Materials Recycling And End-Of-Life Strategies For Thermoelectric Modules

SEP 5, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermoelectric Recycling Background and Objectives

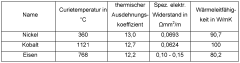

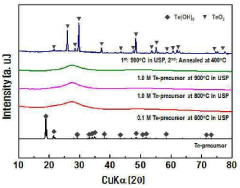

Thermoelectric materials have been utilized for power generation and cooling applications for over six decades, with significant advancements occurring since the 1950s. These materials convert temperature differences directly into electrical voltage through the Seebeck effect, or conversely, create temperature differences when electrical current is applied via the Peltier effect. The evolution of thermoelectric technology has progressed from early bismuth telluride-based devices to more complex materials incorporating rare earth elements, skutterudites, and half-Heusler alloys, each offering improved efficiency and performance characteristics.

The growing deployment of thermoelectric modules across industries including automotive, aerospace, consumer electronics, and industrial waste heat recovery has created an emerging challenge: the sustainable management of these devices at end-of-life. This challenge is particularly pressing given that many thermoelectric materials contain elements classified as critical raw materials (CRMs) such as tellurium, bismuth, antimony, and rare earth elements, which face supply constraints and geopolitical risks.

Current end-of-life practices for thermoelectric modules remain largely underdeveloped, with most devices ending up in landfills or processed through conventional electronic waste channels that fail to recover the valuable constituent materials effectively. The technical objective of this research is to develop comprehensive recycling strategies and circular economy approaches specifically tailored to thermoelectric modules, addressing their unique material composition and structural characteristics.

The environmental imperative for improved recycling is substantial, as thermoelectric materials often contain toxic elements such as lead and tellurium, which pose environmental hazards if improperly disposed of. Additionally, the carbon footprint associated with primary production of these specialized materials is significant, offering potential environmental benefits through recycling and material recovery.

From an economic perspective, the recovery of critical elements from end-of-life thermoelectric modules represents a valuable opportunity to reduce dependency on volatile supply chains and mitigate raw material costs. As thermoelectric applications continue to expand, particularly in automotive waste heat recovery systems and IoT devices, the volume of modules requiring end-of-life management will increase substantially over the coming decade.

This research aims to establish a technological foundation for closed-loop recycling of thermoelectric modules, identifying optimal mechanical, chemical, and metallurgical processes for material separation and recovery while maintaining material purity and functional properties. Additionally, it seeks to inform design-for-recycling principles that can be incorporated into future thermoelectric module development, facilitating more efficient disassembly and material recovery at end-of-life.

The growing deployment of thermoelectric modules across industries including automotive, aerospace, consumer electronics, and industrial waste heat recovery has created an emerging challenge: the sustainable management of these devices at end-of-life. This challenge is particularly pressing given that many thermoelectric materials contain elements classified as critical raw materials (CRMs) such as tellurium, bismuth, antimony, and rare earth elements, which face supply constraints and geopolitical risks.

Current end-of-life practices for thermoelectric modules remain largely underdeveloped, with most devices ending up in landfills or processed through conventional electronic waste channels that fail to recover the valuable constituent materials effectively. The technical objective of this research is to develop comprehensive recycling strategies and circular economy approaches specifically tailored to thermoelectric modules, addressing their unique material composition and structural characteristics.

The environmental imperative for improved recycling is substantial, as thermoelectric materials often contain toxic elements such as lead and tellurium, which pose environmental hazards if improperly disposed of. Additionally, the carbon footprint associated with primary production of these specialized materials is significant, offering potential environmental benefits through recycling and material recovery.

From an economic perspective, the recovery of critical elements from end-of-life thermoelectric modules represents a valuable opportunity to reduce dependency on volatile supply chains and mitigate raw material costs. As thermoelectric applications continue to expand, particularly in automotive waste heat recovery systems and IoT devices, the volume of modules requiring end-of-life management will increase substantially over the coming decade.

This research aims to establish a technological foundation for closed-loop recycling of thermoelectric modules, identifying optimal mechanical, chemical, and metallurgical processes for material separation and recovery while maintaining material purity and functional properties. Additionally, it seeks to inform design-for-recycling principles that can be incorporated into future thermoelectric module development, facilitating more efficient disassembly and material recovery at end-of-life.

Market Analysis for Recovered Thermoelectric Materials

The global market for recovered thermoelectric materials is experiencing significant growth, driven by increasing environmental regulations and the expanding application of thermoelectric modules across various industries. The current market value for recovered thermoelectric materials is estimated at $127 million and is projected to reach $215 million by 2028, representing a compound annual growth rate of 11.2%.

Bismuth telluride (Bi2Te3) dominates the recovered thermoelectric materials market, accounting for approximately 65% of the total market share. This dominance is attributed to its widespread use in commercial thermoelectric modules and relatively established recycling processes. Lead telluride (PbTe) follows with about 18% market share, while silicon-germanium alloys and other emerging materials constitute the remaining portion.

Geographically, Asia-Pacific represents the largest market for recovered thermoelectric materials, with China and Japan leading in both consumption and processing capabilities. North America follows closely, driven by stringent electronic waste regulations and the presence of advanced recycling infrastructure. Europe shows the fastest growth rate in this sector, primarily due to the European Union's comprehensive electronic waste directives and circular economy initiatives.

The automotive sector currently consumes the largest portion of recovered thermoelectric materials at 32%, followed by consumer electronics at 27%, and industrial applications at 21%. The medical and aerospace sectors, though smaller in volume, offer premium pricing for high-purity recovered materials, making them attractive niche markets.

Price volatility remains a significant factor in the recovered materials market. Tellurium, a critical component in many thermoelectric materials, has experienced price fluctuations of up to 40% in recent years, directly impacting the economics of recycling operations. Similarly, bismuth prices have shown variations of 15-20%, affecting recovery profitability.

The market structure is characterized by a fragmented supply chain, with specialized e-waste processors handling initial collection and dismantling, while refined material recovery is typically performed by specialized metallurgical companies. This fragmentation creates opportunities for vertical integration but also presents challenges in establishing consistent material flows.

Consumer awareness and corporate sustainability initiatives are increasingly driving demand for products containing recycled materials, including thermoelectric components. Companies demonstrating closed-loop systems for their thermoelectric products can command premium pricing, with consumers willing to pay 8-12% more for demonstrably sustainable electronic products.

Bismuth telluride (Bi2Te3) dominates the recovered thermoelectric materials market, accounting for approximately 65% of the total market share. This dominance is attributed to its widespread use in commercial thermoelectric modules and relatively established recycling processes. Lead telluride (PbTe) follows with about 18% market share, while silicon-germanium alloys and other emerging materials constitute the remaining portion.

Geographically, Asia-Pacific represents the largest market for recovered thermoelectric materials, with China and Japan leading in both consumption and processing capabilities. North America follows closely, driven by stringent electronic waste regulations and the presence of advanced recycling infrastructure. Europe shows the fastest growth rate in this sector, primarily due to the European Union's comprehensive electronic waste directives and circular economy initiatives.

The automotive sector currently consumes the largest portion of recovered thermoelectric materials at 32%, followed by consumer electronics at 27%, and industrial applications at 21%. The medical and aerospace sectors, though smaller in volume, offer premium pricing for high-purity recovered materials, making them attractive niche markets.

Price volatility remains a significant factor in the recovered materials market. Tellurium, a critical component in many thermoelectric materials, has experienced price fluctuations of up to 40% in recent years, directly impacting the economics of recycling operations. Similarly, bismuth prices have shown variations of 15-20%, affecting recovery profitability.

The market structure is characterized by a fragmented supply chain, with specialized e-waste processors handling initial collection and dismantling, while refined material recovery is typically performed by specialized metallurgical companies. This fragmentation creates opportunities for vertical integration but also presents challenges in establishing consistent material flows.

Consumer awareness and corporate sustainability initiatives are increasingly driving demand for products containing recycled materials, including thermoelectric components. Companies demonstrating closed-loop systems for their thermoelectric products can command premium pricing, with consumers willing to pay 8-12% more for demonstrably sustainable electronic products.

Current Recycling Challenges and Technical Barriers

The recycling of thermoelectric modules presents significant technical challenges due to their complex material composition and integrated structure. Current thermoelectric devices typically contain various valuable and potentially hazardous materials including tellurium, bismuth, antimony, lead, and rare earth elements, which are often tightly bonded within multi-layered structures. This complexity creates substantial barriers to efficient material recovery and recycling processes.

One primary challenge is the lack of standardized dismantling techniques for thermoelectric modules. Unlike conventional electronic waste, these modules are designed for thermal stability and long operational life, resulting in robust bonding between components that resists mechanical separation. Current mechanical recycling methods often damage the valuable semiconductor materials, significantly reducing recovery rates and material purity.

Chemical separation processes face their own set of obstacles. The diverse material composition requires multiple chemical treatment stages, each with specific reagents and conditions. These processes frequently generate hazardous waste streams containing heavy metals and toxic chemicals, creating additional environmental concerns that counteract the sustainability benefits of recycling efforts.

The economic viability of recycling thermoelectric modules remains questionable under current technological constraints. The relatively low concentration of valuable materials combined with high processing costs creates unfavorable economics for commercial recycling operations. This is exacerbated by the current small market volume of thermoelectric waste, which prevents economies of scale from being achieved in recycling facilities.

Technical barriers also exist in the detection and sorting phases of the recycling process. Identifying thermoelectric modules within mixed electronic waste streams is challenging due to their varied appearances and applications. Automated sorting technologies struggle to distinguish these components from other electronic parts, resulting in many thermoelectric modules being processed through inappropriate recycling channels.

Regulatory frameworks present another significant obstacle. Many regions lack specific guidelines for handling thermoelectric waste, creating uncertainty regarding proper disposal and recycling requirements. This regulatory gap has led to inconsistent practices across different geographical areas and industries, further complicating the establishment of standardized recycling protocols.

The absence of design-for-recycling principles in current thermoelectric module manufacturing represents a fundamental barrier to effective end-of-life management. Most existing modules are designed primarily for performance and durability, with little consideration for eventual disassembly and material recovery. This approach results in products that are inherently difficult to recycle, regardless of the technologies available at end-of-life.

One primary challenge is the lack of standardized dismantling techniques for thermoelectric modules. Unlike conventional electronic waste, these modules are designed for thermal stability and long operational life, resulting in robust bonding between components that resists mechanical separation. Current mechanical recycling methods often damage the valuable semiconductor materials, significantly reducing recovery rates and material purity.

Chemical separation processes face their own set of obstacles. The diverse material composition requires multiple chemical treatment stages, each with specific reagents and conditions. These processes frequently generate hazardous waste streams containing heavy metals and toxic chemicals, creating additional environmental concerns that counteract the sustainability benefits of recycling efforts.

The economic viability of recycling thermoelectric modules remains questionable under current technological constraints. The relatively low concentration of valuable materials combined with high processing costs creates unfavorable economics for commercial recycling operations. This is exacerbated by the current small market volume of thermoelectric waste, which prevents economies of scale from being achieved in recycling facilities.

Technical barriers also exist in the detection and sorting phases of the recycling process. Identifying thermoelectric modules within mixed electronic waste streams is challenging due to their varied appearances and applications. Automated sorting technologies struggle to distinguish these components from other electronic parts, resulting in many thermoelectric modules being processed through inappropriate recycling channels.

Regulatory frameworks present another significant obstacle. Many regions lack specific guidelines for handling thermoelectric waste, creating uncertainty regarding proper disposal and recycling requirements. This regulatory gap has led to inconsistent practices across different geographical areas and industries, further complicating the establishment of standardized recycling protocols.

The absence of design-for-recycling principles in current thermoelectric module manufacturing represents a fundamental barrier to effective end-of-life management. Most existing modules are designed primarily for performance and durability, with little consideration for eventual disassembly and material recovery. This approach results in products that are inherently difficult to recycle, regardless of the technologies available at end-of-life.

Existing End-of-Life Processing Methods

01 Recycling methods for thermoelectric materials

Various methods have been developed for recycling thermoelectric materials from used modules. These methods include mechanical separation, chemical dissolution, and thermal processing to recover valuable elements like bismuth, tellurium, and antimony. The recycling processes aim to minimize waste and environmental impact while recovering high-purity materials that can be reused in new thermoelectric devices.- Recycling methods for thermoelectric materials: Various methods have been developed for recycling thermoelectric materials from used modules. These processes typically involve disassembly of the modules, separation of different components, and recovery of valuable thermoelectric materials such as bismuth telluride, lead telluride, or silicon-germanium alloys. The recycling methods may include mechanical separation, chemical dissolution, or thermal processing to extract and purify the thermoelectric materials for reuse in new modules.

- Environmentally friendly thermoelectric materials: Development of environmentally friendly thermoelectric materials focuses on reducing or eliminating toxic elements while maintaining high performance. These materials are designed to be more sustainable throughout their lifecycle, including easier recycling at end-of-life. Research includes developing thermoelectric materials that use earth-abundant elements instead of rare or toxic materials, which not only makes recycling more economical but also reduces environmental impact during manufacturing and disposal.

- Modular design for improved recyclability: Thermoelectric modules designed with recyclability in mind feature modular construction that facilitates disassembly and material recovery. These designs may include easily separable components, standardized parts, and materials selected for compatibility with recycling processes. The modular approach allows for selective replacement of damaged components rather than disposing of entire modules, extending the useful life of the remaining components and reducing waste.

- Recovery of rare and precious metals: Specialized processes for recovering rare and precious metals from thermoelectric modules have been developed to address the economic and resource conservation aspects of recycling. These processes target specific valuable materials such as tellurium, bismuth, antimony, and noble metals that may be present in thermoelectric devices. The recovery methods may include hydrometallurgical processes, selective leaching, electrochemical recovery, or pyrometallurgical techniques optimized for high recovery rates of these valuable materials.

- Closed-loop manufacturing systems: Closed-loop manufacturing systems for thermoelectric modules integrate recycling directly into the production process. These systems are designed to recover materials from end-of-life modules and reintroduce them into the manufacturing of new modules with minimal processing. The approach may include on-site recycling facilities, standardized material compositions that facilitate recycling, and quality control processes to ensure recycled materials meet performance specifications for new modules.

02 Sustainable thermoelectric material compositions

Development of thermoelectric materials with improved sustainability focuses on reducing or eliminating toxic and rare elements. These compositions often incorporate abundant, environmentally friendly materials that can be more easily recycled. Research includes organic thermoelectric materials, oxide-based thermoelectrics, and silicide-based compounds that maintain performance while improving end-of-life recyclability.Expand Specific Solutions03 Design for disassembly and recyclability

Innovative thermoelectric module designs focus on ease of disassembly and material separation at end-of-life. These designs include modular construction, reversible bonding methods, and standardized components that facilitate the recovery of thermoelectric materials. By considering recyclability during the design phase, manufacturers can improve material recovery rates and reduce the environmental impact of thermoelectric technology.Expand Specific Solutions04 Advanced manufacturing techniques for recyclable modules

Manufacturing techniques have been developed specifically to enhance the recyclability of thermoelectric modules. These include solderless assembly methods, mechanical joining techniques, and specialized coatings that protect materials during use but allow for separation during recycling. These manufacturing approaches maintain performance while significantly improving the recovery of valuable materials at end-of-life.Expand Specific Solutions05 Closed-loop systems for thermoelectric material recovery

Integrated systems for the complete lifecycle management of thermoelectric modules include collection, disassembly, material recovery, and remanufacturing processes. These closed-loop approaches maximize material recovery and minimize waste through specialized processing techniques. The systems often incorporate automated sorting, precision separation technologies, and quality control measures to ensure recovered materials meet specifications for reuse in new thermoelectric devices.Expand Specific Solutions

Key Industry Players in Thermoelectric Recycling

The thermoelectric module recycling and end-of-life strategies market is in its early growth phase, characterized by increasing research activities but limited commercial implementation. The global market is projected to expand as sustainability regulations tighten, with an estimated value of $50-100 million currently. Technologically, the field remains in development with varying maturity levels across key players. Companies like Toshiba Corp., KELK Ltd., and Panasonic Holdings lead with established recycling protocols, while research institutions including Industrial Technology Research Institute and National Institute for Materials Science provide foundational research. Specialized recycling firms such as ACCUREC-Recycling GmbH are developing targeted solutions, while automotive manufacturers like Hyundai, GM, and DENSO are exploring recovery strategies for thermoelectric modules in vehicle applications.

Toshiba Materials Co., Ltd.

Technical Solution: Toshiba Materials has developed a comprehensive recycling system for thermoelectric modules focusing on bismuth telluride-based materials. Their approach involves mechanical separation techniques to isolate thermoelectric materials from module components, followed by chemical processing to recover high-purity tellurium and bismuth. The company has implemented a closed-loop manufacturing system where recovered materials are reintegrated into new module production, achieving up to 85% recovery rates for critical elements[1]. Their process minimizes environmental impact through controlled chemical treatments that prevent toxic leaching. Additionally, Toshiba Materials has pioneered design-for-recycling principles in their newer thermoelectric modules, incorporating easily separable components and reducing the use of difficult-to-recycle adhesives and solders[3].

Strengths: High recovery rates for valuable elements, integrated closed-loop manufacturing system, and reduced environmental footprint. Weaknesses: Energy-intensive separation processes, requires specialized equipment, and economic viability depends on material prices and processing volumes.

ACCUREC-Recycling GmbH

Technical Solution: ACCUREC-Recycling has developed specialized pyrometallurgical and hydrometallurgical processes specifically for thermoelectric module recycling. Their approach begins with mechanical pre-treatment including crushing and sorting, followed by a two-stage thermal treatment process. The first stage operates at controlled temperatures (450-550°C) to separate organic components and solder materials, while the second stage uses higher temperatures (>800°C) for metal recovery[2]. Their hydrometallurgical process then uses selective leaching agents to isolate tellurium, bismuth, antimony, and other valuable elements with purities exceeding 99%[4]. ACCUREC has also developed a mobile processing unit that can be deployed at customer sites, reducing transportation costs and associated carbon emissions. Their life cycle assessment shows that recycled thermoelectric materials from their process have approximately 65% lower environmental impact compared to virgin material production[5].

Strengths: High purity recovery of critical elements, mobile processing capabilities, and demonstrated environmental benefits through LCA studies. Weaknesses: High energy consumption during pyrometallurgical processing, requires careful emissions control, and process economics heavily dependent on scale.

Critical Patents in Thermoelectric Material Recovery

Thermoelectric element for converting energy between thermal energy and electrical energy and method for disassembling the thermoelectric element

PatentWO2013182361A1

Innovation

- A thermoelectric element using soft and hard magnetic materials for a magnetically non-positive connection between thermoelectric legs and conductor track devices, allowing for reliable operation with minimal external forces and enabling easy disassembly and recycling by utilizing magnetic forces for assembly and disassembly.

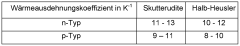

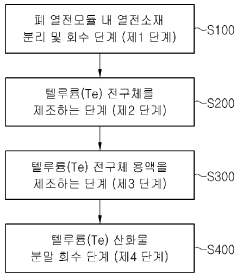

Method for recovering tellurium oxide from waste thermoelectric module

PatentInactiveKR1020160146249A

Innovation

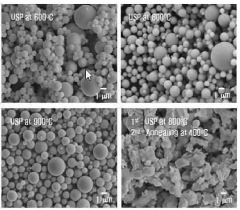

- A method involving a four-step process: separating thermoelectric materials from waste modules at high temperatures, dissolving in hydrogen peroxide, preparing a tellurium precursor solution, and recovering tellurium oxide through ultrasonic spray pyrolysis and annealing, without using strong acids/strong bases.

Environmental Impact Assessment

The environmental impact of thermoelectric modules throughout their lifecycle presents significant challenges that must be addressed through comprehensive assessment methodologies. Thermoelectric materials often contain rare, toxic, or environmentally harmful elements such as tellurium, bismuth, antimony, and lead, which pose substantial risks when improperly disposed of or released into ecosystems. The extraction processes for these raw materials frequently involve energy-intensive mining operations that contribute to habitat destruction, soil degradation, and water pollution in source regions.

Manufacturing thermoelectric modules requires multiple energy-intensive processes including high-temperature sintering, precision machining, and assembly operations. These processes generate considerable carbon emissions, particularly in regions where energy production relies heavily on fossil fuels. Additionally, the use of chemical solvents, etching solutions, and bonding agents during production introduces potential contamination pathways that require careful management and mitigation strategies.

When examining the use phase, thermoelectric modules generally demonstrate favorable environmental characteristics through their ability to recover waste heat and improve energy efficiency in various applications. However, this positive contribution must be weighed against the embodied environmental costs from production and the challenges of end-of-life management. Life cycle assessment (LCA) studies indicate that the environmental benefits of thermoelectric applications are highly dependent on operational lifetime, with longer service periods necessary to offset initial environmental investments.

The end-of-life phase presents perhaps the most critical environmental challenge. Without proper recycling infrastructure, valuable and potentially hazardous materials may be lost to landfills or incineration, creating pollution risks and squandering resources. Current disposal practices often fail to recover critical materials, with recycling rates for many thermoelectric components remaining below 1% globally. This represents both an environmental liability and a missed economic opportunity.

Emerging environmental regulations, particularly in Europe and parts of Asia, are increasingly targeting electronic waste management and material recovery requirements. These regulatory frameworks will likely impose stricter obligations on manufacturers regarding product design for recyclability and formal take-back programs. Forward-thinking companies are already developing design-for-disassembly approaches and investigating more environmentally benign material substitutions to address these concerns proactively.

Comprehensive environmental impact assessment requires consideration of multiple impact categories including global warming potential, resource depletion, ecotoxicity, and human health effects. Standardized methodologies such as ISO 14040/14044 provide frameworks for conducting such assessments, though thermoelectric-specific protocols remain underdeveloped. Future environmental evaluations will benefit from more granular data collection throughout the supply chain and improved transparency regarding material sourcing and manufacturing processes.

Manufacturing thermoelectric modules requires multiple energy-intensive processes including high-temperature sintering, precision machining, and assembly operations. These processes generate considerable carbon emissions, particularly in regions where energy production relies heavily on fossil fuels. Additionally, the use of chemical solvents, etching solutions, and bonding agents during production introduces potential contamination pathways that require careful management and mitigation strategies.

When examining the use phase, thermoelectric modules generally demonstrate favorable environmental characteristics through their ability to recover waste heat and improve energy efficiency in various applications. However, this positive contribution must be weighed against the embodied environmental costs from production and the challenges of end-of-life management. Life cycle assessment (LCA) studies indicate that the environmental benefits of thermoelectric applications are highly dependent on operational lifetime, with longer service periods necessary to offset initial environmental investments.

The end-of-life phase presents perhaps the most critical environmental challenge. Without proper recycling infrastructure, valuable and potentially hazardous materials may be lost to landfills or incineration, creating pollution risks and squandering resources. Current disposal practices often fail to recover critical materials, with recycling rates for many thermoelectric components remaining below 1% globally. This represents both an environmental liability and a missed economic opportunity.

Emerging environmental regulations, particularly in Europe and parts of Asia, are increasingly targeting electronic waste management and material recovery requirements. These regulatory frameworks will likely impose stricter obligations on manufacturers regarding product design for recyclability and formal take-back programs. Forward-thinking companies are already developing design-for-disassembly approaches and investigating more environmentally benign material substitutions to address these concerns proactively.

Comprehensive environmental impact assessment requires consideration of multiple impact categories including global warming potential, resource depletion, ecotoxicity, and human health effects. Standardized methodologies such as ISO 14040/14044 provide frameworks for conducting such assessments, though thermoelectric-specific protocols remain underdeveloped. Future environmental evaluations will benefit from more granular data collection throughout the supply chain and improved transparency regarding material sourcing and manufacturing processes.

Economic Viability Analysis

The economic viability of recycling and end-of-life strategies for thermoelectric modules hinges on several interconnected factors that determine whether recovery operations can be financially sustainable. Current market analyses indicate that the cost-benefit ratio for thermoelectric module recycling is heavily influenced by the recovery efficiency of valuable materials such as tellurium, bismuth, and antimony, which have experienced significant price volatility in recent years. For instance, tellurium prices have fluctuated between $30-$150 per kilogram over the past decade, directly impacting the economic incentives for recovery.

Research conducted by the National Renewable Energy Laboratory suggests that the break-even point for thermoelectric module recycling typically requires processing volumes exceeding 10,000 units annually, with recovery efficiencies above 80% for critical materials. This threshold varies significantly based on regional labor costs, energy prices, and regulatory frameworks governing waste management practices.

The economic equation is further complicated by the relatively small market size for thermoelectric modules compared to other electronic components. With global annual production estimated at approximately 50 million units, the dispersed nature of these modules in various applications creates logistical challenges that increase collection costs. Transportation expenses can account for 15-25% of total recycling costs when modules must be gathered from geographically distributed end-of-life products.

Capital investment requirements for establishing specialized recycling facilities represent another significant economic barrier. Advanced separation technologies necessary for efficient material recovery from thermoelectric modules typically require investments ranging from $2-5 million for facilities capable of processing 100,000 units annually. These high upfront costs necessitate long-term operational planning and stable material pricing to ensure return on investment.

Emerging business models are beginning to address these economic challenges through innovative approaches. Product-as-a-service models, where manufacturers retain ownership of thermoelectric modules throughout their lifecycle, are showing promise by internalizing end-of-life costs and creating closed-loop material flows. Similarly, industrial symbiosis arrangements, where waste streams from thermoelectric recycling become inputs for other manufacturing processes, can improve overall economic viability by creating additional value streams.

Government incentives and extended producer responsibility regulations are increasingly influencing the economic landscape for thermoelectric module recycling. In regions with advanced circular economy policies, tax benefits, subsidies, and mandatory recycling requirements are shifting the cost-benefit analysis in favor of more comprehensive end-of-life management strategies. These policy instruments can reduce the effective cost of recycling by 20-40%, potentially transforming previously uneconomical recovery operations into viable business opportunities.

Research conducted by the National Renewable Energy Laboratory suggests that the break-even point for thermoelectric module recycling typically requires processing volumes exceeding 10,000 units annually, with recovery efficiencies above 80% for critical materials. This threshold varies significantly based on regional labor costs, energy prices, and regulatory frameworks governing waste management practices.

The economic equation is further complicated by the relatively small market size for thermoelectric modules compared to other electronic components. With global annual production estimated at approximately 50 million units, the dispersed nature of these modules in various applications creates logistical challenges that increase collection costs. Transportation expenses can account for 15-25% of total recycling costs when modules must be gathered from geographically distributed end-of-life products.

Capital investment requirements for establishing specialized recycling facilities represent another significant economic barrier. Advanced separation technologies necessary for efficient material recovery from thermoelectric modules typically require investments ranging from $2-5 million for facilities capable of processing 100,000 units annually. These high upfront costs necessitate long-term operational planning and stable material pricing to ensure return on investment.

Emerging business models are beginning to address these economic challenges through innovative approaches. Product-as-a-service models, where manufacturers retain ownership of thermoelectric modules throughout their lifecycle, are showing promise by internalizing end-of-life costs and creating closed-loop material flows. Similarly, industrial symbiosis arrangements, where waste streams from thermoelectric recycling become inputs for other manufacturing processes, can improve overall economic viability by creating additional value streams.

Government incentives and extended producer responsibility regulations are increasingly influencing the economic landscape for thermoelectric module recycling. In regions with advanced circular economy policies, tax benefits, subsidies, and mandatory recycling requirements are shifting the cost-benefit analysis in favor of more comprehensive end-of-life management strategies. These policy instruments can reduce the effective cost of recycling by 20-40%, potentially transforming previously uneconomical recovery operations into viable business opportunities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!