Hydrofluoric Acid vs Hydrogen Chloride: Corrosion Potential

AUG 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HF and HCl Corrosion Background and Objectives

Hydrofluoric acid (HF) and hydrogen chloride (HCl) have been fundamental chemicals in industrial applications since the early 19th century. HF was first isolated in 1771 by Carl Wilhelm Scheele, while HCl's industrial production began in the Leblanc process around 1810. The evolution of these acids has been closely tied to advancements in materials science, particularly in understanding and mitigating their corrosive effects.

The corrosion mechanisms of these acids represent distinct challenges in industrial settings. HF, despite being a weak acid in aqueous solution, demonstrates exceptional corrosivity due to its unique ability to dissolve silica and form complex fluorides. This property has made it invaluable in semiconductor manufacturing and glass etching, but simultaneously presents severe material compatibility challenges.

HCl, conversely, exhibits strong acid properties in solution but follows more predictable corrosion patterns primarily through hydrogen evolution and direct oxidation mechanisms. Its widespread use in steel pickling, chemical processing, and oil well acidizing has driven extensive research into corrosion-resistant materials and protective measures.

Recent technological trends show increasing focus on developing advanced materials and coatings capable of withstanding these aggressive environments. The past decade has witnessed significant innovations in fluoropolymers, specialized alloys, and composite materials specifically engineered to resist HF and HCl attack under various operating conditions.

The primary technical objective of this investigation is to establish a comprehensive comparative analysis of the corrosion potential of HF versus HCl across different material systems. This includes quantifying corrosion rates, understanding degradation mechanisms, and identifying critical factors that influence material performance in these environments.

Secondary objectives include mapping temperature-concentration corrosion profiles for both acids, evaluating synergistic effects when these acids are present in mixtures or with other chemical species, and assessing the effectiveness of current corrosion mitigation strategies including inhibitors, coatings, and material selection guidelines.

The ultimate goal is to develop predictive models for material performance in HF and HCl environments that can guide engineering decisions in industries ranging from chemical processing and semiconductor manufacturing to oil and gas production. These models will incorporate not only traditional metallurgical factors but also operational parameters such as flow conditions, temperature cycling, and concentration fluctuations that significantly impact real-world corrosion behavior.

Understanding these corrosion mechanisms has become increasingly critical as industries push toward more aggressive processing conditions, longer equipment lifespans, and stricter safety standards regarding the handling of these hazardous acids.

The corrosion mechanisms of these acids represent distinct challenges in industrial settings. HF, despite being a weak acid in aqueous solution, demonstrates exceptional corrosivity due to its unique ability to dissolve silica and form complex fluorides. This property has made it invaluable in semiconductor manufacturing and glass etching, but simultaneously presents severe material compatibility challenges.

HCl, conversely, exhibits strong acid properties in solution but follows more predictable corrosion patterns primarily through hydrogen evolution and direct oxidation mechanisms. Its widespread use in steel pickling, chemical processing, and oil well acidizing has driven extensive research into corrosion-resistant materials and protective measures.

Recent technological trends show increasing focus on developing advanced materials and coatings capable of withstanding these aggressive environments. The past decade has witnessed significant innovations in fluoropolymers, specialized alloys, and composite materials specifically engineered to resist HF and HCl attack under various operating conditions.

The primary technical objective of this investigation is to establish a comprehensive comparative analysis of the corrosion potential of HF versus HCl across different material systems. This includes quantifying corrosion rates, understanding degradation mechanisms, and identifying critical factors that influence material performance in these environments.

Secondary objectives include mapping temperature-concentration corrosion profiles for both acids, evaluating synergistic effects when these acids are present in mixtures or with other chemical species, and assessing the effectiveness of current corrosion mitigation strategies including inhibitors, coatings, and material selection guidelines.

The ultimate goal is to develop predictive models for material performance in HF and HCl environments that can guide engineering decisions in industries ranging from chemical processing and semiconductor manufacturing to oil and gas production. These models will incorporate not only traditional metallurgical factors but also operational parameters such as flow conditions, temperature cycling, and concentration fluctuations that significantly impact real-world corrosion behavior.

Understanding these corrosion mechanisms has become increasingly critical as industries push toward more aggressive processing conditions, longer equipment lifespans, and stricter safety standards regarding the handling of these hazardous acids.

Market Analysis for Acid-Resistant Materials

The global market for acid-resistant materials is experiencing significant growth, driven by increasing industrial applications requiring corrosion protection against aggressive chemicals like hydrofluoric acid (HF) and hydrogen chloride (HCl). Current market valuation stands at approximately 7.2 billion USD, with projections indicating a compound annual growth rate of 5.8% through 2028.

Chemical processing industries represent the largest market segment, accounting for 34% of total demand. This is followed by metal processing (22%), semiconductor manufacturing (18%), and pharmaceutical production (12%). The remaining market share is distributed across various industries including mining, waste management, and laboratory equipment.

Regional analysis reveals that Asia-Pacific dominates the market with 42% share, led by China, Japan, and South Korea where semiconductor and electronics manufacturing drives demand for specialized acid-resistant materials. North America follows with 28% market share, while Europe accounts for 23%. Emerging markets in Latin America and Middle East regions are showing accelerated growth rates of 7-9% annually.

Material segmentation shows fluoropolymers (particularly PTFE, PFA, and PVDF) leading the market with 38% share due to their exceptional resistance to both HF and HCl. High-performance alloys including Hastelloy, Monel, and tantalum represent 27% of the market. Advanced ceramics and glass-lined equipment account for 18%, while specialized elastomers and coatings comprise the remaining 17%.

Customer demand is increasingly focused on materials that can withstand multiple acid environments simultaneously, as industrial processes often involve exposure to both HF and HCl. This trend is driving innovation toward hybrid and composite materials that offer broader chemical resistance profiles.

Price sensitivity varies significantly by application. High-tech industries like semiconductor manufacturing prioritize performance over cost, while traditional chemical processing operations seek optimal cost-performance balance. The average price premium for HF-resistant materials versus standard corrosion-resistant options is approximately 40-60%.

Supply chain analysis indicates moderate concentration among raw material suppliers, with 65% of specialized polymers and alloys sourced from fewer than 20 global manufacturers. This creates potential vulnerability to supply disruptions, particularly for rare elements used in high-performance alloys.

Regulatory factors are increasingly influencing market dynamics, with stricter environmental and safety standards driving demand for more durable materials that reduce replacement frequency and associated waste. Additionally, workplace safety regulations regarding acid handling are creating secondary markets for detection systems and containment solutions that complement acid-resistant materials.

Chemical processing industries represent the largest market segment, accounting for 34% of total demand. This is followed by metal processing (22%), semiconductor manufacturing (18%), and pharmaceutical production (12%). The remaining market share is distributed across various industries including mining, waste management, and laboratory equipment.

Regional analysis reveals that Asia-Pacific dominates the market with 42% share, led by China, Japan, and South Korea where semiconductor and electronics manufacturing drives demand for specialized acid-resistant materials. North America follows with 28% market share, while Europe accounts for 23%. Emerging markets in Latin America and Middle East regions are showing accelerated growth rates of 7-9% annually.

Material segmentation shows fluoropolymers (particularly PTFE, PFA, and PVDF) leading the market with 38% share due to their exceptional resistance to both HF and HCl. High-performance alloys including Hastelloy, Monel, and tantalum represent 27% of the market. Advanced ceramics and glass-lined equipment account for 18%, while specialized elastomers and coatings comprise the remaining 17%.

Customer demand is increasingly focused on materials that can withstand multiple acid environments simultaneously, as industrial processes often involve exposure to both HF and HCl. This trend is driving innovation toward hybrid and composite materials that offer broader chemical resistance profiles.

Price sensitivity varies significantly by application. High-tech industries like semiconductor manufacturing prioritize performance over cost, while traditional chemical processing operations seek optimal cost-performance balance. The average price premium for HF-resistant materials versus standard corrosion-resistant options is approximately 40-60%.

Supply chain analysis indicates moderate concentration among raw material suppliers, with 65% of specialized polymers and alloys sourced from fewer than 20 global manufacturers. This creates potential vulnerability to supply disruptions, particularly for rare elements used in high-performance alloys.

Regulatory factors are increasingly influencing market dynamics, with stricter environmental and safety standards driving demand for more durable materials that reduce replacement frequency and associated waste. Additionally, workplace safety regulations regarding acid handling are creating secondary markets for detection systems and containment solutions that complement acid-resistant materials.

Current Challenges in Acid Corrosion Prevention

The prevention of acid corrosion remains a significant challenge in various industries, particularly when dealing with highly corrosive substances like hydrofluoric acid (HF) and hydrogen chloride (HCl). These acids present unique corrosion mechanisms that conventional prevention methods struggle to address effectively.

For hydrofluoric acid, its ability to penetrate deeply into materials creates particularly complex prevention challenges. Unlike other acids that primarily attack surface layers, HF can diffuse through seemingly intact protective barriers, causing subsurface damage that remains undetected until catastrophic failure occurs. This penetrative property necessitates specialized prevention approaches beyond traditional surface treatments.

Hydrogen chloride presents different challenges, particularly in its gaseous form. When HCl gas combines with moisture, it forms hydrochloric acid that can initiate corrosion in unexpected locations far from the original source. This transport mechanism makes containment strategies particularly difficult to implement effectively in real-world industrial settings.

Temperature fluctuations significantly complicate acid corrosion prevention for both acids. Prevention systems that perform adequately at ambient temperatures often fail dramatically when exposed to process-related temperature variations. This thermal cycling can create micro-cracks in protective coatings, accelerating corrosion rates by orders of magnitude under certain conditions.

Current material selection approaches also face limitations. While specialized alloys like Hastelloy and titanium offer improved resistance, they remain susceptible to specific attack mechanisms. Hastelloy, despite its excellent general acid resistance, shows vulnerability to HF at certain concentrations. Similarly, titanium, often considered ideal for HCl environments, can experience rapid degradation when exposed to even trace amounts of HF.

Monitoring technologies represent another significant challenge area. Conventional corrosion monitoring tools often provide data too late in the corrosion process, detecting damage only after significant material loss has occurred. Real-time monitoring systems capable of detecting the early stages of acid attack remain limited in their deployment and effectiveness.

Economic constraints further complicate implementation of optimal prevention strategies. The most effective corrosion-resistant materials and monitoring systems often carry prohibitive costs, forcing many operations to implement less effective solutions. This cost-benefit calculation frequently results in compromised prevention approaches that manage rather than eliminate corrosion risks.

Regulatory compliance adds another layer of complexity, as environmental regulations increasingly restrict the use of certain effective corrosion inhibitors due to their environmental impact. This regulatory landscape forces industries to develop new prevention approaches that balance effectiveness with environmental sustainability.

For hydrofluoric acid, its ability to penetrate deeply into materials creates particularly complex prevention challenges. Unlike other acids that primarily attack surface layers, HF can diffuse through seemingly intact protective barriers, causing subsurface damage that remains undetected until catastrophic failure occurs. This penetrative property necessitates specialized prevention approaches beyond traditional surface treatments.

Hydrogen chloride presents different challenges, particularly in its gaseous form. When HCl gas combines with moisture, it forms hydrochloric acid that can initiate corrosion in unexpected locations far from the original source. This transport mechanism makes containment strategies particularly difficult to implement effectively in real-world industrial settings.

Temperature fluctuations significantly complicate acid corrosion prevention for both acids. Prevention systems that perform adequately at ambient temperatures often fail dramatically when exposed to process-related temperature variations. This thermal cycling can create micro-cracks in protective coatings, accelerating corrosion rates by orders of magnitude under certain conditions.

Current material selection approaches also face limitations. While specialized alloys like Hastelloy and titanium offer improved resistance, they remain susceptible to specific attack mechanisms. Hastelloy, despite its excellent general acid resistance, shows vulnerability to HF at certain concentrations. Similarly, titanium, often considered ideal for HCl environments, can experience rapid degradation when exposed to even trace amounts of HF.

Monitoring technologies represent another significant challenge area. Conventional corrosion monitoring tools often provide data too late in the corrosion process, detecting damage only after significant material loss has occurred. Real-time monitoring systems capable of detecting the early stages of acid attack remain limited in their deployment and effectiveness.

Economic constraints further complicate implementation of optimal prevention strategies. The most effective corrosion-resistant materials and monitoring systems often carry prohibitive costs, forcing many operations to implement less effective solutions. This cost-benefit calculation frequently results in compromised prevention approaches that manage rather than eliminate corrosion risks.

Regulatory compliance adds another layer of complexity, as environmental regulations increasingly restrict the use of certain effective corrosion inhibitors due to their environmental impact. This regulatory landscape forces industries to develop new prevention approaches that balance effectiveness with environmental sustainability.

Comparative Analysis of HF vs HCl Corrosion Mechanisms

01 Corrosion resistance materials for HF and HCl environments

Various materials have been developed to resist corrosion from hydrofluoric acid and hydrogen chloride. These include specialized alloys, coatings, and composite materials designed to withstand the aggressive nature of these acids. The materials are engineered to maintain structural integrity and prevent degradation when exposed to these corrosive substances in industrial applications, extending equipment lifespan and improving safety in chemical processing environments.- Corrosion resistant materials and coatings: Various materials and coatings have been developed to resist corrosion from hydrofluoric acid and hydrogen chloride. These include specialized alloys, fluoropolymer linings, and composite materials that provide a protective barrier against these highly corrosive acids. These materials are designed to withstand the aggressive nature of these acids, particularly in industrial applications where exposure to these chemicals is common.

- Corrosion inhibitors for acid environments: Chemical additives can be incorporated into hydrofluoric acid and hydrogen chloride solutions to reduce their corrosive potential. These corrosion inhibitors work by forming protective films on metal surfaces or by neutralizing the corrosive components of the acids. Various organic and inorganic compounds have been developed specifically to mitigate the corrosive effects of these acids in industrial processes.

- Acid-resistant equipment and process design: Specialized equipment designs and process configurations have been developed to handle hydrofluoric acid and hydrogen chloride safely. These include specially designed reactors, storage tanks, valves, and piping systems that minimize exposure to these corrosive acids. Process parameters such as temperature, pressure, and flow rates are carefully controlled to reduce corrosion potential and extend equipment life.

- Monitoring and detection of acid corrosion: Methods and systems for monitoring the corrosive effects of hydrofluoric acid and hydrogen chloride have been developed to prevent equipment failure and ensure safety. These include corrosion sensors, real-time monitoring systems, and predictive maintenance approaches that can detect early signs of corrosion damage. Regular inspection protocols and corrosion rate measurements help in assessing the integrity of equipment exposed to these acids.

- Acid neutralization and waste treatment: Techniques for neutralizing hydrofluoric acid and hydrogen chloride and treating acid waste streams have been developed to reduce their corrosive potential and environmental impact. These include chemical neutralization processes, precipitation methods, and advanced treatment technologies that convert these acids into less harmful compounds. Proper neutralization is essential for safe disposal and for protecting downstream equipment from corrosion damage.

02 Corrosion inhibitors for acid environments

Chemical additives can be incorporated into hydrofluoric acid and hydrogen chloride solutions to reduce their corrosive potential. These inhibitors work by forming protective films on metal surfaces or by neutralizing the corrosive components of the acids. Various organic and inorganic compounds have been developed as effective inhibitors, providing significant protection to equipment and infrastructure exposed to these highly corrosive acids in industrial processes.Expand Specific Solutions03 Equipment design for handling corrosive acids

Specialized equipment designs have been developed to handle hydrofluoric acid and hydrogen chloride safely. These designs incorporate features such as corrosion-resistant linings, specialized seals, and optimized flow patterns to minimize contact with vulnerable components. The equipment is engineered to prevent leaks, reduce maintenance requirements, and extend operational life when processing these highly corrosive substances in industrial applications.Expand Specific Solutions04 Monitoring and assessment of corrosion potential

Methods and systems for monitoring the corrosion potential of hydrofluoric acid and hydrogen chloride have been developed to assess risk and prevent equipment failure. These include sensors, testing protocols, and analytical techniques that can detect early signs of corrosion, measure corrosion rates, and evaluate the effectiveness of protective measures. Continuous monitoring allows for timely intervention before significant damage occurs to industrial equipment and infrastructure.Expand Specific Solutions05 Treatment and neutralization processes

Processes have been developed for treating and neutralizing hydrofluoric acid and hydrogen chloride to reduce their corrosion potential. These include chemical neutralization methods, scrubbing techniques, and waste treatment processes that convert these acids into less corrosive forms. The treatments are designed to minimize environmental impact and reduce the risk of corrosion damage to equipment and infrastructure during handling, storage, and disposal of these hazardous acids.Expand Specific Solutions

Key Industry Players in Corrosion-Resistant Solutions

The corrosion potential comparison between hydrofluoric acid and hydrogen chloride represents a mature technical field currently experiencing steady growth, with a global market valued at approximately $8.5 billion. The industry is in a consolidation phase, with established chemical manufacturers like DuPont, BASF, and Dow Global Technologies dominating through extensive intellectual property portfolios. Specialty chemical companies such as Dorf Ketal, Fluid Energy Group, and Halliburton have developed niche applications in oil and gas sectors. Asian manufacturers including AGC, DAIKIN, and Central Glass are rapidly expanding market share through cost-effective production methods. Technical maturity is high, with recent innovations focusing on environmentally safer alternatives and specialized corrosion inhibitors for extreme conditions.

Halliburton Energy Services, Inc.

Technical Solution: Halliburton has developed advanced corrosion inhibition technologies specifically addressing the comparative corrosion potential of hydrofluoric acid versus hydrogen chloride in oil and gas applications. Their proprietary StimStar™ acid system incorporates specialized inhibitor packages that mitigate the aggressive corrosive properties of both acids while maintaining their effectiveness in stimulation treatments. For hydrofluoric acid applications, they've engineered fluoride-specific inhibitors that form protective films on metal surfaces, significantly reducing corrosion rates even at elevated temperatures (up to 300°F). Their hydrogen chloride corrosion management approach utilizes proprietary organic inhibitors that adsorb onto metal surfaces, creating a protective barrier that reduces corrosion rates by up to 95% compared to uninhibited solutions.

Strengths: Highly effective in high-temperature environments where traditional inhibitors fail; formulations specifically designed for different metallurgies encountered in wellbore environments; environmentally compliant formulations meeting global regulatory standards. Weaknesses: Higher cost compared to standard inhibitor packages; some formulations require precise mixing protocols; performance can be affected by certain contaminants in field conditions.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed comprehensive corrosion management solutions addressing the distinct challenges posed by hydrofluoric acid and hydrogen chloride. Their approach integrates materials science with advanced monitoring technologies. For hydrofluoric acid applications, Honeywell's FluoroGuard™ technology employs fluoropolymer-based protective systems that resist HF's unique ability to penetrate oxide layers on metals. This system includes specialized elastomers and coatings with exceptional resistance to fluoride ion attack. For hydrogen chloride environments, their ChlorShield™ system utilizes proprietary alloys and monitoring solutions specifically designed to withstand chloride stress corrosion cracking. Honeywell's integrated approach combines material selection with real-time corrosion monitoring using their SmartCET® technology, which provides continuous electrochemical measurement of corrosion rates, allowing for predictive maintenance before critical failure occurs.

Strengths: Comprehensive solution combining materials, coatings and real-time monitoring; extensive field validation across multiple industries; integration with digital systems for predictive maintenance. Weaknesses: Higher initial implementation costs; requires specialized training for maintenance personnel; some monitoring systems require regular calibration and maintenance.

Critical Patents and Literature on Acid Corrosion Resistance

Corrosion-resistant, high-hardness alloy composition and method for producing same

PatentActiveUS20170218484A1

Innovation

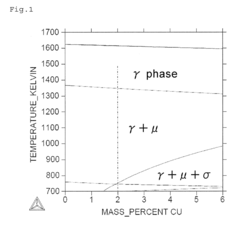

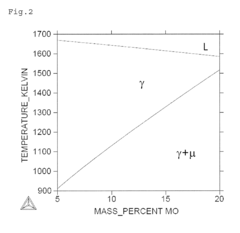

- A Ni—Co—Cr—Mo—Fe—Cu-based alloy composition with optimized chemical and heat treatment conditions, including 15.5% Cr, 7.5% Mo, 0% to 30% Co, 4.5% Fe, and 0.5% to 4.0% Cu, with γ phase crystal structure and Vickers hardness of 500 HV or more, achieved through homogenization, cold processing, and aging treatment.

Process for making axially fluorinated-phthalocyanines and their use in photovoltaic applications

PatentWO2015063692A1

Innovation

- Employing an aprotic fluoride source instead of HF or hydrofluoric acid, and using aprotic solvents to limit the presence of free protons during the reaction, thereby avoiding the production of HF or hydrofluoric acid as a by-product, resulting in a safer and more efficient process for producing axially fluorinated-phthalocyanines.

Safety Protocols and Handling Requirements

The handling of hydrofluoric acid (HF) and hydrogen chloride (HCl) requires stringent safety protocols due to their severe corrosive properties and health hazards. For HF, standard protocols mandate the use of specialized personal protective equipment (PPE), including chemical-resistant suits made of materials such as neoprene or butyl rubber, which demonstrate superior resistance to HF penetration compared to standard laboratory attire. Face shields, chemical splash goggles, and double-layered gloves are essential, with the inner glove typically made of nitrile and the outer of neoprene or butyl rubber.

Storage requirements for HF necessitate polyethylene or Teflon containers, as glass containers may deteriorate over time due to HF's ability to etch silica. Facilities must maintain dedicated, well-ventilated storage areas with secondary containment systems capable of holding at least 110% of the largest container's volume. Emergency response equipment, including calcium gluconate gel for immediate treatment of HF exposure, must be readily accessible in all handling areas.

For hydrogen chloride, particularly in its gaseous form, ventilation systems must meet specific standards, including a minimum of 6-12 air changes per hour and face velocities of 80-120 feet per minute at hood openings. PPE requirements include acid-resistant clothing, chemical goggles, and gloves made of materials such as neoprene or PVC. Unlike HF, which requires specialized medical countermeasures, standard emergency equipment such as eyewash stations and safety showers are sufficient for initial HCl exposure response.

Training protocols differ significantly between the two substances. HF handlers require specialized training that includes recognition of delayed symptoms of exposure, proper application of calcium gluconate, and specific emergency procedures. This training must be refreshed annually and documented according to OSHA standards. HCl handling training, while still comprehensive, focuses more on general acid safety protocols and respiratory protection.

Waste disposal procedures also vary considerably. HF waste requires neutralization with calcium compounds before disposal, while HCl can typically be neutralized with standard bases like sodium bicarbonate. Both neutralization processes must be conducted with extreme caution due to exothermic reactions.

Monitoring requirements include regular atmospheric testing for HCl gas using dedicated sensors with alarm thresholds set at 5 ppm (OSHA ceiling limit). For HF, both air monitoring and surface wipe testing are recommended to detect potential contamination. Medical surveillance programs for regular handlers of either acid should include baseline and periodic pulmonary function tests, with additional specific monitoring for fluoride levels in urine for HF workers.

Storage requirements for HF necessitate polyethylene or Teflon containers, as glass containers may deteriorate over time due to HF's ability to etch silica. Facilities must maintain dedicated, well-ventilated storage areas with secondary containment systems capable of holding at least 110% of the largest container's volume. Emergency response equipment, including calcium gluconate gel for immediate treatment of HF exposure, must be readily accessible in all handling areas.

For hydrogen chloride, particularly in its gaseous form, ventilation systems must meet specific standards, including a minimum of 6-12 air changes per hour and face velocities of 80-120 feet per minute at hood openings. PPE requirements include acid-resistant clothing, chemical goggles, and gloves made of materials such as neoprene or PVC. Unlike HF, which requires specialized medical countermeasures, standard emergency equipment such as eyewash stations and safety showers are sufficient for initial HCl exposure response.

Training protocols differ significantly between the two substances. HF handlers require specialized training that includes recognition of delayed symptoms of exposure, proper application of calcium gluconate, and specific emergency procedures. This training must be refreshed annually and documented according to OSHA standards. HCl handling training, while still comprehensive, focuses more on general acid safety protocols and respiratory protection.

Waste disposal procedures also vary considerably. HF waste requires neutralization with calcium compounds before disposal, while HCl can typically be neutralized with standard bases like sodium bicarbonate. Both neutralization processes must be conducted with extreme caution due to exothermic reactions.

Monitoring requirements include regular atmospheric testing for HCl gas using dedicated sensors with alarm thresholds set at 5 ppm (OSHA ceiling limit). For HF, both air monitoring and surface wipe testing are recommended to detect potential contamination. Medical surveillance programs for regular handlers of either acid should include baseline and periodic pulmonary function tests, with additional specific monitoring for fluoride levels in urine for HF workers.

Environmental Impact and Regulatory Compliance

The environmental impact of hydrofluoric acid (HF) and hydrogen chloride (HCl) extends far beyond their corrosive properties, encompassing significant ecological and health concerns that necessitate stringent regulatory oversight. Both chemicals, when released into the environment, can cause severe acidification of soil and water bodies, disrupting ecosystems and threatening biodiversity. HF presents particularly acute risks due to its ability to penetrate biological tissues rapidly, potentially causing widespread damage to plant and animal life even at relatively low concentrations.

Regulatory frameworks governing these substances vary globally but generally follow similar principles of risk management and exposure limitation. In the United States, the Environmental Protection Agency (EPA) regulates both chemicals under the Clean Air Act as Hazardous Air Pollutants and under the Resource Conservation and Recovery Act as hazardous wastes. The Occupational Safety and Health Administration (OSHA) has established Permissible Exposure Limits (PELs) of 3 ppm for HF and 5 ppm for HCl, reflecting their respective hazard profiles.

European regulations, particularly under REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), impose additional requirements for risk assessment and safe handling. The classification of both acids as "substances of very high concern" triggers enhanced monitoring and reporting obligations for industrial users. Asian markets, particularly China and Japan, have implemented increasingly stringent controls in recent years, aligning more closely with Western standards while adapting to their industrial contexts.

Compliance challenges for industries utilizing these acids are substantial and multifaceted. Facilities must implement comprehensive emission control technologies, including scrubbers and neutralization systems, to prevent atmospheric releases. Wastewater treatment protocols require specialized approaches to neutralize acidity before discharge, with HF demanding additional treatment steps to address fluoride content. Regular monitoring and documentation of emissions, exposure levels, and disposal practices constitute a significant operational burden but remain essential for regulatory compliance.

The economic implications of environmental compliance are considerable, with capital investments for control technologies often reaching millions of dollars for large facilities. However, these costs must be weighed against potential liabilities from non-compliance, including regulatory fines, remediation expenses, and reputational damage. Forward-thinking companies increasingly view robust environmental management of these acids not merely as a compliance obligation but as a competitive advantage in markets where environmental performance influences customer decisions.

Emerging regulatory trends suggest a trajectory toward even more stringent controls, particularly for HF due to its extreme hazard profile. Several jurisdictions are exploring the feasibility of partial or complete phase-outs of HF in certain applications, encouraging the development of alternative technologies. This regulatory pressure is driving innovation in less hazardous substitutes and more efficient containment systems, reshaping industrial practices across sectors from semiconductor manufacturing to petroleum refining.

Regulatory frameworks governing these substances vary globally but generally follow similar principles of risk management and exposure limitation. In the United States, the Environmental Protection Agency (EPA) regulates both chemicals under the Clean Air Act as Hazardous Air Pollutants and under the Resource Conservation and Recovery Act as hazardous wastes. The Occupational Safety and Health Administration (OSHA) has established Permissible Exposure Limits (PELs) of 3 ppm for HF and 5 ppm for HCl, reflecting their respective hazard profiles.

European regulations, particularly under REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), impose additional requirements for risk assessment and safe handling. The classification of both acids as "substances of very high concern" triggers enhanced monitoring and reporting obligations for industrial users. Asian markets, particularly China and Japan, have implemented increasingly stringent controls in recent years, aligning more closely with Western standards while adapting to their industrial contexts.

Compliance challenges for industries utilizing these acids are substantial and multifaceted. Facilities must implement comprehensive emission control technologies, including scrubbers and neutralization systems, to prevent atmospheric releases. Wastewater treatment protocols require specialized approaches to neutralize acidity before discharge, with HF demanding additional treatment steps to address fluoride content. Regular monitoring and documentation of emissions, exposure levels, and disposal practices constitute a significant operational burden but remain essential for regulatory compliance.

The economic implications of environmental compliance are considerable, with capital investments for control technologies often reaching millions of dollars for large facilities. However, these costs must be weighed against potential liabilities from non-compliance, including regulatory fines, remediation expenses, and reputational damage. Forward-thinking companies increasingly view robust environmental management of these acids not merely as a compliance obligation but as a competitive advantage in markets where environmental performance influences customer decisions.

Emerging regulatory trends suggest a trajectory toward even more stringent controls, particularly for HF due to its extreme hazard profile. Several jurisdictions are exploring the feasibility of partial or complete phase-outs of HF in certain applications, encouraging the development of alternative technologies. This regulatory pressure is driving innovation in less hazardous substitutes and more efficient containment systems, reshaping industrial practices across sectors from semiconductor manufacturing to petroleum refining.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!