Solid sorbents for CO2 capture for pharmaceutical and specialty chemical applications

SEP 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

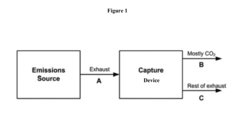

CO2 Capture Technology Evolution and Objectives

Carbon dioxide capture technologies have evolved significantly over the past several decades, transitioning from theoretical concepts to practical industrial applications. The journey began in the 1930s with the development of amine-based absorption processes primarily for natural gas sweetening. By the 1970s, these technologies gained renewed attention as environmental concerns about greenhouse gas emissions emerged. The 1990s marked a pivotal shift with the introduction of the first dedicated carbon capture and storage (CCS) projects, establishing the foundation for modern CO2 capture methodologies.

In recent years, solid sorbent technologies have emerged as promising alternatives to traditional liquid absorption systems, particularly for pharmaceutical and specialty chemical applications where product purity and process efficiency are paramount. These solid materials offer advantages including lower energy requirements for regeneration, reduced corrosion issues, and greater operational flexibility in varying pressure and temperature conditions.

The evolution of solid sorbents has progressed through several generations. First-generation materials included activated carbons and zeolites, which demonstrated basic CO2 capture capabilities but suffered from limited selectivity and capacity. Second-generation materials introduced metal-organic frameworks (MOFs) and functionalized porous polymers with significantly improved adsorption properties. Current third-generation materials incorporate advanced composites and hierarchical structures designed to optimize both kinetics and thermodynamics of the capture process.

The primary technical objectives for solid sorbent development in pharmaceutical and specialty chemical contexts include achieving high CO2 selectivity in the presence of complex gas mixtures, maintaining sorbent stability through multiple adsorption-desorption cycles, and ensuring compatibility with stringent product quality requirements. Additionally, these materials must demonstrate economic viability when scaled to industrial applications, with particular emphasis on minimizing energy penalties associated with sorbent regeneration.

Another critical objective is the development of modular and flexible capture systems that can be readily integrated into existing pharmaceutical and specialty chemical production facilities without significant process modifications. This includes designing capture units that can handle variable gas flow rates and compositions typical in batch manufacturing environments common to these industries.

Looking forward, the technology roadmap aims to achieve breakthrough performance metrics including CO2 capture costs below $40 per ton, regeneration energy requirements under 2 GJ/ton CO2, and sorbent lifespans exceeding 10,000 cycles. These ambitious targets necessitate continued innovation in material science, process engineering, and system integration to position solid sorbent technologies as the preferred solution for carbon management in high-value chemical production.

In recent years, solid sorbent technologies have emerged as promising alternatives to traditional liquid absorption systems, particularly for pharmaceutical and specialty chemical applications where product purity and process efficiency are paramount. These solid materials offer advantages including lower energy requirements for regeneration, reduced corrosion issues, and greater operational flexibility in varying pressure and temperature conditions.

The evolution of solid sorbents has progressed through several generations. First-generation materials included activated carbons and zeolites, which demonstrated basic CO2 capture capabilities but suffered from limited selectivity and capacity. Second-generation materials introduced metal-organic frameworks (MOFs) and functionalized porous polymers with significantly improved adsorption properties. Current third-generation materials incorporate advanced composites and hierarchical structures designed to optimize both kinetics and thermodynamics of the capture process.

The primary technical objectives for solid sorbent development in pharmaceutical and specialty chemical contexts include achieving high CO2 selectivity in the presence of complex gas mixtures, maintaining sorbent stability through multiple adsorption-desorption cycles, and ensuring compatibility with stringent product quality requirements. Additionally, these materials must demonstrate economic viability when scaled to industrial applications, with particular emphasis on minimizing energy penalties associated with sorbent regeneration.

Another critical objective is the development of modular and flexible capture systems that can be readily integrated into existing pharmaceutical and specialty chemical production facilities without significant process modifications. This includes designing capture units that can handle variable gas flow rates and compositions typical in batch manufacturing environments common to these industries.

Looking forward, the technology roadmap aims to achieve breakthrough performance metrics including CO2 capture costs below $40 per ton, regeneration energy requirements under 2 GJ/ton CO2, and sorbent lifespans exceeding 10,000 cycles. These ambitious targets necessitate continued innovation in material science, process engineering, and system integration to position solid sorbent technologies as the preferred solution for carbon management in high-value chemical production.

Market Analysis for Pharmaceutical CO2 Capture Solutions

The pharmaceutical and specialty chemical industries are experiencing a significant shift towards sustainable manufacturing practices, with CO2 capture technologies becoming increasingly important. The global market for carbon capture in these sectors is projected to reach $3.5 billion by 2027, growing at a compound annual growth rate of 7.8%. This growth is primarily driven by stringent environmental regulations, corporate sustainability commitments, and the increasing cost of carbon emissions.

Within the pharmaceutical sector, there is a particularly strong demand for CO2 capture solutions due to the industry's high energy consumption and significant carbon footprint. Pharmaceutical manufacturing processes often involve energy-intensive operations such as fermentation, distillation, and drying, which collectively contribute to approximately 55% of the industry's total emissions. Major pharmaceutical companies including Pfizer, Novartis, and Johnson & Johnson have established ambitious carbon neutrality targets, creating immediate market opportunities for effective carbon capture technologies.

The specialty chemicals segment presents another substantial market, with companies seeking to reduce emissions from processes involving organic synthesis, catalytic reactions, and solvent recovery. This segment values solutions that can be integrated into existing production lines without compromising product quality or production efficiency. Market research indicates that 68% of specialty chemical manufacturers are actively seeking carbon reduction technologies that offer return on investment within 3-5 years.

Regional analysis reveals that Europe currently leads the market adoption of pharmaceutical CO2 capture solutions, accounting for approximately 42% of global implementation. This is largely attributed to the EU's aggressive carbon pricing mechanisms and regulatory framework. North America follows with 28% market share, while Asia-Pacific represents the fastest-growing region with 15% annual growth in adoption rates, particularly in Japan, South Korea, and Singapore.

From a customer perspective, the market can be segmented into three tiers: large multinational corporations seeking comprehensive carbon management solutions, mid-sized manufacturers focusing on regulatory compliance and cost reduction, and contract manufacturing organizations (CMOs) looking for modular, scalable solutions. Each segment presents distinct requirements regarding implementation scale, integration capabilities, and return on investment expectations.

The competitive landscape for solid sorbent technologies in these industries remains relatively fragmented, with specialized technology providers competing alongside diversified industrial gas companies. Current market penetration of solid sorbent technologies specifically designed for pharmaceutical applications is estimated at only 12%, indicating substantial growth potential as the technology matures and demonstrates clear economic and operational advantages over traditional carbon capture methods.

Within the pharmaceutical sector, there is a particularly strong demand for CO2 capture solutions due to the industry's high energy consumption and significant carbon footprint. Pharmaceutical manufacturing processes often involve energy-intensive operations such as fermentation, distillation, and drying, which collectively contribute to approximately 55% of the industry's total emissions. Major pharmaceutical companies including Pfizer, Novartis, and Johnson & Johnson have established ambitious carbon neutrality targets, creating immediate market opportunities for effective carbon capture technologies.

The specialty chemicals segment presents another substantial market, with companies seeking to reduce emissions from processes involving organic synthesis, catalytic reactions, and solvent recovery. This segment values solutions that can be integrated into existing production lines without compromising product quality or production efficiency. Market research indicates that 68% of specialty chemical manufacturers are actively seeking carbon reduction technologies that offer return on investment within 3-5 years.

Regional analysis reveals that Europe currently leads the market adoption of pharmaceutical CO2 capture solutions, accounting for approximately 42% of global implementation. This is largely attributed to the EU's aggressive carbon pricing mechanisms and regulatory framework. North America follows with 28% market share, while Asia-Pacific represents the fastest-growing region with 15% annual growth in adoption rates, particularly in Japan, South Korea, and Singapore.

From a customer perspective, the market can be segmented into three tiers: large multinational corporations seeking comprehensive carbon management solutions, mid-sized manufacturers focusing on regulatory compliance and cost reduction, and contract manufacturing organizations (CMOs) looking for modular, scalable solutions. Each segment presents distinct requirements regarding implementation scale, integration capabilities, and return on investment expectations.

The competitive landscape for solid sorbent technologies in these industries remains relatively fragmented, with specialized technology providers competing alongside diversified industrial gas companies. Current market penetration of solid sorbent technologies specifically designed for pharmaceutical applications is estimated at only 12%, indicating substantial growth potential as the technology matures and demonstrates clear economic and operational advantages over traditional carbon capture methods.

Current Solid Sorbents Landscape and Technical Barriers

The current landscape of solid sorbents for CO2 capture in pharmaceutical and specialty chemical applications is characterized by a diverse range of materials with varying properties and performance metrics. Activated carbons remain among the most widely utilized sorbents due to their high surface area, relatively low cost, and established manufacturing processes. These materials typically exhibit CO2 adsorption capacities ranging from 2-4 mmol/g under ambient conditions, though their selectivity for CO2 over other gases can be limited.

Metal-organic frameworks (MOFs) represent a more advanced class of sorbents that have gained significant attention in recent years. Notable examples include HKUST-1, MIL-101, and ZIF-8, which demonstrate exceptional CO2 uptake capacities (up to 8 mmol/g) and tunable pore structures. However, their widespread industrial implementation faces challenges related to scalability, cost, and long-term stability under real operating conditions.

Zeolites, particularly 13X and 5A types, continue to be important in industrial applications due to their robust nature and good CO2 selectivity. These aluminosilicate materials offer moderate adsorption capacities (2-5 mmol/g) and benefit from established regeneration protocols, though they typically require higher regeneration temperatures than newer sorbent technologies.

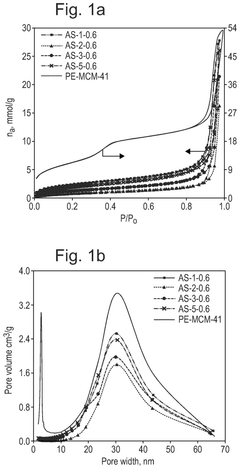

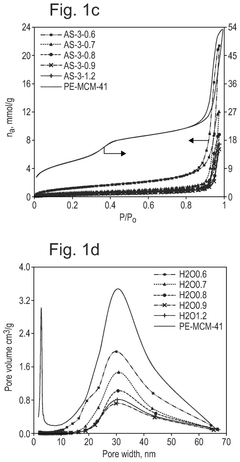

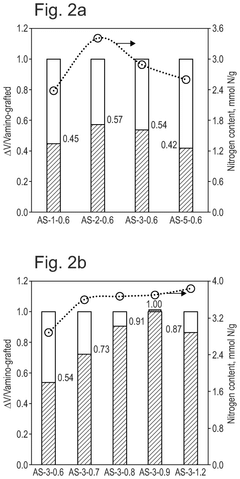

Amine-functionalized silica materials have emerged as promising candidates, combining the mechanical stability of inorganic supports with the high CO2 affinity of amine groups. These hybrid materials can achieve capacities of 3-6 mmol/g with excellent selectivity, but often suffer from amine leaching and oxidative degradation during repeated cycling.

Despite these advances, several critical technical barriers impede the widespread adoption of solid sorbents in pharmaceutical and specialty chemical applications. Foremost among these is the challenge of maintaining sorbent performance under the complex gas mixtures typical in these industries, which often contain volatile organic compounds and other contaminants that can poison or deactivate sorbent materials.

Energy requirements for regeneration represent another significant barrier, with most current sorbents requiring substantial thermal energy input for desorption, which impacts process economics and sustainability. The trade-off between adsorption capacity and regeneration energy remains a fundamental challenge in sorbent design.

Mechanical and chemical stability under industrial conditions constitutes a third major barrier. Many high-performance sorbents that excel in laboratory settings demonstrate rapid degradation when exposed to moisture, oxygen, or thermal cycling in real-world applications. This is particularly problematic in pharmaceutical manufacturing, where process reliability and product purity are paramount concerns.

Scale-up and manufacturing consistency of advanced sorbent materials also present significant challenges, with many novel materials still confined to laboratory-scale synthesis. The gap between academic research and industrial implementation remains substantial, with few technologies successfully bridging this divide.

Metal-organic frameworks (MOFs) represent a more advanced class of sorbents that have gained significant attention in recent years. Notable examples include HKUST-1, MIL-101, and ZIF-8, which demonstrate exceptional CO2 uptake capacities (up to 8 mmol/g) and tunable pore structures. However, their widespread industrial implementation faces challenges related to scalability, cost, and long-term stability under real operating conditions.

Zeolites, particularly 13X and 5A types, continue to be important in industrial applications due to their robust nature and good CO2 selectivity. These aluminosilicate materials offer moderate adsorption capacities (2-5 mmol/g) and benefit from established regeneration protocols, though they typically require higher regeneration temperatures than newer sorbent technologies.

Amine-functionalized silica materials have emerged as promising candidates, combining the mechanical stability of inorganic supports with the high CO2 affinity of amine groups. These hybrid materials can achieve capacities of 3-6 mmol/g with excellent selectivity, but often suffer from amine leaching and oxidative degradation during repeated cycling.

Despite these advances, several critical technical barriers impede the widespread adoption of solid sorbents in pharmaceutical and specialty chemical applications. Foremost among these is the challenge of maintaining sorbent performance under the complex gas mixtures typical in these industries, which often contain volatile organic compounds and other contaminants that can poison or deactivate sorbent materials.

Energy requirements for regeneration represent another significant barrier, with most current sorbents requiring substantial thermal energy input for desorption, which impacts process economics and sustainability. The trade-off between adsorption capacity and regeneration energy remains a fundamental challenge in sorbent design.

Mechanical and chemical stability under industrial conditions constitutes a third major barrier. Many high-performance sorbents that excel in laboratory settings demonstrate rapid degradation when exposed to moisture, oxygen, or thermal cycling in real-world applications. This is particularly problematic in pharmaceutical manufacturing, where process reliability and product purity are paramount concerns.

Scale-up and manufacturing consistency of advanced sorbent materials also present significant challenges, with many novel materials still confined to laboratory-scale synthesis. The gap between academic research and industrial implementation remains substantial, with few technologies successfully bridging this divide.

Existing Solid Sorbent Solutions for Pharmaceutical Applications

01 Metal-organic frameworks (MOFs) for CO2 capture

Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated with organic ligands. They have high surface areas, tunable pore sizes, and can be functionalized to enhance CO2 selectivity and capacity. MOFs can be designed with specific binding sites for CO2 molecules, making them effective solid sorbents for carbon capture applications. Their modular nature allows for customization to optimize adsorption-desorption cycles and energy efficiency.- Metal-organic frameworks (MOFs) for CO2 capture: Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated to organic ligands. They have high surface areas, tunable pore sizes, and can be functionalized to enhance CO2 selectivity and adsorption capacity. MOFs can be designed with specific metal centers and organic linkers to optimize CO2 capture performance under various conditions, making them promising candidates for carbon capture applications.

- Amine-functionalized solid sorbents: Amine-functionalized materials are widely used for CO2 capture due to their strong chemical affinity for CO2 molecules. These sorbents typically consist of a porous support material (such as silica, alumina, or polymers) impregnated or grafted with various amine compounds. The amine groups react with CO2 to form carbamates or bicarbonates, enabling efficient capture even at low CO2 concentrations. These materials offer advantages including high selectivity and good regeneration capabilities.

- Zeolite-based CO2 adsorbents: Zeolites are crystalline aluminosilicate materials with well-defined pore structures that can selectively adsorb CO2. Their molecular sieving properties, high thermal stability, and tunable surface chemistry make them effective for carbon capture applications. Modified zeolites with enhanced adsorption properties can be created through ion exchange, impregnation with alkali metals, or incorporation of functional groups to improve CO2 selectivity and capacity.

- Carbon-based sorbents for CO2 capture: Carbon-based materials including activated carbons, carbon nanotubes, graphene, and carbon molecular sieves are effective CO2 adsorbents due to their high surface area, pore volume, and tunable surface chemistry. These materials can be modified through chemical activation, nitrogen doping, or functionalization to enhance CO2 capture performance. Carbon-based sorbents offer advantages including low cost, good stability, and relatively easy regeneration, making them suitable for large-scale carbon capture applications.

- Regeneration methods for solid CO2 sorbents: Various regeneration techniques are employed to release captured CO2 from solid sorbents and restore their adsorption capacity for repeated use. These methods include temperature swing adsorption (TSA), pressure swing adsorption (PSA), vacuum swing adsorption (VSA), and combinations thereof. Novel approaches such as microwave-assisted regeneration, electrical swing adsorption, and steam stripping have been developed to reduce energy requirements and improve the efficiency of the regeneration process, which is critical for the economic viability of carbon capture systems.

02 Amine-functionalized solid sorbents

Amine-functionalized materials represent a significant class of solid sorbents for CO2 capture. These materials incorporate amine groups that can chemically bind with CO2 through acid-base interactions. Common supports include silica, polymers, and porous carbon materials that are modified with various amine compounds. The amine functionality provides high selectivity for CO2 over other gases and can operate effectively at moderate temperatures, making them suitable for post-combustion capture applications.Expand Specific Solutions03 Zeolites and molecular sieves for CO2 adsorption

Zeolites and molecular sieves are aluminosilicate materials with well-defined pore structures that can selectively adsorb CO2 based on molecular size and polarity. These materials have high thermal stability and can be regenerated multiple times without significant loss of performance. Their adsorption capacity can be enhanced through ion exchange, introducing cations that increase the affinity for CO2. The rigid framework structure provides consistent performance under various operating conditions.Expand Specific Solutions04 Carbon-based adsorbents for CO2 capture

Carbon-based materials such as activated carbon, carbon nanotubes, and graphene derivatives serve as effective CO2 adsorbents. These materials offer high surface area, good thermal conductivity, and chemical stability. They can be produced from various precursors including biomass, making them potentially sustainable options. Surface modification techniques can enhance their CO2 selectivity and capacity. The hydrophobic nature of many carbon-based adsorbents provides advantages in humid conditions where water competition can reduce the efficiency of other sorbents.Expand Specific Solutions05 Regeneration methods for solid CO2 sorbents

Effective regeneration of solid sorbents is crucial for sustainable CO2 capture processes. Various methods include temperature swing adsorption (TSA), pressure swing adsorption (PSA), vacuum swing adsorption (VSA), and combinations thereof. Novel approaches incorporate microwave heating, electrical swing adsorption, and steam regeneration to reduce energy requirements. The regeneration process must balance energy consumption with maintaining the structural integrity and adsorption capacity of the sorbent over multiple cycles, which is essential for commercial viability.Expand Specific Solutions

Leading Companies and Research Institutions in CO2 Sorbents

The solid sorbents for CO2 capture market in pharmaceutical and specialty chemical applications is in an early growth phase, with increasing market size driven by sustainability regulations. The technology is advancing from laboratory to commercial scale, with varying maturity levels across players. Academic institutions like University of Southern California, Rice University, and Norwegian University of Science & Technology are conducting foundational research, while companies demonstrate different commercialization stages. Climeworks and Carboncapture lead with deployed direct air capture technologies, while established corporations like Air Products & Chemicals and Sinopec leverage their industrial expertise to develop specialized sorbent solutions. Korean power companies (KEPCO and subsidiaries) are actively pursuing integration of these technologies into their operations.

Climeworks AG

Technical Solution: Climeworks has developed a direct air capture (DAC) technology using solid sorbents that can be applied in pharmaceutical and specialty chemical applications. Their proprietary technology employs amine-functionalized filter materials that selectively capture CO2 from ambient air. The process operates in a cyclic manner where the filters first capture CO2 when air is drawn through them, and then release concentrated CO2 when heated to approximately 100°C. This technology has been commercialized through modular CO2 collectors that can be stacked to scale capacity according to requirements. For pharmaceutical applications, Climeworks provides high-purity CO2 that meets stringent quality standards required for drug manufacturing processes. Their systems can be integrated into existing pharmaceutical facilities to provide on-site CO2 supply, reducing dependency on delivered CO2 and ensuring consistent quality.

Strengths: Modular design allows for flexible scaling; produces high-purity CO2 suitable for pharmaceutical applications; operates with relatively low temperature regeneration (100°C) compared to other technologies; can utilize waste heat from industrial processes. Weaknesses: Higher capital costs compared to conventional CO2 sources; energy requirements for the thermal swing process can be significant without waste heat integration; limited deployment at pharmaceutical scale to date.

Carboncapture, Inc.

Technical Solution: Carboncapture has developed an innovative modular direct air capture system using zeolite-based solid sorbents specifically engineered for CO2 capture applications. Their technology employs a temperature swing adsorption process with proprietary zeolite materials that demonstrate high selectivity for CO2 even at low atmospheric concentrations. The company's approach involves a continuous carousel system where multiple adsorption modules rotate through capture and regeneration phases, ensuring constant CO2 production. For pharmaceutical and specialty chemical applications, their system delivers consistent, high-purity CO2 that meets USP and EP standards. The modular design allows for installation at various scales, from small specialty chemical facilities to larger pharmaceutical manufacturing plants. Their technology incorporates advanced heat management systems that minimize energy consumption during the regeneration phase, utilizing temperatures around 85-95°C for sorbent regeneration, which can be supplied through waste heat or renewable energy sources.

Strengths: Highly modular system allows for precise scaling to match facility requirements; zeolite-based sorbents offer excellent stability over thousands of cycles; lower regeneration temperatures than many competing technologies; continuous operation design maximizes equipment utilization. Weaknesses: Relatively new technology with limited long-term operational data; zeolite materials may be susceptible to performance degradation in humid conditions without proper moisture management; higher initial capital investment compared to conventional CO2 sourcing methods.

Key Patents and Breakthroughs in Specialty Chemical CO2 Capture

sorbent

PatentPendingUS20250281904A1

Innovation

- Development of a solid sorbent comprising a silica support with covalently attached secondary amines confined inside its pores, optimized through controlled grafting and polymerization, achieving high amine density and stability.

Sorbents for carbon dioxide capture

PatentActiveUS20140286844A1

Innovation

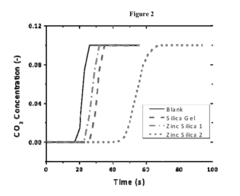

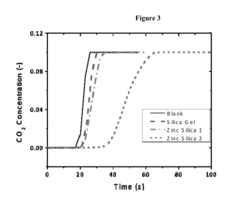

- A mesoporous structure with functionalizing moieties, including zinc atoms or amines, is used for CO2 sorption, employing chemisorption and physisorption mechanisms to enhance CO2 capture selectivity and capacity, while maintaining low diffusional resistance and energy efficiency.

Environmental Impact and Sustainability Assessment

The implementation of solid sorbents for CO2 capture in pharmaceutical and specialty chemical industries presents significant environmental implications that must be thoroughly assessed. These industries traditionally generate substantial carbon emissions through energy-intensive processes and chemical reactions. Solid sorbent technologies offer a promising pathway to reduce these emissions while potentially delivering additional environmental benefits beyond carbon capture.

Life cycle assessment (LCA) studies indicate that solid sorbent-based capture systems can achieve 70-85% reduction in CO2 emissions compared to unabated processes in pharmaceutical manufacturing. However, the environmental footprint extends beyond carbon reduction. The production, regeneration, and disposal of solid sorbents involve resource consumption and potential environmental impacts that must be quantified and minimized.

Water usage represents a critical sustainability metric for these technologies. Unlike traditional amine-based liquid absorbents that require significant water resources, many solid sorbents demonstrate substantially lower water intensity, with some advanced materials reducing process water requirements by up to 60%. This water conservation aspect is particularly valuable in water-stressed regions where pharmaceutical manufacturing facilities often operate.

Energy efficiency improvements constitute another key sustainability benefit. Modern metal-organic frameworks (MOFs) and functionalized porous polymers exhibit regeneration energy requirements of 2.0-2.8 GJ/tonne CO2, compared to 3.5-4.2 GJ/tonne for conventional amine scrubbing. This efficiency translates to reduced indirect emissions and lower operational costs, enhancing the overall sustainability profile.

Waste generation and management present both challenges and opportunities. While spent sorbents require proper disposal or recycling, their typically longer operational lifetimes (2-5 years versus 1-2 years for liquid sorbents) reduce waste volumes. Additionally, certain classes of solid sorbents can be regenerated through environmentally benign methods such as pressure-swing processes rather than energy-intensive thermal regeneration.

Chemical safety considerations reveal further advantages of solid sorbents. The elimination or reduction of volatile organic compounds and corrosive chemicals associated with traditional capture methods decreases environmental hazards and improves workplace safety. This aspect is particularly relevant in pharmaceutical settings where stringent safety protocols already exist.

Integration with existing green chemistry initiatives in pharmaceutical manufacturing creates synergistic sustainability benefits. When CO2 capture systems are coupled with renewable energy sources and process intensification techniques, the environmental footprint can be further minimized, potentially achieving carbon-negative operations in certain applications.

Life cycle assessment (LCA) studies indicate that solid sorbent-based capture systems can achieve 70-85% reduction in CO2 emissions compared to unabated processes in pharmaceutical manufacturing. However, the environmental footprint extends beyond carbon reduction. The production, regeneration, and disposal of solid sorbents involve resource consumption and potential environmental impacts that must be quantified and minimized.

Water usage represents a critical sustainability metric for these technologies. Unlike traditional amine-based liquid absorbents that require significant water resources, many solid sorbents demonstrate substantially lower water intensity, with some advanced materials reducing process water requirements by up to 60%. This water conservation aspect is particularly valuable in water-stressed regions where pharmaceutical manufacturing facilities often operate.

Energy efficiency improvements constitute another key sustainability benefit. Modern metal-organic frameworks (MOFs) and functionalized porous polymers exhibit regeneration energy requirements of 2.0-2.8 GJ/tonne CO2, compared to 3.5-4.2 GJ/tonne for conventional amine scrubbing. This efficiency translates to reduced indirect emissions and lower operational costs, enhancing the overall sustainability profile.

Waste generation and management present both challenges and opportunities. While spent sorbents require proper disposal or recycling, their typically longer operational lifetimes (2-5 years versus 1-2 years for liquid sorbents) reduce waste volumes. Additionally, certain classes of solid sorbents can be regenerated through environmentally benign methods such as pressure-swing processes rather than energy-intensive thermal regeneration.

Chemical safety considerations reveal further advantages of solid sorbents. The elimination or reduction of volatile organic compounds and corrosive chemicals associated with traditional capture methods decreases environmental hazards and improves workplace safety. This aspect is particularly relevant in pharmaceutical settings where stringent safety protocols already exist.

Integration with existing green chemistry initiatives in pharmaceutical manufacturing creates synergistic sustainability benefits. When CO2 capture systems are coupled with renewable energy sources and process intensification techniques, the environmental footprint can be further minimized, potentially achieving carbon-negative operations in certain applications.

Regulatory Framework for CO2 Capture in Pharmaceutical Manufacturing

The pharmaceutical industry faces increasingly stringent regulatory requirements regarding carbon emissions and environmental impact. The regulatory landscape for CO2 capture in pharmaceutical manufacturing is complex and evolving, with significant variations across different regions and jurisdictions. These regulations directly influence the adoption and implementation of solid sorbent technologies for carbon capture.

In the United States, the Environmental Protection Agency (EPA) has established the Greenhouse Gas Reporting Program, which requires pharmaceutical facilities exceeding certain emission thresholds to report their CO2 emissions. Additionally, the Clean Air Act provides a framework for regulating greenhouse gas emissions from stationary sources, including pharmaceutical manufacturing plants. Recent amendments have strengthened these requirements, particularly for facilities producing specialty chemicals.

The European Union has implemented more aggressive regulatory measures through the EU Emissions Trading System (EU ETS), which operates on a cap-and-trade principle. Pharmaceutical companies operating within the EU must comply with emission allowances or purchase additional credits. The European Green Deal further aims to achieve carbon neutrality by 2050, placing additional pressure on pharmaceutical manufacturers to adopt effective carbon capture technologies.

In Asia, regulatory frameworks vary significantly. Japan has established the J-Credit Scheme, which incentivizes CO2 reduction projects. China's national carbon market, launched in 2021, currently focuses on the power sector but is expected to expand to include chemical and pharmaceutical industries in upcoming phases. India has implemented the Perform, Achieve, and Trade (PAT) scheme, which sets energy efficiency targets for energy-intensive industries.

International agreements, particularly the Paris Climate Accord, have established global targets for emissions reduction. While these agreements do not directly regulate pharmaceutical manufacturing, they influence national policies and corporate sustainability commitments. Many pharmaceutical companies have voluntarily adopted science-based targets for emissions reduction, anticipating stricter regulations in the future.

Regulatory compliance costs associated with CO2 emissions are increasing. Carbon taxes and cap-and-trade systems are becoming more widespread, making carbon capture technologies economically advantageous. For specialty chemical applications, regulations concerning product purity and contamination must also be considered when implementing CO2 capture systems, as regulatory bodies like the FDA impose strict requirements on manufacturing processes that might be affected by carbon capture technologies.

Future regulatory trends indicate a move toward more comprehensive life cycle assessment requirements, where pharmaceutical companies will need to account for emissions throughout their supply chain. This shift will likely accelerate the adoption of solid sorbent technologies that can be integrated into existing manufacturing processes with minimal disruption to production and product quality.

In the United States, the Environmental Protection Agency (EPA) has established the Greenhouse Gas Reporting Program, which requires pharmaceutical facilities exceeding certain emission thresholds to report their CO2 emissions. Additionally, the Clean Air Act provides a framework for regulating greenhouse gas emissions from stationary sources, including pharmaceutical manufacturing plants. Recent amendments have strengthened these requirements, particularly for facilities producing specialty chemicals.

The European Union has implemented more aggressive regulatory measures through the EU Emissions Trading System (EU ETS), which operates on a cap-and-trade principle. Pharmaceutical companies operating within the EU must comply with emission allowances or purchase additional credits. The European Green Deal further aims to achieve carbon neutrality by 2050, placing additional pressure on pharmaceutical manufacturers to adopt effective carbon capture technologies.

In Asia, regulatory frameworks vary significantly. Japan has established the J-Credit Scheme, which incentivizes CO2 reduction projects. China's national carbon market, launched in 2021, currently focuses on the power sector but is expected to expand to include chemical and pharmaceutical industries in upcoming phases. India has implemented the Perform, Achieve, and Trade (PAT) scheme, which sets energy efficiency targets for energy-intensive industries.

International agreements, particularly the Paris Climate Accord, have established global targets for emissions reduction. While these agreements do not directly regulate pharmaceutical manufacturing, they influence national policies and corporate sustainability commitments. Many pharmaceutical companies have voluntarily adopted science-based targets for emissions reduction, anticipating stricter regulations in the future.

Regulatory compliance costs associated with CO2 emissions are increasing. Carbon taxes and cap-and-trade systems are becoming more widespread, making carbon capture technologies economically advantageous. For specialty chemical applications, regulations concerning product purity and contamination must also be considered when implementing CO2 capture systems, as regulatory bodies like the FDA impose strict requirements on manufacturing processes that might be affected by carbon capture technologies.

Future regulatory trends indicate a move toward more comprehensive life cycle assessment requirements, where pharmaceutical companies will need to account for emissions throughout their supply chain. This shift will likely accelerate the adoption of solid sorbent technologies that can be integrated into existing manufacturing processes with minimal disruption to production and product quality.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!