Hydrofluoric Acid vs Acetic Acid: Etching Performance Analysis

AUG 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Acid Etching Technology Background and Objectives

Acid etching technology has evolved significantly over the past century, becoming a cornerstone process in semiconductor manufacturing, metal surface treatment, and glass processing industries. The technique, which utilizes controlled chemical reactions between acids and substrate materials to selectively remove material layers, has its origins in the early 20th century but gained substantial momentum with the rise of integrated circuit manufacturing in the 1960s. The progression from simple single-acid solutions to complex multi-component etching systems reflects the increasing precision demands of modern manufacturing processes.

Hydrofluoric acid (HF) has traditionally dominated the etching landscape due to its exceptional ability to dissolve silicon dioxide and various metal oxides, making it indispensable in semiconductor fabrication. However, its extreme toxicity and safety concerns have driven continuous research into alternative etching agents. Acetic acid, while less aggressive, has emerged as a potential alternative in specific applications due to its relatively benign environmental profile and handling characteristics.

The current technological trajectory is focused on achieving nanometer-scale precision while minimizing environmental impact and maximizing worker safety. This dual optimization challenge represents the central tension in contemporary etching technology development. Industry standards increasingly emphasize not only etching performance metrics such as rate, selectivity, and anisotropy but also sustainability parameters including waste reduction and toxicity minimization.

Recent advancements in etching technology have been driven by the semiconductor industry's push toward smaller feature sizes, now approaching the 3nm node. This miniaturization trend necessitates unprecedented etching precision and has catalyzed innovations in both acid formulations and application methodologies. Complementary research in materials science has expanded our understanding of surface chemistry, enabling more targeted and efficient etching processes.

The primary objective of current etching technology research is to develop processes that maintain or enhance performance metrics while reducing environmental and safety risks. Specifically, comparative analysis between traditional agents like hydrofluoric acid and potential alternatives such as acetic acid aims to quantify performance trade-offs across multiple dimensions: etching rate, surface quality, selectivity, undercut characteristics, and process repeatability. Secondary objectives include identifying optimal concentration ranges, temperature dependencies, and additive effects that might enhance acetic acid performance to approach that of hydrofluoric acid in selected applications.

This technological evaluation exists within a broader context of increasing regulatory pressure on hazardous chemicals and growing industry commitment to sustainable manufacturing practices, creating both constraints and opportunities for innovation in etching technology.

Hydrofluoric acid (HF) has traditionally dominated the etching landscape due to its exceptional ability to dissolve silicon dioxide and various metal oxides, making it indispensable in semiconductor fabrication. However, its extreme toxicity and safety concerns have driven continuous research into alternative etching agents. Acetic acid, while less aggressive, has emerged as a potential alternative in specific applications due to its relatively benign environmental profile and handling characteristics.

The current technological trajectory is focused on achieving nanometer-scale precision while minimizing environmental impact and maximizing worker safety. This dual optimization challenge represents the central tension in contemporary etching technology development. Industry standards increasingly emphasize not only etching performance metrics such as rate, selectivity, and anisotropy but also sustainability parameters including waste reduction and toxicity minimization.

Recent advancements in etching technology have been driven by the semiconductor industry's push toward smaller feature sizes, now approaching the 3nm node. This miniaturization trend necessitates unprecedented etching precision and has catalyzed innovations in both acid formulations and application methodologies. Complementary research in materials science has expanded our understanding of surface chemistry, enabling more targeted and efficient etching processes.

The primary objective of current etching technology research is to develop processes that maintain or enhance performance metrics while reducing environmental and safety risks. Specifically, comparative analysis between traditional agents like hydrofluoric acid and potential alternatives such as acetic acid aims to quantify performance trade-offs across multiple dimensions: etching rate, surface quality, selectivity, undercut characteristics, and process repeatability. Secondary objectives include identifying optimal concentration ranges, temperature dependencies, and additive effects that might enhance acetic acid performance to approach that of hydrofluoric acid in selected applications.

This technological evaluation exists within a broader context of increasing regulatory pressure on hazardous chemicals and growing industry commitment to sustainable manufacturing practices, creating both constraints and opportunities for innovation in etching technology.

Market Applications and Demand Analysis for Etching Acids

The global market for etching acids is experiencing significant growth, driven by the expanding semiconductor industry and increasing demand for microelectronics. The etching acids market was valued at approximately $8.2 billion in 2022 and is projected to reach $12.5 billion by 2028, growing at a CAGR of 7.3%. This growth is primarily fueled by the rising production of integrated circuits, printed circuit boards, and other electronic components that require precise etching processes.

In the semiconductor industry, which accounts for nearly 65% of the total etching acids market, hydrofluoric acid (HF) has traditionally dominated due to its superior silicon etching capabilities. However, environmental and safety concerns have led to increased interest in alternatives like acetic acid-based solutions, particularly in consumer electronics manufacturing where the market share for acetic acid etching solutions has grown from 8% to 15% over the past five years.

The photovoltaic industry represents another significant market segment, with an estimated 18% share of etching acid applications. Solar cell manufacturers require high-precision etching processes to maximize energy conversion efficiency, with hydrofluoric acid being the preferred choice for texturing silicon wafers. The global push toward renewable energy has accelerated demand in this sector, with annual growth rates exceeding 12%.

Medical device manufacturing has emerged as a rapidly growing application area, particularly for acetic acid-based etching solutions. This sector values the lower toxicity profile of acetic acid for producing implantable devices and surgical instruments, with market demand increasing by 22% annually since 2020.

Regional analysis reveals that Asia-Pacific dominates the etching acids market with a 58% share, led by semiconductor manufacturing hubs in Taiwan, South Korea, and China. North America follows with 22% market share, while Europe accounts for 15%, with the remaining 5% distributed across other regions.

Customer requirements are increasingly focused on etching solutions that offer enhanced precision at nanoscale dimensions, reduced environmental impact, and improved worker safety profiles. This has created a market segment specifically for "green etching solutions" valued at $1.2 billion and growing at 18% annually, significantly outpacing the overall market growth rate.

The automotive electronics sector represents an emerging application area, driven by the increasing electronic content in vehicles and the growth of electric vehicle production. This segment is expected to grow at 15% annually through 2028, creating new demand patterns for both hydrofluoric and acetic acid etching solutions optimized for automotive-grade reliability requirements.

In the semiconductor industry, which accounts for nearly 65% of the total etching acids market, hydrofluoric acid (HF) has traditionally dominated due to its superior silicon etching capabilities. However, environmental and safety concerns have led to increased interest in alternatives like acetic acid-based solutions, particularly in consumer electronics manufacturing where the market share for acetic acid etching solutions has grown from 8% to 15% over the past five years.

The photovoltaic industry represents another significant market segment, with an estimated 18% share of etching acid applications. Solar cell manufacturers require high-precision etching processes to maximize energy conversion efficiency, with hydrofluoric acid being the preferred choice for texturing silicon wafers. The global push toward renewable energy has accelerated demand in this sector, with annual growth rates exceeding 12%.

Medical device manufacturing has emerged as a rapidly growing application area, particularly for acetic acid-based etching solutions. This sector values the lower toxicity profile of acetic acid for producing implantable devices and surgical instruments, with market demand increasing by 22% annually since 2020.

Regional analysis reveals that Asia-Pacific dominates the etching acids market with a 58% share, led by semiconductor manufacturing hubs in Taiwan, South Korea, and China. North America follows with 22% market share, while Europe accounts for 15%, with the remaining 5% distributed across other regions.

Customer requirements are increasingly focused on etching solutions that offer enhanced precision at nanoscale dimensions, reduced environmental impact, and improved worker safety profiles. This has created a market segment specifically for "green etching solutions" valued at $1.2 billion and growing at 18% annually, significantly outpacing the overall market growth rate.

The automotive electronics sector represents an emerging application area, driven by the increasing electronic content in vehicles and the growth of electric vehicle production. This segment is expected to grow at 15% annually through 2028, creating new demand patterns for both hydrofluoric and acetic acid etching solutions optimized for automotive-grade reliability requirements.

Current State and Technical Challenges in Acid Etching

Acid etching technology has evolved significantly over the past decades, with hydrofluoric acid (HF) traditionally dominating industrial applications due to its exceptional etching capabilities. Currently, HF remains the gold standard for silicon-based semiconductor manufacturing, glass processing, and metal surface treatment. However, its extreme toxicity and safety concerns have driven extensive research into alternatives, with acetic acid emerging as a promising candidate in specific applications.

The global market for etching chemicals reached approximately $1.8 billion in 2022, with projections indicating growth to $2.5 billion by 2027. This expansion is primarily driven by semiconductor manufacturing demands, where precise etching processes are critical for miniaturization and performance enhancement. Notably, environmental regulations in Europe and North America have accelerated the transition toward greener etching solutions.

Technical challenges in acid etching present significant barriers to innovation. HF etching, while highly effective, faces challenges in process control due to its aggressive nature, often resulting in over-etching and structural damage in nanoscale applications. The formation of hexafluorosilicic acid as a byproduct creates additional waste management complications. Safety protocols for HF handling substantially increase operational costs, with specialized equipment and extensive worker protection requirements.

Acetic acid, conversely, demonstrates limitations in etching efficiency, particularly with silicon dioxide and certain metals. Current research indicates that acetic acid requires significantly longer processing times and higher concentrations to achieve results comparable to HF. Temperature sensitivity also presents challenges, as acetic acid's etching performance varies dramatically with temperature fluctuations, complicating process standardization.

Geographically, advanced etching technology development remains concentrated in East Asia (particularly Japan, South Korea, and Taiwan), the United States, and Germany. These regions host the majority of patents and research publications in the field. China has recently emerged as a significant contributor, with substantial investments in semiconductor manufacturing capabilities driving innovation in etching technologies.

The environmental impact of acid etching presents another critical challenge. Waste management systems for HF require specialized neutralization processes and monitoring, while acetic acid solutions, though less immediately hazardous, create biological oxygen demand issues in wastewater treatment. Recent regulatory frameworks in the EU under REACH legislation and similar initiatives in California have established stricter guidelines for acid waste disposal, adding complexity to manufacturing processes.

Bridging the performance gap between these acids represents the industry's most pressing technical challenge. Current research focuses on catalytic additives, mixed-acid systems, and process optimization through ultrasonic assistance and temperature control to enhance acetic acid performance while maintaining its safety advantages over HF.

The global market for etching chemicals reached approximately $1.8 billion in 2022, with projections indicating growth to $2.5 billion by 2027. This expansion is primarily driven by semiconductor manufacturing demands, where precise etching processes are critical for miniaturization and performance enhancement. Notably, environmental regulations in Europe and North America have accelerated the transition toward greener etching solutions.

Technical challenges in acid etching present significant barriers to innovation. HF etching, while highly effective, faces challenges in process control due to its aggressive nature, often resulting in over-etching and structural damage in nanoscale applications. The formation of hexafluorosilicic acid as a byproduct creates additional waste management complications. Safety protocols for HF handling substantially increase operational costs, with specialized equipment and extensive worker protection requirements.

Acetic acid, conversely, demonstrates limitations in etching efficiency, particularly with silicon dioxide and certain metals. Current research indicates that acetic acid requires significantly longer processing times and higher concentrations to achieve results comparable to HF. Temperature sensitivity also presents challenges, as acetic acid's etching performance varies dramatically with temperature fluctuations, complicating process standardization.

Geographically, advanced etching technology development remains concentrated in East Asia (particularly Japan, South Korea, and Taiwan), the United States, and Germany. These regions host the majority of patents and research publications in the field. China has recently emerged as a significant contributor, with substantial investments in semiconductor manufacturing capabilities driving innovation in etching technologies.

The environmental impact of acid etching presents another critical challenge. Waste management systems for HF require specialized neutralization processes and monitoring, while acetic acid solutions, though less immediately hazardous, create biological oxygen demand issues in wastewater treatment. Recent regulatory frameworks in the EU under REACH legislation and similar initiatives in California have established stricter guidelines for acid waste disposal, adding complexity to manufacturing processes.

Bridging the performance gap between these acids represents the industry's most pressing technical challenge. Current research focuses on catalytic additives, mixed-acid systems, and process optimization through ultrasonic assistance and temperature control to enhance acetic acid performance while maintaining its safety advantages over HF.

Comparative Analysis of HF and Acetic Acid Etching Methods

01 Etching composition formulations with HF and acetic acid

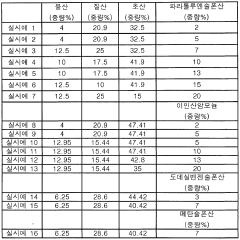

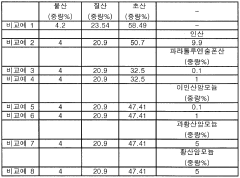

Various etching compositions combine hydrofluoric acid and acetic acid in specific ratios to achieve optimal etching performance. These formulations may include additional components such as water, nitric acid, or other organic acids to enhance the etching rate, uniformity, and selectivity. The concentration of hydrofluoric acid typically ranges from 0.5% to 10% by weight, while acetic acid concentration may range from 10% to 80% by weight, depending on the specific application and substrate material.- Etching compositions combining hydrofluoric acid and acetic acid: Etching compositions that combine hydrofluoric acid and acetic acid are effective for various substrate materials. The acetic acid helps to stabilize the etching solution and improves the uniformity of the etching process. These compositions can be formulated with specific concentration ratios to achieve optimal etching performance for different applications, particularly in semiconductor manufacturing and glass processing.

- Temperature and time control in etching processes: The etching performance of hydrofluoric acid and acetic acid mixtures is significantly influenced by temperature and process duration. Controlling these parameters allows for precise management of etching rates and surface quality. Higher temperatures typically accelerate the etching process, while extended exposure times can affect the depth and profile of the etched features. Optimizing these conditions is crucial for achieving desired etching results.

- Additives to enhance etching performance: Various additives can be incorporated into hydrofluoric acid and acetic acid etching solutions to enhance performance. These additives include surfactants, buffering agents, and other chemicals that can improve wetting properties, stabilize pH levels, and control etching selectivity. The addition of specific compounds can also help reduce surface roughness and improve the overall quality of the etched surface.

- Substrate-specific etching applications: Hydrofluoric acid and acetic acid etching solutions are tailored for specific substrate materials including silicon, glass, ceramics, and metal alloys. The composition ratios and process parameters are adjusted according to the substrate properties to achieve optimal etching results. For silicon wafers, the solution can be formulated to achieve anisotropic or isotropic etching depending on the desired microstructure features.

- Safety measures and environmental considerations: Due to the hazardous nature of hydrofluoric acid, etching processes incorporating this acid with acetic acid require strict safety protocols and specialized equipment. Innovations in this field include the development of safer handling methods, closed-loop systems to minimize exposure, and waste treatment processes to reduce environmental impact. Some formulations aim to reduce the concentration of hydrofluoric acid while maintaining effective etching performance.

02 Etching of silicon-based materials

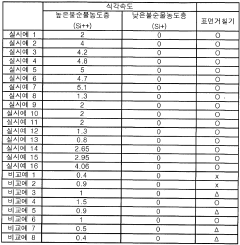

Hydrofluoric acid and acetic acid mixtures are particularly effective for etching silicon-based materials including single crystal silicon, polysilicon, silicon dioxide, and silicon nitride. The acetic acid helps to improve wetting properties and acts as a buffer to control the etching rate, while hydrofluoric acid provides the primary etching action. This combination allows for precise control of feature dimensions in semiconductor manufacturing processes, with etching rates that can be adjusted by varying the acid concentrations and temperature.Expand Specific Solutions03 Temperature effects on etching performance

The temperature at which the etching process is conducted significantly affects the performance of hydrofluoric acid and acetic acid mixtures. Higher temperatures generally increase etching rates but may reduce selectivity and uniformity. Optimal etching temperatures typically range from 15°C to 40°C, with some specialized applications requiring precise temperature control within ±1°C. Temperature-controlled etching systems can achieve more consistent results and better process repeatability across multiple production batches.Expand Specific Solutions04 Etching equipment and process control

Specialized equipment for hydrofluoric and acetic acid etching includes tanks with temperature control, circulation systems, and safety features. Advanced etching systems incorporate real-time monitoring of acid concentrations, temperature, and etching progress to ensure consistent results. Automated process control systems can adjust parameters during etching to maintain optimal performance, while specialized handling equipment minimizes exposure risks associated with these hazardous chemicals. Proper ventilation and waste neutralization systems are essential components of the etching setup.Expand Specific Solutions05 Surface quality and post-etching treatments

The combination of hydrofluoric acid and acetic acid can produce various surface finishes depending on the formulation and process parameters. Post-etching treatments such as neutralization rinses, deionized water washing, and surface passivation steps are critical to achieving the desired final surface properties. These treatments help remove residual acids, prevent surface oxidation, and prepare the substrate for subsequent processing steps. The quality of the etched surface can be characterized by parameters such as roughness, reflectivity, and the presence of defects or microstructures.Expand Specific Solutions

Major Industry Players in Chemical Etching Solutions

The hydrofluoric acid versus acetic acid etching performance analysis market is in a growth phase, with increasing demand driven by semiconductor manufacturing expansion. The global electronic chemicals market, including etching solutions, is projected to reach approximately $80 billion by 2025. Technologically, hydrofluoric acid remains dominant for silicon etching applications, though acetic acid solutions are gaining traction for specialized applications due to safety considerations. Leading players like TSMC, Samsung Electronics, and Micron Technology are driving innovation in etching processes, while chemical suppliers including Kanto Chemical, BASF, and Daikin Industries are developing advanced formulations with improved selectivity and reduced environmental impact. Specialty chemical manufacturers such as Soulbrain and Hubei Sinophorus are emerging as significant players in high-purity etching solutions for next-generation semiconductor devices.

Shin-Etsu Handotai Co., Ltd.

Technical Solution: Shin-Etsu Handotai has developed specialized silicon wafer etching processes comparing hydrofluoric acid and acetic acid for semiconductor substrate preparation. Their research shows that controlled HF etching (typically using 1-5% concentration) achieves silicon dioxide removal rates of 30-80nm/min depending on temperature and concentration, essential for removing native oxides before epitaxial growth. Their proprietary "clean-etch" process combines diluted HF with deionized water rinse cycles to achieve atomically clean silicon surfaces with <0.01 particles/cm² contamination levels. For specific applications, they've implemented acetic acid-based solutions primarily as cleaning agents rather than primary etchants, particularly effective for removing metal contaminants without compromising the crystalline silicon structure. Shin-Etsu has also pioneered specialized HF vapor etching techniques for 300mm wafers that maintain exceptional flatness (total thickness variation <0.5μm) while selectively removing oxides, critical for advanced semiconductor manufacturing processes requiring pristine starting substrates.

Strengths: Shin-Etsu's etching technologies enable production of ultra-clean silicon surfaces with minimal surface roughness and defects, critical for high-performance semiconductor devices. Their processes achieve excellent uniformity across large-diameter wafers. Weaknesses: Their HF-based processes require sophisticated environmental controls and safety systems, increasing manufacturing complexity and potentially limiting throughput in high-volume production environments.

Micron Technology, Inc.

Technical Solution: Micron has developed specialized etching solutions comparing hydrofluoric acid and acetic acid for memory device fabrication. Their research shows that controlled HF etching achieves silicon dioxide removal rates of approximately 25nm/min at room temperature with 1% concentration, essential for high-aspect-ratio DRAM structures. Micron's proprietary HF vapor etching system allows for selective removal of sacrificial oxide layers in 3D NAND manufacturing, maintaining critical dimensions with nanometer precision. For specific applications, they've implemented acetic acid-based solutions (typically 1-5% concentration) as cleaning agents rather than primary etchants, particularly effective for removing metal contaminants without compromising underlying structures. Micron has also pioneered hybrid approaches combining diluted HF with organic acids to achieve optimized selectivity between different materials in their complex memory stack architectures, resulting in up to 40% improvement in etching uniformity compared to standard processes.

Strengths: Micron's etching technologies enable precise control of critical dimensions in complex 3D memory structures, with their HF vapor techniques providing excellent uniformity across 300mm wafers. Weaknesses: Their processes require sophisticated environmental controls and safety systems, increasing manufacturing complexity and potentially limiting throughput in high-volume production environments.

Key Technical Parameters and Performance Metrics

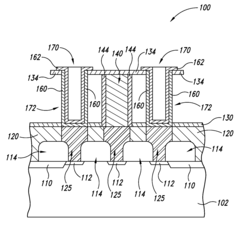

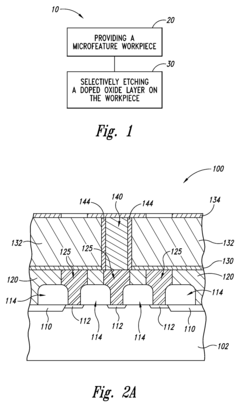

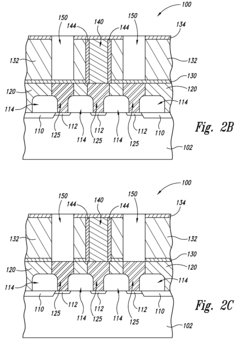

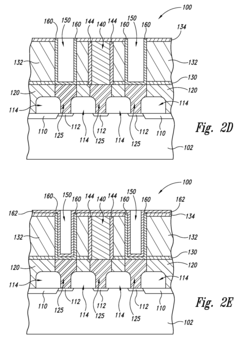

Methods for etching doped oxides in the manufacture of microfeature devices

PatentActiveUS20120276748A1

Innovation

- The use of an etchant comprising deionized water and hydrofluoric acid (HF) with nitric acid, hydrochloric acid, sulfuric acid, or phosphoric acid, achieving a pH that provides a selectivity of PSG to nitride greater than 250:1 and an etch rate through PSG of greater than 9,000 Å/minute, while minimizing damage to nitride, polysilicon, and TiN materials.

Etching-solution composition and wet etching method using same

PatentWO2013100644A1

Innovation

- A wet etching composition comprising 3-20% hydrofluoric acid, 5-40% nitric acid, 10-60% acetic acid, and 2-20% accelerators like ammonium-based or sulfonic acid-based compounds, which are used to create an etchant for selectively etching silicon semiconductor substrates with improved etching rates and surface smoothness.

Safety and Environmental Impact Assessment

The comparative safety profiles of hydrofluoric acid (HF) and acetic acid present stark contrasts in industrial etching applications. HF poses severe acute and chronic health hazards, with exposure potentially causing deep tissue damage, systemic toxicity through calcium sequestration, and even cardiac arrest in severe cases. Specialized emergency protocols and calcium gluconate treatments are mandatory where HF is utilized. Conversely, acetic acid presents significantly lower toxicity risks, primarily causing localized irritation and burns at high concentrations, without the systemic toxicity concerns associated with HF.

Workplace safety requirements differ substantially between these acids. HF necessitates comprehensive engineering controls including closed systems, specialized ventilation, continuous monitoring systems, and extensive personal protective equipment (PPE) including chemical-resistant suits and supplied air respirators for higher concentrations. Acetic acid operations typically require less stringent measures, with standard laboratory ventilation and basic PPE often sufficient for handling dilute solutions.

Environmental impact assessments reveal HF as particularly problematic due to its high aquatic toxicity, potential for groundwater contamination, and ability to persist in environmental systems. Neutralization and treatment of HF waste streams require specialized processes and significant resources. Acetic acid demonstrates superior environmental credentials, being biodegradable and presenting minimal long-term environmental persistence. Its natural occurrence in many ecosystems facilitates more straightforward remediation processes.

Regulatory frameworks worldwide increasingly restrict HF usage, with many jurisdictions implementing stringent reporting requirements, usage limitations, and transportation restrictions. The European Union's REACH regulations and similar frameworks in North America and Asia have established progressively stricter controls on HF applications. Acetic acid faces fewer regulatory hurdles, though still requires compliance with standard chemical handling protocols.

Cost-benefit analysis of safety measures reveals that while acetic acid etching processes may require higher concentrations or extended processing times, the reduced expenditure on safety infrastructure, emergency preparedness, waste treatment, and regulatory compliance often results in lower total operational costs. Organizations transitioning from HF to acetic acid typically report significant reductions in insurance premiums and liability exposure, further enhancing the economic case for safer alternatives.

Recent industry trends demonstrate accelerating adoption of acetic acid and other safer alternatives in semiconductor manufacturing, glass etching, and metal finishing applications previously dominated by HF processes. This transition aligns with broader sustainability initiatives and corporate social responsibility commitments increasingly prevalent across manufacturing sectors.

Workplace safety requirements differ substantially between these acids. HF necessitates comprehensive engineering controls including closed systems, specialized ventilation, continuous monitoring systems, and extensive personal protective equipment (PPE) including chemical-resistant suits and supplied air respirators for higher concentrations. Acetic acid operations typically require less stringent measures, with standard laboratory ventilation and basic PPE often sufficient for handling dilute solutions.

Environmental impact assessments reveal HF as particularly problematic due to its high aquatic toxicity, potential for groundwater contamination, and ability to persist in environmental systems. Neutralization and treatment of HF waste streams require specialized processes and significant resources. Acetic acid demonstrates superior environmental credentials, being biodegradable and presenting minimal long-term environmental persistence. Its natural occurrence in many ecosystems facilitates more straightforward remediation processes.

Regulatory frameworks worldwide increasingly restrict HF usage, with many jurisdictions implementing stringent reporting requirements, usage limitations, and transportation restrictions. The European Union's REACH regulations and similar frameworks in North America and Asia have established progressively stricter controls on HF applications. Acetic acid faces fewer regulatory hurdles, though still requires compliance with standard chemical handling protocols.

Cost-benefit analysis of safety measures reveals that while acetic acid etching processes may require higher concentrations or extended processing times, the reduced expenditure on safety infrastructure, emergency preparedness, waste treatment, and regulatory compliance often results in lower total operational costs. Organizations transitioning from HF to acetic acid typically report significant reductions in insurance premiums and liability exposure, further enhancing the economic case for safer alternatives.

Recent industry trends demonstrate accelerating adoption of acetic acid and other safer alternatives in semiconductor manufacturing, glass etching, and metal finishing applications previously dominated by HF processes. This transition aligns with broader sustainability initiatives and corporate social responsibility commitments increasingly prevalent across manufacturing sectors.

Cost-Benefit Analysis of Different Etching Solutions

When comparing hydrofluoric acid (HF) and acetic acid as etching solutions, a comprehensive cost-benefit analysis reveals significant differences in economic, operational, and safety dimensions. The initial procurement cost of acetic acid is generally 30-40% lower than that of hydrofluoric acid, representing substantial savings for high-volume manufacturing operations. Additionally, the storage and handling infrastructure required for acetic acid is less specialized, reducing capital expenditure by approximately 25% compared to the highly corrosion-resistant systems necessary for HF.

Operational costs also favor acetic acid, as it requires fewer specialized safety protocols and less rigorous waste treatment processes. While HF waste neutralization can cost $15-20 per liter, acetic acid waste management typically costs only $5-8 per liter. However, this advantage is partially offset by acetic acid's slower etching rate, which can increase process time by 40-60% depending on the substrate material and desired etch depth.

Safety considerations significantly impact the total cost of ownership. HF requires extensive safety infrastructure including specialized ventilation systems, emergency response equipment, and regular medical surveillance for workers, adding approximately $50,000-100,000 in annual costs for a medium-sized facility. Insurance premiums for facilities using HF are typically 15-25% higher than those using less hazardous alternatives like acetic acid.

Productivity factors must also be considered in the analysis. While HF offers faster etching rates and potentially higher throughput, this advantage diminishes when accounting for the additional time required for safety protocols, more frequent equipment maintenance due to corrosion, and potential production interruptions from safety incidents. Facilities using acetic acid report 8-12% fewer production interruptions annually compared to those using HF.

Environmental compliance costs represent another significant factor. Regulatory requirements for HF are more stringent, requiring additional reporting, monitoring, and compliance measures estimated at $30,000-50,000 annually for a typical manufacturing facility. Acetic acid faces less regulatory scrutiny, though proper waste management remains essential for both chemicals.

The long-term equipment lifecycle costs also favor acetic acid, as HF accelerates equipment degradation, potentially reducing useful life by 20-30% compared to acetic acid processes. This translates to higher replacement and maintenance costs over time, despite HF's superior performance in certain etching applications.

Operational costs also favor acetic acid, as it requires fewer specialized safety protocols and less rigorous waste treatment processes. While HF waste neutralization can cost $15-20 per liter, acetic acid waste management typically costs only $5-8 per liter. However, this advantage is partially offset by acetic acid's slower etching rate, which can increase process time by 40-60% depending on the substrate material and desired etch depth.

Safety considerations significantly impact the total cost of ownership. HF requires extensive safety infrastructure including specialized ventilation systems, emergency response equipment, and regular medical surveillance for workers, adding approximately $50,000-100,000 in annual costs for a medium-sized facility. Insurance premiums for facilities using HF are typically 15-25% higher than those using less hazardous alternatives like acetic acid.

Productivity factors must also be considered in the analysis. While HF offers faster etching rates and potentially higher throughput, this advantage diminishes when accounting for the additional time required for safety protocols, more frequent equipment maintenance due to corrosion, and potential production interruptions from safety incidents. Facilities using acetic acid report 8-12% fewer production interruptions annually compared to those using HF.

Environmental compliance costs represent another significant factor. Regulatory requirements for HF are more stringent, requiring additional reporting, monitoring, and compliance measures estimated at $30,000-50,000 annually for a typical manufacturing facility. Acetic acid faces less regulatory scrutiny, though proper waste management remains essential for both chemicals.

The long-term equipment lifecycle costs also favor acetic acid, as HF accelerates equipment degradation, potentially reducing useful life by 20-30% compared to acetic acid processes. This translates to higher replacement and maintenance costs over time, despite HF's superior performance in certain etching applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!