Evaluation of Solid sorbents for CO2 capture for cement, steel, and chemical industries

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Technology Evolution and Objectives

Carbon dioxide capture technologies have evolved significantly over the past decades, driven by the urgent need to mitigate greenhouse gas emissions and combat climate change. The journey began with conventional absorption-based technologies using liquid solvents such as monoethanolamine (MEA), which dominated the early landscape of CO2 capture. However, these technologies faced substantial challenges including high energy requirements for solvent regeneration, equipment corrosion, and solvent degradation issues.

The evolution progressed toward more efficient approaches, with solid sorbents emerging as a promising alternative around the early 2000s. These materials offered advantages such as lower regeneration energy, reduced corrosion problems, and potentially higher CO2 selectivity. The development trajectory has been marked by continuous improvements in sorbent formulations, moving from simple metal oxides to more sophisticated materials including zeolites, activated carbons, and metal-organic frameworks (MOFs).

A significant milestone occurred with the introduction of amine-functionalized solid sorbents, which combined the high selectivity of amines with the structural advantages of solid supports. This hybrid approach represented a crucial evolutionary step, addressing many limitations of traditional liquid amine systems while maintaining their high affinity for CO2.

Recent years have witnessed accelerated development in advanced materials science, particularly in the design of tailored porous structures with optimized surface chemistry for CO2 capture. The integration of nanotechnology has further expanded the possibilities, enabling precise control over material properties at the molecular level.

The primary objective of current research in solid sorbents for CO2 capture is to develop materials that can efficiently operate under the specific conditions prevalent in cement, steel, and chemical industries. These sectors present unique challenges due to their high-temperature processes, varying flue gas compositions, and substantial CO2 emission volumes. The technical goals include achieving high CO2 selectivity in the presence of other gases, maintaining structural stability under harsh industrial conditions, and ensuring rapid adsorption-desorption kinetics.

Another critical objective is reducing the overall energy penalty associated with carbon capture, which remains a significant barrier to widespread implementation. Research aims to develop sorbents with minimal regeneration energy requirements while maintaining high working capacities across multiple cycles. Additionally, there is a focus on materials that can be manufactured at scale using cost-effective processes, ensuring economic viability for industrial deployment.

The ultimate goal extends beyond mere technical performance to creating integrated systems that can be seamlessly retrofitted into existing industrial infrastructure, minimizing disruption to operations while maximizing carbon capture efficiency.

The evolution progressed toward more efficient approaches, with solid sorbents emerging as a promising alternative around the early 2000s. These materials offered advantages such as lower regeneration energy, reduced corrosion problems, and potentially higher CO2 selectivity. The development trajectory has been marked by continuous improvements in sorbent formulations, moving from simple metal oxides to more sophisticated materials including zeolites, activated carbons, and metal-organic frameworks (MOFs).

A significant milestone occurred with the introduction of amine-functionalized solid sorbents, which combined the high selectivity of amines with the structural advantages of solid supports. This hybrid approach represented a crucial evolutionary step, addressing many limitations of traditional liquid amine systems while maintaining their high affinity for CO2.

Recent years have witnessed accelerated development in advanced materials science, particularly in the design of tailored porous structures with optimized surface chemistry for CO2 capture. The integration of nanotechnology has further expanded the possibilities, enabling precise control over material properties at the molecular level.

The primary objective of current research in solid sorbents for CO2 capture is to develop materials that can efficiently operate under the specific conditions prevalent in cement, steel, and chemical industries. These sectors present unique challenges due to their high-temperature processes, varying flue gas compositions, and substantial CO2 emission volumes. The technical goals include achieving high CO2 selectivity in the presence of other gases, maintaining structural stability under harsh industrial conditions, and ensuring rapid adsorption-desorption kinetics.

Another critical objective is reducing the overall energy penalty associated with carbon capture, which remains a significant barrier to widespread implementation. Research aims to develop sorbents with minimal regeneration energy requirements while maintaining high working capacities across multiple cycles. Additionally, there is a focus on materials that can be manufactured at scale using cost-effective processes, ensuring economic viability for industrial deployment.

The ultimate goal extends beyond mere technical performance to creating integrated systems that can be seamlessly retrofitted into existing industrial infrastructure, minimizing disruption to operations while maximizing carbon capture efficiency.

Market Analysis for Industrial Carbon Capture Solutions

The global market for industrial carbon capture solutions is experiencing significant growth, driven by increasing regulatory pressures and corporate sustainability commitments. The cement, steel, and chemical industries collectively account for approximately 20% of global CO2 emissions, making them prime targets for carbon capture technologies. Current market valuations place the industrial carbon capture sector at $2.5 billion, with projections indicating expansion to $7 billion by 2030, representing a compound annual growth rate of 15.8%.

Solid sorbents for CO2 capture are gaining particular traction within these heavy industries due to their lower energy requirements compared to traditional liquid solvent systems. Market research indicates that solid sorbent technologies could reduce capture costs by 30-40% compared to first-generation amine scrubbing methods, presenting a compelling value proposition for industrial adopters.

Regional analysis reveals varying market dynamics, with Europe leading adoption due to stringent emissions regulations and carbon pricing mechanisms. The European Union's carbon price, currently exceeding €80 per ton, has created strong economic incentives for industrial decarbonization. North America follows with growing momentum, particularly as the U.S. Inflation Reduction Act provides tax credits of up to $85 per ton for carbon capture and storage.

Customer segmentation within these industries shows distinct needs and adoption patterns. Cement manufacturers, responsible for 8% of global CO2 emissions, are increasingly exploring solid sorbent solutions compatible with their high-temperature processes. Steel producers, contributing 7% of global emissions, seek technologies that can integrate with blast furnace operations without compromising production efficiency. Chemical manufacturers prioritize solutions that can selectively capture CO2 from mixed gas streams.

Market barriers include high capital expenditure requirements, with typical industrial-scale carbon capture installations costing between $100-500 million depending on capacity and integration complexity. Operational expenditures remain a concern, though solid sorbents offer potential advantages through reduced energy penalties and longer operational lifespans compared to liquid systems.

Demand forecasting indicates accelerating adoption rates as technology costs decline and regulatory pressures increase. By 2025, an estimated 40% of new cement and steel facilities in developed markets will incorporate carbon capture capabilities, with retrofit solutions gaining momentum in existing plants. The market for specialized solid sorbents optimized for specific industrial applications is expected to grow at 20% annually, outpacing the broader carbon capture market.

Solid sorbents for CO2 capture are gaining particular traction within these heavy industries due to their lower energy requirements compared to traditional liquid solvent systems. Market research indicates that solid sorbent technologies could reduce capture costs by 30-40% compared to first-generation amine scrubbing methods, presenting a compelling value proposition for industrial adopters.

Regional analysis reveals varying market dynamics, with Europe leading adoption due to stringent emissions regulations and carbon pricing mechanisms. The European Union's carbon price, currently exceeding €80 per ton, has created strong economic incentives for industrial decarbonization. North America follows with growing momentum, particularly as the U.S. Inflation Reduction Act provides tax credits of up to $85 per ton for carbon capture and storage.

Customer segmentation within these industries shows distinct needs and adoption patterns. Cement manufacturers, responsible for 8% of global CO2 emissions, are increasingly exploring solid sorbent solutions compatible with their high-temperature processes. Steel producers, contributing 7% of global emissions, seek technologies that can integrate with blast furnace operations without compromising production efficiency. Chemical manufacturers prioritize solutions that can selectively capture CO2 from mixed gas streams.

Market barriers include high capital expenditure requirements, with typical industrial-scale carbon capture installations costing between $100-500 million depending on capacity and integration complexity. Operational expenditures remain a concern, though solid sorbents offer potential advantages through reduced energy penalties and longer operational lifespans compared to liquid systems.

Demand forecasting indicates accelerating adoption rates as technology costs decline and regulatory pressures increase. By 2025, an estimated 40% of new cement and steel facilities in developed markets will incorporate carbon capture capabilities, with retrofit solutions gaining momentum in existing plants. The market for specialized solid sorbents optimized for specific industrial applications is expected to grow at 20% annually, outpacing the broader carbon capture market.

Solid Sorbents: Current Status and Technical Barriers

Solid sorbents have emerged as promising materials for CO2 capture across energy-intensive industries, offering potential advantages over conventional liquid amine-based systems. Currently, various classes of solid sorbents are being investigated, including activated carbons, zeolites, metal-organic frameworks (MOFs), hydrotalcites, and amine-functionalized silica. Each material class exhibits distinct adsorption mechanisms, capacities, and operational characteristics that determine their suitability for specific industrial applications.

The current technological landscape shows that while laboratory-scale research has demonstrated impressive CO2 capture performance for many solid sorbents, significant challenges remain in scaling these materials for industrial implementation. Zeolites and activated carbons have reached commercial maturity for some gas separation applications but face limitations in CO2 capture due to their sensitivity to moisture and relatively low CO2 selectivity under flue gas conditions typical in cement and steel production.

MOFs represent a newer class of materials with exceptional tunability and record-breaking CO2 capacities in laboratory settings. However, their industrial deployment is hindered by stability issues in the presence of water vapor, SOx, and NOx contaminants commonly found in industrial flue gases. Similarly, amine-functionalized sorbents offer high CO2 selectivity but suffer from degradation during multiple adsorption-desorption cycles.

A critical technical barrier across all solid sorbent technologies is the trade-off between adsorption capacity and regeneration energy. Materials with strong CO2 binding typically require higher energy inputs for regeneration, negatively impacting the overall energy efficiency of the capture process. This challenge is particularly acute for cement and steel industries, where energy costs significantly influence operational economics.

Heat management represents another substantial hurdle, as the exothermic nature of CO2 adsorption can lead to temperature increases that reduce working capacity. Conversely, the endothermic desorption process requires efficient heat transfer systems that are difficult to implement in large-scale solid sorbent beds.

Mechanical stability presents additional challenges, with many promising materials showing degradation through attrition, crushing, or chemical decomposition during cyclic operation. This is especially problematic in fluidized bed configurations being considered for large-scale implementation.

From a manufacturing perspective, the production of advanced sorbents like MOFs and functionalized materials at industrial scales remains costly and technically challenging. Current synthesis methods often involve expensive precursors and complex procedures that are difficult to scale while maintaining material performance and consistency.

The geographical distribution of solid sorbent research shows concentration in North America, Europe, and East Asia, with significant contributions from academic institutions and national laboratories. However, industrial adoption remains limited, highlighting the gap between laboratory innovation and commercial implementation in real-world industrial settings.

The current technological landscape shows that while laboratory-scale research has demonstrated impressive CO2 capture performance for many solid sorbents, significant challenges remain in scaling these materials for industrial implementation. Zeolites and activated carbons have reached commercial maturity for some gas separation applications but face limitations in CO2 capture due to their sensitivity to moisture and relatively low CO2 selectivity under flue gas conditions typical in cement and steel production.

MOFs represent a newer class of materials with exceptional tunability and record-breaking CO2 capacities in laboratory settings. However, their industrial deployment is hindered by stability issues in the presence of water vapor, SOx, and NOx contaminants commonly found in industrial flue gases. Similarly, amine-functionalized sorbents offer high CO2 selectivity but suffer from degradation during multiple adsorption-desorption cycles.

A critical technical barrier across all solid sorbent technologies is the trade-off between adsorption capacity and regeneration energy. Materials with strong CO2 binding typically require higher energy inputs for regeneration, negatively impacting the overall energy efficiency of the capture process. This challenge is particularly acute for cement and steel industries, where energy costs significantly influence operational economics.

Heat management represents another substantial hurdle, as the exothermic nature of CO2 adsorption can lead to temperature increases that reduce working capacity. Conversely, the endothermic desorption process requires efficient heat transfer systems that are difficult to implement in large-scale solid sorbent beds.

Mechanical stability presents additional challenges, with many promising materials showing degradation through attrition, crushing, or chemical decomposition during cyclic operation. This is especially problematic in fluidized bed configurations being considered for large-scale implementation.

From a manufacturing perspective, the production of advanced sorbents like MOFs and functionalized materials at industrial scales remains costly and technically challenging. Current synthesis methods often involve expensive precursors and complex procedures that are difficult to scale while maintaining material performance and consistency.

The geographical distribution of solid sorbent research shows concentration in North America, Europe, and East Asia, with significant contributions from academic institutions and national laboratories. However, industrial adoption remains limited, highlighting the gap between laboratory innovation and commercial implementation in real-world industrial settings.

Current Solid Sorbent Solutions for Industrial Applications

01 Metal-organic frameworks (MOFs) for CO2 capture

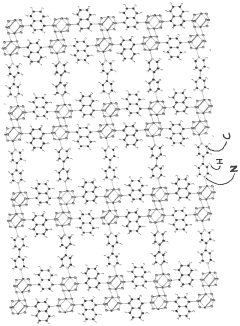

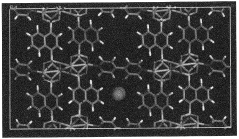

Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated with organic ligands. They have high surface areas, tunable pore sizes, and can be designed with specific functional groups to enhance CO2 adsorption capacity and selectivity. MOFs can be modified to improve their stability in humid conditions and can achieve rapid adsorption-desorption cycles, making them promising candidates for industrial CO2 capture applications.- Metal-organic frameworks (MOFs) for CO2 capture: Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated to organic ligands. They have high surface areas, tunable pore sizes, and can be functionalized to enhance CO2 selectivity and adsorption capacity. MOFs can be designed with specific metal centers and organic linkers to optimize CO2 capture performance under various conditions, making them promising candidates for carbon capture applications.

- Amine-functionalized solid sorbents: Amine-functionalized materials are effective CO2 sorbents due to the strong chemical interaction between amine groups and CO2 molecules. These sorbents can be prepared by grafting or impregnating various amine compounds onto porous supports such as silica, activated carbon, or polymeric materials. The amine groups form carbamates or bicarbonates with CO2, allowing for selective capture even at low CO2 concentrations. These materials can be regenerated through temperature or pressure swing processes.

- Zeolite-based CO2 adsorbents: Zeolites are crystalline aluminosilicate materials with well-defined pore structures that can selectively adsorb CO2. Their high thermal stability, chemical resistance, and tunable properties make them suitable for carbon capture applications. Zeolites can be modified through ion exchange, dealumination, or incorporation of functional groups to enhance CO2 selectivity and capacity. These materials are particularly effective for pressure swing adsorption systems and can be regenerated multiple times without significant performance degradation.

- Carbon-based sorbents for CO2 capture: Carbon-based materials such as activated carbon, carbon nanotubes, and graphene derivatives serve as effective CO2 adsorbents due to their high surface area, pore volume, and stability. These materials can be functionalized with nitrogen-containing groups or metal particles to enhance CO2 selectivity and adsorption capacity. Carbon-based sorbents are advantageous due to their low cost, availability, lightweight nature, and potential for regeneration through temperature or pressure swing processes.

- Alkali metal-based solid sorbents: Alkali metal-based sorbents, particularly those containing lithium, sodium, or potassium compounds, demonstrate high CO2 capture capacity through carbonation reactions. These materials include lithium silicates, sodium carbonates, and potassium-promoted oxides that form stable carbonates upon CO2 adsorption. The sorbents can operate at elevated temperatures, making them suitable for integration with high-temperature industrial processes. Regeneration typically occurs through temperature swing processes, where the carbonates decompose at higher temperatures to release concentrated CO2.

02 Amine-functionalized solid sorbents

Amine-functionalized materials represent a significant class of solid sorbents for CO2 capture. These materials incorporate various amine groups onto solid supports such as silica, alumina, or polymeric substrates. The amine groups react with CO2 through chemisorption, forming carbamates or bicarbonates. These sorbents typically offer high selectivity for CO2 over other gases and can operate effectively at moderate temperatures, though they may require higher regeneration energy compared to physical adsorbents.Expand Specific Solutions03 Zeolite-based CO2 capture materials

Zeolites are microporous aluminosilicate minerals with well-defined crystalline structures that make them effective for CO2 capture. Their molecular sieve properties allow for selective adsorption of CO2 from gas mixtures. Zeolites can be modified by ion exchange or impregnation with various metals to enhance their CO2 adsorption capacity and selectivity. These materials typically perform well at moderate temperatures and pressures but may be sensitive to moisture, which can reduce their CO2 capture efficiency.Expand Specific Solutions04 Carbon-based adsorbents for CO2 capture

Carbon-based materials such as activated carbon, carbon nanotubes, graphene, and carbon molecular sieves are widely used as CO2 adsorbents. These materials offer advantages including high surface area, hydrophobicity, good thermal stability, and relatively low cost. Carbon-based sorbents can be functionalized with nitrogen-containing groups or metal particles to enhance their CO2 capture performance. They typically operate through physical adsorption mechanisms and can be regenerated using pressure or temperature swing processes with relatively low energy requirements.Expand Specific Solutions05 Alkali metal-based solid sorbents

Alkali metal-based sorbents, particularly those containing lithium, sodium, or potassium compounds, are effective for high-temperature CO2 capture. These materials typically operate through carbonation reactions, forming stable carbonates when exposed to CO2. Common examples include lithium zirconate, lithium silicate, sodium carbonate, and potassium-promoted materials. These sorbents offer high CO2 selectivity and capacity at elevated temperatures (400-700°C), making them suitable for integration with high-temperature industrial processes such as pre-combustion capture or sorption-enhanced reforming.Expand Specific Solutions

Leading Organizations in Solid Sorbent Development

The solid sorbent CO2 capture market for industrial sectors is in a growth phase, with increasing market size driven by decarbonization imperatives in cement, steel, and chemical industries. The technology is advancing from early commercial to mature deployment stages, with varying degrees of readiness. Leading players include academic institutions (University of Southern California, Cornell University, Norwegian University of Science & Technology) conducting fundamental research, while commercial entities like Carboncapture, Climeworks, and Shell are scaling deployments. Major industrial corporations (Sinopec, KEPCO and its subsidiaries) are integrating capture technologies into existing operations. The competitive landscape features collaboration between research institutions and industry partners to accelerate technology commercialization and cost reduction for industrial-scale implementation.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a comprehensive solid sorbent technology platform for CO2 capture targeting high-emission industrial sectors. Their approach centers on hierarchically structured zeolite and carbon-based materials with tailored porosity and surface functionality. Sinopec's technology employs a vacuum-temperature swing adsorption (VTSA) process where specially formulated sorbents capture CO2 from flue gas streams at near-ambient temperatures, followed by regeneration under mild vacuum conditions and moderate heating. This dual-mode regeneration significantly reduces energy requirements to approximately 2.0-2.3 GJ/tonne CO2. The company has demonstrated this technology at multiple pilot facilities processing 1-5 tonnes of CO2 per day from various industrial sources including cement kilns and steel plants. Their sorbent materials feature innovative binder systems that enhance mechanical durability while maintaining high CO2 working capacity (>2.5 mmol/g) even after thousands of adsorption-desorption cycles[6][7]. Sinopec has integrated their solid sorbent technology with existing industrial processes to utilize waste heat for sorbent regeneration, improving overall energy efficiency. The company has reported capture costs of approximately $40-50 per tonne CO2, representing a 30-40% reduction compared to conventional amine scrubbing technologies when applied to cement and steel manufacturing.

Strengths: Significantly lower regeneration energy requirements; excellent sorbent stability and longevity; proven operation with actual industrial flue gases; cost-effective implementation through waste heat integration; established manufacturing capacity for sorbent materials. Weaknesses: Performance sensitivity to flue gas composition variations; requires careful process control to maintain optimal operation; vacuum systems add complexity and maintenance requirements; potential for dust contamination in cement and steel applications requiring additional filtration.

Cabot Corp.

Technical Solution: Cabot Corporation has developed specialized activated carbon and mesoporous silica-based solid sorbents for CO2 capture applications in industrial settings. Their technology leverages the company's expertise in carbon black and specialty materials to create highly engineered sorbents with optimized pore structure, surface area (exceeding 1,000 m²/g), and surface chemistry. Cabot's approach involves amine-functionalized mesoporous materials that combine high CO2 selectivity with rapid adsorption kinetics and good regenerability. The company has demonstrated a pressure/temperature swing adsorption process where their sorbents can achieve CO2 capture efficiencies of 80-90% from industrial flue gases with regeneration energy requirements of approximately 2.5-3.0 GJ/tonne CO2. Cabot's materials exhibit exceptional stability under the harsh conditions typical in cement and steel manufacturing, including tolerance to moisture, SOx, and NOx contaminants[5]. Their manufacturing capabilities allow for large-scale production of consistent sorbent materials, addressing a key challenge in commercializing solid sorbent technologies. Recent advancements include composite materials that incorporate heat-conducting elements to improve thermal management during regeneration cycles, reducing energy consumption and cycle times by approximately 20% compared to first-generation materials.

Strengths: Established manufacturing infrastructure for large-scale sorbent production; materials with high contaminant tolerance suitable for real industrial conditions; good mechanical stability reducing attrition losses; potential for integration with existing carbon capture equipment. Weaknesses: Higher production costs compared to conventional sorbents; regeneration still requires significant energy input; potential for pore blocking over extended operation in particulate-laden environments; limited field demonstration data in full-scale industrial settings.

Key Patents and Research in Advanced Sorbent Materials

Solid sorbents for capturing co 2

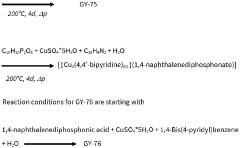

PatentWO2023232666A1

Innovation

- Development of phosphonate and organoarsonate MOFs with specific molecular formulas, such as [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediphosphonate)] and [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediarsonate)], which maintain selectivity and stability under harsh conditions, including high humidity and temperatures up to 360°C, by creating a hydrophobic environment that favors CO2 physisorption over H2O.

Layered solid sorbents for carbon dioxide capture

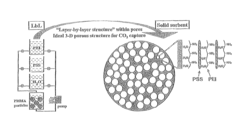

PatentActiveUS8889589B2

Innovation

- Development of nano-layered solid sorbents using electrostatic layer-by-layer nanoassembly, where positively charged polyethylenimine and negatively charged polystyrene sulfonate layers are alternately deposited on a porous substrate, enhancing CO2 capture and transport kinetics.

Industry-Specific Implementation Challenges

The implementation of solid sorbent technologies for CO2 capture faces distinct challenges across cement, steel, and chemical industries due to their unique operational environments and process requirements.

In the cement industry, integration of solid sorbent systems presents significant spatial constraints as existing facilities typically lack sufficient space for large-scale capture units. The high dust content in cement plant flue gases can lead to sorbent contamination and degradation, reducing operational efficiency and increasing maintenance frequency. Temperature management also poses a challenge, as the sorbent regeneration process must be carefully aligned with the cement kiln's thermal profile to optimize energy usage.

Steel manufacturing facilities encounter challenges related to the variable composition of off-gases from different production processes. Blast furnace gases contain lower CO2 concentrations compared to basic oxygen furnace emissions, requiring sorbents with different selectivity profiles. The presence of sulfur compounds and particulates in steel plant emissions can poison many solid sorbents, necessitating robust pre-treatment systems or specially designed sorbent materials with higher contaminant tolerance.

The chemical industry presents perhaps the most diverse implementation challenges due to the wide variety of processes and emission sources. Chemical plants often have complex, integrated heat management systems, making it difficult to efficiently incorporate the thermal requirements of sorbent regeneration. The presence of various chemical compounds in process streams can interfere with sorbent performance through competitive adsorption or irreversible chemical reactions with the sorbent material.

Across all three industries, retrofitting existing facilities with solid sorbent systems requires significant process modifications and potential production interruptions. The capital expenditure for such retrofits often exceeds that of greenfield implementations, creating economic barriers to adoption. Additionally, the energy penalty associated with sorbent regeneration impacts the overall efficiency and operating costs of these energy-intensive industries, which already operate on thin profit margins.

Scale-up challenges also persist across sectors, as laboratory and pilot-scale sorbent performance does not always translate directly to industrial-scale operations. Mechanical stability of sorbents under industrial conditions, including resistance to attrition in fluidized bed systems, remains a critical concern for long-term implementation viability.

In the cement industry, integration of solid sorbent systems presents significant spatial constraints as existing facilities typically lack sufficient space for large-scale capture units. The high dust content in cement plant flue gases can lead to sorbent contamination and degradation, reducing operational efficiency and increasing maintenance frequency. Temperature management also poses a challenge, as the sorbent regeneration process must be carefully aligned with the cement kiln's thermal profile to optimize energy usage.

Steel manufacturing facilities encounter challenges related to the variable composition of off-gases from different production processes. Blast furnace gases contain lower CO2 concentrations compared to basic oxygen furnace emissions, requiring sorbents with different selectivity profiles. The presence of sulfur compounds and particulates in steel plant emissions can poison many solid sorbents, necessitating robust pre-treatment systems or specially designed sorbent materials with higher contaminant tolerance.

The chemical industry presents perhaps the most diverse implementation challenges due to the wide variety of processes and emission sources. Chemical plants often have complex, integrated heat management systems, making it difficult to efficiently incorporate the thermal requirements of sorbent regeneration. The presence of various chemical compounds in process streams can interfere with sorbent performance through competitive adsorption or irreversible chemical reactions with the sorbent material.

Across all three industries, retrofitting existing facilities with solid sorbent systems requires significant process modifications and potential production interruptions. The capital expenditure for such retrofits often exceeds that of greenfield implementations, creating economic barriers to adoption. Additionally, the energy penalty associated with sorbent regeneration impacts the overall efficiency and operating costs of these energy-intensive industries, which already operate on thin profit margins.

Scale-up challenges also persist across sectors, as laboratory and pilot-scale sorbent performance does not always translate directly to industrial-scale operations. Mechanical stability of sorbents under industrial conditions, including resistance to attrition in fluidized bed systems, remains a critical concern for long-term implementation viability.

Economic Viability and Scaling Considerations

The economic viability of solid sorbents for CO2 capture in cement, steel, and chemical industries hinges on several critical factors. Initial capital expenditure for implementing solid sorbent technologies remains significantly high, with installation costs ranging from $50-150 million for medium-scale industrial applications. However, operational expenses show promising trends, with recent advancements reducing energy penalties by 15-25% compared to conventional amine scrubbing methods.

Cost-benefit analyses indicate that solid sorbent technologies become economically competitive when carbon prices exceed $40-60 per ton, depending on the specific industry and regional energy costs. Metal-organic frameworks (MOFs) and amine-functionalized materials demonstrate particularly favorable economics in long-term scenarios, with projected payback periods of 5-8 years under current carbon pricing trajectories in European markets.

Scaling considerations present both challenges and opportunities for widespread adoption. Laboratory-scale successes with novel sorbents often face significant hurdles during industrial scaling. Sorbent degradation rates increase under real-world conditions, with performance decreases of 2-5% per cycle observed in pilot plants compared to controlled laboratory environments. This necessitates more frequent replacement cycles, impacting operational economics.

Manufacturing capacity represents another critical scaling bottleneck. Current global production capabilities for advanced solid sorbents meet only approximately 5% of potential industrial demand. Significant investment in manufacturing infrastructure is required, with estimates suggesting $2-3 billion in capital investment needed to scale production to meet just 25% of potential industrial applications by 2030.

Integration with existing industrial infrastructure presents varying degrees of complexity across target industries. Cement plants offer relatively straightforward retrofit opportunities, with integration costs averaging $15-25 million per facility. Steel plants present moderate challenges, while chemical plants often require more extensive modifications costing $30-50 million per installation due to complex process integration requirements.

Economies of scale follow predictable patterns, with cost reductions of 15-20% achievable when scaling from pilot (1-5 MW) to small commercial (10-50 MW) implementations. Further scaling to large industrial applications (100+ MW) yields additional 10-15% cost efficiencies. These scaling benefits are most pronounced for zeolite-based sorbents, which benefit from established manufacturing processes, while novel materials like covalent organic frameworks face steeper scaling curves.

Cost-benefit analyses indicate that solid sorbent technologies become economically competitive when carbon prices exceed $40-60 per ton, depending on the specific industry and regional energy costs. Metal-organic frameworks (MOFs) and amine-functionalized materials demonstrate particularly favorable economics in long-term scenarios, with projected payback periods of 5-8 years under current carbon pricing trajectories in European markets.

Scaling considerations present both challenges and opportunities for widespread adoption. Laboratory-scale successes with novel sorbents often face significant hurdles during industrial scaling. Sorbent degradation rates increase under real-world conditions, with performance decreases of 2-5% per cycle observed in pilot plants compared to controlled laboratory environments. This necessitates more frequent replacement cycles, impacting operational economics.

Manufacturing capacity represents another critical scaling bottleneck. Current global production capabilities for advanced solid sorbents meet only approximately 5% of potential industrial demand. Significant investment in manufacturing infrastructure is required, with estimates suggesting $2-3 billion in capital investment needed to scale production to meet just 25% of potential industrial applications by 2030.

Integration with existing industrial infrastructure presents varying degrees of complexity across target industries. Cement plants offer relatively straightforward retrofit opportunities, with integration costs averaging $15-25 million per facility. Steel plants present moderate challenges, while chemical plants often require more extensive modifications costing $30-50 million per installation due to complex process integration requirements.

Economies of scale follow predictable patterns, with cost reductions of 15-20% achievable when scaling from pilot (1-5 MW) to small commercial (10-50 MW) implementations. Further scaling to large industrial applications (100+ MW) yields additional 10-15% cost efficiencies. These scaling benefits are most pronounced for zeolite-based sorbents, which benefit from established manufacturing processes, while novel materials like covalent organic frameworks face steeper scaling curves.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!