Lifecycle Cost Comparison Of Electrochemical Hydrogen Compressors And Mechanical Compressors

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Hydrogen Compression Technology Background and Objectives

Hydrogen compression technology has evolved significantly over the past century, with mechanical compression methods dominating the industrial landscape since the early 1900s. These traditional systems, primarily reciprocating and centrifugal compressors, have been the backbone of hydrogen infrastructure across various applications including petroleum refining, ammonia production, and more recently, fuel cell technologies. The historical development trajectory shows a consistent focus on improving efficiency, reliability, and cost-effectiveness of these mechanical systems.

In recent decades, electrochemical hydrogen compression (EHC) has emerged as a promising alternative technology. First conceptualized in the 1970s but only gaining significant research momentum in the early 2000s, EHC leverages principles similar to those used in proton exchange membrane fuel cells to compress hydrogen without moving parts. This represents a paradigm shift in compression technology, potentially addressing many limitations inherent to mechanical systems.

The global push toward hydrogen as a clean energy carrier has accelerated development in compression technologies. With projections indicating hydrogen could meet up to 24% of global energy demand by 2050, efficient and cost-effective compression solutions have become critical enablers for the hydrogen economy. This transition necessitates a comprehensive reassessment of existing compression technologies against emerging alternatives.

Current technical objectives in hydrogen compression focus on several key parameters: achieving higher compression ratios (particularly for mobility applications requiring 350-700 bar), improving energy efficiency, reducing capital and operational costs, enhancing reliability, and minimizing maintenance requirements. Additionally, as hydrogen production scales up, compression systems must demonstrate compatibility with fluctuating renewable energy sources and variable hydrogen production rates.

The lifecycle cost comparison between electrochemical and mechanical hydrogen compressors represents a crucial analysis for industry stakeholders. While mechanical compressors benefit from technological maturity and established supply chains, they face challenges related to efficiency losses, maintenance requirements, and reliability issues. Conversely, electrochemical compressors promise higher efficiency, fewer moving parts, and potentially lower maintenance costs, but currently face higher capital costs and durability concerns.

Understanding the total cost of ownership across the entire lifecycle of these competing technologies will inform strategic investment decisions and technology development priorities. This analysis must account for capital expenditure, operational costs including energy consumption, maintenance requirements, replacement schedules, and end-of-life considerations across various deployment scenarios and scales.

In recent decades, electrochemical hydrogen compression (EHC) has emerged as a promising alternative technology. First conceptualized in the 1970s but only gaining significant research momentum in the early 2000s, EHC leverages principles similar to those used in proton exchange membrane fuel cells to compress hydrogen without moving parts. This represents a paradigm shift in compression technology, potentially addressing many limitations inherent to mechanical systems.

The global push toward hydrogen as a clean energy carrier has accelerated development in compression technologies. With projections indicating hydrogen could meet up to 24% of global energy demand by 2050, efficient and cost-effective compression solutions have become critical enablers for the hydrogen economy. This transition necessitates a comprehensive reassessment of existing compression technologies against emerging alternatives.

Current technical objectives in hydrogen compression focus on several key parameters: achieving higher compression ratios (particularly for mobility applications requiring 350-700 bar), improving energy efficiency, reducing capital and operational costs, enhancing reliability, and minimizing maintenance requirements. Additionally, as hydrogen production scales up, compression systems must demonstrate compatibility with fluctuating renewable energy sources and variable hydrogen production rates.

The lifecycle cost comparison between electrochemical and mechanical hydrogen compressors represents a crucial analysis for industry stakeholders. While mechanical compressors benefit from technological maturity and established supply chains, they face challenges related to efficiency losses, maintenance requirements, and reliability issues. Conversely, electrochemical compressors promise higher efficiency, fewer moving parts, and potentially lower maintenance costs, but currently face higher capital costs and durability concerns.

Understanding the total cost of ownership across the entire lifecycle of these competing technologies will inform strategic investment decisions and technology development priorities. This analysis must account for capital expenditure, operational costs including energy consumption, maintenance requirements, replacement schedules, and end-of-life considerations across various deployment scenarios and scales.

Market Analysis for Hydrogen Compression Solutions

The global hydrogen compression market is experiencing significant growth, driven by the increasing adoption of hydrogen as a clean energy carrier across various industries. The market size was valued at approximately 1.5 billion USD in 2021 and is projected to reach 2.7 billion USD by 2028, representing a compound annual growth rate of 8.7%. This growth trajectory is primarily fueled by expanding hydrogen infrastructure development, particularly in regions committed to decarbonization targets.

Mechanical compressors currently dominate the market with over 85% market share, owing to their established technology, widespread availability, and industry familiarity. However, electrochemical hydrogen compressors (EHCs) are emerging as a disruptive technology, expected to grow at a faster rate of approximately 12% annually through 2030, albeit from a smaller base.

The market segmentation reveals distinct application sectors with varying compression requirements. Industrial applications, including refining and chemical production, constitute the largest segment at 45% of the market, followed by mobility applications at 30%, which includes hydrogen refueling stations requiring high-pressure compression. Energy storage applications represent 15% of the market, with the remainder distributed across specialized applications.

Regional analysis indicates that Asia-Pacific leads the market with 38% share, driven by China's aggressive hydrogen strategy and Japan's advanced hydrogen economy initiatives. Europe follows closely at 32%, supported by strong policy frameworks promoting hydrogen adoption, particularly in Germany, France, and the Netherlands. North America accounts for 25% of the market, with significant growth potential as the U.S. implements its hydrogen roadmap.

Customer requirements are evolving rapidly, with increasing emphasis on total cost of ownership rather than initial capital expenditure. End-users are prioritizing energy efficiency, reliability, and maintenance costs—areas where EHCs potentially offer advantages over mechanical systems. Additionally, there is growing demand for compression solutions that can handle variable input pressures and flow rates to accommodate renewable hydrogen production's intermittent nature.

Market barriers include high capital costs for both technologies, with mechanical compressors typically requiring investments of $500,000 to $2 million for industrial-scale installations. EHCs face challenges related to limited production scale and higher upfront costs, though this gap is narrowing. Technical limitations such as compression ratios and throughput capacity also remain significant market constraints, particularly for EHCs in high-volume applications.

The competitive landscape is characterized by established industrial gas equipment manufacturers dominating the mechanical compressor segment, while EHC technology is being pioneered by specialized technology companies and startups, many backed by strategic investments from energy majors seeking to diversify their hydrogen technology portfolios.

Mechanical compressors currently dominate the market with over 85% market share, owing to their established technology, widespread availability, and industry familiarity. However, electrochemical hydrogen compressors (EHCs) are emerging as a disruptive technology, expected to grow at a faster rate of approximately 12% annually through 2030, albeit from a smaller base.

The market segmentation reveals distinct application sectors with varying compression requirements. Industrial applications, including refining and chemical production, constitute the largest segment at 45% of the market, followed by mobility applications at 30%, which includes hydrogen refueling stations requiring high-pressure compression. Energy storage applications represent 15% of the market, with the remainder distributed across specialized applications.

Regional analysis indicates that Asia-Pacific leads the market with 38% share, driven by China's aggressive hydrogen strategy and Japan's advanced hydrogen economy initiatives. Europe follows closely at 32%, supported by strong policy frameworks promoting hydrogen adoption, particularly in Germany, France, and the Netherlands. North America accounts for 25% of the market, with significant growth potential as the U.S. implements its hydrogen roadmap.

Customer requirements are evolving rapidly, with increasing emphasis on total cost of ownership rather than initial capital expenditure. End-users are prioritizing energy efficiency, reliability, and maintenance costs—areas where EHCs potentially offer advantages over mechanical systems. Additionally, there is growing demand for compression solutions that can handle variable input pressures and flow rates to accommodate renewable hydrogen production's intermittent nature.

Market barriers include high capital costs for both technologies, with mechanical compressors typically requiring investments of $500,000 to $2 million for industrial-scale installations. EHCs face challenges related to limited production scale and higher upfront costs, though this gap is narrowing. Technical limitations such as compression ratios and throughput capacity also remain significant market constraints, particularly for EHCs in high-volume applications.

The competitive landscape is characterized by established industrial gas equipment manufacturers dominating the mechanical compressor segment, while EHC technology is being pioneered by specialized technology companies and startups, many backed by strategic investments from energy majors seeking to diversify their hydrogen technology portfolios.

Current Status and Challenges in Hydrogen Compression

Hydrogen compression technology has evolved significantly over the past decades, with mechanical compressors dominating the market since the early industrial applications of hydrogen. Currently, two primary compression technologies exist in the hydrogen value chain: mechanical compressors (including reciprocating, diaphragm, and centrifugal types) and electrochemical hydrogen compressors (EHCs). Mechanical compressors represent approximately 95% of the installed base globally, with mature supply chains and established operational protocols.

The global hydrogen compression market is estimated at $5.2 billion as of 2023, with a projected CAGR of 6.8% through 2030, driven primarily by the expanding hydrogen economy. Mechanical compressors face significant challenges including high maintenance requirements, substantial energy consumption (accounting for 10-15% of total hydrogen production energy), and reliability issues at high pressures. These systems typically achieve 65-75% efficiency under optimal conditions but often operate below these levels in real-world applications.

Electrochemical hydrogen compressors, while representing only about 5% of current installations, have demonstrated promising technical advantages. EHCs can achieve theoretical efficiencies of up to 90% and operate with significantly fewer moving parts, potentially reducing maintenance requirements by 60-70% compared to mechanical alternatives. However, they currently face limitations in throughput capacity, with most commercial units limited to 100 kg/day or less, whereas mechanical systems can handle several tons daily.

A critical challenge for both technologies is durability under varying operational conditions. Mechanical compressors typically require major overhauls every 6,000-8,000 operating hours, with component replacement costs representing 15-25% of initial capital expenditure annually. EHCs face different durability challenges, primarily membrane degradation and catalyst poisoning, with current systems demonstrating 10,000-15,000 hour lifespans before significant performance degradation occurs.

Cost structures differ substantially between the technologies. Mechanical compressors have lower upfront capital costs ($1,000-$2,500 per kg/day capacity) but higher operational expenses, while EHCs feature higher initial investment ($3,000-$5,000 per kg/day capacity) but potentially lower lifetime operational costs. This creates a complex lifecycle cost comparison that varies significantly based on application scale, duty cycle, and required pressure ratios.

Geographical distribution of technology development shows concentration of mechanical compressor expertise in Europe, North America, and Japan, while EHC development is emerging strongly in North America, Germany, and increasingly in China and South Korea. This regional specialization influences both technology availability and total cost of ownership in different markets.

The global hydrogen compression market is estimated at $5.2 billion as of 2023, with a projected CAGR of 6.8% through 2030, driven primarily by the expanding hydrogen economy. Mechanical compressors face significant challenges including high maintenance requirements, substantial energy consumption (accounting for 10-15% of total hydrogen production energy), and reliability issues at high pressures. These systems typically achieve 65-75% efficiency under optimal conditions but often operate below these levels in real-world applications.

Electrochemical hydrogen compressors, while representing only about 5% of current installations, have demonstrated promising technical advantages. EHCs can achieve theoretical efficiencies of up to 90% and operate with significantly fewer moving parts, potentially reducing maintenance requirements by 60-70% compared to mechanical alternatives. However, they currently face limitations in throughput capacity, with most commercial units limited to 100 kg/day or less, whereas mechanical systems can handle several tons daily.

A critical challenge for both technologies is durability under varying operational conditions. Mechanical compressors typically require major overhauls every 6,000-8,000 operating hours, with component replacement costs representing 15-25% of initial capital expenditure annually. EHCs face different durability challenges, primarily membrane degradation and catalyst poisoning, with current systems demonstrating 10,000-15,000 hour lifespans before significant performance degradation occurs.

Cost structures differ substantially between the technologies. Mechanical compressors have lower upfront capital costs ($1,000-$2,500 per kg/day capacity) but higher operational expenses, while EHCs feature higher initial investment ($3,000-$5,000 per kg/day capacity) but potentially lower lifetime operational costs. This creates a complex lifecycle cost comparison that varies significantly based on application scale, duty cycle, and required pressure ratios.

Geographical distribution of technology development shows concentration of mechanical compressor expertise in Europe, North America, and Japan, while EHC development is emerging strongly in North America, Germany, and increasingly in China and South Korea. This regional specialization influences both technology availability and total cost of ownership in different markets.

Technical Comparison of EHC vs Mechanical Compressors

01 Electrochemical hydrogen compressor design and efficiency

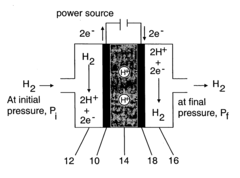

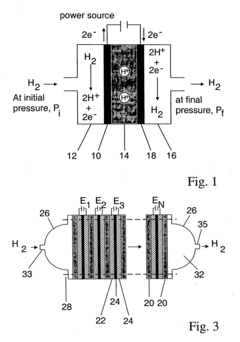

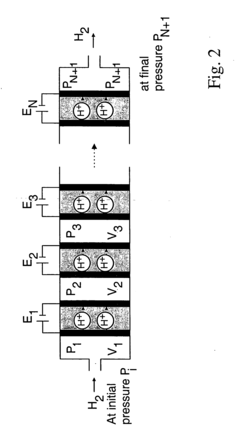

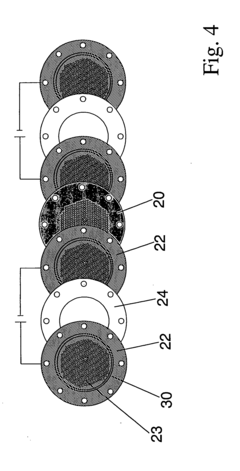

Electrochemical hydrogen compressors utilize electrochemical cells to compress hydrogen without moving parts, offering higher efficiency compared to mechanical alternatives. These systems can achieve compression through proton exchange membranes that selectively transport hydrogen ions across an electrolyte barrier. The design focuses on minimizing energy consumption while maximizing compression ratios, resulting in potentially lower operational costs over the system lifecycle.- Electrochemical hydrogen compression technology: Electrochemical hydrogen compressors utilize electrochemical cells to compress hydrogen without moving parts, offering advantages such as higher efficiency, lower maintenance requirements, and reduced noise compared to mechanical compressors. These systems use proton exchange membranes or similar technologies to transport hydrogen ions across an electrolyte barrier, allowing for compression without the mechanical wear associated with traditional compressors. This technology can achieve high compression ratios with lower energy consumption, potentially reducing lifecycle costs.

- Mechanical hydrogen compression systems: Mechanical hydrogen compressors rely on physical compression mechanisms such as pistons, diaphragms, or rotary components to increase hydrogen pressure. While these systems have been the traditional approach to hydrogen compression, they face challenges including higher maintenance costs due to moving parts, increased wear and tear, and lower efficiency compared to newer technologies. The lifecycle cost analysis of mechanical compressors must account for regular maintenance, part replacements, and higher energy consumption over the operational lifespan.

- Lifecycle cost comparison and economic analysis: Comparative analyses of electrochemical and mechanical hydrogen compression systems reveal significant differences in lifecycle costs. While electrochemical systems typically have higher initial capital costs, they often demonstrate lower operational expenses due to reduced energy consumption, minimal maintenance requirements, and longer service life. Mechanical compressors generally have lower upfront costs but incur higher operational and maintenance expenses over time. The total cost of ownership analysis includes factors such as energy efficiency, maintenance frequency, component replacement, system reliability, and operational lifespan.

- Energy efficiency and operational performance: Energy consumption represents a significant portion of the lifecycle cost for hydrogen compression systems. Electrochemical compressors typically demonstrate higher energy efficiency, particularly at higher compression ratios, compared to mechanical alternatives. This efficiency advantage translates to lower operational costs over the system lifespan. Performance metrics such as compression ratio capabilities, hydrogen purity maintenance, response to variable loads, and system durability under different operating conditions all impact the long-term economic viability of compression technologies.

- Integration with hydrogen infrastructure and applications: The selection between electrochemical and mechanical compression technologies is influenced by their integration requirements within broader hydrogen infrastructure. Factors affecting lifecycle costs include compatibility with hydrogen production methods, storage systems, and end-use applications. Electrochemical compressors may offer advantages in distributed hydrogen systems due to their scalability, while mechanical compressors might be more cost-effective in certain centralized applications. The overall system design, including balance of plant components, control systems, and safety measures, significantly impacts the total lifecycle cost of hydrogen compression solutions.

02 Mechanical hydrogen compressor technologies and maintenance

Mechanical hydrogen compressors rely on traditional compression methods using pistons, diaphragms, or other moving components. While these systems have been the industry standard, they typically require more frequent maintenance due to wear and tear of moving parts. The lifecycle costs include regular replacement of seals, lubricants, and mechanical components, as well as higher energy consumption compared to newer electrochemical alternatives.Expand Specific Solutions03 Lifecycle cost analysis and comparison methodologies

Comprehensive lifecycle cost analysis methodologies have been developed to compare electrochemical and mechanical hydrogen compression technologies. These analyses consider capital expenditure, operational costs including energy consumption, maintenance requirements, component replacement schedules, and system longevity. The total cost of ownership calculations reveal that while electrochemical systems typically have higher upfront costs, they often demonstrate lower long-term operational expenses.Expand Specific Solutions04 Energy efficiency and power consumption optimization

Energy consumption represents a significant portion of lifecycle costs for hydrogen compression systems. Innovations focus on optimizing power consumption through improved materials, system design, and operational parameters. Electrochemical compressors typically demonstrate higher electrical efficiency, particularly at lower compression ratios, while mechanical systems may be more efficient for certain high-pressure applications. Advanced control systems can further optimize energy usage based on demand patterns.Expand Specific Solutions05 Integration with renewable energy and hydrogen infrastructure

The integration of hydrogen compression systems with renewable energy sources significantly impacts lifecycle costs. Systems designed to operate efficiently with variable power inputs from solar or wind can reduce operational expenses. Additionally, the role of compression technology within the broader hydrogen infrastructure affects overall economics. Considerations include scalability, compatibility with production and storage systems, and adaptability to varying hydrogen purity levels.Expand Specific Solutions

Key Industry Players in Hydrogen Compression Market

The electrochemical hydrogen compressor (EHC) market is in its early growth phase, with mechanical compressors still dominating the hydrogen compression landscape. The global hydrogen compressor market is projected to expand significantly as hydrogen gains importance in clean energy transitions. Technologically, EHCs are advancing rapidly but remain less mature than traditional mechanical systems. Companies like Skyre, HyET Holding, and H2gremm are pioneering EHC technologies with promising lifecycle cost advantages, while established players such as Air Liquide, Shell, and Plug Power are investing in both technologies. Research institutions including Xi'an Jiaotong University, Zhejiang University, and Korea Institute of Machinery & Materials are contributing significant advancements in electrochemical compression technology, accelerating the transition toward more efficient and cost-effective hydrogen compression solutions.

Air Liquide SA

Technical Solution: Air Liquide has developed comprehensive lifecycle cost analysis frameworks for hydrogen compression technologies, with particular focus on electrochemical hydrogen compressors (EHCs). Their approach integrates capital expenditure, operational costs, maintenance requirements, and system longevity across the entire lifecycle. Air Liquide's technical solution involves a hybrid compression system that strategically combines EHCs for lower pressure stages (up to 30-50 bar) with mechanical compressors for higher pressure requirements. This configuration optimizes energy efficiency while minimizing maintenance costs. Their proprietary EHC technology utilizes advanced proton exchange membranes with enhanced conductivity and durability, achieving compression efficiencies of 60-70% compared to 45-55% in conventional systems. Air Liquide has implemented real-time monitoring systems that track performance metrics and predict maintenance needs, extending system lifetime by approximately 20-30% compared to traditional mechanical compression systems.

Strengths: Superior energy efficiency in low-pressure applications, reduced maintenance requirements, and longer operational lifetime. Their hybrid approach leverages the advantages of both technologies while minimizing their respective weaknesses. Weaknesses: Higher initial capital costs compared to purely mechanical systems, and performance limitations in high-pressure applications requiring supplementary mechanical compression.

Plug Power, Inc.

Technical Solution: Plug Power has pioneered an integrated lifecycle cost assessment methodology specifically for electrochemical hydrogen compression technologies. Their technical solution centers on a modular EHC system that can be scaled according to capacity requirements, offering flexibility across various industrial applications. The company's proprietary membrane electrode assembly (MEA) technology features enhanced proton conductivity and mechanical stability, enabling compression ratios exceeding 1000:1 in multi-stage configurations. Their EHCs operate with no moving parts, eliminating oil contamination risks and reducing maintenance frequency to annual intervals rather than quarterly requirements typical of mechanical systems. Plug Power's lifecycle analysis demonstrates that while their EHC systems have approximately 30-40% higher initial capital costs, the total cost of ownership over a 10-year period is typically 15-25% lower than equivalent mechanical compression systems due to energy savings of 20-30% and maintenance cost reductions of up to 60%. The company has also developed predictive maintenance algorithms that optimize performance and extend system lifetime.

Strengths: Modular design allows for flexible deployment and scaling; elimination of oil contamination provides higher hydrogen purity; significantly reduced maintenance requirements translate to higher system availability (>98%). Weaknesses: Higher upfront capital costs create adoption barriers; current technology has limitations in very high-pressure applications (>700 bar); membrane degradation can occur under certain operating conditions, potentially reducing efficiency over time.

Critical Patents and Innovations in Hydrogen Compression

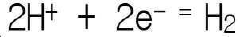

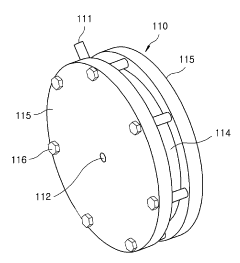

Electrochemical hydrogen compressor

PatentInactiveUS20040211679A1

Innovation

- An electrochemical hydrogen compression apparatus and process using a membrane electrolyte cell assembly with a proton-conducting electrolyte membrane, anode, and cathode, along with planar gas distribution and support plates, connected in series to achieve high-pressure differentials up to 12,000 psi, leveraging electrochemical reactions to oxidize and reduce hydrogen across the membrane.

Electrochemical hydrogen compressor

PatentActiveKR1020210001556A

Innovation

- An electrochemical hydrogen compressor with a stacked anode and cathode structure, using a hydrogen ion permeable membrane, allows for high-efficiency hydrogen compression and pumping by facilitating oxidation and reduction reactions, reducing system size and energy consumption.

Total Cost of Ownership Analysis Framework

The Total Cost of Ownership (TCO) analysis framework provides a comprehensive methodology for evaluating the complete economic impact of hydrogen compression technologies throughout their operational lifespan. This framework extends beyond initial capital expenditure to encompass all costs incurred during acquisition, operation, maintenance, and eventual decommissioning of both electrochemical hydrogen compressors (EHCs) and mechanical compressors.

The framework begins with capital expenditure assessment, including equipment procurement costs, installation expenses, and necessary infrastructure modifications. For EHCs, this typically involves the electrochemical stack, power electronics, and control systems, while mechanical compressors require the compressor unit, motors, and potentially more extensive foundation work.

Operational expenditures form the second major component, with energy consumption representing the most significant ongoing cost. The framework quantifies electricity consumption patterns under various load profiles, accounting for the higher electrical efficiency of EHCs at partial loads compared to mechanical compressors' relatively constant energy requirements regardless of throughput.

Maintenance costs are structured into scheduled and unscheduled categories. The analysis captures the fundamental difference between EHCs' minimal moving parts requiring less frequent maintenance versus mechanical compressors' regular lubrication, seal replacements, and overhauls. This includes labor costs, replacement parts inventory, and associated downtime impacts.

The framework incorporates reliability metrics through mean time between failures (MTBF) and mean time to repair (MTTR) calculations, translating these into financial implications of production losses. EHCs generally demonstrate superior reliability due to their solid-state nature, potentially offsetting their higher initial capital costs through reduced downtime expenses.

Environmental compliance costs are also factored in, including potential carbon taxation, emissions permits, and waste disposal considerations. This becomes increasingly relevant as regulatory frameworks evolve toward stricter emissions standards, potentially favoring the cleaner operation of EHCs.

Finally, the framework applies appropriate financial modeling techniques including discounted cash flow analysis, net present value calculations, and internal rate of return assessments. These tools enable fair comparison between technologies with different cost structures and operational lifespans, typically 10-15 years for mechanical compressors versus the potentially longer service life of properly maintained EHCs.

This comprehensive TCO framework provides decision-makers with a holistic economic perspective beyond simple payback period calculations, revealing the true long-term financial implications of hydrogen compression technology choices.

The framework begins with capital expenditure assessment, including equipment procurement costs, installation expenses, and necessary infrastructure modifications. For EHCs, this typically involves the electrochemical stack, power electronics, and control systems, while mechanical compressors require the compressor unit, motors, and potentially more extensive foundation work.

Operational expenditures form the second major component, with energy consumption representing the most significant ongoing cost. The framework quantifies electricity consumption patterns under various load profiles, accounting for the higher electrical efficiency of EHCs at partial loads compared to mechanical compressors' relatively constant energy requirements regardless of throughput.

Maintenance costs are structured into scheduled and unscheduled categories. The analysis captures the fundamental difference between EHCs' minimal moving parts requiring less frequent maintenance versus mechanical compressors' regular lubrication, seal replacements, and overhauls. This includes labor costs, replacement parts inventory, and associated downtime impacts.

The framework incorporates reliability metrics through mean time between failures (MTBF) and mean time to repair (MTTR) calculations, translating these into financial implications of production losses. EHCs generally demonstrate superior reliability due to their solid-state nature, potentially offsetting their higher initial capital costs through reduced downtime expenses.

Environmental compliance costs are also factored in, including potential carbon taxation, emissions permits, and waste disposal considerations. This becomes increasingly relevant as regulatory frameworks evolve toward stricter emissions standards, potentially favoring the cleaner operation of EHCs.

Finally, the framework applies appropriate financial modeling techniques including discounted cash flow analysis, net present value calculations, and internal rate of return assessments. These tools enable fair comparison between technologies with different cost structures and operational lifespans, typically 10-15 years for mechanical compressors versus the potentially longer service life of properly maintained EHCs.

This comprehensive TCO framework provides decision-makers with a holistic economic perspective beyond simple payback period calculations, revealing the true long-term financial implications of hydrogen compression technology choices.

Environmental Impact and Sustainability Considerations

The environmental impact assessment of hydrogen compression technologies reveals significant differences between electrochemical hydrogen compressors (EHCs) and mechanical compressors. EHCs demonstrate superior environmental performance with near-zero direct emissions during operation, as they rely solely on electricity without requiring lubricants or coolants that could potentially leak and cause environmental contamination. This advantage becomes particularly pronounced when powered by renewable energy sources, creating a truly carbon-neutral compression solution.

In contrast, mechanical compressors generate considerable noise pollution, vibration, and potential refrigerant or lubricant leakages that may contribute to environmental degradation. Their operation typically results in higher carbon emissions, especially when powered by conventional electricity grids dominated by fossil fuels. The maintenance activities for mechanical systems also generate waste materials including used oils and worn components that require proper disposal.

From a lifecycle perspective, EHC systems demonstrate lower environmental impact during operation but face challenges in the manufacturing and end-of-life phases. The production of specialized materials for EHC membranes and catalysts often involves energy-intensive processes and rare earth elements with their own extraction-related environmental concerns. However, recent advancements in material science are progressively reducing these impacts through more sustainable manufacturing techniques.

Water consumption represents another critical environmental consideration. While mechanical compressors may require water for cooling systems, EHCs potentially generate pure water as a byproduct of their electrochemical processes, offering a positive environmental externality in water-stressed regions. This water recovery capability could be particularly valuable in integrated hydrogen energy systems.

The sustainability profile of both technologies is heavily influenced by their energy efficiency and durability. Though EHCs currently demonstrate lower efficiency than their mechanical counterparts, their efficiency is expected to improve significantly with ongoing technological development. The longer operational lifespan of EHCs, with fewer moving parts subject to wear, translates to reduced resource consumption for replacement parts and maintenance over time.

Carbon footprint analysis across the entire lifecycle reveals that EHCs can achieve carbon payback more rapidly than mechanical systems when powered by renewable energy. This advantage becomes increasingly important as global energy systems transition toward decarbonization, positioning EHCs as a more future-proof technology aligned with stringent environmental regulations and sustainability goals that are likely to become more prevalent in coming decades.

In contrast, mechanical compressors generate considerable noise pollution, vibration, and potential refrigerant or lubricant leakages that may contribute to environmental degradation. Their operation typically results in higher carbon emissions, especially when powered by conventional electricity grids dominated by fossil fuels. The maintenance activities for mechanical systems also generate waste materials including used oils and worn components that require proper disposal.

From a lifecycle perspective, EHC systems demonstrate lower environmental impact during operation but face challenges in the manufacturing and end-of-life phases. The production of specialized materials for EHC membranes and catalysts often involves energy-intensive processes and rare earth elements with their own extraction-related environmental concerns. However, recent advancements in material science are progressively reducing these impacts through more sustainable manufacturing techniques.

Water consumption represents another critical environmental consideration. While mechanical compressors may require water for cooling systems, EHCs potentially generate pure water as a byproduct of their electrochemical processes, offering a positive environmental externality in water-stressed regions. This water recovery capability could be particularly valuable in integrated hydrogen energy systems.

The sustainability profile of both technologies is heavily influenced by their energy efficiency and durability. Though EHCs currently demonstrate lower efficiency than their mechanical counterparts, their efficiency is expected to improve significantly with ongoing technological development. The longer operational lifespan of EHCs, with fewer moving parts subject to wear, translates to reduced resource consumption for replacement parts and maintenance over time.

Carbon footprint analysis across the entire lifecycle reveals that EHCs can achieve carbon payback more rapidly than mechanical systems when powered by renewable energy. This advantage becomes increasingly important as global energy systems transition toward decarbonization, positioning EHCs as a more future-proof technology aligned with stringent environmental regulations and sustainability goals that are likely to become more prevalent in coming decades.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!