Research on Solid sorbents for CO2 capture for high throughput carbon capture systems

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Technology Evolution and Objectives

Carbon dioxide capture technology has evolved significantly over the past several decades, driven by increasing global concerns about climate change and greenhouse gas emissions. The journey began in the 1970s with basic absorption processes using liquid amines, primarily developed for natural gas sweetening rather than climate mitigation. By the 1990s, as climate science advanced, these technologies were adapted specifically for carbon capture from power plants and industrial facilities, marking the first generation of purposeful CO2 capture systems.

The early 2000s witnessed the emergence of membrane-based separation technologies and initial research into solid sorbents, representing the second generation of capture technologies. These developments aimed to address the high energy penalties and corrosion issues associated with liquid amine systems. The period from 2010 to 2020 saw accelerated innovation in advanced materials, including metal-organic frameworks (MOFs), functionalized porous silicas, and carbon-based sorbents, establishing the foundation for today's high-throughput carbon capture systems.

Currently, solid sorbents represent one of the most promising technological pathways for next-generation carbon capture. These materials offer significant advantages over traditional liquid absorbents, including lower regeneration energy requirements, reduced corrosion issues, and greater operational flexibility across various industrial settings. The technical objective is to develop solid sorbent systems capable of capturing CO2 with at least 90% efficiency while reducing the energy penalty to below 1.0 GJ/tonne CO2—a substantial improvement over first-generation technologies that required 3.5-4.0 GJ/tonne.

Research objectives specifically focus on enhancing three critical parameters: adsorption capacity, selectivity for CO2 over other gases, and cycling stability. The target specifications include achieving CO2 working capacities exceeding 3 mmol/g under realistic flue gas conditions, selectivity factors above 100 for CO2/N2 separation, and maintaining performance over thousands of adsorption-desorption cycles.

Beyond technical performance, research aims to develop materials and systems that can be manufactured at scale with costs below $30 per tonne of CO2 captured. This economic threshold is considered essential for widespread commercial adoption across various industrial sectors. The ultimate goal is to create modular, scalable carbon capture units that can be retrofitted to existing facilities or integrated into new designs across power generation, cement production, steel manufacturing, and other carbon-intensive industries.

The early 2000s witnessed the emergence of membrane-based separation technologies and initial research into solid sorbents, representing the second generation of capture technologies. These developments aimed to address the high energy penalties and corrosion issues associated with liquid amine systems. The period from 2010 to 2020 saw accelerated innovation in advanced materials, including metal-organic frameworks (MOFs), functionalized porous silicas, and carbon-based sorbents, establishing the foundation for today's high-throughput carbon capture systems.

Currently, solid sorbents represent one of the most promising technological pathways for next-generation carbon capture. These materials offer significant advantages over traditional liquid absorbents, including lower regeneration energy requirements, reduced corrosion issues, and greater operational flexibility across various industrial settings. The technical objective is to develop solid sorbent systems capable of capturing CO2 with at least 90% efficiency while reducing the energy penalty to below 1.0 GJ/tonne CO2—a substantial improvement over first-generation technologies that required 3.5-4.0 GJ/tonne.

Research objectives specifically focus on enhancing three critical parameters: adsorption capacity, selectivity for CO2 over other gases, and cycling stability. The target specifications include achieving CO2 working capacities exceeding 3 mmol/g under realistic flue gas conditions, selectivity factors above 100 for CO2/N2 separation, and maintaining performance over thousands of adsorption-desorption cycles.

Beyond technical performance, research aims to develop materials and systems that can be manufactured at scale with costs below $30 per tonne of CO2 captured. This economic threshold is considered essential for widespread commercial adoption across various industrial sectors. The ultimate goal is to create modular, scalable carbon capture units that can be retrofitted to existing facilities or integrated into new designs across power generation, cement production, steel manufacturing, and other carbon-intensive industries.

Market Analysis for Carbon Capture Solutions

The global carbon capture and storage (CCS) market is experiencing significant growth, driven by increasing environmental concerns and stringent regulations aimed at reducing greenhouse gas emissions. As of 2023, the market was valued at approximately $7.3 billion, with projections indicating a compound annual growth rate (CAGR) of 19.2% through 2030, potentially reaching $35.9 billion by the end of the decade.

Solid sorbents for CO2 capture represent a rapidly expanding segment within this market, offering advantages over traditional liquid-based capture methods. This segment is expected to grow at a CAGR of 23.5% between 2023 and 2030, outpacing the overall CCS market growth due to technological advancements and efficiency improvements.

Geographically, North America currently dominates the carbon capture market with a 42% share, followed by Europe at 31% and Asia-Pacific at 21%. However, the Asia-Pacific region is anticipated to witness the fastest growth rate of 24.7% annually through 2030, primarily driven by China and India's increasing focus on emission reduction technologies while maintaining industrial growth.

By industry vertical, power generation represents the largest application sector for carbon capture technologies, accounting for 38% of the market. This is followed by oil and gas (27%), cement production (15%), chemical processing (12%), and other industries (8%). High-throughput carbon capture systems using solid sorbents are gaining particular traction in the power generation and cement sectors due to their ability to handle large volumes of flue gas efficiently.

Investment in carbon capture technologies has seen remarkable growth, with venture capital funding increasing from $336 million in 2020 to over $1.9 billion in 2023. Government initiatives worldwide are further stimulating market growth, with the US Inflation Reduction Act allocating $369 billion toward climate change initiatives, including substantial tax credits for carbon capture projects.

Customer demand is increasingly driven by corporate sustainability commitments, with over 300 major global corporations having pledged to achieve net-zero emissions by 2050. This creates a substantial market for high-throughput carbon capture solutions that can be retrofitted to existing industrial facilities or integrated into new designs.

The economic viability of carbon capture technologies remains a critical market factor, with current costs ranging from $58-$120 per ton of CO2 captured. Solid sorbent technologies are positioned to potentially reduce these costs to $30-$50 per ton by 2030, which would significantly accelerate market adoption across multiple industries and geographies.

Solid sorbents for CO2 capture represent a rapidly expanding segment within this market, offering advantages over traditional liquid-based capture methods. This segment is expected to grow at a CAGR of 23.5% between 2023 and 2030, outpacing the overall CCS market growth due to technological advancements and efficiency improvements.

Geographically, North America currently dominates the carbon capture market with a 42% share, followed by Europe at 31% and Asia-Pacific at 21%. However, the Asia-Pacific region is anticipated to witness the fastest growth rate of 24.7% annually through 2030, primarily driven by China and India's increasing focus on emission reduction technologies while maintaining industrial growth.

By industry vertical, power generation represents the largest application sector for carbon capture technologies, accounting for 38% of the market. This is followed by oil and gas (27%), cement production (15%), chemical processing (12%), and other industries (8%). High-throughput carbon capture systems using solid sorbents are gaining particular traction in the power generation and cement sectors due to their ability to handle large volumes of flue gas efficiently.

Investment in carbon capture technologies has seen remarkable growth, with venture capital funding increasing from $336 million in 2020 to over $1.9 billion in 2023. Government initiatives worldwide are further stimulating market growth, with the US Inflation Reduction Act allocating $369 billion toward climate change initiatives, including substantial tax credits for carbon capture projects.

Customer demand is increasingly driven by corporate sustainability commitments, with over 300 major global corporations having pledged to achieve net-zero emissions by 2050. This creates a substantial market for high-throughput carbon capture solutions that can be retrofitted to existing industrial facilities or integrated into new designs.

The economic viability of carbon capture technologies remains a critical market factor, with current costs ranging from $58-$120 per ton of CO2 captured. Solid sorbent technologies are positioned to potentially reduce these costs to $30-$50 per ton by 2030, which would significantly accelerate market adoption across multiple industries and geographies.

Solid Sorbents: Current Status and Technical Barriers

Solid sorbents have emerged as promising materials for CO2 capture systems due to their potential advantages over traditional liquid amine-based absorption technologies. Currently, several classes of solid sorbents are being investigated, including activated carbons, zeolites, metal-organic frameworks (MOFs), amine-functionalized silica, and hydrotalcites. Each category offers unique properties in terms of adsorption capacity, selectivity, and regeneration energy requirements.

Activated carbons demonstrate good thermal stability and relatively low regeneration energy, but often suffer from low CO2 selectivity in the presence of water vapor. Zeolites exhibit high CO2 adsorption capacities at ambient temperatures but experience significant performance degradation in humid conditions. MOFs show exceptional tunability and record-breaking surface areas exceeding 7000 m²/g, though many promising variants still face stability challenges in industrial environments.

Amine-functionalized materials combine the physical structure of porous supports with the chemical reactivity of amines, offering good performance at low CO2 partial pressures. However, these materials often experience capacity degradation over multiple adsorption-desorption cycles due to amine leaching and oxidative degradation.

Despite significant progress, several technical barriers impede the widespread implementation of solid sorbents in high-throughput carbon capture systems. Heat management during adsorption and desorption cycles remains challenging, as the exothermic nature of CO2 adsorption can lead to temperature fluctuations that reduce working capacity. Additionally, the mechanical stability of sorbents under pressure and temperature swings presents a significant hurdle, with particle attrition and crushing leading to pressure drop increases and material losses.

Water co-adsorption represents another major challenge, as most solid sorbents either suffer from competitive adsorption with CO2 or require significant energy for water removal during regeneration. Scale-up issues also persist, with laboratory-optimized materials often showing diminished performance in pilot-scale operations due to mass transfer limitations and non-uniform flow distribution.

Manufacturing costs remain prohibitively high for many advanced sorbents, particularly MOFs and specialized amine-functionalized materials. Current synthesis methods are often complex, requiring expensive precursors and multiple processing steps that limit economic viability at industrial scales.

The development of effective contacting systems that maximize gas-solid interactions while minimizing pressure drop represents another significant technical barrier. Traditional fixed-bed configurations often struggle to achieve the necessary throughput for large-scale applications, while fluidized bed systems face challenges with particle entrainment and attrition.

Activated carbons demonstrate good thermal stability and relatively low regeneration energy, but often suffer from low CO2 selectivity in the presence of water vapor. Zeolites exhibit high CO2 adsorption capacities at ambient temperatures but experience significant performance degradation in humid conditions. MOFs show exceptional tunability and record-breaking surface areas exceeding 7000 m²/g, though many promising variants still face stability challenges in industrial environments.

Amine-functionalized materials combine the physical structure of porous supports with the chemical reactivity of amines, offering good performance at low CO2 partial pressures. However, these materials often experience capacity degradation over multiple adsorption-desorption cycles due to amine leaching and oxidative degradation.

Despite significant progress, several technical barriers impede the widespread implementation of solid sorbents in high-throughput carbon capture systems. Heat management during adsorption and desorption cycles remains challenging, as the exothermic nature of CO2 adsorption can lead to temperature fluctuations that reduce working capacity. Additionally, the mechanical stability of sorbents under pressure and temperature swings presents a significant hurdle, with particle attrition and crushing leading to pressure drop increases and material losses.

Water co-adsorption represents another major challenge, as most solid sorbents either suffer from competitive adsorption with CO2 or require significant energy for water removal during regeneration. Scale-up issues also persist, with laboratory-optimized materials often showing diminished performance in pilot-scale operations due to mass transfer limitations and non-uniform flow distribution.

Manufacturing costs remain prohibitively high for many advanced sorbents, particularly MOFs and specialized amine-functionalized materials. Current synthesis methods are often complex, requiring expensive precursors and multiple processing steps that limit economic viability at industrial scales.

The development of effective contacting systems that maximize gas-solid interactions while minimizing pressure drop represents another significant technical barrier. Traditional fixed-bed configurations often struggle to achieve the necessary throughput for large-scale applications, while fluidized bed systems face challenges with particle entrainment and attrition.

High-Throughput Carbon Capture System Architectures

01 Metal-organic frameworks (MOFs) for CO2 capture

Metal-organic frameworks are crystalline porous materials that have shown exceptional performance for CO2 capture due to their high surface area, tunable pore size, and chemical functionality. These materials can be designed with specific metal centers and organic linkers to enhance CO2 selectivity and adsorption capacity. MOFs can achieve high throughput in CO2 capture systems due to their rapid adsorption-desorption kinetics and stability over multiple cycles.- Metal-organic frameworks (MOFs) for CO2 capture: Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated with organic ligands. These materials offer high surface area, tunable pore sizes, and chemical functionality that can be optimized for CO2 adsorption. MOFs demonstrate excellent CO2 selectivity and capacity, making them promising candidates for carbon capture applications with high throughput potential. Their modular nature allows for customization to enhance CO2 binding affinity and improve capture efficiency under various operating conditions.

- Amine-functionalized solid sorbents: Amine-functionalized materials represent a significant class of solid sorbents for CO2 capture. These materials incorporate amine groups that chemically bind with CO2 through acid-base interactions. Common supports include silica, polymers, and porous carbon materials that are modified with various amine compounds. The high selectivity for CO2 and relatively low regeneration energy requirements make these materials attractive for industrial applications. Optimization of amine loading, distribution, and accessibility can significantly enhance CO2 capture throughput and cycling stability.

- Zeolite-based CO2 capture systems: Zeolites are aluminosilicate minerals with highly ordered microporous structures that demonstrate strong affinity for CO2 molecules. Their uniform pore size distribution and high thermal stability make them suitable for pressure swing adsorption (PSA) and temperature swing adsorption (TSA) processes. Zeolite-based systems can be tailored by adjusting the silicon-to-aluminum ratio and cation exchange to optimize CO2 selectivity and adsorption capacity. These materials offer robust performance under various operating conditions, contributing to enhanced throughput in carbon capture applications.

- Carbon-based adsorbents for CO2 capture: Carbon-based materials, including activated carbon, carbon nanotubes, and graphene derivatives, serve as effective CO2 adsorbents due to their high surface area and pore volume. These materials can be functionalized or doped with nitrogen, oxygen, or metal particles to enhance CO2 selectivity and capacity. The relatively low cost, high thermal stability, and resistance to moisture make carbon-based adsorbents attractive for large-scale CO2 capture applications. Their tunable pore structure allows for optimization of gas diffusion pathways, improving overall capture throughput and efficiency.

- Process optimization for enhanced CO2 capture throughput: Various process engineering approaches can significantly improve the throughput of CO2 capture systems using solid sorbents. These include optimizing adsorption-desorption cycle times, implementing advanced reactor designs such as fluidized beds or moving beds, and developing hybrid capture systems. Temperature and pressure management strategies, along with innovative regeneration techniques, can reduce energy requirements while maintaining high capture rates. Integration of heat recovery systems and process intensification methods further enhance the overall efficiency and throughput of carbon capture operations.

02 Amine-functionalized solid sorbents

Amine-functionalized materials represent a significant class of solid sorbents for CO2 capture. These materials incorporate various amine groups onto solid supports such as silica, alumina, or polymeric substrates. The amine groups react with CO2 through chemisorption, forming carbamates or bicarbonates. This chemical interaction provides high selectivity for CO2 over other gases and can be optimized for increased throughput by controlling the amine loading, type of amine, and support structure.Expand Specific Solutions03 Structured adsorbents and process optimization

Structured adsorbents such as monoliths, laminates, and hierarchical materials are designed to overcome mass transfer limitations in traditional packed beds. These structures provide lower pressure drop, improved heat management, and enhanced gas-solid contact, resulting in higher throughput for CO2 capture processes. Process optimization techniques including temperature swing adsorption (TSA), pressure swing adsorption (PSA), and vacuum swing adsorption (VSA) can be tailored to maximize the throughput of specific sorbent systems.Expand Specific Solutions04 Carbon-based sorbents and composites

Carbon-based materials including activated carbon, carbon nanotubes, graphene, and carbon molecular sieves offer advantages for CO2 capture due to their high surface area, hydrophobicity, and thermal stability. These materials can be modified through chemical activation, doping with nitrogen or metals, or incorporation into composite structures to enhance CO2 adsorption capacity and selectivity. Carbon-based sorbents typically demonstrate good regenerability and mechanical stability, contributing to sustained throughput in capture systems.Expand Specific Solutions05 Zeolites and inorganic porous materials

Zeolites and other inorganic porous materials such as hydrotalcites, layered double hydroxides, and mesoporous silicas are effective CO2 sorbents due to their well-defined pore structures and high thermal stability. These materials can be synthesized with specific cation compositions and pore architectures to optimize CO2 capture performance. The throughput of these materials can be enhanced through ion exchange, impregnation with alkali metals, or incorporation of functional groups to increase CO2 affinity while maintaining fast adsorption-desorption kinetics.Expand Specific Solutions

Leading Organizations in Solid Sorbent Development

The solid sorbent CO2 capture technology market is in a growth phase, with increasing demand driven by global decarbonization efforts. The market is projected to expand significantly as carbon capture becomes essential for meeting climate goals. Technologically, the field shows varying maturity levels, with companies at different development stages. Major players include energy giants like Sinopec, Shell, and ExxonMobil, who leverage their industrial infrastructure for large-scale implementation. Research institutions such as Shanghai Advanced Research Institute and specialized firms like Carboncapture and Susteon are advancing novel sorbent technologies. Korean power companies (KEPCO and subsidiaries) are actively developing applications for their coal plants, while 8 Rivers Capital is pioneering integrated carbon capture solutions. Collaboration between industry and academia is accelerating innovation in high-throughput capture systems.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a comprehensive solid sorbent technology platform for high-throughput carbon capture. Their approach centers on hierarchically structured porous materials, particularly modified activated carbons and mesoporous silicas with tailored surface chemistry. Sinopec's proprietary amine-grafted sorbents demonstrate CO2 capacities of 4-5 mmol/g under typical flue gas conditions with adsorption kinetics allowing for cycle times under 10 minutes. The company has engineered these materials for mechanical stability in fluidized bed operations, enabling higher throughput configurations than fixed bed alternatives. Their process incorporates temperature swing adsorption with waste heat integration, achieving regeneration temperatures below 100°C and energy requirements of approximately 2.3 GJ/tonne CO2. Sinopec has demonstrated this technology at pilot scale (capturing 100+ tonnes CO2/day) at their refinery facilities, showing stable performance over extended operation periods. Their research also addresses water tolerance issues through hydrophobic surface modifications while maintaining high CO2 selectivity.

Strengths: Cost-effective sorbent production at scale; excellent mechanical stability for fluidized bed applications; lower regeneration temperatures than competing technologies. Weaknesses: Somewhat lower CO2 capacity compared to some MOF-based alternatives; potential for amine leaching during extended operation; higher pressure drop in certain reactor configurations.

Carboncapture, Inc.

Technical Solution: Carboncapture has developed a revolutionary modular direct air capture (DAC) system utilizing advanced zeolite-based solid sorbents. Their proprietary technology employs specially modified zeolites with enhanced CO2 selectivity and capacity under atmospheric conditions. The company's innovation lies in their rapid temperature swing adsorption process that enables complete cycle times under 10 minutes, dramatically increasing throughput compared to conventional DAC approaches. Their modular "CarbonCollector" units incorporate these sorbents in a structured arrangement that optimizes airflow while minimizing pressure drop and energy consumption. The system achieves regeneration using low-grade heat (85-95°C), significantly reducing energy requirements compared to high-temperature alternatives. Carboncapture's approach allows for distributed deployment with scalable capacity based on the number of modules installed. Their sorbents demonstrate exceptional stability with minimal capacity loss over thousands of cycles, even under variable humidity conditions. The company has successfully deployed commercial installations capturing thousands of tonnes of CO2 annually, with plans for megaton-scale deployment.

Strengths: Highly modular and scalable system architecture; ability to operate using low-grade waste heat; minimal water requirements compared to liquid sorbent systems. Weaknesses: Lower CO2 capture rate per unit volume compared to point-source capture technologies; higher capital costs per tonne of CO2 captured; performance sensitivity to ambient temperature fluctuations.

Critical Patents and Research in Solid Sorbent Materials

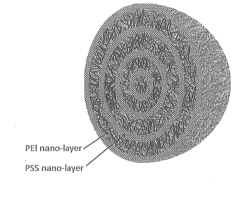

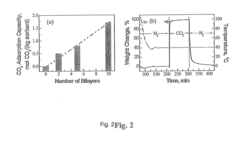

Layered Solid Sorbents For Carbon Dioxide Capture

PatentActiveUS20140127104A1

Innovation

- Development of nano-layered solid sorbents using electrostatic layer-by-layer nanoassembly, where CO2-adsorbing polymers like polyethylenimine and oppositely charged polyelectrolytes are alternately deposited on porous substrates, creating bilayers that enhance CO2 capture and transport efficiency.

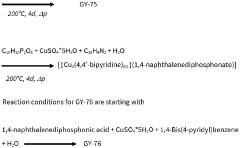

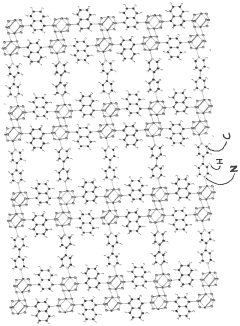

Solid sorbents for capturing co 2

PatentWO2023232666A1

Innovation

- Development of phosphonate and organoarsonate MOFs with specific molecular formulas, such as [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediphosphonate)] and [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediarsonate)], which maintain selectivity and stability under harsh conditions, including high humidity and temperatures up to 360°C, by creating a hydrophobic environment that favors CO2 physisorption over H2O.

Environmental Impact Assessment of Sorbent Technologies

The environmental impact of solid sorbent technologies for CO2 capture extends beyond their primary function of carbon sequestration. These technologies, while designed to mitigate climate change, themselves carry environmental footprints that must be thoroughly assessed to ensure their net benefit to ecological systems.

Life cycle assessment (LCA) studies reveal that the production phase of solid sorbents often represents a significant environmental burden. Materials such as zeolites, metal-organic frameworks (MOFs), and amine-functionalized sorbents require energy-intensive manufacturing processes. For instance, zeolite synthesis typically involves hydrothermal conditions requiring substantial thermal energy, while MOF production often utilizes solvents that may pose environmental hazards if not properly managed.

Water consumption represents another critical environmental consideration. Certain sorbent regeneration processes demand significant water resources, potentially creating stress in water-scarce regions. Advanced water recycling systems integrated with sorbent technologies can substantially reduce this impact, though they add complexity and cost to capture systems.

The degradation of sorbents over multiple capture-regeneration cycles necessitates periodic replacement, generating solid waste streams. Research indicates that some degraded sorbents may contain compounds requiring special disposal protocols to prevent soil or water contamination. Emerging circular economy approaches focusing on sorbent recycling and repurposing show promise in minimizing this waste stream.

Energy requirements for sorbent regeneration constitute perhaps the most significant environmental concern. Thermal swing adsorption (TSA) systems typically demand substantial heat input, while pressure swing adsorption (PSA) systems require considerable electrical energy for compression. The environmental benefit of carbon capture is partially offset when fossil fuels power these regeneration processes. Integration with renewable energy sources dramatically improves the net environmental profile of sorbent-based capture systems.

Land use impacts vary significantly between different capture implementations. Distributed capture systems utilizing solid sorbents generally require less dedicated land area compared to liquid solvent systems with similar capture capacity. However, the mining operations for raw materials used in certain sorbent types can create substantial land disturbance and habitat fragmentation if not managed according to sustainable practices.

Toxicity profiles of novel sorbent materials, particularly those incorporating nanomaterials or synthetic compounds, require thorough evaluation. While most commercial sorbents demonstrate low acute toxicity, long-term exposure effects and potential environmental accumulation remain important research areas, especially as deployment scales increase to meet climate targets.

Life cycle assessment (LCA) studies reveal that the production phase of solid sorbents often represents a significant environmental burden. Materials such as zeolites, metal-organic frameworks (MOFs), and amine-functionalized sorbents require energy-intensive manufacturing processes. For instance, zeolite synthesis typically involves hydrothermal conditions requiring substantial thermal energy, while MOF production often utilizes solvents that may pose environmental hazards if not properly managed.

Water consumption represents another critical environmental consideration. Certain sorbent regeneration processes demand significant water resources, potentially creating stress in water-scarce regions. Advanced water recycling systems integrated with sorbent technologies can substantially reduce this impact, though they add complexity and cost to capture systems.

The degradation of sorbents over multiple capture-regeneration cycles necessitates periodic replacement, generating solid waste streams. Research indicates that some degraded sorbents may contain compounds requiring special disposal protocols to prevent soil or water contamination. Emerging circular economy approaches focusing on sorbent recycling and repurposing show promise in minimizing this waste stream.

Energy requirements for sorbent regeneration constitute perhaps the most significant environmental concern. Thermal swing adsorption (TSA) systems typically demand substantial heat input, while pressure swing adsorption (PSA) systems require considerable electrical energy for compression. The environmental benefit of carbon capture is partially offset when fossil fuels power these regeneration processes. Integration with renewable energy sources dramatically improves the net environmental profile of sorbent-based capture systems.

Land use impacts vary significantly between different capture implementations. Distributed capture systems utilizing solid sorbents generally require less dedicated land area compared to liquid solvent systems with similar capture capacity. However, the mining operations for raw materials used in certain sorbent types can create substantial land disturbance and habitat fragmentation if not managed according to sustainable practices.

Toxicity profiles of novel sorbent materials, particularly those incorporating nanomaterials or synthetic compounds, require thorough evaluation. While most commercial sorbents demonstrate low acute toxicity, long-term exposure effects and potential environmental accumulation remain important research areas, especially as deployment scales increase to meet climate targets.

Techno-Economic Analysis of Solid Sorbent Systems

The techno-economic analysis of solid sorbent systems for carbon capture reveals significant potential for cost reduction compared to conventional liquid amine scrubbing technologies. Current economic assessments indicate that solid sorbent-based capture systems could achieve costs between $40-70 per ton of CO2 captured, representing a 20-35% reduction from first-generation capture technologies.

Capital expenditure for solid sorbent systems benefits from simpler equipment designs and reduced corrosion concerns. The absence of large liquid handling systems and lower pressure requirements translate to approximately 15-25% lower initial investment costs compared to amine-based systems of equivalent capacity. However, these savings must be balanced against the need for specialized sorbent containment and gas-solid contacting equipment.

Operating costs demonstrate even more favorable economics, with energy penalties for solid sorbent regeneration typically ranging from 1.5-2.5 GJ/ton CO2, compared to 3.0-4.0 GJ/ton for conventional amine systems. This energy advantage stems from lower regeneration temperatures (often 80-120°C versus 120-150°C for amines) and elimination of the substantial water heating requirements inherent to aqueous systems.

Sorbent lifetime and replacement costs remain critical economic factors. Current materials demonstrate stability for 1,000-10,000 cycles depending on composition and operating conditions. At industrial scale, this translates to replacement intervals of 1-3 years, with replacement costs estimated at $3-8 per ton of CO2 captured. Ongoing research into more durable formulations could extend replacement intervals to 5+ years, further improving economics.

Scaling considerations reveal favorable economics at larger capacities. Analysis of systems processing 0.5-4 million tons CO2 annually shows economies of scale with approximately 15% cost reduction per doubling of capacity. This suggests particular suitability for large point sources like power plants and industrial facilities.

Integration costs with existing infrastructure vary significantly by application. Retrofit scenarios typically add 10-30% to base system costs, while new-build integration can be more cost-effective. The compact nature of solid sorbent systems provides advantages in space-constrained environments, potentially reducing integration expenses by 5-15% compared to liquid systems requiring larger footprints.

Future economic projections indicate potential for further cost reductions of 30-50% through materials innovation, process optimization, and manufacturing scale-up over the next decade, potentially bringing costs below $30 per ton CO2 captured in optimal applications.

Capital expenditure for solid sorbent systems benefits from simpler equipment designs and reduced corrosion concerns. The absence of large liquid handling systems and lower pressure requirements translate to approximately 15-25% lower initial investment costs compared to amine-based systems of equivalent capacity. However, these savings must be balanced against the need for specialized sorbent containment and gas-solid contacting equipment.

Operating costs demonstrate even more favorable economics, with energy penalties for solid sorbent regeneration typically ranging from 1.5-2.5 GJ/ton CO2, compared to 3.0-4.0 GJ/ton for conventional amine systems. This energy advantage stems from lower regeneration temperatures (often 80-120°C versus 120-150°C for amines) and elimination of the substantial water heating requirements inherent to aqueous systems.

Sorbent lifetime and replacement costs remain critical economic factors. Current materials demonstrate stability for 1,000-10,000 cycles depending on composition and operating conditions. At industrial scale, this translates to replacement intervals of 1-3 years, with replacement costs estimated at $3-8 per ton of CO2 captured. Ongoing research into more durable formulations could extend replacement intervals to 5+ years, further improving economics.

Scaling considerations reveal favorable economics at larger capacities. Analysis of systems processing 0.5-4 million tons CO2 annually shows economies of scale with approximately 15% cost reduction per doubling of capacity. This suggests particular suitability for large point sources like power plants and industrial facilities.

Integration costs with existing infrastructure vary significantly by application. Retrofit scenarios typically add 10-30% to base system costs, while new-build integration can be more cost-effective. The compact nature of solid sorbent systems provides advantages in space-constrained environments, potentially reducing integration expenses by 5-15% compared to liquid systems requiring larger footprints.

Future economic projections indicate potential for further cost reductions of 30-50% through materials innovation, process optimization, and manufacturing scale-up over the next decade, potentially bringing costs below $30 per ton CO2 captured in optimal applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!