How to Integrate Hydrofluoric Acid into Solar Panel Manufacturing

AUG 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HF Integration Background and Objectives

Hydrofluoric acid (HF) has been a critical component in semiconductor manufacturing for decades, serving as a primary etching agent for silicon dioxide. As the solar photovoltaic industry has evolved, HF has increasingly found applications in solar panel manufacturing processes, particularly in texturing silicon wafers to improve light absorption efficiency. The integration of HF into solar manufacturing represents a significant technical challenge due to its highly corrosive nature and severe health hazards, requiring specialized handling protocols and equipment.

The historical development of HF usage in solar manufacturing can be traced back to the early 2000s when the industry began adopting wet chemical processes from the semiconductor industry. Initially, HF was primarily used in combination with nitric acid for saw damage removal and texturing of monocrystalline silicon wafers. As the industry progressed, more sophisticated applications emerged, including the development of selective emitter structures and advanced cleaning processes that enhance cell efficiency.

Current technological trends indicate a growing emphasis on reducing HF consumption while maintaining or improving process effectiveness. This is driven by both environmental concerns and worker safety considerations. Innovations in dilute HF solutions, recovery systems, and alternative chemistries that can partially replace HF are gaining traction across the industry. Additionally, there is significant research into closed-loop systems that minimize waste and emissions.

The primary objective of integrating HF into solar panel manufacturing is to optimize the surface properties of silicon wafers to maximize light absorption and electrical performance. Specifically, HF-based processes aim to create a textured surface with pyramidal structures that trap incoming light, reducing reflection and increasing the probability of photon absorption. Furthermore, HF cleaning steps are essential for removing oxides and contaminants that would otherwise reduce cell efficiency.

Secondary objectives include developing cost-effective implementation strategies that balance performance benefits against the additional expenses of safety equipment, waste treatment, and specialized training. As the solar industry continues to focus on reducing the levelized cost of electricity (LCOE), any HF integration must demonstrate clear economic advantages through improved cell efficiency or reduced material consumption.

Looking forward, the integration of HF in solar manufacturing faces evolving regulatory challenges as environmental standards become more stringent globally. This necessitates research into process optimization that can maintain performance while reducing chemical usage and environmental impact. The development of safer handling protocols and equipment designs will be crucial for sustainable implementation across diverse manufacturing environments.

The historical development of HF usage in solar manufacturing can be traced back to the early 2000s when the industry began adopting wet chemical processes from the semiconductor industry. Initially, HF was primarily used in combination with nitric acid for saw damage removal and texturing of monocrystalline silicon wafers. As the industry progressed, more sophisticated applications emerged, including the development of selective emitter structures and advanced cleaning processes that enhance cell efficiency.

Current technological trends indicate a growing emphasis on reducing HF consumption while maintaining or improving process effectiveness. This is driven by both environmental concerns and worker safety considerations. Innovations in dilute HF solutions, recovery systems, and alternative chemistries that can partially replace HF are gaining traction across the industry. Additionally, there is significant research into closed-loop systems that minimize waste and emissions.

The primary objective of integrating HF into solar panel manufacturing is to optimize the surface properties of silicon wafers to maximize light absorption and electrical performance. Specifically, HF-based processes aim to create a textured surface with pyramidal structures that trap incoming light, reducing reflection and increasing the probability of photon absorption. Furthermore, HF cleaning steps are essential for removing oxides and contaminants that would otherwise reduce cell efficiency.

Secondary objectives include developing cost-effective implementation strategies that balance performance benefits against the additional expenses of safety equipment, waste treatment, and specialized training. As the solar industry continues to focus on reducing the levelized cost of electricity (LCOE), any HF integration must demonstrate clear economic advantages through improved cell efficiency or reduced material consumption.

Looking forward, the integration of HF in solar manufacturing faces evolving regulatory challenges as environmental standards become more stringent globally. This necessitates research into process optimization that can maintain performance while reducing chemical usage and environmental impact. The development of safer handling protocols and equipment designs will be crucial for sustainable implementation across diverse manufacturing environments.

Solar Panel Market Demand Analysis

The global solar panel market has experienced remarkable growth over the past decade, with a compound annual growth rate exceeding 20% between 2010 and 2022. This surge is primarily driven by declining manufacturing costs, improved efficiency, and supportive government policies worldwide. The market value reached approximately $180 billion in 2022, with projections indicating continued expansion to potentially reach $300 billion by 2030.

Demand for solar panels is segmented across residential, commercial, and utility-scale applications. Utility-scale installations represent the largest market segment, accounting for roughly 60% of total installations globally. However, residential installations are growing at the fastest rate due to increasing energy costs and consumer awareness of renewable energy benefits.

Geographically, China dominates both production and consumption, manufacturing over 70% of global solar panels while also being the largest market for installations. Other significant markets include the United States, Europe (particularly Germany and Spain), Japan, and India. Emerging markets in Southeast Asia, Latin America, and Africa are showing accelerated adoption rates as solar achieves grid parity in more regions.

The integration of hydrofluoric acid (HF) in solar panel manufacturing directly impacts market dynamics through its role in texturing silicon wafers and cleaning processes. Manufacturers capable of implementing safer and more efficient HF handling processes gain competitive advantages through reduced production costs and improved panel efficiency. Market research indicates that advanced texturing techniques using controlled HF processes can improve cell efficiency by 0.5-1.5%, translating to significant value in the highly competitive solar market.

Consumer and regulatory trends are increasingly favoring environmentally responsible manufacturing processes. Solar panels produced with reduced chemical waste and lower environmental impact command premium positioning in developed markets. This trend is particularly evident in Europe, where environmental regulations are stringent and consumers demonstrate willingness to pay premium prices for sustainably manufactured products.

Supply chain considerations are becoming increasingly critical as the industry expands. The availability and cost of high-purity hydrofluoric acid, along with associated safety equipment and waste treatment technologies, represent significant factors in manufacturing site selection and production economics. Regions with established chemical manufacturing infrastructure and favorable regulatory environments for HF handling maintain competitive advantages in attracting solar manufacturing investments.

Future market growth will be influenced by technological innovations that improve efficiency while reducing environmental impact. Solar panels manufactured with advanced HF-based texturing processes that minimize chemical usage while maximizing light absorption properties are positioned to capture premium market segments, particularly in applications where space efficiency is paramount.

Demand for solar panels is segmented across residential, commercial, and utility-scale applications. Utility-scale installations represent the largest market segment, accounting for roughly 60% of total installations globally. However, residential installations are growing at the fastest rate due to increasing energy costs and consumer awareness of renewable energy benefits.

Geographically, China dominates both production and consumption, manufacturing over 70% of global solar panels while also being the largest market for installations. Other significant markets include the United States, Europe (particularly Germany and Spain), Japan, and India. Emerging markets in Southeast Asia, Latin America, and Africa are showing accelerated adoption rates as solar achieves grid parity in more regions.

The integration of hydrofluoric acid (HF) in solar panel manufacturing directly impacts market dynamics through its role in texturing silicon wafers and cleaning processes. Manufacturers capable of implementing safer and more efficient HF handling processes gain competitive advantages through reduced production costs and improved panel efficiency. Market research indicates that advanced texturing techniques using controlled HF processes can improve cell efficiency by 0.5-1.5%, translating to significant value in the highly competitive solar market.

Consumer and regulatory trends are increasingly favoring environmentally responsible manufacturing processes. Solar panels produced with reduced chemical waste and lower environmental impact command premium positioning in developed markets. This trend is particularly evident in Europe, where environmental regulations are stringent and consumers demonstrate willingness to pay premium prices for sustainably manufactured products.

Supply chain considerations are becoming increasingly critical as the industry expands. The availability and cost of high-purity hydrofluoric acid, along with associated safety equipment and waste treatment technologies, represent significant factors in manufacturing site selection and production economics. Regions with established chemical manufacturing infrastructure and favorable regulatory environments for HF handling maintain competitive advantages in attracting solar manufacturing investments.

Future market growth will be influenced by technological innovations that improve efficiency while reducing environmental impact. Solar panels manufactured with advanced HF-based texturing processes that minimize chemical usage while maximizing light absorption properties are positioned to capture premium market segments, particularly in applications where space efficiency is paramount.

Current HF Usage Status and Challenges

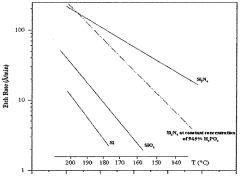

Hydrofluoric acid (HF) is currently a critical component in multiple stages of solar panel manufacturing, particularly in the texturing and cleaning processes of crystalline silicon wafers. The industry standard involves using HF in combination with nitric acid (HNO3) to create an acidic etching solution that effectively removes saw damage and creates a textured surface on silicon wafers, enhancing light absorption capabilities. This wet chemical etching process typically utilizes HF concentrations between 2-10% depending on the specific manufacturing requirements and desired surface properties.

Global solar manufacturing facilities collectively consume approximately 15,000-20,000 metric tons of HF annually, with consumption rates growing at 10-15% per year in line with solar industry expansion. Chinese manufacturers account for roughly 70% of this usage, followed by Southeast Asian facilities at 15%, and the remainder distributed across Europe, North America, and other regions.

Despite its effectiveness, HF integration presents significant challenges across technical, safety, and environmental dimensions. The highly corrosive and toxic nature of HF requires specialized handling protocols and equipment. Exposure risks necessitate comprehensive safety systems including specialized ventilation, neutralization stations, and personal protective equipment. Manufacturing facilities must maintain strict compliance with increasingly stringent regulations such as the EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and various national environmental protection standards.

Technical challenges include maintaining precise concentration control during etching processes, as even minor variations can significantly impact surface texturing quality and subsequent solar cell efficiency. The etching rate variability between different silicon wafer batches requires continuous process monitoring and adjustment, complicating automation efforts. Additionally, HF waste management represents a substantial operational burden, requiring specialized neutralization processes before disposal.

Environmental concerns have intensified as the solar industry scales. The industry generates approximately 7-10 million liters of HF-containing wastewater annually, requiring extensive treatment. Regulatory pressure is mounting globally, with several jurisdictions implementing stricter discharge limits and mandating advanced treatment technologies. The European Solar Manufacturing Council has established a roadmap to reduce HF usage by 50% by 2030, reflecting the industry's recognition of these challenges.

Supply chain vulnerabilities represent another significant challenge. HF production is concentrated among a limited number of chemical manufacturers, creating potential bottlenecks during supply disruptions. Recent geopolitical tensions and pandemic-related logistics issues have highlighted these vulnerabilities, with some manufacturers experiencing production delays due to HF availability constraints. Price volatility has also impacted manufacturing economics, with HF costs fluctuating by 15-30% in recent years.

Global solar manufacturing facilities collectively consume approximately 15,000-20,000 metric tons of HF annually, with consumption rates growing at 10-15% per year in line with solar industry expansion. Chinese manufacturers account for roughly 70% of this usage, followed by Southeast Asian facilities at 15%, and the remainder distributed across Europe, North America, and other regions.

Despite its effectiveness, HF integration presents significant challenges across technical, safety, and environmental dimensions. The highly corrosive and toxic nature of HF requires specialized handling protocols and equipment. Exposure risks necessitate comprehensive safety systems including specialized ventilation, neutralization stations, and personal protective equipment. Manufacturing facilities must maintain strict compliance with increasingly stringent regulations such as the EU's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and various national environmental protection standards.

Technical challenges include maintaining precise concentration control during etching processes, as even minor variations can significantly impact surface texturing quality and subsequent solar cell efficiency. The etching rate variability between different silicon wafer batches requires continuous process monitoring and adjustment, complicating automation efforts. Additionally, HF waste management represents a substantial operational burden, requiring specialized neutralization processes before disposal.

Environmental concerns have intensified as the solar industry scales. The industry generates approximately 7-10 million liters of HF-containing wastewater annually, requiring extensive treatment. Regulatory pressure is mounting globally, with several jurisdictions implementing stricter discharge limits and mandating advanced treatment technologies. The European Solar Manufacturing Council has established a roadmap to reduce HF usage by 50% by 2030, reflecting the industry's recognition of these challenges.

Supply chain vulnerabilities represent another significant challenge. HF production is concentrated among a limited number of chemical manufacturers, creating potential bottlenecks during supply disruptions. Recent geopolitical tensions and pandemic-related logistics issues have highlighted these vulnerabilities, with some manufacturers experiencing production delays due to HF availability constraints. Price volatility has also impacted manufacturing economics, with HF costs fluctuating by 15-30% in recent years.

Current HF Integration Methods and Protocols

01 Etching applications of hydrofluoric acid

Hydrofluoric acid is widely used as an etching agent in semiconductor manufacturing and glass processing. It effectively removes silicon dioxide layers and can be formulated with buffering agents to control etching rates. Various compositions have been developed to optimize etching performance while minimizing damage to underlying materials. These formulations often include additives to improve uniformity and selectivity of the etching process.- Etching and cleaning applications in semiconductor industry: Hydrofluoric acid is widely used in the semiconductor manufacturing process for etching silicon dioxide and cleaning silicon wafers. It effectively removes oxide layers, contaminants, and residues from semiconductor surfaces. Various formulations and concentrations of hydrofluoric acid are used depending on the specific requirements of the etching or cleaning process, often in combination with other chemicals to enhance performance and control the etching rate.

- Production and purification methods of hydrofluoric acid: Various methods are employed for the production and purification of hydrofluoric acid. These include processes for manufacturing high-purity hydrofluoric acid from fluoride-containing raw materials, purification techniques to remove impurities, and recycling methods to recover hydrofluoric acid from waste streams. Advanced distillation, filtration, and chemical treatment processes are used to achieve the desired purity levels for different industrial applications.

- Safety measures and handling of hydrofluoric acid: Due to its highly corrosive and toxic nature, specialized safety measures are required for handling hydrofluoric acid. This includes the development of containment systems, neutralization methods, protective equipment, and emergency response protocols. Various technologies have been developed to detect leaks, neutralize spills, and treat exposure to minimize the risks associated with hydrofluoric acid in industrial settings.

- Hydrofluoric acid in metal treatment and surface modification: Hydrofluoric acid is used in various metal treatment processes including pickling, cleaning, and surface modification of metals like aluminum, titanium, and stainless steel. It effectively removes oxide layers and contaminants from metal surfaces, preparing them for subsequent processes such as coating, plating, or welding. Controlled application of hydrofluoric acid can create specific surface textures and properties on metal components.

- Hydrofluoric acid in chemical synthesis and catalysis: Hydrofluoric acid serves as an important reagent and catalyst in various chemical synthesis processes, particularly in the production of fluorine-containing compounds. It is used in alkylation processes in petroleum refining, as a catalyst in organic synthesis reactions, and in the production of fluorocarbons and other fluorinated materials. Different concentrations and formulations of hydrofluoric acid are employed depending on the specific chemical reaction requirements.

02 Production and purification methods for hydrofluoric acid

Various methods have been developed for the production and purification of hydrofluoric acid. These include processes for manufacturing high-purity hydrofluoric acid from fluoride-containing raw materials, distillation techniques to remove impurities, and specialized equipment designed to handle the corrosive nature of the acid. Purification methods often focus on removing metal contaminants and other impurities that could affect the acid's performance in high-precision applications.Expand Specific Solutions03 Safety measures and handling of hydrofluoric acid

Due to its highly corrosive and toxic nature, specialized safety measures and handling procedures have been developed for hydrofluoric acid. These include neutralization methods, containment systems, and emergency treatment protocols for exposure. Innovations in this area focus on reducing risks during transportation, storage, and use of the acid, as well as developing safer formulations that maintain effectiveness while reducing hazards to workers and the environment.Expand Specific Solutions04 Recovery and recycling of hydrofluoric acid

Systems and methods for recovering and recycling hydrofluoric acid from industrial processes have been developed to reduce waste and environmental impact. These include techniques for capturing hydrofluoric acid from exhaust gases, regenerating spent acid solutions, and extracting the acid from waste streams. Such recovery processes often involve absorption, distillation, or membrane separation technologies to efficiently reclaim the acid for reuse in manufacturing processes.Expand Specific Solutions05 Alternative formulations and substitutes for hydrofluoric acid

Research has focused on developing alternative formulations and substitutes for hydrofluoric acid to address safety and environmental concerns. These include buffered oxide etchants, fluoride-free etching compositions, and less hazardous acid mixtures that can perform similar functions. Some formulations incorporate additives that reduce volatility or toxicity while maintaining the desired chemical reactivity for specific industrial applications.Expand Specific Solutions

Key Industry Players and Supply Chain

The integration of hydrofluoric acid into solar panel manufacturing is currently in a mature growth phase, with the global market estimated at $1.2-1.5 billion annually. The competitive landscape features established chemical manufacturers like Merck Patent GmbH and BASF Corp. providing specialized etching solutions, while solar industry leaders including Trina Solar, JinkoSolar, and Yingli Energy drive implementation innovations. Research institutions such as Fraunhofer-Gesellschaft and Forschungszentrum Jülich are advancing safer handling protocols and efficiency improvements. The technology has reached commercial maturity with standardized processes, though ongoing R&D by companies like SUMCO Corp. and Wonik IPS focuses on reducing acid consumption and environmental impact while maintaining high-efficiency cell production.

Zhejiang Jinko Solar Co. Ltd.

Technical Solution: Jinko Solar has developed an advanced hydrofluoric acid (HF) texturing process for monocrystalline silicon wafers that significantly improves light absorption. Their approach uses a controlled HF-nitric acid mixture with precise temperature regulation (20-25°C) and timing (5-8 minutes) to create uniform pyramid structures on the silicon surface. This texturization process increases light trapping by creating optimal surface roughness of 1-3μm, reducing reflection from 35% to below 10%. Jinko has also implemented a closed-loop acid recycling system that recovers up to 85% of HF for reuse, addressing environmental concerns. Their manufacturing line incorporates advanced automation with real-time monitoring of acid concentration, temperature, and reaction progress, enabling precise control of the etching process while minimizing worker exposure to hazardous chemicals.

Strengths: Superior light absorption efficiency through optimized texturing parameters; significant reduction in manufacturing costs through acid recycling; enhanced worker safety through automation. Weaknesses: Still requires careful handling of hazardous HF; process is sensitive to temperature fluctuations; requires specialized equipment for acid recycling and neutralization.

Mitsubishi Electric Corp.

Technical Solution: Mitsubishi Electric has developed an advanced HF-based silicon surface conditioning technology for their high-efficiency heterojunction solar cells. Their process utilizes a precisely controlled HF-ozone sequence that creates an atomically clean silicon surface essential for high-quality amorphous silicon deposition. The technique employs diluted HF (1-2%) in combination with ozonated water (>5ppm O₃) in alternating cycles, achieving oxygen termination with less than 0.3nm of native oxide regrowth. This surface preparation is critical for their heterojunction cells, which require pristine interfaces between crystalline and amorphous silicon layers. Mitsubishi has also implemented a novel HF vapor etching system for selective removal of tunnel oxide layers in their TOPCon (Tunnel Oxide Passivated Contact) cell architecture, enabling precise control of oxide thickness down to 1.5±0.2nm. Their manufacturing system incorporates advanced robotics for wafer handling during HF processing, along with sophisticated exhaust systems that capture over 99.9% of HF emissions, meeting Japan's stringent environmental regulations while maintaining worker safety.

Strengths: Exceptional surface cleanliness enabling high-efficiency heterojunction cells; precise control of oxide layers for advanced cell architectures; industry-leading safety and environmental protection systems. Weaknesses: Higher processing costs compared to conventional techniques; requires specialized equipment not widely available; process sensitivity to environmental conditions requires controlled manufacturing environment.

Critical Patents and Innovations in HF Processing

Combined etching and doping media for silicon dioxide layers and subjacent silicon

PatentWO2007006381A1

Innovation

- A method using a phosphoric acid-based etching medium that selectively etches silicon dioxide layers and simultaneously dopes underlying silicon, eliminating the need for hydrofluoric acid and reducing process complexity by integrating etching and doping into a single step, utilizing temperatures between 350°C to 1050°C with phosphoric acid or its salts as both etching and doping components.

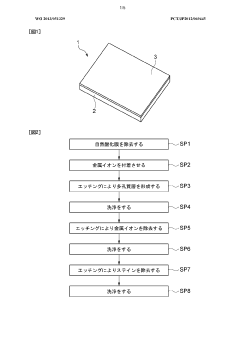

Method for manufacturing solar cell

PatentWO2013051329A1

Innovation

- A method involving electroless plating to attach metal ions uniformly to the silicon substrate surface, followed by a catalytic reaction with a hydrofluoric acid and hydrogen peroxide solution to control pore size and density, ensuring a consistent texture formation.

Environmental Impact Assessment

The integration of hydrofluoric acid (HF) in solar panel manufacturing presents significant environmental challenges that require comprehensive assessment and mitigation strategies. HF is classified as a highly hazardous substance with potential for severe environmental contamination if not properly managed. When released into air, HF forms acidic compounds that contribute to acid rain and atmospheric pollution, affecting ecosystems far beyond the manufacturing facility. Water contamination represents another critical concern, as even small quantities of HF can dramatically alter pH levels in aquatic environments, proving lethal to fish and other aquatic organisms.

Soil contamination from improper disposal or accidental spills can render agricultural land unusable for extended periods, with HF potentially leaching into groundwater systems. The manufacturing process itself generates hazardous waste streams containing HF residues that require specialized treatment and disposal protocols to prevent environmental release. Current industry data indicates that a typical solar manufacturing facility utilizing HF processes may generate between 3-7 tons of hazardous waste annually, necessitating substantial investment in waste management infrastructure.

Carbon footprint considerations must also be evaluated, as the additional safety systems and specialized equipment required for HF handling increase the overall energy consumption of manufacturing operations. Studies suggest that HF-based processes may increase facility energy requirements by 12-18% compared to alternative methods, translating to higher indirect emissions throughout the product lifecycle.

Regulatory compliance frameworks vary significantly across regions, with the European Union's REACH regulations and the United States EPA guidelines imposing strict controls on HF usage and disposal. Manufacturers must navigate increasingly stringent environmental protection standards that often require extensive monitoring, reporting, and remediation capabilities. The financial implications of environmental compliance include not only direct costs for treatment systems but also potential liabilities for remediation in case of accidental releases.

Best practices for environmental impact mitigation include closed-loop processing systems that capture and recycle HF, advanced air scrubbing technologies that can achieve 99.9% removal efficiency, and wastewater treatment systems specifically designed for fluoride removal. Leading manufacturers have demonstrated that implementation of these technologies can reduce environmental releases by over 95% compared to conventional approaches, though requiring capital investments of $2-5 million per production line.

Soil contamination from improper disposal or accidental spills can render agricultural land unusable for extended periods, with HF potentially leaching into groundwater systems. The manufacturing process itself generates hazardous waste streams containing HF residues that require specialized treatment and disposal protocols to prevent environmental release. Current industry data indicates that a typical solar manufacturing facility utilizing HF processes may generate between 3-7 tons of hazardous waste annually, necessitating substantial investment in waste management infrastructure.

Carbon footprint considerations must also be evaluated, as the additional safety systems and specialized equipment required for HF handling increase the overall energy consumption of manufacturing operations. Studies suggest that HF-based processes may increase facility energy requirements by 12-18% compared to alternative methods, translating to higher indirect emissions throughout the product lifecycle.

Regulatory compliance frameworks vary significantly across regions, with the European Union's REACH regulations and the United States EPA guidelines imposing strict controls on HF usage and disposal. Manufacturers must navigate increasingly stringent environmental protection standards that often require extensive monitoring, reporting, and remediation capabilities. The financial implications of environmental compliance include not only direct costs for treatment systems but also potential liabilities for remediation in case of accidental releases.

Best practices for environmental impact mitigation include closed-loop processing systems that capture and recycle HF, advanced air scrubbing technologies that can achieve 99.9% removal efficiency, and wastewater treatment systems specifically designed for fluoride removal. Leading manufacturers have demonstrated that implementation of these technologies can reduce environmental releases by over 95% compared to conventional approaches, though requiring capital investments of $2-5 million per production line.

Worker Safety and Regulatory Compliance

The integration of hydrofluoric acid (HF) into solar panel manufacturing processes presents significant worker safety challenges that require comprehensive regulatory compliance measures. OSHA and EPA regulations mandate strict protocols for HF handling, including detailed exposure limits (PEL of 3 ppm over an 8-hour period) and comprehensive emergency response procedures. Companies must implement these regulations through documented safety management systems that include regular audits and continuous improvement processes.

Personal protective equipment requirements for HF handling are exceptionally stringent, necessitating chemical-resistant full-body protection, specialized gloves (typically neoprene or butyl rubber), face shields with respiratory protection, and emergency eyewash and shower stations within 10 seconds of access from any handling point. These measures must be supported by rigorous training programs covering HF-specific hazards, proper handling techniques, emergency response procedures, and decontamination protocols.

Engineering controls represent the primary defense against HF exposure, with closed-system processing being the gold standard in modern manufacturing facilities. Automated handling systems minimize direct worker contact, while sophisticated ventilation systems with scrubbers effectively capture and neutralize HF vapors. Real-time monitoring systems with multiple detection points throughout the facility provide early warning of potential leaks, with automated shutdown capabilities integrated into critical systems.

Waste management and environmental compliance present additional challenges, as HF-containing waste is classified as hazardous under RCRA regulations. Manufacturing facilities must implement neutralization processes using calcium compounds before disposal, maintain detailed waste tracking systems, and secure appropriate permits for storage and transportation. Environmental monitoring programs must regularly test air emissions and wastewater discharge to ensure compliance with Clean Air Act and Clean Water Act provisions.

Emergency response planning specifically for HF incidents requires specialized protocols beyond standard chemical safety measures. This includes dedicated HF spill response teams with specialized training, calcium gluconate gel stations strategically positioned throughout the facility, coordination with local emergency services familiar with HF hazards, and regular drills simulating various exposure scenarios. Medical surveillance programs must monitor workers for potential chronic exposure effects, with baseline and periodic testing for those regularly working with or near HF processes.

The financial implications of these safety measures are substantial, with comprehensive HF safety systems typically adding 15-20% to operational costs in solar manufacturing. However, these investments must be viewed against the potential liability costs of incidents, which can exceed millions of dollars in medical expenses, regulatory fines, litigation, and production downtime.

Personal protective equipment requirements for HF handling are exceptionally stringent, necessitating chemical-resistant full-body protection, specialized gloves (typically neoprene or butyl rubber), face shields with respiratory protection, and emergency eyewash and shower stations within 10 seconds of access from any handling point. These measures must be supported by rigorous training programs covering HF-specific hazards, proper handling techniques, emergency response procedures, and decontamination protocols.

Engineering controls represent the primary defense against HF exposure, with closed-system processing being the gold standard in modern manufacturing facilities. Automated handling systems minimize direct worker contact, while sophisticated ventilation systems with scrubbers effectively capture and neutralize HF vapors. Real-time monitoring systems with multiple detection points throughout the facility provide early warning of potential leaks, with automated shutdown capabilities integrated into critical systems.

Waste management and environmental compliance present additional challenges, as HF-containing waste is classified as hazardous under RCRA regulations. Manufacturing facilities must implement neutralization processes using calcium compounds before disposal, maintain detailed waste tracking systems, and secure appropriate permits for storage and transportation. Environmental monitoring programs must regularly test air emissions and wastewater discharge to ensure compliance with Clean Air Act and Clean Water Act provisions.

Emergency response planning specifically for HF incidents requires specialized protocols beyond standard chemical safety measures. This includes dedicated HF spill response teams with specialized training, calcium gluconate gel stations strategically positioned throughout the facility, coordination with local emergency services familiar with HF hazards, and regular drills simulating various exposure scenarios. Medical surveillance programs must monitor workers for potential chronic exposure effects, with baseline and periodic testing for those regularly working with or near HF processes.

The financial implications of these safety measures are substantial, with comprehensive HF safety systems typically adding 15-20% to operational costs in solar manufacturing. However, these investments must be viewed against the potential liability costs of incidents, which can exceed millions of dollars in medical expenses, regulatory fines, litigation, and production downtime.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!