Comparative evaluation of Composite coatings for automotive versus aerospace applications

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Composite Coating Technology Evolution and Objectives

Composite coating technologies have evolved significantly over the past decades, transforming from simple protective layers to sophisticated multifunctional systems. The journey began in the 1950s with basic polymer-based coatings, progressing through the integration of ceramic particles in the 1970s, and advancing to nano-enhanced composites in the early 2000s. This evolution has been driven by increasing demands for durability, weight reduction, and performance enhancement in both automotive and aerospace industries.

The fundamental objective of composite coatings is to combine the beneficial properties of different materials to create superior surface protection systems. These coatings aim to provide enhanced corrosion resistance, improved wear characteristics, reduced friction, and increased thermal stability while maintaining or reducing overall weight. In recent years, additional functionalities such as self-healing capabilities, hydrophobicity, and electromagnetic interference shielding have become increasingly important objectives in coating development.

For automotive applications, composite coatings have traditionally focused on corrosion protection and aesthetic appeal, with cost considerations playing a significant role. The industry has gradually shifted toward coatings that also offer scratch resistance, UV stability, and chemical resistance to withstand harsh environmental conditions and cleaning agents. Recent developments have emphasized environmentally friendly formulations with reduced volatile organic compounds (VOCs) and improved recyclability.

In contrast, aerospace applications have prioritized high-temperature resistance, extreme durability, and weight reduction. The aerospace industry has pioneered advanced ceramic matrix composite coatings capable of withstanding temperatures exceeding 1000°C in engine components. Additionally, ice-phobic coatings for aircraft surfaces and radar-absorbing coatings for military applications represent specialized developments in this sector.

The convergence of nanotechnology with composite coating science has opened new frontiers in both industries. Nano-enhanced composite coatings offer unprecedented combinations of hardness, flexibility, and functional properties. Carbon nanotube and graphene-reinforced coatings represent the cutting edge, providing exceptional mechanical properties and electrical conductivity at minimal weight penalties.

Looking forward, the technical objectives for composite coatings are increasingly focused on multifunctionality, sustainability, and smart capabilities. Self-diagnostic coatings that can detect and report damage, environmentally adaptive systems that respond to external stimuli, and coatings with significantly extended service life are key development targets. Additionally, manufacturing scalability and cost-effectiveness remain critical objectives for widespread industrial adoption across both automotive and aerospace sectors.

The fundamental objective of composite coatings is to combine the beneficial properties of different materials to create superior surface protection systems. These coatings aim to provide enhanced corrosion resistance, improved wear characteristics, reduced friction, and increased thermal stability while maintaining or reducing overall weight. In recent years, additional functionalities such as self-healing capabilities, hydrophobicity, and electromagnetic interference shielding have become increasingly important objectives in coating development.

For automotive applications, composite coatings have traditionally focused on corrosion protection and aesthetic appeal, with cost considerations playing a significant role. The industry has gradually shifted toward coatings that also offer scratch resistance, UV stability, and chemical resistance to withstand harsh environmental conditions and cleaning agents. Recent developments have emphasized environmentally friendly formulations with reduced volatile organic compounds (VOCs) and improved recyclability.

In contrast, aerospace applications have prioritized high-temperature resistance, extreme durability, and weight reduction. The aerospace industry has pioneered advanced ceramic matrix composite coatings capable of withstanding temperatures exceeding 1000°C in engine components. Additionally, ice-phobic coatings for aircraft surfaces and radar-absorbing coatings for military applications represent specialized developments in this sector.

The convergence of nanotechnology with composite coating science has opened new frontiers in both industries. Nano-enhanced composite coatings offer unprecedented combinations of hardness, flexibility, and functional properties. Carbon nanotube and graphene-reinforced coatings represent the cutting edge, providing exceptional mechanical properties and electrical conductivity at minimal weight penalties.

Looking forward, the technical objectives for composite coatings are increasingly focused on multifunctionality, sustainability, and smart capabilities. Self-diagnostic coatings that can detect and report damage, environmentally adaptive systems that respond to external stimuli, and coatings with significantly extended service life are key development targets. Additionally, manufacturing scalability and cost-effectiveness remain critical objectives for widespread industrial adoption across both automotive and aerospace sectors.

Market Analysis for Automotive and Aerospace Coating Solutions

The composite coatings market for automotive and aerospace applications represents a significant segment within the advanced materials industry, with distinct growth trajectories and demand drivers. The automotive sector currently dominates the market volume, valued at approximately $5.2 billion in 2022, with projections indicating growth to reach $7.8 billion by 2028, representing a compound annual growth rate (CAGR) of 7.1%. This growth is primarily driven by increasing consumer demand for vehicles with enhanced durability, corrosion resistance, and aesthetic appeal.

In contrast, the aerospace composite coatings market, though smaller in absolute terms at $3.4 billion in 2022, is experiencing a more accelerated growth rate of 8.7% CAGR, potentially reaching $5.6 billion by 2028. This higher growth rate reflects the critical performance requirements in aerospace applications, where coatings must withstand extreme temperature variations, high UV exposure, and aggressive chemical environments while maintaining structural integrity.

Regional analysis reveals that North America currently leads both markets, accounting for 34% of automotive and 41% of aerospace coating consumption. However, Asia-Pacific, particularly China and India, represents the fastest-growing region with projected growth rates exceeding 9% annually through 2028, driven by expanding manufacturing capabilities and increasing domestic demand.

Customer requirements differ substantially between these sectors. Automotive manufacturers prioritize cost-effectiveness, production efficiency, and aesthetic qualities alongside basic performance metrics. The high-volume production environment necessitates coatings that can be applied rapidly and cure quickly within existing manufacturing processes. Recent market surveys indicate that 78% of automotive manufacturers rank cost-performance ratio as their primary selection criterion.

Aerospace customers, conversely, emphasize performance reliability under extreme conditions, with 92% ranking long-term durability as their foremost concern. Weight reduction capabilities of composite coatings have become increasingly important, with each kilogram saved potentially translating to $1,000-$3,000 in fuel savings over an aircraft's operational lifetime.

Market trends indicate growing demand for environmentally compliant solutions in both sectors, with water-based and high-solids formulations gaining market share. Regulatory pressures, particularly in Europe and North America, are accelerating the transition away from traditional solvent-based systems. The automotive sector has achieved 63% adoption of low-VOC formulations, while aerospace applications lag at 47% adoption due to more stringent performance requirements and certification processes.

In contrast, the aerospace composite coatings market, though smaller in absolute terms at $3.4 billion in 2022, is experiencing a more accelerated growth rate of 8.7% CAGR, potentially reaching $5.6 billion by 2028. This higher growth rate reflects the critical performance requirements in aerospace applications, where coatings must withstand extreme temperature variations, high UV exposure, and aggressive chemical environments while maintaining structural integrity.

Regional analysis reveals that North America currently leads both markets, accounting for 34% of automotive and 41% of aerospace coating consumption. However, Asia-Pacific, particularly China and India, represents the fastest-growing region with projected growth rates exceeding 9% annually through 2028, driven by expanding manufacturing capabilities and increasing domestic demand.

Customer requirements differ substantially between these sectors. Automotive manufacturers prioritize cost-effectiveness, production efficiency, and aesthetic qualities alongside basic performance metrics. The high-volume production environment necessitates coatings that can be applied rapidly and cure quickly within existing manufacturing processes. Recent market surveys indicate that 78% of automotive manufacturers rank cost-performance ratio as their primary selection criterion.

Aerospace customers, conversely, emphasize performance reliability under extreme conditions, with 92% ranking long-term durability as their foremost concern. Weight reduction capabilities of composite coatings have become increasingly important, with each kilogram saved potentially translating to $1,000-$3,000 in fuel savings over an aircraft's operational lifetime.

Market trends indicate growing demand for environmentally compliant solutions in both sectors, with water-based and high-solids formulations gaining market share. Regulatory pressures, particularly in Europe and North America, are accelerating the transition away from traditional solvent-based systems. The automotive sector has achieved 63% adoption of low-VOC formulations, while aerospace applications lag at 47% adoption due to more stringent performance requirements and certification processes.

Current Challenges in Cross-Industry Composite Coatings

Despite significant advancements in composite coating technologies, several critical challenges persist when attempting to develop solutions that can serve both automotive and aerospace industries. The fundamental requirements diverge substantially due to the different operating environments and performance expectations in these sectors.

Temperature resistance presents a major challenge, with aerospace coatings needing to withstand extreme thermal cycling from -60°C at cruising altitude to over 200°C near engine components. Automotive applications rarely encounter such extremes but must still perform reliably from -40°C to 120°C. Developing a unified coating system that maintains structural integrity across these diverse thermal ranges remains technically difficult.

Weight considerations create another significant hurdle. While aerospace applications demand ultra-lightweight solutions where every gram impacts fuel efficiency and emissions, automotive applications often prioritize cost-effectiveness and durability over achieving minimum possible weight. This fundamental difference in priorities has led to separate development paths for composite coatings in each industry.

Environmental resistance requirements also differ dramatically. Aerospace coatings must withstand high-altitude UV radiation, ozone exposure, and rapid pressure changes, while automotive coatings primarily contend with road salt, stone impacts, and chemical contaminants. The formulation compromises necessary to address both sets of environmental stressors often result in suboptimal performance in either application.

Cost structures represent perhaps the most significant barrier to cross-industry solutions. Aerospace-grade composite coatings typically cost 5-10 times more than automotive counterparts due to more stringent certification requirements, specialized raw materials, and lower production volumes. This price differential makes aerospace solutions economically unviable for mass-market vehicles, while automotive solutions lack the performance characteristics needed for aircraft.

Regulatory frameworks further complicate cross-industry development. Aerospace coatings must meet stringent FAA and EASA certifications with extensive documentation and testing, while automotive coatings follow different regulatory paths focused on environmental compliance and consumer safety. These divergent approval pathways often necessitate entirely different formulation approaches.

Manufacturing scalability presents additional challenges, as aerospace coating processes are typically designed for lower-volume, high-precision application, while automotive coatings must be optimized for high-throughput production environments. Developing application technologies that can bridge these different manufacturing paradigms remains an ongoing technical challenge.

Temperature resistance presents a major challenge, with aerospace coatings needing to withstand extreme thermal cycling from -60°C at cruising altitude to over 200°C near engine components. Automotive applications rarely encounter such extremes but must still perform reliably from -40°C to 120°C. Developing a unified coating system that maintains structural integrity across these diverse thermal ranges remains technically difficult.

Weight considerations create another significant hurdle. While aerospace applications demand ultra-lightweight solutions where every gram impacts fuel efficiency and emissions, automotive applications often prioritize cost-effectiveness and durability over achieving minimum possible weight. This fundamental difference in priorities has led to separate development paths for composite coatings in each industry.

Environmental resistance requirements also differ dramatically. Aerospace coatings must withstand high-altitude UV radiation, ozone exposure, and rapid pressure changes, while automotive coatings primarily contend with road salt, stone impacts, and chemical contaminants. The formulation compromises necessary to address both sets of environmental stressors often result in suboptimal performance in either application.

Cost structures represent perhaps the most significant barrier to cross-industry solutions. Aerospace-grade composite coatings typically cost 5-10 times more than automotive counterparts due to more stringent certification requirements, specialized raw materials, and lower production volumes. This price differential makes aerospace solutions economically unviable for mass-market vehicles, while automotive solutions lack the performance characteristics needed for aircraft.

Regulatory frameworks further complicate cross-industry development. Aerospace coatings must meet stringent FAA and EASA certifications with extensive documentation and testing, while automotive coatings follow different regulatory paths focused on environmental compliance and consumer safety. These divergent approval pathways often necessitate entirely different formulation approaches.

Manufacturing scalability presents additional challenges, as aerospace coating processes are typically designed for lower-volume, high-precision application, while automotive coatings must be optimized for high-throughput production environments. Developing application technologies that can bridge these different manufacturing paradigms remains an ongoing technical challenge.

Comparative Assessment of Existing Coating Solutions

01 Metal-based composite coatings

Metal-based composite coatings involve the application of metallic materials combined with other substances to create protective layers with enhanced properties. These coatings typically incorporate metals such as aluminum, zinc, or nickel with various additives to improve corrosion resistance, wear resistance, and durability. The metal components provide structural integrity while the additives contribute specific functional properties, resulting in coatings suitable for industrial applications requiring high performance under harsh conditions.- Metal-based composite coatings: Metal-based composite coatings combine metallic materials with other components to enhance properties such as corrosion resistance, wear resistance, and durability. These coatings often incorporate metal particles, alloys, or compounds distributed within a matrix to achieve superior performance characteristics. The metal components provide strength and conductivity while the composite structure offers improved adhesion and protection for various industrial applications.

- Polymer-based composite coatings: Polymer-based composite coatings utilize various polymeric materials as matrices that incorporate functional additives to enhance specific properties. These coatings offer advantages such as flexibility, chemical resistance, and ease of application. By combining polymers with reinforcing materials or functional additives, these composites can be tailored for specific applications including protective barriers, decorative finishes, and specialized industrial coatings with improved durability and performance.

- Ceramic and inorganic composite coatings: Ceramic and inorganic composite coatings incorporate ceramic materials, oxides, carbides, or other inorganic compounds to achieve high-temperature resistance, hardness, and wear protection. These coatings are designed for extreme environments where conventional materials would fail. The composite structure allows for the combination of different inorganic materials to achieve specific property profiles, such as thermal barrier effects, electrical insulation, or enhanced mechanical properties for industrial applications.

- Nanocomposite coating technologies: Nanocomposite coatings incorporate nanoscale materials or particles within a matrix to achieve enhanced properties not possible with conventional materials. By utilizing nanoscale components, these coatings can exhibit superior hardness, wear resistance, self-cleaning properties, or antimicrobial effects. The nanoscale dispersion creates unique interfaces and interactions that contribute to improved performance characteristics, making these coatings suitable for advanced applications in various industries.

- Environmentally friendly composite coating formulations: Environmentally friendly composite coating formulations focus on reducing environmental impact by utilizing sustainable materials, water-based systems, or low-VOC components. These coatings are designed to maintain performance while minimizing harmful emissions and environmental footprint. By incorporating bio-based materials, renewable resources, or environmentally benign processing methods, these composite coatings address growing regulatory requirements and sustainability concerns across various industrial and consumer applications.

02 Polymer-based composite coatings

Polymer-based composite coatings utilize synthetic or natural polymers as the matrix material, enhanced with various fillers and additives. These coatings offer advantages such as flexibility, chemical resistance, and ease of application. The polymer matrix can be formulated with different additives to achieve specific properties like UV resistance, water repellency, or thermal insulation. Applications include protective finishes for consumer products, automotive components, and architectural surfaces where a combination of protection and aesthetic appeal is required.Expand Specific Solutions03 Ceramic and inorganic composite coatings

Ceramic and inorganic composite coatings combine ceramic materials with other inorganic compounds to create highly durable surface treatments. These coatings typically offer exceptional heat resistance, hardness, and wear protection. The ceramic components provide thermal stability while additional inorganic materials enhance properties such as adhesion and impact resistance. These coatings are particularly valuable in high-temperature applications, cutting tools, and components exposed to extreme abrasion where organic coatings would fail.Expand Specific Solutions04 Nanocomposite coating technologies

Nanocomposite coatings incorporate nanoscale particles or structures within a coating matrix to achieve enhanced properties not possible with conventional materials. By dispersing nanoparticles throughout the coating, properties such as hardness, scratch resistance, and barrier performance can be significantly improved while maintaining optical clarity and other desirable characteristics. The nanoscale components create unique interfaces and interactions within the coating structure, resulting in synergistic effects that enhance overall performance for applications in electronics, automotive, and consumer goods.Expand Specific Solutions05 Environmentally friendly composite coating formulations

Environmentally friendly composite coating formulations focus on reducing environmental impact through the use of sustainable raw materials, low-VOC compositions, and biodegradable components. These coatings are designed to maintain high performance while eliminating or reducing hazardous substances. Formulations may incorporate bio-based polymers, water-based systems, or renewable resources as alternatives to traditional petroleum-based ingredients. These eco-friendly approaches address growing regulatory requirements and consumer demand for sustainable products while still providing effective protection and aesthetic properties.Expand Specific Solutions

Leading Manufacturers and Research Institutions Analysis

The composite coatings market for automotive versus aerospace applications is in a mature growth phase, with aerospace applications commanding premium pricing due to higher performance requirements. The global market size is estimated at $5-7 billion, growing at 4-6% annually, with automotive applications representing the larger volume segment. Technologically, aerospace coatings are more advanced, requiring superior corrosion resistance, thermal stability, and weight reduction properties. Leading players include PPG Industries and Boeing in aerospace applications, while automotive is dominated by Nippon Paint, BASF Coatings, and Geely Automobile Research. Research institutions like Harbin Institute of Technology and Nanjing University of Aeronautics & Astronautics are advancing composite coating technologies through partnerships with industry leaders, focusing on environmentally friendly solutions and enhanced durability for extreme conditions.

PPG Industries Ohio, Inc.

Technical Solution: PPG has developed advanced multi-layer composite coating systems specifically engineered for both automotive and aerospace applications. For automotive, their technology focuses on electrocoat primers with cathodic deposition processes that provide superior corrosion protection while maintaining flexibility for metal expansion. Their CeramiClear® clearcoat technology incorporates nanoparticle ceramic additives that enhance scratch and chemical resistance while maintaining gloss retention under harsh environmental conditions. For aerospace applications, PPG has pioneered chromate-free primer systems that utilize complex phosphate compounds and conductive polymers to achieve corrosion protection comparable to traditional chromate primers while meeting stringent environmental regulations[1]. Their aerospace coatings incorporate specialized UV blockers and elastomeric components that accommodate the extreme temperature fluctuations experienced at high altitudes.

Strengths: Industry-leading corrosion protection while meeting environmental regulations; excellent adhesion properties across diverse substrates; proven durability in extreme conditions. Weaknesses: Higher application costs compared to conventional systems; some aerospace formulations require complex multi-stage application processes; automotive coatings may not achieve the same level of UV resistance as specialized aerospace counterparts.

The Boeing Co.

Technical Solution: Boeing has developed proprietary composite coating systems specifically engineered for aerospace applications with potential crossover benefits for high-performance automotive components. Their technology centers on multi-functional coating systems that integrate corrosion inhibition, lightning strike protection, and thermal management. Boeing's aerospace coatings utilize advanced sol-gel chemistry with organofunctional silanes that create strong covalent bonds with composite substrates while providing excellent adhesion for subsequent coating layers[2]. Their systems incorporate specialized conductive networks using carbon nanotubes and metallic fillers precisely dispersed to maintain electrical continuity for lightning strike protection without compromising the structural integrity of composite components. For thermal management, Boeing employs phase-change materials embedded within coating matrices that absorb and dissipate heat during temperature spikes, critical for both aerospace applications and potentially valuable for high-performance automotive components exposed to extreme conditions.

Strengths: Exceptional durability under extreme temperature cycling (-65°F to 350°F); superior lightning strike protection integrated into coating systems; excellent chemical resistance against aviation fluids and environmental contaminants. Weaknesses: Significantly higher cost compared to automotive-grade coatings; complex application processes requiring specialized equipment and controlled environments; excessive performance capabilities for standard automotive applications resulting in unnecessary expense for non-aerospace use cases.

Critical Patents and Innovations in Composite Coatings

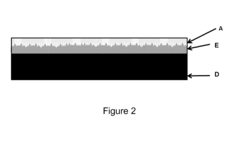

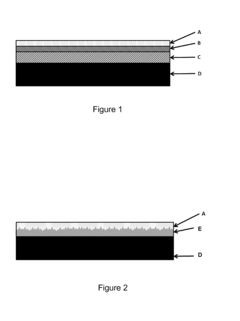

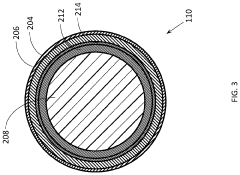

Coated composites

PatentActiveEP2853566A1

Innovation

- A two-phase primer layer with a predefined distribution of reinforcing material elements provides a surface texture, enabling a mechanical interlock that enhances the interface strength between the coating layer and the composite substrate, allowing for reliable adhesion without the need for multiple intermediate layers.

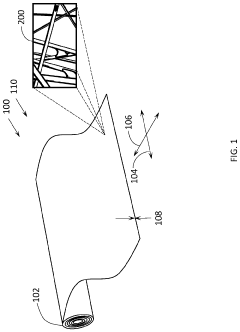

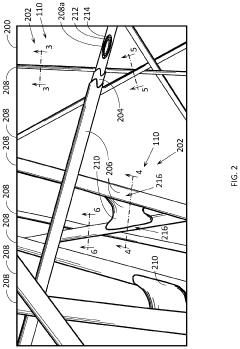

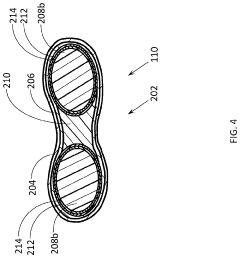

Electrically-conductive broad good

PatentActiveUS20210131026A1

Innovation

- A dimensionally-stable electrically-conductive nonwoven veil made of metal-coated fibers, preferably carbon fibers with nickel, copper, or their alloys, bonded with a binder and coated with multiple layers of metal to create a conductive pathway, reducing sheet resistance and enhancing ampacity for effective lightning strike protection.

Environmental Compliance and Sustainability Considerations

Environmental regulations governing composite coatings have evolved significantly in both automotive and aerospace sectors, with distinct compliance requirements. The automotive industry faces stringent VOC (Volatile Organic Compounds) emission standards under regulations like EU's REACH and EPA guidelines, necessitating a shift toward water-based and high-solid coating systems. These regulations have accelerated the development of environmentally friendly alternatives such as powder coatings and UV-curable systems that minimize harmful emissions while maintaining performance standards.

Aerospace applications encounter more specialized environmental compliance challenges, particularly regarding fire retardancy, off-gassing in enclosed cabin environments, and extreme weather resistance. The industry must adhere to specific standards like FAR 25.853 for flammability and toxicity requirements. Additionally, the long service life of aerospace components demands coatings that maintain environmental compliance throughout extended operational periods, often exceeding 20-30 years.

Life cycle assessment (LCA) methodologies reveal significant differences between automotive and aerospace coating sustainability profiles. Automotive coatings typically prioritize production efficiency and end-of-life recyclability, with manufacturers increasingly adopting circular economy principles. In contrast, aerospace coatings emphasize durability and weight reduction to minimize fuel consumption over extended service periods, thereby reducing lifetime carbon footprint despite potentially more resource-intensive initial production.

Recent innovations in bio-based composite coating technologies show promising applications across both sectors. Automotive manufacturers have successfully implemented plant-derived resins and natural fiber reinforcements in non-critical components, reducing petroleum dependency. Aerospace applications have been more conservative in adopting these technologies, limiting bio-based materials to interior components where performance requirements are less demanding.

End-of-life considerations present distinct challenges for each industry. Automotive composite coatings increasingly incorporate design-for-disassembly principles, facilitating material recovery and recycling. The aerospace sector faces greater complexity due to the heterogeneous nature of advanced composite structures and specialized coating systems, often resulting in limited recycling options. Research into pyrolysis and solvolysis techniques shows potential for recovering carbon fibers from aerospace composites, though commercial-scale implementation remains limited.

Cross-industry collaboration has emerged as a catalyst for sustainable innovation, with knowledge transfer between automotive and aerospace sectors accelerating the development of environmentally compliant coating technologies. Joint research initiatives focusing on nano-enhanced coatings and self-healing systems demonstrate how sustainability challenges can drive technological advancement while meeting the distinct performance requirements of both industries.

Aerospace applications encounter more specialized environmental compliance challenges, particularly regarding fire retardancy, off-gassing in enclosed cabin environments, and extreme weather resistance. The industry must adhere to specific standards like FAR 25.853 for flammability and toxicity requirements. Additionally, the long service life of aerospace components demands coatings that maintain environmental compliance throughout extended operational periods, often exceeding 20-30 years.

Life cycle assessment (LCA) methodologies reveal significant differences between automotive and aerospace coating sustainability profiles. Automotive coatings typically prioritize production efficiency and end-of-life recyclability, with manufacturers increasingly adopting circular economy principles. In contrast, aerospace coatings emphasize durability and weight reduction to minimize fuel consumption over extended service periods, thereby reducing lifetime carbon footprint despite potentially more resource-intensive initial production.

Recent innovations in bio-based composite coating technologies show promising applications across both sectors. Automotive manufacturers have successfully implemented plant-derived resins and natural fiber reinforcements in non-critical components, reducing petroleum dependency. Aerospace applications have been more conservative in adopting these technologies, limiting bio-based materials to interior components where performance requirements are less demanding.

End-of-life considerations present distinct challenges for each industry. Automotive composite coatings increasingly incorporate design-for-disassembly principles, facilitating material recovery and recycling. The aerospace sector faces greater complexity due to the heterogeneous nature of advanced composite structures and specialized coating systems, often resulting in limited recycling options. Research into pyrolysis and solvolysis techniques shows potential for recovering carbon fibers from aerospace composites, though commercial-scale implementation remains limited.

Cross-industry collaboration has emerged as a catalyst for sustainable innovation, with knowledge transfer between automotive and aerospace sectors accelerating the development of environmentally compliant coating technologies. Joint research initiatives focusing on nano-enhanced coatings and self-healing systems demonstrate how sustainability challenges can drive technological advancement while meeting the distinct performance requirements of both industries.

Performance Testing Methodologies and Industry Standards

Performance testing methodologies for composite coatings differ significantly between automotive and aerospace sectors due to their distinct operational requirements. In the automotive industry, standardized tests such as ASTM B117 salt spray test and ASTM D2794 impact resistance test are widely employed to evaluate coating durability under road conditions. These tests typically simulate exposure to road salt, stone chips, and UV radiation that automotive coatings routinely encounter.

Aerospace applications, however, demand more rigorous testing protocols due to extreme operational environments. Standards such as ASTM F1110 for fluid resistance and MIL-STD-810 for environmental testing are fundamental in this sector. These tests evaluate coating performance under conditions including rapid temperature fluctuations (-54°C to +177°C), high-altitude UV exposure, and resistance to specialized hydraulic fluids and de-icing chemicals.

Adhesion testing represents a critical evaluation parameter in both industries, though with different emphasis. The automotive sector primarily utilizes ASTM D3359 (tape test) and ASTM D4541 (pull-off test), focusing on everyday durability. Aerospace coatings undergo these tests plus specialized evaluations like the Boeing wedge test (ASTM D3762) that assesses long-term environmental durability under combined stress and corrosive conditions.

Weathering resistance testing shows marked differences between sectors. Automotive coatings typically undergo 2,000-3,000 hours of accelerated weathering (ASTM G154), while aerospace coatings must withstand 5,000+ hours, with additional testing for resistance to hydraulic fluids and aviation fuels under ASTM F502 standards.

Corrosion resistance testing is paramount in both industries but follows different protocols. Automotive standards like ASTM B117 typically require 1,000 hours of salt spray resistance, while aerospace applications demand 3,000+ hours under more complex cyclic corrosion tests (ASTM G85) that better simulate real-world flight conditions.

Emerging test methodologies include electrochemical impedance spectroscopy (EIS) for non-destructive evaluation and digital image correlation for micro-scale deformation analysis. These advanced techniques are being adopted more rapidly in aerospace applications but are gradually finding their way into automotive testing standards as composite coatings become more sophisticated across both industries.

Aerospace applications, however, demand more rigorous testing protocols due to extreme operational environments. Standards such as ASTM F1110 for fluid resistance and MIL-STD-810 for environmental testing are fundamental in this sector. These tests evaluate coating performance under conditions including rapid temperature fluctuations (-54°C to +177°C), high-altitude UV exposure, and resistance to specialized hydraulic fluids and de-icing chemicals.

Adhesion testing represents a critical evaluation parameter in both industries, though with different emphasis. The automotive sector primarily utilizes ASTM D3359 (tape test) and ASTM D4541 (pull-off test), focusing on everyday durability. Aerospace coatings undergo these tests plus specialized evaluations like the Boeing wedge test (ASTM D3762) that assesses long-term environmental durability under combined stress and corrosive conditions.

Weathering resistance testing shows marked differences between sectors. Automotive coatings typically undergo 2,000-3,000 hours of accelerated weathering (ASTM G154), while aerospace coatings must withstand 5,000+ hours, with additional testing for resistance to hydraulic fluids and aviation fuels under ASTM F502 standards.

Corrosion resistance testing is paramount in both industries but follows different protocols. Automotive standards like ASTM B117 typically require 1,000 hours of salt spray resistance, while aerospace applications demand 3,000+ hours under more complex cyclic corrosion tests (ASTM G85) that better simulate real-world flight conditions.

Emerging test methodologies include electrochemical impedance spectroscopy (EIS) for non-destructive evaluation and digital image correlation for micro-scale deformation analysis. These advanced techniques are being adopted more rapidly in aerospace applications but are gradually finding their way into automotive testing standards as composite coatings become more sophisticated across both industries.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!