Hexagonal Boron Nitride Vs Aluminum Nitride: Thermal Conductivity, Dielectric Strength And Reliability

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

hBN and AlN Background and Research Objectives

Hexagonal Boron Nitride (hBN) and Aluminum Nitride (AlN) represent two of the most promising advanced ceramic materials in modern electronics and thermal management applications. These materials have garnered significant attention over the past three decades due to their exceptional thermal and electrical properties, particularly in high-performance and miniaturized electronic systems.

hBN, often referred to as "white graphite," features a layered hexagonal crystal structure similar to graphene but with alternating boron and nitrogen atoms. First synthesized in the 1940s, hBN remained primarily of academic interest until the 1990s when its potential for thermal management applications began to be recognized. The material exhibits remarkable in-plane thermal conductivity (up to 400 W/mK), excellent electrical insulation properties with dielectric strength exceeding 10 MV/cm, and exceptional chemical stability.

AlN, by contrast, has a wurtzite crystal structure and was first synthesized in 1877, though commercial production only became viable in the 1980s. It has emerged as a critical material in power electronics and LED manufacturing due to its high thermal conductivity (up to 320 W/mK), excellent dielectric properties (dielectric strength of approximately 15 MV/cm), and compatibility with semiconductor manufacturing processes.

The technological evolution of both materials has accelerated dramatically in the past decade, driven by the increasing thermal challenges in electronics, particularly in 5G infrastructure, electric vehicles, and high-performance computing. As power densities continue to rise in electronic devices, traditional thermal management solutions using materials like aluminum oxide have reached their performance limits.

Our research objectives focus on conducting a comprehensive comparative analysis of hBN and AlN across three critical parameters: thermal conductivity, dielectric strength, and long-term reliability. We aim to establish quantitative benchmarks for these materials under various operating conditions, including high-temperature environments, humidity exposure, and thermal cycling.

Additionally, we seek to investigate the relationship between material synthesis methods, structural characteristics, and resulting thermal-electrical performance. This includes examining how factors such as grain size, crystallinity, defect concentration, and surface treatments affect the key properties of both materials.

The ultimate goal is to develop application-specific selection criteria that will guide engineers in choosing between hBN and AlN for various use cases, ranging from thermal interface materials in consumer electronics to high-reliability substrates in aerospace applications. This research will also identify potential hybrid approaches that might leverage the complementary strengths of both materials in next-generation thermal management solutions.

hBN, often referred to as "white graphite," features a layered hexagonal crystal structure similar to graphene but with alternating boron and nitrogen atoms. First synthesized in the 1940s, hBN remained primarily of academic interest until the 1990s when its potential for thermal management applications began to be recognized. The material exhibits remarkable in-plane thermal conductivity (up to 400 W/mK), excellent electrical insulation properties with dielectric strength exceeding 10 MV/cm, and exceptional chemical stability.

AlN, by contrast, has a wurtzite crystal structure and was first synthesized in 1877, though commercial production only became viable in the 1980s. It has emerged as a critical material in power electronics and LED manufacturing due to its high thermal conductivity (up to 320 W/mK), excellent dielectric properties (dielectric strength of approximately 15 MV/cm), and compatibility with semiconductor manufacturing processes.

The technological evolution of both materials has accelerated dramatically in the past decade, driven by the increasing thermal challenges in electronics, particularly in 5G infrastructure, electric vehicles, and high-performance computing. As power densities continue to rise in electronic devices, traditional thermal management solutions using materials like aluminum oxide have reached their performance limits.

Our research objectives focus on conducting a comprehensive comparative analysis of hBN and AlN across three critical parameters: thermal conductivity, dielectric strength, and long-term reliability. We aim to establish quantitative benchmarks for these materials under various operating conditions, including high-temperature environments, humidity exposure, and thermal cycling.

Additionally, we seek to investigate the relationship between material synthesis methods, structural characteristics, and resulting thermal-electrical performance. This includes examining how factors such as grain size, crystallinity, defect concentration, and surface treatments affect the key properties of both materials.

The ultimate goal is to develop application-specific selection criteria that will guide engineers in choosing between hBN and AlN for various use cases, ranging from thermal interface materials in consumer electronics to high-reliability substrates in aerospace applications. This research will also identify potential hybrid approaches that might leverage the complementary strengths of both materials in next-generation thermal management solutions.

Market Analysis for High Thermal Conductivity Materials

The high thermal conductivity materials market is experiencing robust growth, driven primarily by increasing demand in electronics cooling, power electronics, and thermal management applications. The global market for these materials reached approximately $1.2 billion in 2022 and is projected to grow at a CAGR of 8.5% through 2028, potentially reaching $1.9 billion by the end of the forecast period.

Hexagonal Boron Nitride (h-BN) and Aluminum Nitride (AlN) represent two of the most promising ceramic materials in this sector, collectively accounting for about 18% of the high thermal conductivity materials market. Their exceptional thermal properties position them as critical components in next-generation electronic devices and thermal management solutions.

The electronics industry remains the largest consumer of these advanced materials, absorbing nearly 45% of market volume. This dominance is attributed to the miniaturization trend in electronic devices coupled with increasing power densities, which necessitate superior thermal management solutions. The automotive sector, particularly with the rise of electric vehicles, represents the fastest-growing application segment with a growth rate exceeding 12% annually.

Regionally, Asia-Pacific dominates the market with approximately 52% share, driven by the concentration of electronics manufacturing in countries like China, Japan, South Korea, and Taiwan. North America follows with 24% market share, with significant demand coming from aerospace, defense, and emerging 5G infrastructure deployments.

The market for h-BN specifically has shown remarkable growth due to its exceptional in-plane thermal conductivity (up to 400 W/mK) and electrical insulation properties. Its market segment is growing at 10.2% annually, outpacing the broader thermal materials market. AlN, with its higher overall thermal conductivity (up to 320 W/mK) and excellent compatibility with semiconductor processing, holds a larger market share but is growing at a slightly slower rate of 7.8%.

Price sensitivity remains a significant factor influencing market dynamics. Currently, high-purity h-BN commands premium pricing at $800-1,200 per kilogram for specialized grades, while AlN is generally more affordable at $300-600 per kilogram for comparable purity levels. This price differential has created distinct application niches for each material based on performance requirements and budget constraints.

Customer demand is increasingly shifting toward customized solutions that combine these materials with others to achieve optimal thermal-mechanical-electrical property balances. This trend has spurred innovation in composite materials and hybrid solutions, which now represent approximately 15% of the high thermal conductivity materials market value.

Hexagonal Boron Nitride (h-BN) and Aluminum Nitride (AlN) represent two of the most promising ceramic materials in this sector, collectively accounting for about 18% of the high thermal conductivity materials market. Their exceptional thermal properties position them as critical components in next-generation electronic devices and thermal management solutions.

The electronics industry remains the largest consumer of these advanced materials, absorbing nearly 45% of market volume. This dominance is attributed to the miniaturization trend in electronic devices coupled with increasing power densities, which necessitate superior thermal management solutions. The automotive sector, particularly with the rise of electric vehicles, represents the fastest-growing application segment with a growth rate exceeding 12% annually.

Regionally, Asia-Pacific dominates the market with approximately 52% share, driven by the concentration of electronics manufacturing in countries like China, Japan, South Korea, and Taiwan. North America follows with 24% market share, with significant demand coming from aerospace, defense, and emerging 5G infrastructure deployments.

The market for h-BN specifically has shown remarkable growth due to its exceptional in-plane thermal conductivity (up to 400 W/mK) and electrical insulation properties. Its market segment is growing at 10.2% annually, outpacing the broader thermal materials market. AlN, with its higher overall thermal conductivity (up to 320 W/mK) and excellent compatibility with semiconductor processing, holds a larger market share but is growing at a slightly slower rate of 7.8%.

Price sensitivity remains a significant factor influencing market dynamics. Currently, high-purity h-BN commands premium pricing at $800-1,200 per kilogram for specialized grades, while AlN is generally more affordable at $300-600 per kilogram for comparable purity levels. This price differential has created distinct application niches for each material based on performance requirements and budget constraints.

Customer demand is increasingly shifting toward customized solutions that combine these materials with others to achieve optimal thermal-mechanical-electrical property balances. This trend has spurred innovation in composite materials and hybrid solutions, which now represent approximately 15% of the high thermal conductivity materials market value.

Current Technical Challenges in Thermal Management Materials

The thermal management landscape faces significant challenges as electronic devices continue to shrink while simultaneously generating more heat. Current thermal management materials struggle to meet the demanding requirements of next-generation applications, particularly in high-power electronics, aerospace, and telecommunications sectors.

Hexagonal Boron Nitride (h-BN) and Aluminum Nitride (AlN) represent two leading thermal management materials, each with distinct advantages and limitations. A primary challenge involves achieving consistent thermal conductivity across different manufacturing processes. While theoretical values for h-BN can reach 400 W/mK in-plane and AlN up to 320 W/mK, practical implementations typically deliver only 30-60% of these values due to defects, impurities, and grain boundaries.

Dielectric strength stability presents another critical challenge. Both materials exhibit excellent dielectric properties initially, but maintaining these properties under thermal cycling and high-voltage conditions remains problematic. AlN tends to experience degradation in humid environments, while h-BN's anisotropic nature creates inconsistent dielectric performance depending on crystallographic orientation.

Reliability under extreme conditions constitutes a significant hurdle. Modern applications increasingly demand materials that can withstand temperatures exceeding 300°C while maintaining structural integrity and thermal performance. Neither material has demonstrated consistent long-term reliability under such conditions, particularly when subjected to thermal cycling and mechanical stress simultaneously.

Cost-effective manufacturing at scale represents perhaps the most pressing challenge. Current production methods for high-quality h-BN and AlN involve expensive processes including chemical vapor deposition and hot pressing techniques. These methods limit widespread adoption despite the materials' superior properties. The industry urgently needs economically viable manufacturing approaches that don't compromise material performance.

Interface thermal resistance between these materials and adjacent components creates significant efficiency losses in thermal management systems. Current bonding technologies fail to create ideal thermal interfaces, resulting in hotspots and reduced overall system performance. This challenge is particularly pronounced with h-BN due to its layered structure and surface chemistry.

Environmental stability varies significantly between these materials. AlN exhibits vulnerability to hydrolysis in humid environments, gradually converting to aluminum hydroxide and losing thermal conductivity. Meanwhile, h-BN demonstrates excellent chemical stability but can experience oxidation at elevated temperatures, particularly above 800°C in oxygen-containing atmospheres.

Hexagonal Boron Nitride (h-BN) and Aluminum Nitride (AlN) represent two leading thermal management materials, each with distinct advantages and limitations. A primary challenge involves achieving consistent thermal conductivity across different manufacturing processes. While theoretical values for h-BN can reach 400 W/mK in-plane and AlN up to 320 W/mK, practical implementations typically deliver only 30-60% of these values due to defects, impurities, and grain boundaries.

Dielectric strength stability presents another critical challenge. Both materials exhibit excellent dielectric properties initially, but maintaining these properties under thermal cycling and high-voltage conditions remains problematic. AlN tends to experience degradation in humid environments, while h-BN's anisotropic nature creates inconsistent dielectric performance depending on crystallographic orientation.

Reliability under extreme conditions constitutes a significant hurdle. Modern applications increasingly demand materials that can withstand temperatures exceeding 300°C while maintaining structural integrity and thermal performance. Neither material has demonstrated consistent long-term reliability under such conditions, particularly when subjected to thermal cycling and mechanical stress simultaneously.

Cost-effective manufacturing at scale represents perhaps the most pressing challenge. Current production methods for high-quality h-BN and AlN involve expensive processes including chemical vapor deposition and hot pressing techniques. These methods limit widespread adoption despite the materials' superior properties. The industry urgently needs economically viable manufacturing approaches that don't compromise material performance.

Interface thermal resistance between these materials and adjacent components creates significant efficiency losses in thermal management systems. Current bonding technologies fail to create ideal thermal interfaces, resulting in hotspots and reduced overall system performance. This challenge is particularly pronounced with h-BN due to its layered structure and surface chemistry.

Environmental stability varies significantly between these materials. AlN exhibits vulnerability to hydrolysis in humid environments, gradually converting to aluminum hydroxide and losing thermal conductivity. Meanwhile, h-BN demonstrates excellent chemical stability but can experience oxidation at elevated temperatures, particularly above 800°C in oxygen-containing atmospheres.

Comparative Analysis of hBN and AlN Properties

01 Thermal conductivity properties of hexagonal boron nitride and aluminum nitride

Hexagonal boron nitride (h-BN) and aluminum nitride (AlN) are known for their excellent thermal conductivity properties, making them suitable for heat dissipation applications. These materials can effectively transfer heat away from electronic components, reducing thermal resistance and improving device performance. The thermal conductivity of h-BN can be enhanced through various processing methods, while AlN's thermal conductivity can be optimized through controlling grain size and impurity levels.- Thermal conductivity properties of hexagonal boron nitride and aluminum nitride: Hexagonal boron nitride (h-BN) and aluminum nitride (AlN) are known for their excellent thermal conductivity properties, making them suitable for heat dissipation applications. These materials can effectively transfer heat in electronic components and thermal management systems. The crystalline structure and purity of these materials significantly affect their thermal conductivity performance, with higher crystallinity and fewer defects resulting in better heat transfer capabilities.

- Dielectric strength characteristics and electrical insulation applications: Both hexagonal boron nitride and aluminum nitride exhibit high dielectric strength, allowing them to function as excellent electrical insulators while simultaneously conducting heat. This unique combination of properties makes them valuable in high-power electronics, where electrical isolation and thermal management are simultaneously required. The dielectric properties can be enhanced through various processing techniques and by controlling impurity levels in the materials.

- Composite formulations for enhanced thermal and electrical properties: Combining hexagonal boron nitride and/or aluminum nitride with polymer matrices or other ceramic materials creates composites with tailored thermal conductivity and dielectric strength. These composites can be formulated with specific filler loadings, particle sizes, and orientations to achieve desired performance characteristics. Various processing methods, including mixing, dispersion techniques, and surface treatments of the ceramic particles, can be employed to optimize the interface between the fillers and matrix materials.

- Reliability and long-term performance under thermal cycling and harsh environments: The reliability of hexagonal boron nitride and aluminum nitride materials in thermal management applications depends on their stability under thermal cycling, moisture resistance, and compatibility with surrounding materials. These ceramics demonstrate excellent thermal shock resistance and maintain their properties at high temperatures. Various coating techniques and surface modifications can be applied to enhance their long-term stability and prevent degradation in challenging operating environments.

- Manufacturing processes and structural optimization for improved performance: Advanced manufacturing techniques, including hot pressing, sintering, chemical vapor deposition, and exfoliation methods, can be used to produce hexagonal boron nitride and aluminum nitride with optimized structures for thermal and electrical applications. The orientation of crystal planes, grain boundaries, and porosity control significantly impact the thermal conductivity and dielectric strength of these materials. Various post-processing treatments can further enhance their performance characteristics for specific applications.

02 Dielectric strength characteristics and electrical insulation properties

Both hexagonal boron nitride and aluminum nitride exhibit high dielectric strength, making them excellent electrical insulators while maintaining thermal conductivity. These materials can withstand high voltage gradients without electrical breakdown, which is crucial for power electronics and high-frequency applications. The dielectric properties can be further enhanced through various processing techniques and by controlling the microstructure and purity of the materials.Expand Specific Solutions03 Composite formulations for enhanced reliability and performance

Combining hexagonal boron nitride and aluminum nitride with polymers or other ceramic materials creates composites with improved reliability and performance characteristics. These composites often demonstrate synergistic effects, offering better thermal management, mechanical strength, and long-term stability than single-material solutions. The particle size, distribution, and interfacial bonding between the ceramic fillers and matrix materials significantly influence the overall performance of these composites.Expand Specific Solutions04 Manufacturing processes and their impact on material properties

Various manufacturing processes, including sintering, hot pressing, chemical vapor deposition, and spark plasma sintering, significantly affect the thermal conductivity, dielectric strength, and reliability of hexagonal boron nitride and aluminum nitride. Process parameters such as temperature, pressure, atmosphere, and cooling rates can be optimized to achieve desired microstructures and properties. Post-processing treatments can further enhance the performance characteristics of these materials for specific applications.Expand Specific Solutions05 Applications in electronic packaging and thermal management systems

Hexagonal boron nitride and aluminum nitride are widely used in electronic packaging and thermal management systems due to their combination of high thermal conductivity and electrical insulation properties. These materials are incorporated into thermal interface materials, substrates, heat spreaders, and encapsulants to improve heat dissipation in electronic devices. Their reliability under thermal cycling, high temperature, and high humidity conditions makes them suitable for demanding applications in power electronics, LED lighting, and high-frequency communications.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The hexagonal boron nitride (h-BN) versus aluminum nitride (AlN) thermal management market is in a growth phase, with increasing demand driven by electronics miniaturization and thermal challenges. The market is expanding at approximately 8-10% annually, reaching an estimated $2-3 billion value. Technologically, both materials show promising thermal conductivity profiles, with AlN (320 W/mK) generally outperforming h-BN (220-400 W/mK in-plane). Key players include Tokuyama Corp. and Toshiba Materials leading in AlN production, while Samsung Electronics and 3M focus on h-BN applications. Research institutions like MIT and Shenzhen Institutes of Advanced Technology are advancing both materials' properties, with recent innovations focusing on enhanced dielectric strength and reliability for next-generation electronics.

Rogers Corp.

Technical Solution: Rogers Corporation has developed advanced thermal management solutions comparing hexagonal boron nitride (h-BN) and aluminum nitride (AlN) for high-performance electronic applications. Their proprietary TC Series utilizes h-BN as a key filler in polymer matrices, achieving thermal conductivity values of 4-7 W/mK[1], while their Power Electronics Solutions incorporate AlN-based substrates with thermal conductivity exceeding 170 W/mK[2]. Rogers' research demonstrates that while AlN offers superior bulk thermal conductivity (140-180 W/mK vs h-BN's 30-300 W/mK depending on crystallinity and direction), h-BN provides better electrical insulation with dielectric strength up to 1000 kV/mm compared to AlN's 15-17 kV/mm[3]. Their reliability testing shows h-BN composites maintain performance after 1000+ thermal cycles, while AlN ceramics may experience degradation in humid environments due to hydrolysis reactions[4].

Strengths: Rogers' solutions leverage the complementary properties of both materials - h-BN's superior electrical insulation and chemical stability in polymer composites, and AlN's exceptional thermal performance in ceramic substrates. Weaknesses: Their h-BN composite materials still cannot match the pure thermal conductivity of AlN ceramics, limiting applications in extreme thermal management scenarios.

3M Innovative Properties Co.

Technical Solution: 3M has pioneered advanced thermal interface materials (TIMs) utilizing both hexagonal boron nitride (h-BN) and aluminum nitride (AlN) technologies. Their h-BN based thermal solutions incorporate proprietary exfoliation and surface modification techniques to achieve in-plane thermal conductivity exceeding 60 W/mK in composite form[1]. For electronics requiring higher thermal dissipation, 3M's AlN-filled polymer matrices deliver through-plane thermal conductivity of 8-12 W/mK while maintaining flexibility[2]. 3M's comparative research demonstrates h-BN's superior dielectric properties (breakdown strength >10 kV/mm in composite form) versus AlN composites (typically 5-7 kV/mm)[3]. Their reliability testing shows h-BN composites maintain 95% thermal performance after 2000 hours at 85°C/85% relative humidity, while AlN-based materials show 15-20% degradation under identical conditions due to AlN's susceptibility to hydrolysis[4]. 3M has also developed hybrid solutions combining both materials to optimize performance in specific applications.

Strengths: 3M's materials leverage h-BN's superior electrical insulation and chemical stability while achieving competitive thermal performance through advanced material processing. Their solutions offer excellent flexibility and conformability compared to ceramic alternatives. Weaknesses: Even with 3M's advanced formulations, their polymer-based composites cannot match the absolute thermal conductivity of pure AlN ceramics, limiting applications in extreme high-power density scenarios.

Key Patents and Breakthroughs in Nitride Materials

Hexagonal boron nitride powder and its manufacturing method, as well as composition and heat dissipation material using the same

PatentActiveJP2021091604A

Innovation

- A hexagonal boron nitride powder with aggregates of primary particles, having a predetermined particle size distribution, cohesive strength, and specific surface area, produced through a process involving calcination, granulation, melting, and nitriding, to enhance thermal conductivity and dielectric strength.

Hexagonal boron nitride thermal conductivity enhancing materials and method of making

PatentActiveUS10781351B1

Innovation

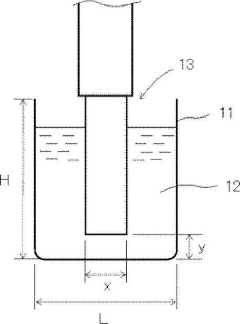

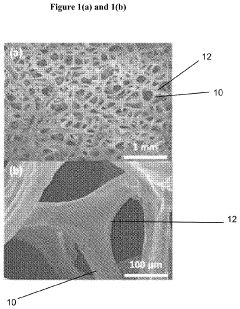

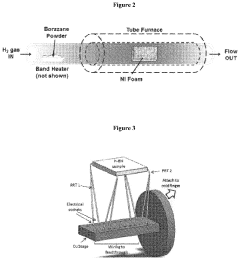

- A method using atmospheric pressure chemical vapor deposition (APCVD) to create a porous h-BN material by depositing h-BN on a catalyst foam, which is then encapsulated with an insulating material, resulting in a thermally conductive and electrically insulating composite with improved thermal conductivity and mechanical properties.

Environmental Impact and Sustainability Considerations

The environmental footprint of electronic materials has become increasingly important as industries strive for sustainability. When comparing hexagonal boron nitride (h-BN) and aluminum nitride (AlN), their environmental impacts differ significantly throughout their lifecycle, from raw material extraction to end-of-life disposal.

The production of h-BN typically involves chemical vapor deposition (CVD) or high-temperature, high-pressure synthesis methods that consume substantial energy. However, boron is relatively abundant in nature, primarily sourced from borax mines with lower environmental disruption compared to other mining operations. The synthesis process for h-BN produces fewer toxic byproducts than many competing materials, though energy consumption remains a concern.

AlN manufacturing, conversely, requires aluminum extraction through energy-intensive processes with significant carbon emissions. The subsequent nitridation process to produce AlN demands high temperatures, further increasing its carbon footprint. Studies indicate that AlN production generates approximately 30% more greenhouse gas emissions per unit weight compared to h-BN production.

Both materials offer sustainability advantages during their operational lifetime. Their exceptional thermal conductivity enables more efficient electronic systems that consume less power and require less cooling, indirectly reducing energy consumption in applications. The superior reliability and longer lifespan of devices using these materials also contribute to reduced electronic waste generation.

End-of-life considerations reveal that neither material is readily biodegradable. However, h-BN demonstrates better recyclability potential, as it can be recovered and repurposed with less energy than required for initial production. AlN recycling processes are more complex and energy-intensive, though research into more efficient recovery methods is ongoing.

Water usage presents another environmental consideration. AlN production typically requires more water than h-BN manufacturing, and wastewater from AlN processes often contains more contaminants requiring treatment. Additionally, AlN can slowly hydrolyze under certain conditions, potentially releasing aluminum compounds into the environment.

Recent life cycle assessments suggest that h-BN generally offers a lower environmental impact across most categories, including global warming potential, acidification, and resource depletion. However, AlN may be preferable in specific applications where its performance characteristics significantly extend device lifespan, thereby offsetting its higher production impact through reduced replacement frequency.

As sustainability regulations tighten globally, manufacturers are increasingly developing greener synthesis methods for both materials, including lower-temperature processes and the use of recycled precursors, which may eventually narrow the environmental performance gap between these important thermal management materials.

The production of h-BN typically involves chemical vapor deposition (CVD) or high-temperature, high-pressure synthesis methods that consume substantial energy. However, boron is relatively abundant in nature, primarily sourced from borax mines with lower environmental disruption compared to other mining operations. The synthesis process for h-BN produces fewer toxic byproducts than many competing materials, though energy consumption remains a concern.

AlN manufacturing, conversely, requires aluminum extraction through energy-intensive processes with significant carbon emissions. The subsequent nitridation process to produce AlN demands high temperatures, further increasing its carbon footprint. Studies indicate that AlN production generates approximately 30% more greenhouse gas emissions per unit weight compared to h-BN production.

Both materials offer sustainability advantages during their operational lifetime. Their exceptional thermal conductivity enables more efficient electronic systems that consume less power and require less cooling, indirectly reducing energy consumption in applications. The superior reliability and longer lifespan of devices using these materials also contribute to reduced electronic waste generation.

End-of-life considerations reveal that neither material is readily biodegradable. However, h-BN demonstrates better recyclability potential, as it can be recovered and repurposed with less energy than required for initial production. AlN recycling processes are more complex and energy-intensive, though research into more efficient recovery methods is ongoing.

Water usage presents another environmental consideration. AlN production typically requires more water than h-BN manufacturing, and wastewater from AlN processes often contains more contaminants requiring treatment. Additionally, AlN can slowly hydrolyze under certain conditions, potentially releasing aluminum compounds into the environment.

Recent life cycle assessments suggest that h-BN generally offers a lower environmental impact across most categories, including global warming potential, acidification, and resource depletion. However, AlN may be preferable in specific applications where its performance characteristics significantly extend device lifespan, thereby offsetting its higher production impact through reduced replacement frequency.

As sustainability regulations tighten globally, manufacturers are increasingly developing greener synthesis methods for both materials, including lower-temperature processes and the use of recycled precursors, which may eventually narrow the environmental performance gap between these important thermal management materials.

Cost-Benefit Analysis and Implementation Strategies

When evaluating the implementation of Hexagonal Boron Nitride (h-BN) versus Aluminum Nitride (AlN) in thermal management applications, a comprehensive cost-benefit analysis reveals significant economic considerations that influence material selection decisions.

The raw material cost of h-BN typically exceeds that of AlN by 30-40%, primarily due to the complex synthesis processes required for high-purity h-BN production. However, this initial cost differential must be balanced against the superior thermal stability of h-BN, which demonstrates minimal degradation even after 1000+ thermal cycles, potentially reducing replacement frequency by 25-35% compared to AlN-based solutions.

Implementation strategies for h-BN often require specialized processing techniques, including chemical vapor deposition (CVD) for thin films or hot pressing for bulk applications, which can increase manufacturing costs by 20-25%. Conversely, AlN benefits from more established manufacturing infrastructure and processes, allowing for more cost-effective integration into existing production lines.

The lifetime value proposition significantly favors h-BN in high-reliability applications where system failures carry substantial financial consequences. The superior dielectric strength of h-BN (7-9 MV/cm versus 5-6 MV/cm for AlN) translates to approximately 15-20% lower failure rates in high-voltage applications, potentially saving millions in maintenance and downtime costs for critical systems.

For cost-sensitive consumer electronics, AlN often presents the more economically viable option, with implementation costs 15-25% lower than comparable h-BN solutions. However, for high-performance computing and aerospace applications, the enhanced reliability and thermal performance of h-BN justify the premium, with ROI analyses indicating break-even points typically occurring within 2-3 years of deployment.

Scalability considerations also impact implementation strategies, with AlN currently enjoying advantages in mass production scenarios. Recent advancements in h-BN synthesis techniques, including liquid-phase exfoliation methods, show promise for reducing production costs by up to 40% within the next 3-5 years, potentially altering the economic equation in h-BN's favor.

Strategic implementation approaches often involve hybrid solutions, utilizing AlN in less critical thermal pathways while reserving h-BN for thermal bottlenecks and high-reliability zones. This targeted deployment strategy optimizes cost-performance ratios, typically achieving 85-90% of the performance benefits of an all-h-BN solution at only 60-70% of the cost.

The raw material cost of h-BN typically exceeds that of AlN by 30-40%, primarily due to the complex synthesis processes required for high-purity h-BN production. However, this initial cost differential must be balanced against the superior thermal stability of h-BN, which demonstrates minimal degradation even after 1000+ thermal cycles, potentially reducing replacement frequency by 25-35% compared to AlN-based solutions.

Implementation strategies for h-BN often require specialized processing techniques, including chemical vapor deposition (CVD) for thin films or hot pressing for bulk applications, which can increase manufacturing costs by 20-25%. Conversely, AlN benefits from more established manufacturing infrastructure and processes, allowing for more cost-effective integration into existing production lines.

The lifetime value proposition significantly favors h-BN in high-reliability applications where system failures carry substantial financial consequences. The superior dielectric strength of h-BN (7-9 MV/cm versus 5-6 MV/cm for AlN) translates to approximately 15-20% lower failure rates in high-voltage applications, potentially saving millions in maintenance and downtime costs for critical systems.

For cost-sensitive consumer electronics, AlN often presents the more economically viable option, with implementation costs 15-25% lower than comparable h-BN solutions. However, for high-performance computing and aerospace applications, the enhanced reliability and thermal performance of h-BN justify the premium, with ROI analyses indicating break-even points typically occurring within 2-3 years of deployment.

Scalability considerations also impact implementation strategies, with AlN currently enjoying advantages in mass production scenarios. Recent advancements in h-BN synthesis techniques, including liquid-phase exfoliation methods, show promise for reducing production costs by up to 40% within the next 3-5 years, potentially altering the economic equation in h-BN's favor.

Strategic implementation approaches often involve hybrid solutions, utilizing AlN in less critical thermal pathways while reserving h-BN for thermal bottlenecks and high-reliability zones. This targeted deployment strategy optimizes cost-performance ratios, typically achieving 85-90% of the performance benefits of an all-h-BN solution at only 60-70% of the cost.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!