Comparing Hall Effect Sensors vs MEMS Sensors: Application Trade-offs

SEP 22, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hall Effect vs MEMS Sensors: Background and Objectives

Sensor technology has evolved significantly over the past decades, with Hall Effect sensors and MEMS (Micro-Electro-Mechanical Systems) sensors representing two distinct approaches to measurement and detection in various applications. Hall Effect sensors, discovered by Edwin Hall in 1879, operate based on the principle that when a current-carrying conductor is placed in a magnetic field, a voltage is generated perpendicular to both the current and the magnetic field. This fundamental principle has been leveraged in industrial applications since the 1950s, with significant commercial adoption beginning in the 1970s.

MEMS sensors, by contrast, emerged in the 1980s as semiconductor manufacturing techniques advanced to allow the fabrication of microscopic mechanical structures alongside electronic circuits. These sensors integrate mechanical elements, sensors, actuators, and electronics on a common silicon substrate through microfabrication technology. The evolution of MEMS technology has been closely tied to the advancement of semiconductor manufacturing processes, enabling increasingly sophisticated and miniaturized sensing solutions.

The technological trajectory for both sensor types has been characterized by continuous improvements in sensitivity, accuracy, power consumption, and integration capabilities. Hall Effect sensors have progressed from simple magnetic field detectors to sophisticated position, rotation, and current sensing devices with integrated signal processing. MEMS technology has expanded from basic accelerometers to encompass gyroscopes, magnetometers, pressure sensors, and complex inertial measurement units (IMUs).

The primary objective of comparing these technologies is to establish a comprehensive understanding of their respective strengths, limitations, and optimal application domains. Hall Effect sensors excel in robust environments requiring magnetic field detection, while MEMS sensors offer advantages in motion detection, orientation sensing, and applications requiring multi-axis measurements in compact form factors.

Current technological trends indicate convergence in some application areas, with both sensor types competing for market share in automotive, industrial automation, and consumer electronics sectors. The ongoing miniaturization of Hall Effect sensors and the increasing robustness of MEMS sensors are blurring traditional application boundaries, creating new opportunities and challenges for system designers.

Looking forward, the evolution of these sensor technologies is expected to continue along paths of increased integration with signal processing capabilities, reduced power consumption, enhanced reliability, and expanded functionality. Understanding the fundamental principles, historical development, and future trajectories of these technologies provides essential context for evaluating their application-specific trade-offs and making informed design decisions in various engineering domains.

MEMS sensors, by contrast, emerged in the 1980s as semiconductor manufacturing techniques advanced to allow the fabrication of microscopic mechanical structures alongside electronic circuits. These sensors integrate mechanical elements, sensors, actuators, and electronics on a common silicon substrate through microfabrication technology. The evolution of MEMS technology has been closely tied to the advancement of semiconductor manufacturing processes, enabling increasingly sophisticated and miniaturized sensing solutions.

The technological trajectory for both sensor types has been characterized by continuous improvements in sensitivity, accuracy, power consumption, and integration capabilities. Hall Effect sensors have progressed from simple magnetic field detectors to sophisticated position, rotation, and current sensing devices with integrated signal processing. MEMS technology has expanded from basic accelerometers to encompass gyroscopes, magnetometers, pressure sensors, and complex inertial measurement units (IMUs).

The primary objective of comparing these technologies is to establish a comprehensive understanding of their respective strengths, limitations, and optimal application domains. Hall Effect sensors excel in robust environments requiring magnetic field detection, while MEMS sensors offer advantages in motion detection, orientation sensing, and applications requiring multi-axis measurements in compact form factors.

Current technological trends indicate convergence in some application areas, with both sensor types competing for market share in automotive, industrial automation, and consumer electronics sectors. The ongoing miniaturization of Hall Effect sensors and the increasing robustness of MEMS sensors are blurring traditional application boundaries, creating new opportunities and challenges for system designers.

Looking forward, the evolution of these sensor technologies is expected to continue along paths of increased integration with signal processing capabilities, reduced power consumption, enhanced reliability, and expanded functionality. Understanding the fundamental principles, historical development, and future trajectories of these technologies provides essential context for evaluating their application-specific trade-offs and making informed design decisions in various engineering domains.

Market Demand Analysis for Position Sensing Technologies

The position sensing technology market is experiencing robust growth driven by increasing automation across multiple industries. The global position sensor market was valued at approximately $5.9 billion in 2020 and is projected to reach $12.8 billion by 2027, growing at a CAGR of 9.2% during the forecast period. This growth is primarily fueled by the automotive, industrial, and consumer electronics sectors, where precise position measurement is critical for operational efficiency and product functionality.

In the automotive industry, the demand for position sensing technologies has surged with the rise of electric vehicles and advanced driver assistance systems (ADAS). Modern vehicles contain an average of 30-40 position sensors, with premium models incorporating up to 100 sensors for various applications including throttle position, steering angle detection, and seat positioning. The transition to electric powertrains has further accelerated this demand, as these systems require additional position monitoring for optimal performance.

Industrial automation represents another significant market driver, with manufacturing facilities increasingly adopting smart factory concepts that rely heavily on position sensing for robotic control, machine tool positioning, and process automation. The Industrial Internet of Things (IIoT) implementation has created a need for more sophisticated position sensing solutions that can provide real-time data for predictive maintenance and process optimization.

Consumer electronics applications, particularly in smartphones, wearables, and gaming devices, have also contributed to market expansion. These devices utilize position sensors for screen orientation, motion tracking, and gesture recognition features that enhance user experience and functionality.

When comparing Hall Effect and MEMS sensor demand, distinct market preferences emerge based on application requirements. Hall Effect sensors dominate in automotive applications due to their reliability in harsh environments and ability to operate in wide temperature ranges. They hold approximately 65% market share in automotive position sensing applications, particularly in powertrain and chassis systems.

MEMS sensors, conversely, have captured nearly 70% of the consumer electronics position sensing market due to their compact size, low power consumption, and cost-effectiveness at high volumes. Their multi-axis sensing capabilities make them particularly valuable in applications requiring complex motion detection.

Regional analysis reveals that Asia-Pacific represents the largest market for position sensing technologies, accounting for 42% of global demand, driven by the region's strong manufacturing base and growing automotive production. North America and Europe follow with 28% and 24% market shares respectively, with particular strength in high-precision industrial applications and premium automotive segments.

The market is increasingly demanding sensors with enhanced features including wireless connectivity, reduced power consumption, and improved accuracy. Miniaturization remains a critical trend, with manufacturers working to reduce sensor footprints while maintaining or improving performance characteristics to meet the space constraints of modern electronic devices.

In the automotive industry, the demand for position sensing technologies has surged with the rise of electric vehicles and advanced driver assistance systems (ADAS). Modern vehicles contain an average of 30-40 position sensors, with premium models incorporating up to 100 sensors for various applications including throttle position, steering angle detection, and seat positioning. The transition to electric powertrains has further accelerated this demand, as these systems require additional position monitoring for optimal performance.

Industrial automation represents another significant market driver, with manufacturing facilities increasingly adopting smart factory concepts that rely heavily on position sensing for robotic control, machine tool positioning, and process automation. The Industrial Internet of Things (IIoT) implementation has created a need for more sophisticated position sensing solutions that can provide real-time data for predictive maintenance and process optimization.

Consumer electronics applications, particularly in smartphones, wearables, and gaming devices, have also contributed to market expansion. These devices utilize position sensors for screen orientation, motion tracking, and gesture recognition features that enhance user experience and functionality.

When comparing Hall Effect and MEMS sensor demand, distinct market preferences emerge based on application requirements. Hall Effect sensors dominate in automotive applications due to their reliability in harsh environments and ability to operate in wide temperature ranges. They hold approximately 65% market share in automotive position sensing applications, particularly in powertrain and chassis systems.

MEMS sensors, conversely, have captured nearly 70% of the consumer electronics position sensing market due to their compact size, low power consumption, and cost-effectiveness at high volumes. Their multi-axis sensing capabilities make them particularly valuable in applications requiring complex motion detection.

Regional analysis reveals that Asia-Pacific represents the largest market for position sensing technologies, accounting for 42% of global demand, driven by the region's strong manufacturing base and growing automotive production. North America and Europe follow with 28% and 24% market shares respectively, with particular strength in high-precision industrial applications and premium automotive segments.

The market is increasingly demanding sensors with enhanced features including wireless connectivity, reduced power consumption, and improved accuracy. Miniaturization remains a critical trend, with manufacturers working to reduce sensor footprints while maintaining or improving performance characteristics to meet the space constraints of modern electronic devices.

Current Technical Challenges in Sensor Technologies

The sensor technology landscape is currently facing several significant challenges that impact both Hall Effect and MEMS sensor development. One of the primary technical hurdles is achieving higher sensitivity while maintaining signal stability across varying environmental conditions. Hall Effect sensors struggle with temperature drift issues, where output signals can vary by up to 10-15% across industrial temperature ranges (-40°C to 125°C), requiring complex compensation algorithms that increase processing overhead.

Power consumption remains a critical constraint, particularly for battery-operated and IoT applications. While MEMS sensors have made substantial progress in this area, with some modern accelerometers consuming less than 10μA in low-power modes, Hall Effect sensors typically require continuous current flow to generate measurable magnetic fields, resulting in power requirements often 5-10 times higher than equivalent MEMS solutions.

Miniaturization presents another significant challenge, especially as devices continue to shrink. Current manufacturing processes for Hall Effect sensors face limitations in reducing die size while maintaining performance, with typical dimensions plateauing around 1.0 × 1.0 mm. MEMS sensors have pushed boundaries further with some inertial measurement units reaching 2.5 × 3.0 × 0.8 mm, but face yield issues at smaller scales due to the complexity of mechanical structures.

Cross-axis sensitivity remains problematic for both technologies. MEMS sensors typically exhibit 2-5% cross-axis interference, while Hall Effect sensors can show magnetic field interference from adjacent components, requiring careful system design and shielding considerations that complicate integration processes.

Integration density poses increasing challenges as more sensing capabilities are demanded in smaller footprints. The industry is struggling to develop effective multi-sensor fusion techniques that can efficiently combine data from different sensor types while minimizing processing requirements and power consumption.

Calibration complexity continues to grow, particularly for high-precision applications. MEMS sensors often require factory calibration plus in-field compensation for optimal performance, while Hall Effect sensors need calibration against magnetic field variations and material inconsistencies. These calibration requirements add significant cost and complexity to manufacturing processes.

Reliability under harsh conditions presents ongoing challenges, with mechanical shock resistance being particularly problematic for MEMS devices due to their moving parts. Meanwhile, Hall Effect sensors face challenges with long-term magnetic stability and susceptibility to external electromagnetic interference, requiring additional shielding that increases size and cost.

These technical challenges collectively drive research toward more robust, efficient, and integrated sensing solutions that can overcome the current limitations of both Hall Effect and MEMS technologies.

Power consumption remains a critical constraint, particularly for battery-operated and IoT applications. While MEMS sensors have made substantial progress in this area, with some modern accelerometers consuming less than 10μA in low-power modes, Hall Effect sensors typically require continuous current flow to generate measurable magnetic fields, resulting in power requirements often 5-10 times higher than equivalent MEMS solutions.

Miniaturization presents another significant challenge, especially as devices continue to shrink. Current manufacturing processes for Hall Effect sensors face limitations in reducing die size while maintaining performance, with typical dimensions plateauing around 1.0 × 1.0 mm. MEMS sensors have pushed boundaries further with some inertial measurement units reaching 2.5 × 3.0 × 0.8 mm, but face yield issues at smaller scales due to the complexity of mechanical structures.

Cross-axis sensitivity remains problematic for both technologies. MEMS sensors typically exhibit 2-5% cross-axis interference, while Hall Effect sensors can show magnetic field interference from adjacent components, requiring careful system design and shielding considerations that complicate integration processes.

Integration density poses increasing challenges as more sensing capabilities are demanded in smaller footprints. The industry is struggling to develop effective multi-sensor fusion techniques that can efficiently combine data from different sensor types while minimizing processing requirements and power consumption.

Calibration complexity continues to grow, particularly for high-precision applications. MEMS sensors often require factory calibration plus in-field compensation for optimal performance, while Hall Effect sensors need calibration against magnetic field variations and material inconsistencies. These calibration requirements add significant cost and complexity to manufacturing processes.

Reliability under harsh conditions presents ongoing challenges, with mechanical shock resistance being particularly problematic for MEMS devices due to their moving parts. Meanwhile, Hall Effect sensors face challenges with long-term magnetic stability and susceptibility to external electromagnetic interference, requiring additional shielding that increases size and cost.

These technical challenges collectively drive research toward more robust, efficient, and integrated sensing solutions that can overcome the current limitations of both Hall Effect and MEMS technologies.

Comparative Analysis of Current Sensor Solutions

01 Sensitivity and accuracy comparison between Hall Effect and MEMS sensors

Hall Effect sensors and MEMS sensors differ significantly in their sensitivity and accuracy characteristics. Hall Effect sensors typically offer high sensitivity to magnetic fields and can provide precise measurements in specific applications. MEMS sensors, on the other hand, excel in multi-axis sensing with high accuracy for motion detection. The trade-off involves considering the specific measurement requirements, with Hall Effect sensors being preferred for magnetic field detection applications and MEMS sensors being advantageous for applications requiring multi-dimensional motion sensing.- Sensitivity and accuracy trade-offs between Hall Effect and MEMS sensors: Hall Effect sensors and MEMS sensors exhibit different sensitivity and accuracy characteristics in various applications. Hall Effect sensors typically offer high sensitivity to magnetic fields but may be affected by temperature variations, while MEMS sensors provide high precision in motion detection but might require additional calibration. These fundamental differences impact their selection for specific applications where measurement accuracy is critical.

- Size and integration considerations: MEMS sensors generally offer advantages in miniaturization and integration capabilities compared to Hall Effect sensors. MEMS technology enables the creation of extremely compact sensing elements that can be integrated into smaller devices. Hall Effect sensors, while also available in small packages, often require specific positioning relative to magnetic fields. These size and integration differences are crucial considerations when designing space-constrained applications.

- Power consumption and efficiency comparison: Power consumption represents a significant trade-off between Hall Effect and MEMS sensor technologies. Hall Effect sensors typically require continuous current flow to operate, which can result in higher power consumption in always-on applications. MEMS sensors often offer lower power modes and can be designed for more efficient operation in battery-powered devices. This difference impacts their suitability for energy-constrained applications.

- Environmental robustness and reliability differences: Hall Effect sensors and MEMS sensors demonstrate different levels of robustness in challenging environments. Hall Effect sensors are generally more resistant to harsh conditions including extreme temperatures, humidity, and mechanical shock. MEMS sensors, with their delicate mechanical structures, may require additional protection but often offer better long-term stability in certain applications. These reliability differences influence sensor selection for industrial, automotive, and outdoor applications.

- Application-specific performance characteristics: The selection between Hall Effect and MEMS sensors often depends on application-specific requirements. Hall Effect sensors excel in applications requiring non-contact magnetic field detection, position sensing, and current measurement. MEMS sensors are preferred for applications requiring motion detection, orientation sensing, and vibration analysis. Understanding these application-specific performance characteristics is essential for optimal sensor selection in fields ranging from automotive systems to consumer electronics.

02 Power consumption and integration considerations

Power consumption represents a significant trade-off between Hall Effect and MEMS sensor technologies. Hall Effect sensors typically require continuous current flow to operate, resulting in higher power consumption compared to MEMS sensors, which can be designed with power-saving modes. However, Hall Effect sensors often offer simpler integration into existing systems. MEMS sensors provide advantages in terms of miniaturization and can be more easily integrated into compact devices, though they may require more complex signal processing circuitry.Expand Specific Solutions03 Environmental robustness and reliability differences

Hall Effect sensors and MEMS sensors exhibit different levels of robustness in various environmental conditions. Hall Effect sensors generally demonstrate excellent temperature stability and can operate reliably in harsh environments with electromagnetic interference. They are less susceptible to mechanical shock and vibration. MEMS sensors, while more vulnerable to certain environmental factors, often incorporate built-in compensation mechanisms. The selection between these technologies often depends on the specific environmental conditions of the application, with Hall Effect sensors typically preferred in extreme conditions.Expand Specific Solutions04 Application-specific performance in automotive and industrial systems

In automotive and industrial applications, the choice between Hall Effect and MEMS sensors involves specific performance trade-offs. Hall Effect sensors are widely used for position sensing, current measurement, and speed detection due to their contactless operation and reliability. MEMS sensors excel in applications requiring motion detection, orientation sensing, and vibration analysis. The selection depends on factors such as required measurement parameters, space constraints, and system integration requirements. Hybrid solutions combining both technologies are sometimes implemented to leverage the strengths of each sensor type.Expand Specific Solutions05 Cost and manufacturing complexity trade-offs

Cost considerations and manufacturing complexity represent important trade-offs between Hall Effect and MEMS sensor technologies. Hall Effect sensors generally feature simpler construction and established manufacturing processes, often resulting in lower unit costs for basic sensing applications. MEMS sensors typically involve more complex fabrication processes, including specialized clean room environments and precision manufacturing techniques. However, MEMS sensors can offer cost advantages through their multi-functionality and ability to integrate multiple sensing capabilities in a single package, potentially reducing overall system costs despite higher initial component pricing.Expand Specific Solutions

Key Industry Players in Sensor Manufacturing

The Hall Effect Sensors vs MEMS Sensors market is currently in a mature growth phase with increasing adoption across automotive, industrial, and consumer electronics sectors. The global market size is estimated at $2.5-3 billion, growing at 6-8% CAGR. Technologically, Hall Effect sensors (led by Honeywell, Allegro MicroSystems, and Texas Instruments) offer robust magnetic field detection with proven reliability, while MEMS sensors (dominated by Bosch, InvenSense/TDK, and ST Microelectronics) provide superior miniaturization and multi-axis sensing capabilities. Companies like NXP, Infineon, and Analog Devices are strategically positioned across both technologies, developing hybrid solutions that leverage complementary strengths for emerging applications in IoT, autonomous vehicles, and industrial automation.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed a comprehensive portfolio of both Hall effect and MEMS sensor technologies with distinct application focuses. Their Hall effect sensors utilize proprietary magnetoresistive technology that provides enhanced sensitivity and stability across wide temperature ranges (-40°C to +150°C). The company's Hall sensors feature integrated signal conditioning circuits that deliver digital output signals with programmable thresholds, making them particularly suitable for position sensing in harsh industrial environments. For MEMS technology, Honeywell has pioneered high-precision inertial measurement units (IMUs) that combine accelerometers, gyroscopes, and magnetometers in compact packages. Their MEMS sensors employ differential capacitive sensing elements with advanced temperature compensation algorithms to maintain accuracy across varying environmental conditions. Honeywell's approach emphasizes reliability through redundant sensing elements and built-in self-test capabilities that ensure continuous operation in critical applications.

Strengths: Superior reliability in extreme environments; advanced signal processing capabilities; comprehensive product ecosystem with software support. Weaknesses: Higher cost compared to commodity sensors; larger form factors for Hall effect solutions; higher power consumption in certain Hall effect implementations compared to newer MEMS alternatives.

Robert Bosch GmbH

Technical Solution: Bosch has developed dual-platform expertise in both Hall effect and MEMS sensor technologies, with particular emphasis on automotive and industrial applications. Their Hall effect sensors employ proprietary planar Hall technology that achieves high magnetic sensitivity while maintaining excellent temperature stability. Bosch's Hall sensors feature integrated signal processing that provides linearized output and programmable switching thresholds, making them ideal for precise position and speed detection in automotive systems. In the MEMS domain, Bosch has pioneered advanced manufacturing processes including their proprietary DRIE (Deep Reactive Ion Etching) technology that enables high-aspect-ratio structures with superior mechanical stability. Their MEMS sensors utilize differential measurement principles with sophisticated compensation algorithms to minimize drift and noise effects. Bosch's MEMS accelerometers and gyroscopes incorporate built-in self-calibration routines that maintain accuracy over the product lifetime, addressing one of the traditional challenges of MEMS technology.

Strengths: Industry-leading manufacturing precision; extensive automotive qualification; advanced integration capabilities combining multiple sensing principles. Weaknesses: Higher implementation complexity requiring specialized expertise; premium pricing compared to commodity solutions; larger power budget requirements for certain Hall effect implementations.

Technical Deep Dive: Core Patents and Innovations

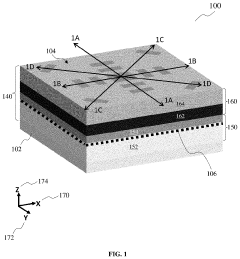

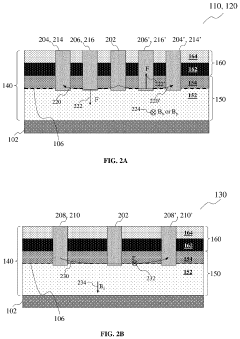

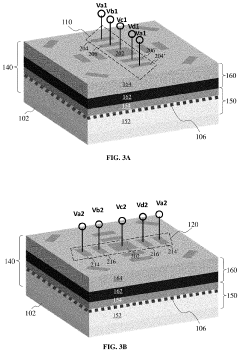

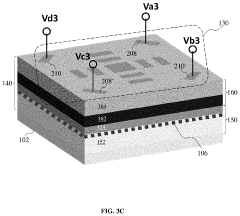

Magnetic field sensor and methods of fabricating a magnetic field sensor

PatentActiveUS20220171001A1

Innovation

- A magnetic field sensor with a semiconductor structure featuring a 2DEG and insulator members, including multiple sensing devices with electrodes extending from the insulator to the 2DEG, configured to sense magnetic fields along three axes, utilizing III-V compound layers for improved electron mobility and thermal stability up to 800°C.

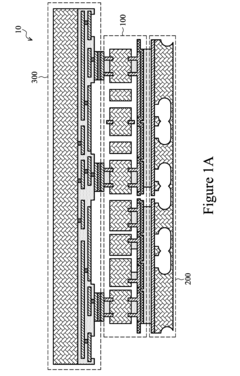

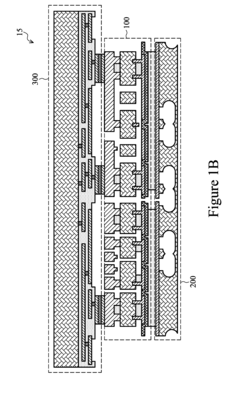

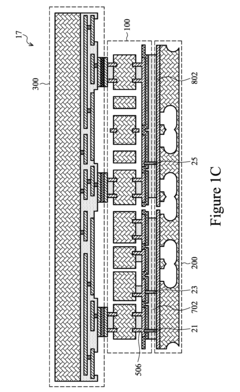

MEMS Devices and Fabrication Methods Thereof

PatentActiveUS20170001860A1

Innovation

- The integration of MEMS devices with CMOS devices using eutectic bonding and the incorporation of thin structure layers and vias to form a shielding plane, which reduces noise interference and improves mechanical functionality while allowing for simultaneous fabrication and bonding of micromechanical and electronic components.

Power Consumption and Efficiency Considerations

Power consumption represents a critical factor in sensor selection, particularly for battery-powered and energy-constrained applications. Hall Effect sensors and MEMS sensors exhibit distinct power consumption profiles that significantly influence their suitability for various use cases.

Hall Effect sensors typically operate with continuous power requirements ranging from 1mA to 10mA during active measurement, depending on the specific implementation and features. These sensors require constant current flow to generate the measurable Hall voltage when exposed to magnetic fields. Traditional Hall Effect sensors lack sophisticated power management capabilities, resulting in relatively consistent power draw regardless of measurement frequency. However, modern variants incorporate sleep modes and power-gating techniques that can reduce average consumption to the microamp range during idle periods.

MEMS sensors, by contrast, demonstrate superior power efficiency in many applications, with active measurement currents often below 500μA and idle currents in the nanoamp range. This efficiency stems from their inherent design characteristics and advanced power management capabilities. MEMS accelerometers and gyroscopes can operate in various power states, dynamically adjusting consumption based on required measurement frequency, resolution, and range.

The efficiency advantage of MEMS becomes particularly pronounced in intermittent sensing applications. When continuous measurement is unnecessary, MEMS sensors can enter ultra-low-power sleep states while maintaining minimal functionality for wake-on-motion detection. This capability enables power consumption reductions of up to 99% compared to continuous operation modes, extending battery life from days to years in certain implementations.

System-level power considerations further differentiate these technologies. Hall Effect sensors often require signal conditioning circuitry that adds to overall power budget. Conversely, many MEMS sensors integrate signal processing, analog-to-digital conversion, and even basic algorithmic functions on-chip, reducing external component requirements and associated power demands.

Temperature sensitivity also impacts power efficiency. Hall Effect sensors typically exhibit stable power consumption across their operating temperature range. MEMS sensors, however, may require additional power for internal temperature compensation in extreme environments, potentially narrowing their efficiency advantage in such conditions.

Emerging developments in both technologies continue to improve power profiles. Advanced Hall Effect sensors now incorporate chopper stabilization and duty-cycling techniques that significantly reduce average consumption. Similarly, MEMS manufacturers are implementing ever more sophisticated power management architectures, including context-aware operation modes that automatically optimize power consumption based on detected usage patterns and environmental conditions.

Hall Effect sensors typically operate with continuous power requirements ranging from 1mA to 10mA during active measurement, depending on the specific implementation and features. These sensors require constant current flow to generate the measurable Hall voltage when exposed to magnetic fields. Traditional Hall Effect sensors lack sophisticated power management capabilities, resulting in relatively consistent power draw regardless of measurement frequency. However, modern variants incorporate sleep modes and power-gating techniques that can reduce average consumption to the microamp range during idle periods.

MEMS sensors, by contrast, demonstrate superior power efficiency in many applications, with active measurement currents often below 500μA and idle currents in the nanoamp range. This efficiency stems from their inherent design characteristics and advanced power management capabilities. MEMS accelerometers and gyroscopes can operate in various power states, dynamically adjusting consumption based on required measurement frequency, resolution, and range.

The efficiency advantage of MEMS becomes particularly pronounced in intermittent sensing applications. When continuous measurement is unnecessary, MEMS sensors can enter ultra-low-power sleep states while maintaining minimal functionality for wake-on-motion detection. This capability enables power consumption reductions of up to 99% compared to continuous operation modes, extending battery life from days to years in certain implementations.

System-level power considerations further differentiate these technologies. Hall Effect sensors often require signal conditioning circuitry that adds to overall power budget. Conversely, many MEMS sensors integrate signal processing, analog-to-digital conversion, and even basic algorithmic functions on-chip, reducing external component requirements and associated power demands.

Temperature sensitivity also impacts power efficiency. Hall Effect sensors typically exhibit stable power consumption across their operating temperature range. MEMS sensors, however, may require additional power for internal temperature compensation in extreme environments, potentially narrowing their efficiency advantage in such conditions.

Emerging developments in both technologies continue to improve power profiles. Advanced Hall Effect sensors now incorporate chopper stabilization and duty-cycling techniques that significantly reduce average consumption. Similarly, MEMS manufacturers are implementing ever more sophisticated power management architectures, including context-aware operation modes that automatically optimize power consumption based on detected usage patterns and environmental conditions.

Reliability and Environmental Resilience Assessment

Reliability and environmental resilience represent critical factors in sensor selection for industrial and automotive applications. Hall Effect sensors demonstrate exceptional durability under extreme conditions, maintaining operational stability across temperatures ranging from -40°C to +150°C. This temperature resilience stems from their solid-state construction with no moving parts, significantly reducing mechanical wear concerns. Furthermore, Hall Effect sensors exhibit remarkable resistance to vibration, shock, and electromagnetic interference (EMI), making them particularly suitable for harsh industrial environments and automotive applications where mechanical stress is constant.

When exposed to contaminants such as dust, moisture, or chemicals, Hall Effect sensors maintain performance integrity due to their encapsulated design. This protective enclosure ensures consistent operation even in challenging environments like engine compartments or outdoor industrial settings. Long-term stability tests indicate that Hall Effect sensors typically maintain calibration parameters within 2% deviation over a 10-year operational period, demonstrating excellent aging characteristics.

MEMS sensors present a more complex reliability profile. While modern MEMS technologies have significantly improved durability, their microstructures containing moving parts remain inherently more susceptible to mechanical fatigue and environmental factors. Temperature performance of MEMS sensors typically ranges from -20°C to +85°C in standard configurations, though specialized versions can extend this range at increased cost. The miniature mechanical elements in MEMS sensors can experience drift or calibration shifts when subjected to prolonged vibration or shock events exceeding 50G.

Environmental testing reveals that MEMS sensors require more sophisticated packaging solutions to achieve comparable protection against moisture and contaminants. Advanced hermetic sealing techniques have improved MEMS resilience, but this adds to manufacturing complexity and cost. Mean Time Between Failures (MTBF) analysis shows MEMS sensors averaging 50,000-100,000 hours in moderate conditions, while Hall Effect sensors frequently exceed 200,000 hours in similar environments.

Accelerated aging tests demonstrate that MEMS sensors may experience sensitivity drift of 3-5% annually in demanding applications, necessitating more frequent recalibration compared to Hall Effect alternatives. However, recent advancements in MEMS design have introduced self-calibration capabilities and improved material science that mitigate these limitations in newer generations.

For applications requiring extended deployment in uncontrolled environments, Hall Effect sensors generally offer superior reliability with minimal maintenance requirements. Conversely, MEMS sensors provide adequate reliability for consumer electronics and moderate industrial applications where environmental conditions remain relatively controlled and periodic maintenance is feasible. The reliability gap continues to narrow as MEMS manufacturing techniques evolve, but Hall Effect technology maintains an advantage in extreme condition resilience and long-term stability without intervention.

When exposed to contaminants such as dust, moisture, or chemicals, Hall Effect sensors maintain performance integrity due to their encapsulated design. This protective enclosure ensures consistent operation even in challenging environments like engine compartments or outdoor industrial settings. Long-term stability tests indicate that Hall Effect sensors typically maintain calibration parameters within 2% deviation over a 10-year operational period, demonstrating excellent aging characteristics.

MEMS sensors present a more complex reliability profile. While modern MEMS technologies have significantly improved durability, their microstructures containing moving parts remain inherently more susceptible to mechanical fatigue and environmental factors. Temperature performance of MEMS sensors typically ranges from -20°C to +85°C in standard configurations, though specialized versions can extend this range at increased cost. The miniature mechanical elements in MEMS sensors can experience drift or calibration shifts when subjected to prolonged vibration or shock events exceeding 50G.

Environmental testing reveals that MEMS sensors require more sophisticated packaging solutions to achieve comparable protection against moisture and contaminants. Advanced hermetic sealing techniques have improved MEMS resilience, but this adds to manufacturing complexity and cost. Mean Time Between Failures (MTBF) analysis shows MEMS sensors averaging 50,000-100,000 hours in moderate conditions, while Hall Effect sensors frequently exceed 200,000 hours in similar environments.

Accelerated aging tests demonstrate that MEMS sensors may experience sensitivity drift of 3-5% annually in demanding applications, necessitating more frequent recalibration compared to Hall Effect alternatives. However, recent advancements in MEMS design have introduced self-calibration capabilities and improved material science that mitigate these limitations in newer generations.

For applications requiring extended deployment in uncontrolled environments, Hall Effect sensors generally offer superior reliability with minimal maintenance requirements. Conversely, MEMS sensors provide adequate reliability for consumer electronics and moderate industrial applications where environmental conditions remain relatively controlled and periodic maintenance is feasible. The reliability gap continues to narrow as MEMS manufacturing techniques evolve, but Hall Effect technology maintains an advantage in extreme condition resilience and long-term stability without intervention.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!