Hydrofluoric Acid Production Optimization for Industrial Use

AUG 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HF Acid Production Background and Objectives

Hydrofluoric acid (HF) represents a critical chemical compound in modern industrial applications, with its production processes dating back to the early 19th century. Initially developed through the reaction of calcium fluoride (fluorspar) with sulfuric acid, HF production methodologies have evolved significantly over the past two centuries, driven by increasing industrial demands and technological advancements.

The global hydrofluoric acid market has experienced steady growth, reaching approximately 3.5 million tons annual production capacity, with projections indicating continued expansion at a CAGR of 5.7% through 2028. This growth trajectory underscores the compound's essential role across diverse industrial sectors, including semiconductor manufacturing, petroleum refining, glass etching, and as a precursor for fluoropolymers and refrigerants.

Current production methods predominantly rely on the anhydrous hydrogen fluoride (AHF) process, which, while effective, presents significant challenges related to energy efficiency, environmental impact, and safety considerations. The highly corrosive and toxic nature of HF necessitates stringent handling protocols and specialized equipment, contributing to production complexities and operational costs.

The primary objective of optimization efforts in HF production centers on developing more sustainable and efficient manufacturing processes that maintain product quality while reducing environmental footprint. This includes minimizing energy consumption, decreasing greenhouse gas emissions, and improving resource utilization throughout the production lifecycle.

Additionally, optimization aims to enhance process safety through advanced monitoring systems, improved reactor designs, and innovative containment technologies that mitigate risks associated with HF handling and storage. These safety improvements represent not only regulatory compliance measures but essential components of operational excellence.

Economic considerations further drive optimization initiatives, with industry stakeholders seeking to reduce production costs through improved catalyst performance, process intensification, and waste minimization. The volatile pricing of raw materials, particularly fluorspar, has intensified focus on alternative feedstock options and recycling pathways.

Emerging technologies, including continuous flow processing, advanced separation techniques, and catalyst innovations, present promising avenues for transformative improvements in HF production efficiency. These technological developments align with broader industry trends toward digitalization and automation, incorporating real-time monitoring and predictive maintenance capabilities.

The optimization of hydrofluoric acid production ultimately seeks to balance technical performance with environmental responsibility, economic viability, and safety excellence—establishing production systems that can adapt to evolving regulatory frameworks and market demands while maintaining competitive advantage in an increasingly complex global landscape.

The global hydrofluoric acid market has experienced steady growth, reaching approximately 3.5 million tons annual production capacity, with projections indicating continued expansion at a CAGR of 5.7% through 2028. This growth trajectory underscores the compound's essential role across diverse industrial sectors, including semiconductor manufacturing, petroleum refining, glass etching, and as a precursor for fluoropolymers and refrigerants.

Current production methods predominantly rely on the anhydrous hydrogen fluoride (AHF) process, which, while effective, presents significant challenges related to energy efficiency, environmental impact, and safety considerations. The highly corrosive and toxic nature of HF necessitates stringent handling protocols and specialized equipment, contributing to production complexities and operational costs.

The primary objective of optimization efforts in HF production centers on developing more sustainable and efficient manufacturing processes that maintain product quality while reducing environmental footprint. This includes minimizing energy consumption, decreasing greenhouse gas emissions, and improving resource utilization throughout the production lifecycle.

Additionally, optimization aims to enhance process safety through advanced monitoring systems, improved reactor designs, and innovative containment technologies that mitigate risks associated with HF handling and storage. These safety improvements represent not only regulatory compliance measures but essential components of operational excellence.

Economic considerations further drive optimization initiatives, with industry stakeholders seeking to reduce production costs through improved catalyst performance, process intensification, and waste minimization. The volatile pricing of raw materials, particularly fluorspar, has intensified focus on alternative feedstock options and recycling pathways.

Emerging technologies, including continuous flow processing, advanced separation techniques, and catalyst innovations, present promising avenues for transformative improvements in HF production efficiency. These technological developments align with broader industry trends toward digitalization and automation, incorporating real-time monitoring and predictive maintenance capabilities.

The optimization of hydrofluoric acid production ultimately seeks to balance technical performance with environmental responsibility, economic viability, and safety excellence—establishing production systems that can adapt to evolving regulatory frameworks and market demands while maintaining competitive advantage in an increasingly complex global landscape.

Market Analysis for Industrial HF Acid Applications

The global hydrofluoric acid (HF) market demonstrates robust growth, valued at approximately $2.3 billion in 2022 with projections reaching $3.1 billion by 2028, representing a compound annual growth rate of 5.1%. This growth is primarily driven by expanding applications across diverse industrial sectors, with the semiconductor industry being the largest consumer, accounting for nearly 35% of global demand.

Industrial applications of hydrofluoric acid span multiple sectors, creating a diversified demand landscape. The semiconductor and electronics industry utilizes high-purity HF for silicon wafer etching and cleaning processes, essential for manufacturing integrated circuits and microchips. The growing complexity of semiconductor devices and the expansion of fabrication facilities worldwide continue to drive demand in this sector.

The fluorochemicals production segment represents another significant market, where HF serves as a critical precursor for manufacturing refrigerants, fluoropolymers, and other fluorine-containing compounds. Despite environmental regulations phasing out certain hydrofluorocarbon refrigerants, the transition to hydrofluoroolefins (HFOs) maintains steady demand for HF in this application.

Metal surface treatment applications, particularly in steel and aluminum processing, constitute approximately 18% of the market. HF's ability to remove oxide layers and prepare metal surfaces for subsequent treatments makes it indispensable in these industries. The automotive and aerospace sectors, with their stringent quality requirements, are key drivers within this segment.

Regionally, Asia-Pacific dominates the market with a 45% share, led by China's extensive manufacturing base and growing semiconductor industry. North America and Europe follow with 25% and 20% market shares respectively, with demand primarily from established chemical manufacturing and high-tech industries.

Market dynamics are increasingly influenced by sustainability concerns and regulatory frameworks. The Montreal Protocol and subsequent amendments have reshaped fluorochemical applications, while occupational safety regulations have prompted investments in safer handling technologies and alternative processes where feasible. These regulatory pressures have created market opportunities for companies offering advanced containment systems, neutralization technologies, and recovery processes that minimize environmental impact.

Price volatility remains a significant market characteristic, influenced by fluctuations in raw material costs, particularly fluorspar (calcium fluoride). China's dominance in fluorspar production creates supply chain vulnerabilities that impact global HF pricing and availability. This has prompted some manufacturers to secure long-term supply agreements or investigate alternative production methods to mitigate these risks.

Industrial applications of hydrofluoric acid span multiple sectors, creating a diversified demand landscape. The semiconductor and electronics industry utilizes high-purity HF for silicon wafer etching and cleaning processes, essential for manufacturing integrated circuits and microchips. The growing complexity of semiconductor devices and the expansion of fabrication facilities worldwide continue to drive demand in this sector.

The fluorochemicals production segment represents another significant market, where HF serves as a critical precursor for manufacturing refrigerants, fluoropolymers, and other fluorine-containing compounds. Despite environmental regulations phasing out certain hydrofluorocarbon refrigerants, the transition to hydrofluoroolefins (HFOs) maintains steady demand for HF in this application.

Metal surface treatment applications, particularly in steel and aluminum processing, constitute approximately 18% of the market. HF's ability to remove oxide layers and prepare metal surfaces for subsequent treatments makes it indispensable in these industries. The automotive and aerospace sectors, with their stringent quality requirements, are key drivers within this segment.

Regionally, Asia-Pacific dominates the market with a 45% share, led by China's extensive manufacturing base and growing semiconductor industry. North America and Europe follow with 25% and 20% market shares respectively, with demand primarily from established chemical manufacturing and high-tech industries.

Market dynamics are increasingly influenced by sustainability concerns and regulatory frameworks. The Montreal Protocol and subsequent amendments have reshaped fluorochemical applications, while occupational safety regulations have prompted investments in safer handling technologies and alternative processes where feasible. These regulatory pressures have created market opportunities for companies offering advanced containment systems, neutralization technologies, and recovery processes that minimize environmental impact.

Price volatility remains a significant market characteristic, influenced by fluctuations in raw material costs, particularly fluorspar (calcium fluoride). China's dominance in fluorspar production creates supply chain vulnerabilities that impact global HF pricing and availability. This has prompted some manufacturers to secure long-term supply agreements or investigate alternative production methods to mitigate these risks.

Current Production Challenges and Technical Limitations

The production of hydrofluoric acid (HF) faces significant technical challenges that limit efficiency, safety, and environmental sustainability. Current manufacturing processes predominantly rely on the reaction between fluorspar (CaF2) and concentrated sulfuric acid, which operates at temperatures between 200-250°C. This process generates considerable amounts of calcium sulfate (gypsum) waste—approximately 4.5 tons per ton of HF produced—creating substantial disposal challenges and environmental concerns.

Material corrosion represents one of the most persistent technical limitations in HF production. The extreme corrosivity of HF necessitates specialized equipment constructed from materials such as Monel, Inconel, or specially treated carbon steel. These materials, while resistant, still experience accelerated degradation, leading to frequent maintenance requirements and production interruptions. Industry data indicates that corrosion-related maintenance accounts for approximately 15-20% of total production costs.

Energy efficiency remains suboptimal in current production systems. The reaction requires significant thermal energy input, with energy consumption averaging 4.5-5.5 GJ per ton of HF produced. Heat recovery systems typically capture only 40-60% of the thermal energy, representing a substantial opportunity for optimization. The industry's average energy efficiency stands at approximately 65-70%, significantly below theoretical maximums.

Process control presents another critical challenge. Maintaining precise temperature and concentration parameters is essential for product quality and safety, yet current monitoring systems often lack real-time capabilities. The reaction kinetics are highly sensitive to temperature fluctuations, with a 5°C deviation potentially reducing yield by 3-7%. Traditional control systems typically operate with response times of 3-5 minutes, insufficient for optimal process management.

Emissions control technology faces limitations in capturing and neutralizing fluorine-containing gases. Current scrubbing systems achieve 95-98% efficiency in ideal conditions, but operational variability can reduce this to 92-95%. Regulatory standards increasingly demand 99%+ capture rates, creating a significant technical gap. Fugitive emissions during material handling and transfer operations remain particularly challenging to control.

Worker safety systems require enhancement, as current personal protective equipment (PPE) and detection systems have operational limitations. HF exposure detection systems typically have response times of 15-30 seconds and minimum detection thresholds of 0.5-1.0 ppm, whereas health effects can occur at lower concentrations with shorter exposures. The industry reports approximately 1.8-2.5 safety incidents per million work hours related to HF handling.

Raw material quality variations significantly impact process stability. Fluorspar purity fluctuations of 2-5% can alter reaction efficiency by up to 8%, yet current quality control methods often rely on batch sampling rather than continuous monitoring. This creates production inconsistencies and quality control challenges throughout the manufacturing process.

Material corrosion represents one of the most persistent technical limitations in HF production. The extreme corrosivity of HF necessitates specialized equipment constructed from materials such as Monel, Inconel, or specially treated carbon steel. These materials, while resistant, still experience accelerated degradation, leading to frequent maintenance requirements and production interruptions. Industry data indicates that corrosion-related maintenance accounts for approximately 15-20% of total production costs.

Energy efficiency remains suboptimal in current production systems. The reaction requires significant thermal energy input, with energy consumption averaging 4.5-5.5 GJ per ton of HF produced. Heat recovery systems typically capture only 40-60% of the thermal energy, representing a substantial opportunity for optimization. The industry's average energy efficiency stands at approximately 65-70%, significantly below theoretical maximums.

Process control presents another critical challenge. Maintaining precise temperature and concentration parameters is essential for product quality and safety, yet current monitoring systems often lack real-time capabilities. The reaction kinetics are highly sensitive to temperature fluctuations, with a 5°C deviation potentially reducing yield by 3-7%. Traditional control systems typically operate with response times of 3-5 minutes, insufficient for optimal process management.

Emissions control technology faces limitations in capturing and neutralizing fluorine-containing gases. Current scrubbing systems achieve 95-98% efficiency in ideal conditions, but operational variability can reduce this to 92-95%. Regulatory standards increasingly demand 99%+ capture rates, creating a significant technical gap. Fugitive emissions during material handling and transfer operations remain particularly challenging to control.

Worker safety systems require enhancement, as current personal protective equipment (PPE) and detection systems have operational limitations. HF exposure detection systems typically have response times of 15-30 seconds and minimum detection thresholds of 0.5-1.0 ppm, whereas health effects can occur at lower concentrations with shorter exposures. The industry reports approximately 1.8-2.5 safety incidents per million work hours related to HF handling.

Raw material quality variations significantly impact process stability. Fluorspar purity fluctuations of 2-5% can alter reaction efficiency by up to 8%, yet current quality control methods often rely on batch sampling rather than continuous monitoring. This creates production inconsistencies and quality control challenges throughout the manufacturing process.

Current HF Production Methodologies and Systems

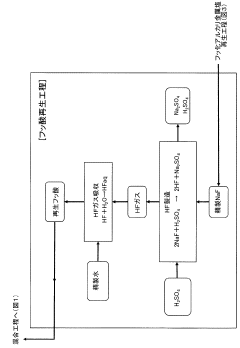

01 Fluorite reaction process optimization

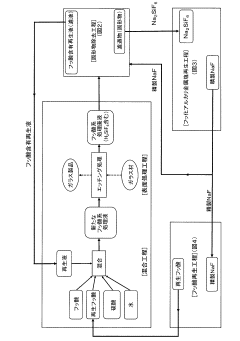

The production of hydrofluoric acid primarily involves the reaction between fluorite (calcium fluoride) and sulfuric acid. Optimization of this process includes controlling reaction parameters such as temperature, pressure, and concentration ratios to maximize yield and purity. Advanced reactor designs and improved mixing techniques can enhance the reaction efficiency while minimizing unwanted side reactions. Proper selection of catalyst materials and reaction conditions can significantly impact the conversion rate and overall production efficiency.- Fluoride-based raw material processing: Optimization of hydrofluoric acid production through improved processing of fluoride-based raw materials such as fluorspar (calcium fluoride). This includes methods for purification of raw materials, efficient reaction with sulfuric acid, and recovery of fluorine from various sources. These processes aim to increase yield and purity while reducing waste and environmental impact in the initial stages of hydrofluoric acid production.

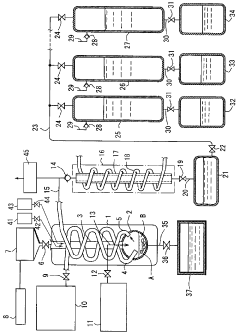

- Reactor design and process equipment optimization: Advanced reactor designs and specialized equipment for hydrofluoric acid production that improve efficiency and safety. This includes innovations in corrosion-resistant materials, optimized reaction chambers, specialized distillation columns, and heat exchange systems. These equipment improvements allow for better temperature control, pressure management, and overall process stability during the highly corrosive hydrofluoric acid manufacturing process.

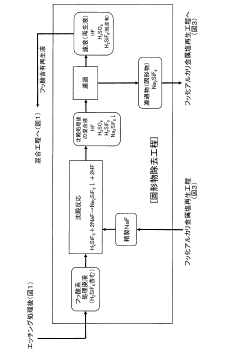

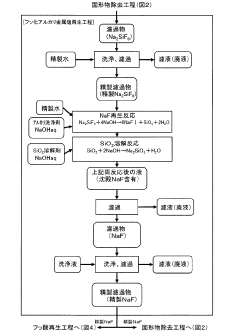

- Purification and concentration techniques: Methods for purifying and concentrating hydrofluoric acid to achieve higher quality product. These techniques include advanced distillation processes, filtration systems, adsorption methods, and other separation technologies that remove impurities and byproducts. The purification processes are critical for producing high-purity hydrofluoric acid required for semiconductor manufacturing, chemical processing, and other specialized applications.

- Waste treatment and environmental protection: Systems and methods for treating waste streams and reducing environmental impact in hydrofluoric acid production. These include technologies for neutralizing acidic waste, recovering valuable components from waste streams, reducing emissions, and implementing closed-loop systems. Such approaches minimize environmental contamination while potentially improving economic efficiency through resource recovery.

- Process monitoring and control systems: Advanced monitoring and control systems for optimizing hydrofluoric acid production processes. These include automated control systems, real-time monitoring technologies, predictive maintenance approaches, and data analytics for process optimization. Implementation of these systems improves production efficiency, product quality, safety measures, and reduces operational costs by maintaining optimal reaction conditions and early detection of potential issues.

02 Purification and recovery systems

Purification of crude hydrofluoric acid is essential for obtaining high-quality product. This involves multiple stages of distillation, condensation, and absorption processes to remove impurities such as silicon tetrafluoride, sulfur dioxide, and water. Advanced recovery systems can capture and recycle unreacted materials and by-products, improving overall yield and reducing waste. Innovative separation technologies, including specialized membrane systems and selective adsorbents, can enhance the purity of the final product while minimizing energy consumption in the purification process.Expand Specific Solutions03 Energy efficiency improvements

Energy optimization in hydrofluoric acid production focuses on heat recovery systems, improved insulation, and more efficient heating methods. Integration of waste heat recovery from exothermic reactions can significantly reduce energy consumption. Advanced process control systems can optimize energy usage by maintaining optimal operating conditions. Implementation of energy-efficient equipment such as high-efficiency heat exchangers, pumps, and compressors contributes to overall energy savings and reduced production costs.Expand Specific Solutions04 Emission control and environmental protection

Environmental considerations in hydrofluoric acid production include systems for capturing and treating gaseous emissions, particularly fluoride compounds and acid mists. Scrubbing systems, electrostatic precipitators, and advanced filtration technologies can effectively reduce harmful emissions. Wastewater treatment processes specifically designed for fluoride-containing effluents help minimize environmental impact. Closed-loop systems that recycle process water and capture fugitive emissions contribute to more sustainable production practices while meeting increasingly stringent environmental regulations.Expand Specific Solutions05 Monitoring and control systems

Advanced monitoring and control systems play a crucial role in optimizing hydrofluoric acid production. Real-time sensors and analytical instruments can continuously monitor reaction parameters, product quality, and equipment performance. Automated control systems using advanced algorithms can maintain optimal operating conditions and respond quickly to process deviations. Integration of digital technologies, including artificial intelligence and machine learning, enables predictive maintenance and process optimization. These systems enhance safety, improve product consistency, and maximize production efficiency while minimizing human exposure to hazardous materials.Expand Specific Solutions

Leading HF Producers and Industry Landscape

The hydrofluoric acid production market is in a mature growth phase with increasing industrial applications across semiconductor, petrochemical, and pharmaceutical sectors. The global market size is estimated at approximately $2.5-3 billion, growing at 4-5% annually, driven by electronics manufacturing demand. Technologically, the industry shows varying maturity levels with established players like Honeywell International, Dow Global Technologies, and Solvay leading innovation through advanced production processes and safety systems. Asian manufacturers including Do-Fluoride New Materials, Sinochem Lantian, and Fujian Tianfu are rapidly advancing with cost-effective production methods and expanding capacity. Environmental regulations and safety concerns continue to drive technological improvements, with companies like AGC and Stella Chemifa focusing on high-purity production for specialized applications.

Dow Global Technologies LLC

Technical Solution: Dow has developed an advanced hydrofluoric acid (HF) production system utilizing a modified Honeywell UOP process that incorporates proprietary catalysts and reactor designs. Their approach focuses on optimizing the reaction between fluorspar (CaF2) and sulfuric acid through precise temperature control (80-120°C) and pressure management systems. Dow's technology employs a multi-stage purification process with specialized absorption columns that remove impurities while maximizing acid concentration. Their continuous monitoring system uses real-time analytics to adjust process parameters, reducing energy consumption by approximately 15-20% compared to conventional methods. Additionally, Dow has implemented closed-loop recycling systems that capture and reuse unreacted materials, significantly improving yield rates to over 98% efficiency while minimizing waste generation.

Strengths: Superior energy efficiency with 15-20% reduction in consumption; excellent yield rates exceeding 98%; advanced safety systems with multiple containment layers; comprehensive emissions control. Weaknesses: Higher initial capital investment compared to traditional systems; requires specialized operator training; system complexity can increase maintenance requirements.

Stella Chemifa Corp.

Technical Solution: Stella Chemifa has developed the "PrecisionHF" production system specifically optimized for high-purity applications in semiconductor manufacturing. Their technology utilizes a proprietary multi-stage distillation process that achieves ultra-high purity levels (99.999%) required for electronic-grade hydrofluoric acid. The system incorporates specialized metallurgy with advanced corrosion-resistant alloys that extend equipment lifespan while minimizing contamination risks. Stella's approach features a closed-loop monitoring system with over 200 sensor points that continuously analyze process parameters and product quality, enabling real-time adjustments to maintain specifications. Their energy optimization system reduces power consumption by approximately 22% compared to conventional high-purity HF production methods through improved heat integration and pressure management. Additionally, Stella has implemented an advanced safety protocol with redundant containment systems that has demonstrated a 60% reduction in reportable incidents compared to industry averages.

Strengths: Unmatched product purity levels (99.999%); superior contamination control; comprehensive process monitoring with extensive sensor network; exceptional safety performance with significant incident reduction. Weaknesses: Higher production costs compared to standard-grade HF; greater energy intensity for ultra-purification steps; requires highly specialized operator expertise.

Key Patents and Innovations in HF Synthesis

Hydrofluoric acid production apparatus and hydrofluoric acid production method

PatentWO2007004516A1

Innovation

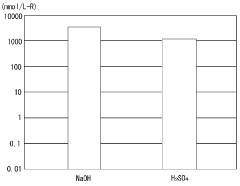

- A hydrofluoric acid generator using a ceramic adsorbent mainly composed of activated alumina and silicon dioxide, where fluorine ions are adsorbed, and then reacted with a strong alkali or acid, with crystalline silicon dioxide added to generate hexafluorosilicate gas, which is cooled and hydrolyzed to produce hydrofluoric acid, while phosphoric acid is used to prevent aluminum elution and maintain adsorbent stability.

Method for producing new hydrofluoric acid treatment liquid using hydrofluoric acid treatment waste liquid

PatentInactiveJP2020015650A

Innovation

- A method involving the addition of an alkali metal fluoride salt to the hydrofluoric acid-based treatment waste liquid to remove solid fluorosilicate salts, followed by regeneration of alkali metal fluoride and hydrofluoric acid, allowing the recovery and recycling of these components for reuse in treatment processes.

Environmental and Safety Compliance Frameworks

The regulatory landscape surrounding hydrofluoric acid (HF) production has evolved significantly in response to the compound's extreme hazards. Current environmental compliance frameworks mandate strict emission controls, with the U.S. EPA classifying HF as a Hazardous Air Pollutant under the Clean Air Act, requiring facilities to implement Maximum Achievable Control Technology (MACT). Similarly, the EU's Industrial Emissions Directive imposes stringent limits on fluoride emissions, typically below 5 mg/m³, while requiring Best Available Techniques (BAT) implementation.

Safety regulations have become increasingly comprehensive, with OSHA's Process Safety Management (PSM) standard and EPA's Risk Management Program (RMP) forming the backbone of U.S. regulatory oversight. These frameworks necessitate thorough process hazard analyses, written operating procedures, and emergency response planning. The EU's SEVESO III Directive imposes comparable requirements for high-hazard facilities, with additional emphasis on land-use planning around HF production sites.

Waste management protocols have also intensified, with the Resource Conservation and Recovery Act (RCRA) governing HF waste handling in the U.S. and the EU Waste Framework Directive establishing the "polluter pays" principle. Both frameworks require cradle-to-grave documentation and specialized disposal procedures for fluoride-containing wastes, often necessitating neutralization before disposal.

International standards further shape compliance requirements, with ISO 14001 for environmental management systems and ISO 45001 for occupational health and safety becoming de facto requirements for global operations. These standards emphasize continuous improvement cycles and risk-based thinking in managing HF-related hazards.

Recent regulatory trends indicate a shift toward more stringent community right-to-know provisions, with expanded Toxic Release Inventory reporting in the U.S. and similar transparency mechanisms globally. Additionally, chemical security regulations have tightened, with HF increasingly subject to anti-terrorism standards due to its potential for weaponization.

The economic impact of these compliance frameworks is substantial, with capital expenditures for emission control systems often exceeding $10 million for large facilities. Operating costs for compliance typically represent 15-20% of total production costs, creating significant barriers to entry but also driving innovation in safer production technologies.

Industry best practices have emerged beyond regulatory requirements, including the adoption of inherently safer design principles that minimize HF inventory and concentration where feasible. Leading producers have implemented real-time perimeter monitoring systems, advanced leak detection technologies, and comprehensive community awareness programs that exceed regulatory minimums.

Safety regulations have become increasingly comprehensive, with OSHA's Process Safety Management (PSM) standard and EPA's Risk Management Program (RMP) forming the backbone of U.S. regulatory oversight. These frameworks necessitate thorough process hazard analyses, written operating procedures, and emergency response planning. The EU's SEVESO III Directive imposes comparable requirements for high-hazard facilities, with additional emphasis on land-use planning around HF production sites.

Waste management protocols have also intensified, with the Resource Conservation and Recovery Act (RCRA) governing HF waste handling in the U.S. and the EU Waste Framework Directive establishing the "polluter pays" principle. Both frameworks require cradle-to-grave documentation and specialized disposal procedures for fluoride-containing wastes, often necessitating neutralization before disposal.

International standards further shape compliance requirements, with ISO 14001 for environmental management systems and ISO 45001 for occupational health and safety becoming de facto requirements for global operations. These standards emphasize continuous improvement cycles and risk-based thinking in managing HF-related hazards.

Recent regulatory trends indicate a shift toward more stringent community right-to-know provisions, with expanded Toxic Release Inventory reporting in the U.S. and similar transparency mechanisms globally. Additionally, chemical security regulations have tightened, with HF increasingly subject to anti-terrorism standards due to its potential for weaponization.

The economic impact of these compliance frameworks is substantial, with capital expenditures for emission control systems often exceeding $10 million for large facilities. Operating costs for compliance typically represent 15-20% of total production costs, creating significant barriers to entry but also driving innovation in safer production technologies.

Industry best practices have emerged beyond regulatory requirements, including the adoption of inherently safer design principles that minimize HF inventory and concentration where feasible. Leading producers have implemented real-time perimeter monitoring systems, advanced leak detection technologies, and comprehensive community awareness programs that exceed regulatory minimums.

Economic Feasibility of Advanced HF Production Methods

The economic viability of advanced hydrofluoric acid (HF) production methods represents a critical consideration for industrial stakeholders. Current analysis indicates that while traditional HF production processes using fluorspar and sulfuric acid remain cost-effective at scale, they face increasing economic pressures from environmental compliance costs and raw material price volatility.

Advanced production methods, particularly those employing fluorosilicic acid (FSA) as a feedstock, demonstrate promising economic potential with calculated ROI periods of 3-5 years for greenfield installations. Capital expenditure requirements for these advanced systems typically range from $15-25 million for facilities producing 5,000-10,000 metric tons annually, representing a 15-20% premium over conventional systems.

Operating expenditure comparisons reveal that advanced methods may reduce energy consumption by up to 30% and decrease waste management costs by 25-40% compared to traditional processes. These efficiency gains partially offset the higher initial investment costs, particularly in regions with stringent environmental regulations or high energy prices.

Sensitivity analysis of production economics shows that feedstock costs remain the dominant factor, constituting 40-60% of total production costs across all methods. Advanced catalytic processes that improve conversion efficiency by 5-10% can therefore significantly impact overall economic performance, potentially reducing per-unit production costs by $50-100 per ton.

Market pricing trends indicate that premium-grade HF produced via advanced methods commands a 10-15% price premium in specialized applications such as semiconductor manufacturing and pharmaceutical synthesis, further enhancing economic feasibility in these high-value segments.

Geographical considerations substantially impact economic viability, with regions offering subsidies for cleaner industrial processes potentially reducing payback periods by 1-2 years. Additionally, proximity to raw material sources can reduce logistics costs by 5-15%, significantly affecting overall production economics.

Long-term economic modeling suggests that regulatory trends toward stricter emissions controls will continue to improve the relative economic position of advanced production methods, with projected cost advantages increasing from current levels of 5-10% to potentially 15-25% within the next decade as carbon pricing and waste disposal costs escalate for conventional processes.

Advanced production methods, particularly those employing fluorosilicic acid (FSA) as a feedstock, demonstrate promising economic potential with calculated ROI periods of 3-5 years for greenfield installations. Capital expenditure requirements for these advanced systems typically range from $15-25 million for facilities producing 5,000-10,000 metric tons annually, representing a 15-20% premium over conventional systems.

Operating expenditure comparisons reveal that advanced methods may reduce energy consumption by up to 30% and decrease waste management costs by 25-40% compared to traditional processes. These efficiency gains partially offset the higher initial investment costs, particularly in regions with stringent environmental regulations or high energy prices.

Sensitivity analysis of production economics shows that feedstock costs remain the dominant factor, constituting 40-60% of total production costs across all methods. Advanced catalytic processes that improve conversion efficiency by 5-10% can therefore significantly impact overall economic performance, potentially reducing per-unit production costs by $50-100 per ton.

Market pricing trends indicate that premium-grade HF produced via advanced methods commands a 10-15% price premium in specialized applications such as semiconductor manufacturing and pharmaceutical synthesis, further enhancing economic feasibility in these high-value segments.

Geographical considerations substantially impact economic viability, with regions offering subsidies for cleaner industrial processes potentially reducing payback periods by 1-2 years. Additionally, proximity to raw material sources can reduce logistics costs by 5-15%, significantly affecting overall production economics.

Long-term economic modeling suggests that regulatory trends toward stricter emissions controls will continue to improve the relative economic position of advanced production methods, with projected cost advantages increasing from current levels of 5-10% to potentially 15-25% within the next decade as carbon pricing and waste disposal costs escalate for conventional processes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!