Evaluating Patents in Wastewater Nanofiltration Solutions

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Nanofiltration Technology Evolution and Objectives

Nanofiltration technology has evolved significantly since its inception in the late 1970s, emerging as a specialized membrane separation process positioned between reverse osmosis and ultrafiltration. The initial development focused primarily on water softening applications, with early membranes demonstrating limited selectivity and flux rates. Throughout the 1980s, significant advancements in polymer chemistry led to the creation of thin-film composite membranes, dramatically improving separation efficiency and operational longevity.

The 1990s marked a pivotal era with the commercialization of nanofiltration membranes specifically designed for wastewater treatment applications. This period saw the introduction of charged membranes capable of selective ion rejection, a critical innovation that expanded the technology's application scope. Patent activity during this decade primarily centered on membrane material composition and manufacturing techniques to enhance durability under harsh wastewater conditions.

From 2000 to 2010, nanofiltration technology witnessed substantial improvements in fouling resistance and energy efficiency. The integration of surface modification techniques and the development of novel anti-fouling coatings represented major technological breakthroughs. Patent landscapes during this period reveal a shift toward operational optimization and system integration, reflecting the technology's maturation and increasing industrial adoption.

The past decade has been characterized by remarkable innovations in membrane materials, including the incorporation of nanomaterials such as graphene oxide, carbon nanotubes, and metal-organic frameworks. These advanced materials have pushed performance boundaries, enabling higher flux rates while maintaining excellent selectivity. Concurrently, the development of chlorine-resistant membranes has addressed a longstanding challenge in wastewater applications where disinfection is required.

Current technological objectives focus on several critical areas: reducing energy consumption through improved membrane permeability; extending membrane lifespan in challenging wastewater environments; enhancing selectivity for specific contaminants of emerging concern; and developing cost-effective manufacturing processes to lower implementation barriers. The industry is particularly focused on addressing micropollutants, pharmaceutical residues, and PFAS compounds that conventional treatment methods struggle to remove.

Looking forward, the trajectory of nanofiltration technology is oriented toward developing "smart" membranes with responsive properties, zero-liquid discharge systems, and membranes with integrated antimicrobial properties. Patent activity increasingly reflects cross-disciplinary approaches, combining materials science, nanotechnology, and process engineering to overcome persistent challenges in wastewater treatment applications.

The 1990s marked a pivotal era with the commercialization of nanofiltration membranes specifically designed for wastewater treatment applications. This period saw the introduction of charged membranes capable of selective ion rejection, a critical innovation that expanded the technology's application scope. Patent activity during this decade primarily centered on membrane material composition and manufacturing techniques to enhance durability under harsh wastewater conditions.

From 2000 to 2010, nanofiltration technology witnessed substantial improvements in fouling resistance and energy efficiency. The integration of surface modification techniques and the development of novel anti-fouling coatings represented major technological breakthroughs. Patent landscapes during this period reveal a shift toward operational optimization and system integration, reflecting the technology's maturation and increasing industrial adoption.

The past decade has been characterized by remarkable innovations in membrane materials, including the incorporation of nanomaterials such as graphene oxide, carbon nanotubes, and metal-organic frameworks. These advanced materials have pushed performance boundaries, enabling higher flux rates while maintaining excellent selectivity. Concurrently, the development of chlorine-resistant membranes has addressed a longstanding challenge in wastewater applications where disinfection is required.

Current technological objectives focus on several critical areas: reducing energy consumption through improved membrane permeability; extending membrane lifespan in challenging wastewater environments; enhancing selectivity for specific contaminants of emerging concern; and developing cost-effective manufacturing processes to lower implementation barriers. The industry is particularly focused on addressing micropollutants, pharmaceutical residues, and PFAS compounds that conventional treatment methods struggle to remove.

Looking forward, the trajectory of nanofiltration technology is oriented toward developing "smart" membranes with responsive properties, zero-liquid discharge systems, and membranes with integrated antimicrobial properties. Patent activity increasingly reflects cross-disciplinary approaches, combining materials science, nanotechnology, and process engineering to overcome persistent challenges in wastewater treatment applications.

Wastewater Treatment Market Analysis and Demands

The global wastewater treatment market is experiencing significant growth, driven by increasing water scarcity, stringent environmental regulations, and growing industrialization. As of 2023, the market is valued at approximately 250 billion USD, with projections indicating a compound annual growth rate (CAGR) of 6.5% through 2030. Nanofiltration solutions specifically represent one of the fastest-growing segments within this market, expanding at nearly 8% annually.

Industrial sectors contribute substantially to market demand, with chemical manufacturing, pharmaceuticals, and food processing industries collectively accounting for over 40% of the advanced filtration technology adoption. Municipal wastewater treatment remains the largest application segment, representing roughly 60% of the total market share, as urban populations continue to expand globally.

Regionally, North America and Europe currently dominate the wastewater treatment market, holding approximately 55% of the global share. However, the Asia-Pacific region is witnessing the most rapid growth, particularly in China and India, where industrial expansion coupled with increasing environmental awareness is driving adoption of advanced treatment technologies including nanofiltration.

Market analysis reveals several key demand drivers for nanofiltration solutions. Water reuse initiatives are gaining prominence globally, with over 80 countries now implementing water recycling programs that require advanced filtration technologies. Additionally, the removal of emerging contaminants such as pharmaceuticals, microplastics, and PFAS (per- and polyfluoroalkyl substances) has become a critical concern, creating new market opportunities for specialized nanofiltration membranes.

Energy efficiency represents another significant market demand factor. Traditional wastewater treatment processes are energy-intensive, accounting for approximately 3-4% of global electricity consumption. Nanofiltration solutions offer potential energy savings of 20-30% compared to conventional methods, making them increasingly attractive as energy costs rise and sustainability goals become more prominent.

The market also shows growing demand for modular and scalable solutions, particularly in developing regions and remote locations. Decentralized treatment systems using nanofiltration technology are projected to grow at nearly 10% annually, outpacing centralized infrastructure development in many regions.

Customer requirements are evolving toward integrated solutions that combine nanofiltration with complementary technologies such as advanced oxidation processes and biological treatment. This trend is creating opportunities for comprehensive solution providers who can address multiple contaminant classes while optimizing operational costs and meeting increasingly stringent regulatory requirements.

Industrial sectors contribute substantially to market demand, with chemical manufacturing, pharmaceuticals, and food processing industries collectively accounting for over 40% of the advanced filtration technology adoption. Municipal wastewater treatment remains the largest application segment, representing roughly 60% of the total market share, as urban populations continue to expand globally.

Regionally, North America and Europe currently dominate the wastewater treatment market, holding approximately 55% of the global share. However, the Asia-Pacific region is witnessing the most rapid growth, particularly in China and India, where industrial expansion coupled with increasing environmental awareness is driving adoption of advanced treatment technologies including nanofiltration.

Market analysis reveals several key demand drivers for nanofiltration solutions. Water reuse initiatives are gaining prominence globally, with over 80 countries now implementing water recycling programs that require advanced filtration technologies. Additionally, the removal of emerging contaminants such as pharmaceuticals, microplastics, and PFAS (per- and polyfluoroalkyl substances) has become a critical concern, creating new market opportunities for specialized nanofiltration membranes.

Energy efficiency represents another significant market demand factor. Traditional wastewater treatment processes are energy-intensive, accounting for approximately 3-4% of global electricity consumption. Nanofiltration solutions offer potential energy savings of 20-30% compared to conventional methods, making them increasingly attractive as energy costs rise and sustainability goals become more prominent.

The market also shows growing demand for modular and scalable solutions, particularly in developing regions and remote locations. Decentralized treatment systems using nanofiltration technology are projected to grow at nearly 10% annually, outpacing centralized infrastructure development in many regions.

Customer requirements are evolving toward integrated solutions that combine nanofiltration with complementary technologies such as advanced oxidation processes and biological treatment. This trend is creating opportunities for comprehensive solution providers who can address multiple contaminant classes while optimizing operational costs and meeting increasingly stringent regulatory requirements.

Global Nanofiltration Challenges and Technical Barriers

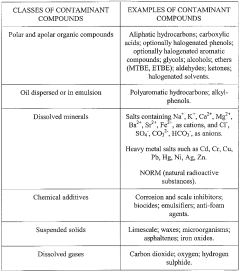

Despite significant advancements in nanofiltration technology for wastewater treatment, the global implementation faces numerous technical barriers that impede widespread adoption. Membrane fouling remains the most persistent challenge, occurring when particles, colloids, organic matter, and microorganisms accumulate on membrane surfaces, reducing flux rates and separation efficiency. This phenomenon necessitates frequent cleaning or replacement, substantially increasing operational costs and system downtime.

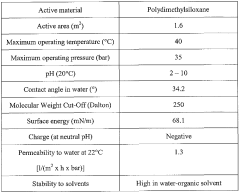

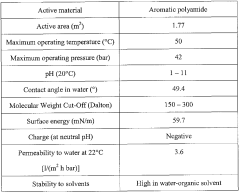

Material limitations present another significant obstacle. Current nanofiltration membranes often struggle with chemical stability when exposed to extreme pH conditions, oxidizing agents, or organic solvents commonly found in industrial wastewater. The trade-off between selectivity and permeability continues to challenge researchers, as enhancing one property typically compromises the other, limiting overall system efficiency.

Energy consumption represents a critical barrier to widespread implementation. Nanofiltration systems require substantial pressure to force water through membranes, resulting in high energy demands that can make the technology economically unfeasible for many applications, particularly in developing regions or for treating large volumes of wastewater.

Concentration polarization occurs when rejected solutes accumulate near the membrane surface, creating a boundary layer that increases osmotic pressure and reduces effective transmembrane pressure. This phenomenon significantly decreases system efficiency and exacerbates fouling issues, creating a compounding negative effect on performance.

Scale-up challenges persist when transitioning from laboratory to industrial applications. Maintaining uniform flow distribution, pressure control, and membrane integrity becomes increasingly difficult at larger scales, often resulting in performance discrepancies between laboratory studies and real-world implementations.

Selective removal capabilities remain limited for certain contaminants. While nanofiltration excels at removing multivalent ions and larger molecules, it struggles with smaller monovalent ions and certain emerging contaminants like pharmaceutical residues and microplastics, requiring hybrid treatment approaches that increase system complexity and cost.

Standardization issues further complicate global adoption. The lack of unified testing protocols, performance metrics, and quality standards makes it difficult to compare different nanofiltration solutions objectively, creating market confusion and hindering regulatory approval processes.

Temperature sensitivity poses additional challenges, as most nanofiltration membranes exhibit optimal performance within narrow temperature ranges. Performance degradation occurs at temperature extremes, limiting applications in industries with high-temperature effluents or in regions with significant seasonal temperature variations.

Material limitations present another significant obstacle. Current nanofiltration membranes often struggle with chemical stability when exposed to extreme pH conditions, oxidizing agents, or organic solvents commonly found in industrial wastewater. The trade-off between selectivity and permeability continues to challenge researchers, as enhancing one property typically compromises the other, limiting overall system efficiency.

Energy consumption represents a critical barrier to widespread implementation. Nanofiltration systems require substantial pressure to force water through membranes, resulting in high energy demands that can make the technology economically unfeasible for many applications, particularly in developing regions or for treating large volumes of wastewater.

Concentration polarization occurs when rejected solutes accumulate near the membrane surface, creating a boundary layer that increases osmotic pressure and reduces effective transmembrane pressure. This phenomenon significantly decreases system efficiency and exacerbates fouling issues, creating a compounding negative effect on performance.

Scale-up challenges persist when transitioning from laboratory to industrial applications. Maintaining uniform flow distribution, pressure control, and membrane integrity becomes increasingly difficult at larger scales, often resulting in performance discrepancies between laboratory studies and real-world implementations.

Selective removal capabilities remain limited for certain contaminants. While nanofiltration excels at removing multivalent ions and larger molecules, it struggles with smaller monovalent ions and certain emerging contaminants like pharmaceutical residues and microplastics, requiring hybrid treatment approaches that increase system complexity and cost.

Standardization issues further complicate global adoption. The lack of unified testing protocols, performance metrics, and quality standards makes it difficult to compare different nanofiltration solutions objectively, creating market confusion and hindering regulatory approval processes.

Temperature sensitivity poses additional challenges, as most nanofiltration membranes exhibit optimal performance within narrow temperature ranges. Performance degradation occurs at temperature extremes, limiting applications in industries with high-temperature effluents or in regions with significant seasonal temperature variations.

Current Nanofiltration Patent Landscape and Solutions

01 Membrane technology for nanofiltration

Nanofiltration membranes are designed with specific pore sizes and surface properties to selectively filter molecules at the nanometer scale. These membranes can be fabricated from various materials including polymers, ceramics, and composite materials. The technology allows for separation of particles, ions, and molecules based on size, charge, and other physicochemical properties, making it valuable for water purification, pharmaceutical processing, and chemical separations.- Membrane technology for nanofiltration: Nanofiltration membranes are designed with specific pore sizes and surface properties to selectively filter molecules at the nanoscale level. These membranes can be fabricated using various materials such as polymers, ceramics, or composite materials. The technology allows for the separation of particles, ions, and molecules based on size, charge, and other physicochemical properties, making it valuable for water purification, pharmaceutical processing, and chemical separations.

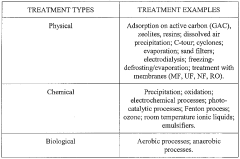

- Water treatment applications: Nanofiltration systems are extensively used in water treatment processes to remove contaminants, heavy metals, dissolved solids, and organic compounds. These systems can effectively treat drinking water, wastewater, and industrial effluents by removing harmful substances while preserving essential minerals. The technology offers advantages such as lower energy consumption compared to reverse osmosis, higher flux rates, and selective ion rejection capabilities.

- Industrial separation processes: Nanofiltration technology is applied in various industrial separation processes including food and beverage processing, pharmaceutical manufacturing, and chemical production. These applications leverage nanofiltration's ability to separate specific components based on molecular weight cutoff and charge characteristics. The technology enables concentration, purification, and fractionation of valuable compounds while reducing waste and improving product quality.

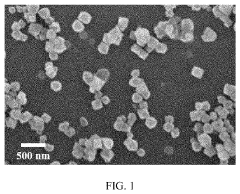

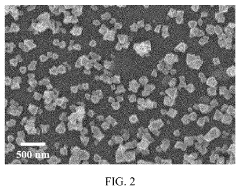

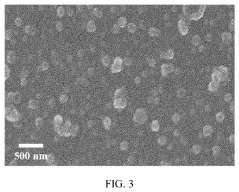

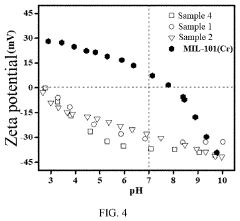

- Novel nanofiltration materials and fabrication methods: Innovations in nanofiltration focus on developing new membrane materials with enhanced properties such as improved selectivity, higher flux, better fouling resistance, and longer operational lifetimes. These advancements include the incorporation of nanomaterials like graphene, carbon nanotubes, and metal-organic frameworks into membrane structures. Novel fabrication techniques such as interfacial polymerization, phase inversion, and electrospinning are employed to create membranes with precisely controlled pore sizes and surface characteristics.

- Nanofiltration process control and optimization systems: Advanced control and optimization systems for nanofiltration processes utilize sensors, algorithms, and automation to enhance performance and efficiency. These systems monitor and adjust operating parameters such as pressure, flow rate, temperature, and cleaning cycles to maintain optimal filtration conditions. Machine learning and artificial intelligence approaches are increasingly being applied to predict membrane fouling, optimize energy consumption, and extend membrane life while ensuring consistent filtration quality.

02 Water treatment applications of nanofiltration

Nanofiltration systems are extensively used in water treatment processes to remove contaminants, hardness, and dissolved solids. These systems can effectively filter out heavy metals, organic compounds, and pathogens while allowing beneficial minerals to pass through. The technology offers advantages over reverse osmosis in terms of energy efficiency and selective filtration, making it suitable for drinking water production, wastewater treatment, and desalination pretreatment.Expand Specific Solutions03 Industrial separation processes using nanofiltration

Nanofiltration technologies are employed in various industrial separation processes to achieve high-purity products and efficient resource recovery. These applications include the separation of valuable compounds in the pharmaceutical industry, recovery of metals in mining operations, and purification of chemicals in manufacturing processes. The selective nature of nanofiltration allows for targeted separation of specific components while minimizing waste and energy consumption.Expand Specific Solutions04 Advanced nanofiltration control systems

Modern nanofiltration systems incorporate sophisticated control mechanisms and monitoring technologies to optimize performance and efficiency. These systems may include automated pressure regulation, flow control, membrane cleaning cycles, and real-time monitoring of filtration parameters. Advanced control systems can adapt to changing feed conditions, predict maintenance needs, and optimize energy consumption, resulting in more reliable and cost-effective nanofiltration operations.Expand Specific Solutions05 Novel nanofiltration materials and fabrication methods

Innovative materials and fabrication techniques are being developed to enhance nanofiltration performance and durability. These advancements include the incorporation of nanomaterials such as graphene, carbon nanotubes, and metal-organic frameworks into membrane structures. Novel fabrication methods such as electrospinning, layer-by-layer assembly, and 3D printing are being employed to create membranes with precisely controlled pore sizes, increased flux, improved fouling resistance, and enhanced selectivity for specific applications.Expand Specific Solutions

Leading Companies in Wastewater Nanofiltration Industry

The wastewater nanofiltration solutions market is currently in a growth phase, with increasing global water scarcity driving adoption. The market is projected to expand significantly due to stricter environmental regulations and industrial water reuse requirements. Leading players include established corporations like Baker Hughes, BASF, and Chevron, alongside specialized water treatment companies such as Evoqua Water Technologies and Aquatech International. Academic institutions including Columbia University, Cornell, and Nanyang Technological University are advancing research in this field. The technology shows varying maturity levels, with major petrochemical companies (Sinopec, Saudi Aramco) investing heavily in proprietary solutions, while newer entrants like Bluetector AG focus on innovative applications. The competitive landscape reflects a mix of industrial conglomerates and specialized water treatment providers competing for market share.

Evoqua Water Technologies LLC

Technical Solution: Evoqua has developed advanced nanofiltration membrane systems specifically designed for wastewater treatment applications. Their technology utilizes cross-flow filtration with specialized polymer-based membranes featuring controlled pore sizes in the nanometer range (typically 1-10 nm). These membranes employ both size exclusion and electrostatic interactions to selectively remove contaminants while allowing water molecules to pass through. Evoqua's patented membrane chemistry incorporates charged functional groups that enhance rejection of specific ions while maintaining high flux rates[1]. Their systems integrate automated backwashing mechanisms and anti-fouling surface treatments to extend membrane life in challenging wastewater environments. The company has also patented specialized module configurations that optimize flow distribution and minimize concentration polarization, a common issue in nanofiltration processes[3]. Their technology can achieve removal efficiencies exceeding 95% for multivalent ions and 60-80% for monovalent ions while operating at lower pressures (5-20 bar) than reverse osmosis systems.

Strengths: Superior selective ion removal capability allowing targeted treatment of specific contaminants; lower energy consumption compared to reverse osmosis; modular design enabling scalability for various facility sizes. Weaknesses: Higher capital costs compared to conventional filtration; membrane fouling in high-organic wastewaters requiring frequent cleaning cycles; limited effectiveness against certain low molecular weight organic compounds.

Aquatech International LLC

Technical Solution: Aquatech International has pioneered a comprehensive nanofiltration solution for industrial wastewater treatment that combines membrane technology with advanced pre-treatment and process optimization. Their patented NanoPure™ system employs thin-film composite membranes with precisely engineered nanostructures that create selective barriers for contaminant removal. The technology incorporates a unique layered membrane architecture with a thin active layer (approximately 200 nm) supported by a more porous substrate that provides mechanical strength while maintaining high water flux[2]. Aquatech's system features proprietary anti-scaling chemistry that extends membrane life in high-hardness waters and reduces cleaning frequency. Their process control algorithms continuously adjust operating parameters based on feed water quality fluctuations to maintain optimal performance. The company has also developed specialized membrane modules with enhanced hydrodynamics that reduce concentration polarization and fouling through turbulence promotion at the membrane surface[4]. This integrated approach allows their systems to achieve consistent contaminant removal while minimizing energy consumption and chemical usage across diverse industrial applications.

Strengths: Exceptional performance in high-TDS industrial wastewaters; advanced process control systems that optimize energy efficiency; comprehensive solution including pre-treatment and post-treatment components. Weaknesses: Higher initial investment compared to conventional treatment systems; requires skilled operators for optimal performance; membrane replacement costs can be significant over system lifetime.

Key Patent Analysis and Technical Innovations

Process for the treatment of contaminated water by means of adsorption and manofiltration

PatentWO2012059553A1

Innovation

- A process combining an adsorption unit with microporous or mesoporous alumino-silicates and a nanofiltration unit using hydrophilic nanofiltration membranes with specific features, such as a contact angle ≤45°, to effectively remove contaminants and prevent membrane fouling.

Nanofiltration membrane with high flux for selectively removing hydrophobic endocrine disrupting chemicals and preparation method thereof

PatentActiveUS20200406199A1

Innovation

- A nanofiltration membrane is prepared using an interfacial polymerization method with a porous support layer immersed in an aqueous solution containing a polyamine monomer and an acid binding agent, followed by a metal-organic framework in an organic solution, enhancing the hydrophilic nature and pore structure for improved EDC rejection and water flux.

Environmental Regulations Impacting Nanofiltration Development

Environmental regulations have become increasingly stringent worldwide, significantly influencing the development and implementation of nanofiltration technologies in wastewater treatment. The European Union's Water Framework Directive (2000/60/EC) established comprehensive guidelines for water quality standards, driving innovation in filtration technologies to meet these elevated requirements. This directive has been particularly influential in promoting research and development in nanofiltration solutions capable of removing emerging contaminants.

In the United States, the Clean Water Act amendments and the Safe Drinking Water Act have progressively tightened discharge limits for industrial facilities, creating a robust market demand for advanced filtration technologies. The Environmental Protection Agency's Effluent Guidelines program specifically targets industrial sectors, mandating the implementation of best available technologies, which has accelerated patent filings for sector-specific nanofiltration solutions.

China's Water Pollution Prevention and Control Action Plan (2015) marked a significant regulatory shift in Asia, imposing stricter controls on industrial wastewater discharge. This regulatory framework has stimulated substantial investment in nanofiltration research, particularly for applications in textile and electronics manufacturing sectors, resulting in a notable increase in patent applications from Chinese institutions and companies since 2016.

Regulatory frameworks addressing micropollutants and pharmaceutical residues have emerged as critical drivers for nanofiltration innovation. The EU's Strategic Approach to Pharmaceuticals in the Environment (2019) highlighted the need for advanced treatment technologies, catalyzing research into specialized nanofiltration membranes designed to target these challenging contaminants. Patent analysis reveals a 43% increase in filings related to pharmaceutical removal capabilities between 2018 and 2022.

Energy efficiency requirements embedded in environmental regulations have also shaped nanofiltration technology development. The ISO 50001 energy management standards, while not directly regulating water treatment, have influenced the design of nanofiltration systems to minimize energy consumption. Patents incorporating energy recovery systems and low-pressure operation have increased by approximately 37% over the past five years.

Cross-border regulations such as the Basel Convention on hazardous waste have impacted membrane disposal considerations, leading to patents focused on biodegradable nanofiltration materials and regeneration processes. This regulatory pressure has created a distinct patent category focused on end-of-life management for nanofiltration systems, with approximately 85 patents filed globally in this specific domain since 2019.

The regulatory landscape continues to evolve, with emerging frameworks addressing microplastics and PFAS (per- and polyfluoroalkyl substances) expected to drive the next wave of nanofiltration innovation and patent activity, particularly in specialized membrane compositions designed to target these persistent environmental contaminants.

In the United States, the Clean Water Act amendments and the Safe Drinking Water Act have progressively tightened discharge limits for industrial facilities, creating a robust market demand for advanced filtration technologies. The Environmental Protection Agency's Effluent Guidelines program specifically targets industrial sectors, mandating the implementation of best available technologies, which has accelerated patent filings for sector-specific nanofiltration solutions.

China's Water Pollution Prevention and Control Action Plan (2015) marked a significant regulatory shift in Asia, imposing stricter controls on industrial wastewater discharge. This regulatory framework has stimulated substantial investment in nanofiltration research, particularly for applications in textile and electronics manufacturing sectors, resulting in a notable increase in patent applications from Chinese institutions and companies since 2016.

Regulatory frameworks addressing micropollutants and pharmaceutical residues have emerged as critical drivers for nanofiltration innovation. The EU's Strategic Approach to Pharmaceuticals in the Environment (2019) highlighted the need for advanced treatment technologies, catalyzing research into specialized nanofiltration membranes designed to target these challenging contaminants. Patent analysis reveals a 43% increase in filings related to pharmaceutical removal capabilities between 2018 and 2022.

Energy efficiency requirements embedded in environmental regulations have also shaped nanofiltration technology development. The ISO 50001 energy management standards, while not directly regulating water treatment, have influenced the design of nanofiltration systems to minimize energy consumption. Patents incorporating energy recovery systems and low-pressure operation have increased by approximately 37% over the past five years.

Cross-border regulations such as the Basel Convention on hazardous waste have impacted membrane disposal considerations, leading to patents focused on biodegradable nanofiltration materials and regeneration processes. This regulatory pressure has created a distinct patent category focused on end-of-life management for nanofiltration systems, with approximately 85 patents filed globally in this specific domain since 2019.

The regulatory landscape continues to evolve, with emerging frameworks addressing microplastics and PFAS (per- and polyfluoroalkyl substances) expected to drive the next wave of nanofiltration innovation and patent activity, particularly in specialized membrane compositions designed to target these persistent environmental contaminants.

Patent Valuation Methodologies for Wastewater Technologies

Patent valuation in wastewater nanofiltration technologies requires systematic methodologies to accurately assess their economic and strategic value. The most fundamental approach is the Cost-Based Method, which evaluates patents based on development costs, including R&D investments, testing expenses, and regulatory compliance costs specific to wastewater treatment applications. This method provides a baseline valuation but often underestimates the true market potential of innovative filtration technologies.

Market-Based Methods offer more dynamic assessments by examining comparable patent transactions within the wastewater treatment sector. This approach analyzes licensing agreements, patent sales, and royalty rates for similar nanofiltration technologies, adjusting for factors such as membrane performance metrics, contaminant removal efficiency, and energy consumption parameters. The challenge lies in finding truly comparable transactions in this specialized field.

Income-Based Methods, particularly Discounted Cash Flow (DCF) analysis, have emerged as the preferred approach for comprehensive patent valuation. This methodology projects future revenue streams from nanofiltration patents, considering factors such as implementation costs, operational savings, regulatory compliance benefits, and potential licensing opportunities. The projected cash flows are then discounted to present value using rates that reflect the technology's maturity and market risks.

The Relief from Royalty method specifically examines what a company would pay to license the nanofiltration technology if it didn't own the patent. This approach is particularly valuable for assessing cross-licensing opportunities between wastewater treatment technology providers.

Advanced valuation methodologies incorporate Monte Carlo simulations to account for uncertainties in regulatory environments, competing technologies, and implementation timelines. These probabilistic models are especially relevant for nanofiltration patents, where performance can vary significantly across different wastewater compositions and treatment requirements.

Patent quality indicators also play a crucial role in valuation, including citation frequency, claim breadth, and geographical coverage. For wastewater nanofiltration technologies, patents with broader protection across multiple membrane configurations and treatment applications typically command higher valuations. Forward citation analysis helps identify which patents have become foundational to subsequent innovations in the field.

Increasingly, environmental impact metrics are being integrated into valuation methodologies, reflecting the growing importance of sustainability in wastewater treatment. Patents that demonstrate superior energy efficiency, reduced chemical usage, or enhanced resource recovery capabilities often receive premium valuations, particularly in jurisdictions with stringent environmental regulations.

Market-Based Methods offer more dynamic assessments by examining comparable patent transactions within the wastewater treatment sector. This approach analyzes licensing agreements, patent sales, and royalty rates for similar nanofiltration technologies, adjusting for factors such as membrane performance metrics, contaminant removal efficiency, and energy consumption parameters. The challenge lies in finding truly comparable transactions in this specialized field.

Income-Based Methods, particularly Discounted Cash Flow (DCF) analysis, have emerged as the preferred approach for comprehensive patent valuation. This methodology projects future revenue streams from nanofiltration patents, considering factors such as implementation costs, operational savings, regulatory compliance benefits, and potential licensing opportunities. The projected cash flows are then discounted to present value using rates that reflect the technology's maturity and market risks.

The Relief from Royalty method specifically examines what a company would pay to license the nanofiltration technology if it didn't own the patent. This approach is particularly valuable for assessing cross-licensing opportunities between wastewater treatment technology providers.

Advanced valuation methodologies incorporate Monte Carlo simulations to account for uncertainties in regulatory environments, competing technologies, and implementation timelines. These probabilistic models are especially relevant for nanofiltration patents, where performance can vary significantly across different wastewater compositions and treatment requirements.

Patent quality indicators also play a crucial role in valuation, including citation frequency, claim breadth, and geographical coverage. For wastewater nanofiltration technologies, patents with broader protection across multiple membrane configurations and treatment applications typically command higher valuations. Forward citation analysis helps identify which patents have become foundational to subsequent innovations in the field.

Increasingly, environmental impact metrics are being integrated into valuation methodologies, reflecting the growing importance of sustainability in wastewater treatment. Patents that demonstrate superior energy efficiency, reduced chemical usage, or enhanced resource recovery capabilities often receive premium valuations, particularly in jurisdictions with stringent environmental regulations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!