What Are the Key Materials Used in Conductive Polymer Composites?

OCT 23, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Polymer Composites Background and Objectives

Conductive polymer composites (CPCs) represent a significant advancement in materials science, combining the electrical conductivity of metals with the processability, flexibility, and lightweight nature of polymers. The evolution of these materials can be traced back to the 1970s with the discovery of conductive polymers by Alan Heeger, Alan MacDiarmid, and Hideki Shirakawa, who were awarded the Nobel Prize in Chemistry in 2000 for their groundbreaking work.

The development of CPCs has accelerated over the past two decades due to increasing demand for flexible electronics, electromagnetic interference (EMI) shielding materials, antistatic coatings, and sensors. This technological progression has been driven by the limitations of traditional metallic conductors in emerging applications requiring conformability, stretchability, and integration with biological systems.

Key materials in CPCs include conductive fillers such as carbon-based materials (carbon black, carbon nanotubes, graphene), metallic particles (silver, copper, nickel), and intrinsically conductive polymers (polyaniline, polypyrrole, PEDOT:PSS). The polymer matrices commonly employed include thermoplastics (polyethylene, polypropylene), thermosets (epoxy resins), and elastomers (silicones, polyurethanes), each offering distinct advantages for specific applications.

The technical objectives of research in this field are multifaceted. Primary goals include enhancing electrical conductivity while maintaining mechanical properties, developing cost-effective manufacturing processes for large-scale production, and improving the long-term stability of these composites under various environmental conditions. Researchers are particularly focused on optimizing the percolation threshold—the minimum filler content required to form a conductive network—to achieve high conductivity with minimal filler loading.

Another critical objective is to develop CPCs with multifunctional properties, combining electrical conductivity with other functionalities such as thermal conductivity, self-healing capabilities, or stimuli-responsiveness. This multifunctionality would expand the application scope of these materials significantly.

The integration of nanotechnology has opened new avenues for CPC development, with nanoscale fillers offering unprecedented improvements in electrical properties at extremely low loading levels. However, challenges related to nanomaterial dispersion, interfacial interactions, and scalable processing techniques remain to be addressed.

Recent trends indicate growing interest in sustainable and bio-based CPCs, utilizing renewable resources and environmentally friendly processing methods. This aligns with global sustainability initiatives and represents a promising direction for future research and development in this field.

The development of CPCs has accelerated over the past two decades due to increasing demand for flexible electronics, electromagnetic interference (EMI) shielding materials, antistatic coatings, and sensors. This technological progression has been driven by the limitations of traditional metallic conductors in emerging applications requiring conformability, stretchability, and integration with biological systems.

Key materials in CPCs include conductive fillers such as carbon-based materials (carbon black, carbon nanotubes, graphene), metallic particles (silver, copper, nickel), and intrinsically conductive polymers (polyaniline, polypyrrole, PEDOT:PSS). The polymer matrices commonly employed include thermoplastics (polyethylene, polypropylene), thermosets (epoxy resins), and elastomers (silicones, polyurethanes), each offering distinct advantages for specific applications.

The technical objectives of research in this field are multifaceted. Primary goals include enhancing electrical conductivity while maintaining mechanical properties, developing cost-effective manufacturing processes for large-scale production, and improving the long-term stability of these composites under various environmental conditions. Researchers are particularly focused on optimizing the percolation threshold—the minimum filler content required to form a conductive network—to achieve high conductivity with minimal filler loading.

Another critical objective is to develop CPCs with multifunctional properties, combining electrical conductivity with other functionalities such as thermal conductivity, self-healing capabilities, or stimuli-responsiveness. This multifunctionality would expand the application scope of these materials significantly.

The integration of nanotechnology has opened new avenues for CPC development, with nanoscale fillers offering unprecedented improvements in electrical properties at extremely low loading levels. However, challenges related to nanomaterial dispersion, interfacial interactions, and scalable processing techniques remain to be addressed.

Recent trends indicate growing interest in sustainable and bio-based CPCs, utilizing renewable resources and environmentally friendly processing methods. This aligns with global sustainability initiatives and represents a promising direction for future research and development in this field.

Market Analysis of Conductive Polymer Applications

The conductive polymer composites market has experienced significant growth in recent years, driven by increasing demand for lightweight, flexible, and cost-effective alternatives to traditional metal conductors. The global market for conductive polymer composites was valued at approximately 3.1 billion USD in 2022 and is projected to reach 5.7 billion USD by 2028, representing a compound annual growth rate of 10.7% during the forecast period.

The electronics industry remains the largest consumer of conductive polymer composites, accounting for nearly 42% of the total market share. This dominance is attributed to the growing adoption of flexible electronics, wearable devices, and miniaturized components that require materials with excellent electrical conductivity while maintaining flexibility and reduced weight. The automotive sector follows closely, representing about 27% of the market, with applications in electromagnetic interference (EMI) shielding, antistatic components, and increasingly in electric vehicle battery systems.

Regionally, Asia-Pacific dominates the conductive polymer composites market with approximately 45% share, primarily due to the strong presence of electronics manufacturing hubs in China, Japan, South Korea, and Taiwan. North America and Europe collectively account for about 48% of the market, with significant research activities and high-end applications in aerospace, defense, and healthcare sectors.

The healthcare and medical devices segment represents the fastest-growing application area for conductive polymer composites, with a growth rate exceeding 14% annually. This surge is driven by innovations in biosensors, drug delivery systems, and implantable medical devices that benefit from the biocompatibility and tailorable conductivity of polymer composites.

Consumer demand trends indicate a growing preference for sustainable and environmentally friendly conductive materials. This has led to increased research in bio-based conductive polymers and composites with reduced environmental footprint, creating a niche but rapidly expanding segment within the market.

Price sensitivity varies significantly across application sectors. While consumer electronics manufacturers prioritize cost-effectiveness, aerospace and medical device companies place greater emphasis on performance reliability and consistency, accepting premium pricing for advanced conductive polymer composites that meet stringent specifications.

Market barriers include the relatively higher cost compared to traditional materials for certain applications, technical challenges in achieving consistent conductivity across large-scale production, and regulatory hurdles particularly in medical and food-contact applications. Despite these challenges, the versatility and customizable nature of conductive polymer composites continue to drive market expansion into new application areas.

The electronics industry remains the largest consumer of conductive polymer composites, accounting for nearly 42% of the total market share. This dominance is attributed to the growing adoption of flexible electronics, wearable devices, and miniaturized components that require materials with excellent electrical conductivity while maintaining flexibility and reduced weight. The automotive sector follows closely, representing about 27% of the market, with applications in electromagnetic interference (EMI) shielding, antistatic components, and increasingly in electric vehicle battery systems.

Regionally, Asia-Pacific dominates the conductive polymer composites market with approximately 45% share, primarily due to the strong presence of electronics manufacturing hubs in China, Japan, South Korea, and Taiwan. North America and Europe collectively account for about 48% of the market, with significant research activities and high-end applications in aerospace, defense, and healthcare sectors.

The healthcare and medical devices segment represents the fastest-growing application area for conductive polymer composites, with a growth rate exceeding 14% annually. This surge is driven by innovations in biosensors, drug delivery systems, and implantable medical devices that benefit from the biocompatibility and tailorable conductivity of polymer composites.

Consumer demand trends indicate a growing preference for sustainable and environmentally friendly conductive materials. This has led to increased research in bio-based conductive polymers and composites with reduced environmental footprint, creating a niche but rapidly expanding segment within the market.

Price sensitivity varies significantly across application sectors. While consumer electronics manufacturers prioritize cost-effectiveness, aerospace and medical device companies place greater emphasis on performance reliability and consistency, accepting premium pricing for advanced conductive polymer composites that meet stringent specifications.

Market barriers include the relatively higher cost compared to traditional materials for certain applications, technical challenges in achieving consistent conductivity across large-scale production, and regulatory hurdles particularly in medical and food-contact applications. Despite these challenges, the versatility and customizable nature of conductive polymer composites continue to drive market expansion into new application areas.

Current Status and Technical Challenges in Composite Materials

Conductive polymer composites (CPCs) represent a significant advancement in materials science, combining the electrical conductivity of metals with the processability and lightweight nature of polymers. Currently, the global market for these materials is experiencing robust growth, with an estimated CAGR of 8.1% through 2026, driven by increasing applications in electronics, automotive, and aerospace industries.

The state-of-the-art in CPC development focuses on several key materials as conductive fillers, including carbon-based materials (carbon nanotubes, graphene, carbon black), metallic particles (silver, copper, nickel), and intrinsically conductive polymers (polyaniline, polypyrrole, PEDOT:PSS). Carbon nanotubes (CNTs) have emerged as particularly promising due to their exceptional electrical conductivity (up to 10^6 S/m) and mechanical strength, though challenges in dispersion and alignment persist.

Despite significant progress, several technical challenges impede the widespread adoption of CPCs. The percolation threshold—the minimum filler content required to achieve conductivity—remains a critical limitation. Current research aims to reduce this threshold, as high filler loadings often compromise mechanical properties and processability. For instance, conventional carbon black composites typically require 15-20 wt% loading, while advanced CNT composites can achieve conductivity at 0.5-2 wt%, though at significantly higher material costs.

Processing challenges represent another major hurdle. Achieving uniform dispersion of conductive fillers within polymer matrices remains difficult, particularly for nanomaterials with high surface area and strong van der Waals interactions. Current industrial-scale production methods struggle to maintain consistent electrical properties across batches, with conductivity variations of up to 30% reported in some manufacturing processes.

Geographically, research and development in CPC technology shows distinct patterns. North America and Europe lead in fundamental research and patent filings, with approximately 45% and 30% of global publications respectively. However, Asia, particularly China, Japan, and South Korea, dominates in commercial production, accounting for over 60% of global manufacturing capacity.

Environmental and health concerns also present significant challenges. The potential toxicity of nanomaterials like CNTs remains under investigation, while end-of-life recycling of CPCs presents technical difficulties due to the intimate mixing of dissimilar materials. Current recycling rates for CPC products remain below 15%, significantly lower than for conventional polymers.

Cost factors continue to limit broader adoption, with high-performance CPCs commanding prices 5-10 times higher than conventional polymers. This price premium restricts their use to high-value applications where performance benefits justify the increased cost, limiting penetration into mass-market products.

The state-of-the-art in CPC development focuses on several key materials as conductive fillers, including carbon-based materials (carbon nanotubes, graphene, carbon black), metallic particles (silver, copper, nickel), and intrinsically conductive polymers (polyaniline, polypyrrole, PEDOT:PSS). Carbon nanotubes (CNTs) have emerged as particularly promising due to their exceptional electrical conductivity (up to 10^6 S/m) and mechanical strength, though challenges in dispersion and alignment persist.

Despite significant progress, several technical challenges impede the widespread adoption of CPCs. The percolation threshold—the minimum filler content required to achieve conductivity—remains a critical limitation. Current research aims to reduce this threshold, as high filler loadings often compromise mechanical properties and processability. For instance, conventional carbon black composites typically require 15-20 wt% loading, while advanced CNT composites can achieve conductivity at 0.5-2 wt%, though at significantly higher material costs.

Processing challenges represent another major hurdle. Achieving uniform dispersion of conductive fillers within polymer matrices remains difficult, particularly for nanomaterials with high surface area and strong van der Waals interactions. Current industrial-scale production methods struggle to maintain consistent electrical properties across batches, with conductivity variations of up to 30% reported in some manufacturing processes.

Geographically, research and development in CPC technology shows distinct patterns. North America and Europe lead in fundamental research and patent filings, with approximately 45% and 30% of global publications respectively. However, Asia, particularly China, Japan, and South Korea, dominates in commercial production, accounting for over 60% of global manufacturing capacity.

Environmental and health concerns also present significant challenges. The potential toxicity of nanomaterials like CNTs remains under investigation, while end-of-life recycling of CPCs presents technical difficulties due to the intimate mixing of dissimilar materials. Current recycling rates for CPC products remain below 15%, significantly lower than for conventional polymers.

Cost factors continue to limit broader adoption, with high-performance CPCs commanding prices 5-10 times higher than conventional polymers. This price premium restricts their use to high-value applications where performance benefits justify the increased cost, limiting penetration into mass-market products.

Current Material Solutions and Formulation Approaches

01 Carbon-based conductive polymer composites

Carbon-based materials such as carbon nanotubes, graphene, and carbon black are commonly incorporated into polymer matrices to create conductive composites. These fillers provide excellent electrical conductivity while maintaining the mechanical properties and processability of the polymer. The resulting composites exhibit enhanced electrical properties suitable for various applications including electromagnetic shielding, antistatic materials, and flexible electronics.- Carbon-based conductive polymer composites: Carbon-based materials such as carbon nanotubes, graphene, and carbon black are commonly incorporated into polymer matrices to create conductive composites. These fillers provide excellent electrical conductivity while maintaining the processability of the polymer. The resulting composites exhibit enhanced mechanical properties and can be used in various applications including electromagnetic shielding, antistatic materials, and flexible electronics.

- Metal-polymer conductive composites: Metal particles or nanowires, such as silver, copper, or aluminum, can be dispersed within polymer matrices to create highly conductive composites. These metal-polymer composites offer excellent electrical conductivity while maintaining flexibility and processability. The metal content, particle size, and distribution significantly affect the conductivity and mechanical properties of the final composite material.

- Intrinsically conductive polymers in composites: Intrinsically conductive polymers like polyaniline, polypyrrole, and PEDOT:PSS can be blended with conventional polymers to create conductive composites. These materials offer unique advantages including tunable conductivity, optical properties, and environmental stability. The composites can be processed using conventional polymer processing techniques and find applications in sensors, actuators, and energy storage devices.

- Processing techniques for conductive polymer composites: Various processing techniques are employed to manufacture conductive polymer composites with optimized properties. These include solution blending, melt mixing, in-situ polymerization, and layer-by-layer assembly. The processing method significantly influences the dispersion of conductive fillers within the polymer matrix, which directly affects the electrical, thermal, and mechanical properties of the final composite material.

- Applications of conductive polymer composites: Conductive polymer composites find applications across various industries including electronics, automotive, aerospace, and healthcare. They are used in electromagnetic interference shielding, antistatic packaging, sensors, actuators, flexible displays, and energy storage devices. The versatility of these materials stems from their unique combination of electrical conductivity, mechanical flexibility, lightweight nature, and processability.

02 Metal-polymer conductive composites

Metal particles or nanowires, particularly silver, copper, and nickel, can be dispersed within polymer matrices to create highly conductive composites. These metal-polymer composites offer superior conductivity compared to carbon-based fillers while maintaining flexibility. The metal fillers can be surface-treated to improve dispersion and adhesion with the polymer matrix, resulting in enhanced electrical performance and stability.Expand Specific Solutions03 Intrinsically conductive polymers in composites

Intrinsically conductive polymers such as polyaniline, polypyrrole, and PEDOT:PSS can be blended with conventional polymers to create conductive composites. These materials offer unique advantages including tunable conductivity, optical properties, and environmental stability. The composites can be processed using conventional polymer processing techniques while maintaining their electrical properties, making them suitable for sensors, actuators, and energy storage applications.Expand Specific Solutions04 Processing techniques for conductive polymer composites

Various processing techniques can be employed to manufacture conductive polymer composites with optimized properties. These include solution blending, melt mixing, in-situ polymerization, and layer-by-layer assembly. The processing method significantly affects the dispersion of conductive fillers within the polymer matrix, which directly impacts the electrical conductivity and mechanical properties of the final composite. Advanced techniques like 3D printing and electrospinning enable the fabrication of complex structures with tailored conductivity.Expand Specific Solutions05 Applications of conductive polymer composites

Conductive polymer composites find applications across various industries including electronics, automotive, aerospace, and healthcare. They are used in electromagnetic interference shielding, antistatic packaging, flexible electronics, sensors, actuators, and energy storage devices. The versatility of these materials stems from their ability to combine the processability and mechanical properties of polymers with the electrical conductivity of fillers, allowing for customized solutions to meet specific application requirements.Expand Specific Solutions

Leading Manufacturers and Research Institutions Analysis

The conductive polymer composites market is in a growth phase, with increasing applications across electronics, automotive, and energy sectors. The global market size is expanding rapidly due to rising demand for lightweight, flexible, and efficient conductive materials. Technologically, the field shows varying maturity levels, with companies like DuPont de Nemours and LG Chem leading commercial applications, while research institutions such as MIT, CNRS, and UCLouvain drive fundamental innovations. Key players include established chemical corporations (Shin-Etsu Chemical, Arkema France) focusing on industrial-scale production, alongside specialized entities like Eamex Corp and Hyper Drive Corp developing niche applications. The competitive landscape reflects a blend of academic research excellence and industrial commercialization efforts, with increasing collaboration between sectors to advance material performance and manufacturing techniques.

DuPont de Nemours, Inc.

Technical Solution: DuPont has developed advanced conductive polymer composites utilizing their proprietary technology that combines carbon nanotubes (CNTs) with engineered polymers. Their Zytel® and Crastin® product lines incorporate precisely dispersed conductive fillers within polymer matrices to achieve optimal electrical conductivity while maintaining mechanical properties. DuPont's research focuses on controlling the percolation threshold through innovative processing techniques that create three-dimensional conductive networks within the polymer matrix. Their technology employs surface functionalization of conductive fillers to enhance compatibility with polymer matrices, resulting in improved dispersion and lower loading requirements. DuPont has also pioneered hybrid filler systems combining graphene, carbon black, and metallic particles to achieve synergistic effects that enhance conductivity at lower filler concentrations, addressing the traditional trade-off between electrical performance and mechanical properties.

Strengths: Industry-leading expertise in polymer chemistry and composite formulation; extensive manufacturing infrastructure; strong intellectual property portfolio. Weaknesses: Higher cost compared to conventional materials; some formulations may require specialized processing equipment; performance can be sensitive to environmental conditions.

LG Chem Ltd.

Technical Solution: LG Chem has developed advanced conductive polymer composites primarily targeting the battery and electronics industries. Their technology platform centers on engineered polymer blends incorporating precisely controlled amounts of carbon nanotubes, graphene, and metallic nanoparticles. LG Chem's approach focuses on hierarchical composite structures where primary conductive networks are reinforced by secondary conductive pathways, significantly reducing the percolation threshold. Their proprietary processing techniques include specialized melt compounding methods that prevent agglomeration of conductive fillers while ensuring uniform dispersion throughout the polymer matrix. LG Chem has pioneered surface-modified carbon nanotubes with functional groups that enhance compatibility with various polymer systems, improving both electrical conductivity and mechanical properties. Their recent innovations include self-healing conductive composites that can restore electrical pathways after mechanical damage, addressing reliability concerns in flexible electronics applications. LG Chem has also developed flame-retardant conductive composites that maintain conductivity while meeting stringent safety requirements for consumer electronics.

Strengths: Vertical integration from raw materials to finished products; extensive R&D capabilities; strong position in battery and electronics markets. Weaknesses: Some technologies heavily dependent on rare or expensive conductive fillers; processing complexity can limit scalability; performance may degrade under extreme environmental conditions.

Key Patents and Scientific Breakthroughs in Conductive Fillers

Polymer composites and methods for producing the same

PatentInactiveUS20100190924A1

Innovation

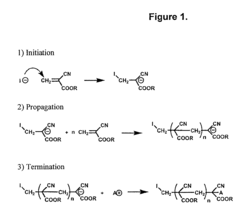

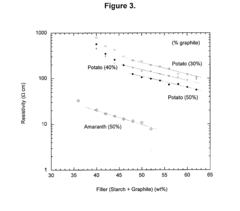

- The development of electrically conductive and non-conductive polymer composites using cyanoacrylate as a polymeric matrix with conductive fillers like graphite, which undergoes rapid and easy anionic polymerization at room temperature, forming a continuous chain structure and achieving high mechanical properties and adjustable conductance by varying the percentage of conductive fillers.

Conductive composites

PatentActiveUS20210313088A1

Innovation

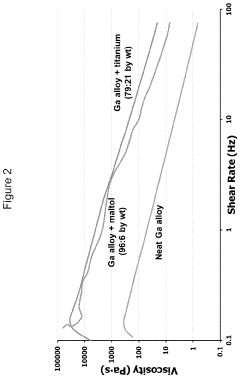

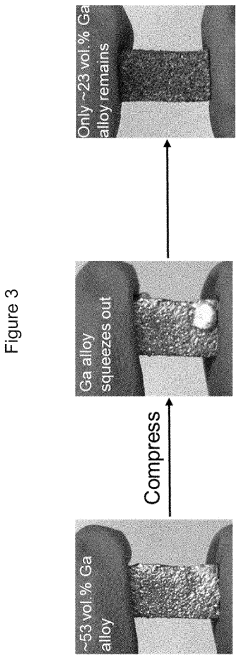

- A conductive composite comprising a polymer and an electrically conductive network with a conductor having a melting point below 60°C and a thickening agent, which prevents metal leakage and enhances elasticity, allowing for flexible and rigid composites with improved thermal stability.

Environmental Impact and Sustainability Considerations

The environmental impact of conductive polymer composites (CPCs) has become increasingly significant as these materials gain wider industrial application. Traditional conductive materials often rely on metals and carbon-based fillers that present substantial environmental challenges throughout their lifecycle. Mining operations for metals like copper and silver generate significant land disruption, water pollution, and energy consumption. Similarly, carbon nanotubes and graphene production typically involves energy-intensive processes and hazardous chemicals that contribute to environmental degradation.

Waste management represents another critical environmental concern for CPCs. The complex nature of these composites, combining polymers with various conductive fillers, often makes recycling difficult or economically unfeasible. End-of-life CPCs frequently end up in landfills where they may leach potentially harmful substances into soil and groundwater systems. The persistence of nanomaterials in the environment remains poorly understood, raising concerns about potential bioaccumulation and long-term ecological effects.

Recent sustainability initiatives have focused on developing more environmentally friendly alternatives for conductive polymer composites. Bio-based polymers derived from renewable resources such as cellulose, starch, and plant oils are being investigated as matrices for conductive composites. These materials offer reduced carbon footprints compared to petroleum-based polymers and potentially improved biodegradability. Additionally, researchers are exploring conductive fillers from sustainable sources, including carbon derived from agricultural waste and naturally occurring conductive minerals.

Life cycle assessment (LCA) studies have become essential tools for evaluating the environmental performance of CPCs. These assessments consider impacts from raw material extraction through manufacturing, use, and disposal phases. Recent LCA research indicates that while CPCs may have higher environmental impacts during production compared to conventional materials, their enhanced performance and longevity can result in net environmental benefits over the complete product lifecycle, particularly in energy-saving applications.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of nanomaterials used in CPCs. The European Union's REACH regulations and similar initiatives in other regions require manufacturers to assess and disclose potential environmental and health risks associated with nanomaterials. These regulatory pressures are driving innovation toward greener synthesis methods, including aqueous processing techniques that eliminate toxic solvents and room-temperature reactions that reduce energy consumption.

The circular economy concept is gaining traction in CPC development, with design strategies focusing on material recovery and reuse. Researchers are developing reversible crosslinking mechanisms and compatible polymer-filler combinations that facilitate separation and recycling. These advances promise to extend material lifespans and reduce the environmental footprint of conductive polymer composites across multiple industrial sectors.

Waste management represents another critical environmental concern for CPCs. The complex nature of these composites, combining polymers with various conductive fillers, often makes recycling difficult or economically unfeasible. End-of-life CPCs frequently end up in landfills where they may leach potentially harmful substances into soil and groundwater systems. The persistence of nanomaterials in the environment remains poorly understood, raising concerns about potential bioaccumulation and long-term ecological effects.

Recent sustainability initiatives have focused on developing more environmentally friendly alternatives for conductive polymer composites. Bio-based polymers derived from renewable resources such as cellulose, starch, and plant oils are being investigated as matrices for conductive composites. These materials offer reduced carbon footprints compared to petroleum-based polymers and potentially improved biodegradability. Additionally, researchers are exploring conductive fillers from sustainable sources, including carbon derived from agricultural waste and naturally occurring conductive minerals.

Life cycle assessment (LCA) studies have become essential tools for evaluating the environmental performance of CPCs. These assessments consider impacts from raw material extraction through manufacturing, use, and disposal phases. Recent LCA research indicates that while CPCs may have higher environmental impacts during production compared to conventional materials, their enhanced performance and longevity can result in net environmental benefits over the complete product lifecycle, particularly in energy-saving applications.

Regulatory frameworks worldwide are increasingly addressing the environmental aspects of nanomaterials used in CPCs. The European Union's REACH regulations and similar initiatives in other regions require manufacturers to assess and disclose potential environmental and health risks associated with nanomaterials. These regulatory pressures are driving innovation toward greener synthesis methods, including aqueous processing techniques that eliminate toxic solvents and room-temperature reactions that reduce energy consumption.

The circular economy concept is gaining traction in CPC development, with design strategies focusing on material recovery and reuse. Researchers are developing reversible crosslinking mechanisms and compatible polymer-filler combinations that facilitate separation and recycling. These advances promise to extend material lifespans and reduce the environmental footprint of conductive polymer composites across multiple industrial sectors.

Manufacturing Scalability and Cost-Effectiveness Analysis

The scalability of manufacturing processes for conductive polymer composites (CPCs) presents significant challenges that directly impact their commercial viability. Current production methods for high-quality CPCs often involve complex multi-step processes that are difficult to scale beyond laboratory settings. Solution-based methods, while effective for producing high-performance materials, typically require substantial solvent usage and lengthy processing times, creating bottlenecks in mass production scenarios.

Melt processing techniques offer better scalability potential but frequently result in compromised electrical conductivity due to uneven dispersion of conductive fillers. This trade-off between processability and performance represents a fundamental challenge in the industry. Recent advancements in twin-screw extrusion and specialized mixing protocols have shown promise in maintaining conductivity while improving throughput, though optimization remains ongoing.

Cost analysis reveals that raw material expenses constitute 40-60% of total production costs for CPCs, with conductive fillers like carbon nanotubes and graphene being particularly price-sensitive components. The market price of high-purity carbon nanotubes (CNTs) has decreased from approximately $100-500/g to $10-50/g over the past decade, yet remains significantly higher than conventional fillers. This cost differential continues to limit widespread adoption in price-sensitive applications.

Energy consumption during processing represents another significant cost factor, particularly for methods requiring high temperatures or extended mixing times. Innovative approaches utilizing microwave-assisted processing and room-temperature curing systems have demonstrated potential for reducing energy requirements by 30-45% compared to conventional techniques, though implementation at industrial scale remains limited.

Equipment investment costs vary substantially based on production methodology, with specialized equipment for nanomaterial handling and processing representing a significant capital expenditure. Facilities producing CPCs at commercial scale typically require initial investments of $2-10 million, creating barriers to entry for smaller manufacturers and startups.

Recycling and waste management considerations are increasingly influencing cost-effectiveness calculations. The complex nature of polymer composites presents challenges for end-of-life processing, though recent developments in selective solvent extraction and thermal recovery techniques show promise for reclaiming valuable conductive components, potentially improving long-term economic viability.

Economies of scale follow non-linear patterns in CPC production, with significant cost reductions observed when scaling from laboratory (grams) to pilot (kilograms) production, but diminishing returns when scaling to full industrial production (tons). This pattern suggests optimal production volumes may exist for specific applications, balancing cost-effectiveness against capital investment requirements.

Melt processing techniques offer better scalability potential but frequently result in compromised electrical conductivity due to uneven dispersion of conductive fillers. This trade-off between processability and performance represents a fundamental challenge in the industry. Recent advancements in twin-screw extrusion and specialized mixing protocols have shown promise in maintaining conductivity while improving throughput, though optimization remains ongoing.

Cost analysis reveals that raw material expenses constitute 40-60% of total production costs for CPCs, with conductive fillers like carbon nanotubes and graphene being particularly price-sensitive components. The market price of high-purity carbon nanotubes (CNTs) has decreased from approximately $100-500/g to $10-50/g over the past decade, yet remains significantly higher than conventional fillers. This cost differential continues to limit widespread adoption in price-sensitive applications.

Energy consumption during processing represents another significant cost factor, particularly for methods requiring high temperatures or extended mixing times. Innovative approaches utilizing microwave-assisted processing and room-temperature curing systems have demonstrated potential for reducing energy requirements by 30-45% compared to conventional techniques, though implementation at industrial scale remains limited.

Equipment investment costs vary substantially based on production methodology, with specialized equipment for nanomaterial handling and processing representing a significant capital expenditure. Facilities producing CPCs at commercial scale typically require initial investments of $2-10 million, creating barriers to entry for smaller manufacturers and startups.

Recycling and waste management considerations are increasingly influencing cost-effectiveness calculations. The complex nature of polymer composites presents challenges for end-of-life processing, though recent developments in selective solvent extraction and thermal recovery techniques show promise for reclaiming valuable conductive components, potentially improving long-term economic viability.

Economies of scale follow non-linear patterns in CPC production, with significant cost reductions observed when scaling from laboratory (grams) to pilot (kilograms) production, but diminishing returns when scaling to full industrial production (tons). This pattern suggests optimal production volumes may exist for specific applications, balancing cost-effectiveness against capital investment requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!