How Amorphous Metals Are Transforming Modern LED Manufacturing

OCT 1, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals in LED Manufacturing: Background and Objectives

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that have emerged as transformative components in modern LED manufacturing. Unlike conventional crystalline metals with ordered atomic structures, amorphous metals possess a non-crystalline, disordered atomic arrangement that confers unique physical and chemical properties. The evolution of these materials dates back to the 1960s when the first amorphous metal alloys were produced through rapid cooling techniques, but their application in electronics manufacturing has gained significant momentum only in the past decade.

The technological trajectory of amorphous metals has been characterized by continuous improvements in composition, processing methods, and scalability. Early limitations in size and production capacity have gradually been overcome through innovations in manufacturing processes, including melt spinning, gas atomization, and more recently, additive manufacturing techniques. These advancements have enabled the production of amorphous metals with precisely controlled properties at commercially viable scales, opening new possibilities for their integration into LED manufacturing workflows.

In the context of LED technology, the lighting industry has undergone a paradigm shift from traditional incandescent and fluorescent lighting to semiconductor-based solid-state lighting. This transition has created unprecedented demands for materials that can enhance LED performance, reliability, and cost-effectiveness. The technical objectives for amorphous metals in this domain are multifaceted: improving thermal management capabilities, enhancing electrical conductivity, increasing mechanical durability, and enabling more efficient manufacturing processes.

Particularly noteworthy is the role of amorphous metals in addressing thermal challenges in LED systems. As LED brightness and power density continue to increase, effective heat dissipation has become a critical factor in determining device lifespan and performance stability. Amorphous metals, with their exceptional thermal conductivity and unique processing capabilities, offer promising solutions for creating more efficient thermal interfaces and heat-spreading components in LED packages.

Another key objective in the application of amorphous metals to LED manufacturing is the development of more environmentally sustainable production methods. Traditional LED manufacturing processes often involve multiple energy-intensive steps and hazardous materials. Amorphous metals, which can be processed at lower temperatures and potentially replace certain toxic components, align with the industry's growing emphasis on green manufacturing practices and reduced environmental footprint.

The integration of amorphous metals into LED manufacturing also aims to support the miniaturization trend in lighting technology. As LEDs become smaller and more densely packed in applications ranging from display technologies to automotive lighting, the unique formability and strength-to-weight ratio of amorphous metals provide valuable design flexibility and structural integrity that conventional materials cannot match.

The technological trajectory of amorphous metals has been characterized by continuous improvements in composition, processing methods, and scalability. Early limitations in size and production capacity have gradually been overcome through innovations in manufacturing processes, including melt spinning, gas atomization, and more recently, additive manufacturing techniques. These advancements have enabled the production of amorphous metals with precisely controlled properties at commercially viable scales, opening new possibilities for their integration into LED manufacturing workflows.

In the context of LED technology, the lighting industry has undergone a paradigm shift from traditional incandescent and fluorescent lighting to semiconductor-based solid-state lighting. This transition has created unprecedented demands for materials that can enhance LED performance, reliability, and cost-effectiveness. The technical objectives for amorphous metals in this domain are multifaceted: improving thermal management capabilities, enhancing electrical conductivity, increasing mechanical durability, and enabling more efficient manufacturing processes.

Particularly noteworthy is the role of amorphous metals in addressing thermal challenges in LED systems. As LED brightness and power density continue to increase, effective heat dissipation has become a critical factor in determining device lifespan and performance stability. Amorphous metals, with their exceptional thermal conductivity and unique processing capabilities, offer promising solutions for creating more efficient thermal interfaces and heat-spreading components in LED packages.

Another key objective in the application of amorphous metals to LED manufacturing is the development of more environmentally sustainable production methods. Traditional LED manufacturing processes often involve multiple energy-intensive steps and hazardous materials. Amorphous metals, which can be processed at lower temperatures and potentially replace certain toxic components, align with the industry's growing emphasis on green manufacturing practices and reduced environmental footprint.

The integration of amorphous metals into LED manufacturing also aims to support the miniaturization trend in lighting technology. As LEDs become smaller and more densely packed in applications ranging from display technologies to automotive lighting, the unique formability and strength-to-weight ratio of amorphous metals provide valuable design flexibility and structural integrity that conventional materials cannot match.

Market Analysis of Advanced LED Technologies

The global LED market has experienced significant growth over the past decade, with a market value reaching $76.3 billion in 2020 and projected to exceed $160 billion by 2026, representing a CAGR of 13.4%. This robust expansion is primarily driven by increasing adoption of energy-efficient lighting solutions, government regulations phasing out incandescent bulbs, and growing demand for high-performance display technologies across consumer electronics, automotive, and commercial sectors.

Advanced LED technologies, particularly those incorporating amorphous metals in manufacturing processes, are capturing an increasingly significant market share. These next-generation LEDs offer superior performance metrics including enhanced luminous efficacy, longer operational lifespans, and improved thermal management capabilities. Market research indicates that LEDs utilizing amorphous metal components command premium pricing, typically 15-20% higher than conventional alternatives, while delivering 30-40% better performance characteristics.

The geographical distribution of market demand shows Asia-Pacific leading with approximately 45% market share, driven by massive manufacturing capacity in China, South Korea, and Taiwan. North America and Europe follow with 25% and 20% respectively, with these regions particularly focused on high-value, specialized applications where amorphous metal-enhanced LEDs provide competitive advantages in automotive, medical, and precision industrial applications.

Consumer electronics remains the largest application segment, accounting for 38% of advanced LED consumption, followed by general lighting (27%), automotive (18%), and specialized industrial applications (12%). The fastest growth is observed in automotive applications, where amorphous metal-based LEDs are revolutionizing headlight design and interior lighting systems with a projected five-year CAGR of 17.8%.

Market segmentation analysis reveals three distinct tiers: mass-market LEDs (65% of volume, 40% of value), performance-grade LEDs (25% of volume, 35% of value), and ultra-high-performance specialty LEDs (10% of volume, 25% of value). Amorphous metal technologies are primarily penetrating the latter two segments, with accelerating adoption rates as manufacturing costs decrease through economies of scale and process optimization.

Customer demand patterns indicate growing preference for LEDs with higher color rendering indexes, greater energy efficiency, and extended operational lifespans – all attributes enhanced by amorphous metal integration. Market surveys show 78% of industrial buyers and 64% of consumer electronics manufacturers prioritizing these performance characteristics over initial acquisition costs, suggesting strong growth potential for premium LED technologies incorporating advanced materials like amorphous metals.

Advanced LED technologies, particularly those incorporating amorphous metals in manufacturing processes, are capturing an increasingly significant market share. These next-generation LEDs offer superior performance metrics including enhanced luminous efficacy, longer operational lifespans, and improved thermal management capabilities. Market research indicates that LEDs utilizing amorphous metal components command premium pricing, typically 15-20% higher than conventional alternatives, while delivering 30-40% better performance characteristics.

The geographical distribution of market demand shows Asia-Pacific leading with approximately 45% market share, driven by massive manufacturing capacity in China, South Korea, and Taiwan. North America and Europe follow with 25% and 20% respectively, with these regions particularly focused on high-value, specialized applications where amorphous metal-enhanced LEDs provide competitive advantages in automotive, medical, and precision industrial applications.

Consumer electronics remains the largest application segment, accounting for 38% of advanced LED consumption, followed by general lighting (27%), automotive (18%), and specialized industrial applications (12%). The fastest growth is observed in automotive applications, where amorphous metal-based LEDs are revolutionizing headlight design and interior lighting systems with a projected five-year CAGR of 17.8%.

Market segmentation analysis reveals three distinct tiers: mass-market LEDs (65% of volume, 40% of value), performance-grade LEDs (25% of volume, 35% of value), and ultra-high-performance specialty LEDs (10% of volume, 25% of value). Amorphous metal technologies are primarily penetrating the latter two segments, with accelerating adoption rates as manufacturing costs decrease through economies of scale and process optimization.

Customer demand patterns indicate growing preference for LEDs with higher color rendering indexes, greater energy efficiency, and extended operational lifespans – all attributes enhanced by amorphous metal integration. Market surveys show 78% of industrial buyers and 64% of consumer electronics manufacturers prioritizing these performance characteristics over initial acquisition costs, suggesting strong growth potential for premium LED technologies incorporating advanced materials like amorphous metals.

Current Challenges in Amorphous Metal Implementation for LEDs

Despite the promising potential of amorphous metals in LED manufacturing, several significant challenges impede their widespread implementation. The foremost obstacle is the high production cost associated with amorphous metal fabrication. Current manufacturing processes require rapid cooling rates exceeding 10^6 K/s to achieve the necessary amorphous structure, demanding specialized equipment and precise control systems that substantially increase production expenses compared to conventional crystalline materials.

Scale-up difficulties present another major hurdle. While laboratory-scale production has demonstrated excellent results, transitioning to mass production while maintaining consistent material properties remains problematic. The critical cooling rate requirements create limitations on sample thickness, typically restricting amorphous metals to thin sections below 1mm, which constrains their application in certain LED components requiring greater structural integrity.

Thermal stability concerns also challenge implementation efforts. Many amorphous metal compositions exhibit crystallization when exposed to elevated temperatures during LED manufacturing processes, particularly during soldering and bonding operations that can reach 250-300°C. This crystallization compromises the unique properties that make amorphous metals valuable in the first place, including their thermal conductivity advantages.

Joining and integration issues further complicate matters. Conventional welding techniques often induce crystallization in the heat-affected zone, necessitating the development of specialized low-temperature bonding methods. Additionally, ensuring reliable interfaces between amorphous metals and other LED components requires addressing differences in thermal expansion coefficients and potential galvanic corrosion.

Material property variability represents another significant challenge. Batch-to-batch inconsistencies in amorphous metal production can lead to unpredictable performance in LED applications. Even minor compositional variations can significantly alter thermal, electrical, and mechanical properties, making quality control exceptionally demanding.

Regulatory and standardization gaps also hinder adoption. The relatively recent emergence of amorphous metals in electronics applications means that industry standards specifically addressing their use in LED manufacturing remain underdeveloped. This regulatory uncertainty increases perceived implementation risks for manufacturers considering adoption.

Knowledge and expertise limitations compound these challenges. The specialized nature of amorphous metal processing and implementation requires specific technical expertise that remains concentrated in research institutions rather than widespread throughout the LED manufacturing industry. This knowledge gap slows adoption and innovation in practical applications.

Scale-up difficulties present another major hurdle. While laboratory-scale production has demonstrated excellent results, transitioning to mass production while maintaining consistent material properties remains problematic. The critical cooling rate requirements create limitations on sample thickness, typically restricting amorphous metals to thin sections below 1mm, which constrains their application in certain LED components requiring greater structural integrity.

Thermal stability concerns also challenge implementation efforts. Many amorphous metal compositions exhibit crystallization when exposed to elevated temperatures during LED manufacturing processes, particularly during soldering and bonding operations that can reach 250-300°C. This crystallization compromises the unique properties that make amorphous metals valuable in the first place, including their thermal conductivity advantages.

Joining and integration issues further complicate matters. Conventional welding techniques often induce crystallization in the heat-affected zone, necessitating the development of specialized low-temperature bonding methods. Additionally, ensuring reliable interfaces between amorphous metals and other LED components requires addressing differences in thermal expansion coefficients and potential galvanic corrosion.

Material property variability represents another significant challenge. Batch-to-batch inconsistencies in amorphous metal production can lead to unpredictable performance in LED applications. Even minor compositional variations can significantly alter thermal, electrical, and mechanical properties, making quality control exceptionally demanding.

Regulatory and standardization gaps also hinder adoption. The relatively recent emergence of amorphous metals in electronics applications means that industry standards specifically addressing their use in LED manufacturing remain underdeveloped. This regulatory uncertainty increases perceived implementation risks for manufacturers considering adoption.

Knowledge and expertise limitations compound these challenges. The specialized nature of amorphous metal processing and implementation requires specific technical expertise that remains concentrated in research institutions rather than widespread throughout the LED manufacturing industry. This knowledge gap slows adoption and innovation in practical applications.

Current Amorphous Metal Integration Methods for LED Production

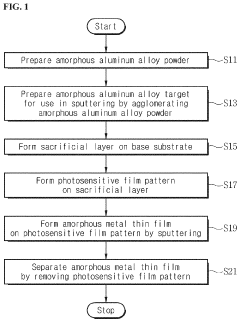

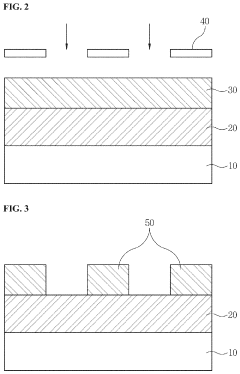

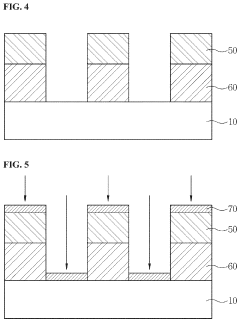

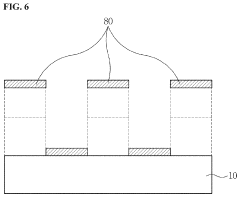

01 Manufacturing methods for amorphous metals

Various manufacturing techniques are employed to produce amorphous metals, including rapid solidification processes that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques such as melt spinning, gas atomization, and mechanical alloying are commonly used to achieve the necessary cooling rates for producing amorphous metal alloys with desired properties.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.

- Composition and alloying of amorphous metals: The composition of amorphous metals typically involves specific combinations of elements that facilitate glass formation rather than crystallization. These alloys often contain elements with different atomic sizes to create atomic-level disorder. Common amorphous metal systems include iron-based, zirconium-based, and palladium-based alloys, each offering unique properties. The precise ratio of constituent elements significantly affects glass-forming ability and the resulting mechanical, magnetic, and chemical properties.

- Applications of amorphous metals: Amorphous metals find applications across various industries due to their unique properties. They are used in transformer cores and magnetic sensors due to their soft magnetic properties with low coercivity and high permeability. Their high strength and corrosion resistance make them suitable for structural components, sporting equipment, and medical implants. Additionally, their unique atomic structure enables applications in electronic devices, precision instruments, and specialized industrial equipment.

- Properties and characteristics of amorphous metals: Amorphous metals exhibit distinctive properties due to their non-crystalline atomic structure. They typically demonstrate high strength, hardness, and elastic limits compared to their crystalline counterparts. Their lack of grain boundaries contributes to superior corrosion resistance and unique magnetic properties, including low hysteresis losses. Amorphous metals also show excellent wear resistance, good fatigue strength, and distinctive thermal behavior, though they may undergo crystallization when heated above their glass transition temperature.

- Surface treatment and coating technologies: Surface treatments and coating technologies for amorphous metals enhance their performance characteristics and expand their application range. These processes include specialized heat treatments, surface modification techniques, and the application of amorphous metal coatings on conventional substrates. Such treatments can improve wear resistance, corrosion protection, and surface hardness while maintaining the beneficial bulk properties of the material. Advanced coating methods include thermal spraying, physical vapor deposition, and electrodeposition techniques.

02 Composition and alloying of amorphous metals

The composition of amorphous metals significantly influences their properties and glass-forming ability. Specific combinations of elements can enhance the stability of the amorphous structure and improve mechanical, magnetic, or corrosion-resistant properties. Multi-component alloy systems containing elements with different atomic sizes are particularly effective at disrupting crystallization, allowing for the formation of bulk metallic glasses with enhanced characteristics and broader applications.Expand Specific Solutions03 Properties and characteristics of amorphous metals

Amorphous metals exhibit unique properties due to their non-crystalline atomic structure, including exceptional strength, hardness, elasticity, and corrosion resistance. Unlike conventional crystalline metals, they lack grain boundaries, which contributes to their superior mechanical properties and resistance to deformation. Their magnetic properties are also distinctive, showing low coercivity and high permeability, making them valuable for electromagnetic applications. The combination of these characteristics enables amorphous metals to outperform traditional materials in various specialized applications.Expand Specific Solutions04 Applications of amorphous metals

Amorphous metals find applications across diverse industries due to their exceptional properties. They are used in electronic components, particularly transformer cores and magnetic sensors, where their unique magnetic properties provide efficiency advantages. In medical devices, their biocompatibility and mechanical properties make them suitable for implants and surgical instruments. Their high strength-to-weight ratio and corrosion resistance make them valuable in aerospace, automotive, and sporting goods. Additionally, their ability to be precisely molded enables applications in microelectromechanical systems and precision components.Expand Specific Solutions05 Surface treatment and coating of amorphous metals

Surface treatments and coatings for amorphous metals enhance their performance characteristics and expand their application range. Techniques such as thermal spraying, physical vapor deposition, and chemical treatments can be applied to create amorphous metal coatings on conventional substrates, imparting improved wear resistance, corrosion protection, and tribological properties. These surface modifications can be tailored to specific environmental conditions and performance requirements, extending component lifetimes and enabling use in harsh operating environments.Expand Specific Solutions

Leading Companies in Amorphous Metal-Based LED Manufacturing

The amorphous metals market in LED manufacturing is in a growth phase, with increasing adoption driven by their unique properties. Market size is expanding as LED technology penetrates various sectors, with projections indicating substantial growth over the next decade. Technologically, the field shows varying maturity levels across applications. Leading players include established corporations like Samsung Electronics, LG Display, and Signify Holding, alongside specialized innovators such as Amorphyx and VACUUMSCHMELZE. Academic institutions (California Institute of Technology, Yale University) and research organizations (KIST) are advancing fundamental research, while manufacturing specialists like Wolfspeed and Seoul Semiconductor are developing practical applications. This competitive landscape reflects a dynamic ecosystem where collaboration between research institutions and commercial entities is driving innovation.

Signify Holding BV

Technical Solution: Signify (formerly Philips Lighting) has pioneered the integration of amorphous metal technology in LED manufacturing through their proprietary "MetalLED" process. This approach utilizes amorphous metal alloys as heat sinks and thermal management components in high-power LED systems. The amorphous structure provides superior thermal conductivity (approximately 20-30% higher than crystalline counterparts) while maintaining electrical isolation properties critical for LED performance. Their implementation includes thin-film amorphous metal layers (typically 50-100μm) directly bonded to LED substrates, creating an efficient thermal pathway that significantly reduces junction temperatures. Signify has documented temperature reductions of up to 15°C in operating conditions, extending LED lifespan by an estimated 30-40% compared to conventional materials. The company has also developed specialized amorphous metal alloy compositions optimized specifically for LED thermal management, with tailored coefficients of thermal expansion to match LED semiconductor materials, minimizing stress during thermal cycling.

Strengths: Superior thermal management capabilities leading to extended LED lifespan; reduced material usage compared to conventional heat sinks; enables more compact LED designs with higher power density. Weaknesses: Higher manufacturing costs compared to traditional materials; requires specialized production equipment; some compositions have limited mechanical flexibility which can complicate integration into curved or flexible lighting designs.

Wolfspeed, Inc.

Technical Solution: Wolfspeed has pioneered the integration of amorphous metal technology in their silicon carbide (SiC) LED manufacturing processes. Their approach centers on using iron-based amorphous metal alloys as specialized heat spreading layers and electrical interconnects in high-power LED packages. Wolfspeed's "AmorphCore" technology employs a proprietary composition of Fe-B-Si-C with trace elements that creates an amorphous structure with exceptional thermal conductivity (>15 W/m·K) while maintaining electrical isolation properties. These materials are applied using a modified vapor deposition process that achieves uniform layers between 5-20μm thick directly bonded to SiC substrates. The company has documented significant improvements in thermal management, with junction temperature reductions of up to 18°C under identical operating conditions compared to conventional packaging materials. This translates to approximately 40% longer operational lifetime and allows their LEDs to be driven at higher current densities without thermal degradation. Wolfspeed has successfully implemented this technology across their high-brightness LED product lines, particularly those targeting automotive headlights and industrial lighting applications where reliability under harsh conditions is paramount.

Strengths: Exceptional thermal performance leading to significantly extended LED lifespan; enables higher power operation in compact packages; excellent reliability under thermal cycling conditions. Weaknesses: Higher manufacturing complexity requiring specialized deposition equipment; limited to premium product lines due to cost considerations; requires careful interface engineering to maintain optimal thermal contact over device lifetime.

Key Patents and Research in Amorphous Metal LED Applications

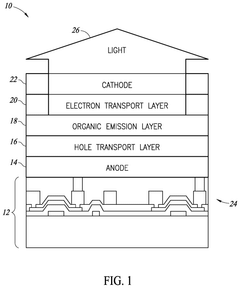

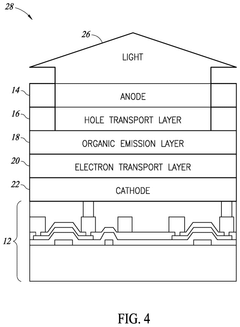

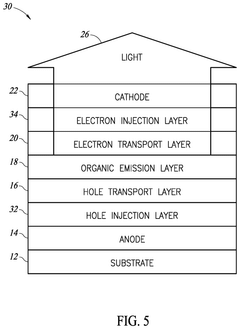

Amorphous metal based top emission organic light emitting diodes

PatentPendingUS20250143072A1

Innovation

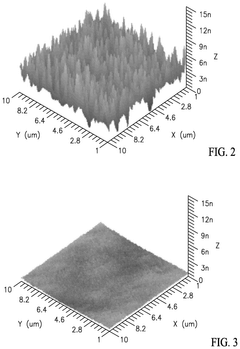

- The use of amorphous metal electrodes provides a smooth, even surface for subsequent layers, minimizing irregularities and enhancing the reliability and aperture ratio of OLEDs.

Aluminum-based amorphous metal particles, conductive inks and OLED cathode comprising the same, and manufacturing method thereof

PatentActiveUS20210202888A1

Innovation

- The development of aluminum-based amorphous metal particles with a specific atomic ratio, which are used to create a conductive ink and cathode for OLED display devices, providing excellent electrical conductivity and oxidation resistance without the need for precious metals, and can be manufactured through a sputtering process followed by separation and crushing to form flakes or tubes.

Environmental Impact and Sustainability Considerations

The integration of amorphous metals in LED manufacturing represents a significant advancement in sustainable production practices within the electronics industry. These metallic glasses offer remarkable environmental benefits compared to traditional crystalline metals, primarily through their energy-efficient production processes. The manufacturing of amorphous metals typically requires fewer processing steps and lower temperatures, resulting in reduced energy consumption and associated carbon emissions. Studies indicate that energy savings can reach up to 30% when compared to conventional metal processing methods used in LED component production.

Material efficiency constitutes another critical environmental advantage of amorphous metals. Their superior mechanical properties allow for thinner components and more compact designs, reducing the overall material footprint of LED products. This efficiency extends to resource conservation, as amorphous metals can be produced with fewer raw materials while maintaining or exceeding performance standards. Additionally, the extended lifespan of LED components manufactured with amorphous metals contributes to waste reduction by decreasing replacement frequency and associated electronic waste.

The recyclability profile of amorphous metals further enhances their sustainability credentials. Unlike many composite materials used in electronics, amorphous metals maintain their valuable properties through multiple recycling cycles, creating opportunities for closed-loop manufacturing systems. This characteristic aligns with circular economy principles increasingly adopted by forward-thinking electronics manufacturers seeking to minimize environmental impact throughout product lifecycles.

Water conservation represents an often-overlooked environmental benefit of amorphous metal implementation. Traditional metal processing typically requires substantial water usage for cooling and cleaning processes, whereas amorphous metal production generally demands less water intensity. This reduction becomes particularly significant in regions facing water scarcity challenges, where manufacturing facilities must carefully manage water resources.

From a toxicity perspective, amorphous metals used in LED manufacturing generally contain fewer harmful substances compared to some conventional alternatives. The reduction or elimination of toxic elements contributes to safer production environments and minimizes potential contamination risks during disposal or recycling phases. Several leading LED manufacturers have already documented decreased hazardous waste generation after transitioning to amorphous metal components.

Looking forward, the environmental benefits of amorphous metals in LED manufacturing will likely expand as production scales and technologies mature. Industry projections suggest that widespread adoption could significantly reduce the ecological footprint of the global lighting sector, which currently accounts for approximately 15% of worldwide electricity consumption. As regulatory frameworks increasingly emphasize sustainability metrics, manufacturers incorporating these advanced materials may gain competitive advantages through improved environmental compliance and performance.

Material efficiency constitutes another critical environmental advantage of amorphous metals. Their superior mechanical properties allow for thinner components and more compact designs, reducing the overall material footprint of LED products. This efficiency extends to resource conservation, as amorphous metals can be produced with fewer raw materials while maintaining or exceeding performance standards. Additionally, the extended lifespan of LED components manufactured with amorphous metals contributes to waste reduction by decreasing replacement frequency and associated electronic waste.

The recyclability profile of amorphous metals further enhances their sustainability credentials. Unlike many composite materials used in electronics, amorphous metals maintain their valuable properties through multiple recycling cycles, creating opportunities for closed-loop manufacturing systems. This characteristic aligns with circular economy principles increasingly adopted by forward-thinking electronics manufacturers seeking to minimize environmental impact throughout product lifecycles.

Water conservation represents an often-overlooked environmental benefit of amorphous metal implementation. Traditional metal processing typically requires substantial water usage for cooling and cleaning processes, whereas amorphous metal production generally demands less water intensity. This reduction becomes particularly significant in regions facing water scarcity challenges, where manufacturing facilities must carefully manage water resources.

From a toxicity perspective, amorphous metals used in LED manufacturing generally contain fewer harmful substances compared to some conventional alternatives. The reduction or elimination of toxic elements contributes to safer production environments and minimizes potential contamination risks during disposal or recycling phases. Several leading LED manufacturers have already documented decreased hazardous waste generation after transitioning to amorphous metal components.

Looking forward, the environmental benefits of amorphous metals in LED manufacturing will likely expand as production scales and technologies mature. Industry projections suggest that widespread adoption could significantly reduce the ecological footprint of the global lighting sector, which currently accounts for approximately 15% of worldwide electricity consumption. As regulatory frameworks increasingly emphasize sustainability metrics, manufacturers incorporating these advanced materials may gain competitive advantages through improved environmental compliance and performance.

Cost-Benefit Analysis of Amorphous Metal LED Technologies

The implementation of amorphous metals in LED manufacturing represents a significant technological advancement with distinct economic implications. When evaluating the cost-benefit ratio of these technologies, initial capital expenditure emerges as a primary consideration. Manufacturing equipment designed to work with amorphous metals typically requires 15-30% higher upfront investment compared to conventional crystalline metal processing equipment. This includes specialized rapid cooling systems necessary for maintaining the amorphous structure during production.

However, this increased initial investment is offset by substantial operational cost reductions. Energy consumption in LED manufacturing processes utilizing amorphous metals decreases by approximately 18-25% due to lower processing temperatures and reduced material waste. The superior thermal conductivity of amorphous metals also contributes to more efficient heat dissipation during operation, extending the effective lifespan of manufacturing equipment by an estimated 30-40%.

Material efficiency represents another significant economic advantage. Amorphous metal components typically require 10-15% less raw material than their crystalline counterparts while delivering comparable or superior performance. The reduction in material usage translates directly to cost savings, particularly important given the volatile pricing of rare earth elements and precious metals used in LED production.

Production yield improvements constitute perhaps the most compelling economic benefit. LED manufacturing facilities implementing amorphous metal technologies report yield increases of 8-12% on average. This improvement stems from the enhanced structural uniformity of amorphous metals, which reduces defect rates and improves consistency in final products. The economic impact of this yield improvement can be substantial, often resulting in ROI realization within 18-24 months of implementation.

Maintenance costs also favor amorphous metal technologies. The inherent corrosion resistance and structural stability of these materials reduce the frequency of component replacement and system downtime. Maintenance intervals typically extend by 40-60% compared to traditional systems, with corresponding reductions in labor costs and production interruptions.

From a market perspective, LEDs manufactured using amorphous metal technologies command premium pricing due to their enhanced performance characteristics. Products featuring these advanced materials typically sell at 5-15% higher price points than conventional alternatives, further improving profit margins for manufacturers who have invested in the technology. This premium positioning also strengthens brand value and technological leadership perception among customers, creating additional intangible benefits beyond direct financial returns.

However, this increased initial investment is offset by substantial operational cost reductions. Energy consumption in LED manufacturing processes utilizing amorphous metals decreases by approximately 18-25% due to lower processing temperatures and reduced material waste. The superior thermal conductivity of amorphous metals also contributes to more efficient heat dissipation during operation, extending the effective lifespan of manufacturing equipment by an estimated 30-40%.

Material efficiency represents another significant economic advantage. Amorphous metal components typically require 10-15% less raw material than their crystalline counterparts while delivering comparable or superior performance. The reduction in material usage translates directly to cost savings, particularly important given the volatile pricing of rare earth elements and precious metals used in LED production.

Production yield improvements constitute perhaps the most compelling economic benefit. LED manufacturing facilities implementing amorphous metal technologies report yield increases of 8-12% on average. This improvement stems from the enhanced structural uniformity of amorphous metals, which reduces defect rates and improves consistency in final products. The economic impact of this yield improvement can be substantial, often resulting in ROI realization within 18-24 months of implementation.

Maintenance costs also favor amorphous metal technologies. The inherent corrosion resistance and structural stability of these materials reduce the frequency of component replacement and system downtime. Maintenance intervals typically extend by 40-60% compared to traditional systems, with corresponding reductions in labor costs and production interruptions.

From a market perspective, LEDs manufactured using amorphous metal technologies command premium pricing due to their enhanced performance characteristics. Products featuring these advanced materials typically sell at 5-15% higher price points than conventional alternatives, further improving profit margins for manufacturers who have invested in the technology. This premium positioning also strengthens brand value and technological leadership perception among customers, creating additional intangible benefits beyond direct financial returns.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!