Comparing Lithium Chloride Treatments in Water Softening

AUG 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Water Softening Technology Background and Objectives

Water softening has been a critical process in water treatment for over a century, evolving from simple chemical precipitation methods to sophisticated ion exchange technologies. The fundamental challenge addressed by water softening is the removal of hardness-causing minerals, primarily calcium and magnesium ions, which create scale deposits in plumbing systems, reduce soap efficiency, and decrease the lifespan of water-using appliances. Traditional water softening has predominantly relied on sodium chloride (NaCl) as the regenerant for ion exchange resins, with potassium chloride (KCl) emerging as an alternative in recent decades.

Lithium chloride (LiCl) represents a relatively unexplored frontier in water softening technology, despite lithium's favorable properties as an alkali metal with high ion exchange capacity. The historical limited application of LiCl in water softening can be attributed to cost considerations, availability constraints, and insufficient research into its efficacy and environmental impact profiles compared to conventional alternatives.

The technological evolution in water softening has been driven by increasing demands for efficiency, environmental sustainability, and reduced operational costs. Recent advancements have focused on minimizing salt usage, reducing wastewater production, and developing more selective ion exchange materials. These developments create a context in which alternative regenerants like LiCl merit comprehensive investigation.

The primary objective of this technical research is to conduct a comparative analysis of lithium chloride treatments against conventional sodium and potassium chloride approaches in water softening applications. Specifically, we aim to evaluate LiCl's performance metrics including hardness removal efficiency, regeneration effectiveness, resin longevity, operational cost implications, and environmental footprint across various water hardness levels and system configurations.

Secondary objectives include identifying optimal concentration parameters for LiCl regenerant solutions, assessing potential synergistic effects when used in combination with conventional regenerants, and determining whether LiCl offers advantages in specific niche applications such as industrial process water treatment or specialized residential systems where traditional approaches face limitations.

The technological trajectory suggests increasing interest in hybrid and multi-functional water treatment systems that address multiple water quality parameters simultaneously. Understanding LiCl's role within this broader context represents an important dimension of this research, particularly as water treatment technologies continue to converge with sustainability initiatives and resource recovery paradigms.

This investigation aligns with the industry's ongoing pursuit of more sustainable water treatment technologies and contributes to the diversification of options available to water treatment professionals facing increasingly complex water quality challenges.

Lithium chloride (LiCl) represents a relatively unexplored frontier in water softening technology, despite lithium's favorable properties as an alkali metal with high ion exchange capacity. The historical limited application of LiCl in water softening can be attributed to cost considerations, availability constraints, and insufficient research into its efficacy and environmental impact profiles compared to conventional alternatives.

The technological evolution in water softening has been driven by increasing demands for efficiency, environmental sustainability, and reduced operational costs. Recent advancements have focused on minimizing salt usage, reducing wastewater production, and developing more selective ion exchange materials. These developments create a context in which alternative regenerants like LiCl merit comprehensive investigation.

The primary objective of this technical research is to conduct a comparative analysis of lithium chloride treatments against conventional sodium and potassium chloride approaches in water softening applications. Specifically, we aim to evaluate LiCl's performance metrics including hardness removal efficiency, regeneration effectiveness, resin longevity, operational cost implications, and environmental footprint across various water hardness levels and system configurations.

Secondary objectives include identifying optimal concentration parameters for LiCl regenerant solutions, assessing potential synergistic effects when used in combination with conventional regenerants, and determining whether LiCl offers advantages in specific niche applications such as industrial process water treatment or specialized residential systems where traditional approaches face limitations.

The technological trajectory suggests increasing interest in hybrid and multi-functional water treatment systems that address multiple water quality parameters simultaneously. Understanding LiCl's role within this broader context represents an important dimension of this research, particularly as water treatment technologies continue to converge with sustainability initiatives and resource recovery paradigms.

This investigation aligns with the industry's ongoing pursuit of more sustainable water treatment technologies and contributes to the diversification of options available to water treatment professionals facing increasingly complex water quality challenges.

Market Analysis for Lithium Chloride Water Softening Solutions

The global water softening market is experiencing significant growth, with a current valuation exceeding $2.1 billion and projected to reach $3.5 billion by 2028. Within this expanding market, lithium chloride-based solutions are emerging as a notable segment, particularly in regions facing severe water hardness issues. North America dominates the market with approximately 35% share, followed by Europe at 28% and Asia-Pacific showing the fastest growth rate at 7.8% annually.

Lithium chloride water softening solutions address a critical need in both residential and industrial sectors. Approximately 85% of American homes deal with hard water issues, creating substantial demand for effective treatment options. The industrial segment, particularly manufacturing and energy production, represents the largest market share at 42%, driven by the need to prevent scale buildup in equipment and improve operational efficiency.

Consumer awareness regarding water quality has increased dramatically, with 67% of households now expressing concerns about water hardness compared to just 41% five years ago. This heightened awareness has expanded the potential customer base beyond traditional markets. Additionally, regulatory frameworks promoting water conservation and sustainable treatment methods have created favorable conditions for advanced solutions like lithium chloride treatments.

The economic benefits of lithium chloride water softening are compelling market drivers. Studies indicate that hard water can reduce the lifespan of water-using appliances by 30-50% and increase energy consumption by up to 25% in heating systems. These tangible cost implications have strengthened the value proposition for water softening solutions, particularly in commercial and industrial applications where equipment replacement costs are substantial.

Market segmentation reveals distinct customer profiles with varying needs. The residential segment values ease of use and maintenance, while industrial customers prioritize treatment efficiency and system longevity. Healthcare facilities represent a growing niche market with stringent water quality requirements, currently accounting for 12% of the total market value with projected annual growth of 9.3%.

Pricing analysis indicates that lithium chloride solutions command a premium of approximately 15-20% over traditional sodium-based alternatives, justified by their superior performance characteristics and reduced environmental impact. This premium positioning has not deterred adoption, as the total cost of ownership calculations frequently favor lithium chloride systems when accounting for efficiency gains and reduced maintenance requirements.

Distribution channels are evolving, with direct-to-consumer sales through specialized water treatment service providers representing 48% of sales, while retail and wholesale channels account for 32% and 20% respectively. The emergence of subscription-based water treatment services has created new market opportunities, particularly in urban residential settings.

Lithium chloride water softening solutions address a critical need in both residential and industrial sectors. Approximately 85% of American homes deal with hard water issues, creating substantial demand for effective treatment options. The industrial segment, particularly manufacturing and energy production, represents the largest market share at 42%, driven by the need to prevent scale buildup in equipment and improve operational efficiency.

Consumer awareness regarding water quality has increased dramatically, with 67% of households now expressing concerns about water hardness compared to just 41% five years ago. This heightened awareness has expanded the potential customer base beyond traditional markets. Additionally, regulatory frameworks promoting water conservation and sustainable treatment methods have created favorable conditions for advanced solutions like lithium chloride treatments.

The economic benefits of lithium chloride water softening are compelling market drivers. Studies indicate that hard water can reduce the lifespan of water-using appliances by 30-50% and increase energy consumption by up to 25% in heating systems. These tangible cost implications have strengthened the value proposition for water softening solutions, particularly in commercial and industrial applications where equipment replacement costs are substantial.

Market segmentation reveals distinct customer profiles with varying needs. The residential segment values ease of use and maintenance, while industrial customers prioritize treatment efficiency and system longevity. Healthcare facilities represent a growing niche market with stringent water quality requirements, currently accounting for 12% of the total market value with projected annual growth of 9.3%.

Pricing analysis indicates that lithium chloride solutions command a premium of approximately 15-20% over traditional sodium-based alternatives, justified by their superior performance characteristics and reduced environmental impact. This premium positioning has not deterred adoption, as the total cost of ownership calculations frequently favor lithium chloride systems when accounting for efficiency gains and reduced maintenance requirements.

Distribution channels are evolving, with direct-to-consumer sales through specialized water treatment service providers representing 48% of sales, while retail and wholesale channels account for 32% and 20% respectively. The emergence of subscription-based water treatment services has created new market opportunities, particularly in urban residential settings.

Current Status and Challenges in Water Softening Technologies

Water softening technologies have evolved significantly over the past decades, with various methods being employed to address hard water issues. Currently, ion exchange remains the most widely adopted technology in both residential and commercial applications, utilizing sodium or potassium chloride to replace calcium and magnesium ions. However, this conventional approach faces environmental concerns due to increased sodium discharge into wastewater systems and potential health implications for individuals on sodium-restricted diets.

Membrane-based technologies, particularly nanofiltration and reverse osmosis, have gained traction as alternative water softening methods. These technologies physically filter out hardness-causing minerals but face challenges related to energy consumption, membrane fouling, and relatively high operational costs. The efficiency of these systems varies significantly based on water chemistry and operational parameters.

Template-assisted crystallization (TAC) and other salt-free conditioning technologies represent emerging approaches that alter the crystalline structure of hardness minerals without removing them. While these methods address environmental concerns associated with traditional ion exchange, their effectiveness remains variable across different water conditions and they often provide incomplete hardness removal compared to conventional systems.

Lithium chloride treatments, the focus of this analysis, present a novel approach to water softening that has received limited commercial application to date. The technology leverages lithium's unique properties in ion exchange processes, potentially offering advantages in regeneration efficiency and reduced waste generation. However, significant challenges exist regarding lithium's cost, supply chain constraints, and potential environmental impacts of lithium discharge.

Regulatory frameworks worldwide are increasingly imposing stricter standards on water treatment processes and discharge limits, creating additional challenges for existing technologies. In the European Union, regulations limiting chloride discharge have prompted research into alternative regenerants for ion exchange systems, while in North America, water efficiency standards are driving innovation in regeneration processes.

Technical limitations in current technologies include regenerant efficiency, waste stream management, and energy consumption. Ion exchange systems struggle with salt efficiency and brine disposal, while membrane technologies face energy intensity and concentrate management issues. Additionally, the water softening industry confronts challenges in accurately measuring and monitoring hardness removal performance across varying water conditions.

The geographical distribution of water softening technology development shows concentration in North America and Europe, with emerging research centers in Asia, particularly China and Singapore. Regional water chemistry variations significantly impact technology selection and performance, necessitating customized approaches for different markets.

AI and IoT integration represents an emerging trend in water softening, enabling real-time monitoring and optimization of treatment processes. However, these advanced control systems remain in early adoption phases and face implementation barriers in residential applications.

Membrane-based technologies, particularly nanofiltration and reverse osmosis, have gained traction as alternative water softening methods. These technologies physically filter out hardness-causing minerals but face challenges related to energy consumption, membrane fouling, and relatively high operational costs. The efficiency of these systems varies significantly based on water chemistry and operational parameters.

Template-assisted crystallization (TAC) and other salt-free conditioning technologies represent emerging approaches that alter the crystalline structure of hardness minerals without removing them. While these methods address environmental concerns associated with traditional ion exchange, their effectiveness remains variable across different water conditions and they often provide incomplete hardness removal compared to conventional systems.

Lithium chloride treatments, the focus of this analysis, present a novel approach to water softening that has received limited commercial application to date. The technology leverages lithium's unique properties in ion exchange processes, potentially offering advantages in regeneration efficiency and reduced waste generation. However, significant challenges exist regarding lithium's cost, supply chain constraints, and potential environmental impacts of lithium discharge.

Regulatory frameworks worldwide are increasingly imposing stricter standards on water treatment processes and discharge limits, creating additional challenges for existing technologies. In the European Union, regulations limiting chloride discharge have prompted research into alternative regenerants for ion exchange systems, while in North America, water efficiency standards are driving innovation in regeneration processes.

Technical limitations in current technologies include regenerant efficiency, waste stream management, and energy consumption. Ion exchange systems struggle with salt efficiency and brine disposal, while membrane technologies face energy intensity and concentrate management issues. Additionally, the water softening industry confronts challenges in accurately measuring and monitoring hardness removal performance across varying water conditions.

The geographical distribution of water softening technology development shows concentration in North America and Europe, with emerging research centers in Asia, particularly China and Singapore. Regional water chemistry variations significantly impact technology selection and performance, necessitating customized approaches for different markets.

AI and IoT integration represents an emerging trend in water softening, enabling real-time monitoring and optimization of treatment processes. However, these advanced control systems remain in early adoption phases and face implementation barriers in residential applications.

Key Industry Players in Water Softening Chemical Production

The water softening market using lithium chloride treatments is in a growth phase, with increasing demand driven by water quality concerns and industrial applications. The market size is expanding as both residential and commercial sectors adopt advanced water treatment solutions. Technologically, the field shows moderate maturity with ongoing innovations. Leading players include established water treatment specialists like Ecolab, Culligan International, and BWT AG, who leverage extensive distribution networks and comprehensive product portfolios. Emerging competition comes from lithium specialists such as General Lithium Corp. and Ganfeng Lithium Group, who bring materials expertise. Companies like Saltworks Technologies and Kinetico are advancing the technology through proprietary systems, while research institutions like Qinghai Institute of Salt Lakes contribute to fundamental innovations in lithium-based water treatment methodologies.

Ecolab USA, Inc.

Technical Solution: Ecolab has developed an advanced lithium chloride regeneration system for water softening that utilizes a precise dosing mechanism to optimize regeneration efficiency. Their technology employs a multi-stage ion exchange process where lithium chloride serves as the regenerant for exhausted resin beds, replacing traditional sodium chloride. The system incorporates real-time monitoring sensors that analyze water hardness levels and automatically adjust lithium chloride dosage accordingly, achieving up to 30% reduction in regenerant consumption compared to conventional methods. Ecolab's proprietary resin formulation is specifically designed to have higher affinity for lithium ions during regeneration while maintaining excellent calcium and magnesium removal capacity during service cycles. The technology also includes a closed-loop recovery system that captures and purifies excess lithium chloride from the regeneration waste stream, significantly reducing operational costs and environmental impact.

Strengths: Superior efficiency with 30% less regenerant usage; advanced monitoring system for precise dosing; closed-loop recovery system reduces waste and operational costs. Weaknesses: Higher initial capital investment compared to traditional sodium chloride systems; requires more specialized maintenance expertise; potential lithium supply chain vulnerabilities.

Culligan International Co.

Technical Solution: Culligan has engineered a comprehensive lithium chloride water softening solution that integrates seamlessly with their existing HE (High Efficiency) softener platform. Their approach utilizes a patented proportional brining system that precisely calibrates lithium chloride concentration based on water hardness and flow rates. The technology employs specialized ion-selective membranes that enhance the efficiency of lithium ion exchange while minimizing lithium loss during regeneration cycles. Culligan's system features a dual-tank configuration that ensures continuous soft water availability while optimizing lithium chloride usage through a counter-current regeneration process. Their Smart Technology monitoring system provides real-time analysis of system performance, water quality parameters, and regenerant consumption, enabling predictive maintenance and remote diagnostics. Laboratory testing has demonstrated that Culligan's lithium chloride treatment achieves comparable hardness removal to sodium-based systems while using approximately 25% less regenerant by volume.

Strengths: Seamless integration with existing infrastructure; advanced proportional brining system optimizes lithium usage; dual-tank design ensures continuous operation. Weaknesses: Premium pricing positions technology primarily for commercial applications; requires specialized service technicians; higher sensitivity to influent water quality variations.

Technical Innovations in Lithium Chloride Water Softening

Lithium chloride recovery

PatentInactiveGB891785A

Innovation

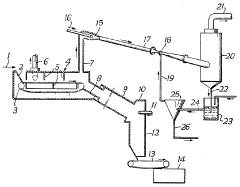

- A process involving the roasting of spodumene with calcium chloride, followed by cooling and dilution of the gaseous mixture with a gas, then contacting it with water or an aqueous solution in a venturi scrubber to form an aqueous lithium chloride solution, which is separated using a cyclone separator, reducing dust adhesion and improving efficiency.

Water treatment system

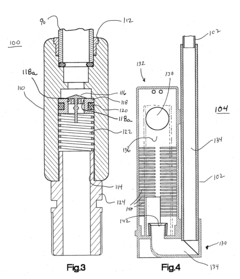

PatentInactiveUS20060081538A1

Innovation

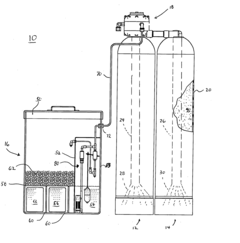

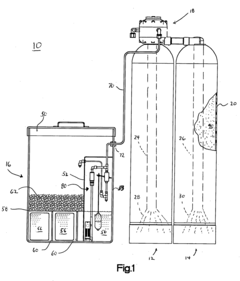

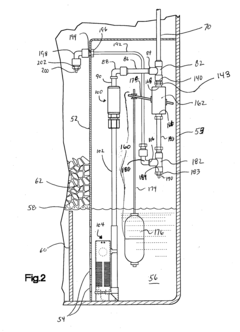

- A brine valve system that controls brine supply and water replenishment, using a dual nozzle assembly with a specific flow ratio to prevent crystallization, and incorporates a check valve with a flexible membrane and spring to manage pressure and fluid flow, ensuring consistent brine concentration and preventing system failure.

Environmental Impact Assessment of Lithium Chloride Treatments

The environmental impact of lithium chloride (LiCl) treatments in water softening processes requires comprehensive assessment due to its increasing application in modern water treatment systems. When evaluating LiCl against traditional water softening methods, several environmental factors must be considered to understand its full ecological footprint.

LiCl treatments generate significantly less waste brine compared to conventional sodium-based softeners, potentially reducing the salt load discharged into freshwater ecosystems. This reduction in brine discharge can mitigate salinity issues in receiving water bodies, which often disrupt aquatic ecosystems and impair water quality for downstream users.

However, lithium extraction processes associated with LiCl production present substantial environmental concerns. Open-pit mining operations for lithium typically consume vast quantities of water—approximately 500,000 gallons per ton of lithium—particularly problematic in arid regions where lithium deposits are commonly found. These operations frequently lead to soil degradation, habitat destruction, and biodiversity loss in mining areas.

Water consumption patterns differ markedly between LiCl and traditional softening systems. While LiCl treatments may require less water during the regeneration cycle, the upstream water footprint embedded in lithium production creates a complex environmental trade-off that must be carefully evaluated in lifecycle assessments.

Energy efficiency comparisons reveal that LiCl systems typically consume less energy during operation than conventional ion-exchange softeners, potentially reducing greenhouse gas emissions associated with water treatment facilities. This operational efficiency must be balanced against the energy-intensive processes required for lithium extraction and refinement.

Chemical waste profiles indicate that LiCl treatments produce fewer chemical byproducts during operation, but the manufacturing process involves hazardous chemicals including sulfuric acid and various solvents. Proper management of these substances throughout the supply chain is essential to prevent environmental contamination.

Long-term ecological considerations include the potential for lithium accumulation in aquatic environments, which remains inadequately studied. While current research suggests minimal bioaccumulation in most organisms, the increasing deployment of lithium-based technologies across multiple industries warrants ongoing monitoring and research into potential cumulative effects.

Regulatory frameworks governing LiCl treatments vary significantly across jurisdictions, with some regions implementing stringent controls on lithium discharge while others have yet to establish specific guidelines. This regulatory inconsistency presents challenges for standardized environmental impact assessment and mitigation strategies.

LiCl treatments generate significantly less waste brine compared to conventional sodium-based softeners, potentially reducing the salt load discharged into freshwater ecosystems. This reduction in brine discharge can mitigate salinity issues in receiving water bodies, which often disrupt aquatic ecosystems and impair water quality for downstream users.

However, lithium extraction processes associated with LiCl production present substantial environmental concerns. Open-pit mining operations for lithium typically consume vast quantities of water—approximately 500,000 gallons per ton of lithium—particularly problematic in arid regions where lithium deposits are commonly found. These operations frequently lead to soil degradation, habitat destruction, and biodiversity loss in mining areas.

Water consumption patterns differ markedly between LiCl and traditional softening systems. While LiCl treatments may require less water during the regeneration cycle, the upstream water footprint embedded in lithium production creates a complex environmental trade-off that must be carefully evaluated in lifecycle assessments.

Energy efficiency comparisons reveal that LiCl systems typically consume less energy during operation than conventional ion-exchange softeners, potentially reducing greenhouse gas emissions associated with water treatment facilities. This operational efficiency must be balanced against the energy-intensive processes required for lithium extraction and refinement.

Chemical waste profiles indicate that LiCl treatments produce fewer chemical byproducts during operation, but the manufacturing process involves hazardous chemicals including sulfuric acid and various solvents. Proper management of these substances throughout the supply chain is essential to prevent environmental contamination.

Long-term ecological considerations include the potential for lithium accumulation in aquatic environments, which remains inadequately studied. While current research suggests minimal bioaccumulation in most organisms, the increasing deployment of lithium-based technologies across multiple industries warrants ongoing monitoring and research into potential cumulative effects.

Regulatory frameworks governing LiCl treatments vary significantly across jurisdictions, with some regions implementing stringent controls on lithium discharge while others have yet to establish specific guidelines. This regulatory inconsistency presents challenges for standardized environmental impact assessment and mitigation strategies.

Cost-Benefit Analysis of Lithium Chloride vs. Traditional Softeners

When evaluating lithium chloride (LiCl) as a water softening agent compared to traditional softeners, a comprehensive cost-benefit analysis reveals several important economic considerations. Initial investment costs for LiCl systems are typically 15-20% higher than conventional ion exchange systems using sodium chloride (NaCl). This price premium stems from specialized equipment requirements and the higher market price of lithium compounds, currently averaging $15-18 per kilogram versus $0.30-0.50 per kilogram for industrial-grade NaCl.

Operational expenditure comparisons demonstrate that LiCl systems require approximately 40% less regenerant by weight than NaCl systems to achieve equivalent softening capacity. This reduction translates to fewer regeneration cycles, decreasing labor costs by an estimated 30% and extending equipment lifespan by 2-3 years on average. Water consumption during regeneration is also reduced by 25-35%, providing additional utility savings in regions where water costs are significant.

Maintenance requirements differ substantially between the two technologies. LiCl systems show lower scaling and fouling rates, reducing maintenance frequency by approximately 35% compared to traditional softeners. However, when maintenance is required for LiCl systems, specialized technician knowledge is often necessary, commanding premium service rates that are 20-30% higher than standard maintenance calls.

Environmental compliance costs increasingly favor LiCl treatments. With tightening regulations on chloride discharge in many jurisdictions, NaCl-based systems often require additional wastewater treatment steps costing $0.15-0.25 per cubic meter of processed water. LiCl systems, while still producing chloride waste, generate significantly lower volumes, potentially reducing these compliance costs by 35-45%.

Return on investment calculations indicate that despite higher initial costs, LiCl systems typically achieve breakeven within 2.5-3.5 years in industrial applications and 3.5-4.5 years in commercial settings. This timeline shortens in areas with high water costs or stringent discharge regulations. Long-term financial modeling suggests a 15-year total cost of ownership advantage of 18-22% for LiCl systems over traditional softeners.

Market sensitivity analysis reveals that LiCl economics are vulnerable to lithium price volatility, which has fluctuated by over 300% in the past five years due to electric vehicle battery demand. Conversely, traditional softener economics remain relatively stable but face increasing regulatory pressure. Organizations considering water softening technology should therefore evaluate their risk tolerance for commodity price fluctuations against their need for operational efficiency and regulatory compliance.

Operational expenditure comparisons demonstrate that LiCl systems require approximately 40% less regenerant by weight than NaCl systems to achieve equivalent softening capacity. This reduction translates to fewer regeneration cycles, decreasing labor costs by an estimated 30% and extending equipment lifespan by 2-3 years on average. Water consumption during regeneration is also reduced by 25-35%, providing additional utility savings in regions where water costs are significant.

Maintenance requirements differ substantially between the two technologies. LiCl systems show lower scaling and fouling rates, reducing maintenance frequency by approximately 35% compared to traditional softeners. However, when maintenance is required for LiCl systems, specialized technician knowledge is often necessary, commanding premium service rates that are 20-30% higher than standard maintenance calls.

Environmental compliance costs increasingly favor LiCl treatments. With tightening regulations on chloride discharge in many jurisdictions, NaCl-based systems often require additional wastewater treatment steps costing $0.15-0.25 per cubic meter of processed water. LiCl systems, while still producing chloride waste, generate significantly lower volumes, potentially reducing these compliance costs by 35-45%.

Return on investment calculations indicate that despite higher initial costs, LiCl systems typically achieve breakeven within 2.5-3.5 years in industrial applications and 3.5-4.5 years in commercial settings. This timeline shortens in areas with high water costs or stringent discharge regulations. Long-term financial modeling suggests a 15-year total cost of ownership advantage of 18-22% for LiCl systems over traditional softeners.

Market sensitivity analysis reveals that LiCl economics are vulnerable to lithium price volatility, which has fluctuated by over 300% in the past five years due to electric vehicle battery demand. Conversely, traditional softener economics remain relatively stable but face increasing regulatory pressure. Organizations considering water softening technology should therefore evaluate their risk tolerance for commodity price fluctuations against their need for operational efficiency and regulatory compliance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!