The Role of Conductive Polymer Composites in Autonomous Vehicles

OCT 23, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Polymer Evolution and Objectives

Conductive polymers have undergone significant evolution since their initial discovery in the 1970s when Alan Heeger, Alan MacDiarmid, and Hideki Shirakawa demonstrated that polyacetylene could conduct electricity when doped with iodine. This groundbreaking work, which earned them the Nobel Prize in Chemistry in 2000, opened a new frontier in materials science that continues to expand today. The early conductive polymers faced limitations in processability, stability, and conductivity levels, restricting their practical applications.

The 1980s and 1990s witnessed substantial improvements in synthesis methods and polymer structures, leading to the development of more stable conductive polymers such as polypyrrole, polyaniline, and poly(3,4-ethylenedioxythiophene) (PEDOT). These materials offered better environmental stability and processability while maintaining reasonable conductivity. The introduction of PEDOT:PSS (poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) marked a significant milestone, as it combined good conductivity with excellent film-forming properties.

In the 2000s, research shifted toward creating conductive polymer composites (CPCs) by incorporating conductive polymers with traditional polymers or adding conductive fillers like carbon nanotubes, graphene, and metal nanoparticles. This approach dramatically expanded the application potential by allowing tailored electrical, mechanical, and thermal properties. The development of flexible and stretchable conductive polymers further broadened their utility in wearable electronics and flexible displays.

The current technological trajectory aims to enhance the performance of conductive polymer composites specifically for autonomous vehicle applications. Key objectives include developing materials with improved electrical conductivity under varying environmental conditions, enhanced durability to withstand automotive operational stresses, and reduced production costs to enable mass adoption. Researchers are particularly focused on creating composites that maintain consistent electrical properties across the wide temperature ranges experienced in automotive environments.

Another critical objective is the development of lightweight conductive polymer composites to replace traditional metal components in vehicles, contributing to overall weight reduction and improved energy efficiency. These materials must simultaneously offer electromagnetic interference (EMI) shielding capabilities to protect sensitive electronic systems in autonomous vehicles from external electromagnetic disturbances.

The integration of self-healing properties represents an emerging research direction, aiming to create conductive polymer systems that can automatically repair minor damage, thereby extending component lifespan and enhancing reliability in safety-critical autonomous driving applications. Additionally, researchers are exploring sustainable synthesis methods and incorporating bio-based materials to reduce the environmental footprint of these advanced composites, aligning with the broader automotive industry's sustainability goals.

The 1980s and 1990s witnessed substantial improvements in synthesis methods and polymer structures, leading to the development of more stable conductive polymers such as polypyrrole, polyaniline, and poly(3,4-ethylenedioxythiophene) (PEDOT). These materials offered better environmental stability and processability while maintaining reasonable conductivity. The introduction of PEDOT:PSS (poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) marked a significant milestone, as it combined good conductivity with excellent film-forming properties.

In the 2000s, research shifted toward creating conductive polymer composites (CPCs) by incorporating conductive polymers with traditional polymers or adding conductive fillers like carbon nanotubes, graphene, and metal nanoparticles. This approach dramatically expanded the application potential by allowing tailored electrical, mechanical, and thermal properties. The development of flexible and stretchable conductive polymers further broadened their utility in wearable electronics and flexible displays.

The current technological trajectory aims to enhance the performance of conductive polymer composites specifically for autonomous vehicle applications. Key objectives include developing materials with improved electrical conductivity under varying environmental conditions, enhanced durability to withstand automotive operational stresses, and reduced production costs to enable mass adoption. Researchers are particularly focused on creating composites that maintain consistent electrical properties across the wide temperature ranges experienced in automotive environments.

Another critical objective is the development of lightweight conductive polymer composites to replace traditional metal components in vehicles, contributing to overall weight reduction and improved energy efficiency. These materials must simultaneously offer electromagnetic interference (EMI) shielding capabilities to protect sensitive electronic systems in autonomous vehicles from external electromagnetic disturbances.

The integration of self-healing properties represents an emerging research direction, aiming to create conductive polymer systems that can automatically repair minor damage, thereby extending component lifespan and enhancing reliability in safety-critical autonomous driving applications. Additionally, researchers are exploring sustainable synthesis methods and incorporating bio-based materials to reduce the environmental footprint of these advanced composites, aligning with the broader automotive industry's sustainability goals.

Market Analysis for Automotive Polymer Applications

The global market for automotive polymer applications is experiencing significant growth, driven by the increasing integration of advanced materials in vehicle manufacturing. The market was valued at approximately $38.5 billion in 2022 and is projected to reach $64.7 billion by 2030, representing a compound annual growth rate (CAGR) of 6.7%. This growth trajectory is particularly pronounced in the conductive polymer composites segment, which is emerging as a critical component for autonomous vehicle technologies.

Conductive polymer composites offer a unique combination of electrical conductivity and mechanical flexibility that traditional materials cannot match. The demand for these materials is primarily driven by the rapid expansion of the autonomous vehicle sector, which requires sophisticated sensor systems, lightweight components, and enhanced electromagnetic interference (EMI) shielding. Market research indicates that approximately 22% of new vehicles will feature some level of autonomy by 2025, creating substantial opportunities for conductive polymer applications.

Regional analysis reveals that North America currently leads the automotive polymer market with a 34% share, followed closely by Europe at 31% and Asia-Pacific at 28%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate over the next decade, primarily due to the expanding automotive manufacturing base in China, Japan, and South Korea, coupled with increasing government initiatives supporting electric and autonomous vehicle development.

The market segmentation for automotive polymer applications shows that interior components currently represent the largest application area (41%), followed by exterior components (27%), under-the-hood applications (22%), and electrical components (10%). However, with the rise of autonomous vehicles, the electrical components segment is projected to grow at the fastest rate, potentially reaching 18% of the total market by 2028.

Consumer preferences are increasingly favoring vehicles with advanced technological features, including those enabled by conductive polymer composites. A recent industry survey revealed that 67% of potential car buyers consider advanced driver-assistance systems (ADAS) as important factors in their purchasing decisions, while 53% expressed interest in fully autonomous capabilities for future purchases.

Key market drivers include stringent fuel efficiency regulations, growing demand for vehicle electrification, increasing safety requirements, and the push toward vehicle lightweighting. Challenges facing market expansion include high material costs, complex manufacturing processes, and concerns regarding long-term durability and performance consistency of polymer composites in demanding automotive environments.

Conductive polymer composites offer a unique combination of electrical conductivity and mechanical flexibility that traditional materials cannot match. The demand for these materials is primarily driven by the rapid expansion of the autonomous vehicle sector, which requires sophisticated sensor systems, lightweight components, and enhanced electromagnetic interference (EMI) shielding. Market research indicates that approximately 22% of new vehicles will feature some level of autonomy by 2025, creating substantial opportunities for conductive polymer applications.

Regional analysis reveals that North America currently leads the automotive polymer market with a 34% share, followed closely by Europe at 31% and Asia-Pacific at 28%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate over the next decade, primarily due to the expanding automotive manufacturing base in China, Japan, and South Korea, coupled with increasing government initiatives supporting electric and autonomous vehicle development.

The market segmentation for automotive polymer applications shows that interior components currently represent the largest application area (41%), followed by exterior components (27%), under-the-hood applications (22%), and electrical components (10%). However, with the rise of autonomous vehicles, the electrical components segment is projected to grow at the fastest rate, potentially reaching 18% of the total market by 2028.

Consumer preferences are increasingly favoring vehicles with advanced technological features, including those enabled by conductive polymer composites. A recent industry survey revealed that 67% of potential car buyers consider advanced driver-assistance systems (ADAS) as important factors in their purchasing decisions, while 53% expressed interest in fully autonomous capabilities for future purchases.

Key market drivers include stringent fuel efficiency regulations, growing demand for vehicle electrification, increasing safety requirements, and the push toward vehicle lightweighting. Challenges facing market expansion include high material costs, complex manufacturing processes, and concerns regarding long-term durability and performance consistency of polymer composites in demanding automotive environments.

Current Status and Challenges in Automotive Polymer Composites

The global landscape of conductive polymer composites (CPCs) in automotive applications has evolved significantly over the past decade. Currently, these materials are being integrated into various autonomous vehicle systems, with applications ranging from sensors and electromagnetic interference (EMI) shielding to lightweight structural components. The market is witnessing a compound annual growth rate of approximately 8.2% for automotive polymer composites, with conductive variants representing a rapidly expanding segment.

Despite promising advancements, several technical challenges persist in the widespread adoption of CPCs in autonomous vehicles. The primary limitation remains the trade-off between electrical conductivity and mechanical properties. As conductive fillers increase to enhance conductivity, mechanical integrity often deteriorates, creating a significant engineering dilemma for safety-critical automotive applications. This balance becomes even more critical in autonomous systems where component reliability directly impacts passenger safety.

Temperature stability presents another substantial challenge, as autonomous vehicle sensors and electronics generate considerable heat during operation. Current CPC formulations exhibit conductivity fluctuations across the wide temperature ranges experienced in automotive environments (-40°C to 125°C), potentially compromising system reliability. Additionally, long-term durability under cyclic mechanical and thermal stresses remains inadequately addressed in existing solutions.

Manufacturing scalability constitutes a significant barrier to widespread implementation. Current production methods for high-performance CPCs often involve complex processes that are difficult to scale to automotive production volumes while maintaining consistent quality. The industry faces challenges in developing standardized manufacturing protocols that can deliver uniform electrical properties across large production batches.

Regulatory frameworks and standardization for conductive materials in autonomous vehicles remain underdeveloped globally. This creates uncertainty for manufacturers regarding performance requirements and safety certifications, particularly for novel applications in autonomous driving systems. The lack of harmonized testing protocols specifically designed for CPCs in automotive applications further complicates qualification processes.

Cost factors continue to impede broader adoption, with high-performance CPCs typically commanding a premium of 30-50% over conventional automotive polymers. This cost differential is particularly challenging for mass-market autonomous vehicle platforms where price sensitivity remains high despite the advanced technology content.

Geographically, research leadership in automotive CPCs is concentrated in East Asia (particularly Japan and South Korea), Western Europe (Germany and France), and North America (USA). Recent collaborative initiatives between automotive OEMs and materials science institutions have emerged to address these challenges through pre-competitive research consortia focused specifically on conductive polymer applications for autonomous mobility.

Despite promising advancements, several technical challenges persist in the widespread adoption of CPCs in autonomous vehicles. The primary limitation remains the trade-off between electrical conductivity and mechanical properties. As conductive fillers increase to enhance conductivity, mechanical integrity often deteriorates, creating a significant engineering dilemma for safety-critical automotive applications. This balance becomes even more critical in autonomous systems where component reliability directly impacts passenger safety.

Temperature stability presents another substantial challenge, as autonomous vehicle sensors and electronics generate considerable heat during operation. Current CPC formulations exhibit conductivity fluctuations across the wide temperature ranges experienced in automotive environments (-40°C to 125°C), potentially compromising system reliability. Additionally, long-term durability under cyclic mechanical and thermal stresses remains inadequately addressed in existing solutions.

Manufacturing scalability constitutes a significant barrier to widespread implementation. Current production methods for high-performance CPCs often involve complex processes that are difficult to scale to automotive production volumes while maintaining consistent quality. The industry faces challenges in developing standardized manufacturing protocols that can deliver uniform electrical properties across large production batches.

Regulatory frameworks and standardization for conductive materials in autonomous vehicles remain underdeveloped globally. This creates uncertainty for manufacturers regarding performance requirements and safety certifications, particularly for novel applications in autonomous driving systems. The lack of harmonized testing protocols specifically designed for CPCs in automotive applications further complicates qualification processes.

Cost factors continue to impede broader adoption, with high-performance CPCs typically commanding a premium of 30-50% over conventional automotive polymers. This cost differential is particularly challenging for mass-market autonomous vehicle platforms where price sensitivity remains high despite the advanced technology content.

Geographically, research leadership in automotive CPCs is concentrated in East Asia (particularly Japan and South Korea), Western Europe (Germany and France), and North America (USA). Recent collaborative initiatives between automotive OEMs and materials science institutions have emerged to address these challenges through pre-competitive research consortia focused specifically on conductive polymer applications for autonomous mobility.

Current Conductive Polymer Solutions for Autonomous Vehicles

01 Conductive polymer composites with carbon-based fillers

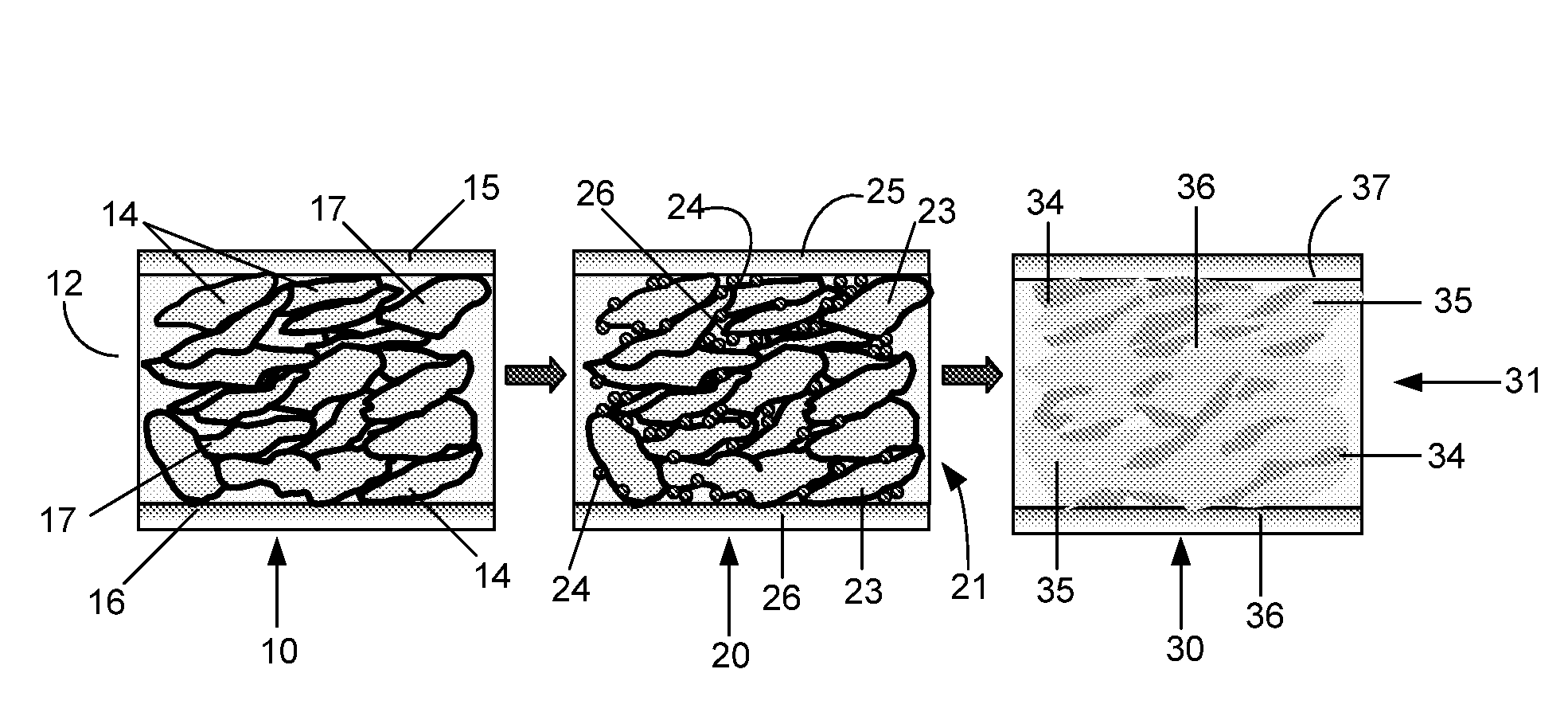

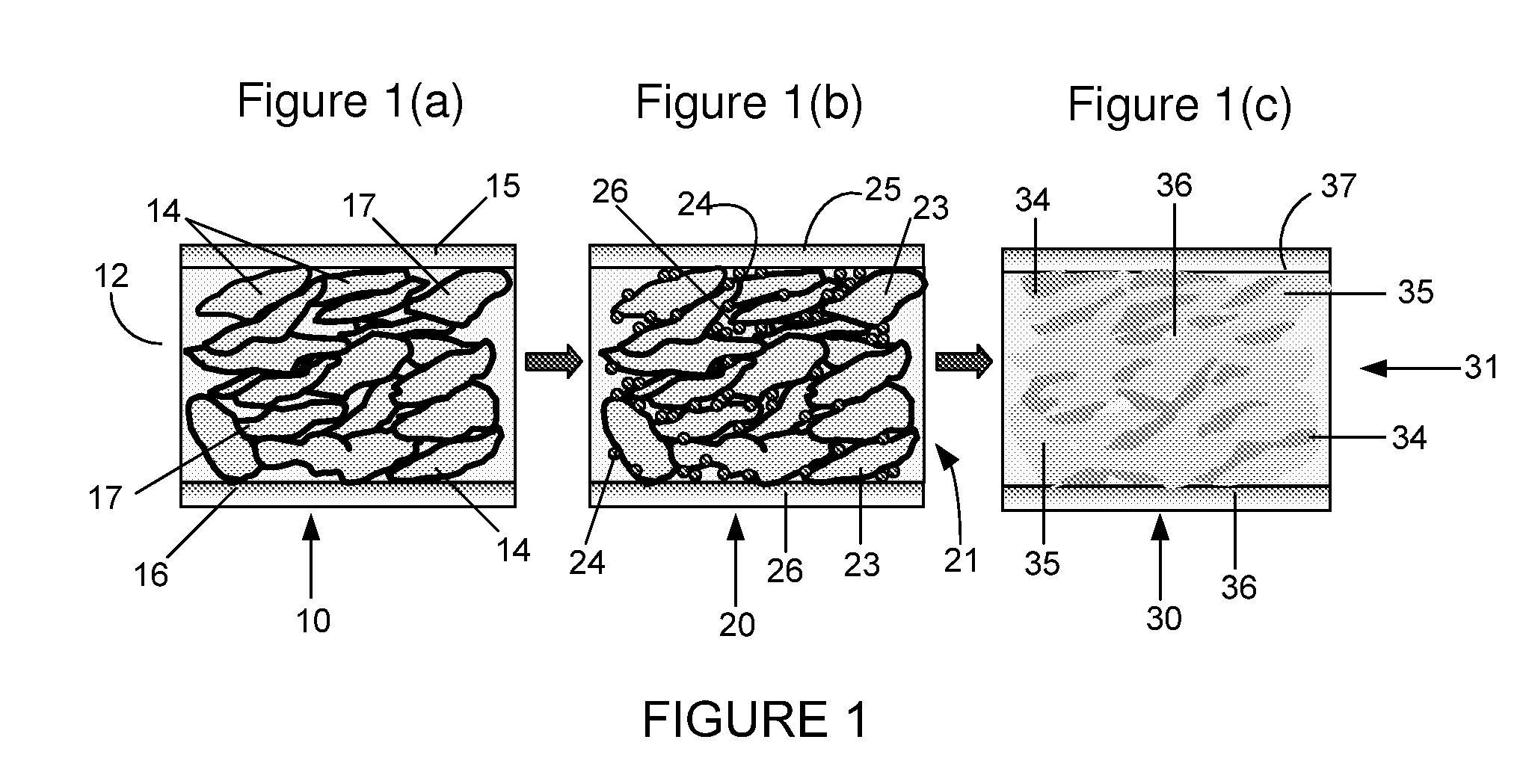

Carbon-based materials such as carbon nanotubes, graphene, and carbon black are commonly used as conductive fillers in polymer composites. These materials enhance electrical conductivity while maintaining the mechanical properties of the polymer matrix. The incorporation of these carbon-based fillers creates a conductive network within the polymer, allowing for efficient electron transfer. These composites find applications in electromagnetic shielding, antistatic materials, and flexible electronics.- Carbon-based conductive fillers in polymer composites: Carbon-based materials such as carbon nanotubes, graphene, and carbon black are widely used as conductive fillers in polymer composites. These materials provide excellent electrical conductivity while maintaining the mechanical properties of the polymer matrix. The incorporation of these carbon-based fillers creates conductive pathways within the polymer, enabling applications in electronics, sensors, and electromagnetic shielding.

- Metal-polymer conductive composites: Metal particles or fibers can be incorporated into polymer matrices to create conductive composites with unique properties. These metal-polymer composites combine the processability of polymers with the high conductivity of metals. Various metals including silver, copper, and nickel are commonly used, with the resulting composites finding applications in printed electronics, electromagnetic interference shielding, and flexible conductors.

- Intrinsically conductive polymers and their blends: Intrinsically conductive polymers such as polyaniline, polypyrrole, and PEDOT:PSS can be used alone or blended with conventional polymers to create conductive composites. These materials offer conductivity without requiring additional fillers and can be processed using standard polymer processing techniques. Their conductivity can be tuned through doping, and they find applications in organic electronics, sensors, and antistatic coatings.

- Processing techniques for conductive polymer composites: Various processing techniques can be employed to enhance the conductivity and performance of polymer composites. These include solution blending, melt mixing, in-situ polymerization, and layer-by-layer assembly. The processing method significantly affects the dispersion of conductive fillers and the resulting electrical properties of the composite. Advanced techniques like 3D printing and electrospinning are also being used to create structured conductive polymer composites.

- Applications of conductive polymer composites: Conductive polymer composites find applications across various industries including electronics, energy storage, sensing, and biomedical fields. They are used in flexible electronics, electromagnetic interference shielding, antistatic packaging, supercapacitors, batteries, strain sensors, and biomedical devices. Their versatility stems from the ability to combine electrical conductivity with other desirable polymer properties such as flexibility, lightweight, and processability.

02 Metal-polymer conductive composites

Metal particles or nanowires, such as silver, copper, and nickel, can be incorporated into polymer matrices to create highly conductive composites. These metal-polymer composites offer excellent electrical conductivity and can be processed using conventional polymer processing techniques. The size, shape, and distribution of the metal particles significantly influence the conductivity of the composite. These materials are used in printed electronics, conductive adhesives, and electromagnetic interference shielding applications.Expand Specific Solutions03 Intrinsically conductive polymers in composites

Intrinsically conductive polymers like polyaniline, polypyrrole, and PEDOT:PSS can be blended with conventional polymers to create conductive composites. These polymers conduct electricity through their conjugated backbone structure and can be doped to enhance conductivity. The advantage of using intrinsically conductive polymers is their organic nature, flexibility, and processability. These composites are utilized in sensors, actuators, organic electronics, and energy storage devices.Expand Specific Solutions04 Processing techniques for conductive polymer composites

Various processing techniques are employed to manufacture conductive polymer composites with optimized properties. These include solution blending, melt mixing, in-situ polymerization, and layer-by-layer assembly. The processing method significantly affects the dispersion of conductive fillers and the resulting electrical properties of the composite. Advanced techniques like 3D printing and electrospinning are also used to create structured conductive polymer composites with tailored properties for specific applications.Expand Specific Solutions05 Functional applications of conductive polymer composites

Conductive polymer composites find applications in various fields including energy storage, sensing, and smart materials. In energy storage, they are used as electrode materials in batteries and supercapacitors. As sensing materials, they can detect changes in temperature, pressure, or chemical environment through changes in electrical properties. Smart materials applications include electrochromic devices, shape memory materials, and self-healing composites. The multifunctional nature of these composites makes them valuable in emerging technologies like wearable electronics and Internet of Things devices.Expand Specific Solutions

Leading Companies in Automotive Polymer Composite Industry

The conductive polymer composites (CPCs) market for autonomous vehicles is in a growth phase, with increasing adoption driven by the need for lightweight, durable, and electrically conductive materials. The global market is projected to expand significantly as autonomous vehicle technology matures, with current estimates suggesting a compound annual growth rate of 8-10%. Technologically, the field shows varying maturity levels across applications, with companies like Cabot Corp., Solvay Specialty Polymers, and Shin-Etsu Chemical leading in commercial solutions for electromagnetic shielding and sensor integration. Research institutions including Zhejiang University and CNRS are advancing next-generation CPC formulations, while automotive specialists like Astemo and Boeing are developing application-specific implementations. The competitive landscape features chemical manufacturers expanding into automotive applications alongside specialized polymer composite developers focusing on performance optimization.

Cabot Corp.

Technical Solution: Cabot Corporation has pioneered specialized conductive carbon black and graphene-enhanced polymer composites designed specifically for autonomous vehicle applications. Their CABELEC® series features precisely engineered particle morphology and distribution within polymer matrices, creating materials with tailored conductivity ranges from 10^2 to 10^6 ohm·cm. These composites are implemented in critical AV components including sensor housings, battery systems, and static discharge protection elements. Cabot's proprietary surface treatment technology enables strong interfacial bonding between conductive fillers and polymer matrices, resulting in exceptional mechanical durability while maintaining electrical performance through temperature cycling and environmental exposure[2]. Their recent innovation includes thermoresponsive composites that can actively adjust conductivity based on environmental conditions, particularly valuable for maintaining sensor performance in varying weather conditions.

Strengths: Exceptional batch-to-batch consistency in electrical properties ensures reliable performance in safety-critical AV systems. Their materials demonstrate superior weathering resistance and UV stability for exterior applications. Weaknesses: Higher loading levels of conductive fillers can compromise mechanical properties in certain applications. Manufacturing scale-up presents challenges in maintaining uniform dispersion quality.

Solvay Specialty Polymers USA LLC

Technical Solution: Solvay has developed advanced conductive polymer composites (CPCs) specifically engineered for autonomous vehicle applications. Their TECNOFLON® and KetaSpire® PEEK-based composites incorporate carbon nanotubes and graphene to create lightweight, high-performance materials with excellent electrical conductivity. These materials are used in sensor housings, electromagnetic interference (EMI) shielding components, and thermal management systems critical for autonomous driving systems. Solvay's CPCs feature self-regulating heating capabilities that maintain optimal operating temperatures for LiDAR and radar sensors in extreme weather conditions, ensuring consistent performance regardless of environmental challenges[1]. Their proprietary processing technology enables the production of complex geometries with uniform conductivity profiles, addressing the demanding requirements of modern autonomous vehicle architectures.

Strengths: Superior thermal stability and chemical resistance allow for deployment in harsh automotive environments. Their materials offer excellent EMI shielding effectiveness (>60dB) while maintaining mechanical integrity. Weaknesses: Higher cost compared to traditional materials limits widespread adoption in price-sensitive vehicle segments. Processing requires specialized equipment and expertise for optimal performance.

Key Patents and Research in Automotive Polymer Composites

Electrical device

PatentWO2016007888A1

Innovation

- A conductive composite comprising a semi-crystalline polymer and metal particles, where the metal particles are blended at a temperature above the polymer's melt temperature to form intermetallic phases, reducing oxidation and enhancing conductivity and stability.

Conductive polymer composites

PatentInactiveUS20080272344A1

Innovation

- A polymer composite is formed by mixing conductive metal flakes and surface-functionalized silver nanoparticles with a polymer precursor, where the nanoparticles are sintered to create a network with reduced contact points, enhancing electrical conductivity without using lead.

Safety and Reliability Standards for Automotive Materials

The integration of conductive polymer composites (CPCs) in autonomous vehicles necessitates adherence to stringent safety and reliability standards. The automotive industry has established comprehensive regulatory frameworks that govern the use of materials in vehicle manufacturing, with particular emphasis on components critical to autonomous operation. These standards are primarily developed by organizations such as the International Organization for Standardization (ISO), Society of Automotive Engineers (SAE), and regional regulatory bodies including the National Highway Traffic Safety Administration (NHTSA) in the United States and the European New Car Assessment Programme (Euro NCAP).

For conductive polymer composites, the ISO 26262 standard for functional safety of electrical and electronic systems in production automobiles serves as a fundamental guideline. This standard specifically addresses the safety requirements for automotive-grade materials used in critical systems, requiring manufacturers to demonstrate reliability through rigorous testing protocols. Additionally, the SAE J3016 standard, which defines levels of driving automation, indirectly influences material requirements by establishing performance expectations for sensors and electronic components that may incorporate CPCs.

Material durability standards for automotive applications typically mandate that components maintain functionality for 10-15 years or approximately 150,000-200,000 miles under varying environmental conditions. For CPCs in autonomous vehicles, this translates to requirements for thermal stability (-40°C to 125°C), resistance to humidity (up to 95% relative humidity), and resilience against vibration and mechanical stress. The UL 94 standard specifically addresses flammability requirements, with most automotive interior materials requiring a V-0 or V-1 rating.

Electromagnetic compatibility (EMC) standards are particularly relevant for CPCs due to their electrical conductivity properties. The CISPR 25 and ISO 11452 standards establish limits for electromagnetic emissions and immunity, ensuring that materials do not interfere with vehicle electronics or nearby vehicles' systems. This is critical for autonomous vehicles where sensor and communication reliability directly impacts safety.

Quality assurance protocols for automotive materials have evolved to include accelerated aging tests, environmental cycling, and performance verification under extreme conditions. The IATF 16949 quality management system, specifically developed for the automotive industry, provides a framework for ensuring consistent material properties and manufacturing processes for CPCs used in autonomous vehicle applications.

Recent developments in regulatory approaches include the emergence of standards specifically addressing materials for autonomous vehicle applications, such as the IEEE P2851 standard for exchanging information related to safety of automated driving systems. These evolving standards increasingly focus on predictive reliability metrics and real-time monitoring capabilities, recognizing the critical role materials play in the overall safety architecture of autonomous transportation systems.

For conductive polymer composites, the ISO 26262 standard for functional safety of electrical and electronic systems in production automobiles serves as a fundamental guideline. This standard specifically addresses the safety requirements for automotive-grade materials used in critical systems, requiring manufacturers to demonstrate reliability through rigorous testing protocols. Additionally, the SAE J3016 standard, which defines levels of driving automation, indirectly influences material requirements by establishing performance expectations for sensors and electronic components that may incorporate CPCs.

Material durability standards for automotive applications typically mandate that components maintain functionality for 10-15 years or approximately 150,000-200,000 miles under varying environmental conditions. For CPCs in autonomous vehicles, this translates to requirements for thermal stability (-40°C to 125°C), resistance to humidity (up to 95% relative humidity), and resilience against vibration and mechanical stress. The UL 94 standard specifically addresses flammability requirements, with most automotive interior materials requiring a V-0 or V-1 rating.

Electromagnetic compatibility (EMC) standards are particularly relevant for CPCs due to their electrical conductivity properties. The CISPR 25 and ISO 11452 standards establish limits for electromagnetic emissions and immunity, ensuring that materials do not interfere with vehicle electronics or nearby vehicles' systems. This is critical for autonomous vehicles where sensor and communication reliability directly impacts safety.

Quality assurance protocols for automotive materials have evolved to include accelerated aging tests, environmental cycling, and performance verification under extreme conditions. The IATF 16949 quality management system, specifically developed for the automotive industry, provides a framework for ensuring consistent material properties and manufacturing processes for CPCs used in autonomous vehicle applications.

Recent developments in regulatory approaches include the emergence of standards specifically addressing materials for autonomous vehicle applications, such as the IEEE P2851 standard for exchanging information related to safety of automated driving systems. These evolving standards increasingly focus on predictive reliability metrics and real-time monitoring capabilities, recognizing the critical role materials play in the overall safety architecture of autonomous transportation systems.

Environmental Impact and Sustainability Considerations

The integration of conductive polymer composites (CPCs) in autonomous vehicles presents significant environmental implications that warrant careful consideration. These materials offer potential sustainability advantages over traditional metallic components, primarily through substantial weight reduction. By replacing heavier metal parts with lightweight CPCs, autonomous vehicles can achieve improved fuel efficiency and extended battery range, directly contributing to reduced carbon emissions throughout the vehicle's operational lifespan.

Manufacturing processes for CPCs generally require lower energy inputs compared to traditional metal processing, which involves energy-intensive mining, refining, and forming operations. This reduced energy footprint translates to lower greenhouse gas emissions during the production phase. Additionally, many polymer composites can be engineered to incorporate recycled materials or bio-based polymers, further enhancing their environmental credentials.

End-of-life considerations represent another critical environmental dimension. While traditional electronics often contain hazardous materials requiring specialized disposal procedures, properly designed CPCs can minimize toxic components. Some advanced conductive polymer systems are being developed with recyclability as a core design parameter, allowing for material recovery and reuse through mechanical or chemical recycling processes.

However, challenges remain in the environmental profile of CPCs. Current manufacturing techniques may involve solvents and additives with potential environmental toxicity. The dispersion of nanomaterials like carbon nanotubes or graphene within polymer matrices raises questions about potential environmental release during production, use, or disposal phases. Regulatory frameworks are still evolving to address these novel materials and their potential environmental impacts.

Lifecycle assessment studies indicate that the environmental benefits of CPCs are highly dependent on specific formulations and applications. For instance, CPCs utilizing renewable carbon sources and biodegradable polymers show promising environmental profiles, while those incorporating rare or toxic elements may present sustainability concerns despite their technical performance advantages.

The automotive industry's transition toward circular economy principles is driving innovation in CPC design, with increasing emphasis on materials that can be easily disassembled, sorted, and reprocessed at end-of-life. This approach aligns with broader sustainability goals and emerging regulatory requirements for extended producer responsibility in the automotive sector.

Manufacturing processes for CPCs generally require lower energy inputs compared to traditional metal processing, which involves energy-intensive mining, refining, and forming operations. This reduced energy footprint translates to lower greenhouse gas emissions during the production phase. Additionally, many polymer composites can be engineered to incorporate recycled materials or bio-based polymers, further enhancing their environmental credentials.

End-of-life considerations represent another critical environmental dimension. While traditional electronics often contain hazardous materials requiring specialized disposal procedures, properly designed CPCs can minimize toxic components. Some advanced conductive polymer systems are being developed with recyclability as a core design parameter, allowing for material recovery and reuse through mechanical or chemical recycling processes.

However, challenges remain in the environmental profile of CPCs. Current manufacturing techniques may involve solvents and additives with potential environmental toxicity. The dispersion of nanomaterials like carbon nanotubes or graphene within polymer matrices raises questions about potential environmental release during production, use, or disposal phases. Regulatory frameworks are still evolving to address these novel materials and their potential environmental impacts.

Lifecycle assessment studies indicate that the environmental benefits of CPCs are highly dependent on specific formulations and applications. For instance, CPCs utilizing renewable carbon sources and biodegradable polymers show promising environmental profiles, while those incorporating rare or toxic elements may present sustainability concerns despite their technical performance advantages.

The automotive industry's transition toward circular economy principles is driving innovation in CPC design, with increasing emphasis on materials that can be easily disassembled, sorted, and reprocessed at end-of-life. This approach aligns with broader sustainability goals and emerging regulatory requirements for extended producer responsibility in the automotive sector.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!