furthermore, long-term durability issues such as creep, fatigue, and environmental degradation continue to restrict their implementation in demanding environments.

Globally, development status shows distinct regional patterns. North America leads in research publications on conductive polymer composites, with significant contributions from institutions like MIT and Stanford University focusing on novel nanofiller integration techniques. The European Union emphasizes environmentally sustainable approaches, with German and French research centers pioneering bio-based conductive composites with reduced environmental footprint.

Asia-Pacific region, particularly China, Japan, and South Korea, dominates in patent filings and manufacturing scale-up. Chinese institutions have made remarkable progress in cost-effective production methods for graphene-based composites, while Japanese companies lead in high-precision applications for automotive electronics.

The development trajectory reveals an acceleration in cross-disciplinary approaches. Recent advancements include self-healing conductive composites from South Korean researchers and stimuli-responsive materials from Singapore that can switch between conductive and non-conductive states. However, standardization remains fragmented globally, with different regions adopting varied testing protocols that complicate international collaboration and technology transfer.

Emerging economies like India and Brazil are rapidly expanding their research capabilities in specialized niches, with India focusing on affordable healthcare applications and Brazil on renewable resource-based composites. This global landscape reflects both the technical challenges and the diverse approaches being pursued to overcome them.

Current Methodologies for Conductivity Enhancement

01 Conductive polymer composites with carbon-based fillers

Polymer composites can be made conductive by incorporating carbon-based fillers such as carbon nanotubes, graphene, or carbon black. These fillers create conductive pathways within the polymer matrix, allowing for electrical conductivity. The concentration and dispersion of these fillers significantly affect the conductivity of the composite. These materials find applications in electromagnetic shielding, antistatic protection, and flexible electronics.- Conductive polymer composites with carbon-based fillers: Polymer composites can be made conductive by incorporating carbon-based fillers such as carbon nanotubes, graphene, or carbon black. These fillers create conductive pathways within the polymer matrix, allowing for electrical conductivity. The level of conductivity can be controlled by adjusting the concentration and dispersion of the fillers. These composites are useful in applications requiring electrical conductivity while maintaining the mechanical properties and processability of polymers.

- Metal-filled polymer composites for enhanced conductivity: Incorporating metal particles or fibers into polymer matrices creates composites with enhanced electrical and thermal conductivity. Common metal fillers include silver, copper, aluminum, and nickel. These metal-filled composites offer advantages such as high conductivity, electromagnetic shielding properties, and heat dissipation capabilities. The conductivity can be tailored by controlling the metal content, particle size, and distribution within the polymer matrix.

- Non-conductive polymer composites with reinforcing fillers: Non-conductive polymer composites incorporate various reinforcing fillers to enhance mechanical properties while maintaining electrical insulation. These fillers include glass fibers, ceramic particles, and non-conductive minerals. The composites exhibit improved strength, stiffness, dimensional stability, and heat resistance compared to unfilled polymers. Applications include structural components, housings for electronic devices, and parts requiring electrical insulation with enhanced mechanical performance.

- Processing techniques for polymer composites: Various processing techniques are employed to manufacture polymer composites with controlled properties. These include melt compounding, solution blending, in-situ polymerization, and additive manufacturing. The processing method significantly affects the dispersion of fillers, interfacial adhesion, and resulting composite properties. Advanced techniques like layer-by-layer assembly and controlled phase separation enable precise control over the composite microstructure, leading to optimized electrical, mechanical, and thermal properties.

- Functional polymer composites with tunable properties: Functional polymer composites are designed with tunable properties for specific applications. These composites incorporate specialized additives to achieve properties such as stimuli-responsiveness, self-healing capabilities, or switchable conductivity. By combining different types of fillers and polymer matrices, composites can be engineered to respond to external stimuli like temperature, pH, light, or electrical fields. This enables smart materials with adaptive properties for applications in sensors, actuators, and responsive devices.

02 Metal-filled polymer composites for enhanced conductivity

Incorporating metal particles or fibers into polymer matrices creates composites with high electrical conductivity. Common metal fillers include silver, copper, and aluminum. These composites offer advantages such as moldability, reduced weight compared to pure metals, and tunable electrical properties. The conductivity can be controlled by adjusting the metal content, particle size, and distribution within the polymer matrix. Applications include electromagnetic interference shielding, printed circuit boards, and conductive adhesives.Expand Specific Solutions03 Non-conductive polymer composites with enhanced mechanical properties

Non-conductive polymer composites are engineered by incorporating reinforcing materials such as glass fibers, ceramic particles, or natural fibers into the polymer matrix. These fillers significantly improve mechanical properties including tensile strength, impact resistance, and dimensional stability without affecting the inherent electrical insulation properties of the polymer. The interface between the filler and matrix is critical for achieving optimal performance. These composites are widely used in automotive components, construction materials, and consumer products.Expand Specific Solutions04 Processing techniques for polymer composite manufacturing

Various processing techniques are employed to manufacture polymer composites with controlled properties. These include melt mixing, solution blending, in-situ polymerization, and additive manufacturing. Each method offers different advantages in terms of filler dispersion, interfacial adhesion, and scalability. Advanced processing techniques like layer-by-layer assembly and freeze-casting allow for precise control over the microstructure of the composites. The choice of processing method significantly impacts the final properties of the composite material.Expand Specific Solutions05 Functional polymer composites with stimuli-responsive properties

Polymer composites can be engineered to respond to external stimuli such as temperature, pH, light, or electrical fields. These smart materials incorporate functional fillers or are based on inherently responsive polymers. Applications include sensors, actuators, drug delivery systems, and self-healing materials. By carefully selecting the polymer matrix and functional additives, composites can be designed to exhibit properties like shape memory, self-healing, or controlled permeability in response to specific environmental triggers.Expand Specific Solutions

Industry Leaders and Competitive Landscape

The polymer composites market is currently in a growth phase, with conductive polymers gaining significant traction due to increasing applications in electronics, automotive, and energy sectors. The global market size for polymer composites is expanding rapidly, projected to reach substantial valuation as industries seek lightweight, versatile materials with enhanced properties. Technologically, conductive polymers are less mature than their non-conductive counterparts, with companies like DuPont, Shin-Etsu Chemical, and Samsung Electronics leading innovation in conductive polymer development. Meanwhile, Dow Chemical (through acquisitions of Rohm & Haas and Union Carbide) dominates the non-conductive polymer space alongside SINOPEC and ArcelorMittal. Academic institutions including Sichuan University, Zhejiang University, and California Institute of Technology are advancing fundamental research, particularly in improving conductivity, thermal properties, and manufacturing processes.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed proprietary polymer composite technologies focusing on electronics applications. Their approach centers on nanoscale engineering of polymer-filler interfaces to achieve precise control over electrical conductivity while maintaining thermal stability and mechanical properties. Samsung's technology utilizes functionalized graphene and carbon nanotube additives with specialized coupling agents to create robust electrical networks within polymer matrices. Their manufacturing processes include controlled rheology techniques that align conductive fillers during processing, creating anisotropic conductivity for directional electrical performance. Samsung has also pioneered hybrid organic-inorganic composites that combine the processability of polymers with the enhanced electrical properties of ceramic materials, particularly valuable for semiconductor packaging and display technologies.

Strengths: Vertical integration allowing direct application in consumer electronics, strong R&D capabilities, and expertise in high-precision manufacturing processes. Weaknesses: Technologies primarily optimized for electronics applications rather than broader industrial uses, and potential intellectual property restrictions limiting external commercialization.

DuPont de Nemours, Inc.

Technical Solution: DuPont has developed advanced polymer composite technologies focusing on both conductive and non-conductive applications. Their portfolio includes Kapton® polyimide films with tailored electrical conductivity properties and Zytel® nylon resins with engineered fillers for controlled conductivity. DuPont's approach involves precise control of filler dispersion within polymer matrices, utilizing carbon nanotubes, graphene, and metallic particles to achieve specific conductivity levels. Their proprietary processing techniques ensure homogeneous distribution of conductive fillers, preventing agglomeration that can compromise mechanical properties. DuPont has also pioneered hybrid systems combining different conductive fillers to achieve synergistic effects, optimizing both electrical and mechanical performance while minimizing filler loading requirements.

Strengths: Extensive materials science expertise, proprietary processing techniques for homogeneous filler dispersion, and established global manufacturing capabilities. Weaknesses: Higher cost compared to conventional materials and potential challenges in scaling production for specialized high-performance composites.

Key Patents and Scientific Breakthroughs

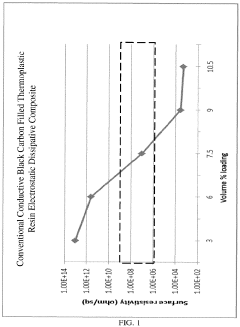

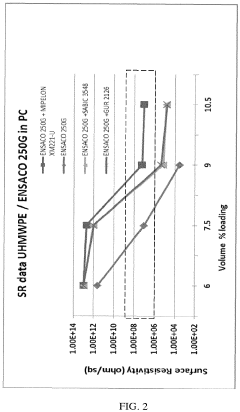

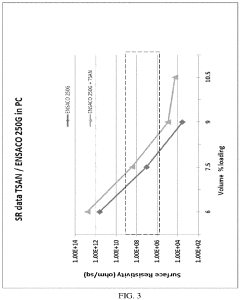

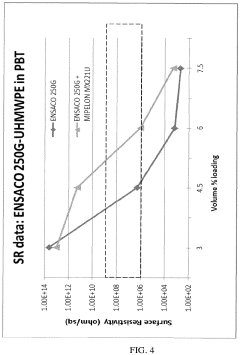

Broadening of percolation slope in conductive carbon black compositions with at least one non-conductive polymer

PatentActiveEP3575354A1

Innovation

- The development of electrostatic dissipative composites comprising a thermoplastic polymer matrix with a filler system consisting of conductive carbon black and a non-conductive polymer, such as ultra-high molecular weight polyethylene or styrene-acrylonitrile copolymer encapsulated polytetrafluoroethylene, within specific volume percentage loadings, to achieve a robust percolation curve and maintain surface resistivity between 10^6 and 10^9 ohms per square.

Solvent assisted processing to control the mechanical properties of electrically and/or thermally conductive polymer composites

PatentInactiveUS9714370B2

Innovation

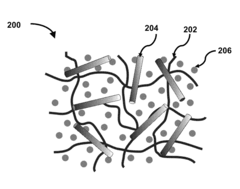

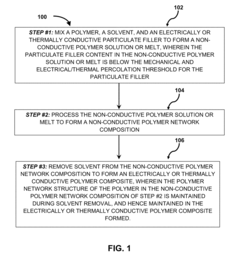

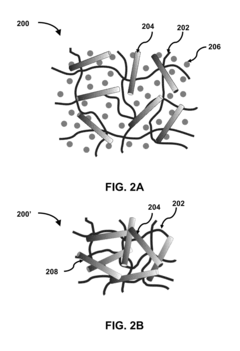

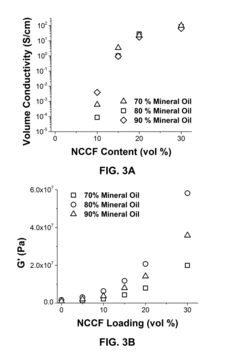

- A method involving mixing a polymer with a conductive particulate filler and a solvent below the mechanical and electrical/thermal percolation thresholds, processing into a non-conductive polymer network, and removing the solvent to form a conductive composite, allowing control over mechanical properties independent of filler concentration.

Environmental Impact and Sustainability Considerations

The environmental impact of polymer composites has become a critical consideration in materials science, with growing emphasis on sustainable development. Conductive polymer composites (CPCs) typically incorporate carbon-based fillers such as carbon nanotubes, graphene, or metallic particles, which present distinct environmental challenges compared to their non-conductive counterparts. The extraction and processing of these conductive fillers often require energy-intensive methods, resulting in higher carbon footprints during the manufacturing phase.

Life cycle assessment (LCA) studies reveal that CPCs generally exhibit 15-30% higher environmental impact during production compared to non-conductive polymer composites. However, this initial environmental cost may be offset by performance benefits in specific applications, particularly in electronics where CPCs can enable longer product lifespans and improved energy efficiency. The environmental equation becomes more complex when considering the entire product lifecycle rather than just manufacturing impacts.

Recyclability presents another significant differentiation point. Non-conductive polymer composites, particularly those using conventional thermoplastic matrices, often demonstrate superior recyclability profiles. The heterogeneous nature of CPCs, with their integrated conductive networks, can complicate separation processes and reduce recycling efficiency. Recent research indicates that only 12-18% of CPCs are effectively recycled, compared to 30-45% for standard polymer composites.

Emerging sustainable approaches are addressing these challenges through bio-based alternatives. Plant-derived conductive fillers, such as carbonized cellulose nanofibers, offer promising environmental advantages with 40-60% reduced carbon footprints compared to synthetic counterparts. Similarly, biodegradable polymer matrices are being developed for both conductive and non-conductive applications, though conductivity maintenance during degradation remains problematic.

End-of-life toxicity concerns also differ significantly between these material classes. Certain metallic fillers in CPCs may present leaching risks in landfill environments, while carbon nanostructures raise persistent questions regarding long-term environmental accumulation. Non-conductive composites generally present fewer toxicity concerns, though flame retardants and other additives common in both material types warrant careful environmental monitoring.

Water consumption patterns during manufacturing reveal that CPCs typically require 25-35% more process water than non-conductive alternatives, primarily due to additional purification steps for conductive fillers. This aspect becomes particularly relevant in water-stressed manufacturing regions. Energy efficiency improvements in newer production methods are gradually narrowing this gap, with recent innovations reducing water usage differentials to approximately 15-20%.

Life cycle assessment (LCA) studies reveal that CPCs generally exhibit 15-30% higher environmental impact during production compared to non-conductive polymer composites. However, this initial environmental cost may be offset by performance benefits in specific applications, particularly in electronics where CPCs can enable longer product lifespans and improved energy efficiency. The environmental equation becomes more complex when considering the entire product lifecycle rather than just manufacturing impacts.

Recyclability presents another significant differentiation point. Non-conductive polymer composites, particularly those using conventional thermoplastic matrices, often demonstrate superior recyclability profiles. The heterogeneous nature of CPCs, with their integrated conductive networks, can complicate separation processes and reduce recycling efficiency. Recent research indicates that only 12-18% of CPCs are effectively recycled, compared to 30-45% for standard polymer composites.

Emerging sustainable approaches are addressing these challenges through bio-based alternatives. Plant-derived conductive fillers, such as carbonized cellulose nanofibers, offer promising environmental advantages with 40-60% reduced carbon footprints compared to synthetic counterparts. Similarly, biodegradable polymer matrices are being developed for both conductive and non-conductive applications, though conductivity maintenance during degradation remains problematic.

End-of-life toxicity concerns also differ significantly between these material classes. Certain metallic fillers in CPCs may present leaching risks in landfill environments, while carbon nanostructures raise persistent questions regarding long-term environmental accumulation. Non-conductive composites generally present fewer toxicity concerns, though flame retardants and other additives common in both material types warrant careful environmental monitoring.

Water consumption patterns during manufacturing reveal that CPCs typically require 25-35% more process water than non-conductive alternatives, primarily due to additional purification steps for conductive fillers. This aspect becomes particularly relevant in water-stressed manufacturing regions. Energy efficiency improvements in newer production methods are gradually narrowing this gap, with recent innovations reducing water usage differentials to approximately 15-20%.

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of conductive and non-conductive polymer composites presents distinct challenges and opportunities that significantly impact their commercial viability. Traditional manufacturing methods for polymer composites include injection molding, extrusion, and compression molding, with each method offering different cost-efficiency profiles depending on production volume and composite complexity.

For conductive polymer composites, the incorporation of conductive fillers such as carbon nanotubes, graphene, or metallic particles introduces additional manufacturing complexities. These materials often require specialized mixing equipment to ensure homogeneous dispersion of conductive elements throughout the polymer matrix. The dispersion quality directly influences the electrical properties of the final product, creating a critical quality control point that increases production costs.

Non-conductive polymer composites generally present fewer manufacturing challenges, as they do not require the precise control of filler distribution needed to achieve specific electrical conductivity thresholds. This simplification typically results in lower production costs and higher manufacturing throughput compared to their conductive counterparts.

Cost analysis reveals that raw material expenses constitute a significant portion of the total manufacturing cost for both types of composites. Conductive fillers, particularly advanced materials like graphene and carbon nanotubes, can increase material costs by 30-200% compared to conventional fillers used in non-conductive composites. This cost differential narrows as production scales increase, but remains a significant factor in product pricing strategies.

Energy consumption during manufacturing also differs substantially between the two composite types. Conductive composites often require additional processing steps, such as post-curing treatments or specialized mixing procedures, which increase energy requirements by approximately 15-40% compared to non-conductive alternatives.

Scalability assessments indicate that non-conductive polymer composites generally achieve economies of scale more readily than conductive variants. Production volume increases typically yield cost reductions of 25-35% for non-conductive composites, while conductive composites show more modest reductions of 15-25% due to the persistent costs associated with quality control and specialized processing requirements.

Recent technological advancements, including continuous processing methods and in-line monitoring systems, are gradually improving the manufacturing efficiency of conductive polymer composites. These innovations have potential to reduce the cost gap between conductive and non-conductive composites by approximately 10-20% over the next five years, potentially expanding market opportunities for conductive composite applications.

For conductive polymer composites, the incorporation of conductive fillers such as carbon nanotubes, graphene, or metallic particles introduces additional manufacturing complexities. These materials often require specialized mixing equipment to ensure homogeneous dispersion of conductive elements throughout the polymer matrix. The dispersion quality directly influences the electrical properties of the final product, creating a critical quality control point that increases production costs.

Non-conductive polymer composites generally present fewer manufacturing challenges, as they do not require the precise control of filler distribution needed to achieve specific electrical conductivity thresholds. This simplification typically results in lower production costs and higher manufacturing throughput compared to their conductive counterparts.

Cost analysis reveals that raw material expenses constitute a significant portion of the total manufacturing cost for both types of composites. Conductive fillers, particularly advanced materials like graphene and carbon nanotubes, can increase material costs by 30-200% compared to conventional fillers used in non-conductive composites. This cost differential narrows as production scales increase, but remains a significant factor in product pricing strategies.

Energy consumption during manufacturing also differs substantially between the two composite types. Conductive composites often require additional processing steps, such as post-curing treatments or specialized mixing procedures, which increase energy requirements by approximately 15-40% compared to non-conductive alternatives.

Scalability assessments indicate that non-conductive polymer composites generally achieve economies of scale more readily than conductive variants. Production volume increases typically yield cost reductions of 25-35% for non-conductive composites, while conductive composites show more modest reductions of 15-25% due to the persistent costs associated with quality control and specialized processing requirements.

Recent technological advancements, including continuous processing methods and in-line monitoring systems, are gradually improving the manufacturing efficiency of conductive polymer composites. These innovations have potential to reduce the cost gap between conductive and non-conductive composites by approximately 10-20% over the next five years, potentially expanding market opportunities for conductive composite applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!