Low-Power Gas Sensor Designs For IoT Deployments

AUG 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

IoT Gas Sensing Technology Background and Objectives

Gas sensing technology has evolved significantly over the past decades, transitioning from large, power-hungry industrial systems to compact, energy-efficient solutions suitable for Internet of Things (IoT) applications. The integration of gas sensors into IoT networks represents a convergence of environmental monitoring capabilities with the connectivity and scalability of modern wireless networks. This technological evolution has been driven by advancements in materials science, microelectronics, and low-power communication protocols.

The historical trajectory of gas sensing technology began with traditional electrochemical and catalytic sensors, which while effective, consumed substantial power and required frequent maintenance. The mid-2000s saw the emergence of metal oxide semiconductor (MOS) sensors, which offered improved sensitivity but still faced power consumption challenges. Recent breakthroughs in nanomaterials and MEMS (Micro-Electro-Mechanical Systems) technology have enabled the development of ultra-low-power gas sensors that can operate effectively within the stringent energy constraints of IoT deployments.

Current technological trends point toward miniaturization, increased sensitivity, and dramatically reduced power requirements. The development of novel sensing materials such as graphene, carbon nanotubes, and metal-organic frameworks has opened new possibilities for gas detection at the molecular level while maintaining minimal energy footprints. Additionally, advancements in signal processing algorithms and edge computing capabilities have enabled more efficient data handling and analysis directly on sensor nodes.

The primary objective of low-power gas sensor technology for IoT deployments is to achieve continuous, reliable environmental monitoring while operating on limited energy resources such as small batteries or energy harvesting systems. This necessitates sensors that can function effectively with power consumption in the microwatt to milliwatt range, representing a reduction of several orders of magnitude compared to traditional sensing technologies.

Secondary objectives include enhancing sensor longevity to match IoT device lifecycles (typically 5-10 years without maintenance), improving selectivity to specific gases of interest, and developing robust calibration methods that minimize drift over extended deployment periods. These technical goals are complemented by the need for cost-effective manufacturing processes that enable widespread adoption across various IoT application domains.

The evolution of this technology is expected to continue toward even lower power consumption, higher integration with other sensing modalities, and improved wireless communication efficiency. Future developments will likely focus on self-powered sensing solutions that eliminate battery dependencies entirely, potentially through innovative energy harvesting techniques coupled with ultra-efficient sensing mechanisms.

The historical trajectory of gas sensing technology began with traditional electrochemical and catalytic sensors, which while effective, consumed substantial power and required frequent maintenance. The mid-2000s saw the emergence of metal oxide semiconductor (MOS) sensors, which offered improved sensitivity but still faced power consumption challenges. Recent breakthroughs in nanomaterials and MEMS (Micro-Electro-Mechanical Systems) technology have enabled the development of ultra-low-power gas sensors that can operate effectively within the stringent energy constraints of IoT deployments.

Current technological trends point toward miniaturization, increased sensitivity, and dramatically reduced power requirements. The development of novel sensing materials such as graphene, carbon nanotubes, and metal-organic frameworks has opened new possibilities for gas detection at the molecular level while maintaining minimal energy footprints. Additionally, advancements in signal processing algorithms and edge computing capabilities have enabled more efficient data handling and analysis directly on sensor nodes.

The primary objective of low-power gas sensor technology for IoT deployments is to achieve continuous, reliable environmental monitoring while operating on limited energy resources such as small batteries or energy harvesting systems. This necessitates sensors that can function effectively with power consumption in the microwatt to milliwatt range, representing a reduction of several orders of magnitude compared to traditional sensing technologies.

Secondary objectives include enhancing sensor longevity to match IoT device lifecycles (typically 5-10 years without maintenance), improving selectivity to specific gases of interest, and developing robust calibration methods that minimize drift over extended deployment periods. These technical goals are complemented by the need for cost-effective manufacturing processes that enable widespread adoption across various IoT application domains.

The evolution of this technology is expected to continue toward even lower power consumption, higher integration with other sensing modalities, and improved wireless communication efficiency. Future developments will likely focus on self-powered sensing solutions that eliminate battery dependencies entirely, potentially through innovative energy harvesting techniques coupled with ultra-efficient sensing mechanisms.

Market Analysis for Low-Power Gas Sensors

The global market for low-power gas sensors is experiencing robust growth, driven primarily by increasing IoT deployments across various sectors. Current market valuations place this segment at approximately $2.3 billion in 2023, with projections indicating a compound annual growth rate (CAGR) of 8.7% through 2028, potentially reaching $3.5 billion by the end of the forecast period.

Environmental monitoring represents the largest application segment, accounting for nearly 32% of the market share. This is followed closely by industrial safety applications at 28%, smart home devices at 21%, and wearable health monitoring at 12%, with various other applications comprising the remaining 7%. The dominance of environmental monitoring applications stems from increasing regulatory pressures and growing public awareness regarding air quality.

Regionally, North America currently leads the market with approximately 35% share, followed by Europe at 30%, Asia-Pacific at 25%, and the rest of the world at 10%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate over the next five years, primarily due to rapid industrialization, increasing smart city initiatives, and growing adoption of IoT technologies in countries like China, Japan, South Korea, and India.

From a competitive landscape perspective, the market exhibits moderate fragmentation with several key players dominating specific technological niches. Major companies include Sensirion, Bosch Sensortec, Honeywell, Alphasense, and Figaro Engineering, collectively accounting for approximately 45% of the global market share. These established players are increasingly facing competition from emerging startups focusing on novel sensing technologies and enhanced power efficiency.

Customer segmentation reveals distinct requirements across different end-user groups. Industrial clients prioritize reliability and certification compliance, while consumer IoT applications emphasize cost-effectiveness and miniaturization. The healthcare sector demands high accuracy and biocompatibility, particularly for wearable applications.

Price sensitivity varies significantly across application domains. While industrial safety applications can accommodate premium pricing for certified sensors, consumer IoT applications face intense price pressure, with average selling prices declining at approximately 5-7% annually due to increasing competition and manufacturing scale economies.

Future market growth will likely be driven by several factors, including the expansion of smart city initiatives worldwide, increasing regulatory requirements for air quality monitoring, growing adoption of predictive maintenance in industrial settings, and the emergence of new application areas such as agricultural monitoring and food safety. Additionally, the integration of gas sensors with artificial intelligence for enhanced data analytics represents a significant value-added opportunity for market participants.

Environmental monitoring represents the largest application segment, accounting for nearly 32% of the market share. This is followed closely by industrial safety applications at 28%, smart home devices at 21%, and wearable health monitoring at 12%, with various other applications comprising the remaining 7%. The dominance of environmental monitoring applications stems from increasing regulatory pressures and growing public awareness regarding air quality.

Regionally, North America currently leads the market with approximately 35% share, followed by Europe at 30%, Asia-Pacific at 25%, and the rest of the world at 10%. However, the Asia-Pacific region is expected to demonstrate the highest growth rate over the next five years, primarily due to rapid industrialization, increasing smart city initiatives, and growing adoption of IoT technologies in countries like China, Japan, South Korea, and India.

From a competitive landscape perspective, the market exhibits moderate fragmentation with several key players dominating specific technological niches. Major companies include Sensirion, Bosch Sensortec, Honeywell, Alphasense, and Figaro Engineering, collectively accounting for approximately 45% of the global market share. These established players are increasingly facing competition from emerging startups focusing on novel sensing technologies and enhanced power efficiency.

Customer segmentation reveals distinct requirements across different end-user groups. Industrial clients prioritize reliability and certification compliance, while consumer IoT applications emphasize cost-effectiveness and miniaturization. The healthcare sector demands high accuracy and biocompatibility, particularly for wearable applications.

Price sensitivity varies significantly across application domains. While industrial safety applications can accommodate premium pricing for certified sensors, consumer IoT applications face intense price pressure, with average selling prices declining at approximately 5-7% annually due to increasing competition and manufacturing scale economies.

Future market growth will likely be driven by several factors, including the expansion of smart city initiatives worldwide, increasing regulatory requirements for air quality monitoring, growing adoption of predictive maintenance in industrial settings, and the emergence of new application areas such as agricultural monitoring and food safety. Additionally, the integration of gas sensors with artificial intelligence for enhanced data analytics represents a significant value-added opportunity for market participants.

Current Challenges in Low-Power Gas Sensing

Despite significant advancements in gas sensing technologies, the integration of these sensors into IoT deployments faces several critical challenges. Power consumption remains the foremost obstacle, as conventional gas sensors typically require substantial energy for heating elements to facilitate chemical reactions necessary for gas detection. This fundamental requirement creates a significant barrier for battery-powered IoT devices intended for long-term deployment without frequent maintenance.

Miniaturization presents another substantial challenge, with many existing gas sensing solutions being too bulky for seamless integration into compact IoT devices. The physical constraints of traditional sensing technologies often conflict with the design requirements of modern IoT applications, particularly in wearable technology and environmental monitoring systems where form factor is crucial.

Sensitivity and selectivity trade-offs pose complex engineering dilemmas. As power consumption is reduced, sensor performance frequently deteriorates, resulting in decreased sensitivity to target gases or diminished ability to differentiate between similar gas compounds. This compromise becomes particularly problematic in applications requiring precise detection of specific gases within complex environmental mixtures.

Environmental stability represents a significant hurdle for real-world deployments. Low-power gas sensors must maintain consistent performance across varying humidity levels, temperature fluctuations, and exposure to interfering gases. Current technologies often exhibit drift over time, necessitating frequent recalibration that contradicts the low-maintenance promise of IoT solutions.

Cost considerations further complicate widespread adoption. While high-performance gas sensors exist, their price points remain prohibitive for mass deployment scenarios. The challenge lies in developing sensors that balance performance requirements with economic viability for large-scale IoT implementations.

Data processing limitations add another layer of complexity. Low-power operation restricts the computational resources available for signal processing and pattern recognition, potentially compromising the accuracy of gas detection and classification. Edge computing solutions must be optimized to handle complex sensing algorithms within strict power budgets.

Manufacturing scalability presents challenges in transitioning from laboratory prototypes to mass production. Many promising low-power sensing technologies demonstrate excellent performance in controlled environments but face significant hurdles in consistent, cost-effective manufacturing processes suitable for commercial deployment.

Standardization gaps further impede integration efforts, with the lack of unified protocols and interfaces across different sensor technologies creating interoperability issues within IoT ecosystems. This fragmentation complicates the development of comprehensive sensing solutions that can be easily deployed across various platforms and applications.

Miniaturization presents another substantial challenge, with many existing gas sensing solutions being too bulky for seamless integration into compact IoT devices. The physical constraints of traditional sensing technologies often conflict with the design requirements of modern IoT applications, particularly in wearable technology and environmental monitoring systems where form factor is crucial.

Sensitivity and selectivity trade-offs pose complex engineering dilemmas. As power consumption is reduced, sensor performance frequently deteriorates, resulting in decreased sensitivity to target gases or diminished ability to differentiate between similar gas compounds. This compromise becomes particularly problematic in applications requiring precise detection of specific gases within complex environmental mixtures.

Environmental stability represents a significant hurdle for real-world deployments. Low-power gas sensors must maintain consistent performance across varying humidity levels, temperature fluctuations, and exposure to interfering gases. Current technologies often exhibit drift over time, necessitating frequent recalibration that contradicts the low-maintenance promise of IoT solutions.

Cost considerations further complicate widespread adoption. While high-performance gas sensors exist, their price points remain prohibitive for mass deployment scenarios. The challenge lies in developing sensors that balance performance requirements with economic viability for large-scale IoT implementations.

Data processing limitations add another layer of complexity. Low-power operation restricts the computational resources available for signal processing and pattern recognition, potentially compromising the accuracy of gas detection and classification. Edge computing solutions must be optimized to handle complex sensing algorithms within strict power budgets.

Manufacturing scalability presents challenges in transitioning from laboratory prototypes to mass production. Many promising low-power sensing technologies demonstrate excellent performance in controlled environments but face significant hurdles in consistent, cost-effective manufacturing processes suitable for commercial deployment.

Standardization gaps further impede integration efforts, with the lack of unified protocols and interfaces across different sensor technologies creating interoperability issues within IoT ecosystems. This fragmentation complicates the development of comprehensive sensing solutions that can be easily deployed across various platforms and applications.

Current Low-Power Gas Sensor Solutions

01 Low power consumption gas sensor designs

Various designs and architectures for gas sensors that minimize power consumption while maintaining detection capabilities. These designs include optimized sensor structures, efficient heating elements, and innovative material choices that require less energy to operate. Such low-power designs are crucial for portable and battery-operated gas detection systems where energy efficiency is a primary concern.- Low power consumption gas sensor designs: Various designs of gas sensors focus on minimizing power consumption while maintaining detection capabilities. These designs include optimized sensor structures, improved materials, and efficient sensing mechanisms that require less energy to operate. Such low-power designs are crucial for portable and battery-operated gas detection systems where energy efficiency is a primary concern.

- Power management techniques for gas sensors: Power management techniques are implemented to reduce the overall energy consumption of gas sensing systems. These techniques include duty cycling where sensors are periodically activated rather than continuously operating, sleep modes during periods of inactivity, and adaptive sampling rates based on environmental conditions or detection needs. Such approaches significantly extend battery life in portable gas detection devices.

- Wireless gas sensor networks with power optimization: Wireless gas sensor networks employ various power optimization strategies to ensure long-term operation without frequent battery replacement. These networks utilize efficient communication protocols, data compression techniques, and intelligent power distribution among sensor nodes. Some implementations include energy harvesting capabilities to supplement battery power, further extending operational lifetimes in field deployments.

- Energy-efficient signal processing for gas detection: Advanced signal processing techniques reduce the power requirements for gas detection systems. These include optimized algorithms for sensor data analysis, efficient filtering methods, and smart threshold detection that minimizes computational overhead. Some systems employ specialized low-power microcontrollers or application-specific integrated circuits (ASICs) designed specifically for gas sensing applications, further reducing energy consumption.

- Thermal management for reduced power consumption: Thermal management strategies are employed to minimize power consumption in gas sensors that require heating elements. These include improved thermal insulation, pulsed heating techniques, and optimized heater designs that achieve the necessary operating temperatures with minimal energy input. Some advanced sensors incorporate temperature compensation mechanisms that adjust heating power based on ambient conditions, further improving energy efficiency.

02 Power management techniques for gas sensors

Implementation of power management strategies specifically for gas sensing applications, including duty cycling, sleep modes, and adaptive power control based on environmental conditions or detection needs. These techniques allow gas sensors to operate only when necessary or at reduced power levels during periods of lower demand, significantly extending battery life in portable gas detection systems.Expand Specific Solutions03 Wireless gas sensor networks with optimized power consumption

Development of wireless sensor network architectures for gas detection that minimize power requirements through efficient communication protocols, data transmission scheduling, and network topology optimization. These networks enable distributed gas monitoring while addressing the power constraints of remote deployment through energy-efficient wireless communication and data processing strategies.Expand Specific Solutions04 Energy harvesting for powering gas sensors

Integration of energy harvesting technologies with gas sensors to supplement or replace battery power. These systems capture energy from the environment (solar, thermal, vibration, or RF) to power gas sensing operations, reducing dependence on batteries and enabling long-term deployment in remote locations without frequent maintenance for battery replacement.Expand Specific Solutions05 Intelligent power control systems for gas sensors

Advanced control systems that dynamically adjust power consumption based on real-time analysis of sensor data, environmental conditions, and detection requirements. These systems employ machine learning algorithms and adaptive control strategies to optimize the trade-off between power consumption and sensing performance, ensuring reliable gas detection while minimizing energy use.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The low-power gas sensor market for IoT deployments is currently in a growth phase, with increasing adoption across smart home, industrial monitoring, and environmental applications. The market is projected to expand significantly as IoT penetration increases, with estimates suggesting a compound annual growth rate of 8-10% through 2028. Technologically, the field shows varying maturity levels, with established players like Honeywell, Bosch, and IBM developing advanced solutions leveraging AI and edge computing, while newer entrants such as AerNos and Micro-Nano Sensing focus on nano-scale innovations. Research institutions including IMEC Nederland and the University of California are driving fundamental breakthroughs in materials science and miniaturization. The competitive landscape features traditional industrial giants competing with specialized sensor manufacturers and semiconductor companies like TSMC, creating a dynamic ecosystem balancing power efficiency with sensing accuracy.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed advanced MEMS-based gas sensor technology specifically optimized for IoT deployments. Their solution integrates ultra-low power microhotplate structures with proprietary metal oxide sensing materials that operate at significantly reduced temperatures compared to conventional sensors. The platform employs intelligent power management techniques including duty-cycling operation where the sensor only activates periodically (typically 1-2% of the time), dramatically reducing average power consumption to sub-milliwatt levels[1]. Honeywell's sensors incorporate adaptive sampling algorithms that adjust sensing frequency based on detected gas concentration patterns, further optimizing power usage. Their integrated ASIC design combines sensing elements with signal processing capabilities in a single package smaller than 5mm², enabling direct integration with wireless communication modules. The sensors support multiple gas detection capabilities (CO, NO2, VOCs) with proprietary drift compensation algorithms that extend calibration intervals to over 5 years, addressing maintenance challenges in distributed IoT networks[3].

Strengths: Industry-leading power efficiency with sub-milliwatt operation; exceptional long-term stability reducing maintenance requirements; compact form factor enabling seamless IoT integration; comprehensive multi-gas detection capabilities. Weaknesses: Higher initial cost compared to simpler sensors; requires specialized expertise for optimal implementation; performance may degrade in extreme environmental conditions; proprietary nature limits customization options.

Robert Bosch GmbH

Technical Solution: Bosch has pioneered ultra-low power gas sensing technology through their BME688 environmental sensing solution specifically designed for IoT applications. The platform integrates gas, pressure, humidity and temperature sensing in a single 3.0 x 3.0 x 0.9 mm³ package with power consumption as low as 0.09 mA in ultra-low power mode[2]. Their innovative approach combines metal oxide semiconductor (MOS) sensing elements with AI-powered algorithms that enable selective gas detection while minimizing energy requirements. The BME688 employs sophisticated power management techniques including dynamic sensor heating profiles that adjust power consumption based on detection requirements and environmental conditions. Bosch's solution features an integrated microcontroller that handles signal processing locally, reducing data transmission needs and further lowering system-level power consumption. Their sensors support sleep modes drawing just 0.15 μA while maintaining rapid response capabilities when activated[4]. The platform includes Bosch's proprietary Software Development Kit (SDK) that enables developers to create custom gas sensing applications with optimized power profiles for specific IoT deployment scenarios.

Strengths: Exceptional integration of multiple environmental sensors in an extremely compact package; industry-leading power efficiency; sophisticated AI algorithms enabling selective gas detection; comprehensive development tools accelerating implementation. Weaknesses: Higher component cost compared to single-function sensors; complex implementation requiring specialized knowledge; performance trade-offs in ultra-low power modes; limited customization of core sensing elements.

Core Patents and Technical Innovations

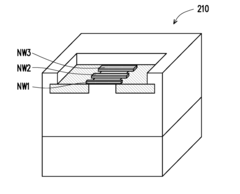

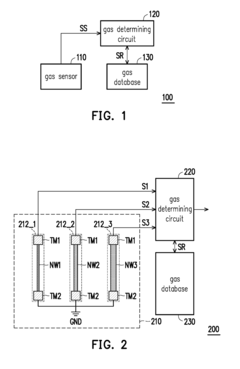

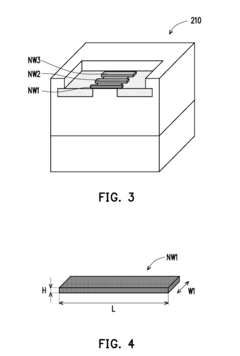

Gas sensing apparatus and a manufacturing process thereof

PatentInactiveUS20180238822A1

Innovation

- A gas sensing apparatus featuring multiple nanowire sensor groups with different structural properties, each capable of sensing multiple gases, coupled with a gas determining circuit and database to determine gas types based on reference data and sensing signals, allowing for simultaneous detection and monitoring of various gases with low area cost and quick response.

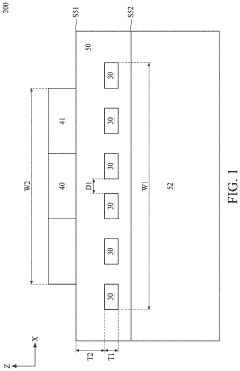

Sensor in an internet-of-things

PatentActiveUS20220333251A1

Innovation

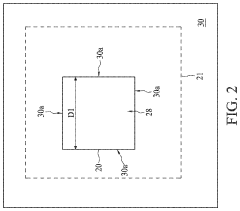

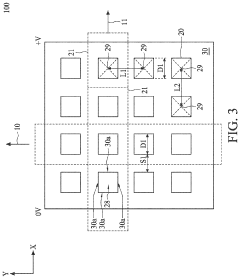

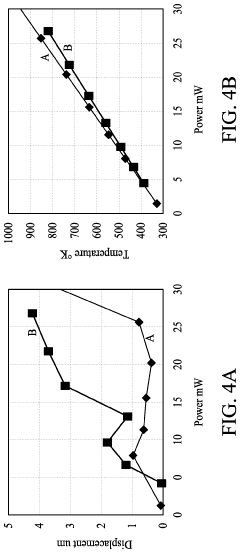

- A gas sensor with a novel heating element pattern featuring conductors embedded in an insulator over a substrate, with a specific top-view design that reduces displacement and deformation, maintaining thermal efficiency while shrinking dimensions, using a pattern with minimal opening dimensions and distances less than 4 micrometers.

Environmental Impact and Sustainability Considerations

The environmental footprint of low-power gas sensor technologies represents a critical consideration in their widespread IoT deployment. Traditional gas sensing technologies often incorporate rare earth metals and toxic materials that pose significant environmental hazards during manufacturing, operation, and disposal phases. Modern low-power gas sensor designs are increasingly addressing these concerns through materials innovation, with manufacturers developing sensors using abundant, non-toxic materials that maintain detection efficacy while reducing environmental impact.

Energy consumption throughout the sensor lifecycle constitutes another major environmental factor. While operational power efficiency receives considerable attention, the embodied energy in manufacturing processes often exceeds the lifetime operational energy requirements. Leading manufacturers are implementing cleaner production techniques and energy-efficient manufacturing processes that reduce carbon emissions by up to 40% compared to conventional methods. These improvements extend beyond the production phase to include more sustainable packaging solutions that minimize waste.

End-of-life considerations present particular challenges for IoT gas sensor deployments. The distributed nature of these devices complicates collection and proper disposal, potentially leading to electronic waste accumulation. Forward-thinking designs now incorporate modular components and biodegradable substrates that facilitate recycling and reduce landfill impact. Several manufacturers have implemented take-back programs, achieving recycling rates exceeding 70% for returned devices.

Lifecycle assessment (LCA) studies reveal that low-power gas sensors with optimized designs can reduce overall environmental impact by 30-60% compared to conventional alternatives. These improvements stem from extended battery life, which reduces replacement frequency and associated resource consumption. Additionally, remote monitoring capabilities minimize maintenance-related transportation emissions, further enhancing sustainability benefits.

Regulatory frameworks increasingly influence environmental considerations in sensor design. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have accelerated the transition toward environmentally benign materials. Similarly, emerging carbon footprint disclosure requirements are driving manufacturers to quantify and reduce emissions throughout their supply chains.

The environmental benefits of low-power gas sensors extend beyond their direct footprint. By enabling more efficient environmental monitoring and industrial process optimization, these sensors contribute to broader sustainability goals. Applications in smart cities, industrial facilities, and agricultural settings demonstrate how precise gas monitoring can reduce resource consumption and emissions across multiple sectors, creating positive environmental impacts that significantly outweigh the sensors' own ecological footprint.

Energy consumption throughout the sensor lifecycle constitutes another major environmental factor. While operational power efficiency receives considerable attention, the embodied energy in manufacturing processes often exceeds the lifetime operational energy requirements. Leading manufacturers are implementing cleaner production techniques and energy-efficient manufacturing processes that reduce carbon emissions by up to 40% compared to conventional methods. These improvements extend beyond the production phase to include more sustainable packaging solutions that minimize waste.

End-of-life considerations present particular challenges for IoT gas sensor deployments. The distributed nature of these devices complicates collection and proper disposal, potentially leading to electronic waste accumulation. Forward-thinking designs now incorporate modular components and biodegradable substrates that facilitate recycling and reduce landfill impact. Several manufacturers have implemented take-back programs, achieving recycling rates exceeding 70% for returned devices.

Lifecycle assessment (LCA) studies reveal that low-power gas sensors with optimized designs can reduce overall environmental impact by 30-60% compared to conventional alternatives. These improvements stem from extended battery life, which reduces replacement frequency and associated resource consumption. Additionally, remote monitoring capabilities minimize maintenance-related transportation emissions, further enhancing sustainability benefits.

Regulatory frameworks increasingly influence environmental considerations in sensor design. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have accelerated the transition toward environmentally benign materials. Similarly, emerging carbon footprint disclosure requirements are driving manufacturers to quantify and reduce emissions throughout their supply chains.

The environmental benefits of low-power gas sensors extend beyond their direct footprint. By enabling more efficient environmental monitoring and industrial process optimization, these sensors contribute to broader sustainability goals. Applications in smart cities, industrial facilities, and agricultural settings demonstrate how precise gas monitoring can reduce resource consumption and emissions across multiple sectors, creating positive environmental impacts that significantly outweigh the sensors' own ecological footprint.

Standardization and Interoperability Requirements

Standardization efforts for low-power gas sensors in IoT deployments have become increasingly critical as the ecosystem expands across multiple vendors, platforms, and applications. The fragmentation of protocols and interfaces currently poses significant challenges to widespread adoption and seamless integration. Industry consortia such as the Open Connectivity Foundation (OCF) and the Industrial Internet Consortium (IIC) have begun developing reference architectures specifically addressing gas sensor interoperability requirements, focusing on standardized data formats, communication protocols, and security frameworks.

Key standardization bodies including IEEE, ISO, and ETSI have established working groups dedicated to IoT sensing technologies, with recent publications outlining specifications for power consumption benchmarking, data representation models, and calibration procedures specific to gas sensors. The IEEE 1451 family of standards has been extended to accommodate the unique requirements of low-power gas sensing, providing standardized transducer electronic data sheets (TEDS) that facilitate plug-and-play capabilities across heterogeneous IoT platforms.

Interoperability challenges persist at multiple levels of the technology stack. At the hardware level, sensor interface standardization remains fragmented between I²C, SPI, UART, and emerging low-power alternatives. The middleware layer faces challenges in standardizing calibration data formats and drift compensation algorithms, which are often proprietary and vendor-specific. At the application layer, semantic interoperability for gas concentration measurements, alarm thresholds, and environmental context data requires further harmonization.

Cross-platform compatibility testing frameworks have emerged as essential tools for validating interoperability. The IPSO Alliance's Smart Objects initiative has developed test specifications specifically for gas sensing devices, enabling certification processes that verify compliance with interoperability requirements. These frameworks evaluate power management interfaces, data representation consistency, and protocol compatibility across diverse deployment scenarios.

Security and privacy standards represent another critical dimension of interoperability. The IEC 62443 framework has been adapted for low-power sensing applications, establishing requirements for secure bootstrapping, lightweight authentication, and encrypted communications that balance security needs with power constraints. Regulatory bodies in various regions have begun mandating compliance with these standards, particularly for gas sensors deployed in safety-critical environments.

Future standardization efforts are increasingly focused on enabling edge analytics interoperability, where preprocessing algorithms for gas detection and classification must operate consistently across different hardware implementations. The development of standard APIs for accessing sensor data, configuration parameters, and diagnostic information will be crucial for creating truly interoperable ecosystems that can support the diverse requirements of IoT gas sensing applications while maintaining the power efficiency necessary for long-term deployments.

Key standardization bodies including IEEE, ISO, and ETSI have established working groups dedicated to IoT sensing technologies, with recent publications outlining specifications for power consumption benchmarking, data representation models, and calibration procedures specific to gas sensors. The IEEE 1451 family of standards has been extended to accommodate the unique requirements of low-power gas sensing, providing standardized transducer electronic data sheets (TEDS) that facilitate plug-and-play capabilities across heterogeneous IoT platforms.

Interoperability challenges persist at multiple levels of the technology stack. At the hardware level, sensor interface standardization remains fragmented between I²C, SPI, UART, and emerging low-power alternatives. The middleware layer faces challenges in standardizing calibration data formats and drift compensation algorithms, which are often proprietary and vendor-specific. At the application layer, semantic interoperability for gas concentration measurements, alarm thresholds, and environmental context data requires further harmonization.

Cross-platform compatibility testing frameworks have emerged as essential tools for validating interoperability. The IPSO Alliance's Smart Objects initiative has developed test specifications specifically for gas sensing devices, enabling certification processes that verify compliance with interoperability requirements. These frameworks evaluate power management interfaces, data representation consistency, and protocol compatibility across diverse deployment scenarios.

Security and privacy standards represent another critical dimension of interoperability. The IEC 62443 framework has been adapted for low-power sensing applications, establishing requirements for secure bootstrapping, lightweight authentication, and encrypted communications that balance security needs with power constraints. Regulatory bodies in various regions have begun mandating compliance with these standards, particularly for gas sensors deployed in safety-critical environments.

Future standardization efforts are increasingly focused on enabling edge analytics interoperability, where preprocessing algorithms for gas detection and classification must operate consistently across different hardware implementations. The development of standard APIs for accessing sensor data, configuration parameters, and diagnostic information will be crucial for creating truly interoperable ecosystems that can support the diverse requirements of IoT gas sensing applications while maintaining the power efficiency necessary for long-term deployments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!