Evaluation of Solid sorbents for CO2 capture patents and technology trends in carbon capture

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CO2 Capture Technology Background and Objectives

Carbon dioxide capture technology has evolved significantly over the past several decades, driven by the urgent need to mitigate climate change impacts. Initially developed in the 1930s for natural gas purification, CO2 capture technologies have expanded into various industrial applications, particularly focusing on emissions reduction from power plants and industrial facilities. The evolution has progressed from first-generation absorption-based methods using liquid amines to more advanced solid sorbent technologies that offer improved efficiency and reduced energy penalties.

Solid sorbents represent a promising second-generation approach to carbon capture, offering advantages in energy efficiency, stability, and operational flexibility compared to conventional liquid-based systems. These materials function through physical adsorption, chemical adsorption, or a combination of both mechanisms to selectively capture CO2 from flue gas or ambient air. The development trajectory has seen significant advancements in material science, with novel engineered sorbents demonstrating increasingly favorable capture characteristics.

The primary technical objective in solid sorbent development is to achieve high CO2 selectivity and capacity while maintaining structural integrity through multiple adsorption-desorption cycles. Researchers aim to reduce the energy requirements for sorbent regeneration, which currently represents a major cost driver in capture operations. Additional objectives include enhancing resistance to contaminants present in industrial gas streams, improving moisture tolerance, and developing materials compatible with existing infrastructure.

Global research efforts are increasingly focused on developing next-generation sorbents including metal-organic frameworks (MOFs), covalent organic frameworks (COFs), functionalized porous carbons, and modified zeolites. These materials offer tunable properties that can be optimized for specific capture conditions. The technical goal is to achieve capture costs below $40 per ton of CO2 by 2030, representing a significant improvement over current technologies that operate at $60-80 per ton.

The technology landscape is shifting toward integrated systems that combine capture with utilization or storage pathways. This holistic approach aims to create closed-loop carbon management systems that not only remove CO2 but convert it into valuable products or securely sequester it. Patent activity in this space has accelerated dramatically since 2010, with particular emphasis on novel material compositions, manufacturing methods, and system integration approaches.

Future technical objectives include developing sorbents capable of direct air capture at economically viable scales, creating materials with ultra-fast kinetics for rapid cycling operations, and engineering systems that can operate effectively across diverse industrial environments. The ultimate goal remains developing carbon capture technologies that are sufficiently cost-effective and scalable to deploy globally as a critical tool in achieving climate stabilization targets.

Solid sorbents represent a promising second-generation approach to carbon capture, offering advantages in energy efficiency, stability, and operational flexibility compared to conventional liquid-based systems. These materials function through physical adsorption, chemical adsorption, or a combination of both mechanisms to selectively capture CO2 from flue gas or ambient air. The development trajectory has seen significant advancements in material science, with novel engineered sorbents demonstrating increasingly favorable capture characteristics.

The primary technical objective in solid sorbent development is to achieve high CO2 selectivity and capacity while maintaining structural integrity through multiple adsorption-desorption cycles. Researchers aim to reduce the energy requirements for sorbent regeneration, which currently represents a major cost driver in capture operations. Additional objectives include enhancing resistance to contaminants present in industrial gas streams, improving moisture tolerance, and developing materials compatible with existing infrastructure.

Global research efforts are increasingly focused on developing next-generation sorbents including metal-organic frameworks (MOFs), covalent organic frameworks (COFs), functionalized porous carbons, and modified zeolites. These materials offer tunable properties that can be optimized for specific capture conditions. The technical goal is to achieve capture costs below $40 per ton of CO2 by 2030, representing a significant improvement over current technologies that operate at $60-80 per ton.

The technology landscape is shifting toward integrated systems that combine capture with utilization or storage pathways. This holistic approach aims to create closed-loop carbon management systems that not only remove CO2 but convert it into valuable products or securely sequester it. Patent activity in this space has accelerated dramatically since 2010, with particular emphasis on novel material compositions, manufacturing methods, and system integration approaches.

Future technical objectives include developing sorbents capable of direct air capture at economically viable scales, creating materials with ultra-fast kinetics for rapid cycling operations, and engineering systems that can operate effectively across diverse industrial environments. The ultimate goal remains developing carbon capture technologies that are sufficiently cost-effective and scalable to deploy globally as a critical tool in achieving climate stabilization targets.

Market Analysis for Carbon Capture Solutions

The global carbon capture market is experiencing significant growth, driven by increasing environmental regulations and corporate sustainability commitments. Current market valuations place the carbon capture industry at approximately $2 billion in 2023, with projections indicating expansion to reach $7 billion by 2030, representing a compound annual growth rate of 19.6%. This growth trajectory is supported by substantial government investments, with the United States allocating $12 billion for carbon capture development through the Infrastructure Investment and Jobs Act.

Demand for carbon capture solutions spans multiple sectors, with the power generation industry currently representing the largest market segment at 45% of total implementation. Industrial applications, particularly in cement, steel, and chemical manufacturing, collectively account for 35% of the market share and are expected to grow at the fastest rate due to increasing pressure to decarbonize hard-to-abate sectors.

Geographically, North America leads the market with 38% share, followed by Europe at 32% and Asia-Pacific at 22%. China and India are emerging as high-potential markets due to their continued reliance on fossil fuels coupled with growing environmental commitments. The Middle East, despite its slower adoption rate, presents significant opportunities given its carbon-intensive industries and increasing climate action pledges.

Solid sorbent technologies for CO2 capture are gaining particular traction in the market, with annual patent filings in this specific segment increasing by 27% over the past five years. Metal-organic frameworks (MOFs) and amine-functionalized materials represent the most commercially promising solid sorbent categories, with over 60% of recent patents focusing on these materials.

Customer adoption patterns reveal that large industrial emitters prioritize cost-effectiveness and operational integration capabilities when selecting carbon capture solutions. The average cost of carbon capture using current solid sorbent technologies ranges from $50-90 per ton of CO2, with industry targets aiming to reduce this to $30-40 per ton by 2030 to achieve widespread commercial viability.

Market barriers include high capital expenditure requirements, uncertain regulatory frameworks in developing markets, and competition from alternative decarbonization strategies. However, the implementation of carbon pricing mechanisms in 46 countries and growing corporate net-zero commitments are creating strong market pull factors that are expected to accelerate adoption rates over the next decade.

Demand for carbon capture solutions spans multiple sectors, with the power generation industry currently representing the largest market segment at 45% of total implementation. Industrial applications, particularly in cement, steel, and chemical manufacturing, collectively account for 35% of the market share and are expected to grow at the fastest rate due to increasing pressure to decarbonize hard-to-abate sectors.

Geographically, North America leads the market with 38% share, followed by Europe at 32% and Asia-Pacific at 22%. China and India are emerging as high-potential markets due to their continued reliance on fossil fuels coupled with growing environmental commitments. The Middle East, despite its slower adoption rate, presents significant opportunities given its carbon-intensive industries and increasing climate action pledges.

Solid sorbent technologies for CO2 capture are gaining particular traction in the market, with annual patent filings in this specific segment increasing by 27% over the past five years. Metal-organic frameworks (MOFs) and amine-functionalized materials represent the most commercially promising solid sorbent categories, with over 60% of recent patents focusing on these materials.

Customer adoption patterns reveal that large industrial emitters prioritize cost-effectiveness and operational integration capabilities when selecting carbon capture solutions. The average cost of carbon capture using current solid sorbent technologies ranges from $50-90 per ton of CO2, with industry targets aiming to reduce this to $30-40 per ton by 2030 to achieve widespread commercial viability.

Market barriers include high capital expenditure requirements, uncertain regulatory frameworks in developing markets, and competition from alternative decarbonization strategies. However, the implementation of carbon pricing mechanisms in 46 countries and growing corporate net-zero commitments are creating strong market pull factors that are expected to accelerate adoption rates over the next decade.

Solid Sorbents Technology Status and Challenges

Solid sorbents for CO2 capture represent a promising alternative to traditional liquid-based capture systems, offering potential advantages in energy efficiency, operational flexibility, and environmental impact. Currently, the global landscape of solid sorbent technology shows significant regional disparities, with North America, Europe, and East Asia leading research and development efforts. The United States, Germany, China, and Japan collectively account for over 70% of patent filings in this domain, indicating concentrated innovation centers.

The technological maturity of solid sorbents varies considerably across different material classes. Physical adsorbents such as activated carbons and zeolites have reached commercial readiness in niche applications, while chemical adsorbents including amine-functionalized materials are predominantly at pilot-scale demonstration. Metal-organic frameworks (MOFs) and covalent organic frameworks (COFs), despite their exceptional theoretical performance, remain largely confined to laboratory settings due to scalability and stability challenges.

A critical technical challenge facing solid sorbent development is the "performance triangle" trade-off between adsorption capacity, selectivity, and regeneration energy. Materials exhibiting high CO2 uptake often require prohibitive energy inputs for regeneration, undermining overall process efficiency. Additionally, long-term stability under industrial conditions remains problematic, with many promising materials showing significant performance degradation after multiple adsorption-desorption cycles, particularly in the presence of moisture, SOx, and NOx contaminants.

Manufacturing scalability presents another significant hurdle. Current synthesis methods for advanced materials like MOFs typically involve batch processes with low yields and high solvent usage, resulting in prohibitive production costs estimated at $200-1000/kg compared to conventional carbon capture solvents at $2-5/kg. The environmental footprint of sorbent production itself must be addressed to ensure net carbon reduction benefits.

Process engineering challenges further complicate implementation. Heat management during adsorption (exothermic) and desorption (endothermic) cycles requires sophisticated thermal integration strategies. Additionally, the mechanical properties of solid sorbents, including attrition resistance and pressure drop characteristics in fixed or fluidized bed configurations, significantly impact system reliability and operational costs.

Standardization of performance metrics and testing protocols represents another obstacle. The diversity of testing conditions across research groups complicates direct comparison of materials, hindering technology assessment and commercialization decisions. Recent initiatives by organizations such as the U.S. Department of Energy's National Carbon Capture Center and the European Materials Characterisation Council aim to establish unified benchmarking frameworks, though widespread adoption remains limited.

The technological maturity of solid sorbents varies considerably across different material classes. Physical adsorbents such as activated carbons and zeolites have reached commercial readiness in niche applications, while chemical adsorbents including amine-functionalized materials are predominantly at pilot-scale demonstration. Metal-organic frameworks (MOFs) and covalent organic frameworks (COFs), despite their exceptional theoretical performance, remain largely confined to laboratory settings due to scalability and stability challenges.

A critical technical challenge facing solid sorbent development is the "performance triangle" trade-off between adsorption capacity, selectivity, and regeneration energy. Materials exhibiting high CO2 uptake often require prohibitive energy inputs for regeneration, undermining overall process efficiency. Additionally, long-term stability under industrial conditions remains problematic, with many promising materials showing significant performance degradation after multiple adsorption-desorption cycles, particularly in the presence of moisture, SOx, and NOx contaminants.

Manufacturing scalability presents another significant hurdle. Current synthesis methods for advanced materials like MOFs typically involve batch processes with low yields and high solvent usage, resulting in prohibitive production costs estimated at $200-1000/kg compared to conventional carbon capture solvents at $2-5/kg. The environmental footprint of sorbent production itself must be addressed to ensure net carbon reduction benefits.

Process engineering challenges further complicate implementation. Heat management during adsorption (exothermic) and desorption (endothermic) cycles requires sophisticated thermal integration strategies. Additionally, the mechanical properties of solid sorbents, including attrition resistance and pressure drop characteristics in fixed or fluidized bed configurations, significantly impact system reliability and operational costs.

Standardization of performance metrics and testing protocols represents another obstacle. The diversity of testing conditions across research groups complicates direct comparison of materials, hindering technology assessment and commercialization decisions. Recent initiatives by organizations such as the U.S. Department of Energy's National Carbon Capture Center and the European Materials Characterisation Council aim to establish unified benchmarking frameworks, though widespread adoption remains limited.

Current Solid Sorbent Solutions for CO2 Capture

01 Metal-organic frameworks (MOFs) for CO2 capture

Metal-organic frameworks are crystalline porous materials composed of metal ions or clusters coordinated to organic ligands, forming one-, two-, or three-dimensional structures with high surface areas. These materials demonstrate exceptional CO2 adsorption capacities due to their tunable pore sizes and functionalities. MOFs can be designed with specific metal centers and organic linkers to enhance CO2 selectivity and capacity, making them promising candidates for carbon capture applications.- Metal-organic frameworks (MOFs) for CO2 capture: Metal-organic frameworks (MOFs) are crystalline porous materials composed of metal ions or clusters coordinated to organic ligands. They have high surface areas, tunable pore sizes, and can be functionalized to enhance CO2 selectivity and capacity. MOFs can be designed with specific metal centers and organic linkers to optimize CO2 adsorption properties, making them effective solid sorbents for carbon capture applications.

- Amine-functionalized solid sorbents: Amine-functionalized materials are widely used as solid sorbents for CO2 capture due to their strong chemical affinity for CO2. These materials typically consist of amines grafted onto high surface area supports such as silica, activated carbon, or polymers. The amine groups react with CO2 to form carbamates or bicarbonates, enabling efficient capture even at low CO2 concentrations. These sorbents can be regenerated through temperature or pressure swing processes.

- Zeolites and molecular sieves for CO2 adsorption: Zeolites and molecular sieves are aluminosilicate materials with well-defined pore structures that can selectively adsorb CO2 based on molecular size and polarity. These materials have high thermal stability and can be tailored by adjusting the silicon-to-aluminum ratio or incorporating different cations to enhance CO2 selectivity. Their rigid framework structure allows for multiple adsorption-desorption cycles without significant degradation, making them suitable for industrial carbon capture applications.

- Carbon-based adsorbents for CO2 capture: Carbon-based materials such as activated carbon, carbon nanotubes, and graphene derivatives serve as effective CO2 adsorbents due to their high surface area and pore volume. These materials can be modified through chemical activation, surface functionalization, or doping with nitrogen or metal particles to enhance CO2 selectivity and capacity. Carbon-based sorbents offer advantages including low cost, high stability, and ease of regeneration, making them attractive for large-scale carbon capture applications.

- Alkali metal-based solid sorbents: Alkali metal-based sorbents, particularly those containing lithium, sodium, or potassium compounds, can effectively capture CO2 through carbonation reactions. These materials include lithium silicates, sodium carbonates, and potassium-promoted oxides that form stable carbonates when reacting with CO2. The carbonation-calcination cycle allows for repeated CO2 capture and release, with high theoretical capacity and good selectivity at elevated temperatures. These sorbents are particularly suitable for high-temperature carbon capture applications such as pre-combustion capture or direct air capture.

02 Amine-functionalized solid sorbents

Amine-functionalized materials represent a significant class of solid sorbents for CO2 capture. These materials incorporate various amine groups onto solid supports such as silica, polymers, or porous carbons. The amine groups interact with CO2 through chemisorption, forming carbamates or bicarbonates. These sorbents typically offer high CO2 selectivity and can operate effectively at lower temperatures compared to traditional capture methods, reducing the energy penalty associated with carbon capture processes.Expand Specific Solutions03 Zeolite-based CO2 adsorbents

Zeolites are crystalline aluminosilicate materials with well-defined pore structures that can effectively separate CO2 from gas mixtures. Their molecular sieving properties, high thermal stability, and tunable surface properties make them suitable for CO2 capture applications. Zeolites can be modified through ion exchange, impregnation with alkali metals, or incorporation of functional groups to enhance their CO2 adsorption capacity and selectivity, particularly in post-combustion capture scenarios.Expand Specific Solutions04 Carbon-based adsorbents for CO2 capture

Carbon-based materials, including activated carbons, carbon nanotubes, and graphene derivatives, serve as effective CO2 adsorbents due to their high surface area, pore volume, and structural stability. These materials can be produced from various precursors, including biomass, polymers, or fossil-based resources. Surface modification techniques, such as nitrogen doping or incorporation of basic functional groups, can significantly enhance the CO2 adsorption properties of carbon-based sorbents, making them cost-effective options for large-scale carbon capture applications.Expand Specific Solutions05 Regeneration and cyclic stability of CO2 sorbents

The development of solid sorbents with enhanced regeneration capabilities and cyclic stability is crucial for practical CO2 capture applications. Various regeneration methods, including temperature swing adsorption (TSA), pressure swing adsorption (PSA), and vacuum swing adsorption (VSA), are employed to desorb captured CO2 and restore the sorbent's capacity. Advanced materials engineering approaches focus on minimizing degradation during multiple adsorption-desorption cycles, reducing energy requirements for regeneration, and extending the operational lifetime of sorbents in industrial settings.Expand Specific Solutions

Leading Companies in Solid Sorbent Development

The solid sorbents for CO2 capture technology landscape is currently in a growth phase, with increasing market size driven by global carbon reduction initiatives. The technology maturity varies across different approaches, with major players demonstrating diverse levels of advancement. Chinese entities like Sinopec and Tianjin University are making significant contributions in industrial applications, while Korean power companies (KEPCO and its subsidiaries) show strong collaborative research efforts. Academic institutions including Arizona State, Rice, and Columbia universities are advancing fundamental research, while commercial players like Global Thermostat, ExxonMobil, and BASF are developing proprietary technologies. The competitive landscape reflects a balance between established energy companies adapting their infrastructure and specialized technology providers focusing on innovative capture solutions.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced solid sorbent technologies for CO2 capture focusing on metal-organic frameworks (MOFs) and amine-functionalized mesoporous silica materials. Their patented MOF-based sorbents demonstrate exceptional CO2 selectivity and capacity under flue gas conditions, with adsorption capacities reaching 4-5 mmol/g at typical power plant emission temperatures[1]. Sinopec has integrated these materials into a proprietary temperature-swing adsorption (TSA) process that reduces regeneration energy requirements by approximately 30% compared to conventional amine scrubbing technologies[3]. Their pilot-scale implementation at coal-fired power plants in China has demonstrated capture efficiencies exceeding 90% with regeneration temperatures below 120°C, significantly lowering the energy penalty associated with carbon capture[5]. Sinopec has also developed composite sorbents combining the high surface area of silica supports with amine functionality, achieving stability over 1000+ adsorption-desorption cycles while maintaining over 85% of initial capacity[7].

Strengths: Superior adsorption capacity and selectivity compared to conventional materials; significantly lower regeneration energy requirements; proven scalability from laboratory to pilot scale; extensive industrial implementation experience. Weaknesses: Higher initial material costs compared to liquid amine systems; potential for performance degradation in the presence of SOx and NOx contaminants; regeneration still requires moderate heating which impacts overall energy efficiency.

Global Thermostat Operations LLC

Technical Solution: Global Thermostat has pioneered a revolutionary approach to CO2 capture using proprietary amine-based solid sorbents deposited on honeycomb monolith structures. Their patented technology enables direct air capture (DAC) as well as point-source carbon capture from industrial emissions. The company's sorbent formulation consists of primary, secondary, and tertiary amines chemically bonded to a high-surface-area porous ceramic substrate, creating a material with CO2 adsorption capacity exceeding 2.5 mmol/g under ambient conditions[2]. The monolithic structure provides exceptional mass transfer characteristics while minimizing pressure drop, allowing for efficient gas-solid contact. Global Thermostat's process operates through a rapid temperature-swing cycle, with adsorption occurring at 25-45°C and regeneration at relatively low temperatures (85-95°C)[4], enabling the use of low-grade waste heat for the regeneration process. This significantly reduces operational costs compared to traditional solvent-based systems. Their modular capture units can be deployed at various scales, from small industrial applications to large power plants, with demonstrated CO2 capture costs reported between $50-100 per ton depending on heat source availability and scale[8].

Strengths: Versatility for both direct air capture and point-source emissions; ability to utilize low-grade waste heat for regeneration; modular design allowing scalable implementation; lower water consumption compared to aqueous systems. Weaknesses: Higher initial capital costs compared to conventional technologies; potential for amine degradation over extended operation periods; performance sensitivity to humidity variations; requires careful thermal management to maintain optimal efficiency.

Key Patents and Innovations in Solid Sorbents

Solid sorbents for capturing co 2

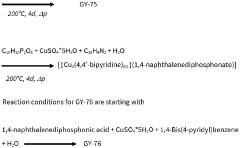

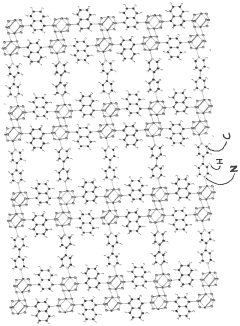

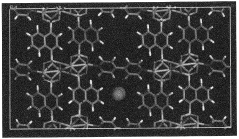

PatentWO2023232666A1

Innovation

- Development of phosphonate and organoarsonate MOFs with specific molecular formulas, such as [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediphosphonate)] and [{M2(4,4’-bipyridine)0.5}(l,4-naphthalenediarsonate)], which maintain selectivity and stability under harsh conditions, including high humidity and temperatures up to 360°C, by creating a hydrophobic environment that favors CO2 physisorption over H2O.

Environmental Policy Impact on Carbon Capture

Environmental policies have become a critical driver in the development and deployment of carbon capture technologies globally. The Paris Agreement of 2015 marked a significant turning point, establishing legally binding commitments for nations to limit global warming to well below 2°C above pre-industrial levels. This international framework has catalyzed substantial policy shifts across major economies, directly influencing research priorities and investment in carbon capture technologies.

In the United States, policy evolution has been notable with the introduction of the 45Q tax credit, which provides up to $50 per metric ton of CO2 permanently sequestered. This financial incentive has significantly accelerated interest in solid sorbent technologies for carbon capture. Similarly, the European Union's Emissions Trading System (EU ETS) has created a market-based approach to reducing emissions, with carbon prices reaching record levels of over €90 per ton in 2023, making carbon capture increasingly economically viable.

China's commitment to carbon neutrality by 2060 has led to the implementation of provincial carbon trading schemes and substantial government funding for carbon capture research, particularly focusing on solid sorbent technologies suitable for integration with the country's coal-dominated energy infrastructure. These policy frameworks have directly influenced patent activity, with a notable increase in solid sorbent-related patents filed in regions with stronger carbon pricing mechanisms.

Regulatory standards for emissions from industrial facilities have also evolved significantly. In Canada, the Clean Fuel Standard and Output-Based Pricing System have created compliance pathways that specifically recognize carbon capture technologies. Japan's Green Innovation Fund has allocated substantial resources toward developing next-generation carbon capture technologies, with particular emphasis on solid sorbents for industrial applications.

The impact of these policies extends beyond direct financial incentives. Environmental regulations have increasingly incorporated lifecycle assessment requirements, pushing researchers to develop solid sorbents with lower environmental footprints and regeneration energy requirements. This has led to a measurable shift in patent applications toward sorbents with improved durability, selectivity, and energy efficiency.

Looking forward, policy uncertainty remains a significant challenge for technology developers. The long-term nature of carbon capture investments requires stable policy frameworks that extend beyond electoral cycles. Countries with more consistent and predictable environmental policies have demonstrated higher rates of innovation in solid sorbent technologies, as evidenced by patent filing trends and commercial deployment rates.

In the United States, policy evolution has been notable with the introduction of the 45Q tax credit, which provides up to $50 per metric ton of CO2 permanently sequestered. This financial incentive has significantly accelerated interest in solid sorbent technologies for carbon capture. Similarly, the European Union's Emissions Trading System (EU ETS) has created a market-based approach to reducing emissions, with carbon prices reaching record levels of over €90 per ton in 2023, making carbon capture increasingly economically viable.

China's commitment to carbon neutrality by 2060 has led to the implementation of provincial carbon trading schemes and substantial government funding for carbon capture research, particularly focusing on solid sorbent technologies suitable for integration with the country's coal-dominated energy infrastructure. These policy frameworks have directly influenced patent activity, with a notable increase in solid sorbent-related patents filed in regions with stronger carbon pricing mechanisms.

Regulatory standards for emissions from industrial facilities have also evolved significantly. In Canada, the Clean Fuel Standard and Output-Based Pricing System have created compliance pathways that specifically recognize carbon capture technologies. Japan's Green Innovation Fund has allocated substantial resources toward developing next-generation carbon capture technologies, with particular emphasis on solid sorbents for industrial applications.

The impact of these policies extends beyond direct financial incentives. Environmental regulations have increasingly incorporated lifecycle assessment requirements, pushing researchers to develop solid sorbents with lower environmental footprints and regeneration energy requirements. This has led to a measurable shift in patent applications toward sorbents with improved durability, selectivity, and energy efficiency.

Looking forward, policy uncertainty remains a significant challenge for technology developers. The long-term nature of carbon capture investments requires stable policy frameworks that extend beyond electoral cycles. Countries with more consistent and predictable environmental policies have demonstrated higher rates of innovation in solid sorbent technologies, as evidenced by patent filing trends and commercial deployment rates.

Economic Feasibility of Solid Sorbent Technologies

The economic viability of solid sorbent technologies for carbon capture represents a critical factor in their potential widespread adoption. Current cost analyses indicate that solid sorbents may offer significant economic advantages over traditional liquid amine systems, with potential reductions in energy penalties ranging from 30-50% depending on the specific sorbent material and process configuration.

Capital expenditure (CAPEX) considerations for solid sorbent systems show promising trends, particularly for metal-organic frameworks (MOFs) and amine-functionalized silica materials. Recent techno-economic assessments suggest that the initial investment costs for solid sorbent capture plants could be 15-25% lower than conventional technologies due to reduced equipment size and complexity. However, these advantages must be balanced against the current higher production costs of advanced sorbent materials.

Operational expenditure (OPEX) metrics reveal that solid sorbents typically demonstrate superior performance in terms of regeneration energy requirements. The average regeneration energy for leading solid sorbents ranges from 2.0-3.0 GJ/tonne CO₂, compared to 3.5-4.5 GJ/tonne CO₂ for conventional amine scrubbing. This translates to potential operational cost savings of $10-20 per tonne of CO₂ captured.

Scalability economics present both opportunities and challenges. While laboratory-scale economics appear favorable, industrial-scale production of specialized sorbents remains a significant hurdle. Current production capacities for advanced materials like covalent organic frameworks (COFs) and certain MOFs are limited to kilogram quantities, with costs exceeding $1000/kg in some cases. Pathways to cost reduction through mass production and manufacturing optimization suggest potential price points below $50/kg are achievable within 5-10 years.

Lifecycle economic analysis indicates that solid sorbent technologies may offer superior long-term value propositions due to extended operational lifetimes and reduced degradation rates compared to liquid systems. The estimated sorbent replacement frequency is 2-3 years for most solid materials versus annual replacement requirements for liquid amines, representing potential maintenance cost reductions of 30-40%.

Market sensitivity analysis demonstrates that solid sorbent technologies become increasingly economically attractive as carbon prices rise above $50/tonne CO₂. Under current policy scenarios and technology readiness levels, the break-even point for most solid sorbent systems is projected to occur between 2025-2030, contingent upon continued research investment and supportive regulatory frameworks.

Capital expenditure (CAPEX) considerations for solid sorbent systems show promising trends, particularly for metal-organic frameworks (MOFs) and amine-functionalized silica materials. Recent techno-economic assessments suggest that the initial investment costs for solid sorbent capture plants could be 15-25% lower than conventional technologies due to reduced equipment size and complexity. However, these advantages must be balanced against the current higher production costs of advanced sorbent materials.

Operational expenditure (OPEX) metrics reveal that solid sorbents typically demonstrate superior performance in terms of regeneration energy requirements. The average regeneration energy for leading solid sorbents ranges from 2.0-3.0 GJ/tonne CO₂, compared to 3.5-4.5 GJ/tonne CO₂ for conventional amine scrubbing. This translates to potential operational cost savings of $10-20 per tonne of CO₂ captured.

Scalability economics present both opportunities and challenges. While laboratory-scale economics appear favorable, industrial-scale production of specialized sorbents remains a significant hurdle. Current production capacities for advanced materials like covalent organic frameworks (COFs) and certain MOFs are limited to kilogram quantities, with costs exceeding $1000/kg in some cases. Pathways to cost reduction through mass production and manufacturing optimization suggest potential price points below $50/kg are achievable within 5-10 years.

Lifecycle economic analysis indicates that solid sorbent technologies may offer superior long-term value propositions due to extended operational lifetimes and reduced degradation rates compared to liquid systems. The estimated sorbent replacement frequency is 2-3 years for most solid materials versus annual replacement requirements for liquid amines, representing potential maintenance cost reductions of 30-40%.

Market sensitivity analysis demonstrates that solid sorbent technologies become increasingly economically attractive as carbon prices rise above $50/tonne CO₂. Under current policy scenarios and technology readiness levels, the break-even point for most solid sorbent systems is projected to occur between 2025-2030, contingent upon continued research investment and supportive regulatory frameworks.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!