How Do Patents Influence Developments in Conductive Polymer Composites?

OCT 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Polymer Composites Background and Objectives

Conductive polymer composites (CPCs) represent a significant advancement in materials science, combining the electrical conductivity of metals with the processability, flexibility, and lightweight properties of polymers. The evolution of these materials began in the 1970s with the discovery of conductive polymers by Alan Heeger, Alan MacDiarmid, and Hideki Shirakawa, who were awarded the Nobel Prize in Chemistry in 2000 for their groundbreaking work.

Over the past five decades, CPCs have evolved from laboratory curiosities to commercially viable materials with applications spanning multiple industries. The technological trajectory has been characterized by continuous improvements in conductivity, mechanical properties, and processing techniques, driven largely by patent-protected innovations.

Patents have played a pivotal role in shaping the development landscape of conductive polymer composites. They have served as both catalysts for innovation and barriers to entry, creating a complex ecosystem where intellectual property rights significantly influence research directions and commercialization strategies.

The primary objective of this technical research report is to analyze how patent activities have influenced the technological evolution of conductive polymer composites. We aim to identify key patents that have redirected research efforts, accelerated development in specific areas, or created technological bottlenecks that required innovative workarounds.

Current trends indicate a growing interest in nano-enhanced CPCs, with carbon nanotubes, graphene, and metal nanoparticles being incorporated to achieve unprecedented levels of conductivity while maintaining the inherent advantages of polymeric materials. Patent activities in these areas have intensified, suggesting a competitive race to secure intellectual property rights for next-generation composites.

Another emerging trend is the development of stimuli-responsive CPCs that can change their electrical properties in response to external factors such as temperature, pH, or mechanical stress. These smart materials represent a frontier where patent protection is actively being sought to secure market advantages in emerging applications.

The global push toward sustainable technologies has also influenced the patent landscape, with increasing focus on environmentally friendly processing methods, bio-based conductive polymers, and recyclable composite systems. These developments align with broader technological goals of reducing environmental impact while maintaining or enhancing performance characteristics.

This report will examine how patent strategies have shaped technological trajectories, influenced corporate R&D decisions, and ultimately determined which conductive polymer composite technologies have succeeded in the marketplace. Understanding these dynamics is crucial for identifying future innovation opportunities and developing effective intellectual property strategies in this rapidly evolving field.

Over the past five decades, CPCs have evolved from laboratory curiosities to commercially viable materials with applications spanning multiple industries. The technological trajectory has been characterized by continuous improvements in conductivity, mechanical properties, and processing techniques, driven largely by patent-protected innovations.

Patents have played a pivotal role in shaping the development landscape of conductive polymer composites. They have served as both catalysts for innovation and barriers to entry, creating a complex ecosystem where intellectual property rights significantly influence research directions and commercialization strategies.

The primary objective of this technical research report is to analyze how patent activities have influenced the technological evolution of conductive polymer composites. We aim to identify key patents that have redirected research efforts, accelerated development in specific areas, or created technological bottlenecks that required innovative workarounds.

Current trends indicate a growing interest in nano-enhanced CPCs, with carbon nanotubes, graphene, and metal nanoparticles being incorporated to achieve unprecedented levels of conductivity while maintaining the inherent advantages of polymeric materials. Patent activities in these areas have intensified, suggesting a competitive race to secure intellectual property rights for next-generation composites.

Another emerging trend is the development of stimuli-responsive CPCs that can change their electrical properties in response to external factors such as temperature, pH, or mechanical stress. These smart materials represent a frontier where patent protection is actively being sought to secure market advantages in emerging applications.

The global push toward sustainable technologies has also influenced the patent landscape, with increasing focus on environmentally friendly processing methods, bio-based conductive polymers, and recyclable composite systems. These developments align with broader technological goals of reducing environmental impact while maintaining or enhancing performance characteristics.

This report will examine how patent strategies have shaped technological trajectories, influenced corporate R&D decisions, and ultimately determined which conductive polymer composite technologies have succeeded in the marketplace. Understanding these dynamics is crucial for identifying future innovation opportunities and developing effective intellectual property strategies in this rapidly evolving field.

Market Demand Analysis for Conductive Polymer Applications

The global market for conductive polymer composites has witnessed substantial growth in recent years, driven primarily by increasing demand across multiple industries. The electronics sector represents the largest application area, with conductive polymers being extensively utilized in flexible displays, touch screens, organic light-emitting diodes (OLEDs), and printed circuit boards. According to industry analyses, the market value for conductive polymers in electronics applications alone exceeded $3 billion in 2022, with a projected compound annual growth rate of 8.2% through 2028.

The automotive industry has emerged as another significant consumer of conductive polymer composites, particularly for electromagnetic interference (EMI) shielding, antistatic applications, and lightweight components. As vehicle electrification accelerates globally, the demand for conductive polymers in automotive applications is expected to grow at nearly 10% annually, outpacing most other application segments.

Healthcare and biomedical applications represent a rapidly expanding market for conductive polymer composites. These materials are increasingly utilized in biosensors, drug delivery systems, tissue engineering, and medical devices. The biocompatibility of certain conductive polymers, combined with their electrical properties, makes them particularly valuable for implantable medical devices and point-of-care diagnostic tools.

Energy storage and conversion systems constitute another high-growth application area. Conductive polymers are being incorporated into batteries, supercapacitors, and solar cells, offering advantages in flexibility, weight reduction, and potentially lower manufacturing costs. The renewable energy sector's expansion has directly contributed to increased demand for advanced materials, including conductive polymer composites.

Patent activity strongly correlates with market demand trends, with approximately 65% of conductive polymer composite patents filed in the last decade focusing on electronics and energy applications. This alignment between patent focus and market demand underscores how intellectual property development is strategically directed toward high-value commercial opportunities.

Regional analysis reveals that Asia-Pacific currently dominates the conductive polymer composites market, accounting for approximately 45% of global demand. This regional concentration is attributed to the strong presence of electronics manufacturing and increasing automotive production in countries like China, Japan, and South Korea. North America and Europe follow with significant market shares, driven by advanced manufacturing sectors and substantial R&D investments.

Customer requirements are increasingly focused on enhanced conductivity, improved mechanical properties, environmental stability, and cost-effectiveness. These market demands directly influence patent development strategies, with recent innovations concentrating on addressing these specific performance parameters while maintaining commercial viability.

The automotive industry has emerged as another significant consumer of conductive polymer composites, particularly for electromagnetic interference (EMI) shielding, antistatic applications, and lightweight components. As vehicle electrification accelerates globally, the demand for conductive polymers in automotive applications is expected to grow at nearly 10% annually, outpacing most other application segments.

Healthcare and biomedical applications represent a rapidly expanding market for conductive polymer composites. These materials are increasingly utilized in biosensors, drug delivery systems, tissue engineering, and medical devices. The biocompatibility of certain conductive polymers, combined with their electrical properties, makes them particularly valuable for implantable medical devices and point-of-care diagnostic tools.

Energy storage and conversion systems constitute another high-growth application area. Conductive polymers are being incorporated into batteries, supercapacitors, and solar cells, offering advantages in flexibility, weight reduction, and potentially lower manufacturing costs. The renewable energy sector's expansion has directly contributed to increased demand for advanced materials, including conductive polymer composites.

Patent activity strongly correlates with market demand trends, with approximately 65% of conductive polymer composite patents filed in the last decade focusing on electronics and energy applications. This alignment between patent focus and market demand underscores how intellectual property development is strategically directed toward high-value commercial opportunities.

Regional analysis reveals that Asia-Pacific currently dominates the conductive polymer composites market, accounting for approximately 45% of global demand. This regional concentration is attributed to the strong presence of electronics manufacturing and increasing automotive production in countries like China, Japan, and South Korea. North America and Europe follow with significant market shares, driven by advanced manufacturing sectors and substantial R&D investments.

Customer requirements are increasingly focused on enhanced conductivity, improved mechanical properties, environmental stability, and cost-effectiveness. These market demands directly influence patent development strategies, with recent innovations concentrating on addressing these specific performance parameters while maintaining commercial viability.

Current State and Challenges in Polymer Composite Technology

Conductive polymer composites (CPCs) represent a significant advancement in materials science, combining the electrical conductivity of metals with the processability and lightweight properties of polymers. Currently, the global market for these materials is experiencing robust growth, with applications spanning electronics, automotive, aerospace, and healthcare sectors. The compound annual growth rate (CAGR) for CPCs is projected at 8.1% through 2028, indicating strong commercial interest and technological momentum.

The current technological landscape of CPCs is characterized by several key developments. Carbon-based fillers, particularly carbon nanotubes (CNTs), graphene, and carbon black, dominate the field due to their exceptional electrical properties and relatively established manufacturing processes. Metal-based composites, utilizing silver, copper, and nickel particles, represent another significant segment, especially in applications requiring higher conductivity levels. Additionally, intrinsically conductive polymers like polyaniline (PANI) and polypyrrole (PPy) continue to gain traction in specialized applications.

Despite these advancements, the field faces substantial challenges. Dispersion issues remain paramount, as achieving homogeneous distribution of conductive fillers within polymer matrices continues to be technically difficult, particularly at industrial scales. The percolation threshold—the minimum filler content required for electrical conductivity—presents another significant hurdle, with researchers striving to achieve conductivity at lower filler loadings to preserve mechanical properties and reduce costs.

Manufacturing scalability represents a critical bottleneck, with many laboratory-demonstrated techniques proving difficult to implement in mass production environments. This challenge is particularly evident in processes involving nanomaterials like graphene and CNTs, where handling, safety protocols, and quality control become increasingly complex at industrial scales.

Geographically, research and development in CPC technology shows distinct patterns. North America and Europe lead in patent filings and fundamental research, while Asian countries, particularly China, Japan, and South Korea, demonstrate growing dominance in manufacturing innovations and application-specific developments. This distribution reflects broader industrial capabilities and strategic priorities in advanced materials development.

The patent landscape reveals significant concentration among major chemical and electronics corporations, with companies like DuPont, BASF, LG Chem, and Samsung holding substantial intellectual property portfolios. These patents often create barriers to entry for smaller players while simultaneously driving innovation through competitive pressure and licensing opportunities.

The current technological landscape of CPCs is characterized by several key developments. Carbon-based fillers, particularly carbon nanotubes (CNTs), graphene, and carbon black, dominate the field due to their exceptional electrical properties and relatively established manufacturing processes. Metal-based composites, utilizing silver, copper, and nickel particles, represent another significant segment, especially in applications requiring higher conductivity levels. Additionally, intrinsically conductive polymers like polyaniline (PANI) and polypyrrole (PPy) continue to gain traction in specialized applications.

Despite these advancements, the field faces substantial challenges. Dispersion issues remain paramount, as achieving homogeneous distribution of conductive fillers within polymer matrices continues to be technically difficult, particularly at industrial scales. The percolation threshold—the minimum filler content required for electrical conductivity—presents another significant hurdle, with researchers striving to achieve conductivity at lower filler loadings to preserve mechanical properties and reduce costs.

Manufacturing scalability represents a critical bottleneck, with many laboratory-demonstrated techniques proving difficult to implement in mass production environments. This challenge is particularly evident in processes involving nanomaterials like graphene and CNTs, where handling, safety protocols, and quality control become increasingly complex at industrial scales.

Geographically, research and development in CPC technology shows distinct patterns. North America and Europe lead in patent filings and fundamental research, while Asian countries, particularly China, Japan, and South Korea, demonstrate growing dominance in manufacturing innovations and application-specific developments. This distribution reflects broader industrial capabilities and strategic priorities in advanced materials development.

The patent landscape reveals significant concentration among major chemical and electronics corporations, with companies like DuPont, BASF, LG Chem, and Samsung holding substantial intellectual property portfolios. These patents often create barriers to entry for smaller players while simultaneously driving innovation through competitive pressure and licensing opportunities.

Current Patent-Protected Technical Solutions

01 Conductive polymer composites with carbon-based fillers

Carbon-based materials such as carbon nanotubes, graphene, and carbon black are commonly used as conductive fillers in polymer matrices to create electrically conductive composites. These fillers create conductive networks within the polymer matrix, enhancing electrical conductivity while maintaining the mechanical properties and processability of the polymer. The dispersion method and concentration of these carbon-based fillers significantly affect the final conductivity of the composite.- Conductive polymer composites with carbon-based fillers: Carbon-based materials such as carbon nanotubes, graphene, and carbon black can be incorporated into polymer matrices to create conductive composites. These fillers form conductive networks within the polymer, enhancing electrical conductivity while maintaining the processability and mechanical properties of the base polymer. The resulting composites exhibit tunable conductivity based on filler concentration and dispersion quality, making them suitable for various electronic applications.

- Metal-polymer conductive composites: Metal particles or nanowires can be dispersed within polymer matrices to create conductive composites with unique properties. These composites combine the processability and flexibility of polymers with the high conductivity of metals. The conductivity can be controlled by adjusting the metal content, particle size, and distribution. Applications include electromagnetic shielding, flexible electronics, and sensors where both electrical conductivity and polymer properties are desired.

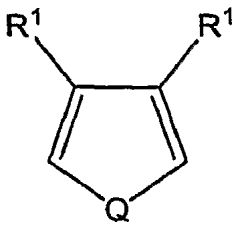

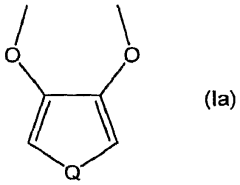

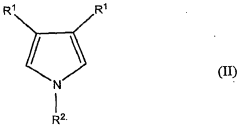

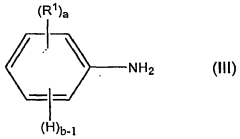

- Intrinsically conductive polymer composites: Intrinsically conductive polymers such as polyaniline, polypyrrole, and PEDOT:PSS can be blended with conventional polymers to create composites with enhanced electrical properties. These materials feature conjugated backbone structures that allow electron movement along the polymer chain. The conductivity can be further enhanced through doping processes. These composites offer advantages in terms of processability, stability, and compatibility with various substrates for applications in energy storage, sensors, and flexible electronics.

- Thermal management conductive polymer composites: Polymer composites can be engineered to exhibit high thermal conductivity alongside electrical conductivity. These materials incorporate fillers such as boron nitride, aluminum oxide, or specialized carbon structures that efficiently transfer heat while maintaining electrical properties. The composites address thermal management challenges in electronic devices, batteries, and high-power applications where heat dissipation is critical for performance and safety.

- Stimuli-responsive conductive polymer composites: These advanced composites change their electrical, mechanical, or optical properties in response to external stimuli such as temperature, pH, light, or mechanical stress. By incorporating responsive elements into conductive polymer systems, these materials can function as sensors, actuators, or smart switches. The responsive behavior can be tuned by adjusting the composition and structure of the composite, enabling applications in soft robotics, wearable electronics, and adaptive systems.

02 Metal-polymer conductive composites

Metal particles, nanowires, or flakes can be incorporated into polymer matrices to create conductive composites with unique properties. These metal fillers, including silver, copper, and aluminum, provide excellent electrical conductivity while the polymer matrix offers flexibility and processability. The size, shape, and distribution of metal particles within the polymer matrix significantly influence the electrical and mechanical properties of the resulting composite materials.Expand Specific Solutions03 Intrinsically conductive polymers and their blends

Intrinsically conductive polymers such as polyaniline, polypyrrole, and PEDOT:PSS can be used alone or blended with conventional polymers to create conductive composites. These polymers contain conjugated double bonds that allow electron movement along the polymer backbone. By controlling the doping level and processing conditions, the electrical conductivity of these polymers can be tuned for specific applications, from antistatic protection to electromagnetic shielding.Expand Specific Solutions04 Conductive polymer composites for energy storage applications

Conductive polymer composites are increasingly used in energy storage devices such as batteries, supercapacitors, and fuel cells. These composites combine the electrical conductivity needed for efficient charge transfer with the structural properties required for device fabrication. By incorporating specific conductive fillers or using specially designed polymer matrices, these composites can enhance energy density, power density, and cycling stability in energy storage applications.Expand Specific Solutions05 Thermal and electrical management in conductive polymer composites

Conductive polymer composites can be engineered to provide both thermal and electrical conductivity for applications requiring heat dissipation alongside electrical performance. By selecting appropriate fillers and optimizing their distribution within the polymer matrix, these composites can efficiently manage heat while maintaining electrical functionality. This dual functionality is particularly valuable in electronic packaging, LED lighting, and automotive applications where thermal management is critical for device performance and longevity.Expand Specific Solutions

Key Industry Players and Patent Holders Analysis

The conductive polymer composites market is currently in a growth phase, with patents playing a crucial role in shaping technological advancements and competitive dynamics. The global market is expanding rapidly due to increasing applications in electronics, automotive, and energy sectors. Leading companies like DuPont de Nemours, SABIC Global Technologies, and Samsung Electronics are driving innovation through extensive patent portfolios focused on material formulations and manufacturing processes. Academic institutions including MIT, Northwestern University, and South China University of Technology are contributing significantly to fundamental research, often partnering with industry players. The technology is approaching maturity in certain applications, but emerging areas like flexible electronics and energy storage present new frontiers where patent activity is intensifying, creating both barriers to entry and opportunities for cross-licensing agreements.

DuPont de Nemours, Inc.

Technical Solution: DuPont has pioneered significant advancements in conductive polymer composites through their extensive patent portfolio. Their technology focuses on integrating conductive fillers like carbon nanotubes and graphene into polymer matrices using proprietary dispersion techniques. DuPont's patents cover novel processing methods that achieve uniform dispersion of conductive particles at lower loading levels (typically 3-5 wt% compared to conventional 15-20 wt%), resulting in composites with enhanced electrical conductivity while maintaining mechanical properties. Their patented compatibilization agents create stronger interfaces between fillers and polymer matrices, addressing a critical challenge in composite development. DuPont has also developed patents for tailoring percolation thresholds through controlled filler orientation and hierarchical structures, enabling precise conductivity control across different applications.

Strengths: Extensive R&D infrastructure and decades of polymer expertise; strong patent protection for processing techniques; global manufacturing capabilities enabling commercial scale production. Weaknesses: Higher production costs compared to conventional materials; some technologies require specialized processing equipment; certain patents focus on specific polymer systems with limited broader applicability.

Arkema, Inc.

Technical Solution: Arkema has established a significant patent position in conductive polymer composites through their work with PEBA (polyether block amide) and PVDF (polyvinylidene fluoride) matrices. Their patents cover innovative approaches to creating flexible conductive materials with strain-sensing capabilities. Arkema's proprietary technology involves the use of structured conductive networks that maintain connectivity during mechanical deformation, allowing for conductivity retention at strains exceeding 100%. Their patents describe methods for creating segregated conductive networks using selective localization of carbon nanotubes and graphene at polymer interfaces, achieving percolation thresholds as low as 0.5 wt%. Arkema has also patented processes for creating temperature-responsive conductive composites with positive temperature coefficient (PTC) behavior for circuit protection applications. Their recent innovations include patents on spray-coatable conductive formulations that enable complex geometries to be coated with uniform conductive layers.

Strengths: Strong expertise in specialty polymers; established manufacturing infrastructure; patents covering both material formulations and processing methods. Weaknesses: Some technologies limited to specific polymer families; certain applications require precise processing control that may limit manufacturing scalability; competition from lower-cost alternatives in less demanding applications.

Critical Patent Analysis and Technical Implications

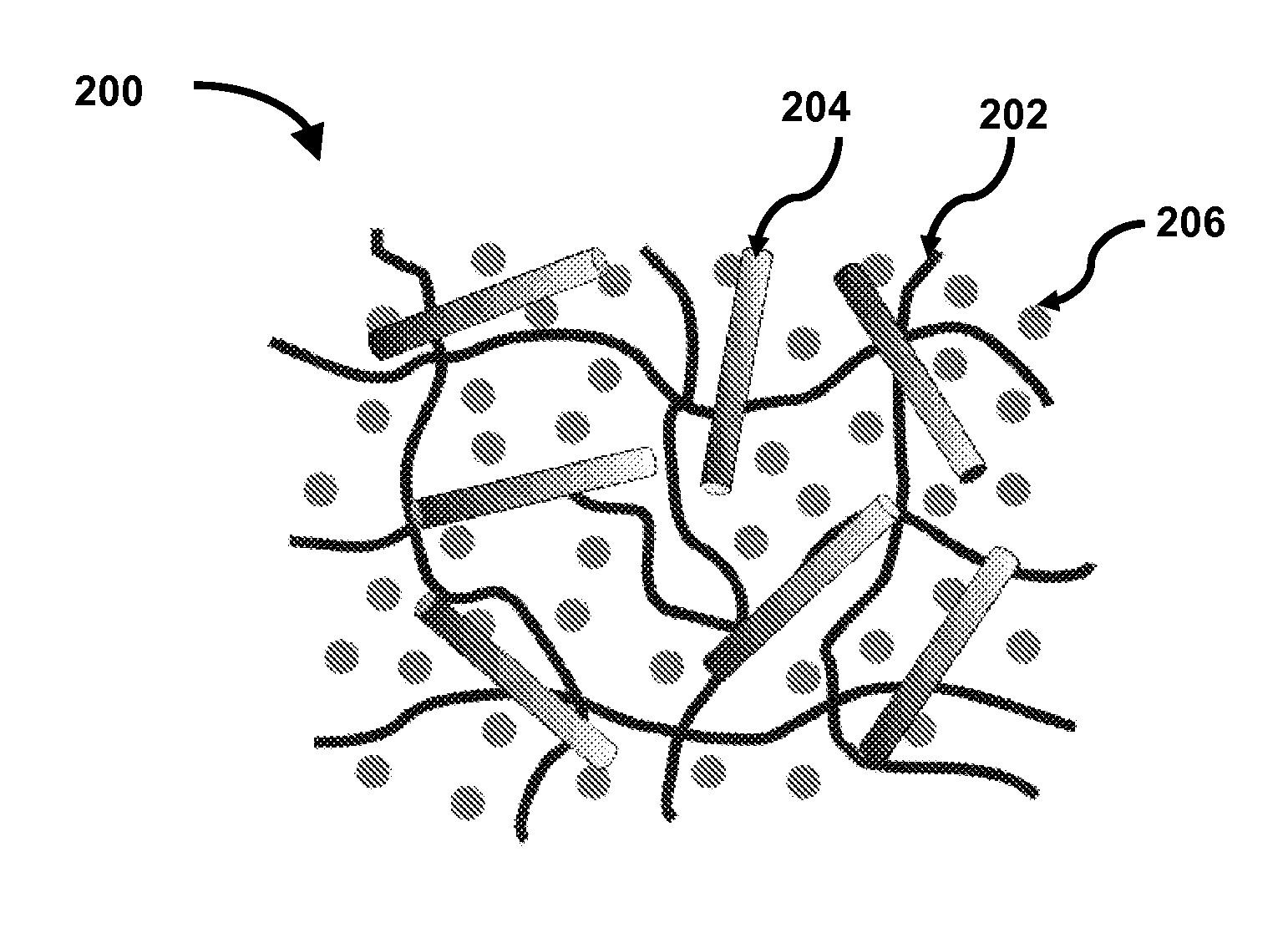

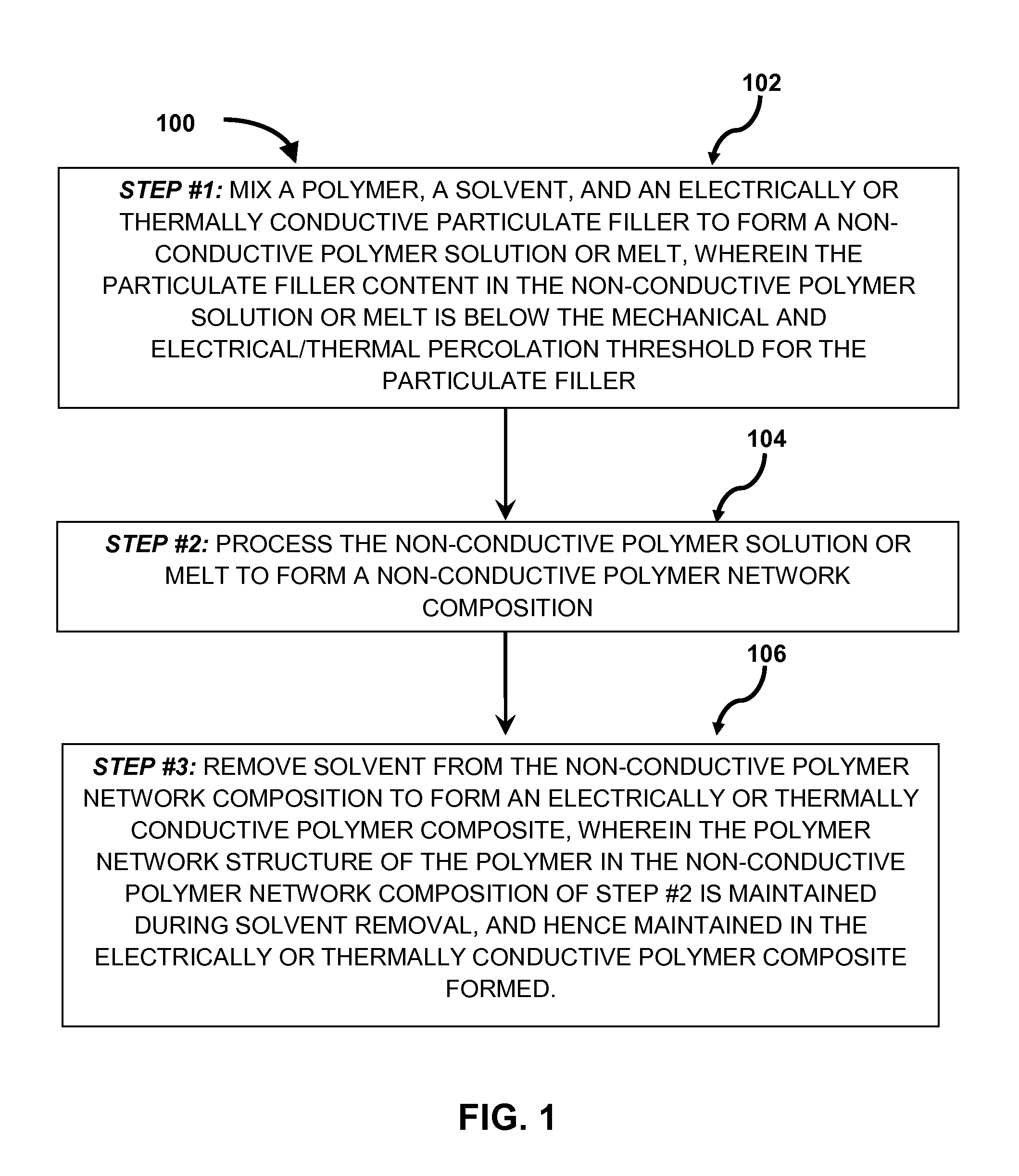

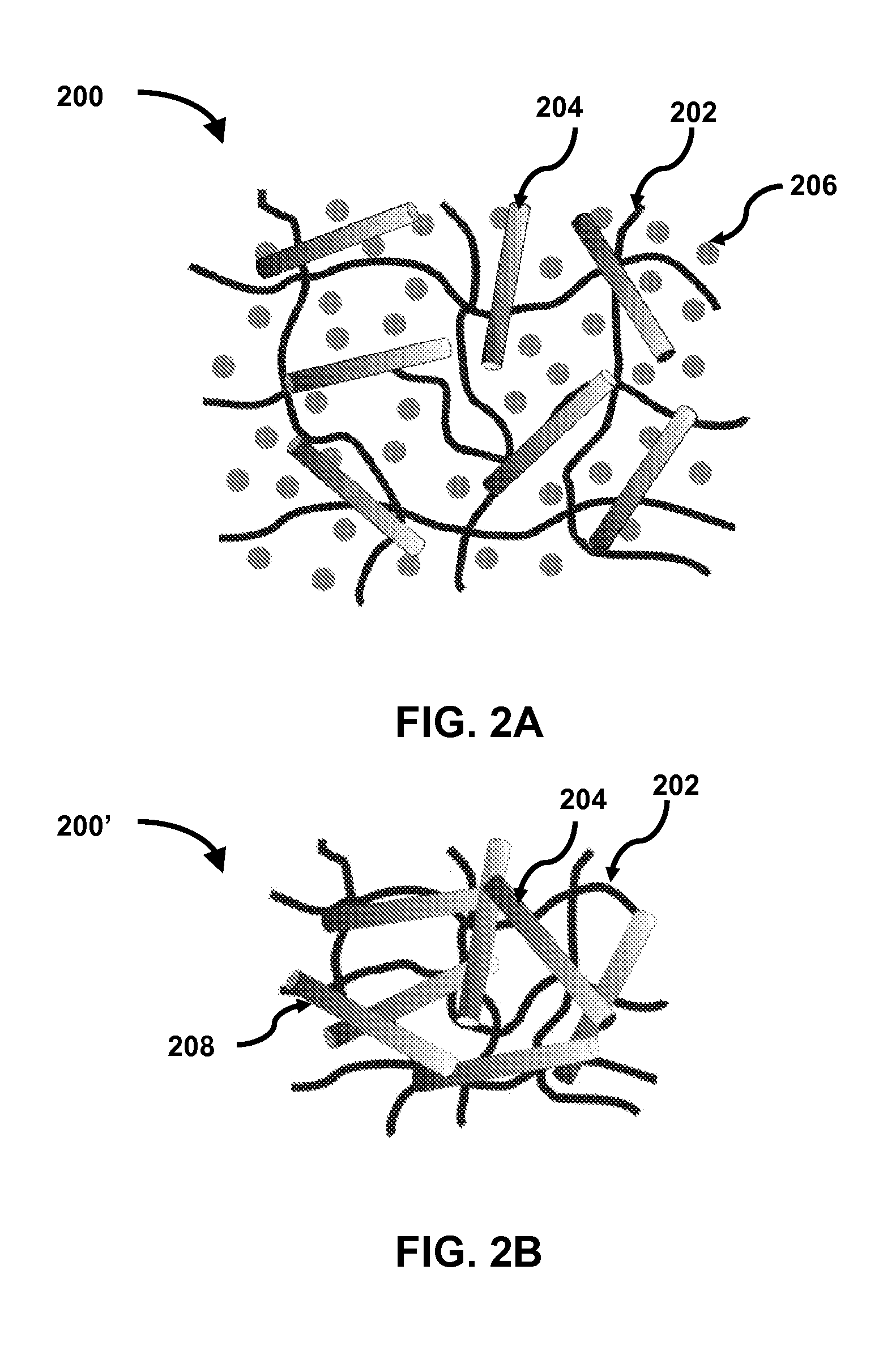

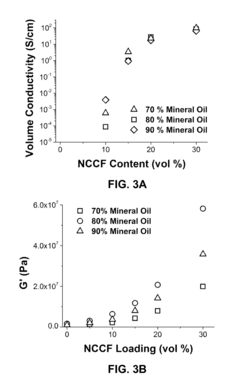

Solvent assisted processing to control the mechanical properties of electrically and/or thermally conductive polymer composites

PatentInactiveUS20150083961A1

Innovation

- A method involving mixing a polymer with a conductive particulate filler and a solvent below the mechanical and electrical/thermal percolation thresholds, processing into a non-conductive polymer network, and then removing the solvent to form a conductive composite, allowing control over mechanical properties independent of filler concentration.

Conductive polymer compositions

PatentWO2007143124A1

Innovation

- The development of an electrically conductive polymer composition dispersed in an aqueous liquid medium with a dissolved oxygen content less than 10% of the saturated level, using a conductive polymer doped with a fluorinated acid polymer or in admixture with one, and a method involving polymerization in the presence of a fluorinated acid polymer followed by oxygen removal using a hollow fiber filter.

Patent Landscape and IP Strategy Considerations

The patent landscape for conductive polymer composites (CPCs) reveals a complex and increasingly competitive field, with significant growth in patent filings over the past decade. Major patent holders include multinational corporations such as DuPont, BASF, and 3M, alongside emerging specialized players like PolyOne and RTP Company. These patents predominantly focus on composition innovations, manufacturing processes, and application-specific formulations, creating a dense network of intellectual property rights.

Geographic distribution of patents shows concentration in the United States, Japan, Germany, and increasingly China, reflecting the global nature of CPC research and development. Recent patent trends indicate growing interest in nano-enhanced composites, self-healing materials, and environmentally sustainable formulations, suggesting these as key innovation frontiers.

Freedom-to-operate challenges are particularly significant in this field due to the overlapping nature of many patents. Companies developing new CPC technologies must navigate a complex web of existing patents, often necessitating extensive prior art searches and careful claim analysis to avoid infringement issues. This complexity has led to strategic patent pooling and cross-licensing arrangements among major industry players.

For companies entering or expanding in the CPC market, a multi-faceted IP strategy is essential. Defensive patenting approaches focus on building portfolios that protect core technologies while creating barriers to competitors. Meanwhile, offensive strategies involve identifying white space opportunities where novel innovations can be developed and protected. The increasing value of CPC technologies has also led to more aggressive enforcement actions, with several high-profile litigation cases shaping the competitive landscape.

Open innovation models are emerging as an alternative approach, with some companies pursuing collaborative development through joint ventures or research consortia. These arrangements allow for shared IP development while distributing costs and risks. Additionally, strategic licensing has become a revenue stream for companies with strong patent portfolios but limited manufacturing capabilities.

For future development, companies should consider establishing dedicated IP monitoring systems to track competitor activities and identify emerging trends. Regular patent landscape analyses can reveal strategic opportunities and potential infringement risks before significant R&D investments are made. Furthermore, integrating IP considerations early in the R&D process can help align technical development with patentability requirements and freedom-to-operate considerations.

Geographic distribution of patents shows concentration in the United States, Japan, Germany, and increasingly China, reflecting the global nature of CPC research and development. Recent patent trends indicate growing interest in nano-enhanced composites, self-healing materials, and environmentally sustainable formulations, suggesting these as key innovation frontiers.

Freedom-to-operate challenges are particularly significant in this field due to the overlapping nature of many patents. Companies developing new CPC technologies must navigate a complex web of existing patents, often necessitating extensive prior art searches and careful claim analysis to avoid infringement issues. This complexity has led to strategic patent pooling and cross-licensing arrangements among major industry players.

For companies entering or expanding in the CPC market, a multi-faceted IP strategy is essential. Defensive patenting approaches focus on building portfolios that protect core technologies while creating barriers to competitors. Meanwhile, offensive strategies involve identifying white space opportunities where novel innovations can be developed and protected. The increasing value of CPC technologies has also led to more aggressive enforcement actions, with several high-profile litigation cases shaping the competitive landscape.

Open innovation models are emerging as an alternative approach, with some companies pursuing collaborative development through joint ventures or research consortia. These arrangements allow for shared IP development while distributing costs and risks. Additionally, strategic licensing has become a revenue stream for companies with strong patent portfolios but limited manufacturing capabilities.

For future development, companies should consider establishing dedicated IP monitoring systems to track competitor activities and identify emerging trends. Regular patent landscape analyses can reveal strategic opportunities and potential infringement risks before significant R&D investments are made. Furthermore, integrating IP considerations early in the R&D process can help align technical development with patentability requirements and freedom-to-operate considerations.

Cross-Industry Applications and Commercialization Pathways

Conductive polymer composites (CPCs) have demonstrated remarkable versatility across multiple industries, with patents playing a crucial role in shaping their commercialization pathways. In the automotive sector, patented CPC technologies have enabled the development of lightweight, conductive components that reduce vehicle weight while maintaining electromagnetic shielding properties. Major automotive manufacturers have licensed these patented formulations for applications ranging from fuel systems to sensor housings, demonstrating a clear path from patent protection to market implementation.

The electronics industry represents another significant commercialization avenue, where patents covering novel CPC formulations have facilitated the development of flexible circuits, EMI shielding materials, and antistatic packaging. Companies like Samsung and LG have built substantial patent portfolios around CPC applications for consumer electronics, creating competitive advantages while establishing clear commercialization channels through internal development and strategic licensing agreements.

Healthcare applications of CPCs have followed a distinct commercialization pathway, often involving regulatory approval processes alongside patent protection. Patented CPC formulations for biosensors, drug delivery systems, and medical devices typically undergo clinical validation before commercialization, with patents providing the necessary exclusivity period to recoup substantial development investments. This sector demonstrates how patents can facilitate industry-specific commercialization strategies tailored to regulatory environments.

The energy sector has leveraged CPC patents to develop advanced battery components, supercapacitors, and solar cell elements. Commercialization in this space frequently involves partnerships between material developers holding key patents and energy technology manufacturers, creating symbiotic relationships that accelerate market entry while respecting intellectual property boundaries.

Aerospace and defense applications represent high-value, specialized commercialization pathways for patented CPC technologies. These sectors prioritize performance over cost considerations, allowing for premium pricing of patented materials with unique properties such as radiation resistance or extreme temperature stability. The commercialization cycle in these industries typically involves extensive testing and certification processes, with patents providing competitive protection throughout these lengthy development periods.

Cross-licensing agreements have emerged as a significant commercialization strategy across industries, allowing companies to access complementary CPC technologies while maintaining their own patent positions. This collaborative approach has accelerated commercialization timelines while reducing litigation risks, particularly in complex applications requiring multiple patented technologies to create viable commercial products.

The electronics industry represents another significant commercialization avenue, where patents covering novel CPC formulations have facilitated the development of flexible circuits, EMI shielding materials, and antistatic packaging. Companies like Samsung and LG have built substantial patent portfolios around CPC applications for consumer electronics, creating competitive advantages while establishing clear commercialization channels through internal development and strategic licensing agreements.

Healthcare applications of CPCs have followed a distinct commercialization pathway, often involving regulatory approval processes alongside patent protection. Patented CPC formulations for biosensors, drug delivery systems, and medical devices typically undergo clinical validation before commercialization, with patents providing the necessary exclusivity period to recoup substantial development investments. This sector demonstrates how patents can facilitate industry-specific commercialization strategies tailored to regulatory environments.

The energy sector has leveraged CPC patents to develop advanced battery components, supercapacitors, and solar cell elements. Commercialization in this space frequently involves partnerships between material developers holding key patents and energy technology manufacturers, creating symbiotic relationships that accelerate market entry while respecting intellectual property boundaries.

Aerospace and defense applications represent high-value, specialized commercialization pathways for patented CPC technologies. These sectors prioritize performance over cost considerations, allowing for premium pricing of patented materials with unique properties such as radiation resistance or extreme temperature stability. The commercialization cycle in these industries typically involves extensive testing and certification processes, with patents providing competitive protection throughout these lengthy development periods.

Cross-licensing agreements have emerged as a significant commercialization strategy across industries, allowing companies to access complementary CPC technologies while maintaining their own patent positions. This collaborative approach has accelerated commercialization timelines while reducing litigation risks, particularly in complex applications requiring multiple patented technologies to create viable commercial products.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!