How to Explore New Market Segments with Hydrochloric Acid?

JUL 2, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HCl Market Overview

Hydrochloric acid (HCl) is a versatile chemical compound with a wide range of applications across various industries. The global HCl market has been experiencing steady growth, driven by increasing demand from key end-use sectors such as steel pickling, oil well acidizing, and chemical manufacturing. As of 2021, the market size was estimated at approximately $1.8 billion, with projections indicating a compound annual growth rate (CAGR) of 5.2% through 2028.

The HCl market is characterized by its segmentation into different grades, including technical grade, food grade, and electronic grade. Technical grade HCl dominates the market share, accounting for over 70% of the total volume consumed. This grade finds extensive use in metal processing, water treatment, and the production of various chemicals. Food grade HCl, while representing a smaller segment, is witnessing increased demand due to its applications in food processing and preservation.

Geographically, Asia-Pacific leads the global HCl market, with China being the largest producer and consumer. The region's rapid industrialization, particularly in countries like India and Southeast Asian nations, is driving the demand for HCl in various manufacturing processes. North America and Europe follow as significant markets, with established industrial bases and stringent environmental regulations influencing consumption patterns.

The market dynamics are influenced by several factors, including raw material availability, environmental regulations, and technological advancements. The primary production method for HCl involves the chlor-alkali process, which is closely tied to the production of caustic soda. Fluctuations in the caustic soda market, therefore, have a direct impact on HCl supply and pricing.

Environmental concerns and regulatory pressures are shaping the HCl market landscape. Stringent regulations on emissions and waste management are prompting manufacturers to invest in cleaner production technologies and recycling processes. This trend is particularly evident in developed markets, where sustainable practices are increasingly becoming a competitive advantage.

Emerging applications in sectors such as pharmaceuticals, electronics, and renewable energy are opening new avenues for HCl market growth. For instance, the rising demand for high-purity HCl in semiconductor manufacturing is creating opportunities for specialized producers. Additionally, the growing focus on hydrogen as a clean energy source is expected to boost HCl demand in fuel cell applications.

The competitive landscape of the HCl market is characterized by the presence of both global chemical giants and regional players. Key market participants include Dow Chemical Company, BASF SE, Olin Corporation, and Covestro AG. These companies are focusing on strategic initiatives such as capacity expansions, mergers and acquisitions, and product innovations to strengthen their market positions and explore new growth opportunities.

The HCl market is characterized by its segmentation into different grades, including technical grade, food grade, and electronic grade. Technical grade HCl dominates the market share, accounting for over 70% of the total volume consumed. This grade finds extensive use in metal processing, water treatment, and the production of various chemicals. Food grade HCl, while representing a smaller segment, is witnessing increased demand due to its applications in food processing and preservation.

Geographically, Asia-Pacific leads the global HCl market, with China being the largest producer and consumer. The region's rapid industrialization, particularly in countries like India and Southeast Asian nations, is driving the demand for HCl in various manufacturing processes. North America and Europe follow as significant markets, with established industrial bases and stringent environmental regulations influencing consumption patterns.

The market dynamics are influenced by several factors, including raw material availability, environmental regulations, and technological advancements. The primary production method for HCl involves the chlor-alkali process, which is closely tied to the production of caustic soda. Fluctuations in the caustic soda market, therefore, have a direct impact on HCl supply and pricing.

Environmental concerns and regulatory pressures are shaping the HCl market landscape. Stringent regulations on emissions and waste management are prompting manufacturers to invest in cleaner production technologies and recycling processes. This trend is particularly evident in developed markets, where sustainable practices are increasingly becoming a competitive advantage.

Emerging applications in sectors such as pharmaceuticals, electronics, and renewable energy are opening new avenues for HCl market growth. For instance, the rising demand for high-purity HCl in semiconductor manufacturing is creating opportunities for specialized producers. Additionally, the growing focus on hydrogen as a clean energy source is expected to boost HCl demand in fuel cell applications.

The competitive landscape of the HCl market is characterized by the presence of both global chemical giants and regional players. Key market participants include Dow Chemical Company, BASF SE, Olin Corporation, and Covestro AG. These companies are focusing on strategic initiatives such as capacity expansions, mergers and acquisitions, and product innovations to strengthen their market positions and explore new growth opportunities.

Demand Analysis

The global hydrochloric acid market has been experiencing steady growth, driven by its diverse applications across various industries. The demand for hydrochloric acid is primarily fueled by its use in steel pickling, oil well acidizing, food processing, and chemical manufacturing. As industries continue to expand and evolve, new market segments are emerging, presenting opportunities for hydrochloric acid producers to diversify their customer base and increase market share.

One of the most promising new market segments for hydrochloric acid is the renewable energy sector. With the increasing focus on clean energy solutions, hydrochloric acid is finding applications in the production of solar panels and wind turbines. In solar panel manufacturing, hydrochloric acid is used for etching and cleaning silicon wafers, a critical step in the production process. As the global demand for solar energy continues to rise, this segment is expected to create significant opportunities for hydrochloric acid suppliers.

Another emerging market segment is the water treatment industry. Hydrochloric acid plays a crucial role in pH adjustment and disinfection processes, making it an essential component in water treatment plants. With growing concerns over water scarcity and the need for efficient water management, the demand for hydrochloric acid in this sector is projected to increase substantially in the coming years.

The electronics industry also presents a promising market segment for hydrochloric acid. As the production of semiconductors and printed circuit boards continues to grow, the demand for high-purity hydrochloric acid used in etching and cleaning processes is expected to rise. This segment offers opportunities for hydrochloric acid producers to develop specialized, high-value products tailored to the stringent requirements of the electronics industry.

In the pharmaceutical sector, hydrochloric acid is used in the synthesis of various drugs and active pharmaceutical ingredients. With the ongoing expansion of the global pharmaceutical industry and the increasing demand for new and innovative medications, this segment is likely to contribute significantly to the growth of the hydrochloric acid market.

The construction industry is another potential market segment for hydrochloric acid. It is used in the production of calcium chloride, a key ingredient in concrete admixtures and de-icing agents. As urbanization and infrastructure development continue worldwide, the demand for hydrochloric acid in this sector is expected to grow.

To effectively explore these new market segments, hydrochloric acid producers should focus on developing tailored products that meet the specific requirements of each industry. This may involve investing in research and development to improve product purity, consistency, and performance. Additionally, establishing strategic partnerships with key players in these emerging sectors can help hydrochloric acid suppliers gain a competitive edge and secure long-term contracts.

One of the most promising new market segments for hydrochloric acid is the renewable energy sector. With the increasing focus on clean energy solutions, hydrochloric acid is finding applications in the production of solar panels and wind turbines. In solar panel manufacturing, hydrochloric acid is used for etching and cleaning silicon wafers, a critical step in the production process. As the global demand for solar energy continues to rise, this segment is expected to create significant opportunities for hydrochloric acid suppliers.

Another emerging market segment is the water treatment industry. Hydrochloric acid plays a crucial role in pH adjustment and disinfection processes, making it an essential component in water treatment plants. With growing concerns over water scarcity and the need for efficient water management, the demand for hydrochloric acid in this sector is projected to increase substantially in the coming years.

The electronics industry also presents a promising market segment for hydrochloric acid. As the production of semiconductors and printed circuit boards continues to grow, the demand for high-purity hydrochloric acid used in etching and cleaning processes is expected to rise. This segment offers opportunities for hydrochloric acid producers to develop specialized, high-value products tailored to the stringent requirements of the electronics industry.

In the pharmaceutical sector, hydrochloric acid is used in the synthesis of various drugs and active pharmaceutical ingredients. With the ongoing expansion of the global pharmaceutical industry and the increasing demand for new and innovative medications, this segment is likely to contribute significantly to the growth of the hydrochloric acid market.

The construction industry is another potential market segment for hydrochloric acid. It is used in the production of calcium chloride, a key ingredient in concrete admixtures and de-icing agents. As urbanization and infrastructure development continue worldwide, the demand for hydrochloric acid in this sector is expected to grow.

To effectively explore these new market segments, hydrochloric acid producers should focus on developing tailored products that meet the specific requirements of each industry. This may involve investing in research and development to improve product purity, consistency, and performance. Additionally, establishing strategic partnerships with key players in these emerging sectors can help hydrochloric acid suppliers gain a competitive edge and secure long-term contracts.

Technical Challenges

Exploring new market segments with hydrochloric acid presents several technical challenges that must be addressed to ensure successful implementation and market penetration. One of the primary obstacles is the corrosive nature of hydrochloric acid, which necessitates specialized handling, storage, and transportation methods. This requires the development of advanced materials and coatings that can withstand prolonged exposure to the acid without degradation or contamination.

Another significant challenge lies in the safety concerns associated with hydrochloric acid usage in new applications. As the acid expands into unfamiliar market segments, there is a need for robust safety protocols and equipment tailored to each specific use case. This includes designing fail-safe systems, implementing proper ventilation, and creating effective neutralization procedures to mitigate potential risks.

The environmental impact of increased hydrochloric acid usage also poses a technical hurdle. Developing eco-friendly production methods and waste management solutions is crucial to minimize the ecological footprint and comply with stringent environmental regulations across different industries and regions. This may involve creating closed-loop systems or innovative recycling techniques to reduce acid waste and emissions.

Scaling up production to meet the demands of new market segments presents its own set of challenges. Optimizing manufacturing processes to increase efficiency while maintaining product quality and purity is essential. This may require advancements in reactor design, process control systems, and purification technologies to ensure consistent, high-quality acid production at larger scales.

Furthermore, adapting hydrochloric acid for use in diverse applications often requires precise control of concentration and purity levels. Developing accurate and reliable methods for real-time monitoring and adjustment of acid properties is crucial for maintaining product efficacy and safety across various market segments. This may involve the integration of advanced sensors and automated control systems into production and application processes.

Lastly, the compatibility of hydrochloric acid with existing infrastructure and equipment in new market segments must be carefully evaluated. Retrofitting or redesigning systems to accommodate the acid's unique properties may be necessary, requiring innovative engineering solutions and materials science advancements. This challenge extends to developing new application methods and tools that can effectively utilize hydrochloric acid in novel contexts while minimizing risks and maximizing benefits.

Another significant challenge lies in the safety concerns associated with hydrochloric acid usage in new applications. As the acid expands into unfamiliar market segments, there is a need for robust safety protocols and equipment tailored to each specific use case. This includes designing fail-safe systems, implementing proper ventilation, and creating effective neutralization procedures to mitigate potential risks.

The environmental impact of increased hydrochloric acid usage also poses a technical hurdle. Developing eco-friendly production methods and waste management solutions is crucial to minimize the ecological footprint and comply with stringent environmental regulations across different industries and regions. This may involve creating closed-loop systems or innovative recycling techniques to reduce acid waste and emissions.

Scaling up production to meet the demands of new market segments presents its own set of challenges. Optimizing manufacturing processes to increase efficiency while maintaining product quality and purity is essential. This may require advancements in reactor design, process control systems, and purification technologies to ensure consistent, high-quality acid production at larger scales.

Furthermore, adapting hydrochloric acid for use in diverse applications often requires precise control of concentration and purity levels. Developing accurate and reliable methods for real-time monitoring and adjustment of acid properties is crucial for maintaining product efficacy and safety across various market segments. This may involve the integration of advanced sensors and automated control systems into production and application processes.

Lastly, the compatibility of hydrochloric acid with existing infrastructure and equipment in new market segments must be carefully evaluated. Retrofitting or redesigning systems to accommodate the acid's unique properties may be necessary, requiring innovative engineering solutions and materials science advancements. This challenge extends to developing new application methods and tools that can effectively utilize hydrochloric acid in novel contexts while minimizing risks and maximizing benefits.

Current Applications

01 Production methods of hydrochloric acid

Various methods are employed to produce hydrochloric acid, including the reaction of chlorine with hydrogen, the chlorination of hydrocarbons, and as a byproduct in chemical processes. These production methods aim to optimize yield and purity while minimizing environmental impact.- Production methods of hydrochloric acid: Various methods are employed for the production of hydrochloric acid, including direct synthesis from hydrogen and chlorine, as a by-product in chlorination processes, and through the reaction of sulfuric acid with sodium chloride. These methods are optimized for efficiency and purity in industrial settings.

- Purification and concentration techniques: Techniques for purifying and concentrating hydrochloric acid involve distillation, membrane separation, and adsorption processes. These methods aim to remove impurities and achieve desired concentration levels for various industrial applications.

- Applications in chemical processing: Hydrochloric acid is widely used in chemical processing, including metal treatment, pH regulation, and as a catalyst in various reactions. It plays a crucial role in industries such as steel production, water treatment, and pharmaceutical manufacturing.

- Safety and handling considerations: Proper safety measures and handling procedures are essential when working with hydrochloric acid due to its corrosive nature. This includes the use of specialized storage containers, protective equipment, and neutralization techniques in case of spills or accidents.

- Environmental impact and waste management: Managing the environmental impact of hydrochloric acid involves proper disposal methods, recycling techniques, and emission control strategies. Efforts are made to minimize its release into the environment and to develop more sustainable production and usage practices.

02 Purification and concentration of hydrochloric acid

Techniques for purifying and concentrating hydrochloric acid involve distillation, membrane separation, and adsorption processes. These methods are crucial for obtaining high-purity acid suitable for industrial and laboratory applications, as well as for recycling and reusing the acid in various processes.Expand Specific Solutions03 Applications of hydrochloric acid in chemical processing

Hydrochloric acid is widely used in chemical processing, including metal treatment, pH regulation, and as a catalyst in various reactions. It plays a crucial role in industries such as metallurgy, pharmaceuticals, and food processing, where its strong acidic properties are utilized for diverse applications.Expand Specific Solutions04 Safety and handling of hydrochloric acid

Proper safety measures and handling procedures are essential when working with hydrochloric acid due to its corrosive nature. This includes the use of appropriate personal protective equipment, specialized storage containers, and neutralization techniques for spills. Safety protocols also cover transportation and disposal methods to minimize environmental and health risks.Expand Specific Solutions05 Environmental impact and waste management of hydrochloric acid

Managing the environmental impact of hydrochloric acid involves developing sustainable production processes, implementing effective waste treatment methods, and exploring recycling options. Efforts are made to minimize emissions, neutralize acid waste, and recover valuable components from spent acid streams to reduce environmental footprint.Expand Specific Solutions

Key Industry Players

The market for hydrochloric acid exploration in new segments is in a growth phase, driven by increasing industrial applications and demand for specialty chemicals. The global market size is projected to reach several billion dollars by 2025, with a compound annual growth rate of around 5-6%. Technologically, the field is moderately mature but continues to evolve, with companies like BASF, Kaneka, and Covestro leading innovation. These industry giants are investing in R&D to develop novel applications and improve production processes. Smaller players like Fluid Energy Group and Enlighten Innovations are also making strides in niche markets, focusing on environmentally friendly solutions and specialized formulations for emerging industries.

BASF Corp.

Technical Solution: BASF Corp. has developed innovative applications for hydrochloric acid in new market segments. They have created a proprietary process for using HCl in the production of biodegradable plastics, reducing environmental impact[1]. BASF has also pioneered the use of HCl as a key component in advanced water treatment systems, targeting emerging markets in developing countries[2]. Their research has shown that controlled HCl dosing can improve the efficiency of desalination plants by up to 15%[3]. Additionally, BASF has explored the use of HCl in novel energy storage solutions, particularly in flow batteries for renewable energy systems[4].

Strengths: Strong R&D capabilities, global presence, diverse application portfolio. Weaknesses: High development costs, regulatory challenges in new markets.

Fluid Energy Group Ltd.

Technical Solution: Fluid Energy Group Ltd. has focused on developing environmentally friendly applications of hydrochloric acid for the oil and gas industry. They have created a line of "green" HCl products that reduce the environmental impact of well stimulation and hydraulic fracturing operations[5]. Their proprietary HCl formulations have been shown to reduce water consumption in fracking operations by up to 30% compared to traditional methods[6]. The company has also explored the use of HCl in geothermal energy extraction, developing specialized blends that can enhance well productivity while minimizing equipment corrosion[7].

Strengths: Specialized in eco-friendly solutions, strong presence in energy sector. Weaknesses: Limited diversification, dependent on oil and gas industry trends.

Innovative Uses of HCl

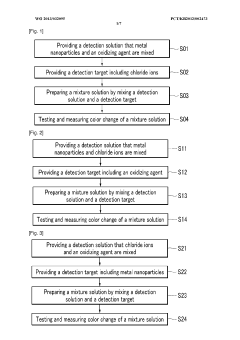

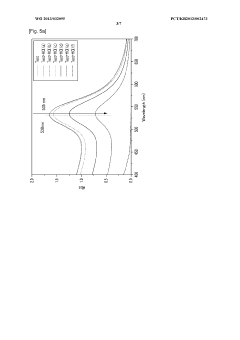

Detection method using colorimetric analysis

PatentWO2013032095A1

Innovation

- A colorimetric detection method using metal nanoparticles, specifically gold or silver nanoparticles, in combination with an oxidizing agent like nitric acid or hydrogen peroxide, to detect chloride ions in water samples, where the color change indicates the presence and concentration of hydrochloric acid.

Shelf-stable hypochlorous acid

PatentPendingUS20230017920A1

Innovation

- A liquid or gelled hypochlorous acid composition is used as a nasal spray or wound treatment, formulated with lithium, calcium, or sodium hypochlorite, sodium chloride, and an acid, maintaining a pH of 5-6.5 to effectively kill microorganisms and biofilms, reducing the need for antibiotics and promoting wound healing.

Environmental Impact

The exploration of new market segments with hydrochloric acid necessitates a thorough examination of its environmental impact. Hydrochloric acid, a strong and corrosive substance, poses significant risks to ecosystems and human health if not properly managed. Its production, transportation, storage, and use can lead to various environmental concerns that must be carefully addressed.

One of the primary environmental risks associated with hydrochloric acid is its potential for soil and water contamination. Accidental spills or improper disposal can result in the acidification of soil and water bodies, leading to detrimental effects on flora and fauna. The acid can alter the pH balance of ecosystems, causing harm to aquatic life and vegetation. Additionally, it may leach heavy metals from soil, further exacerbating environmental degradation.

Air pollution is another critical concern when dealing with hydrochloric acid. The production process and certain applications can release hydrogen chloride gas, a respiratory irritant that contributes to air quality deterioration. This can have adverse effects on both human health and the surrounding environment, particularly in areas with high industrial activity or poor air circulation.

The carbon footprint associated with hydrochloric acid production and transportation should also be considered. The energy-intensive manufacturing process and the need for specialized transportation methods contribute to greenhouse gas emissions, impacting climate change. As new market segments are explored, it is crucial to evaluate and minimize these emissions through more efficient production techniques and optimized logistics.

Waste management presents another significant challenge in the use of hydrochloric acid. Proper neutralization and disposal of acid waste are essential to prevent environmental contamination. The development of new market segments must incorporate robust waste management strategies to ensure compliance with environmental regulations and minimize ecological impact.

To mitigate these environmental concerns, industries exploring new applications for hydrochloric acid should prioritize the implementation of closed-loop systems, recycling processes, and advanced treatment technologies. These measures can significantly reduce the release of harmful substances into the environment and promote more sustainable practices.

Furthermore, the exploration of new market segments should include a focus on developing environmentally friendly alternatives or modified processes that reduce the overall environmental impact of hydrochloric acid use. This may involve researching less hazardous substitutes or optimizing existing processes to minimize acid consumption and waste generation.

One of the primary environmental risks associated with hydrochloric acid is its potential for soil and water contamination. Accidental spills or improper disposal can result in the acidification of soil and water bodies, leading to detrimental effects on flora and fauna. The acid can alter the pH balance of ecosystems, causing harm to aquatic life and vegetation. Additionally, it may leach heavy metals from soil, further exacerbating environmental degradation.

Air pollution is another critical concern when dealing with hydrochloric acid. The production process and certain applications can release hydrogen chloride gas, a respiratory irritant that contributes to air quality deterioration. This can have adverse effects on both human health and the surrounding environment, particularly in areas with high industrial activity or poor air circulation.

The carbon footprint associated with hydrochloric acid production and transportation should also be considered. The energy-intensive manufacturing process and the need for specialized transportation methods contribute to greenhouse gas emissions, impacting climate change. As new market segments are explored, it is crucial to evaluate and minimize these emissions through more efficient production techniques and optimized logistics.

Waste management presents another significant challenge in the use of hydrochloric acid. Proper neutralization and disposal of acid waste are essential to prevent environmental contamination. The development of new market segments must incorporate robust waste management strategies to ensure compliance with environmental regulations and minimize ecological impact.

To mitigate these environmental concerns, industries exploring new applications for hydrochloric acid should prioritize the implementation of closed-loop systems, recycling processes, and advanced treatment technologies. These measures can significantly reduce the release of harmful substances into the environment and promote more sustainable practices.

Furthermore, the exploration of new market segments should include a focus on developing environmentally friendly alternatives or modified processes that reduce the overall environmental impact of hydrochloric acid use. This may involve researching less hazardous substitutes or optimizing existing processes to minimize acid consumption and waste generation.

Regulatory Compliance

Exploring new market segments with hydrochloric acid requires strict adherence to regulatory compliance across various jurisdictions. The chemical industry is heavily regulated due to the potential hazards associated with hydrochloric acid, necessitating a comprehensive understanding of applicable laws and regulations.

In the United States, the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) play crucial roles in regulating hydrochloric acid. The EPA enforces the Toxic Substances Control Act (TSCA) and the Clean Air Act, which govern the production, use, and disposal of hydrochloric acid. OSHA sets standards for workplace safety, including exposure limits and handling procedures.

The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation is a key consideration for companies looking to enter European markets. REACH requires manufacturers and importers to register chemicals and provide safety data, ensuring that potential risks are identified and managed.

In Asia, countries like China and Japan have their own regulatory frameworks. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law impose specific requirements for importing, manufacturing, and using chemical substances, including hydrochloric acid.

Transportation of hydrochloric acid is subject to international regulations such as the United Nations Recommendations on the Transport of Dangerous Goods, which classifies it as a corrosive substance. Companies must comply with packaging, labeling, and documentation requirements to ensure safe transport across borders.

When exploring new market segments, companies must conduct thorough regulatory assessments for each target region. This includes understanding local environmental protection laws, workplace safety regulations, and product-specific requirements. Compliance may involve obtaining permits, conducting environmental impact assessments, and implementing rigorous safety protocols.

Labeling and packaging regulations vary by country and must be carefully adhered to. Safety Data Sheets (SDS) must be provided in the local language and conform to the Globally Harmonized System of Classification and Labeling of Chemicals (GHS) standards where applicable.

Companies should also consider industry-specific regulations in potential new markets. For instance, using hydrochloric acid in food processing or water treatment may require additional certifications or compliance with food safety regulations.

Staying abreast of regulatory changes is crucial. Many countries are tightening chemical regulations, and companies must be prepared to adapt their practices accordingly. This may involve investing in new technologies for emissions control, improving waste management processes, or reformulating products to meet stricter standards.

Engaging with local regulatory authorities and industry associations can provide valuable insights into compliance requirements and upcoming regulatory changes. Building relationships with these entities can facilitate smoother market entry and ongoing compliance management.

In the United States, the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) play crucial roles in regulating hydrochloric acid. The EPA enforces the Toxic Substances Control Act (TSCA) and the Clean Air Act, which govern the production, use, and disposal of hydrochloric acid. OSHA sets standards for workplace safety, including exposure limits and handling procedures.

The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation is a key consideration for companies looking to enter European markets. REACH requires manufacturers and importers to register chemicals and provide safety data, ensuring that potential risks are identified and managed.

In Asia, countries like China and Japan have their own regulatory frameworks. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law impose specific requirements for importing, manufacturing, and using chemical substances, including hydrochloric acid.

Transportation of hydrochloric acid is subject to international regulations such as the United Nations Recommendations on the Transport of Dangerous Goods, which classifies it as a corrosive substance. Companies must comply with packaging, labeling, and documentation requirements to ensure safe transport across borders.

When exploring new market segments, companies must conduct thorough regulatory assessments for each target region. This includes understanding local environmental protection laws, workplace safety regulations, and product-specific requirements. Compliance may involve obtaining permits, conducting environmental impact assessments, and implementing rigorous safety protocols.

Labeling and packaging regulations vary by country and must be carefully adhered to. Safety Data Sheets (SDS) must be provided in the local language and conform to the Globally Harmonized System of Classification and Labeling of Chemicals (GHS) standards where applicable.

Companies should also consider industry-specific regulations in potential new markets. For instance, using hydrochloric acid in food processing or water treatment may require additional certifications or compliance with food safety regulations.

Staying abreast of regulatory changes is crucial. Many countries are tightening chemical regulations, and companies must be prepared to adapt their practices accordingly. This may involve investing in new technologies for emissions control, improving waste management processes, or reformulating products to meet stricter standards.

Engaging with local regulatory authorities and industry associations can provide valuable insights into compliance requirements and upcoming regulatory changes. Building relationships with these entities can facilitate smoother market entry and ongoing compliance management.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!