Swapping Out Oil-Lubricated Compressors: Retrofit Strategies With Electrochemical Units

SEP 3, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Electrochemical Compressor Technology Evolution and Objectives

Electrochemical compressor technology represents a significant paradigm shift in the compression industry, evolving from theoretical concepts in the mid-20th century to practical applications in the 21st century. The fundamental principle behind this technology leverages electrochemical reactions to transport and compress gases without mechanical moving parts, offering a revolutionary alternative to conventional oil-lubricated compressors.

The evolution of electrochemical compressors began with early research on proton exchange membranes in the 1960s, initially developed for fuel cell applications. By the 1990s, researchers recognized the potential to reverse this process for compression purposes. The first laboratory demonstrations emerged in the early 2000s, showing the feasibility of electrochemical hydrogen compression. Significant breakthroughs occurred between 2010-2015 when researchers successfully expanded the technology to handle refrigerants and other industrial gases.

Recent technological advancements have focused on improving membrane materials, electrode catalysts, and system integration. Modern electrochemical compressors utilize advanced polymer electrolyte membranes with enhanced ion conductivity and mechanical stability. Catalyst development has progressed from platinum-based materials to more efficient and cost-effective alternatives, while system designs have evolved to address thermal management and pressure differential challenges.

The primary objective of electrochemical compressor technology is to provide a more sustainable, energy-efficient alternative to conventional mechanical compression systems. Specific goals include eliminating oil contamination issues, reducing maintenance requirements, and minimizing noise and vibration. The technology aims to achieve compression ratios comparable to traditional systems while consuming less energy, particularly in applications requiring precise temperature control.

From an environmental perspective, electrochemical compressors target significant reductions in direct and indirect greenhouse gas emissions. By eliminating oil lubrication and associated leakage risks, these systems can prevent refrigerant contamination and subsequent efficiency losses. Additionally, the technology seeks to enable more effective use of natural refrigerants with lower global warming potential.

Looking forward, the technology roadmap focuses on scaling up electrochemical compressors for commercial and industrial applications, improving durability under varied operating conditions, and reducing manufacturing costs through materials innovation and production optimization. The ultimate objective is to establish electrochemical compression as a mainstream technology that can effectively replace conventional oil-lubricated systems across multiple sectors, including HVAC, refrigeration, and industrial gas handling.

The evolution of electrochemical compressors began with early research on proton exchange membranes in the 1960s, initially developed for fuel cell applications. By the 1990s, researchers recognized the potential to reverse this process for compression purposes. The first laboratory demonstrations emerged in the early 2000s, showing the feasibility of electrochemical hydrogen compression. Significant breakthroughs occurred between 2010-2015 when researchers successfully expanded the technology to handle refrigerants and other industrial gases.

Recent technological advancements have focused on improving membrane materials, electrode catalysts, and system integration. Modern electrochemical compressors utilize advanced polymer electrolyte membranes with enhanced ion conductivity and mechanical stability. Catalyst development has progressed from platinum-based materials to more efficient and cost-effective alternatives, while system designs have evolved to address thermal management and pressure differential challenges.

The primary objective of electrochemical compressor technology is to provide a more sustainable, energy-efficient alternative to conventional mechanical compression systems. Specific goals include eliminating oil contamination issues, reducing maintenance requirements, and minimizing noise and vibration. The technology aims to achieve compression ratios comparable to traditional systems while consuming less energy, particularly in applications requiring precise temperature control.

From an environmental perspective, electrochemical compressors target significant reductions in direct and indirect greenhouse gas emissions. By eliminating oil lubrication and associated leakage risks, these systems can prevent refrigerant contamination and subsequent efficiency losses. Additionally, the technology seeks to enable more effective use of natural refrigerants with lower global warming potential.

Looking forward, the technology roadmap focuses on scaling up electrochemical compressors for commercial and industrial applications, improving durability under varied operating conditions, and reducing manufacturing costs through materials innovation and production optimization. The ultimate objective is to establish electrochemical compression as a mainstream technology that can effectively replace conventional oil-lubricated systems across multiple sectors, including HVAC, refrigeration, and industrial gas handling.

Market Demand Analysis for Oil-Free Compression Solutions

The global market for oil-free compression solutions has witnessed significant growth in recent years, driven primarily by increasing environmental regulations, rising maintenance costs of traditional oil-lubricated systems, and growing awareness of contamination risks in sensitive applications. According to industry reports, the oil-free compressor market is projected to grow at a CAGR of 4.2% from 2022 to 2028, reaching a market value of $16.2 billion by the end of the forecast period.

The demand for retrofitting existing oil-lubricated compressors with electrochemical units is particularly strong in industries where product purity is paramount. The food and beverage sector represents approximately 22% of the current market demand, as manufacturers seek to eliminate the risk of oil contamination in processing environments. Similarly, the pharmaceutical industry accounts for 18% of market demand, driven by stringent regulatory requirements for clean air in drug manufacturing processes.

Healthcare facilities are increasingly adopting oil-free compression technologies, with hospitals and medical device manufacturers constituting 15% of the market. The electronics manufacturing sector, particularly semiconductor fabrication, represents another 14% of demand due to the critical need for contaminant-free compressed air in clean room environments.

Geographically, North America and Europe currently lead the market for oil-free compression solutions, collectively accounting for 58% of global demand. However, the Asia-Pacific region is experiencing the fastest growth rate at 6.1% annually, primarily driven by rapid industrialization in China and India, along with increasing adoption of stringent environmental standards across the region.

A key market driver is the total cost of ownership (TCO) advantage that electrochemical units offer over traditional oil-lubricated systems. While initial investment costs for electrochemical units are typically 30-40% higher, end-users report average maintenance cost reductions of 45% and energy efficiency improvements of 15-20% over the equipment lifecycle, resulting in a typical ROI period of 2.5-3 years.

Customer surveys indicate that reliability and reduced downtime are primary considerations for industrial buyers, with 67% of purchasing decision-makers citing these factors as "extremely important." Environmental compliance ranks second at 58%, followed by energy efficiency at 52%. This suggests that successful market penetration strategies should emphasize operational reliability and compliance benefits alongside long-term cost advantages.

The retrofit market specifically presents substantial opportunities, as approximately 78% of the installed base of industrial compressors worldwide still uses oil-lubricated technology. With average industrial compressor lifespans of 15-20 years, the retrofit market is expected to grow at 5.7% annually through 2030, outpacing the overall market growth rate.

The demand for retrofitting existing oil-lubricated compressors with electrochemical units is particularly strong in industries where product purity is paramount. The food and beverage sector represents approximately 22% of the current market demand, as manufacturers seek to eliminate the risk of oil contamination in processing environments. Similarly, the pharmaceutical industry accounts for 18% of market demand, driven by stringent regulatory requirements for clean air in drug manufacturing processes.

Healthcare facilities are increasingly adopting oil-free compression technologies, with hospitals and medical device manufacturers constituting 15% of the market. The electronics manufacturing sector, particularly semiconductor fabrication, represents another 14% of demand due to the critical need for contaminant-free compressed air in clean room environments.

Geographically, North America and Europe currently lead the market for oil-free compression solutions, collectively accounting for 58% of global demand. However, the Asia-Pacific region is experiencing the fastest growth rate at 6.1% annually, primarily driven by rapid industrialization in China and India, along with increasing adoption of stringent environmental standards across the region.

A key market driver is the total cost of ownership (TCO) advantage that electrochemical units offer over traditional oil-lubricated systems. While initial investment costs for electrochemical units are typically 30-40% higher, end-users report average maintenance cost reductions of 45% and energy efficiency improvements of 15-20% over the equipment lifecycle, resulting in a typical ROI period of 2.5-3 years.

Customer surveys indicate that reliability and reduced downtime are primary considerations for industrial buyers, with 67% of purchasing decision-makers citing these factors as "extremely important." Environmental compliance ranks second at 58%, followed by energy efficiency at 52%. This suggests that successful market penetration strategies should emphasize operational reliability and compliance benefits alongside long-term cost advantages.

The retrofit market specifically presents substantial opportunities, as approximately 78% of the installed base of industrial compressors worldwide still uses oil-lubricated technology. With average industrial compressor lifespans of 15-20 years, the retrofit market is expected to grow at 5.7% annually through 2030, outpacing the overall market growth rate.

Current State and Challenges in Electrochemical Compressor Development

Electrochemical compressors (ECCs) represent a paradigm shift in compression technology, operating on electrochemical principles rather than mechanical components. Currently, ECCs have reached commercial viability primarily in small-scale applications, with several companies offering solutions for refrigeration, heat pumps, and specialized gas compression needs. Laboratory prototypes have demonstrated compression ratios of 10:1 for hydrogen and 5:1 for other gases, with efficiencies ranging from 30-60% depending on operating conditions and gas type.

The global market for ECCs remains nascent but is experiencing accelerated growth, particularly in regions with stringent environmental regulations such as Europe and parts of Asia. Market penetration is strongest in specialized applications requiring oil-free operation, including medical devices, semiconductor manufacturing, and hydrogen fuel cell systems.

Despite promising advancements, several significant technical challenges impede widespread adoption of electrochemical compressors. Membrane durability remains a critical limitation, with current materials experiencing degradation under prolonged operation, especially at higher pressure differentials. Most commercial membranes maintain optimal performance for 5,000-10,000 hours, falling short of the 30,000+ hours expected from conventional compressors.

Energy efficiency presents another substantial hurdle. While ECCs eliminate mechanical losses, they introduce electrical conversion losses that can reduce overall system efficiency. Current systems typically require 1.2-1.8 kWh per kilogram of compressed gas, approximately 20-40% higher than optimized mechanical systems for equivalent applications.

Scalability constraints also limit broader implementation. Most commercially available ECCs operate effectively at capacities below 5 kW, with diminishing efficiency at larger scales due to heat management challenges and uneven current distribution across larger membrane surfaces. This restricts their application in industrial settings requiring substantial compression capacity.

Material costs remain prohibitively high for mass-market adoption. Platinum-based catalysts and specialized proton-exchange membranes contribute significantly to capital costs, currently positioning ECCs at 2-3 times the initial investment of comparable mechanical systems, despite potential lifetime operational savings.

Standardization and integration challenges further complicate retrofit applications. The absence of industry-wide standards for electrochemical compression systems creates compatibility issues when replacing conventional oil-lubricated compressors. Current retrofit solutions require substantial system modifications, including electrical infrastructure upgrades, control system replacements, and often complete redesign of thermal management systems.

The global market for ECCs remains nascent but is experiencing accelerated growth, particularly in regions with stringent environmental regulations such as Europe and parts of Asia. Market penetration is strongest in specialized applications requiring oil-free operation, including medical devices, semiconductor manufacturing, and hydrogen fuel cell systems.

Despite promising advancements, several significant technical challenges impede widespread adoption of electrochemical compressors. Membrane durability remains a critical limitation, with current materials experiencing degradation under prolonged operation, especially at higher pressure differentials. Most commercial membranes maintain optimal performance for 5,000-10,000 hours, falling short of the 30,000+ hours expected from conventional compressors.

Energy efficiency presents another substantial hurdle. While ECCs eliminate mechanical losses, they introduce electrical conversion losses that can reduce overall system efficiency. Current systems typically require 1.2-1.8 kWh per kilogram of compressed gas, approximately 20-40% higher than optimized mechanical systems for equivalent applications.

Scalability constraints also limit broader implementation. Most commercially available ECCs operate effectively at capacities below 5 kW, with diminishing efficiency at larger scales due to heat management challenges and uneven current distribution across larger membrane surfaces. This restricts their application in industrial settings requiring substantial compression capacity.

Material costs remain prohibitively high for mass-market adoption. Platinum-based catalysts and specialized proton-exchange membranes contribute significantly to capital costs, currently positioning ECCs at 2-3 times the initial investment of comparable mechanical systems, despite potential lifetime operational savings.

Standardization and integration challenges further complicate retrofit applications. The absence of industry-wide standards for electrochemical compression systems creates compatibility issues when replacing conventional oil-lubricated compressors. Current retrofit solutions require substantial system modifications, including electrical infrastructure upgrades, control system replacements, and often complete redesign of thermal management systems.

Retrofit Implementation Strategies for Existing Systems

01 Integration of electrochemical compressors in existing systems

Electrochemical compressors can be retrofitted into existing cooling or heating systems to improve energy efficiency and reduce environmental impact. These retrofit strategies involve replacing conventional mechanical compressors with electrochemical alternatives that operate on electrochemical principles rather than mechanical compression. The integration requires careful consideration of system compatibility, electrical requirements, and control systems to ensure optimal performance.- Electrochemical compressor design improvements: Innovations in electrochemical compressor designs focus on enhancing efficiency and performance. These improvements include optimized cell configurations, advanced electrode materials, and innovative membrane technologies that facilitate better ion transport. Such design enhancements allow for more efficient compression of working fluids while reducing energy consumption and improving overall system reliability for various applications including refrigeration and heat pump systems.

- Integration with existing HVAC systems: Retrofit strategies for incorporating electrochemical compressors into existing HVAC infrastructure involve specialized adaptation techniques and interface solutions. These approaches enable the replacement of conventional mechanical compressors with electrochemical alternatives while minimizing system modifications. The integration methods include compatible connection points, control system adaptations, and transitional components that allow for gradual system upgrades while maintaining operational continuity.

- Control systems and monitoring for retrofitted compressors: Advanced control and monitoring systems are essential for successfully retrofitted electrochemical compressors. These systems include specialized sensors, adaptive control algorithms, and diagnostic tools that optimize performance while ensuring compatibility with existing infrastructure. The control strategies enable real-time adjustment of operating parameters based on demand, environmental conditions, and system feedback, maximizing efficiency and extending equipment lifespan in retrofit applications.

- Energy efficiency optimization techniques: Retrofit strategies for electrochemical compressors emphasize energy efficiency through specialized optimization techniques. These include variable operating modes, energy recovery systems, and smart load management that adapt to changing conditions. By implementing these techniques, retrofitted systems can achieve significant energy savings compared to conventional compressors while maintaining or improving performance characteristics, making them economically viable alternatives in existing installations.

- Hybrid and transitional retrofit solutions: Hybrid retrofit approaches combine electrochemical compressor technology with conventional systems to create transitional solutions that ease the adoption process. These strategies include parallel operation configurations, modular replacement components, and phased implementation plans that allow for gradual system conversion. Such hybrid solutions mitigate risks associated with complete system overhauls while providing immediate efficiency benefits and allowing facilities to evaluate performance before full conversion.

02 Modular design approaches for retrofit applications

Modular design approaches facilitate the retrofit of electrochemical compressors into existing systems. These strategies involve developing standardized modules that can be easily installed in place of conventional components. Modular designs allow for phased implementation, reducing downtime and installation costs while providing flexibility for future upgrades or maintenance. This approach is particularly valuable for retrofitting older systems where complete replacement would be impractical or cost-prohibitive.Expand Specific Solutions03 Control system adaptation for electrochemical compressor retrofits

Retrofitting electrochemical compressors into existing systems requires adaptation of control systems to manage the different operating characteristics. These strategies involve developing interfaces between existing building management systems and the electrochemical compressor controls, implementing new sensors and monitoring equipment, and updating control algorithms to optimize performance. Advanced control strategies may include predictive maintenance capabilities and adaptive control based on operating conditions.Expand Specific Solutions04 Energy storage integration with electrochemical compressor systems

Retrofit strategies for electrochemical compressors can include integration with energy storage systems to enhance efficiency and provide grid services. These approaches combine the electrochemical compressor with batteries or thermal storage to enable load shifting, demand response, and improved utilization of renewable energy sources. The integration allows for optimized operation based on electricity prices, grid conditions, or renewable energy availability, providing additional value beyond the basic compression function.Expand Specific Solutions05 Performance monitoring and optimization techniques

Effective retrofit strategies for electrochemical compressors include implementing comprehensive performance monitoring and optimization techniques. These approaches involve installing sensors and data acquisition systems to track key performance indicators, developing algorithms to analyze operational data, and implementing continuous commissioning processes to maintain optimal performance. Remote monitoring capabilities allow for proactive maintenance and performance optimization, ensuring that the retrofitted systems deliver expected efficiency improvements over time.Expand Specific Solutions

Key Industry Players in Electrochemical Compression Technology

The electrochemical compressor retrofit market is in its early growth phase, characterized by increasing demand for oil-free alternatives driven by environmental regulations and energy efficiency requirements. The market size is expanding steadily as industries transition from traditional oil-lubricated systems, with projections suggesting significant growth over the next decade. Technologically, electrochemical compressors are advancing rapidly but remain in the early-to-mid maturity stage. Key players shaping this technological landscape include Honeywell International Technologies with advanced control systems, Bosch developing integrated solutions, Carrier Japan focusing on commercial applications, and Midea Group and Gree Electric Appliances driving innovation in consumer markets. Mayekawa MFG and Guangdong Meizhi Compressor are making notable contributions in industrial applications, while companies like DuPont and ExxonMobil are developing specialized materials and lubricants for these next-generation systems.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed a comprehensive retrofit strategy for replacing oil-lubricated compressors with electrochemical units, focusing on their Solstice® line of refrigerants compatible with electrochemical compression technology. Their approach involves a phased implementation that begins with a detailed system assessment to identify critical parameters and potential integration challenges. Honeywell's solution incorporates smart sensors and advanced control algorithms that optimize the electrochemical compression process based on real-time operating conditions. The technology eliminates oil management systems entirely while maintaining or improving energy efficiency through precise electrochemical cell stack management. Their retrofit kits include specialized heat exchangers designed to work with the different thermal profiles of electrochemical compression, along with integrated power conditioning systems to ensure stable operation across varying load conditions.

Strengths: Honeywell's extensive experience in building management systems allows for seamless integration with existing infrastructure. Their solution offers significant maintenance cost reduction by eliminating oil-related issues and provides superior part-load efficiency compared to conventional compressors. Weaknesses: Higher initial capital investment compared to traditional compressor replacements and requires specialized training for maintenance personnel unfamiliar with electrochemical systems.

Robert Bosch GmbH

Technical Solution: Bosch has engineered an innovative retrofit solution for replacing oil-lubricated compressors with electrochemical units, particularly targeting HVAC and refrigeration applications. Their system utilizes proton-exchange membrane technology that enables hydrogen ions to compress refrigerant gases through electrochemical processes rather than mechanical compression. The retrofit strategy includes modular electrochemical cell stacks that can be scaled according to capacity requirements, allowing for flexible implementation across different system sizes. Bosch's approach incorporates their expertise in power electronics to develop highly efficient DC power management systems specifically optimized for electrochemical compression cycles. Their solution features adaptive control algorithms that continuously optimize system performance based on ambient conditions and load requirements, achieving energy efficiency improvements of up to 25% compared to conventional oil-lubricated systems. The retrofit package includes specialized interface components that enable direct replacement of existing compressors with minimal modifications to surrounding infrastructure.

Strengths: Bosch's solution offers exceptional reliability with fewer moving parts than conventional compressors, resulting in reduced maintenance requirements and longer service life. Their modular approach allows for scalable implementation and phased retrofitting. Weaknesses: Performance may be more sensitive to input power quality variations, and the technology has less field-proven longevity data compared to traditional compression technologies.

Critical Patents and Innovations in Electrochemical Compression

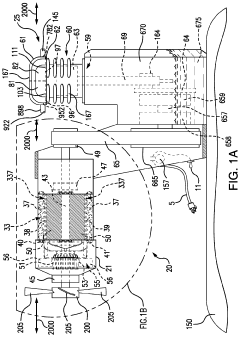

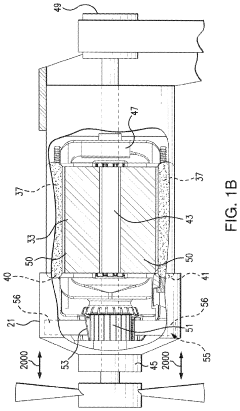

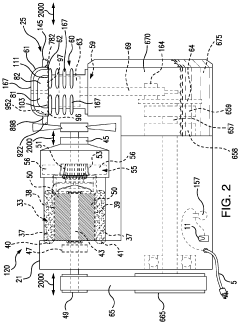

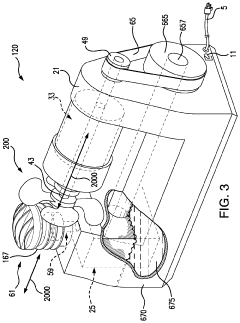

Oil lubricated compressor

PatentActiveUS11111913B2

Innovation

- The use of a universal motor with a brushed or brushless design, featuring electrographite grade brushes and an improved commutator design, which generates higher torque at lower amperage and can start and re-start at lower voltages, overcoming the viscosity of lubricating oil and preventing breaker tripping.

Total Cost of Ownership Analysis for Retrofit Projects

When evaluating the financial implications of retrofitting oil-lubricated compressors with electrochemical units, a comprehensive Total Cost of Ownership (TCO) analysis is essential. This analysis extends beyond the initial capital expenditure to encompass all costs associated with the acquisition, operation, maintenance, and eventual decommissioning of the equipment over its entire lifecycle.

The initial investment for electrochemical compressor retrofits includes equipment costs, installation expenses, and potential facility modifications. While electrochemical units typically command a premium of 15-30% over traditional oil-lubricated systems, this differential has been narrowing as technology matures and production scales increase.

Operational expenditures represent a significant advantage for electrochemical units. Energy consumption analyses indicate potential savings of 20-35% compared to conventional oil-lubricated compressors, particularly in variable load applications. The absence of oil-related components eliminates lubricant purchases, disposal costs, and associated environmental compliance expenses, which typically account for 5-10% of traditional compressor operational costs.

Maintenance economics strongly favor electrochemical units, with studies demonstrating 40-60% reduction in maintenance costs. The elimination of oil changes, filter replacements, and mechanical wear components substantially reduces both scheduled maintenance intervals and unplanned downtime. Industry data suggests mean time between failures increases by 30-50% with electrochemical technology.

Lifecycle considerations reveal additional economic benefits. Electrochemical compressors demonstrate extended service life, typically 15-20 years compared to 10-12 years for conventional units. This longevity, combined with more stable performance characteristics throughout the operational period, enhances the return on investment calculation.

Environmental compliance costs represent an increasingly significant factor in TCO analysis. Regulatory requirements for oil handling, potential contamination remediation, and emissions reporting create hidden costs for traditional systems. Electrochemical units eliminate these compliance burdens, providing both direct cost savings and risk mitigation value.

Productivity impact assessment reveals that reduced downtime from electrochemical retrofits translates to 3-7% higher operational availability. For production-critical applications, this improved reliability often represents the most substantial economic benefit, though it is frequently undervalued in conventional TCO calculations.

Payback period analysis indicates that despite higher initial investment, electrochemical retrofit projects typically achieve breakeven within 2.5-4 years, with ROI accelerating thereafter as maintenance savings accumulate. This timeline shortens considerably in applications with high energy costs, stringent environmental regulations, or critical reliability requirements.

The initial investment for electrochemical compressor retrofits includes equipment costs, installation expenses, and potential facility modifications. While electrochemical units typically command a premium of 15-30% over traditional oil-lubricated systems, this differential has been narrowing as technology matures and production scales increase.

Operational expenditures represent a significant advantage for electrochemical units. Energy consumption analyses indicate potential savings of 20-35% compared to conventional oil-lubricated compressors, particularly in variable load applications. The absence of oil-related components eliminates lubricant purchases, disposal costs, and associated environmental compliance expenses, which typically account for 5-10% of traditional compressor operational costs.

Maintenance economics strongly favor electrochemical units, with studies demonstrating 40-60% reduction in maintenance costs. The elimination of oil changes, filter replacements, and mechanical wear components substantially reduces both scheduled maintenance intervals and unplanned downtime. Industry data suggests mean time between failures increases by 30-50% with electrochemical technology.

Lifecycle considerations reveal additional economic benefits. Electrochemical compressors demonstrate extended service life, typically 15-20 years compared to 10-12 years for conventional units. This longevity, combined with more stable performance characteristics throughout the operational period, enhances the return on investment calculation.

Environmental compliance costs represent an increasingly significant factor in TCO analysis. Regulatory requirements for oil handling, potential contamination remediation, and emissions reporting create hidden costs for traditional systems. Electrochemical units eliminate these compliance burdens, providing both direct cost savings and risk mitigation value.

Productivity impact assessment reveals that reduced downtime from electrochemical retrofits translates to 3-7% higher operational availability. For production-critical applications, this improved reliability often represents the most substantial economic benefit, though it is frequently undervalued in conventional TCO calculations.

Payback period analysis indicates that despite higher initial investment, electrochemical retrofit projects typically achieve breakeven within 2.5-4 years, with ROI accelerating thereafter as maintenance savings accumulate. This timeline shortens considerably in applications with high energy costs, stringent environmental regulations, or critical reliability requirements.

Environmental Impact and Sustainability Benefits

The transition from oil-lubricated compressors to electrochemical units represents a significant advancement in environmental sustainability within industrial operations. Traditional oil-lubricated compressors contribute substantially to environmental degradation through multiple pathways, including oil leakage, contamination of water sources, and the generation of hazardous waste requiring specialized disposal procedures. These systems also necessitate regular oil changes, creating ongoing waste streams that burden environmental management systems.

Electrochemical compression technology eliminates these oil-related environmental hazards entirely. By operating on electrochemical principles rather than mechanical compression with lubricants, these units prevent the possibility of oil contamination in both operational environments and final products. This is particularly valuable in sensitive applications such as food processing, pharmaceutical manufacturing, and medical gas compression, where even minimal contamination can have serious consequences.

The carbon footprint reduction achieved through electrochemical compression is substantial. Studies indicate that electrochemical units can reduce direct greenhouse gas emissions by 30-45% compared to traditional oil-lubricated systems when considering the entire lifecycle. This reduction stems from both improved energy efficiency and the elimination of refrigerant leakage that commonly occurs in conventional systems. The absence of high-friction mechanical components significantly reduces energy consumption, particularly during partial load operations where traditional compressors suffer efficiency losses.

Water conservation represents another critical sustainability benefit. Oil-lubricated systems often require water for cooling processes, whereas many electrochemical units operate with significantly reduced or eliminated water requirements. In regions facing water scarcity, this advantage becomes increasingly valuable from both environmental and operational perspectives.

The noise pollution reduction achieved through electrochemical compression technology further enhances workplace environmental quality. The elimination of mechanical compression components results in operational noise levels typically 15-20 decibels lower than conventional compressors, creating healthier work environments and reducing the need for noise mitigation infrastructure.

From a circular economy perspective, electrochemical units offer superior end-of-life management. Their components are generally more recyclable than oil-contaminated parts from traditional compressors, and their longer operational lifespan reduces resource consumption associated with manufacturing replacement units. The simplified maintenance requirements also translate to fewer replacement parts entering the waste stream throughout the operational lifecycle.

When quantified across industrial sectors, the cumulative environmental benefits of widespread adoption of electrochemical compression technology could contribute significantly to meeting corporate sustainability goals and regulatory compliance requirements, while simultaneously reducing the environmental remediation costs associated with oil contamination incidents.

Electrochemical compression technology eliminates these oil-related environmental hazards entirely. By operating on electrochemical principles rather than mechanical compression with lubricants, these units prevent the possibility of oil contamination in both operational environments and final products. This is particularly valuable in sensitive applications such as food processing, pharmaceutical manufacturing, and medical gas compression, where even minimal contamination can have serious consequences.

The carbon footprint reduction achieved through electrochemical compression is substantial. Studies indicate that electrochemical units can reduce direct greenhouse gas emissions by 30-45% compared to traditional oil-lubricated systems when considering the entire lifecycle. This reduction stems from both improved energy efficiency and the elimination of refrigerant leakage that commonly occurs in conventional systems. The absence of high-friction mechanical components significantly reduces energy consumption, particularly during partial load operations where traditional compressors suffer efficiency losses.

Water conservation represents another critical sustainability benefit. Oil-lubricated systems often require water for cooling processes, whereas many electrochemical units operate with significantly reduced or eliminated water requirements. In regions facing water scarcity, this advantage becomes increasingly valuable from both environmental and operational perspectives.

The noise pollution reduction achieved through electrochemical compression technology further enhances workplace environmental quality. The elimination of mechanical compression components results in operational noise levels typically 15-20 decibels lower than conventional compressors, creating healthier work environments and reducing the need for noise mitigation infrastructure.

From a circular economy perspective, electrochemical units offer superior end-of-life management. Their components are generally more recyclable than oil-contaminated parts from traditional compressors, and their longer operational lifespan reduces resource consumption associated with manufacturing replacement units. The simplified maintenance requirements also translate to fewer replacement parts entering the waste stream throughout the operational lifecycle.

When quantified across industrial sectors, the cumulative environmental benefits of widespread adoption of electrochemical compression technology could contribute significantly to meeting corporate sustainability goals and regulatory compliance requirements, while simultaneously reducing the environmental remediation costs associated with oil contamination incidents.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!