Solid sorbents for CO2 capture patent landscape and competitive technology assessment

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Sorbent Evolution and Objectives

Carbon dioxide capture technology has evolved significantly over the past decades, transitioning from theoretical concepts to practical applications in response to growing climate change concerns. The evolution of solid sorbents for CO2 capture represents a critical pathway in this technological progression, moving from conventional liquid amine scrubbing to more efficient and environmentally friendly solid-based systems. Early developments in the 1990s focused primarily on basic zeolite and activated carbon materials, which demonstrated limited capacity and selectivity under real-world conditions.

The 2000s marked a significant turning point with the emergence of metal-organic frameworks (MOFs) and functionalized porous materials, which dramatically increased capture capacity and operational flexibility. By the 2010s, research expanded into advanced composite materials, combining the benefits of different sorbent types to overcome individual limitations. Recent innovations have focused on developing materials with enhanced stability under industrial conditions, improved regeneration capabilities, and reduced energy penalties during the capture-release cycle.

Current technological objectives in solid sorbent development center around several key parameters: increasing CO2 selectivity in mixed gas environments, enhancing adsorption capacity under practical operating conditions, improving mechanical and chemical stability during multiple adsorption-desorption cycles, and reducing regeneration energy requirements. Additionally, there is significant emphasis on developing materials that maintain performance under moisture and contaminant exposure, which has historically been a major challenge for many sorbent technologies.

From a sustainability perspective, research objectives have expanded to include minimizing the environmental footprint of sorbent production, utilizing abundant and non-toxic materials, and extending operational lifetimes to improve overall system economics. The integration of these materials into existing industrial infrastructure represents another critical objective, requiring sorbents that can function effectively within the constraints of current power plants and industrial facilities.

Looking forward, the field is increasingly focused on developing "smart" responsive sorbents that can adapt to changing conditions, as well as materials optimized for direct air capture applications. The convergence of computational materials science with experimental approaches has accelerated discovery processes, enabling more targeted development of next-generation sorbents with precisely engineered properties. These technological objectives align with broader climate goals of achieving cost-effective carbon capture at scale, with solid sorbents positioned as a potentially transformative technology in the global effort to reduce atmospheric CO2 concentrations.

The 2000s marked a significant turning point with the emergence of metal-organic frameworks (MOFs) and functionalized porous materials, which dramatically increased capture capacity and operational flexibility. By the 2010s, research expanded into advanced composite materials, combining the benefits of different sorbent types to overcome individual limitations. Recent innovations have focused on developing materials with enhanced stability under industrial conditions, improved regeneration capabilities, and reduced energy penalties during the capture-release cycle.

Current technological objectives in solid sorbent development center around several key parameters: increasing CO2 selectivity in mixed gas environments, enhancing adsorption capacity under practical operating conditions, improving mechanical and chemical stability during multiple adsorption-desorption cycles, and reducing regeneration energy requirements. Additionally, there is significant emphasis on developing materials that maintain performance under moisture and contaminant exposure, which has historically been a major challenge for many sorbent technologies.

From a sustainability perspective, research objectives have expanded to include minimizing the environmental footprint of sorbent production, utilizing abundant and non-toxic materials, and extending operational lifetimes to improve overall system economics. The integration of these materials into existing industrial infrastructure represents another critical objective, requiring sorbents that can function effectively within the constraints of current power plants and industrial facilities.

Looking forward, the field is increasingly focused on developing "smart" responsive sorbents that can adapt to changing conditions, as well as materials optimized for direct air capture applications. The convergence of computational materials science with experimental approaches has accelerated discovery processes, enabling more targeted development of next-generation sorbents with precisely engineered properties. These technological objectives align with broader climate goals of achieving cost-effective carbon capture at scale, with solid sorbents positioned as a potentially transformative technology in the global effort to reduce atmospheric CO2 concentrations.

Market Analysis for Carbon Capture Technologies

The global carbon capture and storage (CCS) market has witnessed significant growth in recent years, driven by increasing environmental concerns and stringent regulations aimed at reducing greenhouse gas emissions. As of 2023, the market was valued at approximately $7.5 billion, with projections indicating a compound annual growth rate (CAGR) of 19.2% through 2030, potentially reaching $25.3 billion by the end of the decade.

Solid sorbents for CO2 capture represent a rapidly expanding segment within this market, currently accounting for about 15% of the total carbon capture technology market share. This segment is expected to grow at an accelerated rate of 23.7% annually, outpacing other capture technologies due to its operational advantages and lower energy requirements.

Geographically, North America dominates the market with approximately 40% share, followed by Europe at 30% and Asia-Pacific at 20%. The United States, Canada, and Norway lead in terms of deployment and investment in solid sorbent technologies, while China and Japan are rapidly increasing their market presence through aggressive research and development initiatives.

Industry-wise, power generation remains the largest application sector, representing 45% of the market for solid sorbent CO2 capture technologies. However, industrial applications, particularly in cement, steel, and chemical manufacturing, are showing the fastest growth rates, with a collective CAGR of 25.3% as these hard-to-abate sectors face increasing pressure to decarbonize.

Key market drivers include tightening carbon emission regulations globally, increasing carbon pricing mechanisms, and growing corporate commitments to net-zero targets. The European Union's Carbon Border Adjustment Mechanism and similar policies in other regions are creating strong financial incentives for industries to adopt carbon capture technologies.

Investment in solid sorbent technologies has seen a remarkable surge, with venture capital funding increasing by 187% between 2020 and 2023. Corporate R&D spending in this sector has similarly grown by 78% during the same period, reflecting strong confidence in the commercial potential of these technologies.

Customer adoption patterns indicate a shift from pilot projects to commercial-scale implementations, with the number of large-scale (>100,000 tons CO2/year) projects utilizing solid sorbents increasing from just 3 in 2019 to 17 in 2023. This trend suggests growing market confidence in the technology's reliability and cost-effectiveness.

Market barriers include high initial capital costs, with current installation expenses ranging from $600-1,200 per ton of annual CO2 capture capacity, though these costs are projected to decrease by 30-40% by 2030 as technologies mature and economies of scale are realized.

Solid sorbents for CO2 capture represent a rapidly expanding segment within this market, currently accounting for about 15% of the total carbon capture technology market share. This segment is expected to grow at an accelerated rate of 23.7% annually, outpacing other capture technologies due to its operational advantages and lower energy requirements.

Geographically, North America dominates the market with approximately 40% share, followed by Europe at 30% and Asia-Pacific at 20%. The United States, Canada, and Norway lead in terms of deployment and investment in solid sorbent technologies, while China and Japan are rapidly increasing their market presence through aggressive research and development initiatives.

Industry-wise, power generation remains the largest application sector, representing 45% of the market for solid sorbent CO2 capture technologies. However, industrial applications, particularly in cement, steel, and chemical manufacturing, are showing the fastest growth rates, with a collective CAGR of 25.3% as these hard-to-abate sectors face increasing pressure to decarbonize.

Key market drivers include tightening carbon emission regulations globally, increasing carbon pricing mechanisms, and growing corporate commitments to net-zero targets. The European Union's Carbon Border Adjustment Mechanism and similar policies in other regions are creating strong financial incentives for industries to adopt carbon capture technologies.

Investment in solid sorbent technologies has seen a remarkable surge, with venture capital funding increasing by 187% between 2020 and 2023. Corporate R&D spending in this sector has similarly grown by 78% during the same period, reflecting strong confidence in the commercial potential of these technologies.

Customer adoption patterns indicate a shift from pilot projects to commercial-scale implementations, with the number of large-scale (>100,000 tons CO2/year) projects utilizing solid sorbents increasing from just 3 in 2019 to 17 in 2023. This trend suggests growing market confidence in the technology's reliability and cost-effectiveness.

Market barriers include high initial capital costs, with current installation expenses ranging from $600-1,200 per ton of annual CO2 capture capacity, though these costs are projected to decrease by 30-40% by 2030 as technologies mature and economies of scale are realized.

Solid Sorbent Technology Status and Barriers

Solid sorbent technologies for CO2 capture have advanced significantly over the past decade, yet several critical barriers impede their widespread commercial deployment. Current solid sorbents include metal-organic frameworks (MOFs), zeolites, activated carbons, amine-functionalized materials, and alkali metal-based sorbents. Each category demonstrates unique advantages in CO2 selectivity, capacity, and operating conditions, but none has achieved the optimal balance required for large-scale implementation.

The primary technical challenge facing solid sorbents is the trade-off between adsorption capacity and regeneration energy requirements. High-capacity materials often demand substantial energy input for regeneration, reducing overall process efficiency. For instance, amine-functionalized sorbents exhibit excellent CO2 selectivity but suffer from degradation at higher temperatures necessary for efficient regeneration.

Stability issues present another significant barrier. Many promising sorbents demonstrate performance degradation after multiple adsorption-desorption cycles, particularly in the presence of contaminants like SOx, NOx, and water vapor found in real flue gas streams. This degradation manifests as reduced capacity, structural collapse, or chemical alteration of active sites, necessitating frequent replacement and increasing operational costs.

Heat management during adsorption-desorption cycles remains problematic. The exothermic nature of CO2 adsorption generates heat that can reduce working capacity, while the endothermic desorption process requires substantial energy input. Current heat integration strategies are insufficient to overcome this thermodynamic challenge cost-effectively at industrial scales.

Material synthesis and manufacturing scalability constitute another barrier. Laboratory-scale production methods for advanced sorbents like MOFs often involve expensive precursors and complex synthesis procedures that are difficult to scale up economically. The gap between laboratory performance and industrial-scale production represents a significant hurdle for commercialization.

Mechanical stability presents challenges in practical applications. Solid sorbents must withstand physical stresses in fixed-bed, fluidized-bed, or moving-bed configurations without generating excessive fines or experiencing attrition. Current materials often lack the necessary mechanical robustness for long-term operation in industrial settings.

System integration complexities further complicate deployment. Incorporating solid sorbent technologies into existing power plants or industrial facilities requires significant process redesign and capital investment. The absence of standardized engineering approaches for solid sorbent systems increases project risks and costs.

Economic barriers compound these technical challenges. The current cost of CO2 capture using solid sorbents remains substantially higher than the carbon price in most markets, creating insufficient economic incentives for adoption without regulatory mandates or significant subsidies.

The primary technical challenge facing solid sorbents is the trade-off between adsorption capacity and regeneration energy requirements. High-capacity materials often demand substantial energy input for regeneration, reducing overall process efficiency. For instance, amine-functionalized sorbents exhibit excellent CO2 selectivity but suffer from degradation at higher temperatures necessary for efficient regeneration.

Stability issues present another significant barrier. Many promising sorbents demonstrate performance degradation after multiple adsorption-desorption cycles, particularly in the presence of contaminants like SOx, NOx, and water vapor found in real flue gas streams. This degradation manifests as reduced capacity, structural collapse, or chemical alteration of active sites, necessitating frequent replacement and increasing operational costs.

Heat management during adsorption-desorption cycles remains problematic. The exothermic nature of CO2 adsorption generates heat that can reduce working capacity, while the endothermic desorption process requires substantial energy input. Current heat integration strategies are insufficient to overcome this thermodynamic challenge cost-effectively at industrial scales.

Material synthesis and manufacturing scalability constitute another barrier. Laboratory-scale production methods for advanced sorbents like MOFs often involve expensive precursors and complex synthesis procedures that are difficult to scale up economically. The gap between laboratory performance and industrial-scale production represents a significant hurdle for commercialization.

Mechanical stability presents challenges in practical applications. Solid sorbents must withstand physical stresses in fixed-bed, fluidized-bed, or moving-bed configurations without generating excessive fines or experiencing attrition. Current materials often lack the necessary mechanical robustness for long-term operation in industrial settings.

System integration complexities further complicate deployment. Incorporating solid sorbent technologies into existing power plants or industrial facilities requires significant process redesign and capital investment. The absence of standardized engineering approaches for solid sorbent systems increases project risks and costs.

Economic barriers compound these technical challenges. The current cost of CO2 capture using solid sorbents remains substantially higher than the carbon price in most markets, creating insufficient economic incentives for adoption without regulatory mandates or significant subsidies.

Current Solid Sorbent Solutions Assessment

01 Metal-organic frameworks (MOFs) for CO2 capture

Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated with organic ligands. These materials have high surface areas and tunable pore sizes, making them effective for selective CO2 adsorption. MOFs can be designed with specific functional groups to enhance CO2 binding affinity and selectivity. Their modular nature allows for customization of properties to optimize CO2 capture performance under various conditions.- Metal-organic frameworks (MOFs) for CO2 capture: Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated with organic ligands. They have high surface areas, tunable pore sizes, and can be designed with specific functional groups to enhance CO2 adsorption capacity and selectivity. MOFs can be modified to improve stability under various conditions and can achieve rapid adsorption-desorption cycles, making them promising candidates for industrial CO2 capture applications.

- Amine-functionalized solid sorbents: Amine-functionalized materials incorporate various amine groups onto solid supports to chemically bind CO2 through carbamate formation. These sorbents can be prepared by impregnating or grafting amines onto porous substrates like silica, activated carbon, or polymers. They typically offer high CO2 selectivity even at low concentrations and can operate effectively at moderate temperatures. The amine loading and type can be optimized to balance adsorption capacity with regeneration energy requirements.

- Zeolite-based CO2 sorbents: Zeolites are crystalline aluminosilicate materials with well-defined pore structures that can selectively adsorb CO2. Their adsorption properties can be tuned by adjusting the silicon-to-aluminum ratio, cation exchange, and framework structure. Zeolites offer good thermal stability and can be regenerated multiple times without significant performance degradation. Modified zeolites with enhanced hydrophobicity show improved performance in humid conditions, addressing a common limitation of traditional zeolite sorbents.

- Carbon-based sorbents for CO2 capture: Carbon-based materials including activated carbon, carbon nanotubes, and graphene derivatives serve as effective CO2 sorbents due to their high surface area and porous structure. These materials can be produced from various precursors including biomass, polymers, or waste materials, making them potentially cost-effective. Surface modification through chemical treatment or doping with nitrogen, oxygen, or metal particles can significantly enhance CO2 adsorption capacity and selectivity. Carbon-based sorbents typically demonstrate good stability under various operating conditions.

- Alkali metal-based solid sorbents: Alkali metal-based sorbents, particularly those containing lithium, sodium, or potassium compounds, can effectively capture CO2 through carbonation reactions. These materials include lithium zirconates, lithium silicates, sodium carbonates, and potassium-promoted oxides. They typically operate at elevated temperatures (200-700°C) and offer high theoretical CO2 capacity. The reaction kinetics and cycling stability can be improved through various synthesis methods, particle size control, and the addition of promoters or support materials.

02 Amine-functionalized solid sorbents

Amine-functionalized materials represent a significant class of solid sorbents for CO2 capture. These materials incorporate amine groups onto various supports such as silica, polymers, or carbon-based materials. The amine groups react with CO2 through chemisorption, forming carbamates or bicarbonates. This chemical interaction provides high selectivity for CO2 over other gases and good adsorption capacity even at low CO2 partial pressures, making them suitable for post-combustion capture applications.Expand Specific Solutions03 Zeolite-based CO2 adsorbents

Zeolites are crystalline aluminosilicate materials with well-defined pore structures that can effectively capture CO2 through physical adsorption. Their molecular sieving properties allow for selective adsorption of CO2 over other gases based on molecular size. Zeolites can be modified by ion exchange or impregnation with various metals to enhance their CO2 capture performance. These materials offer advantages including thermal stability, resistance to degradation, and the ability to be regenerated through temperature or pressure swing processes.Expand Specific Solutions04 Carbon-based sorbents for CO2 capture

Carbon-based materials, including activated carbons, carbon nanotubes, and graphene derivatives, serve as effective CO2 sorbents. These materials can be produced from various precursors including biomass, polymers, or fossil resources. Their high surface area, tunable pore structure, and surface chemistry make them versatile for CO2 capture applications. Carbon-based sorbents can be functionalized with nitrogen-containing groups or metal particles to enhance CO2 adsorption capacity and selectivity. They offer advantages including low cost, good stability, and ease of regeneration.Expand Specific Solutions05 Alkali metal-based solid sorbents

Alkali metal-based sorbents, particularly those containing lithium, sodium, or potassium compounds, are effective for high-temperature CO2 capture. These materials typically operate through carbonation reactions, where the metal oxide reacts with CO2 to form carbonates. The process is reversible through temperature swing, allowing for sorbent regeneration. These materials offer advantages for pre-combustion capture or industrial processes where high temperatures are already present. Their high CO2 selectivity and capacity at elevated temperatures make them suitable for integration with power generation or industrial processes.Expand Specific Solutions

Leading Companies in Solid Sorbent Development

The solid sorbents for CO2 capture market is in a growth phase, with increasing global focus on carbon reduction technologies. The market size is expanding rapidly, driven by stringent emission regulations and corporate sustainability goals. Technologically, the field shows varying maturity levels, with Korean power companies (KEPCO and its subsidiaries) demonstrating significant innovation leadership through extensive patent portfolios. Research institutions like Georgia Tech Research Corp and universities (Tianjin University, Arizona State) are advancing fundamental technologies, while commercial players including Global Thermostat, NGK Insulators, and DACMa GmbH are developing scalable solutions. Energy conglomerates such as Shell, ExxonMobil, and CHN Energy are strategically positioning themselves in this space, indicating the technology's growing commercial viability and cross-sector importance.

Global Thermostat Operations LLC

Technical Solution: Global Thermostat has pioneered a direct air capture (DAC) technology using amine-functionalized porous silica monoliths as solid sorbents. Their patented "carbon negative" process can capture CO2 directly from ambient air or from concentrated sources like power plant emissions. The company's proprietary sorbent formulation features high surface area (>300 m²/g) silica substrates with carefully engineered pore structures functionalized with primary, secondary, and tertiary amines to maximize CO2 binding capacity while minimizing regeneration energy. Their modular system design enables low-temperature (85-95°C) sorbent regeneration using waste heat from industrial processes, significantly improving overall energy efficiency. Global Thermostat's technology demonstrates CO2 capture rates of 2-3 tons per day per standard module with sorbent durability exceeding 10,000 cycles in commercial operations.

Strengths: Versatility to capture CO2 from both ambient air and concentrated sources; modular design allowing scalable implementation; ability to utilize low-grade waste heat for regeneration. Weaknesses: Higher capital costs compared to point-source-only technologies; performance dependent on ambient conditions when used for direct air capture; requires significant land area for large-scale deployment.

Shell Internationale Research Maatschappij BV

Technical Solution: Shell has developed advanced metal-organic frameworks (MOFs) and amine-functionalized solid sorbents for CO2 capture. Their technology focuses on pressure/temperature swing adsorption systems that can be integrated into industrial processes. Shell's patented materials demonstrate CO2 adsorption capacities exceeding 3 mmol/g under flue gas conditions with working capacities maintained over 1000+ cycles. Their solid sorbent technology employs structured contactors with optimized heat management systems to address the exothermic nature of CO2 adsorption, reducing energy penalties by approximately 30% compared to conventional liquid amine scrubbing. Shell has also pioneered hybrid systems combining solid sorbents with membrane technology for enhanced selectivity in mixed gas streams.

Strengths: Extensive global deployment capability through existing industrial partnerships; materials demonstrate exceptional stability under industrial conditions; integrated systems approach addressing both material and process engineering. Weaknesses: Higher capital costs compared to some competing technologies; regeneration energy requirements still present challenges for widespread implementation.

Key Patents and Technical Innovations Analysis

Solid sorbents for capturing co 2

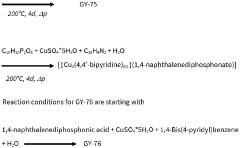

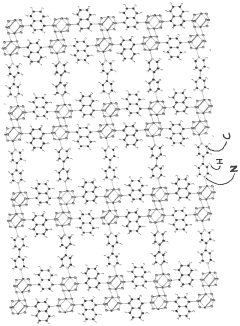

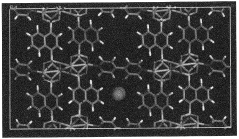

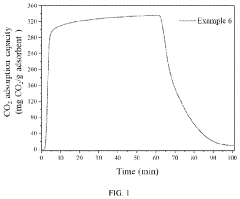

PatentWO2023232666A1

Innovation

- Development of phosphonate and organoarsonate MOFs with specific molecular formulas, such as [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediphosphonate)] and [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediarsonate)], which maintain selectivity and stability under harsh conditions, including high humidity and temperatures up to 360°C, by creating a hydrophobic environment that favors CO2 physisorption over H2O.

Silicon-based solid amine sorbent for co2 and making method thereof

PatentActiveUS20240123423A1

Innovation

- A method to produce a silicon-based solid amine sorbent with a large support pore volume by using a silicate solution or liquid organosilicate, precipitating silicic acid, performing azeotropic distillation, and impregnating with an organic amine solution, resulting in a sorbent with enhanced specific surface area and pore volume, and high CO2 adsorption capacity.

Environmental Impact and Sustainability Metrics

The environmental impact of solid sorbents for CO2 capture extends far beyond their primary function of carbon sequestration. Life cycle assessment (LCA) studies reveal that while these technologies reduce atmospheric CO2, their production, operation, and disposal generate environmental footprints that must be carefully evaluated. Energy consumption during sorbent regeneration represents a significant environmental concern, with thermal-swing processes typically requiring substantial heat input that may offset carbon reduction benefits if powered by fossil fuels.

Material sustainability metrics indicate varying environmental profiles among different sorbent classes. Amine-functionalized materials often involve toxic precursors and energy-intensive synthesis routes, while metal-organic frameworks (MOFs) frequently require rare metals and environmentally problematic solvents. In contrast, carbon-based sorbents and zeolites generally demonstrate lower production impacts, though their performance characteristics may necessitate more frequent replacement cycles.

Water consumption represents another critical sustainability parameter, particularly for solid sorbents deployed in water-stressed regions. Hydrophilic materials like zeolites and certain amine-functionalized sorbents can compete with CO2 for adsorption sites when moisture is present, potentially requiring energy-intensive drying processes that increase the overall environmental burden.

Toxicity profiles and end-of-life management constitute essential considerations in comprehensive environmental assessments. Patent analyses reveal increasing attention to biodegradable supports and environmentally benign functionalization agents, with recent innovations focusing on bio-derived sorbents that minimize hazardous waste generation. However, standardized protocols for sorbent disposal or regeneration remain underdeveloped across the industry.

Sustainability metrics increasingly incorporate social dimensions alongside environmental parameters. Recent competitive assessments highlight the importance of considering raw material sourcing ethics, particularly for sorbents containing rare earth elements or materials extracted from conflict regions. Leading companies in the field have begun publishing sustainability reports that track these expanded metrics, signaling a shift toward more holistic environmental accounting.

The environmental resilience of sorbent technologies under changing climate conditions represents an emerging area of concern. Patent activity indicates growing interest in developing materials that maintain performance despite temperature fluctuations, humidity variations, and exposure to atmospheric contaminants—factors that will become increasingly relevant as deployment scales in diverse global settings.

Material sustainability metrics indicate varying environmental profiles among different sorbent classes. Amine-functionalized materials often involve toxic precursors and energy-intensive synthesis routes, while metal-organic frameworks (MOFs) frequently require rare metals and environmentally problematic solvents. In contrast, carbon-based sorbents and zeolites generally demonstrate lower production impacts, though their performance characteristics may necessitate more frequent replacement cycles.

Water consumption represents another critical sustainability parameter, particularly for solid sorbents deployed in water-stressed regions. Hydrophilic materials like zeolites and certain amine-functionalized sorbents can compete with CO2 for adsorption sites when moisture is present, potentially requiring energy-intensive drying processes that increase the overall environmental burden.

Toxicity profiles and end-of-life management constitute essential considerations in comprehensive environmental assessments. Patent analyses reveal increasing attention to biodegradable supports and environmentally benign functionalization agents, with recent innovations focusing on bio-derived sorbents that minimize hazardous waste generation. However, standardized protocols for sorbent disposal or regeneration remain underdeveloped across the industry.

Sustainability metrics increasingly incorporate social dimensions alongside environmental parameters. Recent competitive assessments highlight the importance of considering raw material sourcing ethics, particularly for sorbents containing rare earth elements or materials extracted from conflict regions. Leading companies in the field have begun publishing sustainability reports that track these expanded metrics, signaling a shift toward more holistic environmental accounting.

The environmental resilience of sorbent technologies under changing climate conditions represents an emerging area of concern. Patent activity indicates growing interest in developing materials that maintain performance despite temperature fluctuations, humidity variations, and exposure to atmospheric contaminants—factors that will become increasingly relevant as deployment scales in diverse global settings.

Cost-Efficiency Analysis and Commercialization Pathways

The economic viability of solid sorbent technologies for CO2 capture remains a critical factor in their widespread adoption. Current cost analyses indicate that solid sorbents can potentially reduce capture costs to $30-50 per ton of CO2, compared to $40-80 for conventional amine scrubbing technologies. This cost advantage stems primarily from lower energy requirements for regeneration and reduced equipment corrosion issues.

Capital expenditure for solid sorbent systems varies significantly based on sorbent type and system configuration. Metal-organic frameworks (MOFs) and certain engineered adsorbents currently face high synthesis costs, while activated carbons and certain zeolites offer more economical alternatives. Operational expenses are dominated by sorbent replacement costs and energy consumption, with promising developments in extending sorbent lifetimes from hundreds to potentially thousands of cycles.

Scale-up challenges represent significant barriers to commercialization. Laboratory-scale successes often encounter difficulties in maintaining performance metrics when scaled to industrial levels. Key challenges include maintaining sorbent stability under real-world conditions, managing pressure drops in large fixed-bed configurations, and developing efficient heat management systems for temperature swing processes.

The commercialization pathway typically follows a staged approach. Initial deployment focuses on niche applications where CO2 concentration is high and capture volumes moderate, such as biogas upgrading or natural gas processing. These early markets provide valuable operational data while generating revenue to support further development. Mid-term commercialization targets include cement production and steel manufacturing, where process integration can be optimized.

Strategic partnerships between technology developers and industrial end-users have emerged as a crucial commercialization accelerator. Companies like Carbon Clean and Svante have successfully leveraged such partnerships to access test facilities and secure initial commercial deployments. Government incentives, including carbon pricing mechanisms and tax credits like the 45Q in the United States, significantly improve the business case for early adopters.

Market entry strategies increasingly focus on modular designs that allow for gradual capacity expansion and reduced initial capital requirements. This approach enables companies to demonstrate technology at commercially relevant scales while managing financial risk, as evidenced by recent deployments from Carbon Engineering and Climeworks in direct air capture applications using solid sorbent technologies.

Capital expenditure for solid sorbent systems varies significantly based on sorbent type and system configuration. Metal-organic frameworks (MOFs) and certain engineered adsorbents currently face high synthesis costs, while activated carbons and certain zeolites offer more economical alternatives. Operational expenses are dominated by sorbent replacement costs and energy consumption, with promising developments in extending sorbent lifetimes from hundreds to potentially thousands of cycles.

Scale-up challenges represent significant barriers to commercialization. Laboratory-scale successes often encounter difficulties in maintaining performance metrics when scaled to industrial levels. Key challenges include maintaining sorbent stability under real-world conditions, managing pressure drops in large fixed-bed configurations, and developing efficient heat management systems for temperature swing processes.

The commercialization pathway typically follows a staged approach. Initial deployment focuses on niche applications where CO2 concentration is high and capture volumes moderate, such as biogas upgrading or natural gas processing. These early markets provide valuable operational data while generating revenue to support further development. Mid-term commercialization targets include cement production and steel manufacturing, where process integration can be optimized.

Strategic partnerships between technology developers and industrial end-users have emerged as a crucial commercialization accelerator. Companies like Carbon Clean and Svante have successfully leveraged such partnerships to access test facilities and secure initial commercial deployments. Government incentives, including carbon pricing mechanisms and tax credits like the 45Q in the United States, significantly improve the business case for early adopters.

Market entry strategies increasingly focus on modular designs that allow for gradual capacity expansion and reduced initial capital requirements. This approach enables companies to demonstrate technology at commercially relevant scales while managing financial risk, as evidenced by recent deployments from Carbon Engineering and Climeworks in direct air capture applications using solid sorbent technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!