Comparing Mobile vs Stationary Hall Effect Sensor Applications

SEP 22, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hall Effect Sensor Evolution and Objectives

The Hall Effect sensor, discovered by Edwin Hall in 1879, has evolved significantly over the past century, transforming from a laboratory curiosity into a critical component in numerous industrial and consumer applications. Initially limited to scientific research, these sensors began gaining commercial traction in the 1950s with the advent of semiconductor technology, which allowed for miniaturization and improved sensitivity. The evolution accelerated in the 1980s and 1990s with the integration of Hall Effect sensors into automotive systems, industrial equipment, and consumer electronics.

The fundamental principle behind Hall Effect sensors remains unchanged—they detect magnetic fields and convert this detection into measurable electrical signals. However, the implementation, sensitivity, form factor, and application scope have undergone remarkable transformation. Modern Hall Effect sensors now incorporate advanced signal processing capabilities, temperature compensation, and can operate in increasingly harsh environments, making them suitable for both stationary and mobile applications.

In comparing mobile versus stationary applications, we observe distinct evolutionary paths. Stationary Hall Effect sensors, typically found in industrial settings, evolved with a focus on long-term stability, precision, and reliability under controlled conditions. These sensors have been optimized for continuous operation in fixed positions, often serving critical monitoring functions in manufacturing processes, power systems, and security installations.

Mobile Hall Effect sensor applications, conversely, have evolved to address unique challenges including vibration resistance, power efficiency, size constraints, and adaptability to changing environmental conditions. The miniaturization trend has been particularly pronounced in this segment, with modern mobile sensors achieving remarkably small footprints while maintaining high sensitivity and accuracy. This evolution has enabled their integration into portable devices, vehicles, and wearable technology.

The technological objectives for Hall Effect sensors continue to evolve in response to emerging market demands. For stationary applications, key objectives include enhancing detection range, improving immunity to electromagnetic interference, extending operational lifespan, and developing self-diagnostic capabilities. For mobile applications, objectives focus on further miniaturization, reducing power consumption, improving shock resistance, and enhancing wireless connectivity options.

Looking forward, the convergence of Hall Effect sensor technology with IoT frameworks represents a significant evolutionary direction. Both mobile and stationary sensors are increasingly being designed with network connectivity in mind, enabling remote monitoring, predictive maintenance, and integration with larger data analytics systems. This connectivity-focused evolution aims to transform Hall Effect sensors from discrete components into nodes within intelligent sensing networks, capable of contributing to complex decision-making processes in both industrial and consumer contexts.

The fundamental principle behind Hall Effect sensors remains unchanged—they detect magnetic fields and convert this detection into measurable electrical signals. However, the implementation, sensitivity, form factor, and application scope have undergone remarkable transformation. Modern Hall Effect sensors now incorporate advanced signal processing capabilities, temperature compensation, and can operate in increasingly harsh environments, making them suitable for both stationary and mobile applications.

In comparing mobile versus stationary applications, we observe distinct evolutionary paths. Stationary Hall Effect sensors, typically found in industrial settings, evolved with a focus on long-term stability, precision, and reliability under controlled conditions. These sensors have been optimized for continuous operation in fixed positions, often serving critical monitoring functions in manufacturing processes, power systems, and security installations.

Mobile Hall Effect sensor applications, conversely, have evolved to address unique challenges including vibration resistance, power efficiency, size constraints, and adaptability to changing environmental conditions. The miniaturization trend has been particularly pronounced in this segment, with modern mobile sensors achieving remarkably small footprints while maintaining high sensitivity and accuracy. This evolution has enabled their integration into portable devices, vehicles, and wearable technology.

The technological objectives for Hall Effect sensors continue to evolve in response to emerging market demands. For stationary applications, key objectives include enhancing detection range, improving immunity to electromagnetic interference, extending operational lifespan, and developing self-diagnostic capabilities. For mobile applications, objectives focus on further miniaturization, reducing power consumption, improving shock resistance, and enhancing wireless connectivity options.

Looking forward, the convergence of Hall Effect sensor technology with IoT frameworks represents a significant evolutionary direction. Both mobile and stationary sensors are increasingly being designed with network connectivity in mind, enabling remote monitoring, predictive maintenance, and integration with larger data analytics systems. This connectivity-focused evolution aims to transform Hall Effect sensors from discrete components into nodes within intelligent sensing networks, capable of contributing to complex decision-making processes in both industrial and consumer contexts.

Market Analysis for Hall Effect Sensor Applications

The global Hall Effect sensor market has demonstrated robust growth, valued at approximately $2.1 billion in 2022 and projected to reach $3.5 billion by 2028, representing a compound annual growth rate (CAGR) of 8.9%. This growth trajectory is fueled by increasing demand across multiple industries, with automotive and industrial sectors leading adoption rates.

Mobile applications for Hall Effect sensors have seen particularly strong market traction, accounting for nearly 40% of the total market share. The automotive industry represents the largest consumer segment, where these sensors are extensively utilized in wheel speed detection, position sensing, and electronic throttle control systems. The average modern vehicle contains between 10-15 Hall Effect sensors, with premium models incorporating up to 25 units.

Stationary applications maintain significant market presence in industrial automation, where they command approximately 35% of market share. These installations primarily serve in position detection, speed monitoring, and current measurement applications. The industrial automation sector's continued expansion, growing at 7.5% annually, provides a stable demand foundation for stationary Hall Effect sensor implementations.

Consumer electronics represents the fastest-growing application segment for mobile Hall Effect sensors, with a CAGR of 12.3%. This surge is driven by increasing integration in smartphones, tablets, and wearable devices for functions like lid closure detection, screen rotation, and power management. Approximately 2.8 billion consumer electronic devices shipped in 2022 incorporated at least one Hall Effect sensor.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for 45% of global consumption, followed by North America (28%) and Europe (20%). China and South Korea lead manufacturing capacity, while Germany and the United States maintain technological innovation leadership, particularly in high-precision applications.

Price sensitivity varies significantly between application types. Mobile applications typically demand lower-cost sensors (average unit price: $0.50-$2.00) produced at high volume, while stationary industrial applications often utilize higher-precision, more robust sensors commanding premium prices ($5.00-$25.00 per unit).

Market forecasts indicate that mobile applications will continue outpacing stationary implementations in growth rate (10.2% vs. 7.1% CAGR), driven by expanding IoT ecosystems and smart device proliferation. However, stationary applications are projected to maintain higher average selling prices and profit margins due to their specialized nature and higher performance requirements.

Mobile applications for Hall Effect sensors have seen particularly strong market traction, accounting for nearly 40% of the total market share. The automotive industry represents the largest consumer segment, where these sensors are extensively utilized in wheel speed detection, position sensing, and electronic throttle control systems. The average modern vehicle contains between 10-15 Hall Effect sensors, with premium models incorporating up to 25 units.

Stationary applications maintain significant market presence in industrial automation, where they command approximately 35% of market share. These installations primarily serve in position detection, speed monitoring, and current measurement applications. The industrial automation sector's continued expansion, growing at 7.5% annually, provides a stable demand foundation for stationary Hall Effect sensor implementations.

Consumer electronics represents the fastest-growing application segment for mobile Hall Effect sensors, with a CAGR of 12.3%. This surge is driven by increasing integration in smartphones, tablets, and wearable devices for functions like lid closure detection, screen rotation, and power management. Approximately 2.8 billion consumer electronic devices shipped in 2022 incorporated at least one Hall Effect sensor.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for 45% of global consumption, followed by North America (28%) and Europe (20%). China and South Korea lead manufacturing capacity, while Germany and the United States maintain technological innovation leadership, particularly in high-precision applications.

Price sensitivity varies significantly between application types. Mobile applications typically demand lower-cost sensors (average unit price: $0.50-$2.00) produced at high volume, while stationary industrial applications often utilize higher-precision, more robust sensors commanding premium prices ($5.00-$25.00 per unit).

Market forecasts indicate that mobile applications will continue outpacing stationary implementations in growth rate (10.2% vs. 7.1% CAGR), driven by expanding IoT ecosystems and smart device proliferation. However, stationary applications are projected to maintain higher average selling prices and profit margins due to their specialized nature and higher performance requirements.

Technical Challenges in Mobile vs Stationary Implementations

The implementation of Hall effect sensors in mobile versus stationary applications presents distinct technical challenges that significantly impact their performance, reliability, and application scope. Mobile implementations face severe environmental constraints not encountered in stationary settings, primarily due to constant movement and exposure to varying conditions.

In mobile applications, Hall effect sensors must withstand continuous vibration and mechanical shock that can affect sensor alignment and calibration. These vibrations, particularly in automotive or industrial mobile equipment, can reach frequencies that interfere with sensor readings or cause premature component fatigue. Stationary implementations, while not immune to vibration, typically experience more predictable and controllable mechanical stresses.

Temperature variation poses another critical challenge for mobile sensors. As mobile equipment moves between different environments, sensors may experience rapid temperature fluctuations that can cause thermal expansion, drift in calibration, and changes in magnetic field strength detection. Stationary sensors generally operate within more consistent thermal environments, allowing for more stable calibration and performance.

Power management represents a significant technical hurdle for mobile implementations. Many mobile applications rely on battery power or limited energy sources, requiring Hall effect sensors with extremely low power consumption profiles. This constraint often necessitates compromises in sampling rates, resolution, or signal processing capabilities. Stationary implementations typically have access to consistent power supplies, enabling more sophisticated signal processing and higher performance specifications.

Electromagnetic interference (EMI) presents varying challenges across both implementations. Mobile sensors frequently operate near motors, alternators, or other electromagnetic field generators that change position relative to the sensor. This dynamic EMI environment requires more robust shielding and filtering solutions compared to stationary applications where interference sources are fixed and can be more effectively isolated or compensated for.

Size and weight constraints are particularly demanding in mobile applications. Modern mobile equipment designs prioritize miniaturization and weight reduction, forcing sensor manufacturers to develop increasingly compact solutions without compromising performance. This miniaturization often leads to challenges in thermal management and magnetic field isolation that are less pronounced in stationary implementations.

Signal processing requirements also differ significantly. Mobile applications typically require real-time processing capabilities to compensate for movement-induced variations and environmental changes. This necessitates more sophisticated algorithms and often on-board processing capabilities. Stationary implementations can sometimes leverage centralized processing systems with greater computational resources, enabling more complex signal analysis and higher precision.

Durability and reliability standards diverge substantially between the two implementation types. Mobile sensors must maintain calibration and performance despite constant movement, exposure to elements, and potential impacts. This necessitates more robust encapsulation, specialized mounting solutions, and extensive environmental testing that may not be necessary for controlled-environment stationary applications.

In mobile applications, Hall effect sensors must withstand continuous vibration and mechanical shock that can affect sensor alignment and calibration. These vibrations, particularly in automotive or industrial mobile equipment, can reach frequencies that interfere with sensor readings or cause premature component fatigue. Stationary implementations, while not immune to vibration, typically experience more predictable and controllable mechanical stresses.

Temperature variation poses another critical challenge for mobile sensors. As mobile equipment moves between different environments, sensors may experience rapid temperature fluctuations that can cause thermal expansion, drift in calibration, and changes in magnetic field strength detection. Stationary sensors generally operate within more consistent thermal environments, allowing for more stable calibration and performance.

Power management represents a significant technical hurdle for mobile implementations. Many mobile applications rely on battery power or limited energy sources, requiring Hall effect sensors with extremely low power consumption profiles. This constraint often necessitates compromises in sampling rates, resolution, or signal processing capabilities. Stationary implementations typically have access to consistent power supplies, enabling more sophisticated signal processing and higher performance specifications.

Electromagnetic interference (EMI) presents varying challenges across both implementations. Mobile sensors frequently operate near motors, alternators, or other electromagnetic field generators that change position relative to the sensor. This dynamic EMI environment requires more robust shielding and filtering solutions compared to stationary applications where interference sources are fixed and can be more effectively isolated or compensated for.

Size and weight constraints are particularly demanding in mobile applications. Modern mobile equipment designs prioritize miniaturization and weight reduction, forcing sensor manufacturers to develop increasingly compact solutions without compromising performance. This miniaturization often leads to challenges in thermal management and magnetic field isolation that are less pronounced in stationary implementations.

Signal processing requirements also differ significantly. Mobile applications typically require real-time processing capabilities to compensate for movement-induced variations and environmental changes. This necessitates more sophisticated algorithms and often on-board processing capabilities. Stationary implementations can sometimes leverage centralized processing systems with greater computational resources, enabling more complex signal analysis and higher precision.

Durability and reliability standards diverge substantially between the two implementation types. Mobile sensors must maintain calibration and performance despite constant movement, exposure to elements, and potential impacts. This necessitates more robust encapsulation, specialized mounting solutions, and extensive environmental testing that may not be necessary for controlled-environment stationary applications.

Current Mobile and Stationary Sensing Solutions

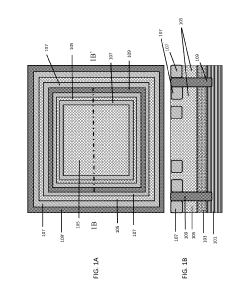

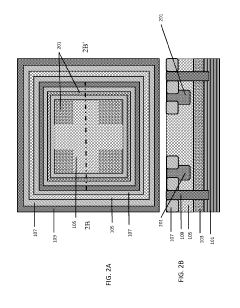

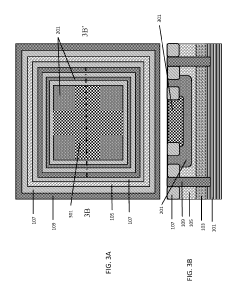

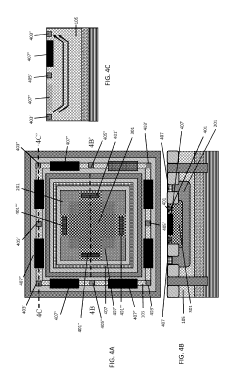

01 Hall Effect Sensor Design and Structure

Hall effect sensors are designed with specific structures to optimize their performance. These designs include various semiconductor materials, layering techniques, and geometric configurations that enhance sensitivity and reduce noise. The structure often incorporates magnetic field concentrators and specialized packaging to protect the sensing element while allowing efficient magnetic field interaction.- Hall Effect Sensor Design and Structure: Hall effect sensors are semiconductor devices that detect magnetic fields and convert them into measurable electrical signals. The basic structure includes a semiconductor material with current flowing through it, which when exposed to a magnetic field perpendicular to the current flow, generates a voltage across the material due to the Lorentz force. Various design improvements focus on enhancing sensitivity, reducing size, and improving integration with other electronic components.

- Magnetic Field Detection and Measurement Applications: Hall effect sensors are widely used for precise magnetic field detection and measurement in various applications. These sensors can detect the presence, strength, and direction of magnetic fields, making them suitable for position sensing, speed detection, and current measurement. Advanced implementations include linear and angular position sensing, proximity detection, and non-contact switching applications in automotive, industrial, and consumer electronics.

- Integrated Circuit Implementation and Signal Processing: Modern Hall effect sensors are often implemented as integrated circuits that combine the sensing element with signal conditioning circuitry. These integrated solutions include amplifiers, temperature compensation, voltage regulators, and digital signal processing capabilities. The integration enhances performance by improving signal-to-noise ratio, providing calibration features, and enabling digital output formats compatible with microcontrollers and other digital systems.

- Enhanced Sensitivity and Noise Reduction Techniques: Various techniques are employed to enhance the sensitivity of Hall effect sensors and reduce noise interference. These include chopper stabilization, spinning current techniques, and differential sensing arrangements. Advanced materials and fabrication methods are used to minimize temperature drift and offset voltage. These improvements allow for detection of weaker magnetic fields and operation in challenging environments with electromagnetic interference.

- Specialized Applications and System Integration: Hall effect sensors are adapted for specialized applications through custom packaging, materials, and system integration approaches. These include automotive applications like wheel speed sensing and throttle position detection, industrial applications such as motor control and current sensing, and consumer electronics applications including smartphones and appliances. The sensors are designed to meet specific requirements for temperature range, durability, power consumption, and interface compatibility with host systems.

02 Measurement and Detection Applications

Hall effect sensors are widely used for measurement and detection applications across various industries. They can detect position, proximity, speed, and rotation by measuring changes in magnetic fields. These sensors are implemented in automotive systems, industrial equipment, consumer electronics, and medical devices where non-contact sensing is required for reliability and longevity.Expand Specific Solutions03 Signal Processing and Conditioning

Advanced signal processing techniques are employed to enhance the performance of Hall effect sensors. These include amplification circuits, temperature compensation, offset cancellation, and digital signal processing algorithms. Such conditioning improves the sensor's accuracy, reduces drift, and enables operation in harsh environments with varying temperatures and electromagnetic interference.Expand Specific Solutions04 Integration with Other Technologies

Hall effect sensors are increasingly integrated with other technologies to create more sophisticated sensing systems. This includes combination with MEMS devices, integration into ICs, incorporation into IoT platforms, and fusion with other sensor types. Such integration enables multi-parameter sensing, reduced form factors, and enhanced functionality in complex applications.Expand Specific Solutions05 Power Efficiency and Miniaturization

Significant advancements have been made in improving the power efficiency and reducing the size of Hall effect sensors. These innovations include low-power operating modes, energy harvesting capabilities, and miniaturized designs that maintain sensitivity while consuming less power. Such developments are particularly important for battery-powered and space-constrained applications like wearable devices and automotive sensors.Expand Specific Solutions

Leading Hall Effect Sensor Manufacturers and Competitors

The Hall Effect sensor market is currently in a growth phase, with increasing applications across mobile and stationary implementations. The market is expanding rapidly due to rising demand in automotive, industrial, and consumer electronics sectors, projected to reach significant valuation in coming years. Technologically, established players like Infineon Technologies, Honeywell International, and Sensata Technologies lead with mature offerings, while companies such as CTS Corp. and Yamaha Motor are developing specialized applications. Emerging players like Nanjing Xinjie Zhongxu Microelectronics and CardiacSense are advancing innovative implementations in microelectronics and healthcare. The competitive landscape shows a blend of large industrial conglomerates and specialized sensor manufacturers competing across diverse application domains, with automotive and industrial sectors seeing the most intense competition.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed comprehensive Hall effect sensor solutions for both mobile and stationary applications. For mobile applications, they've created miniaturized sensors with enhanced power management capabilities that operate efficiently under 3V with current consumption as low as 1.8mA. Their mobile sensors feature integrated temperature compensation circuits that maintain accuracy across varying environmental conditions, crucial for automotive and portable device applications. For stationary applications, Honeywell offers high-precision industrial-grade sensors with enhanced stability features, capable of operating in harsh environments with temperatures ranging from -40°C to +150°C. Their stationary sensors provide digital output options with programmable thresholds and hysteresis settings, allowing for customized sensitivity in factory automation systems. Honeywell's dual-approach strategy addresses the distinct requirements of both application types while maintaining cross-compatibility where possible.

Strengths: Industry-leading temperature compensation technology provides exceptional stability across wide operating ranges. Comprehensive product portfolio addresses both mobile and stationary needs with optimized designs for each. Weaknesses: Higher cost compared to some competitors, particularly for simpler applications. Mobile solutions may have higher power consumption than some specialized competitors focused exclusively on low-power applications.

Infineon Technologies AG

Technical Solution: Infineon has pioneered differential Hall effect sensor technology that addresses the unique challenges of both mobile and stationary applications. For mobile applications, their TLE4966 series features ultra-low power consumption (typically 1.6mA) with integrated power management that extends battery life in portable devices. These sensors incorporate dynamic offset cancellation techniques that maintain measurement accuracy despite the vibration and movement inherent in mobile environments. For stationary applications, Infineon's TLE4997 industrial series offers enhanced EMC protection with up to 4kV ESD resistance and integrated diagnostic functions for predictive maintenance in factory settings. Their XENSIV™ Hall sensor portfolio includes specialized variants with programmable switching thresholds and temperature compensation circuits that maintain ±1% accuracy across the entire operating temperature range. Infineon's approach emphasizes scalable solutions that can be optimized for either mobile or stationary requirements while maintaining a common development framework.

Strengths: Superior EMC immunity makes their sensors ideal for electrically noisy environments. Advanced power management features in mobile sensors extend battery life significantly. Weaknesses: Higher implementation complexity requiring more sophisticated integration support. Some specialized mobile applications may require additional external components for optimal performance.

Key Patents and Innovations in Hall Effect Sensing

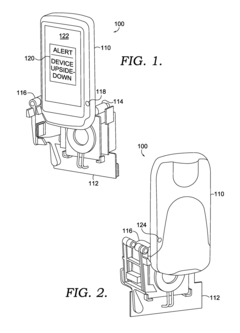

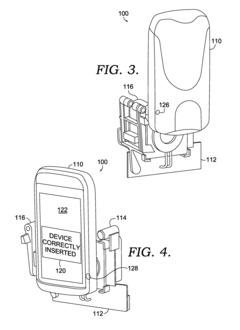

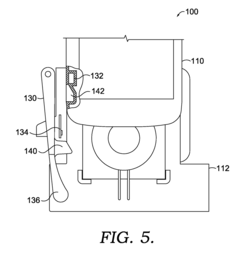

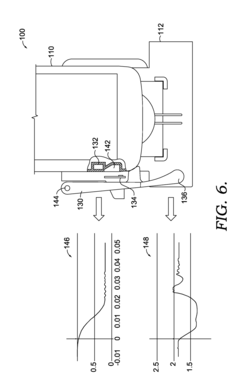

Using hall sensors to detect insertion and locking of a portable device in a base

PatentActiveUS20170176214A1

Innovation

- The use of Hall effect sensors, which respond to magnetic fields, is employed to detect the correct orientation and full insertion of portable devices into bases by generating voltage signals based on the proximity of magnets, allowing for contact-less detection and alerting mechanisms to ensure proper alignment and coupling.

Hall element for 3-d sensing and method for producing the same

PatentActiveUS20190259936A1

Innovation

- The development of a 3D Hall element with separate sensing for each magnetic field component, utilizing deep trench isolation (DTI) and shallow trench isolation (STI) regions, along with p-type and n-type wells, to optimize both planar and vertical Hall elements for improved sensitivity and reduced interference, compatible with CMOS technology nodes.

Environmental Impact and Sustainability Considerations

The environmental impact of Hall Effect sensors varies significantly between mobile and stationary applications, with each presenting distinct sustainability considerations. Mobile applications typically involve sensors integrated into vehicles, portable devices, and moving machinery, where power consumption becomes a critical factor. These sensors must operate efficiently to minimize battery drain and reduce the frequency of battery replacement or recharging, thereby decreasing electronic waste generation. The miniaturization trend in mobile Hall Effect sensors has led to reduced material usage per unit, though this often comes with more complex manufacturing processes that may involve rare earth elements and specialized materials.

Stationary Hall Effect sensor installations, while not constrained by the same power limitations, present different environmental challenges. These fixed installations often operate continuously for extended periods, making their cumulative energy consumption substantial despite lower instantaneous power requirements. However, they benefit from the possibility of direct connection to power grids, potentially allowing integration with renewable energy sources. The longer operational lifespan of stationary sensors—often exceeding a decade—represents a significant sustainability advantage by reducing replacement frequency and associated manufacturing impacts.

Manufacturing processes for both sensor types involve similar environmental considerations, including resource extraction, chemical processing, and electronic waste management. However, the end-of-life handling differs substantially. Mobile sensors, frequently embedded in consumer electronics or vehicles, often face challenges in proper recycling due to their integration with other components. Stationary sensors, being more accessible and discretely installed, typically allow for more straightforward recovery and recycling of valuable materials.

Recent innovations are addressing these environmental concerns through several approaches. Energy harvesting technologies are being developed to power mobile Hall Effect sensors using ambient vibrations, temperature differentials, or electromagnetic fields, potentially eliminating battery requirements altogether. Meanwhile, manufacturers are increasingly adopting design-for-disassembly principles, facilitating easier component separation and recycling. Bio-based substrates and lead-free soldering techniques are also emerging as more environmentally friendly alternatives in sensor production.

The carbon footprint comparison between mobile and stationary applications reveals interesting patterns. While mobile sensors may consume less energy individually, their production volumes are significantly higher, resulting in greater cumulative manufacturing impacts. Conversely, stationary sensors' environmental impact is dominated by operational energy consumption rather than production-related factors. This distinction highlights the importance of lifecycle assessment approaches when evaluating the environmental sustainability of different Hall Effect sensor applications.

Stationary Hall Effect sensor installations, while not constrained by the same power limitations, present different environmental challenges. These fixed installations often operate continuously for extended periods, making their cumulative energy consumption substantial despite lower instantaneous power requirements. However, they benefit from the possibility of direct connection to power grids, potentially allowing integration with renewable energy sources. The longer operational lifespan of stationary sensors—often exceeding a decade—represents a significant sustainability advantage by reducing replacement frequency and associated manufacturing impacts.

Manufacturing processes for both sensor types involve similar environmental considerations, including resource extraction, chemical processing, and electronic waste management. However, the end-of-life handling differs substantially. Mobile sensors, frequently embedded in consumer electronics or vehicles, often face challenges in proper recycling due to their integration with other components. Stationary sensors, being more accessible and discretely installed, typically allow for more straightforward recovery and recycling of valuable materials.

Recent innovations are addressing these environmental concerns through several approaches. Energy harvesting technologies are being developed to power mobile Hall Effect sensors using ambient vibrations, temperature differentials, or electromagnetic fields, potentially eliminating battery requirements altogether. Meanwhile, manufacturers are increasingly adopting design-for-disassembly principles, facilitating easier component separation and recycling. Bio-based substrates and lead-free soldering techniques are also emerging as more environmentally friendly alternatives in sensor production.

The carbon footprint comparison between mobile and stationary applications reveals interesting patterns. While mobile sensors may consume less energy individually, their production volumes are significantly higher, resulting in greater cumulative manufacturing impacts. Conversely, stationary sensors' environmental impact is dominated by operational energy consumption rather than production-related factors. This distinction highlights the importance of lifecycle assessment approaches when evaluating the environmental sustainability of different Hall Effect sensor applications.

Miniaturization Trends and Power Efficiency Advancements

The miniaturization of Hall effect sensors has accelerated dramatically over the past decade, with significant implications for both mobile and stationary applications. Modern Hall effect sensors have shrunk from traditional packages exceeding 5mm² to ultra-compact designs under 1mm², enabling integration into increasingly space-constrained devices. This miniaturization trend has been particularly beneficial for mobile applications, where every millimeter of space and milliwatt of power is critical.

In mobile applications such as smartphones, wearables, and portable medical devices, the reduced sensor footprint has enabled more sophisticated functionality without increasing device size. Manufacturers have achieved this miniaturization through advanced semiconductor processes, transitioning from older 180nm processes to cutting-edge 65nm and below, allowing for more efficient circuit designs with smaller die sizes.

Power efficiency advancements have paralleled these size reductions, with modern Hall effect sensors consuming microwatts rather than milliwatts in standby modes. This represents a critical evolution for battery-powered mobile applications, where sensor power consumption directly impacts device runtime. The introduction of intelligent power management features, such as programmable sampling rates and sleep modes, has further optimized energy usage in mobile implementations.

Stationary applications have benefited differently from these advancements. While size constraints may be less stringent in industrial equipment or automotive systems, the reduced power consumption has enabled new deployment scenarios, including energy harvesting configurations that eliminate battery replacement needs. Additionally, smaller sensor packages have allowed for higher density installations in complex machinery, improving measurement resolution and system reliability.

Recent innovations include the development of 3D Hall effect sensors that combine multiple sensing elements in a single package, maintaining a small footprint while providing multi-axis measurement capabilities. This has proven particularly valuable in mobile applications requiring orientation detection and gesture recognition, while also benefiting stationary applications through improved spatial awareness and measurement accuracy.

The convergence of MEMS technology with Hall effect sensing principles has further accelerated miniaturization, with some experimental designs achieving sub-millimeter dimensions. These ultra-compact sensors incorporate advanced signal processing directly within the sensor package, reducing external component requirements and overall system complexity while maintaining measurement precision across varying environmental conditions.

In mobile applications such as smartphones, wearables, and portable medical devices, the reduced sensor footprint has enabled more sophisticated functionality without increasing device size. Manufacturers have achieved this miniaturization through advanced semiconductor processes, transitioning from older 180nm processes to cutting-edge 65nm and below, allowing for more efficient circuit designs with smaller die sizes.

Power efficiency advancements have paralleled these size reductions, with modern Hall effect sensors consuming microwatts rather than milliwatts in standby modes. This represents a critical evolution for battery-powered mobile applications, where sensor power consumption directly impacts device runtime. The introduction of intelligent power management features, such as programmable sampling rates and sleep modes, has further optimized energy usage in mobile implementations.

Stationary applications have benefited differently from these advancements. While size constraints may be less stringent in industrial equipment or automotive systems, the reduced power consumption has enabled new deployment scenarios, including energy harvesting configurations that eliminate battery replacement needs. Additionally, smaller sensor packages have allowed for higher density installations in complex machinery, improving measurement resolution and system reliability.

Recent innovations include the development of 3D Hall effect sensors that combine multiple sensing elements in a single package, maintaining a small footprint while providing multi-axis measurement capabilities. This has proven particularly valuable in mobile applications requiring orientation detection and gesture recognition, while also benefiting stationary applications through improved spatial awareness and measurement accuracy.

The convergence of MEMS technology with Hall effect sensing principles has further accelerated miniaturization, with some experimental designs achieving sub-millimeter dimensions. These ultra-compact sensors incorporate advanced signal processing directly within the sensor package, reducing external component requirements and overall system complexity while maintaining measurement precision across varying environmental conditions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!