Hexagonal Boron Nitride Environmental And EHS Profiles: Dust Control, REACH/RoHS And Waste Handling

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

h-BN Background and Technical Objectives

Hexagonal Boron Nitride (h-BN) has emerged as a significant advanced material in various industrial applications due to its exceptional thermal, chemical, and electrical properties. First synthesized in the mid-20th century, h-BN has gained prominence in the materials science community for its structural similarity to graphite, earning it the nickname "white graphite." The layered structure of h-BN consists of alternating boron and nitrogen atoms arranged in a hexagonal lattice, providing unique characteristics that make it valuable across multiple sectors.

The evolution of h-BN technology has accelerated significantly over the past decade, with manufacturing processes becoming more refined and scalable. Initially limited to specialized applications due to production challenges, recent advancements in synthesis methods have expanded its availability and reduced costs, enabling broader industrial adoption. The global market for h-BN has consequently experienced substantial growth, with projections indicating continued expansion as new applications emerge.

Environmental, health, and safety (EHS) considerations have become increasingly central to h-BN development and application. As industrial utilization grows, so does the need for comprehensive understanding of its environmental footprint, potential health impacts, and proper handling protocols. This represents a critical juncture in the material's technological trajectory, where responsible management practices must evolve alongside expanding applications.

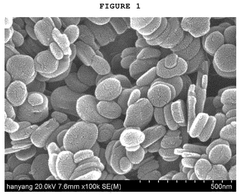

The primary technical objectives of this research focus on three interconnected areas: dust control methodologies, regulatory compliance frameworks (particularly REACH and RoHS), and waste handling protocols for h-BN materials. Dust control represents a significant challenge due to h-BN's fine particulate nature when processed, necessitating advanced containment and filtration systems to protect both workers and the environment.

Regulatory compliance presents another crucial dimension, as global frameworks continue to evolve regarding nanomaterials and advanced ceramics. Understanding h-BN's position within REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) in Europe and RoHS (Restriction of Hazardous Substances) directives is essential for manufacturers and end-users to ensure legal compliance and market access.

Waste handling constitutes the third pillar of this technical investigation, addressing the full lifecycle management of h-BN materials. As industrial applications increase, developing efficient, environmentally sound disposal and recycling methodologies becomes imperative to minimize environmental impact and resource inefficiency.

This technical research aims to establish comprehensive guidelines and best practices for h-BN handling throughout its lifecycle, balancing industrial utility with environmental responsibility. By addressing these objectives, we seek to facilitate sustainable growth in h-BN applications while mitigating potential environmental and health risks.

The evolution of h-BN technology has accelerated significantly over the past decade, with manufacturing processes becoming more refined and scalable. Initially limited to specialized applications due to production challenges, recent advancements in synthesis methods have expanded its availability and reduced costs, enabling broader industrial adoption. The global market for h-BN has consequently experienced substantial growth, with projections indicating continued expansion as new applications emerge.

Environmental, health, and safety (EHS) considerations have become increasingly central to h-BN development and application. As industrial utilization grows, so does the need for comprehensive understanding of its environmental footprint, potential health impacts, and proper handling protocols. This represents a critical juncture in the material's technological trajectory, where responsible management practices must evolve alongside expanding applications.

The primary technical objectives of this research focus on three interconnected areas: dust control methodologies, regulatory compliance frameworks (particularly REACH and RoHS), and waste handling protocols for h-BN materials. Dust control represents a significant challenge due to h-BN's fine particulate nature when processed, necessitating advanced containment and filtration systems to protect both workers and the environment.

Regulatory compliance presents another crucial dimension, as global frameworks continue to evolve regarding nanomaterials and advanced ceramics. Understanding h-BN's position within REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) in Europe and RoHS (Restriction of Hazardous Substances) directives is essential for manufacturers and end-users to ensure legal compliance and market access.

Waste handling constitutes the third pillar of this technical investigation, addressing the full lifecycle management of h-BN materials. As industrial applications increase, developing efficient, environmentally sound disposal and recycling methodologies becomes imperative to minimize environmental impact and resource inefficiency.

This technical research aims to establish comprehensive guidelines and best practices for h-BN handling throughout its lifecycle, balancing industrial utility with environmental responsibility. By addressing these objectives, we seek to facilitate sustainable growth in h-BN applications while mitigating potential environmental and health risks.

Market Analysis for h-BN Applications

The global hexagonal boron nitride (h-BN) market has demonstrated robust growth in recent years, with a market value reaching approximately $810 million in 2022. Industry analysts project this market to expand at a compound annual growth rate (CAGR) of 6.8% through 2030, potentially reaching $1.4 billion. This growth trajectory is primarily driven by increasing applications across multiple high-value industries.

The electronics and semiconductor sector represents the largest application segment for h-BN, accounting for roughly 32% of the total market share. The material's exceptional thermal conductivity combined with electrical insulation properties makes it invaluable for thermal management solutions in advanced electronics. As device miniaturization continues and power densities increase, the demand for h-BN as a thermal interface material is expected to grow significantly.

Cosmetics and personal care products constitute the second-largest application segment at approximately 24% market share. The material's lubricity, softness, and optical properties make it an excellent additive in premium cosmetic formulations. Market research indicates that consumer preference for high-performance cosmetics with enhanced texture properties is driving increased h-BN adoption in this sector.

Industrial lubricants and coatings represent another substantial application area, comprising about 18% of the market. The material's high-temperature stability and low friction coefficient make it particularly valuable in extreme operating environments where conventional lubricants fail. The aerospace and automotive industries are key consumers in this segment.

Regionally, Asia-Pacific dominates the h-BN market with approximately 42% share, driven by the region's robust electronics manufacturing ecosystem and growing industrial base. North America follows at 28%, with strong demand from advanced materials research and defense applications. Europe accounts for 22% of the market, with particular strength in automotive and industrial applications.

Emerging applications showing significant growth potential include thermal management materials for electric vehicles, advanced ceramic composites for aerospace, and specialized coatings for renewable energy infrastructure. These applications are expected to create new market opportunities as technological adoption increases.

Market challenges include relatively high production costs compared to alternative materials, limited awareness of h-BN's full application potential among end-users, and environmental concerns related to dust control during processing. These factors are being addressed through ongoing research into more cost-effective production methods and improved environmental handling protocols.

The electronics and semiconductor sector represents the largest application segment for h-BN, accounting for roughly 32% of the total market share. The material's exceptional thermal conductivity combined with electrical insulation properties makes it invaluable for thermal management solutions in advanced electronics. As device miniaturization continues and power densities increase, the demand for h-BN as a thermal interface material is expected to grow significantly.

Cosmetics and personal care products constitute the second-largest application segment at approximately 24% market share. The material's lubricity, softness, and optical properties make it an excellent additive in premium cosmetic formulations. Market research indicates that consumer preference for high-performance cosmetics with enhanced texture properties is driving increased h-BN adoption in this sector.

Industrial lubricants and coatings represent another substantial application area, comprising about 18% of the market. The material's high-temperature stability and low friction coefficient make it particularly valuable in extreme operating environments where conventional lubricants fail. The aerospace and automotive industries are key consumers in this segment.

Regionally, Asia-Pacific dominates the h-BN market with approximately 42% share, driven by the region's robust electronics manufacturing ecosystem and growing industrial base. North America follows at 28%, with strong demand from advanced materials research and defense applications. Europe accounts for 22% of the market, with particular strength in automotive and industrial applications.

Emerging applications showing significant growth potential include thermal management materials for electric vehicles, advanced ceramic composites for aerospace, and specialized coatings for renewable energy infrastructure. These applications are expected to create new market opportunities as technological adoption increases.

Market challenges include relatively high production costs compared to alternative materials, limited awareness of h-BN's full application potential among end-users, and environmental concerns related to dust control during processing. These factors are being addressed through ongoing research into more cost-effective production methods and improved environmental handling protocols.

h-BN Environmental Challenges and Limitations

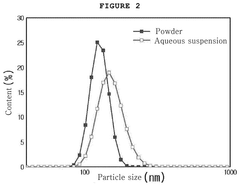

Hexagonal Boron Nitride (h-BN) faces significant environmental challenges that impact its industrial application and sustainability profile. The primary concern relates to airborne particulate matter during manufacturing, processing, and handling operations. Due to h-BN's fine particle size distribution, especially in powder form, it presents respiratory hazards when particles become airborne, potentially causing lung irritation and related health issues upon prolonged exposure.

Regulatory compliance presents another major challenge, with h-BN materials increasingly scrutinized under frameworks like REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) in Europe and similar regulations globally. While h-BN itself is generally considered inert, impurities or processing additives may trigger regulatory concerns, requiring extensive documentation and testing to maintain market access.

Waste management of h-BN materials poses unique difficulties due to their high thermal and chemical stability. These properties, while beneficial for applications, complicate end-of-life disposal and recycling efforts. Traditional thermal decomposition methods are ineffective, and h-BN waste often requires specialized handling protocols that increase disposal costs and environmental footprint.

Water contamination risks exist when h-BN nanoparticles enter aquatic ecosystems, potentially affecting aquatic organisms through physical interference mechanisms rather than chemical toxicity. The long-term environmental persistence of these materials remains inadequately studied, creating uncertainty regarding their environmental fate.

Energy-intensive production processes for high-purity h-BN contribute significantly to its environmental impact. Current synthesis methods require high temperatures (often exceeding 1500°C) and specialized equipment, resulting in substantial carbon footprints that contradict sustainability goals in advanced materials development.

Scalability limitations further compound these challenges. Environmentally optimized production methods often struggle to maintain consistent quality at industrial scales, creating a tension between environmental performance and commercial viability. This has slowed the implementation of greener manufacturing approaches across the industry.

Occupational exposure management requires sophisticated engineering controls, including specialized ventilation systems, enclosures, and personal protective equipment. These measures add operational complexity and cost to h-BN handling facilities, particularly for small and medium enterprises with limited resources for environmental health and safety infrastructure.

Regulatory compliance presents another major challenge, with h-BN materials increasingly scrutinized under frameworks like REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) in Europe and similar regulations globally. While h-BN itself is generally considered inert, impurities or processing additives may trigger regulatory concerns, requiring extensive documentation and testing to maintain market access.

Waste management of h-BN materials poses unique difficulties due to their high thermal and chemical stability. These properties, while beneficial for applications, complicate end-of-life disposal and recycling efforts. Traditional thermal decomposition methods are ineffective, and h-BN waste often requires specialized handling protocols that increase disposal costs and environmental footprint.

Water contamination risks exist when h-BN nanoparticles enter aquatic ecosystems, potentially affecting aquatic organisms through physical interference mechanisms rather than chemical toxicity. The long-term environmental persistence of these materials remains inadequately studied, creating uncertainty regarding their environmental fate.

Energy-intensive production processes for high-purity h-BN contribute significantly to its environmental impact. Current synthesis methods require high temperatures (often exceeding 1500°C) and specialized equipment, resulting in substantial carbon footprints that contradict sustainability goals in advanced materials development.

Scalability limitations further compound these challenges. Environmentally optimized production methods often struggle to maintain consistent quality at industrial scales, creating a tension between environmental performance and commercial viability. This has slowed the implementation of greener manufacturing approaches across the industry.

Occupational exposure management requires sophisticated engineering controls, including specialized ventilation systems, enclosures, and personal protective equipment. These measures add operational complexity and cost to h-BN handling facilities, particularly for small and medium enterprises with limited resources for environmental health and safety infrastructure.

Current Dust Control and Containment Solutions

01 Dust control methods for hexagonal boron nitride

Various methods are employed to control dust generated during the handling and processing of hexagonal boron nitride materials. These include wet processing techniques, encapsulation methods, and specialized filtration systems that can effectively capture fine particles. Some approaches involve the use of binding agents or surfactants to reduce airborne particulates, while others implement closed-system handling to minimize worker exposure to potentially harmful dust.- Dust control methods for hexagonal boron nitride: Various methods are employed to control dust generated during the handling and processing of hexagonal boron nitride materials. These include wet processing techniques, encapsulation methods, and specialized filtration systems that can effectively capture fine particles. Some approaches involve the use of binding agents or surfactants to reduce airborne particulates, while others implement closed-system handling to minimize worker exposure to potentially hazardous dust.

- REACH and RoHS compliance strategies: Compliance with REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) regulations for hexagonal boron nitride involves careful material selection, documentation, and testing procedures. Manufacturers implement substitution strategies for restricted substances, maintain detailed safety data sheets, and conduct regular compliance audits. Some approaches include developing alternative formulations that maintain performance while eliminating regulated substances.

- Waste handling and disposal techniques: Proper waste handling of hexagonal boron nitride materials involves specialized collection systems, treatment processes, and disposal methods that comply with environmental regulations. Techniques include solidification/stabilization methods, chemical treatment to reduce toxicity, and controlled disposal in designated facilities. Some approaches focus on waste minimization through recycling and recovery processes that can extract valuable components from waste streams.

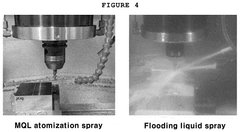

- Environmentally friendly processing methods: Environmentally friendly processing methods for hexagonal boron nitride focus on reducing environmental impact while maintaining material performance. These include water-based processing techniques, solvent-free production methods, and energy-efficient manufacturing processes. Some approaches incorporate green chemistry principles to minimize waste generation and reduce the use of hazardous substances throughout the material lifecycle.

- Worker safety and exposure prevention: Protecting workers from exposure to hexagonal boron nitride dust involves engineering controls, personal protective equipment, and administrative measures. Techniques include local exhaust ventilation systems, specialized respirators designed for nanomaterials, and automated handling systems that minimize direct contact. Training programs and exposure monitoring protocols are implemented to ensure ongoing safety compliance and risk reduction in manufacturing environments.

02 REACH and RoHS compliance strategies for h-BN materials

Compliance with REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) regulations for hexagonal boron nitride materials involves careful documentation, testing, and material formulation. Manufacturers implement strategies such as substituting restricted substances, ensuring proper registration of chemical components, and maintaining detailed safety data sheets. Compliance often requires regular testing to verify the absence of restricted substances and heavy metals below regulatory thresholds.Expand Specific Solutions03 Waste handling and disposal of h-BN materials

Proper waste handling and disposal of hexagonal boron nitride materials involves specialized procedures to minimize environmental impact. These include segregation of waste streams, treatment processes to neutralize potentially harmful components, and appropriate containment methods. Some approaches involve recycling or repurposing of h-BN waste materials, while others focus on stabilization techniques prior to disposal in accordance with local regulations. Waste management protocols often include monitoring and documentation to ensure regulatory compliance.Expand Specific Solutions04 Safety measures for handling h-BN nanomaterials

Handling hexagonal boron nitride nanomaterials requires specific safety measures due to their unique properties and potential health risks. These include the use of personal protective equipment, implementation of engineering controls such as ventilation systems, and establishment of handling protocols to minimize exposure. Training programs for workers, regular monitoring of workplace air quality, and emergency response procedures are also essential components of comprehensive safety management for h-BN nanomaterials.Expand Specific Solutions05 Environmental impact mitigation for h-BN processing

Mitigating the environmental impact of hexagonal boron nitride processing involves various approaches to reduce emissions, energy consumption, and waste generation. These include the development of cleaner production methods, implementation of closed-loop systems to recover and reuse materials, and adoption of energy-efficient processing techniques. Some strategies focus on reducing the use of harmful solvents or reagents, while others aim to minimize water usage and contamination through advanced treatment and recycling systems.Expand Specific Solutions

Key Industry Players and Manufacturers

Hexagonal Boron Nitride (h-BN) environmental and EHS management is currently in a growth phase, with the market expanding due to increasing applications in electronics, thermal management, and lubricants. The global h-BN market is projected to reach significant scale as industries adopt this material for its unique properties. From a technical maturity perspective, companies like Momentive Performance Materials, Resonac Corp., and Tokuyama Corp. have established advanced dust control and waste handling protocols, while Samsung Electronics and Rogers Corp. are implementing REACH/RoHS compliant manufacturing processes. Academic institutions including MIT, Rice University, and Chinese research centers are developing next-generation environmentally friendly synthesis methods. The industry is transitioning from basic regulatory compliance to proactive environmental stewardship, with leading players investing in sustainable production technologies.

Denka Corp.

Technical Solution: Denka has developed a systematic approach to h-BN environmental management that integrates production technology with exposure controls. Their dust management system incorporates specialized agglomeration techniques that increase particle size distribution, reducing inhalation hazards while maintaining product performance. The company has implemented isolated processing environments with dedicated air handling systems that prevent cross-contamination while achieving over 99% dust capture efficiency. Denka's regulatory compliance program includes comprehensive material testing against both European REACH requirements and Asian regulatory frameworks including Japan's Chemical Substances Control Law. Their waste management protocol incorporates a proprietary chemical stabilization process that renders h-BN waste non-leachable according to multiple international standards. The company has also developed specialized training programs for customers on proper handling techniques to minimize environmental impacts throughout the supply chain.

Strengths: Particle agglomeration technology effectively reduces inhalation hazards while preserving functionality; comprehensive regulatory compliance across multiple international frameworks; effective customer education programs that extend environmental controls beyond manufacturing. Weaknesses: Agglomeration processes may affect certain performance characteristics in high-purity applications; chemical stabilization of waste requires precise process control; implementation requires significant technical expertise.

Momentive Performance Materials, Inc.

Technical Solution: Momentive has developed comprehensive environmental management systems for hexagonal boron nitride (h-BN) handling that integrate dust control technologies with regulatory compliance frameworks. Their approach includes specialized ventilation systems with HEPA filtration that captures over 99.97% of h-BN particulates down to 0.3 microns in size. The company has implemented a closed-loop processing system that minimizes worker exposure while reducing environmental releases. Momentive's h-BN products are fully REACH registered and RoHS compliant, with detailed Safety Data Sheets that exceed regulatory requirements. Their waste management protocol incorporates recycling of production scrap and a specialized solidification process for liquid waste containing h-BN that renders it non-hazardous according to EPA leachability tests. The company also conducts regular environmental monitoring to verify containment effectiveness.

Strengths: Industry-leading dust control systems with documented 99.97% efficiency; fully integrated EHS management system that addresses the entire lifecycle of h-BN materials; early REACH compliance with complete registration dossiers. Weaknesses: Higher implementation costs compared to basic systems; requires specialized training for personnel; more complex waste handling procedures that may increase operational overhead.

Critical REACH/RoHS Compliance Technologies

Product harmful substance management and control method, system and equipment and storage medium

PatentPendingCN117114233A

Innovation

- By establishing a list of environmental protection data control requirements for components, a list of environmental protection data period control and a supplier environmental protection evaluation form, we can query the type of environmental protection data and determine the validity period of new materials, automatically issue and upload environmental protection data tasks, and generate a list of environmental protection attributes of materials. Provide expiration reminders for material environmental protection data to ensure the standardization and accuracy of environmental protection data.

Aqueous suspension and cutting fluid including the same

PatentPendingUS20240327746A1

Innovation

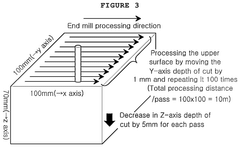

- Aqueous suspension comprising hexagonal boron nitride particles and a dispersant, which are synthesized to remain uniformly dispersed, providing a cutting fluid that can be diluted with water and further enhanced with alkaline electrolyzed water, rust preventatives, anti-foaming agents, and preservatives for improved metal processing precision and tool life, while being environmentally friendly.

Regulatory Compliance Framework

The regulatory landscape governing hexagonal boron nitride (h-BN) is complex and multifaceted, encompassing various international, regional, and local frameworks. Understanding these regulations is crucial for manufacturers, distributors, and end-users to ensure compliance throughout the material's lifecycle.

At the international level, h-BN falls under the purview of chemical substance regulations such as the Globally Harmonized System of Classification and Labeling of Chemicals (GHS). This framework establishes standardized criteria for classifying chemicals according to their health, environmental, and physical hazards, and communicates these hazards through labels and safety data sheets.

In the European Union, REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation represents the most comprehensive chemical regulatory framework affecting h-BN. Under REACH, companies must register substances manufactured or imported in quantities exceeding one tonne per year, providing detailed information on properties, hazards, and safe use guidelines. For h-BN specifically, its registration status depends on production volume and intended applications.

The RoHS (Restriction of Hazardous Substances) Directive restricts the use of specific hazardous materials in electrical and electronic equipment. While h-BN itself is not directly listed among restricted substances, products containing h-BN must comply with RoHS limitations on heavy metals and other hazardous substances that might be present as impurities or additives.

In the United States, h-BN is regulated under the Toxic Substances Control Act (TSCA), which requires manufacturers to submit premanufacture notifications for new chemical substances and maintain records of significant adverse effects. The Occupational Safety and Health Administration (OSHA) also establishes permissible exposure limits for airborne particulates, which apply to h-BN dust in workplace environments.

Asian markets have developed their own regulatory frameworks. Japan's Chemical Substances Control Law (CSCL) and China's Measures for Environmental Management of New Chemical Substances impose registration and notification requirements similar to REACH but with distinct procedural differences.

Waste handling of h-BN materials falls under various waste management regulations. In the EU, the Waste Framework Directive classifies waste according to the European Waste Catalogue, with h-BN potentially categorized as industrial waste requiring special handling procedures. Similarly, in the US, the Resource Conservation and Recovery Act (RCRA) governs hazardous waste management, though pure h-BN is generally not classified as hazardous waste.

Emerging regulations focusing on nanomaterials present additional compliance considerations, as h-BN can be produced in nano-form. Several jurisdictions have introduced specific reporting requirements for nanomaterials, including the EU's nanomaterial definition and France's mandatory declaration system for nanomaterials.

At the international level, h-BN falls under the purview of chemical substance regulations such as the Globally Harmonized System of Classification and Labeling of Chemicals (GHS). This framework establishes standardized criteria for classifying chemicals according to their health, environmental, and physical hazards, and communicates these hazards through labels and safety data sheets.

In the European Union, REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation represents the most comprehensive chemical regulatory framework affecting h-BN. Under REACH, companies must register substances manufactured or imported in quantities exceeding one tonne per year, providing detailed information on properties, hazards, and safe use guidelines. For h-BN specifically, its registration status depends on production volume and intended applications.

The RoHS (Restriction of Hazardous Substances) Directive restricts the use of specific hazardous materials in electrical and electronic equipment. While h-BN itself is not directly listed among restricted substances, products containing h-BN must comply with RoHS limitations on heavy metals and other hazardous substances that might be present as impurities or additives.

In the United States, h-BN is regulated under the Toxic Substances Control Act (TSCA), which requires manufacturers to submit premanufacture notifications for new chemical substances and maintain records of significant adverse effects. The Occupational Safety and Health Administration (OSHA) also establishes permissible exposure limits for airborne particulates, which apply to h-BN dust in workplace environments.

Asian markets have developed their own regulatory frameworks. Japan's Chemical Substances Control Law (CSCL) and China's Measures for Environmental Management of New Chemical Substances impose registration and notification requirements similar to REACH but with distinct procedural differences.

Waste handling of h-BN materials falls under various waste management regulations. In the EU, the Waste Framework Directive classifies waste according to the European Waste Catalogue, with h-BN potentially categorized as industrial waste requiring special handling procedures. Similarly, in the US, the Resource Conservation and Recovery Act (RCRA) governs hazardous waste management, though pure h-BN is generally not classified as hazardous waste.

Emerging regulations focusing on nanomaterials present additional compliance considerations, as h-BN can be produced in nano-form. Several jurisdictions have introduced specific reporting requirements for nanomaterials, including the EU's nanomaterial definition and France's mandatory declaration system for nanomaterials.

Occupational Safety Best Practices

Implementing effective occupational safety practices is critical when handling hexagonal boron nitride (h-BN) materials in industrial settings. Engineering controls represent the first line of defense, with properly designed local exhaust ventilation systems being essential for capturing airborne h-BN particles at their source. These systems should incorporate HEPA filtration to prevent the release of nanoscale particles into the workplace atmosphere. Enclosed processing equipment and automated handling systems can significantly reduce worker exposure during manufacturing operations.

Personal protective equipment requirements for h-BN handling should include respiratory protection with P100 or equivalent filters for operations generating significant dust. Disposable or dedicated work clothing, chemical-resistant gloves, and safety goggles provide additional protection against skin and eye contact. For high-exposure scenarios, full-body protective suits may be necessary to prevent contamination of personal clothing.

Workplace monitoring programs should include regular air sampling to measure respirable and inhalable h-BN dust concentrations, with comparison to established occupational exposure limits. Surface wipe sampling helps evaluate the effectiveness of housekeeping procedures and identifies potential cross-contamination areas. Biological monitoring may be considered for workers with high exposure potential, though specific biomarkers for h-BN exposure remain under development.

Training protocols must ensure workers understand h-BN's physical properties, potential health hazards, proper handling procedures, and emergency response measures. Hands-on demonstrations of proper PPE donning/doffing techniques and spill cleanup procedures enhance retention of safety information. Training should be refreshed annually and updated whenever processes or materials change.

Emergency response procedures should address potential h-BN release scenarios, including spill containment using HEPA-filtered vacuum systems rather than dry sweeping. Decontamination protocols for affected workers should be clearly established, with emergency eyewash and shower stations readily accessible in handling areas.

Medical surveillance programs should include baseline and periodic pulmonary function tests, chest X-rays, and dermatological examinations for workers regularly handling h-BN materials. Special attention should be given to workers with pre-existing respiratory conditions who may have increased susceptibility to particulate exposures.

Documentation and recordkeeping systems must maintain exposure monitoring results, training records, medical surveillance data, and incident reports in accordance with regulatory requirements. Regular safety audits should evaluate compliance with established protocols and identify opportunities for continuous improvement in occupational safety practices.

Personal protective equipment requirements for h-BN handling should include respiratory protection with P100 or equivalent filters for operations generating significant dust. Disposable or dedicated work clothing, chemical-resistant gloves, and safety goggles provide additional protection against skin and eye contact. For high-exposure scenarios, full-body protective suits may be necessary to prevent contamination of personal clothing.

Workplace monitoring programs should include regular air sampling to measure respirable and inhalable h-BN dust concentrations, with comparison to established occupational exposure limits. Surface wipe sampling helps evaluate the effectiveness of housekeeping procedures and identifies potential cross-contamination areas. Biological monitoring may be considered for workers with high exposure potential, though specific biomarkers for h-BN exposure remain under development.

Training protocols must ensure workers understand h-BN's physical properties, potential health hazards, proper handling procedures, and emergency response measures. Hands-on demonstrations of proper PPE donning/doffing techniques and spill cleanup procedures enhance retention of safety information. Training should be refreshed annually and updated whenever processes or materials change.

Emergency response procedures should address potential h-BN release scenarios, including spill containment using HEPA-filtered vacuum systems rather than dry sweeping. Decontamination protocols for affected workers should be clearly established, with emergency eyewash and shower stations readily accessible in handling areas.

Medical surveillance programs should include baseline and periodic pulmonary function tests, chest X-rays, and dermatological examinations for workers regularly handling h-BN materials. Special attention should be given to workers with pre-existing respiratory conditions who may have increased susceptibility to particulate exposures.

Documentation and recordkeeping systems must maintain exposure monitoring results, training records, medical surveillance data, and incident reports in accordance with regulatory requirements. Regular safety audits should evaluate compliance with established protocols and identify opportunities for continuous improvement in occupational safety practices.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!