Conductive Polymer Composites in Aerospace Applications: A Review

OCT 23, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Aerospace Conductive Polymers: Background & Objectives

Conductive polymer composites (CPCs) represent a significant advancement in materials science, combining the electrical conductivity of metals with the lightweight, flexible, and corrosion-resistant properties of polymers. The evolution of these materials dates back to the 1970s with the discovery of conductive polymers, which earned Alan Heeger, Alan MacDiarmid, and Hideki Shirakawa the Nobel Prize in Chemistry in 2000. Since then, the field has expanded dramatically, particularly in aerospace applications where weight reduction and multifunctionality are paramount.

The aerospace industry has traditionally relied on metallic materials for electrical conductivity requirements, but these come with significant weight penalties and corrosion concerns. As aircraft and spacecraft designs push toward greater efficiency and performance, the demand for lightweight alternatives has accelerated the development of conductive polymer composites. The integration of nanomaterials such as carbon nanotubes, graphene, and metallic nanoparticles into polymer matrices has further enhanced the capabilities of these composites.

Current technological trends in aerospace CPCs focus on achieving higher conductivity-to-weight ratios, improved mechanical properties, and enhanced durability in extreme environments. Research is increasingly directed toward multifunctional composites that can simultaneously provide structural support, electrical conductivity, electromagnetic interference (EMI) shielding, and thermal management. This multifunctionality represents a paradigm shift from traditional aerospace material selection approaches.

The primary technical objectives for aerospace CPCs include achieving consistent and reliable electrical conductivity across a range of operating temperatures (-65°C to 150°C), maintaining mechanical integrity under cyclic loading conditions, and ensuring compatibility with existing aerospace manufacturing processes. Additionally, there is significant interest in developing self-sensing capabilities, where changes in electrical resistance can indicate structural damage or stress, enabling real-time structural health monitoring.

Another critical objective is to develop CPCs with tailorable conductivity properties to meet specific aerospace requirements, from static discharge prevention to lightning strike protection. The percolation threshold—the minimum conductive filler content needed to create continuous conductive pathways—remains a key parameter for optimization, as it directly impacts both electrical performance and mechanical properties.

Looking forward, the field aims to establish standardized testing protocols and qualification procedures specifically for aerospace CPCs, addressing the unique challenges of the aerospace operating environment. The development of scalable, cost-effective manufacturing techniques for these advanced materials represents another significant goal, as current production methods often limit widespread adoption despite the compelling performance benefits.

The aerospace industry has traditionally relied on metallic materials for electrical conductivity requirements, but these come with significant weight penalties and corrosion concerns. As aircraft and spacecraft designs push toward greater efficiency and performance, the demand for lightweight alternatives has accelerated the development of conductive polymer composites. The integration of nanomaterials such as carbon nanotubes, graphene, and metallic nanoparticles into polymer matrices has further enhanced the capabilities of these composites.

Current technological trends in aerospace CPCs focus on achieving higher conductivity-to-weight ratios, improved mechanical properties, and enhanced durability in extreme environments. Research is increasingly directed toward multifunctional composites that can simultaneously provide structural support, electrical conductivity, electromagnetic interference (EMI) shielding, and thermal management. This multifunctionality represents a paradigm shift from traditional aerospace material selection approaches.

The primary technical objectives for aerospace CPCs include achieving consistent and reliable electrical conductivity across a range of operating temperatures (-65°C to 150°C), maintaining mechanical integrity under cyclic loading conditions, and ensuring compatibility with existing aerospace manufacturing processes. Additionally, there is significant interest in developing self-sensing capabilities, where changes in electrical resistance can indicate structural damage or stress, enabling real-time structural health monitoring.

Another critical objective is to develop CPCs with tailorable conductivity properties to meet specific aerospace requirements, from static discharge prevention to lightning strike protection. The percolation threshold—the minimum conductive filler content needed to create continuous conductive pathways—remains a key parameter for optimization, as it directly impacts both electrical performance and mechanical properties.

Looking forward, the field aims to establish standardized testing protocols and qualification procedures specifically for aerospace CPCs, addressing the unique challenges of the aerospace operating environment. The development of scalable, cost-effective manufacturing techniques for these advanced materials represents another significant goal, as current production methods often limit widespread adoption despite the compelling performance benefits.

Market Analysis for Aerospace Polymer Composites

The aerospace polymer composites market is experiencing robust growth, driven by the increasing demand for lightweight materials that can enhance fuel efficiency and reduce emissions in aircraft. The global market for aerospace composites was valued at approximately $29.5 billion in 2021 and is projected to reach $65.4 billion by 2030, growing at a CAGR of 9.3% during the forecast period. Conductive polymer composites (CPCs) represent a significant segment within this market, offering unique electrical properties alongside mechanical strength.

North America currently dominates the aerospace polymer composites market, accounting for about 42% of the global share, followed by Europe at 31% and Asia-Pacific at 21%. This regional distribution aligns with the concentration of major aerospace manufacturers and their supply chains. The United States, in particular, maintains leadership due to the presence of key players like Boeing, Lockheed Martin, and their extensive supplier networks.

The demand for conductive polymer composites in aerospace applications is primarily driven by the need for lightning strike protection, electromagnetic interference (EMI) shielding, and electrostatic discharge (ESD) protection. As modern aircraft incorporate more composite materials in their structures, replacing traditional aluminum which naturally conducts electricity, the requirement for materials that can provide electrical conductivity while maintaining lightweight characteristics has intensified.

Commercial aviation represents the largest application segment for aerospace polymer composites, constituting approximately 65% of the market. Military aircraft account for about 25%, while space applications make up the remaining 10%. The commercial segment's dominance is attributed to the increasing production rates of commercial aircraft and the industry's aggressive pursuit of fuel efficiency improvements.

Key market trends include the integration of nanomaterials such as carbon nanotubes and graphene into polymer matrices to enhance conductivity while minimizing weight penalties. Additionally, there is growing interest in multifunctional composites that can simultaneously provide structural support, electrical conductivity, and sensing capabilities.

The market faces challenges related to high production costs, complex manufacturing processes, and stringent certification requirements. However, technological advancements in automated manufacturing techniques and increasing research investments are gradually addressing these barriers. The development of cost-effective production methods for conductive polymer composites represents a significant opportunity for market expansion.

Sustainability considerations are increasingly influencing market dynamics, with growing emphasis on recyclable composites and bio-based polymers. This trend is expected to reshape material selection criteria in the aerospace industry over the next decade, potentially creating new market segments within the conductive polymer composites space.

North America currently dominates the aerospace polymer composites market, accounting for about 42% of the global share, followed by Europe at 31% and Asia-Pacific at 21%. This regional distribution aligns with the concentration of major aerospace manufacturers and their supply chains. The United States, in particular, maintains leadership due to the presence of key players like Boeing, Lockheed Martin, and their extensive supplier networks.

The demand for conductive polymer composites in aerospace applications is primarily driven by the need for lightning strike protection, electromagnetic interference (EMI) shielding, and electrostatic discharge (ESD) protection. As modern aircraft incorporate more composite materials in their structures, replacing traditional aluminum which naturally conducts electricity, the requirement for materials that can provide electrical conductivity while maintaining lightweight characteristics has intensified.

Commercial aviation represents the largest application segment for aerospace polymer composites, constituting approximately 65% of the market. Military aircraft account for about 25%, while space applications make up the remaining 10%. The commercial segment's dominance is attributed to the increasing production rates of commercial aircraft and the industry's aggressive pursuit of fuel efficiency improvements.

Key market trends include the integration of nanomaterials such as carbon nanotubes and graphene into polymer matrices to enhance conductivity while minimizing weight penalties. Additionally, there is growing interest in multifunctional composites that can simultaneously provide structural support, electrical conductivity, and sensing capabilities.

The market faces challenges related to high production costs, complex manufacturing processes, and stringent certification requirements. However, technological advancements in automated manufacturing techniques and increasing research investments are gradually addressing these barriers. The development of cost-effective production methods for conductive polymer composites represents a significant opportunity for market expansion.

Sustainability considerations are increasingly influencing market dynamics, with growing emphasis on recyclable composites and bio-based polymers. This trend is expected to reshape material selection criteria in the aerospace industry over the next decade, potentially creating new market segments within the conductive polymer composites space.

Current State and Challenges in Aerospace Polymer Technology

The aerospace industry has witnessed significant advancements in polymer technology over the past decade, with conductive polymer composites (CPCs) emerging as a critical material class. Currently, these materials are primarily utilized in electromagnetic interference (EMI) shielding, electrostatic discharge (ESD) protection, and lightweight structural components across various aircraft systems. The global aerospace polymer market is estimated at approximately $15.2 billion as of 2023, with CPCs representing about 8% of this segment and growing at a compound annual growth rate of 6.7%.

Despite promising developments, several technical challenges persist in aerospace polymer applications. Thermal stability remains a primary concern, as aerospace environments demand materials that can withstand extreme temperature fluctuations ranging from -65°C to over 200°C without significant degradation in electrical conductivity or mechanical properties. Current CPC formulations typically experience conductivity losses of 30-45% when subjected to these thermal cycles, substantially below industry requirements.

Mechanical durability presents another significant hurdle. Aerospace-grade polymers must maintain structural integrity under high vibration, pressure differentials, and mechanical stress. Most conductive polymer composites exhibit premature fatigue failure, with crack propagation occurring at approximately 60-70% of the cycles that traditional aerospace materials can withstand. This performance gap necessitates substantial improvement before widespread implementation becomes viable.

Manufacturing scalability constitutes a third major challenge. Current production methods for high-performance CPCs often involve complex processing techniques that are difficult to scale for large aerospace components. Techniques such as in-situ polymerization and specialized dispersion methods yield excellent laboratory results but face significant barriers in industrial-scale implementation. The rejection rate for aerospace-grade CPCs remains at approximately 18-22%, considerably higher than the 5-7% industry standard for conventional materials.

Regulatory compliance and certification represent additional obstacles. The aerospace industry operates under stringent safety standards, requiring extensive testing and validation before new materials can be incorporated into aircraft systems. The certification process for conductive polymer composites typically takes 3-5 years, significantly longer than the 1-2 years for modifications to established materials, creating a substantial barrier to market entry.

Environmental considerations also pose challenges, as the industry moves toward more sustainable practices. Many high-performance conductive fillers used in CPCs, such as certain carbon nanotubes and metal nanoparticles, raise environmental and health concerns throughout their lifecycle. Current recycling technologies can only recover 40-50% of these materials from end-of-life components, well below the aerospace industry's sustainability targets.

Despite promising developments, several technical challenges persist in aerospace polymer applications. Thermal stability remains a primary concern, as aerospace environments demand materials that can withstand extreme temperature fluctuations ranging from -65°C to over 200°C without significant degradation in electrical conductivity or mechanical properties. Current CPC formulations typically experience conductivity losses of 30-45% when subjected to these thermal cycles, substantially below industry requirements.

Mechanical durability presents another significant hurdle. Aerospace-grade polymers must maintain structural integrity under high vibration, pressure differentials, and mechanical stress. Most conductive polymer composites exhibit premature fatigue failure, with crack propagation occurring at approximately 60-70% of the cycles that traditional aerospace materials can withstand. This performance gap necessitates substantial improvement before widespread implementation becomes viable.

Manufacturing scalability constitutes a third major challenge. Current production methods for high-performance CPCs often involve complex processing techniques that are difficult to scale for large aerospace components. Techniques such as in-situ polymerization and specialized dispersion methods yield excellent laboratory results but face significant barriers in industrial-scale implementation. The rejection rate for aerospace-grade CPCs remains at approximately 18-22%, considerably higher than the 5-7% industry standard for conventional materials.

Regulatory compliance and certification represent additional obstacles. The aerospace industry operates under stringent safety standards, requiring extensive testing and validation before new materials can be incorporated into aircraft systems. The certification process for conductive polymer composites typically takes 3-5 years, significantly longer than the 1-2 years for modifications to established materials, creating a substantial barrier to market entry.

Environmental considerations also pose challenges, as the industry moves toward more sustainable practices. Many high-performance conductive fillers used in CPCs, such as certain carbon nanotubes and metal nanoparticles, raise environmental and health concerns throughout their lifecycle. Current recycling technologies can only recover 40-50% of these materials from end-of-life components, well below the aerospace industry's sustainability targets.

Current Implementation Solutions in Aerospace Applications

01 Conductive polymer composites with carbon-based fillers

Carbon-based materials such as carbon nanotubes, graphene, and carbon black can be incorporated into polymer matrices to create conductive composites. These fillers form conductive networks within the polymer, significantly enhancing electrical conductivity while maintaining the processability and mechanical properties of the base polymer. The resulting composites offer tunable conductivity based on filler concentration and dispersion methods, making them suitable for various electronic applications.- Carbon-based conductive polymer composites: Carbon-based materials such as carbon nanotubes, graphene, and carbon black are incorporated into polymer matrices to create conductive composites. These fillers provide excellent electrical conductivity while maintaining the mechanical properties and processability of the polymer. The resulting composites can be used in various applications including electromagnetic shielding, antistatic materials, and flexible electronics.

- Metal-polymer conductive composites: Metal particles or nanowires are dispersed within polymer matrices to create conductive composites with enhanced electrical properties. These composites combine the flexibility and processability of polymers with the high conductivity of metals. Various metals including silver, copper, and nickel are commonly used as conductive fillers. Applications include printed electronics, sensors, and electromagnetic interference shielding materials.

- Intrinsically conductive polymer composites: Intrinsically conductive polymers such as polyaniline, polypyrrole, and PEDOT:PSS are combined with other materials to form composites with tunable electrical properties. These polymers conduct electricity through their conjugated backbone structure and can be further enhanced through doping. The resulting composites offer advantages including lightweight construction, flexibility, and solution processability for applications in energy storage, sensors, and actuators.

- Thermal management in conductive polymer composites: Conductive polymer composites are formulated with specific fillers to enhance thermal conductivity alongside electrical conductivity. These materials address heat dissipation challenges in electronic applications. By incorporating thermally conductive fillers such as boron nitride, aluminum oxide, or specialized carbon structures, these composites can efficiently transfer heat while maintaining electrical properties, making them suitable for high-power electronics, LED packaging, and thermal interface materials.

- Processing techniques for conductive polymer composites: Various processing techniques are employed to optimize the dispersion of conductive fillers within polymer matrices, including solution blending, melt mixing, in-situ polymerization, and layer-by-layer assembly. These methods aim to achieve uniform distribution of conductive materials while maintaining low percolation thresholds. Advanced processing techniques can significantly enhance the electrical conductivity, mechanical properties, and overall performance of the composites for applications in flexible electronics, sensors, and energy storage devices.

02 Metal-polymer conductive composites

Metal particles or nanostructures can be integrated into polymer matrices to create conductive composites with enhanced electrical properties. These composites typically use metals like silver, copper, or aluminum in various forms (particles, flakes, or nanowires) to establish conductive pathways. The metal content, particle size, and distribution significantly affect the composite's conductivity, while the polymer matrix provides mechanical stability and processing advantages. These materials find applications in electromagnetic shielding, flexible electronics, and conductive adhesives.Expand Specific Solutions03 Self-healing conductive polymer composites

Self-healing conductive polymer composites incorporate mechanisms that allow the material to restore electrical conductivity after mechanical damage. These composites typically combine conductive fillers with polymers that can reform bonds or reconnect conductive pathways when damaged. Various approaches include microencapsulated healing agents, reversible chemical bonds, or physical interactions that promote autonomous healing. These materials enhance the durability and reliability of electronic devices, wearable technology, and sensors that may experience mechanical stress during use.Expand Specific Solutions04 Thermally conductive polymer composites

Polymer composites can be engineered to exhibit enhanced thermal conductivity while maintaining electrical insulation properties. These materials typically incorporate fillers such as boron nitride, aluminum oxide, or specialized carbon structures that promote heat transfer without creating electrical pathways. The thermal conductivity can be optimized through filler orientation, hybrid filler systems, and interface engineering. These composites are valuable for thermal management in electronics, LED lighting, and battery systems where heat dissipation is critical but electrical insulation must be maintained.Expand Specific Solutions05 Stimuli-responsive conductive polymer composites

These advanced composites change their electrical, mechanical, or optical properties in response to external stimuli such as temperature, pH, light, or mechanical force. They typically combine conductive polymers or fillers with responsive polymer matrices that undergo conformational changes when stimulated. This responsiveness enables applications in sensors, actuators, and smart materials that can adapt to environmental conditions. The design of these composites focuses on the interface between the conductive components and the responsive polymer to maximize sensitivity and response magnitude.Expand Specific Solutions

Key Industry Players and Competitive Landscape

Conductive Polymer Composites in aerospace applications are currently in a growth phase, with the market expected to expand significantly due to increasing demand for lightweight, high-performance materials in aircraft manufacturing. The global market size is projected to reach several billion dollars by 2025, driven by the need for fuel efficiency and reduced emissions. Technologically, the field shows varying maturity levels across applications, with companies like Boeing, Eaton Intelligent Power, and DuPont leading commercial implementation. Research institutions including Sichuan University, KIST, and Rensselaer Polytechnic Institute are advancing fundamental innovations, while specialized manufacturers such as Crompton Technology Group and SABIC are developing application-specific solutions. The collaboration between academic research and industrial implementation is accelerating the transition from laboratory concepts to flight-certified components.

The Boeing Co.

Technical Solution: Boeing has developed advanced conductive polymer composite (CPC) systems specifically engineered for aerospace applications, focusing on lightning strike protection and electromagnetic interference (EMI) shielding. Their proprietary technology incorporates carbon nanotube (CNT) and graphene-enhanced polymer matrices that maintain structural integrity while providing electrical conductivity of 10^2-10^4 S/m. Boeing's approach involves multi-functional composites that integrate structural, electrical, and thermal management capabilities into single components, reducing weight by up to 15% compared to traditional metallic solutions. Their CFRP (Carbon Fiber Reinforced Polymer) systems with conductive polymer layers have been implemented in the 787 Dreamliner and 777X aircraft, demonstrating successful commercial application. Boeing has also pioneered self-healing conductive polymer composites that can restore up to 85% of electrical conductivity after mechanical damage through embedded microcapsules containing conductive materials.

Strengths: Industry-leading integration of CPCs in commercial aircraft with proven flight performance; comprehensive testing infrastructure for aerospace qualification standards; vertical integration capabilities from material development to full-scale implementation. Weaknesses: Higher initial production costs compared to traditional materials; longer certification timelines for novel conductive polymer systems; potential challenges in scaling production for next-generation aircraft programs.

Cytec Industries, Inc.

Technical Solution: Cytec Industries (now part of Solvay Group) has developed specialized conductive polymer composite systems for aerospace applications, focusing on structural components with integrated electrical functionality. Their CYCOM® series incorporates precisely engineered conductive networks using carbon nanotubes, graphene, and metallic nanoparticles within aerospace-grade epoxy and bismaleimide (BMI) matrices. These materials achieve electrical conductivity ranging from 10^-4 to 10^1 S/cm while maintaining mechanical properties comparable to traditional aerospace composites. Cytec's technology employs a hierarchical approach to conductive network formation, with primary and secondary conductive pathways that maintain performance even after mechanical stress or thermal cycling. Their proprietary surface functionalization techniques create strong interfaces between conductive fillers and polymer matrices, preventing agglomeration and ensuring uniform dispersion. These materials have been successfully implemented in aircraft structural components requiring lightning strike protection, EMI shielding, and electrostatic discharge protection, with documented weight savings of 15-30% compared to traditional metallic solutions while meeting FAR 25.581 lightning protection requirements.

Strengths: Deep expertise in aerospace-grade composite formulation and processing; established relationships with major aircraft manufacturers; comprehensive testing capabilities for aerospace qualification. Weaknesses: Higher raw material costs compared to conventional composites; complex manufacturing processes requiring specialized equipment; challenges in achieving consistent electrical properties across large structural components.

Critical Patents and Technical Literature Analysis

Conductive polymeric materials, preparation and use thereof

PatentActiveEP2882801A1

Innovation

- Development of electrostatically-dispersive translucent or transparent films with carbon nanoparticles dispersed in a polymer matrix, achieving high optical transmission and electrical conductivity while maintaining mechanical integrity, using methods like melt mixing, solvent-based dispersion, and plasma treatment to ensure uniform particle distribution.

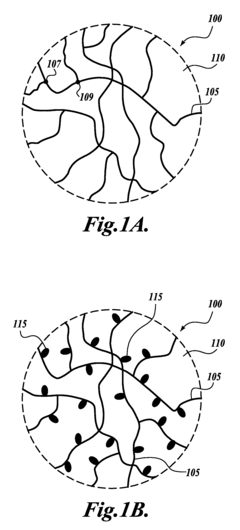

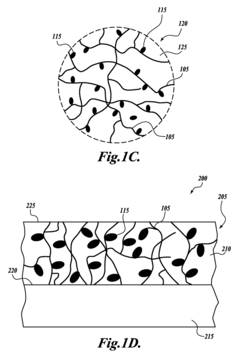

Composites incorporated a conductive polymer nanofiber network

PatentInactiveUS9620259B2

Innovation

- The development of a composite incorporating networks of conductive polymer nanofibers formed by self-assembling conjugated polymers, doping them with chemical dopants, and dispersing them in a liquid matrix to create a conductive finish that effectively manages EME without significant weight increase or degradation of mechanical properties.

Environmental Impact and Sustainability Considerations

The aerospace industry's growing adoption of conductive polymer composites (CPCs) necessitates careful consideration of their environmental impact throughout their lifecycle. Traditional aerospace materials often involve energy-intensive manufacturing processes and contain toxic substances that pose significant environmental hazards. CPCs offer potential advantages in this regard, as their production typically requires lower processing temperatures compared to metals, resulting in reduced energy consumption and associated carbon emissions.

When examining the raw material sourcing for CPCs, several sustainability factors emerge. Many conductive fillers used in aerospace-grade composites, such as carbon nanotubes and graphene, currently have energy-intensive production methods. However, ongoing research into bio-based conductive fillers and environmentally friendly synthesis routes shows promise for reducing the ecological footprint of these materials.

The manufacturing processes for CPCs present both challenges and opportunities from a sustainability perspective. While polymer processing generally consumes less energy than metal fabrication, certain specialized techniques for aerospace-grade CPCs may still involve substantial energy inputs. Solvent usage in processing represents another environmental concern, though water-based and solvent-free formulations are increasingly being developed to address this issue.

End-of-life considerations for aerospace CPCs remain particularly challenging. The complex nature of these composites often makes recycling difficult, as separating the conductive fillers from the polymer matrix requires specialized processes. Current aerospace industry practices frequently rely on landfilling or incineration for composite waste disposal, neither of which is environmentally optimal.

Regulatory frameworks worldwide are increasingly emphasizing sustainable materials in aerospace applications. The European Union's REACH regulations and similar initiatives globally are restricting the use of certain hazardous substances commonly found in traditional aerospace materials, creating additional incentives for developing environmentally friendly CPCs.

Life cycle assessment (LCA) studies comparing CPCs with conventional aerospace materials demonstrate varying results depending on specific applications. While CPCs generally show advantages in production energy requirements and use-phase fuel efficiency due to weight reduction, their end-of-life environmental impact remains problematic without effective recycling solutions.

Future research directions should focus on developing closed-loop recycling systems for CPCs, incorporating renewable or recycled raw materials into their formulation, and optimizing manufacturing processes to minimize energy consumption and waste generation. These advancements will be crucial for ensuring that the growing implementation of CPCs in aerospace applications aligns with broader sustainability goals in the aviation industry.

When examining the raw material sourcing for CPCs, several sustainability factors emerge. Many conductive fillers used in aerospace-grade composites, such as carbon nanotubes and graphene, currently have energy-intensive production methods. However, ongoing research into bio-based conductive fillers and environmentally friendly synthesis routes shows promise for reducing the ecological footprint of these materials.

The manufacturing processes for CPCs present both challenges and opportunities from a sustainability perspective. While polymer processing generally consumes less energy than metal fabrication, certain specialized techniques for aerospace-grade CPCs may still involve substantial energy inputs. Solvent usage in processing represents another environmental concern, though water-based and solvent-free formulations are increasingly being developed to address this issue.

End-of-life considerations for aerospace CPCs remain particularly challenging. The complex nature of these composites often makes recycling difficult, as separating the conductive fillers from the polymer matrix requires specialized processes. Current aerospace industry practices frequently rely on landfilling or incineration for composite waste disposal, neither of which is environmentally optimal.

Regulatory frameworks worldwide are increasingly emphasizing sustainable materials in aerospace applications. The European Union's REACH regulations and similar initiatives globally are restricting the use of certain hazardous substances commonly found in traditional aerospace materials, creating additional incentives for developing environmentally friendly CPCs.

Life cycle assessment (LCA) studies comparing CPCs with conventional aerospace materials demonstrate varying results depending on specific applications. While CPCs generally show advantages in production energy requirements and use-phase fuel efficiency due to weight reduction, their end-of-life environmental impact remains problematic without effective recycling solutions.

Future research directions should focus on developing closed-loop recycling systems for CPCs, incorporating renewable or recycled raw materials into their formulation, and optimizing manufacturing processes to minimize energy consumption and waste generation. These advancements will be crucial for ensuring that the growing implementation of CPCs in aerospace applications aligns with broader sustainability goals in the aviation industry.

Certification and Safety Standards for Aerospace Materials

The aerospace industry maintains exceptionally rigorous certification and safety standards for materials used in aircraft and spacecraft construction. For conductive polymer composites (CPCs) to gain widespread adoption in aerospace applications, they must meet or exceed these stringent requirements. The Federal Aviation Administration (FAA), European Union Aviation Safety Agency (EASA), and other international regulatory bodies have established comprehensive frameworks for material qualification that CPCs must navigate successfully.

Fire safety represents a paramount concern in aerospace material certification. Standards such as FAR 25.853 and FAR 25.855 specify strict flammability, smoke emission, and toxicity requirements. CPCs must demonstrate self-extinguishing properties and minimal smoke generation during combustion tests. The UL 94 V-0 rating is often considered a minimum benchmark for polymer materials in aerospace applications, requiring materials to cease burning within 10 seconds after flame removal.

Electrical safety standards present another critical certification hurdle for conductive polymer composites. Standards like RTCA DO-160 establish requirements for electromagnetic compatibility and lightning strike protection. CPCs intended for use in aircraft structures must demonstrate appropriate electrical conductivity without introducing electromagnetic interference with onboard systems. Materials must also maintain their electrical properties under varying environmental conditions.

Environmental durability testing constitutes a significant component of aerospace material certification. CPCs must withstand extreme temperature cycling (typically -55°C to +85°C), humidity exposure, fluid resistance, and UV radiation without significant degradation of mechanical or electrical properties. Standards such as ASTM D5229 for moisture absorption and ASTM G155 for weathering resistance provide testing protocols that CPCs must satisfy.

Mechanical performance requirements are equally stringent, with standards like ASTM D3039 for tensile properties and ASTM D7136 for impact resistance defining minimum acceptable performance levels. CPCs must maintain consistent mechanical properties throughout their service life, which may extend to decades in aerospace applications. Fatigue resistance under cyclic loading conditions is particularly critical for structural components.

The certification process typically involves multiple stages, beginning with material specification development, followed by extensive testing, data collection, and finally, approval by regulatory authorities. This process can take several years and cost millions of dollars, representing a significant barrier to entry for new materials. However, recent initiatives like the FAA's Advanced Composite Material Qualification and Equivalency framework aim to streamline certification for innovative materials like CPCs.

Fire safety represents a paramount concern in aerospace material certification. Standards such as FAR 25.853 and FAR 25.855 specify strict flammability, smoke emission, and toxicity requirements. CPCs must demonstrate self-extinguishing properties and minimal smoke generation during combustion tests. The UL 94 V-0 rating is often considered a minimum benchmark for polymer materials in aerospace applications, requiring materials to cease burning within 10 seconds after flame removal.

Electrical safety standards present another critical certification hurdle for conductive polymer composites. Standards like RTCA DO-160 establish requirements for electromagnetic compatibility and lightning strike protection. CPCs intended for use in aircraft structures must demonstrate appropriate electrical conductivity without introducing electromagnetic interference with onboard systems. Materials must also maintain their electrical properties under varying environmental conditions.

Environmental durability testing constitutes a significant component of aerospace material certification. CPCs must withstand extreme temperature cycling (typically -55°C to +85°C), humidity exposure, fluid resistance, and UV radiation without significant degradation of mechanical or electrical properties. Standards such as ASTM D5229 for moisture absorption and ASTM G155 for weathering resistance provide testing protocols that CPCs must satisfy.

Mechanical performance requirements are equally stringent, with standards like ASTM D3039 for tensile properties and ASTM D7136 for impact resistance defining minimum acceptable performance levels. CPCs must maintain consistent mechanical properties throughout their service life, which may extend to decades in aerospace applications. Fatigue resistance under cyclic loading conditions is particularly critical for structural components.

The certification process typically involves multiple stages, beginning with material specification development, followed by extensive testing, data collection, and finally, approval by regulatory authorities. This process can take several years and cost millions of dollars, representing a significant barrier to entry for new materials. However, recent initiatives like the FAA's Advanced Composite Material Qualification and Equivalency framework aim to streamline certification for innovative materials like CPCs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!