Evaluation of Solid sorbents for CO2 capture for power plant and cement industry integration

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Technology Background and Objectives

Carbon dioxide capture and sequestration (CCS) has emerged as a critical technology in the global effort to mitigate climate change. The historical development of CO2 capture technologies dates back to the 1930s when absorption processes using amines were first developed for natural gas sweetening. However, the application of these technologies specifically for climate change mitigation gained momentum only in the late 1990s as global awareness of greenhouse gas impacts increased.

The evolution of CO2 capture technologies has progressed through several generations, from conventional amine scrubbing to more advanced methods including solid sorbents, which represent a promising alternative due to their potential for lower energy penalties and operational costs. Solid sorbents for CO2 capture have been under intensive research and development over the past two decades, with significant advancements in materials science contributing to improved capture efficiency and selectivity.

Power plants and cement industries collectively account for approximately 40% of global CO2 emissions, making them prime targets for carbon capture implementation. The cement industry alone contributes about 8% of global CO2 emissions, with roughly 60% coming from the calcination process itself—a particularly challenging source to decarbonize without capture technologies.

The technical objectives for solid sorbent CO2 capture systems in these industries include achieving capture rates exceeding 90% while maintaining energy penalties below 30% of plant output, demonstrating operational stability for at least 10,000 cycles, and reducing capture costs to below $40 per ton of CO2. Additionally, these systems must be designed for seamless integration with existing infrastructure, minimizing disruption to core industrial processes.

Current technological trends indicate a shift toward modular and scalable capture systems that can be retrofitted to existing facilities or incorporated into new plant designs. Research is increasingly focused on developing sorbents with high CO2 selectivity in the presence of other flue gas components, particularly water vapor and sulfur compounds, which are prevalent in both power plant and cement factory emissions.

The trajectory of solid sorbent technology development suggests that by 2030, commercially viable systems could be widely deployed, potentially capturing hundreds of millions of tons of CO2 annually. This aligns with international climate goals that necessitate large-scale deployment of negative emissions technologies in the second half of this century to limit global warming to well below 2°C as outlined in the Paris Agreement.

The evolution of CO2 capture technologies has progressed through several generations, from conventional amine scrubbing to more advanced methods including solid sorbents, which represent a promising alternative due to their potential for lower energy penalties and operational costs. Solid sorbents for CO2 capture have been under intensive research and development over the past two decades, with significant advancements in materials science contributing to improved capture efficiency and selectivity.

Power plants and cement industries collectively account for approximately 40% of global CO2 emissions, making them prime targets for carbon capture implementation. The cement industry alone contributes about 8% of global CO2 emissions, with roughly 60% coming from the calcination process itself—a particularly challenging source to decarbonize without capture technologies.

The technical objectives for solid sorbent CO2 capture systems in these industries include achieving capture rates exceeding 90% while maintaining energy penalties below 30% of plant output, demonstrating operational stability for at least 10,000 cycles, and reducing capture costs to below $40 per ton of CO2. Additionally, these systems must be designed for seamless integration with existing infrastructure, minimizing disruption to core industrial processes.

Current technological trends indicate a shift toward modular and scalable capture systems that can be retrofitted to existing facilities or incorporated into new plant designs. Research is increasingly focused on developing sorbents with high CO2 selectivity in the presence of other flue gas components, particularly water vapor and sulfur compounds, which are prevalent in both power plant and cement factory emissions.

The trajectory of solid sorbent technology development suggests that by 2030, commercially viable systems could be widely deployed, potentially capturing hundreds of millions of tons of CO2 annually. This aligns with international climate goals that necessitate large-scale deployment of negative emissions technologies in the second half of this century to limit global warming to well below 2°C as outlined in the Paris Agreement.

Market Analysis for Solid Sorbent CO2 Capture Solutions

The global market for solid sorbent CO2 capture technologies is experiencing significant growth, driven by increasing regulatory pressures and corporate sustainability commitments. Current market valuations indicate the carbon capture and storage (CCS) sector is worth approximately $7.5 billion globally, with projections suggesting expansion to $15-20 billion by 2030. Within this broader market, solid sorbent technologies represent a rapidly growing segment with estimated annual growth rates of 12-15%.

Power generation and cement production collectively account for nearly 40% of global industrial CO2 emissions, presenting a substantial addressable market for solid sorbent technologies. The cement industry alone contributes roughly 8% of global CO2 emissions, with limited alternative decarbonization options compared to other sectors, making carbon capture solutions particularly valuable in this context.

Market penetration analysis reveals varying adoption rates across regions, with Europe leading implementation due to stringent emissions regulations and carbon pricing mechanisms. The European Union's Emissions Trading System (ETS) carbon price, currently hovering around €80-90 per tonne, has created economic incentives for industrial emitters to invest in capture technologies. North America follows with growing momentum, particularly after the enhancement of 45Q tax credits in the United States, which now offer up to $85 per tonne for permanently sequestered CO2.

Customer segmentation within these industries shows distinct needs and adoption patterns. Large power utilities with coal and natural gas plants represent primary customers with substantial capital resources but require solutions with minimal energy penalties. Cement manufacturers, typically operating with thinner margins, seek cost-effective solutions that can integrate with high-temperature processes without compromising product quality.

Competitive analysis indicates that solid sorbent technologies are gaining market share against traditional amine-based liquid solvent approaches, particularly in retrofit applications where space constraints and energy integration are critical factors. The lower regeneration energy requirements of advanced solid sorbents (1.5-2.5 GJ/tonne CO2 compared to 3.0-4.5 GJ/tonne for conventional amine systems) translate to operational cost advantages that are increasingly recognized by potential adopters.

Market barriers include high capital expenditure requirements, with typical installation costs ranging from $600-1,200 per tonne of annual CO2 capture capacity, and uncertainty regarding long-term policy frameworks for carbon pricing and storage infrastructure development. Despite these challenges, market forecasts suggest solid sorbent technologies could capture 25-30% of the industrial carbon capture market by 2035, representing a significant commercial opportunity for technology developers and solution providers.

Power generation and cement production collectively account for nearly 40% of global industrial CO2 emissions, presenting a substantial addressable market for solid sorbent technologies. The cement industry alone contributes roughly 8% of global CO2 emissions, with limited alternative decarbonization options compared to other sectors, making carbon capture solutions particularly valuable in this context.

Market penetration analysis reveals varying adoption rates across regions, with Europe leading implementation due to stringent emissions regulations and carbon pricing mechanisms. The European Union's Emissions Trading System (ETS) carbon price, currently hovering around €80-90 per tonne, has created economic incentives for industrial emitters to invest in capture technologies. North America follows with growing momentum, particularly after the enhancement of 45Q tax credits in the United States, which now offer up to $85 per tonne for permanently sequestered CO2.

Customer segmentation within these industries shows distinct needs and adoption patterns. Large power utilities with coal and natural gas plants represent primary customers with substantial capital resources but require solutions with minimal energy penalties. Cement manufacturers, typically operating with thinner margins, seek cost-effective solutions that can integrate with high-temperature processes without compromising product quality.

Competitive analysis indicates that solid sorbent technologies are gaining market share against traditional amine-based liquid solvent approaches, particularly in retrofit applications where space constraints and energy integration are critical factors. The lower regeneration energy requirements of advanced solid sorbents (1.5-2.5 GJ/tonne CO2 compared to 3.0-4.5 GJ/tonne for conventional amine systems) translate to operational cost advantages that are increasingly recognized by potential adopters.

Market barriers include high capital expenditure requirements, with typical installation costs ranging from $600-1,200 per tonne of annual CO2 capture capacity, and uncertainty regarding long-term policy frameworks for carbon pricing and storage infrastructure development. Despite these challenges, market forecasts suggest solid sorbent technologies could capture 25-30% of the industrial carbon capture market by 2035, representing a significant commercial opportunity for technology developers and solution providers.

Current Status and Challenges in Solid Sorbent Technology

Solid sorbent technology for CO2 capture has gained significant attention globally as a promising alternative to conventional amine-based absorption processes. Currently, several classes of solid sorbents are being investigated, including activated carbons, zeolites, metal-organic frameworks (MOFs), amine-functionalized silica, and hydrotalcites. Each material class exhibits unique characteristics in terms of CO2 adsorption capacity, selectivity, regeneration energy requirements, and stability under operational conditions.

In the power plant sector, pilot-scale demonstrations have been conducted in the United States, Europe, and Asia, with capacities ranging from 0.1 to 1 MWe. These demonstrations have shown that solid sorbents can potentially reduce the energy penalty associated with CO2 capture by 20-30% compared to liquid amine systems. However, most implementations remain at Technology Readiness Level (TRL) 5-6, with full commercial deployment still facing significant hurdles.

For cement industry applications, solid sorbent technology is at an earlier stage of development (TRL 4-5), with fewer dedicated pilot projects. The high temperature and presence of contaminants in cement plant flue gases present additional challenges for sorbent stability and performance.

The primary technical challenges currently limiting widespread adoption include sorbent degradation over multiple adsorption-desorption cycles, particularly in the presence of SOx, NOx, and moisture. Most promising materials show performance deterioration after 100-1000 cycles, whereas commercial viability typically requires stability over thousands of cycles. Additionally, the trade-off between CO2 adsorption capacity and regeneration energy requirements remains a significant optimization challenge.

Scale-up issues represent another major obstacle. Current manufacturing processes for advanced sorbents like MOFs and functionalized materials are costly and difficult to scale. The estimated production cost for high-performance sorbents ranges from $20-100/kg, whereas commercial viability likely requires costs below $10/kg. Furthermore, the mechanical stability of sorbents under industrial conditions, including attrition resistance in fluidized bed configurations, needs substantial improvement.

Heat management during adsorption (exothermic) and desorption (endothermic) processes presents engineering challenges that impact overall system efficiency. Current reactor designs struggle to effectively manage these thermal effects at industrial scales, leading to reduced working capacities and increased energy consumption.

Geographically, research leadership is distributed across North America (primarily USA), Europe (Germany, UK, Netherlands), and East Asia (China, Japan, South Korea), with increasing contributions from emerging economies like India. Industrial engagement varies significantly by region, with more commercial partnerships evident in East Asia compared to other regions.

In the power plant sector, pilot-scale demonstrations have been conducted in the United States, Europe, and Asia, with capacities ranging from 0.1 to 1 MWe. These demonstrations have shown that solid sorbents can potentially reduce the energy penalty associated with CO2 capture by 20-30% compared to liquid amine systems. However, most implementations remain at Technology Readiness Level (TRL) 5-6, with full commercial deployment still facing significant hurdles.

For cement industry applications, solid sorbent technology is at an earlier stage of development (TRL 4-5), with fewer dedicated pilot projects. The high temperature and presence of contaminants in cement plant flue gases present additional challenges for sorbent stability and performance.

The primary technical challenges currently limiting widespread adoption include sorbent degradation over multiple adsorption-desorption cycles, particularly in the presence of SOx, NOx, and moisture. Most promising materials show performance deterioration after 100-1000 cycles, whereas commercial viability typically requires stability over thousands of cycles. Additionally, the trade-off between CO2 adsorption capacity and regeneration energy requirements remains a significant optimization challenge.

Scale-up issues represent another major obstacle. Current manufacturing processes for advanced sorbents like MOFs and functionalized materials are costly and difficult to scale. The estimated production cost for high-performance sorbents ranges from $20-100/kg, whereas commercial viability likely requires costs below $10/kg. Furthermore, the mechanical stability of sorbents under industrial conditions, including attrition resistance in fluidized bed configurations, needs substantial improvement.

Heat management during adsorption (exothermic) and desorption (endothermic) processes presents engineering challenges that impact overall system efficiency. Current reactor designs struggle to effectively manage these thermal effects at industrial scales, leading to reduced working capacities and increased energy consumption.

Geographically, research leadership is distributed across North America (primarily USA), Europe (Germany, UK, Netherlands), and East Asia (China, Japan, South Korea), with increasing contributions from emerging economies like India. Industrial engagement varies significantly by region, with more commercial partnerships evident in East Asia compared to other regions.

Current Solid Sorbent Solutions for Industrial Applications

01 Metal-organic frameworks (MOFs) for CO2 capture

Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated with organic ligands. They exhibit high surface areas, tunable pore sizes, and chemical functionality, making them effective for selective CO2 adsorption. MOFs can be designed with specific metal centers and organic linkers to enhance CO2 binding affinity and selectivity. Their modular nature allows for customization to optimize capture performance under various conditions, including post-combustion flue gas environments.- Metal-organic frameworks (MOFs) for CO2 capture: Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated with organic ligands. They have high surface areas, tunable pore sizes, and can be designed with specific functional groups to enhance CO2 adsorption capacity and selectivity. MOFs can be modified to improve stability under various conditions and can achieve high CO2 capture efficiency even at low concentrations.

- Amine-functionalized solid sorbents: Solid sorbents functionalized with amine groups demonstrate high affinity for CO2 through chemical adsorption mechanisms. These materials include amine-grafted silica, polymeric resins with amine groups, and other porous substrates modified with various amine compounds. The amine functionality creates strong binding sites for CO2, allowing for efficient capture even at low partial pressures. These sorbents can be regenerated at lower temperatures compared to traditional liquid amine systems, reducing energy requirements.

- Zeolite-based CO2 sorbents: Zeolites are aluminosilicate minerals with highly ordered microporous structures that can effectively capture CO2 through physical adsorption. Their crystalline framework contains uniform pores and cavities that can selectively adsorb CO2 molecules. Zeolites can be modified by ion exchange, impregnation with alkali metals, or incorporation of functional groups to enhance their CO2 capture performance. These materials offer good thermal stability and can be regenerated multiple times without significant loss of capacity.

- Carbon-based sorbents for CO2 capture: Carbon-based materials such as activated carbon, carbon nanotubes, graphene, and carbon molecular sieves serve as effective CO2 sorbents due to their high surface area and porous structure. These materials can be modified through chemical activation, surface functionalization, or doping with nitrogen or metal particles to enhance CO2 selectivity and capacity. Carbon-based sorbents offer advantages including low cost, high thermal stability, hydrophobicity, and resistance to degradation in various operating conditions.

- Regeneration methods for solid CO2 sorbents: Various regeneration techniques are employed to release captured CO2 from solid sorbents and restore their adsorption capacity for repeated use. These methods include temperature swing adsorption (TSA), pressure swing adsorption (PSA), vacuum swing adsorption (VSA), and combinations thereof. Novel approaches such as microwave-assisted regeneration, electrical swing adsorption, and steam stripping have been developed to reduce energy consumption during the regeneration process. Efficient regeneration is crucial for the economic viability of solid sorbent-based CO2 capture systems.

02 Amine-functionalized solid sorbents

Amine-functionalized materials represent a significant class of CO2 sorbents that operate through chemical adsorption mechanisms. These materials incorporate amine groups onto various supports such as silica, polymers, or porous carbons to create strong binding sites for CO2. The amine groups react with CO2 to form carbamates or bicarbonates, enabling high selectivity even at low CO2 concentrations. These sorbents can be regenerated through temperature or pressure swing processes, making them suitable for cyclic capture operations in industrial settings.Expand Specific Solutions03 Zeolite and molecular sieve-based CO2 adsorbents

Zeolites and molecular sieves are aluminosilicate materials with well-defined microporous structures that can selectively adsorb CO2 based on molecular size and polarity. These materials utilize physical adsorption mechanisms and can be modified with cations to enhance CO2 selectivity. Their high thermal stability allows for effective regeneration through temperature swing processes. Zeolites can be tailored with specific Si/Al ratios and framework structures to optimize CO2 capture performance under different operating conditions, including varying temperatures and presence of moisture.Expand Specific Solutions04 Carbon-based sorbents for CO2 capture

Carbon-based materials, including activated carbons, carbon nanotubes, and graphene derivatives, serve as effective CO2 sorbents due to their high surface area and porous structure. These materials can be functionalized or doped with nitrogen, oxygen, or metal particles to enhance CO2 binding affinity. Carbon-based sorbents offer advantages including low cost, high stability, and ease of regeneration. They can be produced from various precursors including biomass, polymers, or waste materials, making them environmentally sustainable options for large-scale carbon capture applications.Expand Specific Solutions05 Hybrid and composite sorbent materials

Hybrid and composite sorbents combine multiple material types to achieve enhanced CO2 capture performance beyond what individual components can provide. These materials often integrate complementary capture mechanisms, such as combining physical adsorption properties of porous supports with chemical binding sites. Examples include polymer-inorganic composites, MOF-polymer hybrids, and layered double hydroxide composites. These materials can be designed to address specific challenges like moisture tolerance, mechanical stability, and heat management during adsorption-desorption cycles, making them promising candidates for practical carbon capture applications.Expand Specific Solutions

Key Industry Players in Solid Sorbent Development

The solid sorbent CO2 capture technology for power plants and cement industries is in a growth phase, with increasing market adoption driven by decarbonization imperatives. The global market is expanding rapidly, projected to reach significant scale as carbon capture becomes essential for emissions reduction. Technologically, the field shows varying maturity levels across different sorbent types. Leading players include energy giants like Sinopec and Korea Electric Power Corporation developing commercial-scale solutions, while specialized entities like Carboncapture focus on direct air capture innovations. Research institutions such as CSIC, Beijing University of Technology, and West Virginia University are advancing fundamental sorbent science. The competitive landscape features collaboration between industrial implementers (BBMG, Huadian Power) and technology developers, with increasing cross-sector partnerships accelerating deployment readiness.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced solid sorbent technologies for CO2 capture focusing on amine-functionalized mesoporous silica materials. Their approach involves grafting various amine compounds onto high-surface-area silica supports to create efficient CO2 adsorption sites. Sinopec's technology employs a temperature swing adsorption (TSA) process where CO2 is captured at lower temperatures (40-60°C) and released during regeneration at moderate temperatures (100-120°C). This system has been tested at pilot scale facilities integrated with both power plants and cement factories, demonstrating capture efficiencies of over 90% with energy penalties significantly lower than conventional amine scrubbing technologies. Sinopec has also developed proprietary fluidized bed adsorption systems that allow continuous operation and better heat management during the adsorption-desorption cycles, improving overall system efficiency and reducing operational costs.

Strengths: Lower regeneration energy requirements compared to liquid amine systems; reduced equipment corrosion issues; ability to operate in the presence of contaminants found in flue gas. Weaknesses: Potential degradation of sorbent capacity over multiple cycles; higher initial capital costs compared to conventional technologies; challenges in scaling up production of specialized sorbent materials.

Huadian Electric Power Research Institute Co., Ltd.

Technical Solution: Huadian Electric Power Research Institute has pioneered a comprehensive solid sorbent CO2 capture system specifically designed for integration with coal-fired power plants. Their technology utilizes metal-organic frameworks (MOFs) and hydrotalcite-derived mixed metal oxides as primary sorbent materials, which demonstrate exceptional CO2 selectivity even in the presence of moisture and other flue gas contaminants. The institute has developed a novel moving bed reactor configuration that allows continuous adsorption and regeneration, significantly reducing the energy penalty associated with traditional capture methods. Their system incorporates waste heat recovery from both the power plant and the cement manufacturing process, creating synergistic energy integration. Laboratory and pilot-scale tests have demonstrated CO2 capture rates exceeding 85% with regeneration energy requirements approximately 30% lower than conventional amine scrubbing technologies. Huadian has also developed specialized sorbent formulations that resist degradation from SOx and NOx contaminants, extending operational lifetimes and reducing replacement costs.

Strengths: Excellent integration capabilities with existing power plant infrastructure; lower water consumption compared to wet scrubbing technologies; reduced parasitic energy load on host facilities. Weaknesses: Higher initial capital investment required; potential challenges with sorbent attrition in moving bed systems; technology still requires further demonstration at commercial scale.

Technical Analysis of Leading Solid Sorbent Patents

Layered Solid Sorbents For Carbon Dioxide Capture

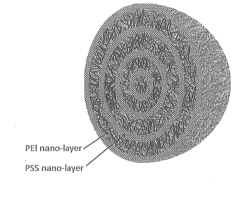

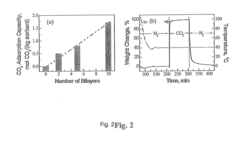

PatentActiveUS20140127104A1

Innovation

- Development of nano-layered solid sorbents using electrostatic layer-by-layer nanoassembly, where CO2-adsorbing polymers like polyethylenimine and oppositely charged polyelectrolytes are alternately deposited on porous substrates, creating bilayers that enhance CO2 capture and transport efficiency.

Integration Frameworks for Power and Cement Industries

The integration of CO2 capture technologies between power plants and cement industries requires robust frameworks that optimize resource utilization while minimizing operational disruptions. These frameworks must address the unique challenges presented by both sectors, including different operational cycles, varying CO2 concentrations, and distinct energy requirements.

Power plants and cement facilities can be integrated through several architectural approaches. The hub-and-spoke model allows multiple cement plants to connect to a centralized power generation facility equipped with carbon capture infrastructure. This enables economies of scale for capture operations while distributing costs across multiple stakeholders. Alternatively, the parallel integration model involves independent capture systems at both facilities with shared transportation and storage infrastructure.

Energy integration represents a critical component of these frameworks. Waste heat recovery systems from cement kilns can provide thermal energy for solvent regeneration in power plant capture units. Similarly, power plants can supply electricity for compression and auxiliary systems in cement facilities. These synergies can reduce the overall energy penalty associated with carbon capture by 15-25% compared to standalone implementations.

Material flow optimization within integration frameworks focuses on balancing CO2 streams with varying concentrations. Cement kilns typically produce more concentrated CO2 streams (25-35%) compared to power plants (12-15%), allowing for strategic blending to improve capture efficiency. Advanced control systems utilizing machine learning algorithms can dynamically adjust capture parameters based on real-time production data from both facilities.

Financial frameworks must address the complex cost-sharing arrangements between different industrial entities. Joint venture models, where power and cement companies co-invest in capture infrastructure, have demonstrated success in pilot projects across Europe. Performance-based contracting frameworks, where technology providers are compensated based on actual CO2 reduction, help mitigate technological risks for industrial partners.

Regulatory considerations significantly impact integration framework design. Cross-sector carbon accounting methodologies must be established to properly allocate emission reductions. Standardized interfaces between facilities ensure interoperability of control systems and physical infrastructure, facilitating seamless integration regardless of the specific solid sorbent technology deployed.

Power plants and cement facilities can be integrated through several architectural approaches. The hub-and-spoke model allows multiple cement plants to connect to a centralized power generation facility equipped with carbon capture infrastructure. This enables economies of scale for capture operations while distributing costs across multiple stakeholders. Alternatively, the parallel integration model involves independent capture systems at both facilities with shared transportation and storage infrastructure.

Energy integration represents a critical component of these frameworks. Waste heat recovery systems from cement kilns can provide thermal energy for solvent regeneration in power plant capture units. Similarly, power plants can supply electricity for compression and auxiliary systems in cement facilities. These synergies can reduce the overall energy penalty associated with carbon capture by 15-25% compared to standalone implementations.

Material flow optimization within integration frameworks focuses on balancing CO2 streams with varying concentrations. Cement kilns typically produce more concentrated CO2 streams (25-35%) compared to power plants (12-15%), allowing for strategic blending to improve capture efficiency. Advanced control systems utilizing machine learning algorithms can dynamically adjust capture parameters based on real-time production data from both facilities.

Financial frameworks must address the complex cost-sharing arrangements between different industrial entities. Joint venture models, where power and cement companies co-invest in capture infrastructure, have demonstrated success in pilot projects across Europe. Performance-based contracting frameworks, where technology providers are compensated based on actual CO2 reduction, help mitigate technological risks for industrial partners.

Regulatory considerations significantly impact integration framework design. Cross-sector carbon accounting methodologies must be established to properly allocate emission reductions. Standardized interfaces between facilities ensure interoperability of control systems and physical infrastructure, facilitating seamless integration regardless of the specific solid sorbent technology deployed.

Environmental Impact and Sustainability Assessment

The environmental impact assessment of solid sorbents for CO2 capture reveals significant sustainability implications across their lifecycle. When comparing solid sorbents with traditional amine-based liquid absorption systems, solid sorbents demonstrate reduced energy penalties and lower water consumption requirements. This translates to approximately 15-30% less energy demand during regeneration processes, directly contributing to decreased indirect emissions from power consumption.

Material production and disposal considerations are paramount for comprehensive sustainability evaluation. Zeolites, metal-organic frameworks (MOFs), and amine-functionalized silica each present distinct environmental footprints. Zeolites, while naturally occurring, require energy-intensive synthesis processes when manufactured at industrial scale. MOFs contain heavy metals that necessitate careful end-of-life management to prevent environmental contamination. Amine-functionalized materials raise concerns regarding potential amine leaching during operation and disposal phases.

Life cycle assessment (LCA) studies indicate that the environmental benefits of CO2 capture using solid sorbents must be weighed against the emissions generated during sorbent production, operation, and disposal. Current research suggests a carbon payback period of 3-7 years for most solid sorbent systems, depending on specific material selection and process configuration. This period represents the time required for the captured CO2 to offset the emissions associated with the capture system implementation.

Integration with cement industry operations presents unique environmental considerations. The high-temperature environment of cement kilns affects sorbent stability and lifetime, potentially increasing replacement frequency and associated environmental impacts. However, the ability to utilize waste heat from cement production for sorbent regeneration offers significant energy efficiency improvements compared to standalone capture systems.

Water usage represents another critical environmental factor. While solid sorbents generally require less cooling water than liquid systems, certain regeneration methods still demand substantial water resources. Advanced dry cooling technologies and water recycling systems can reduce freshwater consumption by up to 60%, enhancing the sustainability profile of solid sorbent systems in water-stressed regions.

Potential secondary environmental impacts include particulate emissions from sorbent attrition, chemical leaching during rainfall exposure at disposal sites, and land use changes associated with mineral extraction for sorbent production. Emerging research focuses on developing biodegradable support structures and environmentally benign functionalization methods to address these concerns and improve the overall sustainability of solid sorbent technologies for carbon capture applications.

Material production and disposal considerations are paramount for comprehensive sustainability evaluation. Zeolites, metal-organic frameworks (MOFs), and amine-functionalized silica each present distinct environmental footprints. Zeolites, while naturally occurring, require energy-intensive synthesis processes when manufactured at industrial scale. MOFs contain heavy metals that necessitate careful end-of-life management to prevent environmental contamination. Amine-functionalized materials raise concerns regarding potential amine leaching during operation and disposal phases.

Life cycle assessment (LCA) studies indicate that the environmental benefits of CO2 capture using solid sorbents must be weighed against the emissions generated during sorbent production, operation, and disposal. Current research suggests a carbon payback period of 3-7 years for most solid sorbent systems, depending on specific material selection and process configuration. This period represents the time required for the captured CO2 to offset the emissions associated with the capture system implementation.

Integration with cement industry operations presents unique environmental considerations. The high-temperature environment of cement kilns affects sorbent stability and lifetime, potentially increasing replacement frequency and associated environmental impacts. However, the ability to utilize waste heat from cement production for sorbent regeneration offers significant energy efficiency improvements compared to standalone capture systems.

Water usage represents another critical environmental factor. While solid sorbents generally require less cooling water than liquid systems, certain regeneration methods still demand substantial water resources. Advanced dry cooling technologies and water recycling systems can reduce freshwater consumption by up to 60%, enhancing the sustainability profile of solid sorbent systems in water-stressed regions.

Potential secondary environmental impacts include particulate emissions from sorbent attrition, chemical leaching during rainfall exposure at disposal sites, and land use changes associated with mineral extraction for sorbent production. Emerging research focuses on developing biodegradable support structures and environmentally benign functionalization methods to address these concerns and improve the overall sustainability of solid sorbent technologies for carbon capture applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!