Nanofiltration Wastewater Treatment in EV Battery Manufacturing

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EV Battery Manufacturing Wastewater Challenges and Objectives

The electric vehicle (EV) battery manufacturing industry faces significant wastewater management challenges due to the complex and hazardous nature of its effluents. These wastewaters typically contain high concentrations of heavy metals such as lithium, cobalt, nickel, and manganese, along with organic solvents, binders, and various process chemicals. The presence of these contaminants poses serious environmental risks if not properly treated before discharge, including potential groundwater contamination and ecosystem disruption.

Current wastewater treatment approaches in EV battery production facilities often rely on conventional methods such as chemical precipitation, flocculation, and activated carbon adsorption. However, these traditional techniques frequently fall short in meeting increasingly stringent environmental regulations, particularly regarding the removal of dissolved metals and emerging contaminants specific to battery manufacturing processes.

Nanofiltration (NF) technology represents a promising advanced solution for addressing these challenges. As a pressure-driven membrane process positioned between reverse osmosis and ultrafiltration in terms of selectivity, nanofiltration offers unique capabilities for treating battery manufacturing wastewater. The technology can effectively remove multivalent ions, larger monovalent ions, and organic molecules with molecular weights above 200-400 Daltons while allowing smaller monovalent ions to pass through.

The primary objectives for implementing nanofiltration in EV battery wastewater treatment include achieving multiple simultaneous benefits: reducing environmental impact through more effective contaminant removal, enabling water reuse within manufacturing facilities to decrease freshwater consumption, and potentially recovering valuable materials from waste streams to improve resource efficiency and economic viability.

Technical goals for nanofiltration implementation in this context include developing specialized membrane materials resistant to the harsh chemical environment of battery manufacturing wastewater, optimizing operating parameters to minimize fouling and maximize separation efficiency, and designing integrated treatment systems that combine nanofiltration with complementary technologies to address the full spectrum of contaminants present.

Additionally, there is a growing focus on developing sustainable treatment solutions that minimize energy consumption and secondary waste generation, aligning with the broader environmental goals of the EV industry. This includes exploring low-pressure nanofiltration systems and renewable energy integration to power treatment processes.

As global EV production continues to accelerate, with projections indicating a tenfold increase in battery manufacturing capacity by 2030, developing effective and scalable wastewater treatment solutions becomes increasingly critical. The successful implementation of nanofiltration technology could significantly contribute to improving the overall sustainability profile of the EV battery manufacturing industry.

Current wastewater treatment approaches in EV battery production facilities often rely on conventional methods such as chemical precipitation, flocculation, and activated carbon adsorption. However, these traditional techniques frequently fall short in meeting increasingly stringent environmental regulations, particularly regarding the removal of dissolved metals and emerging contaminants specific to battery manufacturing processes.

Nanofiltration (NF) technology represents a promising advanced solution for addressing these challenges. As a pressure-driven membrane process positioned between reverse osmosis and ultrafiltration in terms of selectivity, nanofiltration offers unique capabilities for treating battery manufacturing wastewater. The technology can effectively remove multivalent ions, larger monovalent ions, and organic molecules with molecular weights above 200-400 Daltons while allowing smaller monovalent ions to pass through.

The primary objectives for implementing nanofiltration in EV battery wastewater treatment include achieving multiple simultaneous benefits: reducing environmental impact through more effective contaminant removal, enabling water reuse within manufacturing facilities to decrease freshwater consumption, and potentially recovering valuable materials from waste streams to improve resource efficiency and economic viability.

Technical goals for nanofiltration implementation in this context include developing specialized membrane materials resistant to the harsh chemical environment of battery manufacturing wastewater, optimizing operating parameters to minimize fouling and maximize separation efficiency, and designing integrated treatment systems that combine nanofiltration with complementary technologies to address the full spectrum of contaminants present.

Additionally, there is a growing focus on developing sustainable treatment solutions that minimize energy consumption and secondary waste generation, aligning with the broader environmental goals of the EV industry. This includes exploring low-pressure nanofiltration systems and renewable energy integration to power treatment processes.

As global EV production continues to accelerate, with projections indicating a tenfold increase in battery manufacturing capacity by 2030, developing effective and scalable wastewater treatment solutions becomes increasingly critical. The successful implementation of nanofiltration technology could significantly contribute to improving the overall sustainability profile of the EV battery manufacturing industry.

Market Demand for Sustainable Battery Production

The electric vehicle (EV) battery manufacturing industry is experiencing unprecedented growth, with global EV battery demand projected to reach 2,333 GWh by 2030, representing a compound annual growth rate of 26%. This explosive growth has intensified focus on the environmental footprint of battery production, particularly water usage and contamination. A typical gigafactory can consume between 3-5 million gallons of water daily, with significant portions becoming contaminated with heavy metals, organic solvents, and other pollutants.

Market research indicates that sustainable battery production is rapidly transitioning from a regulatory compliance matter to a competitive advantage. Major automotive manufacturers including Tesla, Volkswagen, and BMW have publicly committed to reducing the environmental impact of their supply chains, with water management featuring prominently in their sustainability roadmaps. These commitments are driving demand for advanced wastewater treatment solutions like nanofiltration.

The investment landscape reflects this shift, with venture capital funding for cleantech solutions in battery manufacturing increasing by 43% in 2022 compared to the previous year. Specifically, water treatment technologies for battery production received approximately $780 million in investment during this period, highlighting market recognition of this critical need.

Consumer preferences are also reshaping market demands. Recent surveys indicate that 67% of EV buyers consider the environmental impact of battery production when making purchasing decisions. This consumer awareness is creating market pressure for manufacturers to adopt and promote sustainable production practices, including advanced wastewater treatment.

Regulatory frameworks worldwide are simultaneously tightening restrictions on industrial wastewater discharge. The European Union's Industrial Emissions Directive, China's Water Pollution Prevention and Control Law, and the U.S. Clean Water Act amendments are all imposing stricter limits on heavy metals and chemical contaminants, directly impacting battery manufacturers' operations and costs.

Economic analyses demonstrate that implementing advanced wastewater treatment systems like nanofiltration can reduce water-related operational costs by 30-40% over a five-year period through water recycling and reduced discharge fees. This economic incentive, combined with regulatory pressures and market differentiation opportunities, is creating robust demand for nanofiltration solutions specifically designed for battery manufacturing processes.

The market for specialized nanofiltration systems in battery manufacturing is projected to grow at 34% annually through 2028, outpacing the broader water treatment market. This accelerated growth reflects the urgent need for sustainable water management solutions that can address the unique contamination challenges of battery production while supporting manufacturers' environmental performance goals.

Market research indicates that sustainable battery production is rapidly transitioning from a regulatory compliance matter to a competitive advantage. Major automotive manufacturers including Tesla, Volkswagen, and BMW have publicly committed to reducing the environmental impact of their supply chains, with water management featuring prominently in their sustainability roadmaps. These commitments are driving demand for advanced wastewater treatment solutions like nanofiltration.

The investment landscape reflects this shift, with venture capital funding for cleantech solutions in battery manufacturing increasing by 43% in 2022 compared to the previous year. Specifically, water treatment technologies for battery production received approximately $780 million in investment during this period, highlighting market recognition of this critical need.

Consumer preferences are also reshaping market demands. Recent surveys indicate that 67% of EV buyers consider the environmental impact of battery production when making purchasing decisions. This consumer awareness is creating market pressure for manufacturers to adopt and promote sustainable production practices, including advanced wastewater treatment.

Regulatory frameworks worldwide are simultaneously tightening restrictions on industrial wastewater discharge. The European Union's Industrial Emissions Directive, China's Water Pollution Prevention and Control Law, and the U.S. Clean Water Act amendments are all imposing stricter limits on heavy metals and chemical contaminants, directly impacting battery manufacturers' operations and costs.

Economic analyses demonstrate that implementing advanced wastewater treatment systems like nanofiltration can reduce water-related operational costs by 30-40% over a five-year period through water recycling and reduced discharge fees. This economic incentive, combined with regulatory pressures and market differentiation opportunities, is creating robust demand for nanofiltration solutions specifically designed for battery manufacturing processes.

The market for specialized nanofiltration systems in battery manufacturing is projected to grow at 34% annually through 2028, outpacing the broader water treatment market. This accelerated growth reflects the urgent need for sustainable water management solutions that can address the unique contamination challenges of battery production while supporting manufacturers' environmental performance goals.

Nanofiltration Technology Status and Barriers

Nanofiltration technology has emerged as a promising solution for wastewater treatment in electric vehicle (EV) battery manufacturing, positioned between reverse osmosis and ultrafiltration in terms of selectivity and operating pressure. Currently, nanofiltration membranes can effectively remove multivalent ions, organic compounds, and heavy metals from battery manufacturing wastewater, with rejection rates typically ranging from 60% to 95% depending on the specific contaminants and membrane properties.

The global implementation of nanofiltration in EV battery manufacturing remains uneven. Leading battery producers in East Asia, particularly in South Korea, Japan, and China, have made significant advancements in integrating nanofiltration systems into their production lines. European manufacturers are rapidly adopting these technologies to meet stringent environmental regulations, while North American companies are increasingly investing in nanofiltration research and implementation.

Despite promising developments, nanofiltration technology faces several critical challenges in EV battery wastewater treatment applications. Membrane fouling remains the most persistent issue, significantly reducing operational efficiency and membrane lifespan. The complex chemical composition of battery manufacturing wastewater, containing various organic solvents, binders, and metal ions, accelerates fouling processes and complicates treatment protocols.

Selectivity limitations present another significant barrier. Current nanofiltration membranes struggle to achieve optimal separation of lithium ions from other monovalent ions, which is crucial for resource recovery in closed-loop manufacturing systems. The trade-off between high flux and high selectivity continues to challenge membrane design and material selection.

Energy consumption represents a substantial operational constraint. Although nanofiltration requires less energy than reverse osmosis, the pressure requirements (typically 5-20 bar) still contribute significantly to operational costs, particularly for large-scale battery manufacturing facilities processing thousands of cubic meters of wastewater daily.

Membrane durability under harsh chemical conditions poses another technical barrier. The presence of strong solvents, extreme pH conditions, and oxidizing agents in battery wastewater accelerates membrane degradation, reducing service life and increasing replacement frequency and costs.

Scale-up challenges further complicate widespread adoption. Laboratory-scale successes often face difficulties in maintaining performance metrics when scaled to industrial applications. Variations in wastewater composition between different battery chemistries and manufacturing processes necessitate customized treatment approaches, limiting standardization opportunities.

The economic viability of nanofiltration systems remains a concern for smaller manufacturers. High initial capital expenditure for membrane modules, supporting infrastructure, and integration with existing treatment systems creates adoption barriers, despite potential long-term operational benefits and resource recovery opportunities.

The global implementation of nanofiltration in EV battery manufacturing remains uneven. Leading battery producers in East Asia, particularly in South Korea, Japan, and China, have made significant advancements in integrating nanofiltration systems into their production lines. European manufacturers are rapidly adopting these technologies to meet stringent environmental regulations, while North American companies are increasingly investing in nanofiltration research and implementation.

Despite promising developments, nanofiltration technology faces several critical challenges in EV battery wastewater treatment applications. Membrane fouling remains the most persistent issue, significantly reducing operational efficiency and membrane lifespan. The complex chemical composition of battery manufacturing wastewater, containing various organic solvents, binders, and metal ions, accelerates fouling processes and complicates treatment protocols.

Selectivity limitations present another significant barrier. Current nanofiltration membranes struggle to achieve optimal separation of lithium ions from other monovalent ions, which is crucial for resource recovery in closed-loop manufacturing systems. The trade-off between high flux and high selectivity continues to challenge membrane design and material selection.

Energy consumption represents a substantial operational constraint. Although nanofiltration requires less energy than reverse osmosis, the pressure requirements (typically 5-20 bar) still contribute significantly to operational costs, particularly for large-scale battery manufacturing facilities processing thousands of cubic meters of wastewater daily.

Membrane durability under harsh chemical conditions poses another technical barrier. The presence of strong solvents, extreme pH conditions, and oxidizing agents in battery wastewater accelerates membrane degradation, reducing service life and increasing replacement frequency and costs.

Scale-up challenges further complicate widespread adoption. Laboratory-scale successes often face difficulties in maintaining performance metrics when scaled to industrial applications. Variations in wastewater composition between different battery chemistries and manufacturing processes necessitate customized treatment approaches, limiting standardization opportunities.

The economic viability of nanofiltration systems remains a concern for smaller manufacturers. High initial capital expenditure for membrane modules, supporting infrastructure, and integration with existing treatment systems creates adoption barriers, despite potential long-term operational benefits and resource recovery opportunities.

Current Nanofiltration Solutions for Battery Wastewater

01 Nanofiltration membrane systems for industrial wastewater treatment

Nanofiltration membrane systems are specifically designed for treating industrial wastewater, offering high efficiency in removing contaminants while maintaining operational stability. These systems utilize specialized membrane materials that can withstand harsh industrial conditions while effectively filtering out pollutants. The technology enables the removal of heavy metals, organic compounds, and other industrial contaminants, making the treated water suitable for reuse or safe discharge.- Nanofiltration membrane systems for industrial wastewater treatment: Nanofiltration membrane systems are effective for treating industrial wastewater by removing contaminants at the nanoscale level. These systems can be designed with specific membrane properties to target industrial pollutants such as heavy metals, organic compounds, and dissolved solids. The technology offers advantages including high selectivity, lower energy consumption compared to reverse osmosis, and the ability to operate under various pressure conditions depending on the wastewater characteristics.

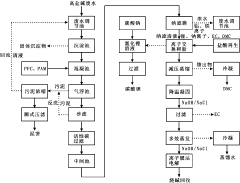

- Combined nanofiltration processes for enhanced wastewater treatment: Combining nanofiltration with other treatment processes creates more effective wastewater treatment systems. These integrated approaches may include pre-treatment steps such as coagulation or biological treatment before nanofiltration, or post-treatment processes to handle concentrate streams. The combined processes can address multiple contaminants simultaneously, improve overall system efficiency, and reduce membrane fouling, resulting in more sustainable wastewater treatment solutions.

- Specialized nanofiltration equipment for specific wastewater applications: Specialized nanofiltration equipment has been developed for specific wastewater treatment applications, including modular systems for decentralized treatment, mobile units for emergency response, and customized configurations for challenging waste streams. These specialized systems incorporate innovations in membrane module design, flow distribution, and automated control systems to optimize performance for particular wastewater characteristics and treatment requirements.

- Anti-fouling and membrane performance enhancement technologies: Anti-fouling technologies and membrane performance enhancements are critical for maintaining nanofiltration efficiency in wastewater treatment. These include modified membrane materials with anti-fouling properties, advanced cleaning protocols, hydrodynamic optimization to reduce concentration polarization, and surface modifications to improve selectivity and flux. These innovations extend membrane life, reduce operational costs, and maintain consistent treatment performance over time.

- Resource recovery and zero liquid discharge systems using nanofiltration: Nanofiltration enables resource recovery and zero liquid discharge approaches in wastewater treatment by selectively separating valuable components from waste streams. These systems can recover nutrients, metals, and reusable water while minimizing discharge. The technology supports circular economy principles by transforming wastewater treatment from a disposal process to a resource recovery operation, with applications in industries such as mining, textiles, and food processing.

02 Combined nanofiltration processes for enhanced wastewater treatment

Combining nanofiltration with other treatment processes creates integrated systems that enhance overall wastewater treatment efficiency. These combined approaches may include pre-treatment steps such as coagulation or biological treatment, followed by nanofiltration as a polishing step. Alternatively, nanofiltration may be used as an intermediate step before advanced oxidation or reverse osmosis. Such combined processes address multiple contaminant types simultaneously and optimize resource utilization while improving treatment outcomes.Expand Specific Solutions03 Modular and portable nanofiltration systems for wastewater treatment

Modular and portable nanofiltration systems provide flexible solutions for wastewater treatment in various settings. These systems are designed to be easily transported, installed, and scaled according to treatment needs. The modular design allows for quick deployment in emergency situations or remote locations where permanent infrastructure is not feasible. These systems typically include compact membrane modules, automated control systems, and self-contained power sources to ensure operational reliability in diverse environments.Expand Specific Solutions04 Energy-efficient nanofiltration technologies for wastewater treatment

Energy-efficient nanofiltration technologies focus on reducing the power consumption associated with wastewater treatment while maintaining high filtration performance. These innovations include low-pressure operation membranes, energy recovery devices, and optimized flow designs that minimize pressure drops. Advanced control systems that adjust operational parameters based on feed water quality and desired output specifications further enhance energy efficiency. These technologies make nanofiltration more economically viable for large-scale wastewater treatment applications.Expand Specific Solutions05 Specialized nanofiltration applications for specific contaminant removal

Specialized nanofiltration applications target specific contaminants in wastewater streams, such as pharmaceuticals, pesticides, or specific industrial chemicals. These applications utilize tailored membrane materials with selective permeability characteristics designed to capture particular molecular sizes or chemical properties. The technology enables high removal rates for targeted pollutants while optimizing flow rates and reducing fouling. These specialized systems are particularly valuable in industries with unique wastewater challenges or where regulatory requirements demand removal of specific substances.Expand Specific Solutions

Leading Companies in Nanofiltration for EV Industry

Nanofiltration wastewater treatment in EV battery manufacturing is currently in a growth phase, with the market expanding rapidly due to increasing EV production and stringent environmental regulations. The global market size is projected to reach significant value as manufacturers seek sustainable water management solutions. Technologically, the field shows varying maturity levels across players. Companies like CATL subsidiary Guangdong Bangpu Recycling Technology have developed advanced recycling methods incorporating filtration technologies, while SiTration and Ecolab are pioneering specialized nanofiltration solutions. Academic institutions including Tongji University and The Hong Kong Polytechnic University are contributing research advancements. Major industrial players like LG Chem, SK Innovation, and Siemens are integrating these technologies into comprehensive manufacturing processes, indicating a competitive landscape with both specialized solution providers and large-scale implementers.

SiTration, Inc.

Technical Solution: SiTration has developed a revolutionary nanofiltration technology specifically designed for EV battery manufacturing wastewater treatment. Their proprietary system utilizes silicon-based nanofiber membranes with precisely engineered surface chemistry and pore architecture that enables highly selective filtration of contaminants while facilitating the recovery of valuable battery materials. The core innovation lies in their electrospun silicon nanofiber membranes that combine high porosity (>70%) with narrow pore size distribution (centered around 2-5 nm), creating an ideal balance between selectivity and permeability. SiTration's technology incorporates a unique charge-modulated filtration mechanism that can be dynamically adjusted to target specific contaminants based on their electrical properties. This approach enables exceptional selectivity for separating metals like lithium, cobalt, and nickel from manufacturing wastewater. The system features a modular, stackable design that allows for easy scaling to match production volumes while minimizing footprint. Additionally, SiTration has developed specialized membrane cleaning and regeneration protocols that utilize environmentally friendly reagents, further enhancing the sustainability profile of their solution while extending membrane operational lifetime.

Strengths: Exceptional selectivity for valuable metal recovery, significantly higher flux rates compared to conventional nanofiltration membranes (up to 3x improvement), and excellent resistance to chemical degradation in harsh manufacturing environments. The silicon-based membranes demonstrate superior mechanical stability and longer operational lifetimes. Weaknesses: Higher initial capital investment compared to conventional polymer-based systems, more complex manufacturing process for the specialized membranes, and limited commercial-scale deployment history compared to more established technologies.

Henkel AG & Co. KGaA

Technical Solution: Henkel has developed a comprehensive nanofiltration solution for EV battery manufacturing wastewater treatment that integrates seamlessly with their existing chemical management systems. Their approach combines specialized nanofiltration membranes with proprietary chemical pre-treatment formulations designed specifically for the complex wastewater streams generated during battery production. The system employs a multi-stage filtration process with membranes featuring controlled molecular weight cut-offs ranging from 200-1000 Da, allowing for selective separation of contaminants while preserving valuable materials. Henkel's technology incorporates an innovative dynamic membrane coating process that continuously regenerates the membrane surface during operation, significantly reducing fouling and extending membrane lifetime. The system also features advanced process control algorithms that automatically adjust operating parameters based on real-time monitoring of wastewater composition and membrane performance. This adaptive approach ensures optimal treatment efficiency across varying production conditions. Additionally, Henkel has developed specialized cleaning formulations that can effectively remove accumulated foulants without damaging the membrane structure, further extending operational lifetime and reducing maintenance requirements.

Strengths: Excellent integration with existing chemical management systems in battery manufacturing, adaptive process control for consistent performance across varying wastewater compositions, and reduced membrane fouling through dynamic surface regeneration. The system achieves high water recovery rates (>85%) while maintaining strict compliance with discharge regulations. Weaknesses: Requires regular chemical inputs for optimal performance, higher complexity in system operation compared to purely physical filtration systems, and potential challenges with treating extremely high TDS (Total Dissolved Solids) wastewaters.

Key Nanofiltration Membrane Technologies and Patents

Method for purifying product mixtures from transesterification reactions

PatentInactiveEP2142286A1

Innovation

- The process employs nanofiltration to separate electrolytes from a polar, electrolyte-containing organic phase, using a pressure-driven membrane separation that retains particles in the nanometer range, reducing energy consumption and equipment complexity while maintaining high product quality.

Lithium resource and salt-alkali recycle method

PatentActiveCN107768760A

Innovation

- Multi-stage precipitation and decontamination processes, nanofiltration membrane permeability and interception, ion exchange resin adsorption and vacuum distillation, cooling coagulation and multi-effect evaporation processes are used to treat salt-alkali, lithium elements and organic solvents in wastewater respectively, achieving Efficient recovery of lithium resources and salt-alkali and reuse of electrolyte.

Environmental Compliance and Regulatory Framework

The regulatory landscape for nanofiltration wastewater treatment in EV battery manufacturing has become increasingly stringent as governments worldwide prioritize environmental protection. In the United States, the Environmental Protection Agency (EPA) has established the Clean Water Act and Resource Conservation and Recovery Act, which specifically regulate industrial wastewater discharge containing heavy metals and other contaminants common in battery production. These regulations mandate treatment of wastewater to remove lithium, cobalt, nickel, and other potentially harmful substances before discharge.

The European Union has implemented even more rigorous standards through the Water Framework Directive and Industrial Emissions Directive. Battery manufacturers operating in the EU must comply with strict limits on hazardous substance concentrations in wastewater, with particular emphasis on zero discharge policies for certain heavy metals. The EU's REACH regulation further controls the use of chemicals throughout the production process, indirectly affecting wastewater treatment requirements.

In Asia, China has recently strengthened its environmental regulations through the Water Pollution Prevention and Control Law, establishing specific discharge standards for the battery manufacturing industry. These standards are particularly relevant as China dominates global EV battery production. Similarly, South Korea and Japan have implemented comprehensive regulatory frameworks focusing on water conservation and recycling in industrial processes.

Compliance with these regulations has become a significant driver for the adoption of advanced nanofiltration technologies in EV battery manufacturing. Companies implementing nanofiltration systems can achieve up to 95% removal efficiency for key contaminants, well above the 80-85% typically required by most regulatory frameworks. This compliance margin provides manufacturers with operational flexibility and reduces regulatory risks.

The economic implications of non-compliance are substantial, with penalties ranging from significant fines to production shutdowns. In the EU, non-compliance can result in fines up to €10 million or 2% of annual global turnover. Beyond direct penalties, manufacturers face reputational damage and potential exclusion from environmentally conscious markets.

Looking forward, regulatory trends indicate increasingly stringent requirements for water recycling and zero liquid discharge (ZLD) systems. Several jurisdictions are moving toward mandatory implementation of closed-loop water systems for battery manufacturing, with nanofiltration positioned as a key enabling technology. Companies investing in advanced nanofiltration systems today are effectively future-proofing their operations against anticipated regulatory developments over the next decade.

The European Union has implemented even more rigorous standards through the Water Framework Directive and Industrial Emissions Directive. Battery manufacturers operating in the EU must comply with strict limits on hazardous substance concentrations in wastewater, with particular emphasis on zero discharge policies for certain heavy metals. The EU's REACH regulation further controls the use of chemicals throughout the production process, indirectly affecting wastewater treatment requirements.

In Asia, China has recently strengthened its environmental regulations through the Water Pollution Prevention and Control Law, establishing specific discharge standards for the battery manufacturing industry. These standards are particularly relevant as China dominates global EV battery production. Similarly, South Korea and Japan have implemented comprehensive regulatory frameworks focusing on water conservation and recycling in industrial processes.

Compliance with these regulations has become a significant driver for the adoption of advanced nanofiltration technologies in EV battery manufacturing. Companies implementing nanofiltration systems can achieve up to 95% removal efficiency for key contaminants, well above the 80-85% typically required by most regulatory frameworks. This compliance margin provides manufacturers with operational flexibility and reduces regulatory risks.

The economic implications of non-compliance are substantial, with penalties ranging from significant fines to production shutdowns. In the EU, non-compliance can result in fines up to €10 million or 2% of annual global turnover. Beyond direct penalties, manufacturers face reputational damage and potential exclusion from environmentally conscious markets.

Looking forward, regulatory trends indicate increasingly stringent requirements for water recycling and zero liquid discharge (ZLD) systems. Several jurisdictions are moving toward mandatory implementation of closed-loop water systems for battery manufacturing, with nanofiltration positioned as a key enabling technology. Companies investing in advanced nanofiltration systems today are effectively future-proofing their operations against anticipated regulatory developments over the next decade.

Resource Recovery and Circular Economy Opportunities

The integration of resource recovery systems within nanofiltration wastewater treatment processes represents a significant opportunity for advancing circular economy principles in EV battery manufacturing. By implementing closed-loop systems, manufacturers can recover valuable materials such as lithium, cobalt, nickel, and manganese from wastewater streams, effectively transforming waste into resources.

Nanofiltration technology enables selective separation of ions and compounds, making it particularly suitable for recovering critical battery materials. Current recovery rates show promising results, with lithium recovery efficiencies reaching 80-90% in optimized systems. This not only reduces raw material costs but also decreases dependency on volatile supply chains for these strategic minerals.

Economic analyses indicate that implementing resource recovery systems can yield return on investment within 3-5 years, depending on facility scale and material prices. For large-scale EV battery manufacturing plants, the recovered materials can represent savings of $2-4 million annually, while simultaneously reducing waste disposal costs by 30-40%.

Beyond direct material recovery, nanofiltration systems contribute to water circularity within manufacturing facilities. Treated water can be reused in various production processes, reducing freshwater consumption by up to 60%. This aspect is particularly valuable in water-stressed regions where battery manufacturing is expanding rapidly.

The circular economy benefits extend to carbon footprint reduction. Life cycle assessments demonstrate that recovering materials through nanofiltration processes requires significantly less energy than primary extraction - approximately 50-70% less for lithium and 40-60% less for cobalt and nickel. This translates to substantial greenhouse gas emission reductions across the battery value chain.

Regulatory frameworks increasingly support these circular approaches. The EU Battery Directive revision and similar initiatives in China and North America are establishing requirements for recycled content in batteries, creating market pull for resource recovery technologies. Companies implementing advanced recovery systems may gain competitive advantages through regulatory compliance and sustainability credentials.

Collaborative ecosystems between battery manufacturers, water treatment specialists, and material refiners are emerging to maximize resource recovery potential. These partnerships facilitate knowledge sharing and technology optimization, accelerating the transition toward truly circular battery production systems that minimize environmental impact while enhancing economic sustainability.

Nanofiltration technology enables selective separation of ions and compounds, making it particularly suitable for recovering critical battery materials. Current recovery rates show promising results, with lithium recovery efficiencies reaching 80-90% in optimized systems. This not only reduces raw material costs but also decreases dependency on volatile supply chains for these strategic minerals.

Economic analyses indicate that implementing resource recovery systems can yield return on investment within 3-5 years, depending on facility scale and material prices. For large-scale EV battery manufacturing plants, the recovered materials can represent savings of $2-4 million annually, while simultaneously reducing waste disposal costs by 30-40%.

Beyond direct material recovery, nanofiltration systems contribute to water circularity within manufacturing facilities. Treated water can be reused in various production processes, reducing freshwater consumption by up to 60%. This aspect is particularly valuable in water-stressed regions where battery manufacturing is expanding rapidly.

The circular economy benefits extend to carbon footprint reduction. Life cycle assessments demonstrate that recovering materials through nanofiltration processes requires significantly less energy than primary extraction - approximately 50-70% less for lithium and 40-60% less for cobalt and nickel. This translates to substantial greenhouse gas emission reductions across the battery value chain.

Regulatory frameworks increasingly support these circular approaches. The EU Battery Directive revision and similar initiatives in China and North America are establishing requirements for recycled content in batteries, creating market pull for resource recovery technologies. Companies implementing advanced recovery systems may gain competitive advantages through regulatory compliance and sustainability credentials.

Collaborative ecosystems between battery manufacturers, water treatment specialists, and material refiners are emerging to maximize resource recovery potential. These partnerships facilitate knowledge sharing and technology optimization, accelerating the transition toward truly circular battery production systems that minimize environmental impact while enhancing economic sustainability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!